Professional Documents

Culture Documents

TeachingGuide - FINANCIAL MATHEMATICS

TeachingGuide - FINANCIAL MATHEMATICS

Uploaded by

saturmendozaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TeachingGuide - FINANCIAL MATHEMATICS

TeachingGuide - FINANCIAL MATHEMATICS

Uploaded by

saturmendozaCopyright:

Available Formats

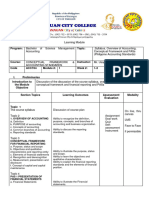

TEACHING GUIDE

FINANCIAL MATHEMATICS

GRADO EN ADMINISTRACIÓN Y DIRECCIÓN DE EMPRESAS

(INGLÉS)

ACADEMIC YEAR 2023-24

Date: 12-07-2023

Vicerrectorado de Calidad y Estrategia

FINANCIAL MATHEMATICS

Vicerrectorado de Calidad y Estrategia Page 2

FINANCIAL MATHEMATICS

I.-Subject Identification

Type OBLIGATORIA

Teaching period 1 course, 2Q semester

Nº of credits 6

Language in wich the subject is taught English

II.-Presentation

The general objective of this subject is to learn how to correctly apply the mathematical principles relating to the variation of the

value of money over time. To this end, the aim is to provide students with the necessary mathematical knowledge to enable them

to learn the fundamentals of Financial Mathematics, as well as a first approach to the study of the most common financial

operations, the analysis and description of the essential aspects of the most relevant financial operations, and the understanding

of the operation of the products and services of the current banking and stock markets. In this way, the student will be able to

interpret correctly from a financial point of view the information extracted from the resolution of the problems of Financial

Mathematics. To this purpose, the precise theoretical foundations will be established, which will be applied in the resolution of

problems through practical cases. Previous knowledge of mathematics is required.

III.-Competences

Generic competences

CI01. Ability to analyse and synthesise: analysis, synthesis, evaluation and decision-making based on relevant information

records on the company's position and potential growth.

CI05. Knowledge of information systems relating to studies: normal use of information and communications technology in all

professional work

CI06. Ability to analyse, search for and interpret information from different sources: ability to identify sources of relevant

economic data, obtain and select information that non-professionals are not capable of recognising

CI07. Ability to solve problems

CI08. Ability to make decisions

CS01. Ability to study independently.

CPR01. Practical application of knowledge.

Specific competences

CP21 . Ability to apply language and mathematical / statistical logic in the approach of an economic - business problem

CE10. Knowledge support necessary for the proper realization of learning and prior knowledge, especially Math

CP01. Domain of IT tools applied with specific character to the different matters

CP02. Ability of application of the theoretical, methodological knowledge and of the technologies acquired in the process of

formation

CP04. Ability to use tools of quantitative nature in the capture of managerial decisions

CP03. Ability to model managerial situations

CP12 . Understanding the financial operations taking place in business

CP13 . Ability to solve problems both financial valuation of funding decisions as business investment

CP14 . Mastery of computer tools applied to financial and accounting management

CP16 . Ability to evaluate the market and the environment integrated into the marketing information system

CP17 . Ability to understand the international implications of business management

Vicerrectorado de Calidad y Estrategia Page 3

FINANCIAL MATHEMATICS

Vicerrectorado de Calidad y Estrategia Page 4

FINANCIAL MATHEMATICS

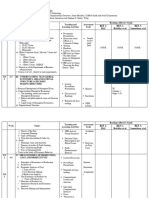

IV.-Contents

IV.A.-Syllabus

Thematic Lessons Sections

1.1. Introduction to Financial Calculus.

1.2.The Time Value of Money

Lesson 1. “Fundamentals of Financial 1.3. Financial Capital

Mathematics” 1.4.Financial Operation

1.5.Operations Classification

1.6.Theoretical Concepts

2.1. Concepts and Properties of

Financial Laws

Lesson 2. “Financial Laws” 2.2. Financial Laws Classification

2.3. Magnitudes related to the Financial

Laws

I.- “Basic Topics. Simple Financial 3.1. Simple Interest. Characteristics and

Operations.” Properties

Lesson 3. “Capitalization Operations: 3.2. Compound Interest. Characteristics

Simple and Compound Interest and Properties

Regimen” 2.3. Commercial Characteristics of

Capitalization Operations

4.1. Simple Discount. Characteristics

and Properties

4.2. Compound Discount.

Lesson 4. “Discount Operations: Simple

Characteristics and Properties

and Compound Discount Regimen”

4.3. Commercial Characteristics of

Discount Interest

5.1. Annuity Concept.

5.2. Financial Value of an Annuity

Lesson 5. Annuities Valuation”

5.3. Financial Annuities Classification

5.4. Ordinary Annuity and Annuity Due

6.1. Compound Financial Operation

Concept.

