Professional Documents

Culture Documents

Premium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021

Premium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021

Uploaded by

ceogaursCopyright:

Available Formats

You might also like

- Premium ReceiptsDocument1 pagePremium Receiptsmanojsh88870% (1)

- Max Life Total Premium ReceiptDocument1 pageMax Life Total Premium ReceiptBhavik Thaker100% (1)

- Max Life InsuranceDocument1 pageMax Life InsuranceLohith Labhala100% (1)

- 80G Certificate: Donation ReceiptDocument1 page80G Certificate: Donation ReceiptNeeraj Raushan KanthNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailssatish varmaNo ratings yet

- Pay Slip July 2020...Document2 pagesPay Slip July 2020...laxman lucky100% (2)

- Premium ReceiptsDocument1 pagePremium ReceiptsNeeraj TyagiNo ratings yet

- 297511794-OctDocument1 page297511794-OctVikash SinghNo ratings yet

- Consolidated Life Insurence Premium Receipt FY-2022-2023-SujanDocument1 pageConsolidated Life Insurence Premium Receipt FY-2022-2023-SujanSujanNo ratings yet

- Life Insurance 47KDocument1 pageLife Insurance 47KRaghupathi PaindlaNo ratings yet

- Consolidated Premium ReceiptDocument1 pageConsolidated Premium ReceiptBhavik ThakerNo ratings yet

- Premium ReceiptDocument1 pagePremium Receiptsvruma2No ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsVijay PendurthiNo ratings yet

- Max Term Insurance - TejkumarDocument1 pageMax Term Insurance - Tejkumarkokkanti tejkumarNo ratings yet

- Parents Policy Father PDFDocument1 pageParents Policy Father PDFshamsehrNo ratings yet

- Personal Details: Duration For Which The Premium Is Received: 01/04/2023Document1 pagePersonal Details: Duration For Which The Premium Is Received: 01/04/2023bbarle69No ratings yet

- Official Receipt 1676234863Document1 pageOfficial Receipt 1676234863vasim hatwadkarNo ratings yet

- Max Life Term PlanDocument1 pageMax Life Term PlanShreya JadhavNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsUttam kumar chintuNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailskathik MNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailssukhpreetdass89686No ratings yet

- July 3Document1 pageJuly 3Vikash SinghNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptKhushbu GuptaNo ratings yet

- Medical InsuranceDocument1 pageMedical Insurancesunil dinodiyaNo ratings yet

- Parents Policy Mother PDFDocument1 pageParents Policy Mother PDFshamsehrNo ratings yet

- Tax Invoice: Billing Address: Regd. OfficeDocument1 pageTax Invoice: Billing Address: Regd. OfficeHorse RidingNo ratings yet

- AdityaDocument1 pageAdityaankit ojhaNo ratings yet

- Policydownload 230207 000615-43Document1 pagePolicydownload 230207 000615-43Anindya SundarNo ratings yet

- Iphone 11 Imagine PDFDocument2 pagesIphone 11 Imagine PDFJonassy SumaïliNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptSaket TiwariNo ratings yet

- Official Receipt 1676234862Document1 pageOfficial Receipt 1676234862vasim hatwadkarNo ratings yet

- Premium Receipts - LifeInsuranceDocument1 pagePremium Receipts - LifeInsuranceUttam kumar chintuNo ratings yet

- Personal Details: Duration For Which The Premium Is Received: 28/07/2021Document1 pagePersonal Details: Duration For Which The Premium Is Received: 28/07/2021ravi kumarNo ratings yet

- Invoice 1273658908Document2 pagesInvoice 1273658908ushaveni3331No ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsThakur Pranay SinghNo ratings yet

- UnlockedDocument1 pageUnlockedAshish NaikNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailsnitish rohiraNo ratings yet

- Zprmrnot 22847670 15676911Document1 pageZprmrnot 22847670 15676911Gulshan GavelNo ratings yet

