Professional Documents

Culture Documents

Naukri SAURABHSHAH (10y 0m)

Naukri SAURABHSHAH (10y 0m)

Uploaded by

Amit PathakOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Naukri SAURABHSHAH (10y 0m)

Naukri SAURABHSHAH (10y 0m)

Uploaded by

Amit PathakCopyright:

Available Formats

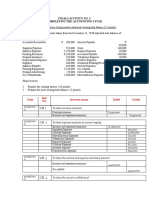

SAURABH SHAH EXPERIENCE

December-2020 till date

➢ Assistant Manager-Finance & Accounts at Montecarlo Limited.

August-2018 to November-2020

➢ Assistant Manager-Accounts at Deep Industries Limited.

February-2016 to July-2018

➢ Assistant Manager-Accounts with

Vishakha Group of Companies.

March -2014 to January -2016

10/B Adhayashkti Apartment, ➢ Senior Accounts Executive with Graffiti Group of Companies.

Suryanagar, Jawahrchock, And Kamdar Carz Pvt. Ltd.

Maninagar, Ahmedabad-08

Gujarat. July- 2013 to February -2014

➢ Audit & Account Assistant with Vimesh Shah & Associates.

+91-99989 37402 October- 2007 to April - 2011

➢ Intern with Vimesh Shah & Associates.

EDUCATION

saurabh89shah@gmail.com ➢ Chartered accountant from the Institute of chartered

accountants of India (May’2013)

➢ Master of commerce from the Gujarat university(April ’2013)

OBJECTIVE

➢ Bachelor of commerce from the Gujarat university(April ’2009)

To pursue a challenging and growth

oriented career in an organization WORK EXPOSURE

that offers opportunities to learn &

grow by delivering the results and Accounting:

contribute to the growth of an • Consolidation of Accounts.

organization by using skills and • Preparation of Annual Reports.

knowledge in the field of account, • Engagement and review of month end and year end activities.

finance, audit and compliance • Review of books of accounts and balance sheet schedules as

per applicable GAAP and IFRS.

• Ledger Scrutiny.

• Reviewing AP, AR and GL function.

• Fixed Assets accounting.

• Prepayment and accrual accounting.

• Review of inter –company reconciliation , transaction and

settlement.

Finance and Budgeting:

• Monthly prepare and submit bank stock statement as per bank

norms in order to secure working capital finance.

• Handling entire gamut of banking activities including fund

management, Letter of Credit, Buyer’s Credit & Bank Guarantee

as well as Foreign Bill Discounting.

• End to end banking process involving LC/BC in favour of

Supplier for procurement of raw material & capex.

• Engagement in preparation of costing & Budgeting relating to

project.

• Cash flow management and preparation.

• Co-ordination with Treasury team for effective cash flow

management.

Taxation:

• Direct tax and Indirect tax compliance relating to TDS and GST and

Income Tax including regular filling of return monthly or quarterly

as applicable.

• Interpretation of changes in applicable laws.

• Implement the changes in tax laws into the system.

• Guide the applicable changes in the tax laws to the team members.

• Keeping updated about the changes in tax laws.

• Completion of tax audit in time and Co-ordination with auditors.

• Preparation of data for the assessment of Income tax

proceedings.

Audit:

• Stock audit.

LANGUAGE PROFICIENCY • Internal audit.

• English • Statutory audit.

• Hindi • Tax Audit.

• Gujarati • Internal Financial Control.

• Process Audit.

SOFTWARE SKILLS • Co -ordination with Internal and statutory auditors for timely

completion of the audit.

• MS Office(Word, Excel, Power point)

• Operating Knowledge of SAP & Other Key areas.

ERP. • MIS reporting per the requirement of the management.

• Profound knowledge of Taxation • Formulation of strategy for reduction in expenses.

software spectrum and Taxman. • Submission of monthly management pack.

• Tally ERP accounting package. • Preparation and review of dashboard relating to account

receivable.

• Dashboard relating to country score cards.

STRENGTHS • Management Accounting.

• Quick learner • People management.

• Decision maker • Process improvement.

• Punctual

PERSONAL INFORMATION

• Enthusiastic

• Date of birth: 18th August,1989.

