Professional Documents

Culture Documents

Far Chapter 2 II Lkas 16 en

Far Chapter 2 II Lkas 16 en

Uploaded by

Tiran WijemanneOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Far Chapter 2 II Lkas 16 en

Far Chapter 2 II Lkas 16 en

Uploaded by

Tiran WijemanneCopyright:

Available Formats

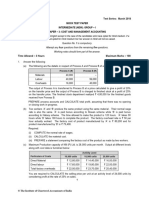

Level 3 – Financial Reporting (FAR)

The following amendments will be tested for the AAT examinations held on or after July 2022.

Chapter 2 Part II

2.9.4.1 LKAS 16 - The Property, Plant and Equipment have been revised with effect from 01 January 2022 and

the following changes are applicable accordingly.

The amendment prohibits an entity from deducting the net amount (Sales-cost) received from selling items

produced while such entity is preparing the assets for its intended use from the cost of property, plant and

equipment. Instead, a company will recognize such sales proceeds and related costs in profits or loss

statement. Entities will therefore need to distinguish between costs associated with producing and selling

items before the item of PPE is available for use and costs associated with making the item of PPE available for

its intended use.

Entities must disclose followings with regard to the sale of items that are not part of the entity’s ordinary

activities,

(i) Disclose separately the sales proceeds and related production cost recognized in profit or loss;

(ii) Specify the line items in which such proceeds and costs are included in the statement of

comprehensive income.

Example

XYZ Limited has purchased machinery in 01.04.2019. The information relating to that item is as follows.

Purchase Price is Rs. 1,000,000 and the discount received on the purchase is 10%.

Import duties of Rs. 100,000 and non- refundable taxes of Rs. 60,000 have been paid at the time of

importing the machine.

Rs. 50,000 has been incurred as transport cost to bring the asset to the site. Rs.35,000 and Rs. 50,000

respectively have been incurred for the site preparation and fixing the machine.

Engineering service has been obtained to fix the machine and testing the machine. It was amounted to

Rs. 30,000.

Just after the fixing a test run was carried out and raw material cost of Rs.35,000/- was incurred for

testing. It is received a net sales value of Rs. 90,000/- by selling of the samples produced during the test

run.

Rs. 15,000 was incurred to remove the old machine to fix the new machine.

An insurance policy was obtained, in order to cover the future losses resulting on the machine. Rs. 58,000

was paid as insurance installment.

You are required to: Calculate the cost of the machine.

Answer

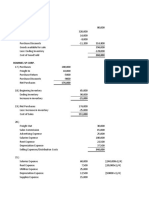

Before revising the LKAS 16 After revise the LKAS 16

Purchase price of the machine 1,100,000 1,100,000

Import Duties 100,000 100,000

Non- Refundable taxes 60,000 60,000

1,260,000 1,260,000

Deductions

Trade Discounts (1,000,000 * 10%) (100,000) (100,000)

1,150,000 1,150,000

Other Costs

Engineer’s Fee 30,000 30,000

Transport cost 50,000 50,000

Site Preparation cost 35,000 35,000

Fixing cost 25,000 25,000

Net proceeds from the sale of products (55,000) Not allowed to deduct

manufactured during testing

(90,000-35,000)

Cost incurred on the removal 15,000 15,000

Cost to be capitalized 1,260,000 1,315,000

You might also like

- Machinery and Capitl ExpendituresDocument18 pagesMachinery and Capitl ExpendituresAnne Estrella0% (1)

- SSP Form United KingdomDocument2 pagesSSP Form United KingdomEduard Tirziu100% (1)

- E BusinessDocument25 pagesE BusinessNikshitha100% (1)

- Null 10Document3 pagesNull 10Ali nawazNo ratings yet

- Income Statement - ProblemsDocument4 pagesIncome Statement - ProblemsKatlene JoyNo ratings yet

- ABC and CashFlow QuestionDocument11 pagesABC and CashFlow QuestionTerryDemetrioCesar100% (1)

