Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

25 viewsCompleting The Accounting Cycle

Completing The Accounting Cycle

Uploaded by

Monica Benitez RicoThe document discusses completing the accounting cycle. It covers three learning objectives: 1) using the worksheet to prepare financial statements, 2) explaining the purpose of closing journal entries and how to close accounts, and 3) preparing a post-closing trial balance. The document provides examples of completing a worksheet, journalizing and posting closing entries to close temporary accounts and bring the accounts to zero, and preparing a post-closing trial balance listing only permanent accounts.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Problem 3-5B: InstructionsDocument4 pagesProblem 3-5B: InstructionsAlba LunaNo ratings yet

- SOB - Accounting For Business Combinations - M1 PDFDocument40 pagesSOB - Accounting For Business Combinations - M1 PDFRyana ConconNo ratings yet

- Accounting Course Latest Outcomes From HCTDocument19 pagesAccounting Course Latest Outcomes From HCTPavan Kumar MylavaramNo ratings yet

- Accounting Survival Guide: An Introduction to Accounting for BeginnersFrom EverandAccounting Survival Guide: An Introduction to Accounting for BeginnersNo ratings yet

- Module 4 Packet: AE 111 - Financial Accounting & ReportingDocument28 pagesModule 4 Packet: AE 111 - Financial Accounting & ReportingHelloNo ratings yet

- Tle 10 Entrepreneurship 2 Quarter 4 Module 1 Caligdong 2Document14 pagesTle 10 Entrepreneurship 2 Quarter 4 Module 1 Caligdong 2johnklientantiguaNo ratings yet

- Nobles Finmgr6 PPT 04 RevisedDocument64 pagesNobles Finmgr6 PPT 04 RevisedzezegallyNo ratings yet

- Financial Accounting and Reporting - SLK - 03Document24 pagesFinancial Accounting and Reporting - SLK - 03Its Nico & SandyNo ratings yet

- Full Download PDF of (Ebook PDF) Accounting: Basic Reports 10th Edition All ChapterDocument43 pagesFull Download PDF of (Ebook PDF) Accounting: Basic Reports 10th Edition All Chapterpiressltana100% (4)

- Fin02 - Financial Statement and ReportsDocument82 pagesFin02 - Financial Statement and ReportserinlomioNo ratings yet

- Ch04 SM Larson FAP16Document64 pagesCh04 SM Larson FAP16josjhNo ratings yet

- Computer Accounting With Quickbooks Online A Cloud Based Approach 1st Edition Yacht Solutions ManualDocument10 pagesComputer Accounting With Quickbooks Online A Cloud Based Approach 1st Edition Yacht Solutions Manualjubasticky.vlvus2100% (27)

- Cruz, Aiyana Gabrielle - CFAS 04Document3 pagesCruz, Aiyana Gabrielle - CFAS 04Misha Laine de LeonNo ratings yet

- Fa PPT CH 3 - 7eDocument69 pagesFa PPT CH 3 - 7eMaria GomezNo ratings yet

- CH3 Titman 12eDocument84 pagesCH3 Titman 12elouise carinoNo ratings yet

- Diploma in Accounting 2010editDocument319 pagesDiploma in Accounting 2010editSeverino Valerio100% (2)

- Module Template FIN 327 (Financial Analysis and Reporting)Document20 pagesModule Template FIN 327 (Financial Analysis and Reporting)Normae AnnNo ratings yet

- Tanauan Institute, Inc.: Using The Worksheet and Closing and Reversing Entries - Finishing The Accounting CycleDocument10 pagesTanauan Institute, Inc.: Using The Worksheet and Closing and Reversing Entries - Finishing The Accounting CycleHanna CaraigNo ratings yet

- Financial AccountingDocument7 pagesFinancial AccountingMbaliChristieNo ratings yet

- Module 5 - Statement of Changes in Equity PDFDocument7 pagesModule 5 - Statement of Changes in Equity PDFSandyNo ratings yet

- Completion of The Accounting PDFDocument10 pagesCompletion of The Accounting PDFZairah HamanaNo ratings yet

- 22 AE 111 Module 4 Adjusting EntriesDocument16 pages22 AE 111 Module 4 Adjusting EntriesslacsonNo ratings yet

- Fin02 - Financial Statement and ReportsDocument41 pagesFin02 - Financial Statement and ReportsGenieffer Kate Gulfo100% (1)

- Book-Keeping and Accounts Level 2 April 2012Document22 pagesBook-Keeping and Accounts Level 2 April 2012Cary LeeNo ratings yet

- NCERT Solutions for Class 11 Accountancy Chapter 9 Financial Statements 1Document44 pagesNCERT Solutions for Class 11 Accountancy Chapter 9 Financial Statements 1harshbut15No ratings yet

