Professional Documents

Culture Documents

P616498467 Cleaned

P616498467 Cleaned

Uploaded by

Adil KhanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

P616498467 Cleaned

P616498467 Cleaned

Uploaded by

Adil KhanCopyright:

Available Formats

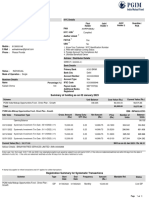

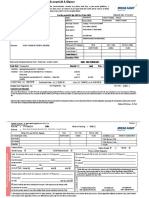

ACCOUNT STATEMENT

Statement Date : 03 January 2024

Unit Holder(s) Details KYC Details

Folio 91015356165 st

1 Holder Jt. Holder 1 Jt. Holder 2 Guardian / POA

Adil Nabi Khan

PAN AWRPN5838J

1

C-9/4, OKHLA VIHAR, JAMIA KYC / KIN Complied

NAGAR, NEW DELHI, DELHI 110025 2

Aadhar Linked Linked

3

FATCA Yes

4

Mobile : 8130933145 UBO No

E-Mail : adilnabikhan@gmail.com 1. Know Your Customer / KYC Identification Number

Phone : Please Provide 2. PAN with Aadhaar Linking Status

3. Foreign Account Tax Compliance Act

4. Ultimate Beneficial Owner

Advisor / Distributor Details

DIRECT ( 000000-0 )

Bank Details

Status : INDIVIDUAL Primary Bank ICICI BANK

Mode of Operation : Single Bank City Delhi

Account Number 003101545522

Nominee Details Account Type Sav

Name Percentage (%) IFSC Code ICIC0000046

Asma Jabeen 100 Payout mode NEFT/RTGS

Additional Banks No

Registered

Summary of Holdings as on 02 January 2024 NAV as on 02 Jan 2024 : Rs. 59.73

Scheme Unit Balance Cost Value (Rs.) Current Value (Rs.) IDCW

Payout (Rs.) Re-investment (Rs.)

PGIM India Midcap Opportunities Fund - Direct Plan - 2,168.890 75,000.00 87,431.46 0.00 0.00

Growth

Total 75,000.00 87,431.46 0.00 0.00

Transactions (03 January 2024 to 03 January 2024)

PGIM India Midcap Opportunities Fund - Direct Plan - Growth ISIN : INF663L01DV3

NAV Date Transaction Type Gross Amount Tax * Net Amount Price Number of Balance

(Rs.) (Rs.) (Rs.) Units Units

03/07/2023 Opening Balance 0.25 1,111.229

03/10/2023 Systematic Investment (Txn Date : 03/10/2023) 15,000.00 0.25 14,999.75 55.1000 272.22 1,383.450

(1/13)

02/11/2023 Systematic Investment (Txn Date : 01/11/2023) (1/1) 15,000.00 0.25 14,999.75 53.9200 278.18 1,661.630

04/12/2023 Systematic Investment (Txn Date : 01/12/2023) (1/1) 15,000.00 0.25 14,999.75 58.5600 256.14 1,917.770

02/01/2024 Systematic Investment (Txn Date : 01/01/2024) (1/1) 15,000.00 0.25 14,999.75 59.7300 251.12 2,168.890

Current Value (Rs.) : 87,431.46 NAV as on 02 Jan 2024 : Rs. 59.73

Advisor : BANAYANTREE SERVICES LIMITED | INA100006898

Pledge / Lien Units : 0.000

Entry Load : NIL; Exit Load : W.E.F 10th Jan 2022, Any redemptions/switch-outs would be subject to an exit load of 0.50%, if the units are redeemed/switched out within 90 days from the date of

allotment of units; NIL - If the units are redeemed/ switched-out after 90 days from the date of allotment of units;

* Stamp Duty applies for inflow transactions, STT applies for outflow transactions and TDS is applicable on redemptions / dividends as per rates prescribed under Income Tax Laws.