- Consolidated Premium Receipt (Chosen Policy)Document1 pageConsolidated Premium Receipt (Chosen Policy)sreeleoenterprisesNo ratings yet

- All Risk PolicyDocument25 pagesAll Risk PolicyPlanning DAPLNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal DetailssunnybisnoiNo ratings yet

- Premium Paid Certificate: Personal DetailsDocument1 pagePremium Paid Certificate: Personal Detailsravikumar281287No ratings yet

- Old LIC PremiumDocument2 pagesOld LIC PremiumVikrantTandelNo ratings yet

- 2018032388Document1 page2018032388Vengal reddyNo ratings yet

- Premium Receipts PDFDocument1 pagePremium Receipts PDFAJAY JAISWALNo ratings yet

- Life Insurance Premium Receipt: Duration For Which The Premium Is Received: 12-DEC-2017 To 11-JAN-2018 Personal DetailsDocument2 pagesLife Insurance Premium Receipt: Duration For Which The Premium Is Received: 12-DEC-2017 To 11-JAN-2018 Personal Detailsnitish rohiraNo ratings yet

- Patil Sunilbhai Bhaskarbhai - GopalbhaiDocument2 pagesPatil Sunilbhai Bhaskarbhai - GopalbhaiHarish PatilNo ratings yet

- L AkshayDocument1 pageL AkshaymksioclNo ratings yet

- HFC Digital TechnologiesDocument1 pageHFC Digital TechnologiesKarna Satish KumarNo ratings yet

- Life Insurance InvoiceDocument1 pageLife Insurance InvoiceAkash DesaiNo ratings yet

- Maa Jwala Devi PiDocument1 pageMaa Jwala Devi Pidhananjay chaudharyNo ratings yet

- Invoice 1266283220Document2 pagesInvoice 1266283220Nitesh NituNo ratings yet

- Invoice: Click Here To Download Seller InvoiceDocument2 pagesInvoice: Click Here To Download Seller InvoicearyandjNo ratings yet

- Invoice 1255761766Document1 pageInvoice 1255761766Munaf AkramNo ratings yet

- Apr-Jan 24 MergedDocument10 pagesApr-Jan 24 Mergedjaythakur1523No ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsHarsh Gandhi0% (1)

- Tax Invoice: Gift From: Gift To: Customer CommentsDocument1 pageTax Invoice: Gift From: Gift To: Customer Commentsanshul sharmaNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- MANJULABENDocument1 pageMANJULABENdurgamadhabaNo ratings yet

- SupplyOutward CE 028Document1 pageSupplyOutward CE 028skgts787737No ratings yet

- Estimate #2023-125963Document1 pageEstimate #2023-125963Karthik DNo ratings yet

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash MemoShivam bohemia raja harzaiNo ratings yet

- Declaration in Respect of Housing LoanDocument1 pageDeclaration in Respect of Housing LoanJitender MadanNo ratings yet

- Firs Form 1 PDFDocument4 pagesFirs Form 1 PDFLugard WoduNo ratings yet

- 1099 ReportingDocument24 pages1099 ReportingAtif JavaidNo ratings yet

- Salary SlipDocument3 pagesSalary SlipPooja GuptaNo ratings yet

- Tax 1 1Document1 pageTax 1 1Krizel rochaNo ratings yet

- Salary Sheet Sathi Ko SathDocument15 pagesSalary Sheet Sathi Ko SathyadavNo ratings yet

- Penalties and RemediesDocument3 pagesPenalties and RemediesAerl XuanNo ratings yet

- Intro To Income TaxationDocument42 pagesIntro To Income TaxationConie PinadosNo ratings yet

- General Principles of VatDocument2 pagesGeneral Principles of VatCali Shandy H.No ratings yet

- The Raj Home INV 301Document2 pagesThe Raj Home INV 301Ankesh MishraNo ratings yet

- Sales Exclusive Tax Rate &Document3 pagesSales Exclusive Tax Rate &HaripriyaNo ratings yet

