Professional Documents

Culture Documents

Cash Flow

Cash Flow

Uploaded by

husse fok0 ratings0% found this document useful (0 votes)

11 views1 pageThe document contains two multiple choice questions about items that could appear on a company's cash flow statement and the correct statements about calculating cash inflow from operating activities using the indirect method. The first question asks which items could appear on a cash flow statement, with options including proceeds from share issues, dividends received, and proposed dividends. The second question asks which statements about calculating cash inflow from operating activities are correct, with options including deducting inventory increases and adding depreciation charges and increases in payables.

Original Description:

Original Title

Cash flow

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains two multiple choice questions about items that could appear on a company's cash flow statement and the correct statements about calculating cash inflow from operating activities using the indirect method. The first question asks which items could appear on a cash flow statement, with options including proceeds from share issues, dividends received, and proposed dividends. The second question asks which statements about calculating cash inflow from operating activities are correct, with options including deducting inventory increases and adding depreciation charges and increases in payables.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

11 views1 pageCash Flow

Cash Flow

Uploaded by

husse fokThe document contains two multiple choice questions about items that could appear on a company's cash flow statement and the correct statements about calculating cash inflow from operating activities using the indirect method. The first question asks which items could appear on a cash flow statement, with options including proceeds from share issues, dividends received, and proposed dividends. The second question asks which statements about calculating cash inflow from operating activities are correct, with options including deducting inventory increases and adding depreciation charges and increases in payables.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

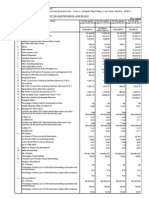

Which of the following items could appear in a company’s cash flow statement?

(1) Surplus on revaluation of non-current assets.

(2) Proceeds of issue of shares.

(3) Proposed dividend.

(4) Bad debts written off.

(5) Dividends received.

A (1), (2) and (5) only

B (2), (3), (4), (5) only

C (2) and (5) only

D (3) and (4) only

Part of the process of preparing a company’s cash flow statement is the calculation of cash inflow from operating

activities.

Which of the following statements about that calculation (using the indirect method) are correct?

(1) Loss on sale of operating non-current assets should be deducted from net profit before taxation.

(2) Increase in inventory should be deducted from operating profits.

(3) Increase in payables should be added to operating profits.

(4) Depreciation charges should be added to net profit before taxation.

A (1), (2) and (3)

B (1), (2) and (4)

C (1), (3) and (4)

D (2), (3) and (4)

You might also like

- Epm QuestionsDocument10 pagesEpm QuestionsChaitali GhodkeNo ratings yet

- Cpa Fin Su3 OutlineDocument23 pagesCpa Fin Su3 OutlineHanh Mai TranNo ratings yet

- Advanced Financial Reporting University ExamDocument8 pagesAdvanced Financial Reporting University ExamHelena ThomasNo ratings yet

- Company Accounts and IAS (Paper f3)Document7 pagesCompany Accounts and IAS (Paper f3)ASISHAHEENNo ratings yet

- Bafs MC QuestionDocument9 pagesBafs MC Questionle2ztungNo ratings yet

- BSNL MT Telecom FinanceDocument152 pagesBSNL MT Telecom FinanceVishwajit SonawaneNo ratings yet

- Bachelor'S Preparatory Programme (B.P.P.) Term-End Examination December, 2012 PC0-01Document16 pagesBachelor'S Preparatory Programme (B.P.P.) Term-End Examination December, 2012 PC0-01Radhe KrishnaNo ratings yet

- Bachelor in Applied Commerce - Year III - Business Accounting and ManagementdocxDocument5 pagesBachelor in Applied Commerce - Year III - Business Accounting and ManagementdocxElora NandyNo ratings yet

- Mar 2019 Paper 1 Questions EngDocument15 pagesMar 2019 Paper 1 Questions EngTerry MaNo ratings yet

- CC CCDocument24 pagesCC CCManish SinghNo ratings yet

- Reconcilation Statement PDFDocument3 pagesReconcilation Statement PDFNimur RahamanNo ratings yet