You might also like

- S-CIS-Bin Zayed Investments (BARCLAYS)Document5 pagesS-CIS-Bin Zayed Investments (BARCLAYS)adaldlrNo ratings yet

- A 36 Sonal Nagar Part 2 Chandlodiall Opp Gota Road AHMEDABAD - 380060 Gujarat, IndiaDocument2 pagesA 36 Sonal Nagar Part 2 Chandlodiall Opp Gota Road AHMEDABAD - 380060 Gujarat, IndiaNilesh ChauhanNo ratings yet

- From 05-MAR-2021 To 05-MAR-2021: Non-TransferableDocument3 pagesFrom 05-MAR-2021 To 05-MAR-2021: Non-TransferableNeha100% (1)

- Statement of AccountDocument2 pagesStatement of AccountSoumya Ranjan Mohanty Pupun100% (1)

- Celcom Biz Registration-EmployeeDocument2 pagesCelcom Biz Registration-EmployeeFadzir Atan0% (1)

- Mutual Funds.Document2 pagesMutual Funds.Adil KhanNo ratings yet

- Account StatementDocument2 pagesAccount Statementanand mishraNo ratings yet

- Inesco Amc 2106735164Document3 pagesInesco Amc 2106735164spahujNo ratings yet

- Mutual Funds (Icici)Document1 pageMutual Funds (Icici)Adil KhanNo ratings yet

- Statement of Account: L103G SBI Blue Chip Fund - Regular Plan - Growth NAV As On 21/08/2023: 70.2124Document3 pagesStatement of Account: L103G SBI Blue Chip Fund - Regular Plan - Growth NAV As On 21/08/2023: 70.2124pratik patilNo ratings yet

- Acctstmt P 11713974Document1 pageAcctstmt P 11713974nisha goyalNo ratings yet

- P801016536 CleanedDocument1 pageP801016536 CleanedAdil KhanNo ratings yet

- 2jf47ypoohmps64t2ncnddvi5rongpik85jc8hlip yDocument2 pages2jf47ypoohmps64t2ncnddvi5rongpik85jc8hlip yMayank SathoneNo ratings yet

- Venugopal Invesco PDFDocument2 pagesVenugopal Invesco PDFV. Manohar LallNo ratings yet

- Account Statement: KritikaDocument1 pageAccount Statement: KritikaPradeep ChauhanNo ratings yet

- Portfolio Summary: Investor Details Holding Information Hunaid Ali HitawalaDocument3 pagesPortfolio Summary: Investor Details Holding Information Hunaid Ali Hitawalaanshu bohra0% (1)

- MF AccountStatement-unlockedDocument2 pagesMF AccountStatement-unlockedRahul SonawaneNo ratings yet

- Account StatementDocument3 pagesAccount StatementkaushikcitNo ratings yet

- Mb1w9vgei25cx Xv2cwuyqiscokjclzyeupbrnlqcwoDocument3 pagesMb1w9vgei25cx Xv2cwuyqiscokjclzyeupbrnlqcwoRatan SinhaNo ratings yet

- Account Statement: Savita Shivagouda PatilDocument3 pagesAccount Statement: Savita Shivagouda Patilsia kamathNo ratings yet

- Account Statement: Folio No.: 11323206 / 73Document2 pagesAccount Statement: Folio No.: 11323206 / 73Inderpaal SinghNo ratings yet

- Account Statement: Folio No.: 18220401 / 43Document4 pagesAccount Statement: Folio No.: 18220401 / 43Shweta RaniNo ratings yet

- Mutual FundsDocument14 pagesMutual FundsSiddharthNo ratings yet

- Siddharth Canara 17733213733Document3 pagesSiddharth Canara 17733213733SiddharthNo ratings yet

- Prbwcgd4dhrzqkdyw4 Hx0cvi9 Iz0w0mx6xolurm7wDocument2 pagesPrbwcgd4dhrzqkdyw4 Hx0cvi9 Iz0w0mx6xolurm7wdarshansah1990No ratings yet

- G S BhadaniDocument2 pagesG S Bhadanigayamansukh25No ratings yet

- MB137076624R7Document4 pagesMB137076624R7SiddharthNo ratings yet

- Statement of Account As On: 08 Jan 2022: 9563182959 Cust ID: 9013726141 Account / Folio NumberDocument2 pagesStatement of Account As On: 08 Jan 2022: 9563182959 Cust ID: 9013726141 Account / Folio NumberSubha DasNo ratings yet

- Statement of Account For The Period Since Inception To 10 Mar 2021Document2 pagesStatement of Account For The Period Since Inception To 10 Mar 2021Eddie SinghNo ratings yet

- Account Summary As On 31-Mar-2021: Page 1 of 1Document1 pageAccount Summary As On 31-Mar-2021: Page 1 of 1Sachin KhamitkarNo ratings yet

