Professional Documents

Culture Documents

Accounts Test Paper From Jeegyasa

Accounts Test Paper From Jeegyasa

Uploaded by

Anushka KunduCopyright:

Available Formats

You might also like

- Statement - Nov 2019 2Document13 pagesStatement - Nov 2019 2Jack Carroll (Attorney Jack B. Carroll)No ratings yet

- Finance Case Study2 FINALDocument6 pagesFinance Case Study2 FINALDan Carlo Delgado PoblacionNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Pitch Deck Sample For StartupsDocument24 pagesPitch Deck Sample For StartupsKetan JajuNo ratings yet

- Intro To Consulting SlidesDocument34 pagesIntro To Consulting Slidesmanojben100% (2)

- Blackbook Project On CSR of Mahindra Amp MahindraDocument56 pagesBlackbook Project On CSR of Mahindra Amp Mahindrasupriya patekar43% (7)

- Mock TestDocument8 pagesMock TestDiksha DudejaNo ratings yet

- Accountancy QP XiDocument4 pagesAccountancy QP XiMohammedNo ratings yet

- +1 Accountancy ONLINE Final Examination 2021Document5 pages+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalNo ratings yet

- Cbse XI 2019-2020 Annual ExamDocument6 pagesCbse XI 2019-2020 Annual Exammadhavmanoj08No ratings yet

- 11th AccountDocument3 pages11th Accountnmzrv8jfq8No ratings yet

- Accounts ExamDocument5 pagesAccounts Examsoulvloggers321No ratings yet

- AtibhaDocument7 pagesAtibhaAangry VermaNo ratings yet

- Session Ending Examination 2019Document7 pagesSession Ending Examination 2019madhudevi06435No ratings yet

- Model Paper, Accountancy, XIDocument13 pagesModel Paper, Accountancy, XIanyaNo ratings yet

- Screenshot 2023-02-21 at 1.23.27 AMDocument12 pagesScreenshot 2023-02-21 at 1.23.27 AMGracy AroraNo ratings yet

- Account Test 2Document5 pagesAccount Test 2klaw6048No ratings yet

- Part - A: (Financial Accounting - I)Document16 pagesPart - A: (Financial Accounting - I)Adit Bohra VIII BNo ratings yet

- Namma Kalvi 11th Accountancy Model Questin Paper EM 221452Document8 pagesNamma Kalvi 11th Accountancy Model Questin Paper EM 221452sharonjamesappuNo ratings yet

- Accountancy PaperDocument7 pagesAccountancy PapersumitaNo ratings yet

- Book Keeping FivDocument6 pagesBook Keeping FivALE MEDIANo ratings yet

- Progress Test-4 (Chapters 1 and 2)Document4 pagesProgress Test-4 (Chapters 1 and 2)buraale94No ratings yet

- MCQ QuestionsDocument6 pagesMCQ QuestionsANo ratings yet

- 11 Sample Papers Accountancy 2Document10 pages11 Sample Papers Accountancy 2AvcelNo ratings yet

- 2) 3) Mark. 1. 2. A+C L-C A-L 4. 6. - 7. L Loan Debt: Examination, November-?Oi7Document4 pages2) 3) Mark. 1. 2. A+C L-C A-L 4. 6. - 7. L Loan Debt: Examination, November-?Oi7Best ThingsNo ratings yet

- 23 Accounts-RTP-DecemberDocument32 pages23 Accounts-RTP-Decemberjustinbieberm77No ratings yet

- Accounts Prelim Paper 28-11-23Document4 pagesAccounts Prelim Paper 28-11-23roshanchoudhary4350No ratings yet

- RTP Dec2023 p1Document32 pagesRTP Dec2023 p1Vaibhav M S100% (1)

- ICAI MOCK TEST CA FOUNDATION DECEMBER 2022 Paper 1 Principles andDocument6 pagesICAI MOCK TEST CA FOUNDATION DECEMBER 2022 Paper 1 Principles andArpit GuptaNo ratings yet

- Cbse 11 Accounts CH 9 To 15 Revision WorksheetDocument9 pagesCbse 11 Accounts CH 9 To 15 Revision WorksheetRiwaanNo ratings yet

- Exam Practice Questions - Holiday Work - Yr 10 - 2023 - 2024Document35 pagesExam Practice Questions - Holiday Work - Yr 10 - 2023 - 2024MUSTHARI KHANNo ratings yet