- Lesson Proper & Learning Activities: Accounting CycleDocument4 pagesLesson Proper & Learning Activities: Accounting CycleHazel Joy UgatesNo ratings yet

- ACC 203 Main Course (R.B. Jat)Document196 pagesACC 203 Main Course (R.B. Jat)Rolfu Bambido Looken100% (1)

- Prepare Operational Budget ModuleDocument22 pagesPrepare Operational Budget Modulehundelamesa2023No ratings yet

- The Conceptual Framework of AccountingDocument34 pagesThe Conceptual Framework of AccountingSuzanne Paderna100% (1)

- Git3e CH 02Document48 pagesGit3e CH 02Edgar Iván Díaz CadenaNo ratings yet

- ACC1701X Course OutlineDocument9 pagesACC1701X Course Outlinekhoo zitingNo ratings yet

- Las Fabm1 Q4 W2Document31 pagesLas Fabm1 Q4 W2nahatdoganNo ratings yet

- ABM-FABM2 12 - Q1 - W2 - Mod2Document16 pagesABM-FABM2 12 - Q1 - W2 - Mod2Jose John Vocal83% (18)

- Business and Management 2: Fundamentals of AccountancyDocument11 pagesBusiness and Management 2: Fundamentals of AccountancyZed MercyNo ratings yet

- Business School: ACCT1501 Accounting and Financial Management 1A Session 1 2015Document14 pagesBusiness School: ACCT1501 Accounting and Financial Management 1A Session 1 2015Patricia ArgeseanuNo ratings yet

- Preparing Financial Reports For Single ProprietorshipDocument22 pagesPreparing Financial Reports For Single Proprietorshipandrea.begulbuilderscorpNo ratings yet

- Test Bank for Financial Accounting in an Economic Context, 10th by Pratt download pdf full chapterDocument54 pagesTest Bank for Financial Accounting in an Economic Context, 10th by Pratt download pdf full chaptermaulmegofile100% (4)

- Tanauan Institute, Inc.: Adjusting EntriesDocument8 pagesTanauan Institute, Inc.: Adjusting EntriesHanna CaraigNo ratings yet

- HanduotDocument20 pagesHanduotTegene TesfayeNo ratings yet

- FundamentalsofABM1 Week15 Module12Document6 pagesFundamentalsofABM1 Week15 Module12RDC Clothing AvenueNo ratings yet

- Tutorial Letter 102/3/2022: General Financial ReportingDocument110 pagesTutorial Letter 102/3/2022: General Financial ReportingMelissaNo ratings yet

- Ncert SolutionsDocument33 pagesNcert SolutionsArif ShaikhNo ratings yet

- General Accounting Principle Notes UPSC EPFO EO 2020Document14 pagesGeneral Accounting Principle Notes UPSC EPFO EO 2020Prince SaviourNo ratings yet

- First Semester - AY 2020-2021: C-AE13: Financial Accounting and ReportingDocument6 pagesFirst Semester - AY 2020-2021: C-AE13: Financial Accounting and Reportingfirestorm riveraNo ratings yet

- Information Sheet - BKKPG-8 - Preparing Financial StatementsDocument10 pagesInformation Sheet - BKKPG-8 - Preparing Financial StatementsEron Roi Centina-gacutanNo ratings yet

- Week 2 Managerial FinanceDocument64 pagesWeek 2 Managerial FinanceCalista Elvina JesslynNo ratings yet

- PGDCM FM Bitc0476 22 Assignment 21 01 2023Document12 pagesPGDCM FM Bitc0476 22 Assignment 21 01 2023Saffu PatelNo ratings yet

- Learning Unit 2 $3Document8 pagesLearning Unit 2 $3mmasalekNo ratings yet

- PDF Solution Manual For College Accounting A Career Approach 13Th Edition Cathy J Scott Online Ebook Full ChapterDocument131 pagesPDF Solution Manual For College Accounting A Career Approach 13Th Edition Cathy J Scott Online Ebook Full Chapterharold.morrison944100% (8)

- Flores, Erika - CFAS 04Document3 pagesFlores, Erika - CFAS 04Misha Laine de LeonNo ratings yet

- ACC CourseDocument22 pagesACC Courseshah md musleminNo ratings yet

- Module 11 ICT 141Document3 pagesModule 11 ICT 141Janice SeterraNo ratings yet

- Financial Accounting and Reporting Notes PDFDocument232 pagesFinancial Accounting and Reporting Notes PDFsmlingwa75% (4)

- Assignment 1 StudentDocument3 pagesAssignment 1 StudentAssagNo ratings yet

- 11 MODULE 4 For AE 19Document14 pages11 MODULE 4 For AE 19Yvonne Marie DavilaNo ratings yet

