Professional Documents

Culture Documents

3.9 Tick Size and Its Impact: CMP at Expiry

3.9 Tick Size and Its Impact: CMP at Expiry

Uploaded by

antiquehindustaniOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3.9 Tick Size and Its Impact: CMP at Expiry

3.9 Tick Size and Its Impact: CMP at Expiry

Uploaded by

antiquehindustaniCopyright:

Available Formats

60

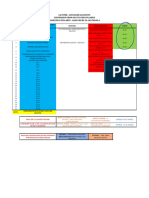

Short Futures Payoff

40

20

Profit/Loss (Rs.)

0

50 60 70 80 90 100 110 120 130 140 150

CMP @ Expiry

-20

-40

Short Futures Payoff

-60

As can be seen, a short futures position makes profits when prices fall. If prices fall to Rs 60

at expiry, the person who has shorted at Rs 100 will buy from the market at Rs 60 on expiry

and sell at 100, thereby making a profit of Rs 40. The lower the price of the underlying (i.e.,

the spot price) at expiry, the higher the profit made by the seller of the futures contract.

Short position in futures means selling a futures contract in anticipation of decrease in the

price before the expiry of the contract. If the price of the futures contract decreases before

the expiry of the contract, then the trader makes a profit by squaring off the position and if

the price of the futures contract increases, then the trader incurs a loss. Short speculators are

those who expect the price to fall and therefore sell futures contracts.

3.9 Tick Size and its impact

Tick size is the minimum price movement in terms of change in price or change in quotation

for order. It is in Rupees terms. If, as per the contract specification, the price of a commodity

is allowed to move from Rs.100 to Rs.100.10 or to Rs.99.90 (but not to prices in between like

Rs.100.05, or Rs.100.03, or Rs.99.95, or Rs.99.92, etc.), it means tick size for this commodity

is fixed as Rs.0.10 (i.e., 10 Paisa).

The tick size for commodity derivatives differs from one commodity to another. The impact

of change in price by one tick plays a significant role in entry and exit decisions for market

participants. Hence it is important to understand the profit and loss arising out of one tick

change on client’s portfolio which is called as “tick value”.

49

You might also like

- Trade ChecklistDocument5 pagesTrade ChecklistScott Neylon67% (3)

- Terms Used in Stock TradingDocument5 pagesTerms Used in Stock TradingRITIKA50% (2)

- FM Mid Term RevisionDocument20 pagesFM Mid Term RevisionSheril ThomasNo ratings yet

- S&PM PPT CH 15Document28 pagesS&PM PPT CH 15newnoobgamer17No ratings yet

- Creating Low-Risk Trading Strategies Using Derivative ProductsDocument12 pagesCreating Low-Risk Trading Strategies Using Derivative Productsshaikhnazneen100No ratings yet

- Two SMAs and Three Stop Loss Strategy - Sept28Document4 pagesTwo SMAs and Three Stop Loss Strategy - Sept28BiantoroKunartoNo ratings yet

- Option Trading StrategiesDocument92 pagesOption Trading StrategiesvarunNo ratings yet

- Frm7 Option StrategiesDocument28 pagesFrm7 Option StrategiesDîvýâñshü MâhâwârNo ratings yet

- Long Call Calendar Spread - 5paisa ArticleDocument4 pagesLong Call Calendar Spread - 5paisa ArticlepksNo ratings yet

- Option StrategiesDocument24 pagesOption Strategiesarvi2020100% (1)

- CA .Tarun Mahajan,: CA Final Strategic Financial Management, Paper 2, Chapter 5Document31 pagesCA .Tarun Mahajan,: CA Final Strategic Financial Management, Paper 2, Chapter 5Prasanni RaoNo ratings yet

- Option Trading StrategiesDocument48 pagesOption Trading StrategiesvarunNo ratings yet

- Margin TradingDocument11 pagesMargin TradingAvi RajNo ratings yet

- Microeconomics Dr. Pallavi Mody: Courage - HeartDocument14 pagesMicroeconomics Dr. Pallavi Mody: Courage - Heartmani kumarNo ratings yet

- Bracket and Cover OrderDocument11 pagesBracket and Cover OrderVaithialingam ArunachalamNo ratings yet