- Model Question Paper Class 11 AccountsDocument97 pagesModel Question Paper Class 11 AccountsAbel Soby Joseph100% (3)

- Explain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Document4 pagesExplain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Anita PanigrahiNo ratings yet

- Practice PaperDocument13 pagesPractice PaperArush BlagganaNo ratings yet

- 11 Accountancy First Term Set BDocument6 pages11 Accountancy First Term Set Bmcsworkshop777No ratings yet

- XI Account QPDocument7 pagesXI Account QPtanushsoni37No ratings yet

- Foundation Accounts Suggested May19Document23 pagesFoundation Accounts Suggested May19Aman SinghNo ratings yet

- 11 Accountancy First Term Set ADocument6 pages11 Accountancy First Term Set Amcsworkshop777No ratings yet

- FA Question Bank TT1-1Document14 pagesFA Question Bank TT1-1rock SINGHALNo ratings yet

- Accountancy Sample Paper Final ImportantDocument18 pagesAccountancy Sample Paper Final ImportantChitra Vasu100% (1)

- Amardeep XI First TermDocument8 pagesAmardeep XI First TermAnahita GuptaNo ratings yet

- Accountancy Sample Paper 2Document8 pagesAccountancy Sample Paper 2mcrekhaaNo ratings yet

- Accounts RTP Foundation Nov 2020Document25 pagesAccounts RTP Foundation Nov 2020Jayasurya MuruganathanNo ratings yet

- Acc Paper Class 11Document16 pagesAcc Paper Class 11Varsha AswaniNo ratings yet

- ACCT 1Document15 pagesACCT 1Joyce OcarizaNo ratings yet

- Acc Xi Class Test-I 2022Document4 pagesAcc Xi Class Test-I 2022shaurya kapoorNo ratings yet

- Sample Paper 5 (Final Exam XI Accountancy)Document9 pagesSample Paper 5 (Final Exam XI Accountancy)pritanshutripathi84No ratings yet

- 11 Sample Papers Accountancy 2020 English Medium Set 3Document10 pages11 Sample Papers Accountancy 2020 English Medium Set 3Joshi DrcpNo ratings yet

- Class XI Acc SM Arya Annual 2023-24Document5 pagesClass XI Acc SM Arya Annual 2023-24pandeyansh962No ratings yet

- Acct Practice PaperDocument11 pagesAcct Practice PaperKrish BajajNo ratings yet

- F3 Book Keeping Monthly Test Feb 2024Document6 pagesF3 Book Keeping Monthly Test Feb 2024abdulsamadm1982No ratings yet

- FA (1st) Dec2017Document3 pagesFA (1st) Dec2017dkdjfNo ratings yet

- Acctg1 MidtermDocument6 pagesAcctg1 MidtermKevin Elrey Arce50% (4)

- Book KeepingDocument6 pagesBook KeepingALE MEDIANo ratings yet

- Review Materials The Accounting Process To Accounts ReceivableDocument7 pagesReview Materials The Accounting Process To Accounts ReceivableMarin, Nicole DondoyanoNo ratings yet

- 2nd Quarter Final Exam Oct. 2019Document3 pages2nd Quarter Final Exam Oct. 2019awdasdNo ratings yet

- CA Foundation Paper 1 Principles and Practice of Accounting SADocument24 pagesCA Foundation Paper 1 Principles and Practice of Accounting SAavula Venkatrao100% (1)

- Test Paper Ca FoundDocument5 pagesTest Paper Ca FoundSarangapani KaliyamoorthyNo ratings yet

- FAR Midterm QuizDocument2 pagesFAR Midterm QuizAllyy DelacruzNo ratings yet

- CA Foundation Accounts RTP May 2023Document32 pagesCA Foundation Accounts RTP May 2023PushkarNo ratings yet

- FA Weekend TestDocument5 pagesFA Weekend TestIryne MerrieNo ratings yet

- 11 Accountancy SP 01Document33 pages11 Accountancy SP 01Haridas OngallurNo ratings yet

- RTP Accounting CA Foundation May 18Document35 pagesRTP Accounting CA Foundation May 18kanishk bahetiNo ratings yet

- 1st Puc Accountancy Midterm Question Paper Nov 2017-Mandya PDFDocument10 pages1st Puc Accountancy Midterm Question Paper Nov 2017-Mandya PDFBest ThingsNo ratings yet