- Level 3 SyllabusDocument17 pagesLevel 3 SyllabusBon Bon ChanNo ratings yet

- Accounting 2 - 2nd ModuleDocument8 pagesAccounting 2 - 2nd ModuleJessalyn Sarmiento Tancio100% (1)

- Business Finance: FinalDocument8 pagesBusiness Finance: FinalBryanNo ratings yet

- Intermediate Course Study Material: TaxationDocument31 pagesIntermediate Course Study Material: Taxationtauseefalam917No ratings yet

- L6 LG Financial Accounting Dec11Document14 pagesL6 LG Financial Accounting Dec11IamThe BossNo ratings yet

- MHDDocument6 pagesMHDSakariyeFarooleNo ratings yet

- Writing A Mini CritiqueDocument17 pagesWriting A Mini CritiqueMonica Benitez RicoNo ratings yet

- Module 3Document6 pagesModule 3Monica Benitez RicoNo ratings yet

- Dev Reading and Cur DevDocument63 pagesDev Reading and Cur DevMonica Benitez RicoNo ratings yet

- Developmental Reading and Curriculum DevelopmentDocument24 pagesDevelopmental Reading and Curriculum DevelopmentMonica Benitez RicoNo ratings yet

- Evaluating and Adapting Materials-Report ContentDocument3 pagesEvaluating and Adapting Materials-Report ContentMonica Benitez RicoNo ratings yet

- Eng 48 Midterm ModuleDocument9 pagesEng 48 Midterm ModuleMonica Benitez RicoNo ratings yet

- English 57 Prelim Module 2Document4 pagesEnglish 57 Prelim Module 2Monica Benitez RicoNo ratings yet

- PDF 20230126 232922 0000Document10 pagesPDF 20230126 232922 0000Monica Benitez RicoNo ratings yet

- MEDUSADocument17 pagesMEDUSAMonica Benitez RicoNo ratings yet

- Module 1 Technology For Teaching and Learning 1Document12 pagesModule 1 Technology For Teaching and Learning 1Monica Benitez Rico67% (3)

- Module 1 Technology For Teaching and Learning 1Document12 pagesModule 1 Technology For Teaching and Learning 1Monica Benitez RicoNo ratings yet

- Prelim ExamDocument2 pagesPrelim ExamMonica Benitez RicoNo ratings yet

- Motion For Extension of Time To File Petition For CertiorariDocument5 pagesMotion For Extension of Time To File Petition For CertiorariIML2016100% (2)

- Class Xii 2020-21 (Accountancy) Assignment 1 (Not For Profit Organisation)Document4 pagesClass Xii 2020-21 (Accountancy) Assignment 1 (Not For Profit Organisation)P Janaki RamanNo ratings yet

- Test Bank For Business Ethics Case Studies and Selected Readings 7th EditionDocument13 pagesTest Bank For Business Ethics Case Studies and Selected Readings 7th Editionuntradedfantan3wg75100% (28)

- Guaranty and Suretyship CasesDocument82 pagesGuaranty and Suretyship Cases001nooneNo ratings yet

- Hong Kong HistoryDocument26 pagesHong Kong HistoryEmryNo ratings yet

- Pyrogel Xt-E MsdsDocument11 pagesPyrogel Xt-E MsdsjitendraNo ratings yet

- The Globalization of RageDocument14 pagesThe Globalization of RagepgotovkinNo ratings yet

- Amazing Grace Sorpano y PianoDocument4 pagesAmazing Grace Sorpano y PianoRoberto ErazoNo ratings yet

- En 10240Document19 pagesEn 10240Ayman Hamed Malah100% (2)

- Crime in Dar Es SalaamDocument64 pagesCrime in Dar Es SalaamUnited Nations Human Settlements Programme (UN-HABITAT)No ratings yet

- ĐỀ TOEIC READING - TỪ MS HOA TOEICDocument43 pagesĐỀ TOEIC READING - TỪ MS HOA TOEICTrang NguyễnNo ratings yet

- 41Document2 pages41KennethAnthonyMagdamitNo ratings yet

- #1 - CID Murder Mystery Problem #2 - Detective Hercule Murder Mystery PuzzleDocument6 pages#1 - CID Murder Mystery Problem #2 - Detective Hercule Murder Mystery Puzzleferml20100% (1)

- Tax Invoice Cum Acknowledgement Receipt of PAN Application (Form 49A)Document1 pageTax Invoice Cum Acknowledgement Receipt of PAN Application (Form 49A)Mahakaal Digital PointNo ratings yet

- NatwestDocument1 pageNatwestVinay SinghNo ratings yet

- Collegium System PDFDocument7 pagesCollegium System PDFVaalu MuthuNo ratings yet

- PCB Quote 1003Document1 pagePCB Quote 1003rhedmishNo ratings yet

- SRT Practice SetDocument3 pagesSRT Practice SetVinay Sharma100% (2)