II.- “Annuities”

6.2. Financial Equivalence

6.3. Compound Financials Operations

Lesson 6. “Compound Financial

Classifications

Operations ”

6.4. Methods of Calculation of the

Mathematical Reserve: Retrospective,

Recurrent and Prospective

6.5. Decision Criteria. NPV and IRR.

7.1. Loan Definition.

7.2. Loan Magnitudes

III.- “Paid off Systems. Loans” Lesson 7. “Loans ”

7.3. Loan Tables and Paid off Systems

7.4. Loan Dynamic Scheme

Vicerrectorado de Calidad y Estrategia Page 5

FINANCIAL MATHEMATICS

7.1. Loan Definition.

7.2. Loan Magnitudes

Lesson 7. “Loans ”

7.3. Loan Tables and Paid off Systems

7.4. Loan Dynamic Scheme

8.1. Paid off Systems. Classification

8.2 French Loan

III.- “Paid off Systems. Loans” 8.3. American Loan

Lesson 8. “Paid off Systems” 8.4. Constant Principal Repayments

(Italian Loan)

8.5. Geometric Loans

8.6 Other Paid off Systems

9.1. Spanish Public Treasury

Lesson 9. “Spanish Public Debt Market”

9.2. Treasury Bills and Bonds

IV.B.-Training activities

Type Title

Bank Customer Website: http://www.bde.es/clientebanca/

Information about the Spanish Government Securities.

Description of the Spanish Public Debt market, the main

Reading

features of these products, the auction calendar and the main

Spanish Interest Rates (EURIOBOR, EAIR, APR, IRR and so

on)

Financial Newspapers: www.eleconomista.es

Reading

www.cincodias.es www.expansion.es

Bank of Spain: www.bde.es Information on the main

Reading

publications on Statistics and Finance.

Practical / resolution of exercises Problem Solving for Thematic Blocks I, II and III

Public Treasury: www.tesoro.es Information on Spanish Public

Reading Debt Market: Treasury Bills and Bonds. Banking and Stock

Exchange Auctions

Possibility of practical workshops with the tools available in the

Others

virtual classroom

Vicerrectorado de Calidad y Estrategia Page 6

FINANCIAL MATHEMATICS

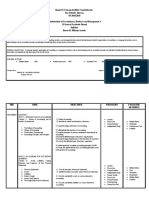

V.-Student worload

Lecture classes 15

Pratical classes/resolution of exercises, case studies, etc. 40

Practical sessions in technological laboratories, hospitals, etc. 0

Tests 5

Academic tutorials 18

Related activities: conferences, seminars, etc. 0

Preparation of lecture classes 15

Preparation of practices, exercises, cases studies work 55

Test preparation 32

Total student workload 180

VI.-Methodology and academic programme

Type Period Content

The course will have an eminently

practical content, including the

Work placements Week 1 to Week 14 introduction of many and varied financial

problems to be developed throughout the

course on a regular basis.

On site academic tutorials. The professor

Academic Tutorials Week 1 to Week 14

will report about it.

Tests in the clasroom about the content

Tests Week 1 to Week 14

of the subject.

Presentation of the course, the teaching

guide and the syllabus. In this activity,

Master classes Week 1 to Week 1

the timetable for the development of the

course will be detailed.

Master classes Week 1 to Week 14 Lectures on the contents of topics 1 to 9.

Attendance or virtual attendance at

Seminars Week 1 to Week 14

seminars related to content.

Vicerrectorado de Calidad y Estrategia Page 7

FINANCIAL MATHEMATICS

VII.-Assessment methods

VII.A.-Assessment weighting

Continuous ordinary assessment:

The distribution and characteristics of the assessment tests are those described below. Only in exceptional case and for special

reasons may the teacher add changes to the Guide. These changes will require the prior consultation with the Subject Head and

the prior and explicit authorisation of the Degree Programme Coordinator, who will notify the Vice-Rector?s office in charge of

Academic Affairs of the modifications made. In any case, the changes proposed must take into account the stipulations of the

verified report. In order for these changes to take effect, they must be duly communicated at the start of the course to the

students using Aula Virtual.