• Passionate about work

• Marital Status: Single

PROFESSIONAL MEMBERSHIP • Permanent address:

10/B , Adhyashakti

• The Institute of Chartered Apartment,

Accountants of India(Since Suryanagar,

August- 2013) Maninagar,

Ahmedabad-380008

Gujarat,India

You might also like

- Cash App - Apps On Google PlayDocument1 pageCash App - Apps On Google PlayMr McMahonNo ratings yet

- Regulatory Framework For Investment Banking in IndiaDocument2 pagesRegulatory Framework For Investment Banking in IndiaDevanshee Kothari0% (1)

- Nerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Document3 pagesNerissa Mae L. Santos Activity On Completing The Accounting Cycle 1Mica Mae Correa100% (1)

- Priyankar ResumeDocument2 pagesPriyankar ResumeAmit SarkarNo ratings yet

- CA Resume For ReferenceDocument2 pagesCA Resume For Referencevinay.yadav1No ratings yet

- Resume of Hasin SadmanDocument3 pagesResume of Hasin Sadmancitfhatil2017No ratings yet

- Kareem&senior GL AccountantDocument3 pagesKareem&senior GL AccountantKareem KhaledNo ratings yet

- Hidayat Ullal - OriginalDocument2 pagesHidayat Ullal - Originalcfo.dammamNo ratings yet

- سيرة ذاتيةAyshaButtDocument3 pagesسيرة ذاتيةAyshaButtIbrahim A AzzamNo ratings yet

- Arqum (AccA)Document2 pagesArqum (AccA)MisbhasaeedaNo ratings yet

- Resume Mohamed SIDDIKDocument1 pageResume Mohamed SIDDIKKhabari GmailNo ratings yet

- Kareem MohamedDocument4 pagesKareem MohamedKareem KhaledNo ratings yet

- Experience HighlightsDocument3 pagesExperience HighlightsIbrahim A AzzamNo ratings yet

- Ashita VarshneyDocument2 pagesAshita VarshneyThe Cultural CommitteeNo ratings yet

- CA Basava ResumeDocument2 pagesCA Basava ResumeLakshmi Manasa NagumallaNo ratings yet

- Ms. Ei Ei NyeinDocument2 pagesMs. Ei Ei NyeinlmNo ratings yet

- M.saqib, Accounts& Finance, 6 Yrs Experience.Document3 pagesM.saqib, Accounts& Finance, 6 Yrs Experience.Nisar AhmedNo ratings yet

- Accounting Grid: Professional Accounting and Financial ServicesDocument2 pagesAccounting Grid: Professional Accounting and Financial Servicesmuhammad mudassarNo ratings yet

- Resume of Hasin SadmanDocument3 pagesResume of Hasin Sadmancitfhatil2017No ratings yet

- Imran Ul Haq ACMA CGMA MBADocument2 pagesImran Ul Haq ACMA CGMA MBASheza FarooqNo ratings yet

- KARTHIKA SUDHARSANAMResumeDocument2 pagesKARTHIKA SUDHARSANAMResumekarthikaks67No ratings yet

- Mohammed - Thabrez ResumeDocument2 pagesMohammed - Thabrez ResumeMohammed Thabrez INo ratings yet

- Bilal Ahmad Abdul Ghafoor ResumeDocument4 pagesBilal Ahmad Abdul Ghafoor ResumeShohidul IslamNo ratings yet

- Subramanyam DVDocument4 pagesSubramanyam DVthetrilight2023No ratings yet

- Purumalla Harish CVDocument2 pagesPurumalla Harish CVRutwik YadavNo ratings yet

- Naukri ARPITA (11y 0m)Document4 pagesNaukri ARPITA (11y 0m)Sandeep FulhamNo ratings yet

- CV Ca Ankit MaheshwaryDocument2 pagesCV Ca Ankit MaheshwaryAman MathurNo ratings yet

- Anil Dhangar - PresentationDocument1 pageAnil Dhangar - Presentationshivling.dhangar2No ratings yet

- Charted Accountant GuidelinesDocument2 pagesCharted Accountant GuidelinesDhawal GargNo ratings yet

- Ca Mohit Ramani: TH STDocument2 pagesCa Mohit Ramani: TH STMD's Excellence Office TraineeNo ratings yet

- Ali Asgar Resume PDFDocument2 pagesAli Asgar Resume PDFayesha siddiquiNo ratings yet

- Resume Nupur Sharma1Document4 pagesResume Nupur Sharma1Vinod KuNo ratings yet

- Agasi Safarov: Chief Financial OfficerDocument2 pagesAgasi Safarov: Chief Financial OfficerRustam AliyevNo ratings yet