- Sinas: PNP To Resume BMI Monitoring To Ensure No Cop Is ObeseDocument2 pagesSinas: PNP To Resume BMI Monitoring To Ensure No Cop Is Obesenut_crackreNo ratings yet

- The Story of Charlie "Two Shoes" TsuiDocument8 pagesThe Story of Charlie "Two Shoes" Tsuisavannahnow.comNo ratings yet

- Buenaflor Car Services Vs Cezar Durumpili David Jr. Case DigestDocument4 pagesBuenaflor Car Services Vs Cezar Durumpili David Jr. Case DigestLex Cabilte100% (1)

- April SBIDocument5 pagesApril SBIRahul kumarNo ratings yet

- Licit - Physically and Judicially Possible - Determinate or Determinable - Possible Equivalent in MoneyDocument7 pagesLicit - Physically and Judicially Possible - Determinate or Determinable - Possible Equivalent in MoneyFrederick Brotherton MeyerNo ratings yet

- Marcoso v. CADocument2 pagesMarcoso v. CAPrincess Samantha SarcedaNo ratings yet

- Ch. 3: Exploration & Colonization TestDocument2 pagesCh. 3: Exploration & Colonization TestJulie GerberNo ratings yet

- Memorandum: Rule 198 of WBSR, PTDocument2 pagesMemorandum: Rule 198 of WBSR, PTMd. Sahir KhanNo ratings yet

- Anyang Riheng Trading Co., LTD: Commercial InvoiceDocument5 pagesAnyang Riheng Trading Co., LTD: Commercial InvoiceHi-Ness EnterprisesNo ratings yet

- Contract: Buyer Details Organisation DetailsDocument3 pagesContract: Buyer Details Organisation DetailsNachiket KolapkarNo ratings yet

Completing The Accounting Cycle

Completing The Accounting Cycle

Uploaded by

Monica Benitez Rico0 ratings0% found this document useful (0 votes)

25 views23 pagesThe document discusses completing the accounting cycle. It covers three learning objectives: 1) using the worksheet to prepare financial statements, 2) explaining the purpose of closing journal entries and how to close accounts, and 3) preparing a post-closing trial balance. The document provides examples of completing a worksheet, journalizing and posting closing entries to close temporary accounts and bring the accounts to zero, and preparing a post-closing trial balance listing only permanent accounts.

Original Description:

Completing the Accounting Cycle NCII

Original Title

Completing the Accounting Cycle

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses completing the accounting cycle. It covers three learning objectives: 1) using the worksheet to prepare financial statements, 2) explaining the purpose of closing journal entries and how to close accounts, and 3) preparing a post-closing trial balance. The document provides examples of completing a worksheet, journalizing and posting closing entries to close temporary accounts and bring the accounts to zero, and preparing a post-closing trial balance listing only permanent accounts.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

25 views23 pagesCompleting The Accounting Cycle

Completing The Accounting Cycle

Uploaded by

Monica Benitez RicoThe document discusses completing the accounting cycle. It covers three learning objectives: 1) using the worksheet to prepare financial statements, 2) explaining the purpose of closing journal entries and how to close accounts, and 3) preparing a post-closing trial balance. The document provides examples of completing a worksheet, journalizing and posting closing entries to close temporary accounts and bring the accounts to zero, and preparing a post-closing trial balance listing only permanent accounts.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 23

COMPLETING THE

ACCOUNTING

CYCLE

Presented by:

MS. ALICIA G. BAÑAS, Ph.D, CPA, LPT, CSEE

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

Learning Objectives

1. Use the worksheet to

prepare financial statements

2. Explain the purpose of

closing journal entries

3. Prepare the post-closing

trial balance

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

Learning Objective 1

Use the worksheet to prepare

financial statements

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

How Could a Worksheet Help in

Preparing Financial Statements?

The first four sections of the worksheet (see Chapter F:3)

helped determine the adjusted trial balance, from which we

prepare financial statements.

Income Statement

Includes only revenue and expense accounts

Balance Sheet

Includes asset, liability, and equity accounts except

revenues and expenses

Determine Net Income or Net Loss

The balancing amount for the income statement and

balance sheet sections (will be the same amount)

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

Exhibit F:4-4 Completed Worksheet

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

Learning Objective 2

Explain the purpose of,

journalize, and post closing

entries

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

What Is the Closing Process, and How

Do We Close the Accounts? (1 of 3)

The closing process zeroes out all revenue and expense

accounts in order to measure each period’s net income

separately from all other periods.

Temporary accounts relate to a particular accounting

period and are closed at the end of that period.

Revenues, expenses, Income Summary, and Owner,

Withdrawal accounts

Permanent accounts are not closed at the end of the

period.

Asset, liability, and Owner, Capital accounts

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

What Is the Closing Process, and How

Do We Close the Accounts? (2 of 3)

Closing entries transfer revenues, expenses, and

Owner, Withdrawals to Owner, Capital.