The combination of activities that are not re-assessable cannot exceed 50% of the subject grade and, in general, cannot have a

minimum grade (except for the case of laboratory or clinical work placements, where duly justified), and tests which exceed 60%

of the subject weighting cannot be added.

Extraordinary assessment: Students who do not manage to pass the ordinary assessment, or who did not attend, will be

subject to completion of an extraordinary assessment to verify their acquisition of the skills established in the guide, only for

activities that are re-assessable.

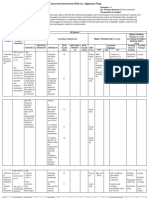

Description of the tests for assessment and their weights.

Vicerrectorado de Calidad y Estrategia Page 8

FINANCIAL MATHEMATICS

The evaluation process is specified in the following table:

Evaluation System Percentage Period Content Venue

Throughout the

teaching period on the

Theoretical and The exam will take

20% date indicated by the Parts I, II and III

practical test place in the classroom.

lecturer who teaches

the subject

Throughout the

teaching period on the

Problem Solving and The exam will take

20% date indicated by the Parts I, and II

práctical cases place in the classroom.

lecturer who teaches

the subject

Throughout the

teaching period on the

date indicated by the The exam will take

Problem solving 60% Parts II and III

lecturer who teaches place in the classroom.

the subject

The minimum score to pass the subject is 5 points out 10. . Extraordinary Examination: the student will take the extraordinary

examination if he/she has not passed the subject in the ordinary examination.

****IMPORTANT: The date of the examination is an official one and is known well in advance, so once published on the web as

final cannot be adapted to change that date or for specific students. The same approach is followed for the exam reviews. The

exam review shall take place on a date between the date on which the examination is held, and the closing date set by the

University for each academic year. The review will take place on a single day, which will be announced in advance together with

the publication of the provisional grades, informing the student at least 48 hours in advance. No individual reviews will be held

for any student outside the established dates. For the purposes of the review, no personal, family or academic circumstances

justify the passing of the subject if the marks obtained show otherwise. If any student considers it appropriate for the teacher to

consider any aspect that he/she considers important because it may affect the satisfactory completion of the subject, he/she

must inform the student of this during the course and, in any case, always before the end of the classes.

In the early days of the course, the professor will detail the methodology to be followed during the course, tutorial hours, and

more specific aspects of the evaluation. Besides, the tutorial hours schedule will be throughout the teaching period (from the first

week of the course until the last week of class).

For the development of the classes, the professor will dictate specific rules on punctuality, participation and few aspects deemed

necessary to specify. The permanence of the student in the classroom is conditional upon them, as well as the rules of academic

behaviour published on the web

http://www.urjc.es/alumnos/normativa/archivos/Normativa 20academica%%% 20conducta 20URJC.pdf

If the professor believes that the minimum conditions are not met for a normal development of the class teacher stops the activity

and inform the relevant body.

- The exam revisions will be carried out on a date between the date on which the exams are held and the closing date set by the

University for each academic year. The exam revisions shall be carried out on a single day which shall be announced in advance

together with the publication of the provisional grades, always informing the student at least 48 hours in advance. No individual

reviews will be held for any student outside the established dates. For the purposes of the review, no personal, family or

academic circumstance will justify the passing of the subject if the grades obtained prove otherwise.

If any student considers it is appropriate for the teacher to take into account any aspect that he/she considers important because

it may affect the satisfactory completion of the subject, he/she must inform about that during the course and always before the

end of the course.

Vicerrectorado de Calidad y Estrategia Page 9

FINANCIAL MATHEMATICS

VII.B. Assessment of students with an academic exemption

Student who wish to opt for this assessment will have to get an academic exemption for the subject, which they will have to

request from the Dean or Director of the Centre which teaches their course. An academic exemption may be granted where the

subjects own characteristics allow for it.

Subject with the possibility of an exemption: Yes

VII.C. Review of assessment tests

In accordance with the exam appeal regulations of the Universidad Rey Juan Carlos.

VII.D.-Students with a disability or special educational needs

Curricular adaptations for students with a disability or special educational needs will be determined by the Disabled Students

Support Department, in accordance with the regulations governing the Disabled Students Support service, approved by the

Universidad Rey Juan Carlos Council, in order to guarantee equal opportunities, inclusive treatment, universal accessibility and a

greater guarantee of academic success.