- Mushak-9.1 VAT Return On 11.JAN.2023Document6 pagesMushak-9.1 VAT Return On 11.JAN.2023Mac TanzinNo ratings yet

- Shareholder Demand LetterDocument3 pagesShareholder Demand LetterParalegal JGGCNo ratings yet

- Offer Letter SagarDocument1 pageOffer Letter Sagarhranjalisharma95No ratings yet

- Cagayan Electric Power vs. CIR, 138 S 629Document3 pagesCagayan Electric Power vs. CIR, 138 S 629Han SamNo ratings yet

- Payslip For The Month of Jul 2022Document1 pagePayslip For The Month of Jul 2022Natural HealthCare IdeasNo ratings yet

- NmNEK0JacjBpTStEQm9uN0JwS2ovdz09 InvoiceDocument2 pagesNmNEK0JacjBpTStEQm9uN0JwS2ovdz09 InvoiceJitender NarulaNo ratings yet

- Talenta Payslip PT Kobus Smart Service Agu 2023 SOPIAN PANCA PUTRADocument1 pageTalenta Payslip PT Kobus Smart Service Agu 2023 SOPIAN PANCA PUTRASopianpancputraNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Mithil UpadhyayNo ratings yet

- 028 Ptrs Modul Matematik t4 Sel-96-99Document4 pages028 Ptrs Modul Matematik t4 Sel-96-99mardhiah88No ratings yet

- Abc Company Pay SlipDocument2 pagesAbc Company Pay SlipFrancois Xavier RugemaNo ratings yet

- Eisner V MacomberDocument2 pagesEisner V Macomberhbs1234No ratings yet

- IPSFDocument7 pagesIPSFmanikandan BalasubramaniyanNo ratings yet

- Advance Payment of TaxDocument11 pagesAdvance Payment of TaxParul Bhardwaj VaidyaNo ratings yet

- 16 Roxas V CTA 23 SCRA 276 1968 Digest 1Document3 pages16 Roxas V CTA 23 SCRA 276 1968 Digest 1Graziella AndayaNo ratings yet

Premium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021

Premium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021

Uploaded by

ceogaursOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Premium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021

Premium Receipt: ' 50,00,000.00 ' 853.78 13-DEC-2020 To 12-JAN-2021 13-JAN-2021

Uploaded by

ceogaursCopyright:

Available Formats

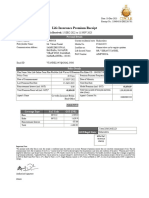

Premium Receipt

Receipt No.: 348877887DEC2001 | Receipt Date: 15-DEC-2020

Personal Details

Policy Number: 348877887 Email ID: ghoshbuddha65@gmail.com

Policyholder Name: Mr. Buddhadeb Ghosh PAN Number: BYKPG0867J

Address:FLAT NO 201 TOWER C ASHIYAN HOMEZ SARASWATI KUNJ GRETAR Customer GSTIN: Not Available

NOIDA SECTOR 16 C Current Residential State: Uttar Pradesh

NEAR SANI MANDIR,GHAZIABAD

Noida- 201009

Uttar Pradesh

Mobile Number: 9348209965

Policy Details

Plan Name: Max Life Online Term Plan Plus Policy Commencement Date: 13-DEC-2020

Life Insured: Mr. Buddhadeb Ghosh Policy Term: 50 Years Premium Payment Term: 38 Years

Premium Payment Frequency: Monthly Date of Maturity: 13-DEC-2070 Modal Premium (incl. GST): ` 853.78

Late Payment Fee (incl GST): ` 0.00 Premium Received (incl. GST): ` 853.78

GST Details Connect for more details

Coverage Type IGST (`) CGST(`) SGST/UTGST(`) Name

Base ` 88.70 ` 0.00 ` 0.00

Rider ` 41.53 ` 0.00 ` 0.00 M/S. Icss Max Life Sparc Distributi

Late Payment ` 0.00 ` 0.00 ` 0.00

Contact

Total GST Value: ` 130.23 GSTIN:06AACCM3201E1Z7

Number 1860

GST Regd. State:Haryana

SAC CODE:997132 120 5577

Mudrank : NA

Total Sum Assured of base

plan and term rider (if any)