- Anchali AUL: Professional ExperienceDocument3 pagesAnchali AUL: Professional ExperienceranadeyNo ratings yet

- Soham Nath: ProfileDocument2 pagesSoham Nath: ProfileVijay SamuelNo ratings yet

- CV-Asad Khan-ACMA-0419 PDFDocument2 pagesCV-Asad Khan-ACMA-0419 PDFShahzaib SadiqNo ratings yet

- Tripti Arora2Document2 pagesTripti Arora2sujata banerjeeNo ratings yet

- CV SampleDocument2 pagesCV Samplehumag143No ratings yet

- Sanoop Saludheen - Senior AccountantDocument2 pagesSanoop Saludheen - Senior AccountantSanoop SanuNo ratings yet

- Aparna Bhanu ResumeDocument2 pagesAparna Bhanu ResumeDexie Cabañelez ManahanNo ratings yet

- Accountant S Ramshad CVDocument2 pagesAccountant S Ramshad CVramshadNo ratings yet

- Soorya Accountant PDFDocument2 pagesSoorya Accountant PDFFurqan BagwanNo ratings yet

- Resume Ravi BansalDocument2 pagesResume Ravi Bansalaasthapoddar155No ratings yet

- Gurappa SAP FI ConsultantDocument4 pagesGurappa SAP FI ConsultantBabji RohitNo ratings yet

- RESUME Imran Zahid.Document2 pagesRESUME Imran Zahid.Imran ZahidNo ratings yet

- Resume ShwetaDocument1 pageResume ShwetaShweta TatheNo ratings yet

- Amit Koshti ResumeDocument2 pagesAmit Koshti Resumed4mzpt4sshNo ratings yet

- Soheb Jamil: Rocess Inancial NstrumentsDocument3 pagesSoheb Jamil: Rocess Inancial NstrumentsMohammedNo ratings yet

- Ali RazaDocument2 pagesAli RazaFahim FerozNo ratings yet

- Knowledge Musendekwa R CV PDFDocument2 pagesKnowledge Musendekwa R CV PDFknowledge musendekwaNo ratings yet

- Ahmed Bharuchi Resume 4 2022 FinalDocument1 pageAhmed Bharuchi Resume 4 2022 FinalMuzammil Ali SyedNo ratings yet

- Ramshad G Accountant CVDocument2 pagesRamshad G Accountant CVramshadNo ratings yet

- CV CAKPO URIEL BritishDocument2 pagesCV CAKPO URIEL Britishchancia angeNo ratings yet

- Muhammad Aamir Mushtaq: Manager Accounts and TaxationDocument3 pagesMuhammad Aamir Mushtaq: Manager Accounts and TaxationAamir MushtaqNo ratings yet

- Finance Operational Accountant Resume 6Document2 pagesFinance Operational Accountant Resume 6andersonmack047No ratings yet

- Albert E. Herrera - OriginalDocument4 pagesAlbert E. Herrera - OriginalAtul SethNo ratings yet

- Phyu Phyu: Account AssistantDocument2 pagesPhyu Phyu: Account AssistantDazzling YeolmaeeNo ratings yet

- Naukri HiteshNada (5y 0m)Document2 pagesNaukri HiteshNada (5y 0m)mjking3818No ratings yet

- Ashwath Shetty CVDocument2 pagesAshwath Shetty CVNatesh BandlapalliNo ratings yet

- CV Pawan JaniDocument2 pagesCV Pawan JaniKETIKA SharmaNo ratings yet

- ShijoDocument2 pagesShijoRahul Kunniyoor100% (1)

- How to Learn Intuit Quickbooks Quickly!: Intuit Quickbooks Mastery: Quick and Easy LearningFrom EverandHow to Learn Intuit Quickbooks Quickly!: Intuit Quickbooks Mastery: Quick and Easy LearningNo ratings yet

- Quickbooks Desktop Pro 2022 Starter Guide: The Made Easy Accounting Software Manual For Small Business Owners To Manage Their Finances Even AsFrom EverandQuickbooks Desktop Pro 2022 Starter Guide: The Made Easy Accounting Software Manual For Small Business Owners To Manage Their Finances Even AsNo ratings yet