For this purpose, this Department will have to issue a curricular adaptation report, therefore students with disabilities or special

educational needs must contact the Department to analyse the different alternatives together.

VII.E.-Academic behaviour, academic integrity and honesty

The Universidad Rey Juan Carlos is completely committed to the highest standards of academic integrity and honesty.

Therefore, studying at the URJC means you accept and agree to the academic integrity and honesty values described in the

University's Code of Ethics. In order to monitor this procedure, the University has Regulations on academic behaviour at the

Universidad Rey Juan Carlos and uses different tools (anti-plagiarism, supervision?) which provides a collective assurance that

these essential values are completely developed

Vicerrectorado de Calidad y Estrategia Page 10

FINANCIAL MATHEMATICS

VII.-Bibliography

Referecence Generic

Title: Cálculo Financiero. Teoría y Ejercicios; Author: Aparicio et al.; Publisher: Thompson-Paraninfo, (2th Edition)(2002)

Title: Principles of Finance with Excel; Author: Simon Benninga; Publisher: Oxford University Press Inc (2006)

Title: Ethics, Professional Standarts and Quantitative Methods; Author: CFA Institute; Publisher:CFA Institute (2004)

Reference literature

Title: Matemática de las Operaciones Financieras; Authors:Bonilla, María; Ivars, Antonia y Moya,Ismael; Publisher:Thomson

(2006)

Title: Curso de Matemática Financiera; Author: Miner, Javier; Publisher: Mc Graw Hill (2008)

Title: Matemática de las Operaciones Financieras.Ejercicios Resueltos; Author: Gil Peláez, L; Publisher: AC

Websites of interest:

www.tesoro.es

www.bde.es

www.excelavanzado.com

Financial newspapers:

www.eleconomista.es

www.expansion.es

www.cincodias.es

IX.-Lecturers/Teachers/Professors

Lecturer/teacher/professor´s name MARIA ELISA GARCIA ABAJO

E-mail address mariaelisa.garcia@urjc.es

Department/field Economía Financiera y Contabilidad

Category Titular de Universidad interino

Academic qualifications Doctor

Subject Coordinator Yes

Para consultar las tutorias póngase en contacto con el/la

Academic tutorial timetable

profesor/-a a través de correo electrónico

Nº of Quinquenios 3

Nº of Sexenio 0

Nº period for technology transfer 0

Stretch Docentia 3

Vicerrectorado de Calidad y Estrategia Page 11

FINANCIAL MATHEMATICS

Vicerrectorado de Calidad y Estrategia Page 12

You might also like

- FIN 2101 Module Book - UpdatedDocument123 pagesFIN 2101 Module Book - UpdatedRay LowNo ratings yet

- Engineering and Commercial Functions in BusinessFrom EverandEngineering and Commercial Functions in BusinessRating: 5 out of 5 stars5/5 (1)

- Four Pillars of Sex - WorthinessDocument5 pagesFour Pillars of Sex - WorthinessVagner VagnerNo ratings yet

- Cfas Chapter 2Document55 pagesCfas Chapter 2Lance Lenard Divinagracia Calimpos100% (1)

- ASM SOC B. Sc. Finance Course Syllabus 2019-20Document90 pagesASM SOC B. Sc. Finance Course Syllabus 2019-20Tapas BarikNo ratings yet

- Syllabus Management Advisory ServicesDocument5 pagesSyllabus Management Advisory ServicesUy SamuelNo ratings yet

- Financial Accounting & Reporting IIDocument6 pagesFinancial Accounting & Reporting IIKendrick PajarinNo ratings yet

- Management Accounting IIDocument7 pagesManagement Accounting IIKendrick PajarinNo ratings yet

- Module 1 TheAcctgProfAndConceptualFrameworkDocument2 pagesModule 1 TheAcctgProfAndConceptualFrameworkMin YoongiNo ratings yet

- Conceptual Framework-IFRSDocument61 pagesConceptual Framework-IFRSAl Rashedin KawserNo ratings yet

- Conceptual Framework PPT 090719 PDFDocument53 pagesConceptual Framework PPT 090719 PDFSheena OroNo ratings yet

- Ch01 Intermediate Accting ContDocument100 pagesCh01 Intermediate Accting Contdtesfaye6395No ratings yet