Revenues and expenses may be transferred first to an

account titled Income Summary.

Income Summary is a temporary account that

summarizes the net income (or net loss) for the

period.

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

What Is the Closing Process, and How

Do We Close the Accounts? (3 of 3)

Exhibit F:4-5 The Closing Process

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

Closing Temporary Accounts—Net

Income for the Period (1 of 7)

Step 1: Make the revenue accounts equal zero via the Income

Summary account.

Example: Smart Touch Learning has a P17,500 credit balance in

Service Revenue. The closing entry would be:

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

Closing Temporary Accounts—Net

Income for the Period (2 of 7)

Step 2: Make expense accounts equal zero via the Income

Summary account.

Example: Smart Touch Learning has a P3,000 debit

balance in Rent Expense account. It will be closed with a

credit to Rent Expense:

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

Closing Temporary Accounts—Net

Income for the Period (3 of 7)

In a compound closing entry, each individual expense account is

credited and the Income Summary account is debited for the total

amount of expenses:

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

Closing Temporary Accounts—Net

Income for the Period (4 of 7)

The Income Summary T-account after closing revenues

and expenses is:

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

Closing Temporary Accounts—Net

Income for the Period (5 of 7)

Step 3: Make the Income Summary account equal zero via the

Owner, Capital account.

Example: Smart Touch Learning’s P8,550 credit balance in the

Income Summary account will be closed to Bright, Capital:

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

Closing Temporary Accounts—Net

Income for the Period (6 of 7)

Step 4: Make the Owner, Withdrawals account equal zero via the

Bright, Capital account.

Example: Smart Touch Learning’s P5,000 debit balance in the

Bright, Withdrawals account will be closed to Bright, Capital:

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

Closing Temporary Accounts—Net

Income for the Period (7 of 7)

Smart Touch Learning’s P5,000 debit balance in the Bright,

Withdrawals account will be closed to Bright, Capital:

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

Closing Temporary Accounts—Net

Loss for the Period

If a business had a net loss for the period, the closing entry

to close the Income Summary account would be different.

Example: If a business had a net loss of P2,000:

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

Closing Temporary Accounts—

Summary (1 of 2)

Exhibit F:4-6

Journalizing and Posting

Closing Entries

Panel A: Journalizing

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

Closing Temporary Accounts—

Summary (2 of 2)

[Exhibit F:4-6 continued] Panel B: Posting

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

Learning Objective 3

Prepare the post-closing trial

balance

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

How Do We Prepare a Post-Closing

Trial Balance? (1 of 2)

The accounting cycle ends with a post-closing trial

balance:

A list of the accounts and their balances at the end of the

period, after journalizing and posting the closing entries

Includes only permanent accounts

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

How Do We Prepare a Post-Closing

Trial Balance? (2 of 2)

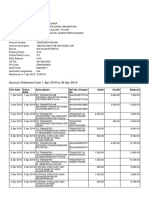

Exhibit F:4-7 Post-Closing Trial Balance

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

Copyright

This work is protected by United States copyright laws and is

provided solely for the use of instructors in teaching their courses

and assessing student learning. Dissemination or sale of any part

of this work (including on the World Wide Web) will destroy the

integrity of the work and is not permitted. The work and materials

from it should never be made available to students except by

instructors using the accompanying text in their classes. All

recipients of this work are expected to abide by these restrictions

and to honor the intended pedagogical purposes and the needs of

other instructors who rely on these materials.

Copyright © 2021 Pearson Education, Inc. All Rights Reserved

You might also like

- Problem 3-5B: InstructionsDocument4 pagesProblem 3-5B: InstructionsAlba LunaNo ratings yet

- SOB - Accounting For Business Combinations - M1 PDFDocument40 pagesSOB - Accounting For Business Combinations - M1 PDFRyana ConconNo ratings yet

- Accounting Course Latest Outcomes From HCTDocument19 pagesAccounting Course Latest Outcomes From HCTPavan Kumar MylavaramNo ratings yet

- Accounting Survival Guide: An Introduction to Accounting for BeginnersFrom EverandAccounting Survival Guide: An Introduction to Accounting for BeginnersNo ratings yet

- Module 4 Packet: AE 111 - Financial Accounting & ReportingDocument28 pagesModule 4 Packet: AE 111 - Financial Accounting & ReportingHelloNo ratings yet

- Tle 10 Entrepreneurship 2 Quarter 4 Module 1 Caligdong 2Document14 pagesTle 10 Entrepreneurship 2 Quarter 4 Module 1 Caligdong 2johnklientantiguaNo ratings yet

- Nobles Finmgr6 PPT 04 RevisedDocument64 pagesNobles Finmgr6 PPT 04 RevisedzezegallyNo ratings yet