- Costs 1 Unit 1 ExercisesDocument15 pagesCosts 1 Unit 1 ExercisesScribdTranslationsNo ratings yet

- Sums On Transactional ValueDocument15 pagesSums On Transactional ValuePrakrithi D NNo ratings yet

- Income Tax June 2023-Dec 2020Document116 pagesIncome Tax June 2023-Dec 2020binuNo ratings yet

- Management & Financial AccountingDocument6 pagesManagement & Financial AccountingAnamitra SenNo ratings yet

- Cost Sheet - Extra SumsDocument12 pagesCost Sheet - Extra SumsPiyush ChhimwalNo ratings yet

- AS 10.docx - 20240320 - 221218 - 0000Document10 pagesAS 10.docx - 20240320 - 221218 - 0000hencika07No ratings yet

- Excercise ProblemsDocument7 pagesExcercise ProblemsKatherine EderosasNo ratings yet

- ABC Questions SolvedDocument6 pagesABC Questions SolvedMedhaNo ratings yet

- Chapter 29 Machinery Capital Expenditures and Revenue Expenditures PDF FreeDocument9 pagesChapter 29 Machinery Capital Expenditures and Revenue Expenditures PDF FreeSherri BonquinNo ratings yet

- As 10Document8 pagesAs 10krithika vasanNo ratings yet

- CMA Inter Management Accounting Importent QuestionsDocument37 pagesCMA Inter Management Accounting Importent QuestionsHarriniNo ratings yet

- MOJICO, BERNIE - Week 1 Activity Answer Sheet - FINALDocument14 pagesMOJICO, BERNIE - Week 1 Activity Answer Sheet - FINAL버니 모지코No ratings yet

- 12914sugg Pe2 gp2 1Document33 pages12914sugg Pe2 gp2 1harshrathore17579No ratings yet

- Accounting - X Is The Manufacture of MumbaiDocument4 pagesAccounting - X Is The Manufacture of MumbaiSailpoint CourseNo ratings yet

- Cost & Management - X Is The Manufacture of MumbaiDocument6 pagesCost & Management - X Is The Manufacture of MumbaiSailpoint CourseNo ratings yet

- Chapter 27Document7 pagesChapter 27Shane Ivory ClaudioNo ratings yet

- Management and Financial Accounting Assessment-2Document6 pagesManagement and Financial Accounting Assessment-2saranyaNo ratings yet

- Minglana, Mitch T. BSA - 301 Quiz 2 Problem 1Document5 pagesMinglana, Mitch T. BSA - 301 Quiz 2 Problem 1Mitch MinglanaNo ratings yet

- Management and Financial Accounting: (Assignment-2)Document10 pagesManagement and Financial Accounting: (Assignment-2)kashish Agarwal100% (1)

- Overhead HWDocument2 pagesOverhead HWTheint Myat KyalsinNo ratings yet

- Case AnalysisDocument5 pagesCase AnalysisChetan Dasgupta0% (1)

- Cost Accounting Smart WorkDocument25 pagesCost Accounting Smart WorkmaacmampadNo ratings yet

- Costing MTP g1Document198 pagesCosting MTP g1Jattu TatiNo ratings yet

- Home Assignment FADocument14 pagesHome Assignment FAMohit SharmaNo ratings yet

- Acccob3 HW9Document33 pagesAcccob3 HW9Reshawn Kimi SantosNo ratings yet

- Group 2-Fin 6000BDocument7 pagesGroup 2-Fin 6000BBellindah wNo ratings yet

- Particulars Units Unit Cost (RS) Total Cost (RS)Document3 pagesParticulars Units Unit Cost (RS) Total Cost (RS)ginish12No ratings yet

- Sem - III CA II AtktDocument4 pagesSem - III CA II Atktabp1677No ratings yet

- IDT CA FINAL Full Question Paper 20may 2016Document22 pagesIDT CA FINAL Full Question Paper 20may 2016Bhanu DangNo ratings yet

- 73256bos559103 Inter p3Document26 pages73256bos559103 Inter p3Ajith SMNo ratings yet