- 11) Ci - ItfDocument5 pages11) Ci - ItfSimeony SimeNo ratings yet

- Module Handbook 2017/2018: Banking Academy of Vietnam Finance FacultyDocument6 pagesModule Handbook 2017/2018: Banking Academy of Vietnam Finance FacultyVũ Thị Lan HươngNo ratings yet

- Intermediate Accounting - Kieso - Chapter 2Document59 pagesIntermediate Accounting - Kieso - Chapter 2Steffy Amory100% (4)

- Poa Scheme of Work - September To December 2022 (Form 4)Document10 pagesPoa Scheme of Work - September To December 2022 (Form 4)pratibha jaggan martinNo ratings yet

- Course Outline Financial Management NTUDocument6 pagesCourse Outline Financial Management NTUHassaanNo ratings yet

- OBE Syllabus Stategic Bus. Analysis Mgt. Acctg.Document10 pagesOBE Syllabus Stategic Bus. Analysis Mgt. Acctg.Rowena RogadoNo ratings yet

- Capital MarketsDocument211 pagesCapital Marketsaddisu bezaNo ratings yet

- Poa Scheme of Work - September To December 2020 (Form 4)Document8 pagesPoa Scheme of Work - September To December 2020 (Form 4)pratibha jaggan martinNo ratings yet

- Tomas Del Rosario College: City of Balanga Curricular Program: AccountancyDocument12 pagesTomas Del Rosario College: City of Balanga Curricular Program: AccountancyVanessa L. VinluanNo ratings yet

- Business Finance CidamDocument7 pagesBusiness Finance CidamCruz AlmigthaNo ratings yet

- Course Objectives: Course Name: Financial Management - 1Document4 pagesCourse Objectives: Course Name: Financial Management - 1Aninda DuttaNo ratings yet

- New - OBTL Modular Fundamentals of Accounting Part1 - First Semester AY2020 2021Document6 pagesNew - OBTL Modular Fundamentals of Accounting Part1 - First Semester AY2020 2021rebecca lisingNo ratings yet

- b47b7c26 Syllabus CF1 CLCDocument8 pagesb47b7c26 Syllabus CF1 CLCKhánh LyNo ratings yet

- Conceptual Framework of Financial ReportingDocument14 pagesConceptual Framework of Financial ReportinghudaNo ratings yet

- CH 02Document59 pagesCH 02abdullah.h.aloibiNo ratings yet

- Conceptual FrameworkDocument125 pagesConceptual FrameworkJonah Marie Therese Burlaza50% (4)

- Admas University Faculty of Business: Department of Accounting and Finance Course OutlineDocument5 pagesAdmas University Faculty of Business: Department of Accounting and Finance Course OutlineTesfaye TadeleNo ratings yet

- Coby Harmon: Prepared by University of California, Santa Barbara Westmont CollegeDocument46 pagesCoby Harmon: Prepared by University of California, Santa Barbara Westmont CollegeDeeb. DeebNo ratings yet

- Learning Mod 1 CfasDocument20 pagesLearning Mod 1 CfasKristine CamposNo ratings yet

- Accounting 1Document146 pagesAccounting 1Touhidul IslamNo ratings yet

- Kieso Inter Ch02 IFRSDocument32 pagesKieso Inter Ch02 IFRSnovita retno anggraini (nino)No ratings yet

- Management Accounting IDocument6 pagesManagement Accounting IKendrick PajarinNo ratings yet

- ch02 - Conceptual Framework For Financial Reporting (5) (Autosaved)Document32 pagesch02 - Conceptual Framework For Financial Reporting (5) (Autosaved)Anna altahea arthicNo ratings yet

- II - Yr - Lesson Plan PDFDocument189 pagesII - Yr - Lesson Plan PDFAbhishek goyalNo ratings yet

- Advanced Accounting 1Document4 pagesAdvanced Accounting 1Ronn CaiNo ratings yet

- Financial Management Ms - Asha E Thomas, Ms - Anju Ravi & Ms - Stella Mary SDocument14 pagesFinancial Management Ms - Asha E Thomas, Ms - Anju Ravi & Ms - Stella Mary Sgopan0090% (1)

- ICAI - Fundamentals of Account TextDocument737 pagesICAI - Fundamentals of Account TextSalmanAnjans100% (1)

- BBA IB Detailed Syllabus PDFDocument13 pagesBBA IB Detailed Syllabus PDFCreate Your Own SpaceNo ratings yet

