Professional Documents

Culture Documents

Ghana Loan Pre Agreement Statement and APR Calculator 30 10 15 - Final Dra..

Ghana Loan Pre Agreement Statement and APR Calculator 30 10 15 - Final Dra..

Uploaded by

Nana Akua AseiduaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ghana Loan Pre Agreement Statement and APR Calculator 30 10 15 - Final Dra..

Ghana Loan Pre Agreement Statement and APR Calculator 30 10 15 - Final Dra..

Uploaded by

Nana Akua AseiduaCopyright:

Available Formats

PRE-AGREEMENT TRUTH IN LENDING DISCLOSURE STATEMENT

Lender's Name: Applicant Name: Date prepared:

Prepared by: Address: Application No:

KEY TERMS & CONDITIONS - Review Carefully Before Agreeing to Loan

Loan Amount All Interest and Other Fees Amount you will pay

GHS 10,000.00 + GHS 1,771.71 = GHS 11,771.71

LOAN SUMMARY FEES & COMMISSIONS REPAYMENT SCHEDULE

Amount of Loan Interest charges

The value of the loan you are GHS 980.98

GHS 1,071.71 Amount of each payment

signing for

Other charges and fees (see

GHS 10,000.00 below for details) GHS 700.00 Payment frequency Monthly

Amount Received Number of payments 12

The actual amount the lender

provides you at beginning of loan GHS 10,000.00 APR* 31.24%

*APR reflects the cost of the credit you are taking on a yearly basis. It is a

Required Compulsory Deposit useful tool to compare costs of similar loans and credits.

GHS 500.00 Loan Term ____ Months

DETAILED DESCRIPTION OF PENALTIES AND CHARGES AND ADDITIONAL REQUIREMENTS

PENALTY CHARGES OTHER CHARGES & FEES

Late Payment: If a payment is more than [ ] days late, you Prepayment: If you pay the loan off early you: Credit history consultation fee GHS -

will be charged ___% on the remaining balance of the loan. * Will have to pay a penalty of ____________ Commitment fee GHS -

* May be entitled to a refund of part of the interest fees and other Processing fees GHS 100.00

charges Other charges GHS -

Insurance fees GHS 100.00

PAYMENT SCHEDULE

Date First Payment Due 31/01/2016

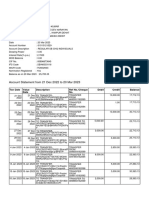

Payment Due Date Payment Amount Interest Charges Principal Remaining Balance

31/01/2016 GHS 980.98 GHS 160.50 GHS 820.48 GHS 9,879.52

28/02/2016 GHS 980.98 GHS 148.19 GHS 832.78 GHS 9,046.74

31/03/2016 GHS 980.98 GHS 135.70 GHS 845.27 GHS 8,201.47

30/04/2016 GHS 980.98 GHS 123.02 GHS 857.95 GHS 7,343.51

31/05/2016 GHS 980.98 GHS 110.15 GHS 870.82 GHS 6,472.69

30/06/2016 GHS 980.98 GHS 97.09 GHS 883.89 GHS 5,588.80

31/07/2016 GHS 980.98 GHS 83.83 GHS 897.14 GHS 4,691.66

31/08/2016 GHS 980.98 GHS 70.37 GHS 910.60 GHS 3,781.06

30/09/2016 GHS 980.98 GHS 56.72 GHS 924.26 GHS 2,856.80

31/10/2016 GHS 980.98 GHS 42.85 GHS 938.12 GHS 1,918.67

30/11/2016 GHS 980.98 GHS 28.78 GHS 952.20 GHS 966.48

31/12/2016 GHS 980.98 GHS 14.50 GHS 966.48 GHS 0.00

TOTAL GHS 11,771.71 GHS 1,071.71 GHS 10,700.00 GHS 0.00

Cooling Off Period: You may, up to 10 days after signing the loan agreement, cancel the loan, and only pay any disbursements to date, as well as an administrative fee of _____% of the Amount of

Loan. To exercise such right, you shall give a written notice through this address :

For any questions or complaints, please contact the Telephone: Address: Email: Complaints Unit Manager:

customer service hotline:

Signature of Customer _________________________ Signature of Loan Officer _________________________