- Financial Accounting and Reporting - SLK - 03Document24 pagesFinancial Accounting and Reporting - SLK - 03Its Nico & SandyNo ratings yet

- Full Download PDF of (Ebook PDF) Accounting: Basic Reports 10th Edition All ChapterDocument43 pagesFull Download PDF of (Ebook PDF) Accounting: Basic Reports 10th Edition All Chapterpiressltana100% (4)

- Fin02 - Financial Statement and ReportsDocument82 pagesFin02 - Financial Statement and ReportserinlomioNo ratings yet

- Ch04 SM Larson FAP16Document64 pagesCh04 SM Larson FAP16josjhNo ratings yet

- Computer Accounting With Quickbooks Online A Cloud Based Approach 1st Edition Yacht Solutions ManualDocument10 pagesComputer Accounting With Quickbooks Online A Cloud Based Approach 1st Edition Yacht Solutions Manualjubasticky.vlvus2100% (27)

- Cruz, Aiyana Gabrielle - CFAS 04Document3 pagesCruz, Aiyana Gabrielle - CFAS 04Misha Laine de LeonNo ratings yet

- Fa PPT CH 3 - 7eDocument69 pagesFa PPT CH 3 - 7eMaria GomezNo ratings yet

- CH3 Titman 12eDocument84 pagesCH3 Titman 12elouise carinoNo ratings yet

- Diploma in Accounting 2010editDocument319 pagesDiploma in Accounting 2010editSeverino Valerio100% (2)

- Module Template FIN 327 (Financial Analysis and Reporting)Document20 pagesModule Template FIN 327 (Financial Analysis and Reporting)Normae AnnNo ratings yet

- Tanauan Institute, Inc.: Using The Worksheet and Closing and Reversing Entries - Finishing The Accounting CycleDocument10 pagesTanauan Institute, Inc.: Using The Worksheet and Closing and Reversing Entries - Finishing The Accounting CycleHanna CaraigNo ratings yet

- Financial AccountingDocument7 pagesFinancial AccountingMbaliChristieNo ratings yet

- Module 5 - Statement of Changes in Equity PDFDocument7 pagesModule 5 - Statement of Changes in Equity PDFSandyNo ratings yet

- Completion of The Accounting PDFDocument10 pagesCompletion of The Accounting PDFZairah HamanaNo ratings yet

- 22 AE 111 Module 4 Adjusting EntriesDocument16 pages22 AE 111 Module 4 Adjusting EntriesslacsonNo ratings yet

- Fin02 - Financial Statement and ReportsDocument41 pagesFin02 - Financial Statement and ReportsGenieffer Kate Gulfo100% (1)

- Book-Keeping and Accounts Level 2 April 2012Document22 pagesBook-Keeping and Accounts Level 2 April 2012Cary LeeNo ratings yet

- NCERT Solutions for Class 11 Accountancy Chapter 9 Financial Statements 1Document44 pagesNCERT Solutions for Class 11 Accountancy Chapter 9 Financial Statements 1harshbut15No ratings yet

- Lesson Proper & Learning Activities: Accounting CycleDocument4 pagesLesson Proper & Learning Activities: Accounting CycleHazel Joy UgatesNo ratings yet

- ACC 203 Main Course (R.B. Jat)Document196 pagesACC 203 Main Course (R.B. Jat)Rolfu Bambido Looken100% (1)

- Prepare Operational Budget ModuleDocument22 pagesPrepare Operational Budget Modulehundelamesa2023No ratings yet

- The Conceptual Framework of AccountingDocument34 pagesThe Conceptual Framework of AccountingSuzanne Paderna100% (1)

- Git3e CH 02Document48 pagesGit3e CH 02Edgar Iván Díaz CadenaNo ratings yet

- ACC1701X Course OutlineDocument9 pagesACC1701X Course Outlinekhoo zitingNo ratings yet

- Las Fabm1 Q4 W2Document31 pagesLas Fabm1 Q4 W2nahatdoganNo ratings yet

- ABM-FABM2 12 - Q1 - W2 - Mod2Document16 pagesABM-FABM2 12 - Q1 - W2 - Mod2Jose John Vocal83% (18)

- Business and Management 2: Fundamentals of AccountancyDocument11 pagesBusiness and Management 2: Fundamentals of AccountancyZed MercyNo ratings yet

- Business School: ACCT1501 Accounting and Financial Management 1A Session 1 2015Document14 pagesBusiness School: ACCT1501 Accounting and Financial Management 1A Session 1 2015Patricia ArgeseanuNo ratings yet

- Preparing Financial Reports For Single ProprietorshipDocument22 pagesPreparing Financial Reports For Single Proprietorshipandrea.begulbuilderscorpNo ratings yet