- 2 Conceptual Framework For Financial ReportingDocument16 pages2 Conceptual Framework For Financial ReportingIman HaidarNo ratings yet

- BBFS4103Document206 pagesBBFS4103Ct CtzudafiqNo ratings yet

- Department of Finance and Accounting: IBS, IFHE, HyderabadDocument54 pagesDepartment of Finance and Accounting: IBS, IFHE, HyderabadRUTHVIK NETHANo ratings yet

- 3.FINA211 Financial ManagementDocument5 pages3.FINA211 Financial ManagementIqtidar Khan0% (1)

- Concepts Underlying Financial AccountingDocument31 pagesConcepts Underlying Financial AccountingsueernNo ratings yet

- Financial Accounting: Course MapDocument11 pagesFinancial Accounting: Course MapSuka BylatNo ratings yet

- FM1 StudentDocument100 pagesFM1 Studenthnhan2472004No ratings yet

- MangEcon-Per RVW Guide-1Document5 pagesMangEcon-Per RVW Guide-1Zein HshsNo ratings yet

- Lecture 2 (For Student)Document46 pagesLecture 2 (For Student)vaneciaNo ratings yet

- 2023 Learning Plan FinManDocument2 pages2023 Learning Plan FinManElizabeth Perey Dimapilis-TejoNo ratings yet

- Course Outline All in OneDocument50 pagesCourse Outline All in OneMillionNo ratings yet

- Conceptual Framework For Financial ReportingDocument16 pagesConceptual Framework For Financial ReportingFAEETNo ratings yet

- JA HS Course Otl Financial Capability 1 2019 PDFDocument9 pagesJA HS Course Otl Financial Capability 1 2019 PDFTasnim BadranNo ratings yet

- Prepared By: Syazliana Hj. Kasim Kamaruzzaman Muhammad Faculty of Accountancy Uitm Shah AlamDocument61 pagesPrepared By: Syazliana Hj. Kasim Kamaruzzaman Muhammad Faculty of Accountancy Uitm Shah AlamSyazliana KasimNo ratings yet

- Conceptual Framework For Financial Reporting Part 1Document32 pagesConceptual Framework For Financial Reporting Part 1cornandpurplecrabNo ratings yet

- Course Outline - Bsa 101 - Fundamentals of Acctng 1 - RBMDocument7 pagesCourse Outline - Bsa 101 - Fundamentals of Acctng 1 - RBMRoselyn Mangaron SagcalNo ratings yet

- Module Financial Management NewDocument49 pagesModule Financial Management Newshannsantos85No ratings yet

- Abm1 BvaDocument7 pagesAbm1 BvaRichell GomezNo ratings yet

- IV A. Course Structure BBA (3) .Document4 pagesIV A. Course Structure BBA (3) .Atulya KhatterNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingFrom EverandWiley CMAexcel Learning System Exam Review 2015: Part 2, Financial Decision MakingNo ratings yet

- Trust the Brand - Corporate Reputation Management in Private BankingFrom EverandTrust the Brand - Corporate Reputation Management in Private BankingNo ratings yet

- Mediasi Perilaku Pengelolaan Keuangan Dalam Pengaruh Fintech Dan Literasi Keuangan Terhadap Kinerja UsahaDocument21 pagesMediasi Perilaku Pengelolaan Keuangan Dalam Pengaruh Fintech Dan Literasi Keuangan Terhadap Kinerja UsahaAli ZulfanNo ratings yet

- Science 7: S7Lt-Iiij-13 Lesson 6 - Electrical ChargesDocument3 pagesScience 7: S7Lt-Iiij-13 Lesson 6 - Electrical ChargesMay Ann BarberoNo ratings yet

- PLV Orientation Slides - Language and LiteratureDocument30 pagesPLV Orientation Slides - Language and Literatureariel villarNo ratings yet

- Needle MatDocument1 pageNeedle MatBruce FerreiraNo ratings yet

- (download pdf) Statistics for the Behavioral Sciences 4th Edition Nolan Solutions Manual full chapterDocument35 pages(download pdf) Statistics for the Behavioral Sciences 4th Edition Nolan Solutions Manual full chaptersurumizahmol100% (9)

- AIRIS Vento: Comfort Class in Permanent Open MRIDocument10 pagesAIRIS Vento: Comfort Class in Permanent Open MRIABDUL WAQARNo ratings yet