- Simdora Manufacturing Private LTD: Project Report OnDocument14 pagesSimdora Manufacturing Private LTD: Project Report OnShivam DashottarNo ratings yet

- 268,800 Rommel SP CorpDocument10 pages268,800 Rommel SP CorpnovyNo ratings yet

- Advacc 3 Answer Key Set A 165pcsDocument3 pagesAdvacc 3 Answer Key Set A 165pcsPearl Mae De VeasNo ratings yet

- Audit of Property, Plant and Equipment: Auditing ProblemsDocument5 pagesAudit of Property, Plant and Equipment: Auditing ProblemsLei PangilinanNo ratings yet

- Villanueva, JaneDocument14 pagesVillanueva, JaneVillanueva, Jane G.No ratings yet

- FYMMS Cost and MA AssignmentDocument2 pagesFYMMS Cost and MA AssignmentRahul Nishad100% (1)

- Cost & Management Accounting MBADocument4 pagesCost & Management Accounting MBAashwinimore811No ratings yet

- Category Cost of Asset Accumulated DepreciationDocument10 pagesCategory Cost of Asset Accumulated DepreciationAaliyah ManuelNo ratings yet

- Skans School of Accountancy Cost & Management Accounting - Caf 08 Class Test # 1Document4 pagesSkans School of Accountancy Cost & Management Accounting - Caf 08 Class Test # 1maryNo ratings yet

- 2.manufacturing Accounts IllustrationDocument2 pages2.manufacturing Accounts Illustrationdaniel.maina2005No ratings yet

- Formative Assessment On Relative CostDocument8 pagesFormative Assessment On Relative CostChai MarapaoNo ratings yet

- Tug AsDocument5 pagesTug Asihalalis5202100% (2)

- Business Taxation: (Malawi)Document11 pagesBusiness Taxation: (Malawi)angaNo ratings yet

- A) 1-Adjustment 1: Closing InventoryDocument12 pagesA) 1-Adjustment 1: Closing InventoryTuba AkbarNo ratings yet

- Hba 2302 Advanced TaxationDocument4 pagesHba 2302 Advanced TaxationprescoviaNo ratings yet

- Imp 2203 - Costing - Question PaperDocument5 pagesImp 2203 - Costing - Question PaperAnshit BahediaNo ratings yet

- 7-28 7-29 The Direct MethodDocument5 pages7-28 7-29 The Direct MethodJohn Carlo AquinoNo ratings yet

- Fabm2 First Grading ReviewerDocument3 pagesFabm2 First Grading ReviewerjhomarNo ratings yet

- A.) Land: Problem No.1Document7 pagesA.) Land: Problem No.1MARICEL URBINANo ratings yet

- Addisu Tadesse Adj FSDocument6 pagesAddisu Tadesse Adj FSGali AbamededNo ratings yet

- Test Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingDocument7 pagesTest Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingMusic WorldNo ratings yet

- Business Accounting and Finance: QUESTION 1 (P17-2A)Document9 pagesBusiness Accounting and Finance: QUESTION 1 (P17-2A)sang_ratu_1No ratings yet

- Paper 3 Cost and Management Accounting PDFDocument6 pagesPaper 3 Cost and Management Accounting PDFMEGHANANo ratings yet

- DAIBB MA Math Solutions 290315Document11 pagesDAIBB MA Math Solutions 290315joyNo ratings yet

- Cost and Management Accounting IpcnDocument20 pagesCost and Management Accounting IpcnlahotishreyanshNo ratings yet

- Interim Order in The Matter of Shri Ram Real Estate and Business Solution Ltd.Document17 pagesInterim Order in The Matter of Shri Ram Real Estate and Business Solution Ltd.Shyam Sunder100% (1)

- Final Requirements: Logistics Management BA-519Document5 pagesFinal Requirements: Logistics Management BA-519GINANo ratings yet