- Am Banklaunches MalaysiasfirstonlinedebtDocument2 pagesAm Banklaunches MalaysiasfirstonlinedebthairyzaltNo ratings yet

- Measuring The Quality of Health Services in AlgeriaDocument14 pagesMeasuring The Quality of Health Services in Algeriaamialotfi20No ratings yet

- EBAY Five ForceDocument14 pagesEBAY Five ForceXiaofang Li100% (4)

- Unemployment and Underemploymentin Rural IndiaDocument9 pagesUnemployment and Underemploymentin Rural IndiaPranavVohraNo ratings yet

- Plan de AfacereDocument18 pagesPlan de AfacereYani CanciuNo ratings yet

- New Standing Order Instruction Nwi50000eDocument1 pageNew Standing Order Instruction Nwi50000ejamalazoz05No ratings yet

- Chapter 8Document31 pagesChapter 8laurenbondy44No ratings yet

- The Business 2.0 VocabularyDocument18 pagesThe Business 2.0 VocabularyGIBRAN CASTAÑEDANo ratings yet

- Cases CH 8Document4 pagesCases CH 8YurmaNo ratings yet

- COST SHEET NumericalsDocument9 pagesCOST SHEET Numericalsmisaki chanNo ratings yet

- Assignment Case Study NegotationDocument6 pagesAssignment Case Study Negotationfkjhvb,No ratings yet

- BUSINESS PROPOSAL SEC A - Group 3Document25 pagesBUSINESS PROPOSAL SEC A - Group 3sanandi DASNo ratings yet

- Thesis Paper On AIBLDocument131 pagesThesis Paper On AIBLMd Khaled NoorNo ratings yet

- The First Assignment For StrategyDocument7 pagesThe First Assignment For StrategySơn TùngNo ratings yet

- Dealings in Properties and The Withholding Tax SystemDocument38 pagesDealings in Properties and The Withholding Tax SystemKenzel lawasNo ratings yet

- BIS Sample Database - IIIDocument2 pagesBIS Sample Database - IIIAarti IyerNo ratings yet

- Importance of Consumer KnowledgeDocument66 pagesImportance of Consumer Knowledgezenith160% (1)

- Nisha CVDocument2 pagesNisha CVNisha SinhaNo ratings yet

- Brksec-1021 (2018)Document84 pagesBrksec-1021 (2018)Paul ZetoNo ratings yet

- Solutions Nss NC 19Document8 pagesSolutions Nss NC 19lethiphuongdanNo ratings yet

- Exporters and Shipping Importers in KuwaitDocument35 pagesExporters and Shipping Importers in Kuwaitgobudas3No ratings yet

- Little Oil CompanyDocument10 pagesLittle Oil CompanyJosann Welch100% (1)

- Business English 4 Test SamplesDocument2 pagesBusiness English 4 Test SamplesAlinaArcanaNo ratings yet

- How To Create Killer Sales Playbooks GuideDocument14 pagesHow To Create Killer Sales Playbooks GuideLeonie Newbury100% (1)

- Globalización? Análisis de Su Marketing-Mix Internacional: Mango: ¿Un Caso de Estrategia y Política deDocument15 pagesGlobalización? Análisis de Su Marketing-Mix Internacional: Mango: ¿Un Caso de Estrategia y Política demichxel psNo ratings yet

Accounts Test Paper From Jeegyasa

Accounts Test Paper From Jeegyasa

Uploaded by

Anushka KunduOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounts Test Paper From Jeegyasa

Accounts Test Paper From Jeegyasa

Uploaded by

Anushka KunduCopyright:

Available Formats

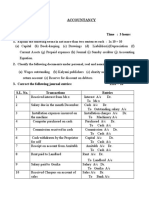

JEEGYASA CLASSES

VI - XII

ACCOUNTS

CLASS- XI

Total Time : 3 hours Total Marks : 80

SECTION A

Question 1 : Choose the correct option from the following :- (1 x 20)

i. The concept that a business enterprise will not be sold or liquidated in the near future is

known as:

a. Business Entity Concept

b. Money Measurement Concept

c. Matching Concept

d. Going Concern Concept

ii. Cost price or realisable value, whichever is less, is used for the valuation of:

a. Current Assets

b. Fixed Assets

c. All assets

d. Closing Stock

iii. Due to which of the following window dressing is prohibited:

a. Convention of Consistency

b. Accounting Period Concept

c. Convention of full Disclosure

d. Money Measurement Concept

iv. According to which concept the same accounting methods should be used each year:

a. Prudence

b. Materiality

c. Full Disclosure

d. Consistency

v. Nature of Accounting Standards is:

a. They direct as to how the transactions should be recorded

b. They make the financial statements comparable

c. They provide information as to the basis on which financial statements have been

prepared

d. All of the above

vi. Accounting Standards are needed:

a. To bring uniformity in the financial statements of different enterprises

b. To limit the area within which accountant has to function

c. To bring clarity in accounting terminology

d. All of the Above

JEEGYASA CLASSES 9007440392

vii. Accounting standards are formulated by

a. By Planning Commission

b. By Institute of Chartered Accountants of India

c. By Companies Act

d. By Institute of Company Secretaries of India

viii. Adopting of Accounting Standards is mandatory for :

a. Sole Traders

b. Companies

c. Partnership Firms

d. All of the Above

ix. Which equation is correct out of the following:

a. Assets = Liabilities – Capital

b. Assets = Capital – Liabilities

c. Assets = Capital + liabilities

d. Assets = Net worth – Liabilities

x. Which equation is correct out of the following:

a. Liabilities = Assets + Capital

b. Assets = Liabilities – Capital

c. Capital = Assets - Liabilities

d. Capital = Assets + Liabilities

xi. Which equation is incorrect out of the following :

a. Assets = Liabilities + Capital

b. Capital = Assets – Liabilities

c. Liabilities = Assets – Capital

d. Assets = Liabilities – Capital

xii. Voucher is prepared for

a. Cash Received and Paid

b. Cash or Credit Sales

c. Cash or Credit Purchases

d. All of the above

xiii. Which of the following items is shown on the Debit side of Trial Balance :

a. Commission Received A/c

b. Bank Overdraft A/c

c. Bills Receivable A/c

d. Bills Payable A/c

xiv. When a transaction is completely omitted to be recorded in the books, it is called:

a. Error of Principle

b. Compensating Error

c. Error of Omission

d. Error of Commission

JEEGYASA CLASSES 9007440392

xv. If wages paid for installation of new machinery is debited to Wages Account, it will be

called :

a. Error of Principle

b. Compensating Error

c. Error of Ommission

d. Error of Commission

xvi. Out of the following, balance of which account is shown on the credit side of Trial

Balance:

a. Purchases A/c

b. Sales Return A/c

c. Discount Received A/c

d. Bills Receivable A/c

xvii. Goods sold to Sethi for 640 was recorded in his account as 460. In the rectifying entry,

Sethi's A/c will be debited with:

a. 180 b. 640 c. 1100 d. 460

xviii. Sohan returned goods to us amounting 4,200 but was recorded as 2,400 in his account.

In the rectifying entry, Sohan's A/c will be credited with:

a. 1800 b. 2400 c. 4200 d. 6600

xix. Purchased goods from Gopal for 3,600 but was recorded in Gopal's A/c as 6,300. In the

rectifying entry, Gopal's A/c will be debited with:

a. 9900 b. 2700 c. 3600 d. 6300

xx. Suspense Account is a

a. Real Account b. Nominal Account c. Personal Account

e. Any of these

SECTION B

Question 2 : On 1st August 2021, Gadore Ltd. purchased a machinery for 3,00,000. On 1st November,

2022 another machinery was purchased for 1,80,000. On 1st July 2023, the machine purchased on

1st August, 2017 was sold for 1,68,000 and on the same date a fresh machinery was purchased for

₹2,00,000. Depreciation was provided @ 10% p.a. on the Reducing Balance Method. Books are

closed on 31st March every year.