- Division of Cebu Province: Lesson Exemplar TemplateDocument3 pagesDivision of Cebu Province: Lesson Exemplar TemplateBlasy Jean BaragaNo ratings yet

- Understanding Culture, Society and Politics: Quarter 1 - Module 4Document18 pagesUnderstanding Culture, Society and Politics: Quarter 1 - Module 4mark turbanada100% (2)

- Solved - A 2.1-M-Long, 0.2-Cm-Diameter Electrical Wire Extends A...Document3 pagesSolved - A 2.1-M-Long, 0.2-Cm-Diameter Electrical Wire Extends A...johan razakNo ratings yet

- AGCO - GD10000101 (2007 Yılı)Document22 pagesAGCO - GD10000101 (2007 Yılı)CEMRE YAŞLI100% (1)

- Physical Testing of PaperDocument239 pagesPhysical Testing of PaperJavier Martinez CañalNo ratings yet

- 2020 Identification of Unbalance in A Rotor-Bearing System Using Kalman Filter-Based Input Estimation TechniqueDocument11 pages2020 Identification of Unbalance in A Rotor-Bearing System Using Kalman Filter-Based Input Estimation TechniqueakashNo ratings yet

- B-TVS-M: Metallized BOPP FilmDocument2 pagesB-TVS-M: Metallized BOPP FilmSayed FathyNo ratings yet

- Daftar PustakaDocument5 pagesDaftar Pustakadiana ndaruNo ratings yet

- Irg 4 BC 30 SPBFDocument8 pagesIrg 4 BC 30 SPBFKentus WNo ratings yet

- Anomaly Detection and Condition Monitoring of Wind Turbine Gearbox Based On LSTM-FS and Transfer LearningDocument14 pagesAnomaly Detection and Condition Monitoring of Wind Turbine Gearbox Based On LSTM-FS and Transfer Learning马子栋No ratings yet

- No. 5 & 20 (Rate of Capillary Rise in Soil)Document10 pagesNo. 5 & 20 (Rate of Capillary Rise in Soil)Rohullah MayarNo ratings yet

- Mirpur University of Science and Technology (Must), Mirpur Deparment Computer Systems Engineering (Cse)Document21 pagesMirpur University of Science and Technology (Must), Mirpur Deparment Computer Systems Engineering (Cse)Marva TouheedNo ratings yet

- Smith - Guidelines For Rolls Used in Web Handling - PresentationDocument63 pagesSmith - Guidelines For Rolls Used in Web Handling - PresentationShivamNo ratings yet

- Implementation Plan: Limited Face-to-Face Learning ModalityDocument48 pagesImplementation Plan: Limited Face-to-Face Learning ModalityimpromtouNo ratings yet

- New American Inside Out Elementary Unit 14 Test: Part ADocument5 pagesNew American Inside Out Elementary Unit 14 Test: Part AKeyra Aguilar CondeNo ratings yet

- Reading and Writing Skills PRETESTDocument4 pagesReading and Writing Skills PRETESTREZITTE MABLES100% (1)

- Reliability Analysis Center: Practical Considerations in Calculating Reliability of Fielded ProductsDocument24 pagesReliability Analysis Center: Practical Considerations in Calculating Reliability of Fielded ProductsNg Wei LihNo ratings yet

- Cross Laminated Timber (CLT) : Overview and DevelopmentDocument2 pagesCross Laminated Timber (CLT) : Overview and DevelopmentDevansh KhareNo ratings yet

- Building Knowledge: Developing A Knowledge-Based Dynamic Capabilities TypologyDocument22 pagesBuilding Knowledge: Developing A Knowledge-Based Dynamic Capabilities Typologylobna_qassem7176100% (1)

- Session - 4Document15 pagesSession - 4IreshaNadeeshaniNo ratings yet

- Class 11 Geography NotesDocument8 pagesClass 11 Geography NotesRohiniNo ratings yet

- Myung Heat TreatmentDocument9 pagesMyung Heat TreatmentBabcsánné Kiss JuditNo ratings yet

- Double-Species Slurry Flow in A Horizontal Pipeline: P. V. Skudarnov C. X. Lin M. A. EbadianDocument8 pagesDouble-Species Slurry Flow in A Horizontal Pipeline: P. V. Skudarnov C. X. Lin M. A. EbadianPrantik DasNo ratings yet