13-DEC-2020 to

` 50,00,000.00 ` 12-JAN-2021 13-JAN-2021

853.78

*Important Note:

1. For payment mode other than in cash, this receipt is conditional upon the credit in our account. Payment of premium amount does not constitute commencement of risk. The risk

commencement starts after acceptance of risk by us.

2. Amount received would be adjusted against the due premium as per terms and conditions of the policy.

3. Premiums may be eligible for tax benefits under section 80C/80CCC/80D/37(1) of the income Tax Act 1961. Kindly consult your tax advisor for more information. Tax benefits are liable

to change due to changes in legislation or government notification.

4. GST shall comprise CGST, SGST / UTGST or IGST (whichever is applicable) including cesses and levies, if any. All applicable taxes, cesses and levies, as per prevailing laws, shall be

borne by you. For GST purposes, this premium receipt is Tax invoice. Assessable Value in GST for Endowment First Year is 25%, Renewal Year is 12.5%, Single Premium Annuity is

10%, Term and Health is 100%.

Authorised Signatory

PRM20 PRODUCT UIN: 104N092V04

E.&O.E

You might also like

- Premium ReceiptsDocument1 pagePremium Receiptsmanojsh88870% (1)

- Max Life Total Premium ReceiptDocument1 pageMax Life Total Premium ReceiptBhavik Thaker100% (1)

- Max Life InsuranceDocument1 pageMax Life InsuranceLohith Labhala100% (1)

- 80G Certificate: Donation ReceiptDocument1 page80G Certificate: Donation ReceiptNeeraj Raushan KanthNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailssatish varmaNo ratings yet

- Pay Slip July 2020...Document2 pagesPay Slip July 2020...laxman lucky100% (2)

- Premium ReceiptsDocument1 pagePremium ReceiptsNeeraj TyagiNo ratings yet

- 297511794-OctDocument1 page297511794-OctVikash SinghNo ratings yet

- Consolidated Life Insurence Premium Receipt FY-2022-2023-SujanDocument1 pageConsolidated Life Insurence Premium Receipt FY-2022-2023-SujanSujanNo ratings yet

- Life Insurance 47KDocument1 pageLife Insurance 47KRaghupathi PaindlaNo ratings yet

- Consolidated Premium ReceiptDocument1 pageConsolidated Premium ReceiptBhavik ThakerNo ratings yet

- Premium ReceiptDocument1 pagePremium Receiptsvruma2No ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsVijay PendurthiNo ratings yet

- Max Term Insurance - TejkumarDocument1 pageMax Term Insurance - Tejkumarkokkanti tejkumarNo ratings yet

- Parents Policy Father PDFDocument1 pageParents Policy Father PDFshamsehrNo ratings yet

- Personal Details: Duration For Which The Premium Is Received: 01/04/2023Document1 pagePersonal Details: Duration For Which The Premium Is Received: 01/04/2023bbarle69No ratings yet

- Official Receipt 1676234863Document1 pageOfficial Receipt 1676234863vasim hatwadkarNo ratings yet

- Max Life Term PlanDocument1 pageMax Life Term PlanShreya JadhavNo ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsUttam kumar chintuNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailskathik MNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal Detailssukhpreetdass89686No ratings yet

- July 3Document1 pageJuly 3Vikash SinghNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptKhushbu GuptaNo ratings yet

- Medical InsuranceDocument1 pageMedical Insurancesunil dinodiyaNo ratings yet

- Parents Policy Mother PDFDocument1 pageParents Policy Mother PDFshamsehrNo ratings yet

- Tax Invoice: Billing Address: Regd. OfficeDocument1 pageTax Invoice: Billing Address: Regd. OfficeHorse RidingNo ratings yet