- Test Bank for Financial Accounting in an Economic Context, 10th by Pratt download pdf full chapterDocument54 pagesTest Bank for Financial Accounting in an Economic Context, 10th by Pratt download pdf full chaptermaulmegofile100% (4)

- Tanauan Institute, Inc.: Adjusting EntriesDocument8 pagesTanauan Institute, Inc.: Adjusting EntriesHanna CaraigNo ratings yet

- HanduotDocument20 pagesHanduotTegene TesfayeNo ratings yet

- FundamentalsofABM1 Week15 Module12Document6 pagesFundamentalsofABM1 Week15 Module12RDC Clothing AvenueNo ratings yet

- Tutorial Letter 102/3/2022: General Financial ReportingDocument110 pagesTutorial Letter 102/3/2022: General Financial ReportingMelissaNo ratings yet

- Ncert SolutionsDocument33 pagesNcert SolutionsArif ShaikhNo ratings yet

- General Accounting Principle Notes UPSC EPFO EO 2020Document14 pagesGeneral Accounting Principle Notes UPSC EPFO EO 2020Prince SaviourNo ratings yet

- First Semester - AY 2020-2021: C-AE13: Financial Accounting and ReportingDocument6 pagesFirst Semester - AY 2020-2021: C-AE13: Financial Accounting and Reportingfirestorm riveraNo ratings yet

- Information Sheet - BKKPG-8 - Preparing Financial StatementsDocument10 pagesInformation Sheet - BKKPG-8 - Preparing Financial StatementsEron Roi Centina-gacutanNo ratings yet

- Week 2 Managerial FinanceDocument64 pagesWeek 2 Managerial FinanceCalista Elvina JesslynNo ratings yet

- PGDCM FM Bitc0476 22 Assignment 21 01 2023Document12 pagesPGDCM FM Bitc0476 22 Assignment 21 01 2023Saffu PatelNo ratings yet

- Learning Unit 2 $3Document8 pagesLearning Unit 2 $3mmasalekNo ratings yet

- PDF Solution Manual For College Accounting A Career Approach 13Th Edition Cathy J Scott Online Ebook Full ChapterDocument131 pagesPDF Solution Manual For College Accounting A Career Approach 13Th Edition Cathy J Scott Online Ebook Full Chapterharold.morrison944100% (8)

- Flores, Erika - CFAS 04Document3 pagesFlores, Erika - CFAS 04Misha Laine de LeonNo ratings yet

- ACC CourseDocument22 pagesACC Courseshah md musleminNo ratings yet

- Module 11 ICT 141Document3 pagesModule 11 ICT 141Janice SeterraNo ratings yet

- Financial Accounting and Reporting Notes PDFDocument232 pagesFinancial Accounting and Reporting Notes PDFsmlingwa75% (4)

- Assignment 1 StudentDocument3 pagesAssignment 1 StudentAssagNo ratings yet

- 11 MODULE 4 For AE 19Document14 pages11 MODULE 4 For AE 19Yvonne Marie DavilaNo ratings yet

- Level 3 SyllabusDocument17 pagesLevel 3 SyllabusBon Bon ChanNo ratings yet

- Accounting 2 - 2nd ModuleDocument8 pagesAccounting 2 - 2nd ModuleJessalyn Sarmiento Tancio100% (1)

- Business Finance: FinalDocument8 pagesBusiness Finance: FinalBryanNo ratings yet

- Intermediate Course Study Material: TaxationDocument31 pagesIntermediate Course Study Material: Taxationtauseefalam917No ratings yet

- L6 LG Financial Accounting Dec11Document14 pagesL6 LG Financial Accounting Dec11IamThe BossNo ratings yet

- MHDDocument6 pagesMHDSakariyeFarooleNo ratings yet

- Writing A Mini CritiqueDocument17 pagesWriting A Mini CritiqueMonica Benitez RicoNo ratings yet

- Module 3Document6 pagesModule 3Monica Benitez RicoNo ratings yet

- Dev Reading and Cur DevDocument63 pagesDev Reading and Cur DevMonica Benitez RicoNo ratings yet

- Developmental Reading and Curriculum DevelopmentDocument24 pagesDevelopmental Reading and Curriculum DevelopmentMonica Benitez RicoNo ratings yet

- Evaluating and Adapting Materials-Report ContentDocument3 pagesEvaluating and Adapting Materials-Report ContentMonica Benitez RicoNo ratings yet

- Eng 48 Midterm ModuleDocument9 pagesEng 48 Midterm ModuleMonica Benitez RicoNo ratings yet

- English 57 Prelim Module 2Document4 pagesEnglish 57 Prelim Module 2Monica Benitez RicoNo ratings yet

- PDF 20230126 232922 0000Document10 pagesPDF 20230126 232922 0000Monica Benitez RicoNo ratings yet