- Cost Management PlanDocument10 pagesCost Management PlanpthavNo ratings yet

- Economics of Education: A Research Agenda: PergamonDocument6 pagesEconomics of Education: A Research Agenda: PergamonEmmanuel MuswaloNo ratings yet

- Marketing Sales & DistributionDocument43 pagesMarketing Sales & DistributionAli SaifyNo ratings yet

- ADFIANP - Semi-Final Examination - 2016NDocument3 pagesADFIANP - Semi-Final Examination - 2016NKenneth Bryan Tegerero TegioNo ratings yet

- Trevor Winchester Swan Volume Ii Contributions To Economic Theory and Policy Peter L Swan All ChapterDocument47 pagesTrevor Winchester Swan Volume Ii Contributions To Economic Theory and Policy Peter L Swan All Chapterfelipe.canada376100% (9)

- The Effect of Customer Relationship Management (CRM) Concept Adoption On Customer Satisfaction - Customers PerspectiveDocument171 pagesThe Effect of Customer Relationship Management (CRM) Concept Adoption On Customer Satisfaction - Customers PerspectiveMaheenNo ratings yet

- Consumer Behavior MicroeconomicsDocument44 pagesConsumer Behavior MicroeconomicsecobibaNo ratings yet

- Auditing Problems Preweek Batch 4Document13 pagesAuditing Problems Preweek Batch 4Gosu TROLLNo ratings yet

- Markowitz ModelDocument47 pagesMarkowitz Modelpaulraju_86100% (2)

- Income Tax Vol-Ii New PDFDocument352 pagesIncome Tax Vol-Ii New PDFGaurav Beniwal100% (1)

- Assignment Chapter 4/6Document4 pagesAssignment Chapter 4/6Muhammad Tahir NawazNo ratings yet

- Tech TalkDocument2 pagesTech TalkManu KrishNo ratings yet

- Module 1 Organizational DevelopmentDocument64 pagesModule 1 Organizational DevelopmentConrad EsguerraNo ratings yet

- Fibonacci Tool - How To UseDocument6 pagesFibonacci Tool - How To UseSaurabh DuaNo ratings yet

- University of Panama Faculty of Business Administration and AccountingDocument4 pagesUniversity of Panama Faculty of Business Administration and AccountingIsabel Krizel SánchezNo ratings yet

- International Macroeconomics 4Th Edition Feenstra Test Bank Full Chapter PDFDocument54 pagesInternational Macroeconomics 4Th Edition Feenstra Test Bank Full Chapter PDFPatriciaSimonrdio100% (10)

- Lesson 10 Monopoly Learning CompetenciesDocument14 pagesLesson 10 Monopoly Learning CompetenciesDianne Jane LirayNo ratings yet

- A4 Growealth Survey Oct 2020 PDFDocument1 pageA4 Growealth Survey Oct 2020 PDFAlois KudzaiNo ratings yet

- DK Goel Solutions Class 12 Accountancy Chapter 4 Admission of A PartnerDocument1 pageDK Goel Solutions Class 12 Accountancy Chapter 4 Admission of A Partnergipige3911No ratings yet

- How To Develop New Profit Centers: Mike Pownall, DVMDocument2 pagesHow To Develop New Profit Centers: Mike Pownall, DVMAditya Pratama SarwonoNo ratings yet

- Athlete Warehouse Case Study - Written Assignement Unit 05Document3 pagesAthlete Warehouse Case Study - Written Assignement Unit 05Gideon DegbeNo ratings yet

- Amanta Resources LimitedDocument2 pagesAmanta Resources Limitedkaiselk50% (2)

- ADR and GDRDocument3 pagesADR and GDRJonney MarkNo ratings yet

- Homework 4題目Document2 pagesHomework 4題目劉百祥No ratings yet

- ACE - Company ProfileDocument2 pagesACE - Company ProfileAhmer TalalNo ratings yet

- Revised Pharmaceutical Supply Transformation Plan 2018-2020Document76 pagesRevised Pharmaceutical Supply Transformation Plan 2018-2020Demis TeshomeNo ratings yet