- FRM SlidesDocument24 pagesFRM Slidesbhaskar sinhaNo ratings yet

- Basics of TradingDocument6 pagesBasics of Tradingfor SaleNo ratings yet

- Short Iron Condor Spread - FidelityDocument8 pagesShort Iron Condor Spread - FidelityanalystbankNo ratings yet

- Quick Lesson: We Have Been Talking About Derivatives Recently, So What Is Derivatives ?Document13 pagesQuick Lesson: We Have Been Talking About Derivatives Recently, So What Is Derivatives ?Rushabh ShahNo ratings yet

- EducationSeries 14.Document2 pagesEducationSeries 14.Saied MastanNo ratings yet

- Hedging Against Foreign Exchange ExposureDocument2 pagesHedging Against Foreign Exchange ExposurehusainnabinNo ratings yet

- VDMV OptionsDocument24 pagesVDMV Optionsnilesh.das22hNo ratings yet

- Derivatives and Risk Management: Options - Basics and StrategiesDocument8 pagesDerivatives and Risk Management: Options - Basics and StrategiesRakshith PsNo ratings yet

- Hedging With FuturesDocument22 pagesHedging With FuturesDhananjay SinghalNo ratings yet

- Delta Hedging Strategy RevisedDocument5 pagesDelta Hedging Strategy RevisedLiladhar GaurNo ratings yet

- Trading and SettlementDocument12 pagesTrading and SettlementLakhan KodiyatarNo ratings yet

- Delta Hedging Strategy RevisedDocument5 pagesDelta Hedging Strategy Revisedவா.ம லெNo ratings yet

- Adobe Scan 21 Dec 2021Document20 pagesAdobe Scan 21 Dec 2021RAJAT SRIVASTAVANo ratings yet

- Intrdaday 30 Min Breakout StrategyDocument7 pagesIntrdaday 30 Min Breakout StrategySunny KhetarpalNo ratings yet

- Stop Limit PDFDocument5 pagesStop Limit PDFNazzta allezNo ratings yet

- Stop LimitDocument5 pagesStop Limitde_me3No ratings yet

- Microsoft PowerPoint - Lecture - Navigating MT4 [Platform)Document22 pagesMicrosoft PowerPoint - Lecture - Navigating MT4 [Platform)Tricia Angel P. BantigueNo ratings yet

- What Are OptionsDocument18 pagesWhat Are OptionsMvelo PhungulaNo ratings yet

- Option Pricing Theory & Financial OptionsDocument70 pagesOption Pricing Theory & Financial OptionsPiyush KhemkaNo ratings yet

- Risk ManagementDocument24 pagesRisk ManagementSoujanya NagarajaNo ratings yet

- Note 4Document4 pagesNote 4vimal vajpeyiNo ratings yet

- ArbitrageDocument5 pagesArbitrage21358 NDIMNo ratings yet

- Nmims BSC Eco Drm3 Oi and CocDocument35 pagesNmims BSC Eco Drm3 Oi and CocVarun MudaliarNo ratings yet

- Bhagyodya Stampings Note utxD0RUNkpDocument3 pagesBhagyodya Stampings Note utxD0RUNkpAshutosh BiswalNo ratings yet

- Podcast Interview Slide ShowDocument45 pagesPodcast Interview Slide Showmakelaristo7No ratings yet

- Option MarketsDocument27 pagesOption MarketsRitika YachnaNo ratings yet

- Trading Strategies NotesDocument3 pagesTrading Strategies Notesrnjuguna100% (1)

- 50767066Document27 pages50767066omprakashNo ratings yet

- BAF 462 Investment Analysis and Portfolio Management Investments and Derivatives StrategiesDocument55 pagesBAF 462 Investment Analysis and Portfolio Management Investments and Derivatives StrategiesLaston MilanziNo ratings yet

- Standard Deviation in OptionDocument2 pagesStandard Deviation in OptionfelixniefeiusNo ratings yet

- Options CA - CS.CMA - MBA: Naveen. RohatgiDocument38 pagesOptions CA - CS.CMA - MBA: Naveen. RohatgiDivyaNo ratings yet

- Option and FutureDocument28 pagesOption and Futuresunil_das95No ratings yet

- Forex Lot and Leverage PDFDocument10 pagesForex Lot and Leverage PDFiven kelebuka100% (2)

- Forex Lot and LeverageDocument10 pagesForex Lot and LeverageThato MotlhabaneNo ratings yet