- Preparatory Course in CommerceDocument16 pagesPreparatory Course in Commerceneeraj61289No ratings yet

- PROFIT & LOSS ACCOUNT - PAcademyDocument1 pagePROFIT & LOSS ACCOUNT - PAcademyvikas bhatiaNo ratings yet

- Business Administration PapersDocument36 pagesBusiness Administration Papersinfiniti786No ratings yet

- Accounting & Finance (SMB108)Document25 pagesAccounting & Finance (SMB108)lravi4uNo ratings yet

- Financial Statment TestDocument3 pagesFinancial Statment TestDerick FloresNo ratings yet

- Accountancy and Auditing-2007Document10 pagesAccountancy and Auditing-2007BabarNo ratings yet

- Fauint Pilot PaperDocument14 pagesFauint Pilot PaperSara DoweNo ratings yet

- MCQ Part 1Document41 pagesMCQ Part 1Santosh Shrestha100% (1)

- Caft 001: Common Accounting and Finance TestDocument21 pagesCaft 001: Common Accounting and Finance TestNaren JangirNo ratings yet

- Commerce&AuditDocument72 pagesCommerce&AuditTaniya MahturNo ratings yet

- 2013 - 3 - 5 - 17 - Financial Accounting - Paper A - March - 2013 - EnglishDocument7 pages2013 - 3 - 5 - 17 - Financial Accounting - Paper A - March - 2013 - EnglishJahanzaib ButtNo ratings yet

- Paper II ITO Advancedaccountancy - 13072009Document15 pagesPaper II ITO Advancedaccountancy - 13072009mukeshNo ratings yet

- Assignment 1Document21 pagesAssignment 1siddhant jainNo ratings yet

- KMBSolution 4Document5 pagesKMBSolution 4Nurbek SeiitovNo ratings yet

- Roll No Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Document8 pagesRoll No Time Allowed: 3 Hours Maximum Marks: 100 Total Number of Questions: 8 Total Number of Printed Pages: 8Maninder BaggaNo ratings yet

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderNo ratings yet

- DeVry ACCT 504 Final ExamDocument8 pagesDeVry ACCT 504 Final ExamdevryfinalexamscomNo ratings yet

- Css Accounting2 2013Document3 pagesCss Accounting2 2013Rana Zafar ArshadNo ratings yet

- Reconciliation of Cost and Financial Accounts PDFDocument14 pagesReconciliation of Cost and Financial Accounts PDFvihangimadu100% (2)

- Vat Budgeting - ApplicationDocument3 pagesVat Budgeting - ApplicationYara AzizNo ratings yet

- HKUGA CollegeDocument8 pagesHKUGA Colleges191056No ratings yet

- 22-23 X2 S4 BAFS P2A MC ExplanationsDocument6 pages22-23 X2 S4 BAFS P2A MC Explanationss191056No ratings yet

- Management Information-PQDocument6 pagesManagement Information-PQRomail QaziNo ratings yet

- Answers Quiz Chapter 4Document4 pagesAnswers Quiz Chapter 4Anthony MartinezNo ratings yet

- Accounting & Auditing Paper-II (2003) : Senior Auditors FPSC MCQSDocument20 pagesAccounting & Auditing Paper-II (2003) : Senior Auditors FPSC MCQSAli khanNo ratings yet

- The Accounting Education EPFO Accounting MCQ QUIZDocument20 pagesThe Accounting Education EPFO Accounting MCQ QUIZAnmol ChawlaNo ratings yet

- Financial Statement Analysis ExamDocument21 pagesFinancial Statement Analysis ExamKheang Sophal100% (2)

- BPP F3 KitDocument7 pagesBPP F3 KitMuhammad Ubaid UllahNo ratings yet

- Company AccountsDocument77 pagesCompany AccountsNamish GuptaNo ratings yet

- Financial Management MCQsDocument42 pagesFinancial Management MCQssaeedsjaan90% (41)

