Professional Documents

Culture Documents

Candy Simpson - (EE & ER) - PDOC-Date Paid-2020-12-12 (WEEK 2)

Candy Simpson - (EE & ER) - PDOC-Date Paid-2020-12-12 (WEEK 2)

Uploaded by

mcocampo20 ratings0% found this document useful (0 votes)

4 views1 pageCandy Simpson worked for Cam Beck's Consultancy and was paid $504 on December 12, 2020. $87.03 was deducted from her pay, including $12.34 in taxes, $22.93 in CPP contributions, and $7.96 in EI premiums. Her year-to-date pensionable earnings were $20,184 and her employer was required to remit $77.30 in deductions to the government.

Original Description:

Original Title

Candy Simpson-(EE & ER)-PDOC-Date paid-2020-12-12 (WEEK 2)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCandy Simpson worked for Cam Beck's Consultancy and was paid $504 on December 12, 2020. $87.03 was deducted from her pay, including $12.34 in taxes, $22.93 in CPP contributions, and $7.96 in EI premiums. Her year-to-date pensionable earnings were $20,184 and her employer was required to remit $77.30 in deductions to the government.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views1 pageCandy Simpson - (EE & ER) - PDOC-Date Paid-2020-12-12 (WEEK 2)

Candy Simpson - (EE & ER) - PDOC-Date Paid-2020-12-12 (WEEK 2)

Uploaded by

mcocampo2Candy Simpson worked for Cam Beck's Consultancy and was paid $504 on December 12, 2020. $87.03 was deducted from her pay, including $12.34 in taxes, $22.93 in CPP contributions, and $7.96 in EI premiums. Her year-to-date pensionable earnings were $20,184 and her employer was required to remit $77.30 in deductions to the government.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

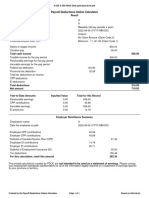

Candy Simpson-(EE & ER)-PDOC-Date paid-2020-12-12.

Payroll Deductions Online Calculator

Result

Employee's name: Candy Simpson

Employer's name: Cam Beck's Consultancy

Pay period frequency: Weekly (52 pay periods a year)

Date the employee is paid: 2020-12-12 (YYYY-MM-DD)

Province of employment: Prince Edward Island

Federal amount from TD1: 17,929.01 - 20,279.00 (Claim Code 4)

Provincial amount from TD1: 18,000.01 - 19,600.00 (Claim Code 7)

Salary or wages income 504.00

Total cash income 504.00

Pensionable earnings for the pay period 504.00

Insurable earnings for the pay period 504.00

Federal tax deduction 5.70

Provincial tax deduction 6.64

Total tax deductions on income 12.34

CPP deductions 22.93

EI deductions 7.96

Amounts deducted at source 43.80

Total deductions 87.03

Net amount 416.97

Amounts deducted at source

Employee contribution to RPP 37.80

Union dues 6.00

Year-to-Date Amounts Inputted Value Total for this Record

Pensionable earnings 19,680.00 20,184.00

CPP contributions 971.67 994.60

Insurable earnings 19,680.00 20,184.00

EI premiums 295.58 303.54

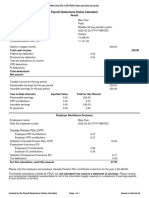

Employer Remittance Summary

Employee's name: Candy Simpson

Date the employee is paid: 2020-12-12 (YYYY-MM-DD)

Employee CPP contributions 22.93

Employer CPP contributions 22.93

Subtotal of Canada Pension Plan (CPP) 45.86

Employee EI contributions 7.96

Employer EI contributions 11.14

Subtotal of Employment Insurance (EI) 19.10

Tax deductions 12.34

For this calculation, remit this amount 77.30

Please note the employee and employer Canada Pension Plan contribution maximum for the year is $2,898.00.