- AdityaDocument1 pageAdityaankit ojhaNo ratings yet

- Policydownload 230207 000615-43Document1 pagePolicydownload 230207 000615-43Anindya SundarNo ratings yet

- Iphone 11 Imagine PDFDocument2 pagesIphone 11 Imagine PDFJonassy SumaïliNo ratings yet

- Consolidated ReceiptDocument1 pageConsolidated ReceiptSaket TiwariNo ratings yet

- Official Receipt 1676234862Document1 pageOfficial Receipt 1676234862vasim hatwadkarNo ratings yet

- Premium Receipts - LifeInsuranceDocument1 pagePremium Receipts - LifeInsuranceUttam kumar chintuNo ratings yet

- Personal Details: Duration For Which The Premium Is Received: 28/07/2021Document1 pagePersonal Details: Duration For Which The Premium Is Received: 28/07/2021ravi kumarNo ratings yet

- Invoice 1273658908Document2 pagesInvoice 1273658908ushaveni3331No ratings yet

- Premium ReceiptsDocument1 pagePremium ReceiptsThakur Pranay SinghNo ratings yet

- UnlockedDocument1 pageUnlockedAshish NaikNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal Detailsnitish rohiraNo ratings yet

- Zprmrnot 22847670 15676911Document1 pageZprmrnot 22847670 15676911Gulshan GavelNo ratings yet

- Consolidated Premium Receipt (Chosen Policy)Document1 pageConsolidated Premium Receipt (Chosen Policy)sreeleoenterprisesNo ratings yet

- All Risk PolicyDocument25 pagesAll Risk PolicyPlanning DAPLNo ratings yet

- Premium Receipt: Personal DetailsDocument1 pagePremium Receipt: Personal DetailssunnybisnoiNo ratings yet

- Premium Paid Certificate: Personal DetailsDocument1 pagePremium Paid Certificate: Personal Detailsravikumar281287No ratings yet

- Old LIC PremiumDocument2 pagesOld LIC PremiumVikrantTandelNo ratings yet

- 2018032388Document1 page2018032388Vengal reddyNo ratings yet

- Premium Receipts PDFDocument1 pagePremium Receipts PDFAJAY JAISWALNo ratings yet

- Life Insurance Premium Receipt: Duration For Which The Premium Is Received: 12-DEC-2017 To 11-JAN-2018 Personal DetailsDocument2 pagesLife Insurance Premium Receipt: Duration For Which The Premium Is Received: 12-DEC-2017 To 11-JAN-2018 Personal Detailsnitish rohiraNo ratings yet

- Patil Sunilbhai Bhaskarbhai - GopalbhaiDocument2 pagesPatil Sunilbhai Bhaskarbhai - GopalbhaiHarish PatilNo ratings yet

- L AkshayDocument1 pageL AkshaymksioclNo ratings yet

- HFC Digital TechnologiesDocument1 pageHFC Digital TechnologiesKarna Satish KumarNo ratings yet

- Life Insurance InvoiceDocument1 pageLife Insurance InvoiceAkash DesaiNo ratings yet

- Maa Jwala Devi PiDocument1 pageMaa Jwala Devi Pidhananjay chaudharyNo ratings yet

- Invoice 1266283220Document2 pagesInvoice 1266283220Nitesh NituNo ratings yet

- Invoice: Click Here To Download Seller InvoiceDocument2 pagesInvoice: Click Here To Download Seller InvoicearyandjNo ratings yet

- Invoice 1255761766Document1 pageInvoice 1255761766Munaf AkramNo ratings yet

- Apr-Jan 24 MergedDocument10 pagesApr-Jan 24 Mergedjaythakur1523No ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsHarsh Gandhi0% (1)

- Tax Invoice: Gift From: Gift To: Customer CommentsDocument1 pageTax Invoice: Gift From: Gift To: Customer Commentsanshul sharmaNo ratings yet