- Format of The Revised Schedule VIDocument2 pagesFormat of The Revised Schedule VIJoydip DasNo ratings yet

- Ba Paper 1 EngDocument12 pagesBa Paper 1 EngChun Kit LauNo ratings yet

- PE Exam March 2012Document31 pagesPE Exam March 2012Shahzada Khayyam NisarNo ratings yet

- Financial Results For The Quarter Ended 30 June 2012Document2 pagesFinancial Results For The Quarter Ended 30 June 2012Jkjiwani AccaNo ratings yet

- Ma 6Document32 pagesMa 6Tausif Narmawala0% (1)

- Term End Examination, June, 2021: Pco-01: Preparatory Course in CommerceDocument23 pagesTerm End Examination, June, 2021: Pco-01: Preparatory Course in CommerceRohit GhuseNo ratings yet

- Top Senior Auditor Solved MCQs Past PapersDocument12 pagesTop Senior Auditor Solved MCQs Past PapersAli100% (1)

- Strategic and Financial MGMT PapersDocument132 pagesStrategic and Financial MGMT Papersdk_sisNo ratings yet

- MRF PNL BalanaceDocument2 pagesMRF PNL BalanaceRupesh DhindeNo ratings yet

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNo ratings yet

- Guide to Management Accounting CCC for managers 2020 EditionFrom EverandGuide to Management Accounting CCC for managers 2020 EditionNo ratings yet

- Guide to Management Accounting CCC (Cash Conversion Cycle) for Managers 2020 EditionFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for Managers 2020 EditionNo ratings yet

- Wiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)From EverandWiley CMAexcel Learning System Exam Review 2017: Part 1, Financial Reporting, Planning, Performance, and Control (1-year access)No ratings yet

- Guide to Strategic Management Accounting for Managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?From EverandGuide to Strategic Management Accounting for Managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?No ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- Chapter 8 - OverheadsDocument2 pagesChapter 8 - Overheadshusse fokNo ratings yet

- Control AccountDocument1 pageControl Accounthusse fokNo ratings yet

- Provisions and ContingenciesDocument4 pagesProvisions and Contingencieshusse fokNo ratings yet

- Assessment ZAkDocument1 pageAssessment ZAkhusse fokNo ratings yet

- Stamina Limited Has A Financial Year End of 31 DecemberDocument2 pagesStamina Limited Has A Financial Year End of 31 Decemberhusse fokNo ratings yet

- Statement of Financial Position As at 31 DecemberDocument1 pageStatement of Financial Position As at 31 Decemberhusse fokNo ratings yet

- EOT Docterm 3.3 Accounting DeptDocument4 pagesEOT Docterm 3.3 Accounting Depthusse fokNo ratings yet

- Cheese BallDocument2 pagesCheese Ballhusse fokNo ratings yet

- Cheese BallDocument2 pagesCheese Ballhusse fokNo ratings yet

- Lesson Plan Correction of ErrorsDocument1 pageLesson Plan Correction of Errorshusse fokNo ratings yet

- Lesson Plan Control AccountsDocument1 pageLesson Plan Control Accountshusse fokNo ratings yet

- Cambridge O Level Exams OctDocument3 pagesCambridge O Level Exams Octhusse fokNo ratings yet

- Assessment ZAkDocument1 pageAssessment ZAkhusse fokNo ratings yet

- Lesson Plan Incomplete RecordDocument1 pageLesson Plan Incomplete Recordhusse fokNo ratings yet

- Lesson Plan - 7!8!22.08 Ac MC Grade 13Document1 pageLesson Plan - 7!8!22.08 Ac MC Grade 13husse fokNo ratings yet

- End of Term - T3.3 - 2022Document3 pagesEnd of Term - T3.3 - 2022husse fokNo ratings yet

- Docket ReportDocument2 pagesDocket Reporthusse fokNo ratings yet

- 9706 - m19 - QP - 22 AdjustedDocument20 pages9706 - m19 - QP - 22 Adjustedhusse fokNo ratings yet

- 8Document1 page8husse fokNo ratings yet