You are required to prepare Machinery Account and Provision for Depreciation Account for three

years ending 31st March, 2024. ( Marks 8)

Question 3 : Pass the following Journal Entries in the Books of RCB LTD. Bangalore. (Marks 8)

Jan 2024 PARTICULARS

1 Purchased goods from Karunakaran of Chennai for 1,00,000. (IGST @18%)

3 Sold goods to Ganeshan of Bengaluru for 1,50,000. (CGST @6% and SGST @6%)

8 Sold goods to S. Nair of Kerala for ₹2,60,000. (IGST @18%)

11 Purchased Machinery for 80,000 from Surya Ltd. against cheque. (CGST @9% and

SGST @9%)

14 Paid rent 30,000 by cheque. (CGST @6% and SGST @6%)

JEEGYASA CLASSES 9007440392

19 Purchased goods from Ram Mohan Rai of Bengaluru for 2,00,000. (CGST @6% and

SGST @6%)

23 Paid insurance premium 10,000 by cheque. (CGST @9% and SGST @9%)

29 Received commission 20,000 by cheque which is deposited into bank. (CGST @9%

and SGST @9%)

30 Payment made of balance amount of GST.

Question 4 : Enter the following transactions in a cash book with cash and bank columns and also

pass journal entries wherever necessary. ( Marks 10)

April 2023 Particulars Amount

1 Cash in Hand 6200

Bank Overdraft 18500

2 Received a cheque from Harry and Deposited in the bank 1300

same day

3 Received a cheque from Binod 3300

5 Cheque received form Binod Deposited into bank

5 Purchased Goods and paid by cheque 20,000

5 Freight Paid in cash 250

6 Sold goods in Cash 12220

8 Sold goods in Cash 16000

9 Sale Proceeds of April 8 deposited into bank

11 Withdrew Cash for Personal use 1000

13 Withdrew with Cheque for Personal use 5000

14 Purchased Goods from Suresh on Credit 2500

16 Paid Cheque to Suresh 2500

17 Received a cheque from Ajay ( Not Banked ) 3700

20 Cheque received from Ajay Endorsed to Vijay

22 Cheque Received from Mahesh deposited into bank 2700

24 Received Cash 1000 and cheque 1200 for Cash sales

25 Paid into bank 10000

26 Received a cheque from Prem. Sent to Bank immediately 4150

28 Cheque from Prem Dishonoured. Bank charges 20

30 Kishan Directly deposited into our bank account 3000

30 Bank has charged 60 for bank charges and interest on 720

overdraft

Question 5 : Pawan Kumar maintains incomplete records. The affairs of his business as at 1st April

2023 are as follows :- (Marks 8)

LIABILITIES AMOUNTS ASSETS AMOUNTS

Creditors 5000 Cash in Hand 400

Capital 70000 Cash at Bank 1600

Debtor 17000

Stock 20000

Furniture 6000

Plant and Machinery 30000

JEEGYASA CLASSES 9007440392

His position on 31st March, 2024 was :- Cash in hand 1,000; Cash at Bank *2,000; B/R 4,000; Debtors

21,000; Stock 32,000; Furniture ₹8,000; Plant and Machinery 40,000 and Creditors 18,000.

He withdrew during the year 30,000, out of which he spent 18,000 for purchasing a scooter for the

business. Calculate his net profit for the year after the following adjustments and prepare a final

Statement of Affairs as at 31st March, 2024:

(1) Depreciate furniture and scooter @ 20%;

(2) 5% of the debtors are doubtful and 800 are absolutely bad.

(3) Make a provision of 5% on Bills Receivable also.

Question 6 : Prepare a Trading and Profit and Loss for M/S Green Ltd for the year and a Balance

Sheet as at that date for the following figures taken from their trial Balance. (Marks 10)

DEBIT BALANCES AMOUNT CREDIT BALANCES AMOUNT

Opening Stock 125000 Sales 250000

Purchase 35000 Purchase Returns 6000

Return Inward 25000 Creditors 55000

Postage 600 Capital 50000

Salary 12300 Discount Received 1000

Wages 3000 Provision for Bad Debts 4500

Rent 1000 Commission Received 5400

Packing and Transport 500

General Expenses 400

Insurance 4000

Debtors 50000

Cash in Hand 20000

Closing Stock 40000

Machinery 20000

Lighting 5000

Discount 3500

Bad Debts 3500

Investments 23100

371900 371900

Adjustments :

(i) Depreciation charged on Machinery @ 5% p.a.

(ii) Further Bad-debts 1,500, provision for discount on debtors @ 5% and provision for Doubtful

Debts on debtors @ 6%.

(iii) Wages prepaid ₹1,000.

(iv) Interest on investments @ 5% p.a.

Question 7 : A sells goods for 40,000 to B on 1st January, 2024 and on the same day draws a bill on B

at three months for the amount. B accepts it and returns it to A, who discounts it on 4th January,

2024 with his bank at 6% per annum. The acceptance is dishonoured on the due date and the noting

charges were paid by bank being ₹200.