The printed calculations created by PDOC are not intended to be used as a statement of earnings. Please contact

your employment standards representative for all of the information legally required on a statement of earnings specific

to your province or territory.

Created by the Payroll Deductions Online Calculator Page 1 of 1 Saved on 2023-04-12

You might also like

- 2023 Individual Tax ReturnDocument31 pages2023 Individual Tax Returnc4tkq8p99g100% (6)

- Plain Paper PayslipDocument4 pagesPlain Paper PayslipmisprumbokodoNo ratings yet

- Payslip MAY 2019 PDFDocument1 pagePayslip MAY 2019 PDFKushal Malhotra100% (1)

- Chapter 7 Payroll Project 2018Document60 pagesChapter 7 Payroll Project 2018yesi25% (12)

- INFOSYS Summary Plan Description 07-10-12202011 - 90521 - PMDocument28 pagesINFOSYS Summary Plan Description 07-10-12202011 - 90521 - PMtj1234No ratings yet

- Coronavirus Relief Funds Final ReportDocument10 pagesCoronavirus Relief Funds Final ReportLeslie RubinNo ratings yet

- Pay Slip July 2020...Document2 pagesPay Slip July 2020...laxman lucky100% (2)

- Micro Economics IA PDFDocument4 pagesMicro Economics IA PDFLuqman HakimNo ratings yet

- Analysis of Financial StatementsDocument49 pagesAnalysis of Financial Statementsnimra farooq0% (1)

- A - (EE & ER) - PDOC-Date Paid-2022-08-05Document1 pageA - (EE & ER) - PDOC-Date Paid-2022-08-05armanf2020zNo ratings yet

- Employee Name - (EE & ER) - PDOC-Date Paid-2023-02-26Document1 pageEmployee Name - (EE & ER) - PDOC-Date Paid-2023-02-26William JoeNo ratings yet

- Mary Doe - (EE & ER) - PDOC-Date Paid-2022-02-25Document1 pageMary Doe - (EE & ER) - PDOC-Date Paid-2022-02-25rahul_ransureNo ratings yet

- Employee Name - (EE & ER) - PDOC-Date Paid-2024-03-28Document2 pagesEmployee Name - (EE & ER) - PDOC-Date Paid-2024-03-28RileyNo ratings yet

- Mirjana Myra Ribich (EE) PDOC Date Paid 2023-08-11Document1 pageMirjana Myra Ribich (EE) PDOC Date Paid 2023-08-11mirjana ribichNo ratings yet

- Iulian Ababei 49 Woodfield Avenue Wembley Ha0 3Np: Pay Reconciliation: Unit Rate AmountDocument1 pageIulian Ababei 49 Woodfield Avenue Wembley Ha0 3Np: Pay Reconciliation: Unit Rate AmountAbabei IulianNo ratings yet

- HTML ReportsDocument8 pagesHTML Reportsdpkch4141No ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- Invitation LetterDocument32 pagesInvitation LetterPRASENJIT DENo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsKlevin LloydNo ratings yet

- PayslipDocument1 pagePayslipchloeNo ratings yet

- XR 80Document1 pageXR 80ncanellosNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- 2021 12 December - 71000700Document2 pages2021 12 December - 71000700Pablo BarónNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVanessa SarraNo ratings yet

- Morin 1 12 2022Document2 pagesMorin 1 12 2022mark san andresNo ratings yet

- Income Computation DetailsDocument4 pagesIncome Computation DetailssachinNo ratings yet

- Payslip Month 10Document1 pagePayslip Month 10AmandaNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Tax Expenditure Report 2021 22Document70 pagesTax Expenditure Report 2021 22hafiza arishaNo ratings yet

- PayslipDocument2 pagesPayslipjzeb.gonzales18No ratings yet

- Instant Download PDF College Accounting Chapters 1-15 22nd Edition Heintz Solutions Manual Full ChapterDocument46 pagesInstant Download PDF College Accounting Chapters 1-15 22nd Edition Heintz Solutions Manual Full Chapterviborgshabou9100% (3)