- Life Insurance Premium Receipt: Personal DetailsDocument1 pageLife Insurance Premium Receipt: Personal DetailsRanjith BNo ratings yet

- MANJULABENDocument1 pageMANJULABENdurgamadhabaNo ratings yet

- SupplyOutward CE 028Document1 pageSupplyOutward CE 028skgts787737No ratings yet

- Estimate #2023-125963Document1 pageEstimate #2023-125963Karthik DNo ratings yet

- Tax Invoice/Bill of Supply/Cash MemoDocument1 pageTax Invoice/Bill of Supply/Cash MemoShivam bohemia raja harzaiNo ratings yet

- Declaration in Respect of Housing LoanDocument1 pageDeclaration in Respect of Housing LoanJitender MadanNo ratings yet

- Firs Form 1 PDFDocument4 pagesFirs Form 1 PDFLugard WoduNo ratings yet

- 1099 ReportingDocument24 pages1099 ReportingAtif JavaidNo ratings yet

- Salary SlipDocument3 pagesSalary SlipPooja GuptaNo ratings yet

- Tax 1 1Document1 pageTax 1 1Krizel rochaNo ratings yet

- Salary Sheet Sathi Ko SathDocument15 pagesSalary Sheet Sathi Ko SathyadavNo ratings yet

- Penalties and RemediesDocument3 pagesPenalties and RemediesAerl XuanNo ratings yet

- Intro To Income TaxationDocument42 pagesIntro To Income TaxationConie PinadosNo ratings yet

- General Principles of VatDocument2 pagesGeneral Principles of VatCali Shandy H.No ratings yet

- The Raj Home INV 301Document2 pagesThe Raj Home INV 301Ankesh MishraNo ratings yet

- Sales Exclusive Tax Rate &Document3 pagesSales Exclusive Tax Rate &HaripriyaNo ratings yet

- Mushak-9.1 VAT Return On 11.JAN.2023Document6 pagesMushak-9.1 VAT Return On 11.JAN.2023Mac TanzinNo ratings yet

- Shareholder Demand LetterDocument3 pagesShareholder Demand LetterParalegal JGGCNo ratings yet

- Offer Letter SagarDocument1 pageOffer Letter Sagarhranjalisharma95No ratings yet

- Cagayan Electric Power vs. CIR, 138 S 629Document3 pagesCagayan Electric Power vs. CIR, 138 S 629Han SamNo ratings yet

- Payslip For The Month of Jul 2022Document1 pagePayslip For The Month of Jul 2022Natural HealthCare IdeasNo ratings yet

- NmNEK0JacjBpTStEQm9uN0JwS2ovdz09 InvoiceDocument2 pagesNmNEK0JacjBpTStEQm9uN0JwS2ovdz09 InvoiceJitender NarulaNo ratings yet

- Talenta Payslip PT Kobus Smart Service Agu 2023 SOPIAN PANCA PUTRADocument1 pageTalenta Payslip PT Kobus Smart Service Agu 2023 SOPIAN PANCA PUTRASopianpancputraNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Mithil UpadhyayNo ratings yet

- 028 Ptrs Modul Matematik t4 Sel-96-99Document4 pages028 Ptrs Modul Matematik t4 Sel-96-99mardhiah88No ratings yet

- Abc Company Pay SlipDocument2 pagesAbc Company Pay SlipFrancois Xavier RugemaNo ratings yet

- Eisner V MacomberDocument2 pagesEisner V Macomberhbs1234No ratings yet

- IPSFDocument7 pagesIPSFmanikandan BalasubramaniyanNo ratings yet

- Advance Payment of TaxDocument11 pagesAdvance Payment of TaxParul Bhardwaj VaidyaNo ratings yet

- 16 Roxas V CTA 23 SCRA 276 1968 Digest 1Document3 pages16 Roxas V CTA 23 SCRA 276 1968 Digest 1Graziella AndayaNo ratings yet