- Account StatementDocument3 pagesAccount StatementKoushik MukherjeeNo ratings yet

- Account Statement: Folio No.: 11323308 / 58Document2 pagesAccount Statement: Folio No.: 11323308 / 58Inderpaal SinghNo ratings yet

- Patanjali YogDocument1 pagePatanjali Yoggaurav_potnisNo ratings yet

- Account StatementDocument3 pagesAccount Statementsia kamathNo ratings yet

- Account Statement: Sip/Stp/SwpDocument2 pagesAccount Statement: Sip/Stp/SwpGanesh PoojatyNo ratings yet

- Tata Mutual Fund: Account StatementDocument4 pagesTata Mutual Fund: Account StatementKirti Kant SrivastavaNo ratings yet

- Folio No. 2054517 / 23: Statement Date: 01-Oct-2021Document1 pageFolio No. 2054517 / 23: Statement Date: 01-Oct-2021Soumya Ranjan Mohanty PupunNo ratings yet

- Statement of Account: L018G SBI Long Term Equity Fund - Regular Plan - Growth NAV As On 22/04/2022: 219.8771Document4 pagesStatement of Account: L018G SBI Long Term Equity Fund - Regular Plan - Growth NAV As On 22/04/2022: 219.8771Kirti Kant SrivastavaNo ratings yet

- Account StatementDocument3 pagesAccount Statementsia kamathNo ratings yet

- Unit Holder Previleges: Account Statement 3012950203 Folio NumberDocument2 pagesUnit Holder Previleges: Account Statement 3012950203 Folio Numberanand mishraNo ratings yet

- Your Portfolio Statement: Folio No. 7991 7743 085Document1 pageYour Portfolio Statement: Folio No. 7991 7743 085miteshNo ratings yet

- Sunil Ramkeshav Dubey Primary Account Holder Name: Your A/C StatusDocument1 pageSunil Ramkeshav Dubey Primary Account Holder Name: Your A/C StatusRaj kumarNo ratings yet

- Portfolio 1700228693331Document3 pagesPortfolio 1700228693331Sumeet SoniNo ratings yet

- Statement of Account: From 01-APR-2020 To 31-MAR-2021Document2 pagesStatement of Account: From 01-APR-2020 To 31-MAR-2021debanwitaNo ratings yet

- Account Statement: Folio Number: 10169457Document2 pagesAccount Statement: Folio Number: 10169457ashishNo ratings yet

- Axis Statement Fy 2020 - 2021Document3 pagesAxis Statement Fy 2020 - 2021ok okNo ratings yet

- Bs 18.04.23Document2 pagesBs 18.04.23harshitNo ratings yet

- Axis Mutual Fund PDFDocument2 pagesAxis Mutual Fund PDFSunil Koricherla100% (1)

- Acctstmt HDocument3 pagesAcctstmt Hrekha nairNo ratings yet

- ELSS Statement UpdatedDocument3 pagesELSS Statement UpdatedNeha JainNo ratings yet

- Folio Details: Sundaram 24/7 Services:: Customer InformationDocument2 pagesFolio Details: Sundaram 24/7 Services:: Customer Informationbakhlaarvind22No ratings yet

- DEEPAKDocument1 pageDEEPAKShivangi SaxenaNo ratings yet

- P3513448674 PDFDocument2 pagesP3513448674 PDFJiban DaleiNo ratings yet

- 558 /5 Sanghrajka House Adenwala Road Near Five Garden Matunga MUMBAI - 400019 Maharashtra, IndiaDocument2 pages558 /5 Sanghrajka House Adenwala Road Near Five Garden Matunga MUMBAI - 400019 Maharashtra, IndiaPankaj GuptaNo ratings yet

- Folio No. 7771 7645 075: Udit VermaDocument2 pagesFolio No. 7771 7645 075: Udit VermaKaran VermaNo ratings yet

- Account Statement: Folio No.: 11325320 / 36Document2 pagesAccount Statement: Folio No.: 11325320 / 36Inderpaal SinghNo ratings yet

- SBI Mutual FundDocument2 pagesSBI Mutual FundAvijeet ChakrabortyNo ratings yet

- Sanjay JajuDocument1 pageSanjay JajuShivangi SaxenaNo ratings yet

- Folio 7775960443 AllMonthsDocument2 pagesFolio 7775960443 AllMonthsPravin AwalkondeNo ratings yet