- MEDUSADocument17 pagesMEDUSAMonica Benitez RicoNo ratings yet

- Module 1 Technology For Teaching and Learning 1Document12 pagesModule 1 Technology For Teaching and Learning 1Monica Benitez Rico67% (3)

- Module 1 Technology For Teaching and Learning 1Document12 pagesModule 1 Technology For Teaching and Learning 1Monica Benitez RicoNo ratings yet

- Prelim ExamDocument2 pagesPrelim ExamMonica Benitez RicoNo ratings yet

- Motion For Extension of Time To File Petition For CertiorariDocument5 pagesMotion For Extension of Time To File Petition For CertiorariIML2016100% (2)

- Class Xii 2020-21 (Accountancy) Assignment 1 (Not For Profit Organisation)Document4 pagesClass Xii 2020-21 (Accountancy) Assignment 1 (Not For Profit Organisation)P Janaki RamanNo ratings yet

- Test Bank For Business Ethics Case Studies and Selected Readings 7th EditionDocument13 pagesTest Bank For Business Ethics Case Studies and Selected Readings 7th Editionuntradedfantan3wg75100% (28)

- Guaranty and Suretyship CasesDocument82 pagesGuaranty and Suretyship Cases001nooneNo ratings yet

- Hong Kong HistoryDocument26 pagesHong Kong HistoryEmryNo ratings yet

- Pyrogel Xt-E MsdsDocument11 pagesPyrogel Xt-E MsdsjitendraNo ratings yet

- The Globalization of RageDocument14 pagesThe Globalization of RagepgotovkinNo ratings yet

- Amazing Grace Sorpano y PianoDocument4 pagesAmazing Grace Sorpano y PianoRoberto ErazoNo ratings yet

- En 10240Document19 pagesEn 10240Ayman Hamed Malah100% (2)

- Crime in Dar Es SalaamDocument64 pagesCrime in Dar Es SalaamUnited Nations Human Settlements Programme (UN-HABITAT)No ratings yet

- ĐỀ TOEIC READING - TỪ MS HOA TOEICDocument43 pagesĐỀ TOEIC READING - TỪ MS HOA TOEICTrang NguyễnNo ratings yet

- 41Document2 pages41KennethAnthonyMagdamitNo ratings yet

- #1 - CID Murder Mystery Problem #2 - Detective Hercule Murder Mystery PuzzleDocument6 pages#1 - CID Murder Mystery Problem #2 - Detective Hercule Murder Mystery Puzzleferml20100% (1)

- Tax Invoice Cum Acknowledgement Receipt of PAN Application (Form 49A)Document1 pageTax Invoice Cum Acknowledgement Receipt of PAN Application (Form 49A)Mahakaal Digital PointNo ratings yet

- NatwestDocument1 pageNatwestVinay SinghNo ratings yet

- Collegium System PDFDocument7 pagesCollegium System PDFVaalu MuthuNo ratings yet

- PCB Quote 1003Document1 pagePCB Quote 1003rhedmishNo ratings yet

- SRT Practice SetDocument3 pagesSRT Practice SetVinay Sharma100% (2)

- Sinas: PNP To Resume BMI Monitoring To Ensure No Cop Is ObeseDocument2 pagesSinas: PNP To Resume BMI Monitoring To Ensure No Cop Is Obesenut_crackreNo ratings yet

- The Story of Charlie "Two Shoes" TsuiDocument8 pagesThe Story of Charlie "Two Shoes" Tsuisavannahnow.comNo ratings yet

- Buenaflor Car Services Vs Cezar Durumpili David Jr. Case DigestDocument4 pagesBuenaflor Car Services Vs Cezar Durumpili David Jr. Case DigestLex Cabilte100% (1)

- April SBIDocument5 pagesApril SBIRahul kumarNo ratings yet

- Licit - Physically and Judicially Possible - Determinate or Determinable - Possible Equivalent in MoneyDocument7 pagesLicit - Physically and Judicially Possible - Determinate or Determinable - Possible Equivalent in MoneyFrederick Brotherton MeyerNo ratings yet

- Marcoso v. CADocument2 pagesMarcoso v. CAPrincess Samantha SarcedaNo ratings yet

- Ch. 3: Exploration & Colonization TestDocument2 pagesCh. 3: Exploration & Colonization TestJulie GerberNo ratings yet

- Memorandum: Rule 198 of WBSR, PTDocument2 pagesMemorandum: Rule 198 of WBSR, PTMd. Sahir KhanNo ratings yet

- Anyang Riheng Trading Co., LTD: Commercial InvoiceDocument5 pagesAnyang Riheng Trading Co., LTD: Commercial InvoiceHi-Ness EnterprisesNo ratings yet

- Contract: Buyer Details Organisation DetailsDocument3 pagesContract: Buyer Details Organisation DetailsNachiket KolapkarNo ratings yet