- Forex Lot and LeverageDocument10 pagesForex Lot and LeverageThato MotlhabaneNo ratings yet

- 00trading Rules FinanciaFX BSC-VIP-VVIP-SHARIA (01042019) FIXDocument14 pages00trading Rules FinanciaFX BSC-VIP-VVIP-SHARIA (01042019) FIXi gede wirayudhanaNo ratings yet

- Bracket Orders & Trailing Stoploss (SL) Z-Connect by ZerodhaDocument167 pagesBracket Orders & Trailing Stoploss (SL) Z-Connect by Zerodhacsakhare82No ratings yet

- Mentoring Session 4, Day 8: 07 June 2021 Chart IndicatorsDocument26 pagesMentoring Session 4, Day 8: 07 June 2021 Chart Indicatorslakshmipathihsr64246100% (1)

- Basic Concepts: Maxfort School-Rohini Chapter - RevenueDocument7 pagesBasic Concepts: Maxfort School-Rohini Chapter - Revenuepiyush rohiraNo ratings yet

- Exit Strategies & Stop Loss TechniquesDocument7 pagesExit Strategies & Stop Loss TechniquesBhavya ShahNo ratings yet

- Topic 2BDocument26 pagesTopic 2BNokubongaNo ratings yet

- 1.1 Lesson 6 - PDF - How To Use Trailing Stops and Rejections of The 70 RSI To Take Profits When in A Winning Trade Using The 200 or 250 SMADocument12 pages1.1 Lesson 6 - PDF - How To Use Trailing Stops and Rejections of The 70 RSI To Take Profits When in A Winning Trade Using The 200 or 250 SMAhotdog10No ratings yet

- Session 5Document22 pagesSession 5nikNo ratings yet

- Series XVI-Commodity Derivatives-Ver-May 2022-21Document1 pageSeries XVI-Commodity Derivatives-Ver-May 2022-21antiquehindustaniNo ratings yet

- Series XVI-Commodity Derivatives-Ver-May 2022-22Document1 pageSeries XVI-Commodity Derivatives-Ver-May 2022-22antiquehindustaniNo ratings yet

- Commodity DerivativesDocument1 pageCommodity DerivativesantiquehindustaniNo ratings yet

- Series XVI-Commodity Derivatives-Ver-May 2022-15Document1 pageSeries XVI-Commodity Derivatives-Ver-May 2022-15antiquehindustaniNo ratings yet

- 10Document1 page10antiquehindustaniNo ratings yet

- 9Document1 page9antiquehindustaniNo ratings yet

- Series XVI Commodity Derivatives Ver May 2022 7Document1 pageSeries XVI Commodity Derivatives Ver May 2022 7antiquehindustaniNo ratings yet

- About NISM CertificationsDocument1 pageAbout NISM CertificationsantiquehindustaniNo ratings yet

- Foreword: DirectorDocument1 pageForeword: DirectorantiquehindustaniNo ratings yet

- Sample Questions: Ans: (B)Document1 pageSample Questions: Ans: (B)antiquehindustaniNo ratings yet

- 4.2 Option TerminologyDocument1 page4.2 Option TerminologyantiquehindustaniNo ratings yet

- About The NISM-Series-XVI: Commodity Derivatives Certification ExaminationDocument2 pagesAbout The NISM-Series-XVI: Commodity Derivatives Certification ExaminationantiquehindustaniNo ratings yet

- 3.10 Spot Price Polling and Final Settlement Price of FuturesDocument1 page3.10 Spot Price Polling and Final Settlement Price of FuturesantiquehindustaniNo ratings yet

- NISM Series IX Merchant Banking May 2023 VersionDocument222 pagesNISM Series IX Merchant Banking May 2023 VersionantiquehindustaniNo ratings yet

- 4Document3 pages4antiquehindustaniNo ratings yet

- 4 HeadsDocument133 pages4 HeadsantiquehindustaniNo ratings yet

- NISM-Series-XX-Taxation in Securities Markets Workbook-FINAL August 2023Document468 pagesNISM-Series-XX-Taxation in Securities Markets Workbook-FINAL August 2023antiquehindustaniNo ratings yet

- Changes in Adv. AccountsDocument1 pageChanges in Adv. AccountsantiquehindustaniNo ratings yet

- 4 Heads - RemovedDocument59 pages4 Heads - Removedantiquehindustani0% (1)