- LIPCReport PremiumCertificate 20240212101433826 C200057358Document1 pageLIPCReport PremiumCertificate 20240212101433826 C200057358Amit PathakNo ratings yet

- 116-ARS-2023-24-116 Revise FMRI OCT-23Document7 pages116-ARS-2023-24-116 Revise FMRI OCT-23Amit PathakNo ratings yet

- Firm Profile - Transaction SquareDocument19 pagesFirm Profile - Transaction SquareAmit PathakNo ratings yet

- EPLM Brochure New 2020-21Document3 pagesEPLM Brochure New 2020-21Amit PathakNo ratings yet

- Naukri HIRENPRAFULSACHDE (11y 0m)Document2 pagesNaukri HIRENPRAFULSACHDE (11y 0m)Amit PathakNo ratings yet

- Naukri ArjunBhansali (3y 0m)Document2 pagesNaukri ArjunBhansali (3y 0m)Amit PathakNo ratings yet

- Assignment AnsDocument6 pagesAssignment AnsVAIGESWARI A/P MANIAM STUDENTNo ratings yet

- Neith: Trial Balance at 31 March 2020 Dr. CRDocument42 pagesNeith: Trial Balance at 31 March 2020 Dr. CRabdulhadisaqib290No ratings yet

- Financial Statement Analysis 11th Edition Test Bank K R SubramanyamDocument46 pagesFinancial Statement Analysis 11th Edition Test Bank K R SubramanyamMarlys Campbell100% (32)

- Financial Services in IndiaDocument5 pagesFinancial Services in IndiavmktptNo ratings yet

- Eonnext Statement 2022 11 02Document4 pagesEonnext Statement 2022 11 02ying yingNo ratings yet

- TOLL Recipt JULY 10 TO 16 2023Document4 pagesTOLL Recipt JULY 10 TO 16 2023Renz Zy BrazaNo ratings yet

- Chapter 3 E - CommerceDocument11 pagesChapter 3 E - CommerceAtaklti TekaNo ratings yet

- Adverse ActionDocument2 pagesAdverse ActioncoreyNo ratings yet

- Preparing FSDocument7 pagesPreparing FSJohn AlbateraNo ratings yet

- Chapter 15: Single Entry Characteristics of Single EntryDocument12 pagesChapter 15: Single Entry Characteristics of Single EntryPaula Bautista100% (2)

- Arranging Finance For ExportDocument14 pagesArranging Finance For ExportmaxsoniiNo ratings yet

- Activity On AbcDocument3 pagesActivity On AbcAvox EverdeenNo ratings yet

- MT 103Document3 pagesMT 103chachouNo ratings yet

- Financial Statements Ias 1Document34 pagesFinancial Statements Ias 1Khalid AzizNo ratings yet

- Customer Account StatementDocument1 pageCustomer Account StatementChemo NgosweNo ratings yet

- Forensic Accounting Activity (US Based) Nasol and SalonDocument3 pagesForensic Accounting Activity (US Based) Nasol and SalonEizel NasolNo ratings yet

- Com BankDocument25 pagesCom BankAnonymous y3E7iaNo ratings yet

- Invoice 4173Document1 pageInvoice 4173Param HeyNo ratings yet

- Sap-Aa P2Document16 pagesSap-Aa P2Wakeel QureshiNo ratings yet

- Bse Star MF User Manual For MFDDocument26 pagesBse Star MF User Manual For MFDSUSHANT YEJARENo ratings yet

- Adjustments and The Ten-Column Work Sheet: What You'll LearnDocument34 pagesAdjustments and The Ten-Column Work Sheet: What You'll LearnJhazz Landagan100% (1)

- Prudential Regulation For Banks andDocument57 pagesPrudential Regulation For Banks andFarzad TouhidNo ratings yet

- Accounting 1 Review Series Worksheet ExercisesDocument14 pagesAccounting 1 Review Series Worksheet ExercisesKayle Mallillin100% (2)

- Journal Entries ServiceDocument4 pagesJournal Entries ServiceJasmine ActaNo ratings yet

- FAR 1 Pre Batch Over All Lecture NotesDocument60 pagesFAR 1 Pre Batch Over All Lecture NotesHadeed HafeezNo ratings yet

- Accounts TodayDocument290 pagesAccounts Todaythomas nationalNo ratings yet

- Non Marketable Financial AssetsDocument3 pagesNon Marketable Financial AssetsSnehal JoshiNo ratings yet