- Payslip India May - 2023Document2 pagesPayslip India May - 2023RAJESH DNo ratings yet

- Check 0805Document2 pagesCheck 080576xzv4kk5vNo ratings yet

- Deposit InformationDocument1 pageDeposit Informationwebmaroc 2020No ratings yet

- Aluwani Matsego - PayslipDocument1 pageAluwani Matsego - PayslipAluwani MatsegoNo ratings yet

- Mar 2024Document2 pagesMar 2024Tuneer SahaNo ratings yet

- NCH Customer Support Services, Inc. PayslipDocument1 pageNCH Customer Support Services, Inc. PayslipTrainer EntainNo ratings yet

- May 2022Document1 pageMay 2022Areeba KhanNo ratings yet

- Heads of Income Monthly Actual YTD Projected Total: EIT Services India PVT LTD Income Tax Computation StatementDocument2 pagesHeads of Income Monthly Actual YTD Projected Total: EIT Services India PVT LTD Income Tax Computation Statementsunit pattanayakNo ratings yet

- Disscor Fs.02Document86 pagesDisscor Fs.02Ricardo DelacruzNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountsakthivelNo ratings yet

- Payslip - 722 - 244572 - 30 - 2022Document2 pagesPayslip - 722 - 244572 - 30 - 2022kostadinkastefanova900No ratings yet

- Telecon Format - Project EngineerDocument1 pageTelecon Format - Project EngineerLily NguyenNo ratings yet

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DNo ratings yet

- S K Tiwari 24-25Document1 pageS K Tiwari 24-25pnmbbsrz1.acilNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected TotalDsr Santhosh KumarNo ratings yet

- Sept 2nd PayoutDocument1 pageSept 2nd PayoutJohn HenryNo ratings yet

- Payslip Tax 1 2024Document2 pagesPayslip Tax 1 2024n17mahey09No ratings yet

- Payslip Tax 12 2023-1Document2 pagesPayslip Tax 12 2023-1n17mahey09No ratings yet

- FormDocument1 pageFormRahul GaurNo ratings yet

- INT085 Payslip To Print Report Design 03-12-2024Document1 pageINT085 Payslip To Print Report Design 03-12-2024lesliedariqusNo ratings yet

- Payslip India April - 2023Document3 pagesPayslip India April - 2023RAJESH DNo ratings yet

- Directors Report FY20Document49 pagesDirectors Report FY20Rajeshwari ShuklaNo ratings yet

- PayStubs 14628Document1 pagePayStubs 14628blackdaniel218No ratings yet

- Bedaprabhash Mishra - 1075 2017 Annual AprisalDocument2 pagesBedaprabhash Mishra - 1075 2017 Annual AprisalBedaprabhashNo ratings yet

- 2023 05 07.santiago AgudeloDocument1 page2023 05 07.santiago Agudelothiago040103No ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionskeen yumangNo ratings yet

- INT085 Payslip To Print Report Design 03-12-2024Document1 pageINT085 Payslip To Print Report Design 03-12-2024lesliedariqusNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- 06 03 Payroll Records (Main)Document5 pages06 03 Payroll Records (Main)Valentina AranyosNo ratings yet

- PayslipsDocument6 pagesPayslipsbskapoor68No ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- Payslip: Employee Details Payment & Leave DetailsDocument1 pagePayslip: Employee Details Payment & Leave DetailsKushal MalhotraNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Policy Issue Paper On Philppine Smes Tax ProfileDocument13 pagesPolicy Issue Paper On Philppine Smes Tax ProfileepraNo ratings yet

- Financial Planning - Helping You Sail Successfully Into The FutureDocument26 pagesFinancial Planning - Helping You Sail Successfully Into The FutureFrank WigintonNo ratings yet