JEEGYASA CLASSES 9007440392

On 4th April, 2024, B accepts a new bill at three months for the amount then due to A together with

interest at 12% per annum.

Make Journal entries to record these transactions in the books of A and B. (Marks 8)

Question 8 : Pass the rectification entries and show the suspense account in the books of a

partnership firm, from the following particulars : (Marks 8)

(a) The total of sales return day book was over-cast by ₹1,000.

(b) Purchase of equipment, from Raj Mohan & Co., worth 2,000, in cash, was entered through the

purchase day book and accordingly, credited to the supplier's account.

(c) Discount 500 allowed by P. Sahoo, a creditor, has not been entered in the books of account.

(d) 350 paid for carriage on sale of goods was credited to carriage inward account when posted from

the cash book.

(e) Bill receivable worth 1,800 received from a debtor was entered in the bills payable book though

correctly entered in the debtor's account.

(f) A sum of ₹2,500 collected from Suraj Singh, a debtor, whose dues were already written off as bad

debt, was posted to the credit side of Suraj Singh account.

JEEGYASA CLASSES 9007440392

You might also like

- Statement - Nov 2019 2Document13 pagesStatement - Nov 2019 2Jack Carroll (Attorney Jack B. Carroll)No ratings yet

- Finance Case Study2 FINALDocument6 pagesFinance Case Study2 FINALDan Carlo Delgado PoblacionNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Pitch Deck Sample For StartupsDocument24 pagesPitch Deck Sample For StartupsKetan JajuNo ratings yet

- Intro To Consulting SlidesDocument34 pagesIntro To Consulting Slidesmanojben100% (2)

- Blackbook Project On CSR of Mahindra Amp MahindraDocument56 pagesBlackbook Project On CSR of Mahindra Amp Mahindrasupriya patekar43% (7)

- Mock TestDocument8 pagesMock TestDiksha DudejaNo ratings yet

- Accountancy QP XiDocument4 pagesAccountancy QP XiMohammedNo ratings yet

- +1 Accountancy ONLINE Final Examination 2021Document5 pages+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalNo ratings yet

- Cbse XI 2019-2020 Annual ExamDocument6 pagesCbse XI 2019-2020 Annual Exammadhavmanoj08No ratings yet

- 11th AccountDocument3 pages11th Accountnmzrv8jfq8No ratings yet

- Accounts ExamDocument5 pagesAccounts Examsoulvloggers321No ratings yet

- AtibhaDocument7 pagesAtibhaAangry VermaNo ratings yet

- Session Ending Examination 2019Document7 pagesSession Ending Examination 2019madhudevi06435No ratings yet

- Model Paper, Accountancy, XIDocument13 pagesModel Paper, Accountancy, XIanyaNo ratings yet

- Screenshot 2023-02-21 at 1.23.27 AMDocument12 pagesScreenshot 2023-02-21 at 1.23.27 AMGracy AroraNo ratings yet

- Account Test 2Document5 pagesAccount Test 2klaw6048No ratings yet

- Part - A: (Financial Accounting - I)Document16 pagesPart - A: (Financial Accounting - I)Adit Bohra VIII BNo ratings yet

- Namma Kalvi 11th Accountancy Model Questin Paper EM 221452Document8 pagesNamma Kalvi 11th Accountancy Model Questin Paper EM 221452sharonjamesappuNo ratings yet

- Accountancy PaperDocument7 pagesAccountancy PapersumitaNo ratings yet

- Book Keeping FivDocument6 pagesBook Keeping FivALE MEDIANo ratings yet

- Progress Test-4 (Chapters 1 and 2)Document4 pagesProgress Test-4 (Chapters 1 and 2)buraale94No ratings yet

- MCQ QuestionsDocument6 pagesMCQ QuestionsANo ratings yet

- 11 Sample Papers Accountancy 2Document10 pages11 Sample Papers Accountancy 2AvcelNo ratings yet

- 2) 3) Mark. 1. 2. A+C L-C A-L 4. 6. - 7. L Loan Debt: Examination, November-?Oi7Document4 pages2) 3) Mark. 1. 2. A+C L-C A-L 4. 6. - 7. L Loan Debt: Examination, November-?Oi7Best ThingsNo ratings yet

- 23 Accounts-RTP-DecemberDocument32 pages23 Accounts-RTP-Decemberjustinbieberm77No ratings yet