- Tata Mutual Fund: Account StatementDocument4 pagesTata Mutual Fund: Account StatementJyoti PandeyNo ratings yet

- Account Summary: Page 1 of 1Document1 pageAccount Summary: Page 1 of 1Sachin KhamitkarNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- Restaurant BillDocument2 pagesRestaurant BillpalavjainNo ratings yet

- Memorandum of Agreement: National Coal Wage Agreement-IxDocument52 pagesMemorandum of Agreement: National Coal Wage Agreement-IxbhishmNo ratings yet

- Manila Prince Hotel CaseDocument1 pageManila Prince Hotel CaseDuke SucgangNo ratings yet

- Nonkupuli Fencing BQDocument178 pagesNonkupuli Fencing BQFeysal AbdyNo ratings yet

- Pre Incorporation Checklist by SleekDocument2 pagesPre Incorporation Checklist by SleekatllNo ratings yet

- Vietnam Sector Analysis Transport and Logistics July 2015Document10 pagesVietnam Sector Analysis Transport and Logistics July 2015ROOPDIP MUKHOPADHYAYNo ratings yet

- GST CertificateDocument3 pagesGST CertificateMohan kumarNo ratings yet

- Mswa's Review March - 2013Document36 pagesMswa's Review March - 2013JnanamNo ratings yet

- Anti-Corruption Policy For Microsoft RepresentativesDocument2 pagesAnti-Corruption Policy For Microsoft RepresentativesNehemiah AttigahNo ratings yet

- Sarathi: Pimpri Chinchwad Municipal Corporation Pimpri - 411 018 MaharashtraDocument172 pagesSarathi: Pimpri Chinchwad Municipal Corporation Pimpri - 411 018 MaharashtraNetaji BhosaleNo ratings yet

- GPPB Resolution No. 06-2003Document4 pagesGPPB Resolution No. 06-2003Jill IsaiahNo ratings yet

- 1 - English Brief Ehsaas Amdan ProgrammeDocument3 pages1 - English Brief Ehsaas Amdan ProgrammeAbdul RehmanNo ratings yet

- Oath of Undertaking: (This Document Is Not Valid Without A Dry Seal)Document3 pagesOath of Undertaking: (This Document Is Not Valid Without A Dry Seal)Carol ArenasNo ratings yet

- Lost Property Policy v1 - 0Document16 pagesLost Property Policy v1 - 0Rey Jan N. VillavicencioNo ratings yet

- DD ONLINE CMS LedgerDocument2 pagesDD ONLINE CMS LedgerMUH RIZALNo ratings yet

- Partnerhsip DeedDocument4 pagesPartnerhsip DeedDilshat RaihanaNo ratings yet

- Director Global Operations MBA in Washington DC Resume Karl GinyardDocument2 pagesDirector Global Operations MBA in Washington DC Resume Karl GinyardKarlGinyardNo ratings yet

- API SI - POV.DDAY DS2 en CSV v2 5872776Document17 pagesAPI SI - POV.DDAY DS2 en CSV v2 5872776Любимые СериалыNo ratings yet

- Spa To Sell A Parcel of LandDocument2 pagesSpa To Sell A Parcel of LandOscar Laborem GarciaNo ratings yet

- Certificate of Operation Elevator - DumbwaiterDocument1 pageCertificate of Operation Elevator - DumbwaiterGian Franco ArafilesNo ratings yet

- The China Model PDFDocument19 pagesThe China Model PDFFelipe González RoaNo ratings yet

- KTHDC-4 Government Policies PDFDocument15 pagesKTHDC-4 Government Policies PDFDuẩn Nguyễn ĐìnhNo ratings yet

- Wealth-Insight - Aug 2022Document70 pagesWealth-Insight - Aug 2022Tejas KothariNo ratings yet

- Quarters ApplicationDocument2 pagesQuarters ApplicationPrabhat VermaNo ratings yet

- Od 329783056775680100Document1 pageOd 329783056775680100adityashastrakar6No ratings yet

- Gr.9 Economic Systems NotesDocument5 pagesGr.9 Economic Systems NotesAditi Jayson100% (1)

- Form 6 Leave Paper Revised 2021Document2 pagesForm 6 Leave Paper Revised 2021marites gallardoNo ratings yet

- Employee Nomination FormDocument2 pagesEmployee Nomination FormAbhinandan GowdaNo ratings yet