- Annexures Q2Document67 pagesAnnexures Q2Prasanth C JohnNo ratings yet

- Tutorial Chapter 4 - QDocument7 pagesTutorial Chapter 4 - QParthiban BanNo ratings yet

- Chap 1bDocument16 pagesChap 1bFauziah MunifaNo ratings yet

- Sold To: Tax InvoiceDocument1 pageSold To: Tax Invoiceমধু্স্মিতা ৰায়No ratings yet

- RMC No. 44-2021 RevisedDocument2 pagesRMC No. 44-2021 RevisedDessere Ann AnchetaNo ratings yet

- Economics 12th Edition Michael Parkin Solutions Manual 1Document36 pagesEconomics 12th Edition Michael Parkin Solutions Manual 1gregorydyercgspwbjekr100% (34)

- Journey of Cryptocurrency in India: in View of Financial Budget 2022-23 Varun Shukla, Manoj Kumar Misra, Atul ChaturvediDocument6 pagesJourney of Cryptocurrency in India: in View of Financial Budget 2022-23 Varun Shukla, Manoj Kumar Misra, Atul ChaturvedisubhamNo ratings yet

- Tax 3Document59 pagesTax 3Thái Minh ChâuNo ratings yet

- SAP Public Sector Business CaseDocument23 pagesSAP Public Sector Business Casezelimir1No ratings yet

- CHAPTER 3 - Transfer and Business TaxDocument6 pagesCHAPTER 3 - Transfer and Business TaxKatKat Olarte0% (1)

- R2.TAXML Question CMA January 2022 ExaminationDocument7 pagesR2.TAXML Question CMA January 2022 ExaminationPavel DhakaNo ratings yet

- Form No. 25Document5 pagesForm No. 25Amit BhatiNo ratings yet

- Rahul Mimani: Carrier ObjectiveDocument3 pagesRahul Mimani: Carrier ObjectiveCa Rahul MimaniNo ratings yet

- Obillos, Jr. vs. Cir - 139 Scra 436Document4 pagesObillos, Jr. vs. Cir - 139 Scra 436Ygh E SargeNo ratings yet

- Solman Tax2 Transfer Bus Tax 2018 Edition Chapters 1 To 8Document43 pagesSolman Tax2 Transfer Bus Tax 2018 Edition Chapters 1 To 8sammie helsonNo ratings yet

- Inv Ka B1 29436538 102363408901 April 2020Document2 pagesInv Ka B1 29436538 102363408901 April 2020anandNo ratings yet

- Invoice M112306106252041397Document1 pageInvoice M112306106252041397android.samsung90No ratings yet

- Fundamental CH 4Document8 pagesFundamental CH 4Tasfa ZarihunNo ratings yet

- Amount Chargeable (In Words) E. & O.EDocument1 pageAmount Chargeable (In Words) E. & O.EManish JaiswalNo ratings yet

- 1.MFRS 112Document46 pages1.MFRS 112Yau Xiang Ying100% (1)

- 2nd Floor, NIRMAL-PAMAN Kamal Phool Chowk, Jaripatka, NAGPURDocument1 page2nd Floor, NIRMAL-PAMAN Kamal Phool Chowk, Jaripatka, NAGPURprimeexotica1No ratings yet

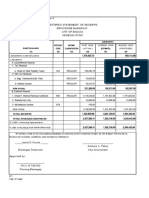

- Past Year Current Year Budget Year (Actual) (Proposed)Document16 pagesPast Year Current Year Budget Year (Actual) (Proposed)Saphire DonsolNo ratings yet

- AS6027 (1) Abinales & Amoroso 2005, Ch. 4, State and Societies, 1764-1898 PDFDocument27 pagesAS6027 (1) Abinales & Amoroso 2005, Ch. 4, State and Societies, 1764-1898 PDFTANG WENYUANNo ratings yet

- Chapter 3 - Financial AnalysisDocument39 pagesChapter 3 - Financial AnalysisHeatstroke0% (1)