- Accounts Prelim Paper 28-11-23Document4 pagesAccounts Prelim Paper 28-11-23roshanchoudhary4350No ratings yet

- RTP Dec2023 p1Document32 pagesRTP Dec2023 p1Vaibhav M S100% (1)

- ICAI MOCK TEST CA FOUNDATION DECEMBER 2022 Paper 1 Principles andDocument6 pagesICAI MOCK TEST CA FOUNDATION DECEMBER 2022 Paper 1 Principles andArpit GuptaNo ratings yet

- Cbse 11 Accounts CH 9 To 15 Revision WorksheetDocument9 pagesCbse 11 Accounts CH 9 To 15 Revision WorksheetRiwaanNo ratings yet

- Exam Practice Questions - Holiday Work - Yr 10 - 2023 - 2024Document35 pagesExam Practice Questions - Holiday Work - Yr 10 - 2023 - 2024MUSTHARI KHANNo ratings yet

- Model Question Paper Class 11 AccountsDocument97 pagesModel Question Paper Class 11 AccountsAbel Soby Joseph100% (3)

- Explain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Document4 pagesExplain The Following Terms in Not More Than Two Sentences Each: 1x 10 10Anita PanigrahiNo ratings yet

- Practice PaperDocument13 pagesPractice PaperArush BlagganaNo ratings yet

- 11 Accountancy First Term Set BDocument6 pages11 Accountancy First Term Set Bmcsworkshop777No ratings yet

- XI Account QPDocument7 pagesXI Account QPtanushsoni37No ratings yet

- Foundation Accounts Suggested May19Document23 pagesFoundation Accounts Suggested May19Aman SinghNo ratings yet

- 11 Accountancy First Term Set ADocument6 pages11 Accountancy First Term Set Amcsworkshop777No ratings yet

- FA Question Bank TT1-1Document14 pagesFA Question Bank TT1-1rock SINGHALNo ratings yet

- Accountancy Sample Paper Final ImportantDocument18 pagesAccountancy Sample Paper Final ImportantChitra Vasu100% (1)

- Amardeep XI First TermDocument8 pagesAmardeep XI First TermAnahita GuptaNo ratings yet

- Accountancy Sample Paper 2Document8 pagesAccountancy Sample Paper 2mcrekhaaNo ratings yet

- Accounts RTP Foundation Nov 2020Document25 pagesAccounts RTP Foundation Nov 2020Jayasurya MuruganathanNo ratings yet

- Acc Paper Class 11Document16 pagesAcc Paper Class 11Varsha AswaniNo ratings yet

- ACCT 1Document15 pagesACCT 1Joyce OcarizaNo ratings yet

- Acc Xi Class Test-I 2022Document4 pagesAcc Xi Class Test-I 2022shaurya kapoorNo ratings yet

- Sample Paper 5 (Final Exam XI Accountancy)Document9 pagesSample Paper 5 (Final Exam XI Accountancy)pritanshutripathi84No ratings yet

- 11 Sample Papers Accountancy 2020 English Medium Set 3Document10 pages11 Sample Papers Accountancy 2020 English Medium Set 3Joshi DrcpNo ratings yet

- Class XI Acc SM Arya Annual 2023-24Document5 pagesClass XI Acc SM Arya Annual 2023-24pandeyansh962No ratings yet

- Acct Practice PaperDocument11 pagesAcct Practice PaperKrish BajajNo ratings yet

- F3 Book Keeping Monthly Test Feb 2024Document6 pagesF3 Book Keeping Monthly Test Feb 2024abdulsamadm1982No ratings yet

- FA (1st) Dec2017Document3 pagesFA (1st) Dec2017dkdjfNo ratings yet

- Acctg1 MidtermDocument6 pagesAcctg1 MidtermKevin Elrey Arce50% (4)

- Book KeepingDocument6 pagesBook KeepingALE MEDIANo ratings yet

- Review Materials The Accounting Process To Accounts ReceivableDocument7 pagesReview Materials The Accounting Process To Accounts ReceivableMarin, Nicole DondoyanoNo ratings yet

- 2nd Quarter Final Exam Oct. 2019Document3 pages2nd Quarter Final Exam Oct. 2019awdasdNo ratings yet

- CA Foundation Paper 1 Principles and Practice of Accounting SADocument24 pagesCA Foundation Paper 1 Principles and Practice of Accounting SAavula Venkatrao100% (1)

- Test Paper Ca FoundDocument5 pagesTest Paper Ca FoundSarangapani KaliyamoorthyNo ratings yet

- FAR Midterm QuizDocument2 pagesFAR Midterm QuizAllyy DelacruzNo ratings yet

- CA Foundation Accounts RTP May 2023Document32 pagesCA Foundation Accounts RTP May 2023PushkarNo ratings yet

- FA Weekend TestDocument5 pagesFA Weekend TestIryne MerrieNo ratings yet

- 11 Accountancy SP 01Document33 pages11 Accountancy SP 01Haridas OngallurNo ratings yet

- RTP Accounting CA Foundation May 18Document35 pagesRTP Accounting CA Foundation May 18kanishk bahetiNo ratings yet

- 1st Puc Accountancy Midterm Question Paper Nov 2017-Mandya PDFDocument10 pages1st Puc Accountancy Midterm Question Paper Nov 2017-Mandya PDFBest ThingsNo ratings yet

- Am Banklaunches MalaysiasfirstonlinedebtDocument2 pagesAm Banklaunches MalaysiasfirstonlinedebthairyzaltNo ratings yet

- Measuring The Quality of Health Services in AlgeriaDocument14 pagesMeasuring The Quality of Health Services in Algeriaamialotfi20No ratings yet

- EBAY Five ForceDocument14 pagesEBAY Five ForceXiaofang Li100% (4)

- Unemployment and Underemploymentin Rural IndiaDocument9 pagesUnemployment and Underemploymentin Rural IndiaPranavVohraNo ratings yet

- Plan de AfacereDocument18 pagesPlan de AfacereYani CanciuNo ratings yet

- New Standing Order Instruction Nwi50000eDocument1 pageNew Standing Order Instruction Nwi50000ejamalazoz05No ratings yet

- Chapter 8Document31 pagesChapter 8laurenbondy44No ratings yet

- The Business 2.0 VocabularyDocument18 pagesThe Business 2.0 VocabularyGIBRAN CASTAÑEDANo ratings yet

- Cases CH 8Document4 pagesCases CH 8YurmaNo ratings yet

- COST SHEET NumericalsDocument9 pagesCOST SHEET Numericalsmisaki chanNo ratings yet

- Assignment Case Study NegotationDocument6 pagesAssignment Case Study Negotationfkjhvb,No ratings yet

- BUSINESS PROPOSAL SEC A - Group 3Document25 pagesBUSINESS PROPOSAL SEC A - Group 3sanandi DASNo ratings yet

- Thesis Paper On AIBLDocument131 pagesThesis Paper On AIBLMd Khaled NoorNo ratings yet

- The First Assignment For StrategyDocument7 pagesThe First Assignment For StrategySơn TùngNo ratings yet

- Dealings in Properties and The Withholding Tax SystemDocument38 pagesDealings in Properties and The Withholding Tax SystemKenzel lawasNo ratings yet

- BIS Sample Database - IIIDocument2 pagesBIS Sample Database - IIIAarti IyerNo ratings yet

- Importance of Consumer KnowledgeDocument66 pagesImportance of Consumer Knowledgezenith160% (1)

- Nisha CVDocument2 pagesNisha CVNisha SinhaNo ratings yet

- Brksec-1021 (2018)Document84 pagesBrksec-1021 (2018)Paul ZetoNo ratings yet

- Solutions Nss NC 19Document8 pagesSolutions Nss NC 19lethiphuongdanNo ratings yet

- Exporters and Shipping Importers in KuwaitDocument35 pagesExporters and Shipping Importers in Kuwaitgobudas3No ratings yet

- Little Oil CompanyDocument10 pagesLittle Oil CompanyJosann Welch100% (1)

- Business English 4 Test SamplesDocument2 pagesBusiness English 4 Test SamplesAlinaArcanaNo ratings yet

- How To Create Killer Sales Playbooks GuideDocument14 pagesHow To Create Killer Sales Playbooks GuideLeonie Newbury100% (1)

- Globalización? Análisis de Su Marketing-Mix Internacional: Mango: ¿Un Caso de Estrategia y Política deDocument15 pagesGlobalización? Análisis de Su Marketing-Mix Internacional: Mango: ¿Un Caso de Estrategia y Política demichxel psNo ratings yet