Date _________________________ Date _________________________

Institution Name

Product Name

Loan Amount GHS 10,000.00

Months of Loan 12

Annual Interest Rate 18.00%

Monthly Interest Rate 1.50%

Declining or Flat Balance

Interest Rate? (1=Declining,

2=Flat) 1

Mandatory Savings GHS 500.00

Fees and Insurance

(1=Financed, 2=Deducted from

Principle) 1.00

Insurance Charge 100.00

Credit History Consultation 0.00

Commitment Fee 0.00

Processing Fee 100.00

Mandatory Savings Cost 500.00

Other Fees

0.00

Fees and Insurance Expressed

in % or GHS (1=%, 2=GHS) 2

Total Other Charges & Fees GHS 700.00

Interest Charges GHS 1,071.71

Amount to Finance GHS 10,700.00

Amount Received GHS 10,000.00

Payment Frequency Monthly

Monthly Payments GHS 980.98

Total Payments GHS 11,771.71

Number of Payments 12

APR 31.24%

Payment Period Capital Interest Charges Principal Balance Monthly Payment

0 GHS 10,000.00 - - -

1 GHS 10,700.00 GHS 160.50 GHS 820.48 GHS 9,879.52 GHS 980.98

2 GHS 9,879.52 GHS 148.19 GHS 832.78 GHS 9,046.74 GHS 980.98

3 GHS 9,046.74 GHS 135.70 GHS 845.27 GHS 8,201.47 GHS 980.98

4 GHS 8,201.47 GHS 123.02 GHS 857.95 GHS 7,343.51 GHS 980.98

5 GHS 7,343.51 GHS 110.15 GHS 870.82 GHS 6,472.69 GHS 980.98

6 GHS 6,472.69 GHS 97.09 GHS 883.89 GHS 5,588.80 GHS 980.98

7 GHS 5,588.80 GHS 83.83 GHS 897.14 GHS 4,691.66 GHS 980.98

8 GHS 4,691.66 GHS 70.37 GHS 910.60 GHS 3,781.06 GHS 980.98

9 GHS 3,781.06 GHS 56.72 GHS 924.26 GHS 2,856.80 GHS 980.98

10 GHS 2,856.80 GHS 42.85 GHS 938.12 GHS 1,918.67 GHS 980.98

11 GHS 1,918.67 GHS 28.78 GHS 952.20 GHS 966.48 GHS 980.98

12 GHS 966.48 GHS 14.50 GHS 966.48 GHS - GHS 980.98

13 GHS - GHS - GHS - GHS - GHS -

14 GHS - GHS - GHS - GHS - GHS -

15 GHS - GHS - GHS - GHS - GHS -

16 GHS - GHS - GHS - GHS - GHS -

17 GHS - GHS - GHS - GHS - GHS -

18 GHS - GHS - GHS - GHS - GHS -

19 GHS - GHS - GHS - GHS - GHS -

20 GHS - GHS - GHS - GHS - GHS -

21 GHS - GHS - GHS - GHS - GHS -

22 GHS - GHS - GHS - GHS - GHS -

23 GHS - GHS - GHS - GHS - GHS -

24 GHS - GHS - GHS - GHS - GHS -

25 GHS - GHS - GHS - GHS - GHS -

26 GHS - GHS - GHS - GHS - GHS -

27 GHS - GHS - GHS - GHS - GHS -

28 GHS - GHS - GHS - GHS - GHS -

29 GHS - GHS - GHS - GHS - GHS -

30 GHS - GHS - GHS - GHS - GHS -

31 GHS - GHS - GHS - GHS - GHS -

32 GHS - GHS - GHS - GHS - GHS -

33 GHS - GHS - GHS - GHS - GHS -

34 GHS - GHS - GHS - GHS - GHS -

35 GHS - GHS - GHS - GHS - GHS -

36 GHS - GHS - GHS - GHS - GHS -

37 GHS - GHS - GHS - GHS - GHS -

38 GHS - GHS - GHS - GHS - GHS -

39 GHS - GHS - GHS - GHS - GHS -

40 GHS - GHS - GHS - GHS - GHS -

41 GHS - GHS - GHS - GHS - GHS -

42 GHS - GHS - GHS - GHS - GHS -

43 GHS - GHS - GHS - GHS - GHS -

44 GHS - GHS - GHS - GHS - GHS -

45 GHS - GHS - GHS - GHS - GHS -

46 GHS - GHS - GHS - GHS - GHS -

47 GHS - GHS - GHS - GHS - GHS -

48 GHS - GHS - GHS - GHS - GHS -

TOTAL GHS 1,071.71 GHS 10,700.00 GHS 11,771.71

Institution Name

Product Name

Loan Amount GHS 10,000.00

Months of Loan 12

Annual Interest Rate 18.00%

Monthly Interest Rate 1.50%

Declining or Flat Balance

Interest Rate? (1=Declining,

2=Flat) 2

Mandatory Savings GHS 500.00

185 Day Treasury Bill Rate 10%

Fees and Insurance

(1=Financed, 2=Deducted from

Principle) 1.00

Insurance Charge 100.00

Credit History Consultation 0.00

Commitment Fee 0.00

Processing Fee 100.00

Mandatory Savings Cost 50.00

Other Charges

0.00

Fees and Insurance Expressed

in % or $ (1=%, 2=$) 2

Total Other Charges & Fees GHS 250.00

Interest Charges GHS 1,845.00

Amount to Finance GHS 10,250.00

Amount Received GHS 10,000.00

Payment Frequency Monthly

Monthly Payments GHS 1,007.92

Total Payments GHS 12,095.00

Number of Payments 12

APR 36.66%

Payment Period Capital Interest Charges Principal Balance Monthly Payment

0 GHS 10,000.00 - - -

1 GHS 10,250.00 GHS 153.75 GHS 854.17 GHS 9,395.83 GHS 1,007.92

2 GHS 9,395.83 GHS 153.75 GHS 854.17 GHS 8,541.67 GHS 1,007.92

3 GHS 8,541.67 GHS 153.75 GHS 854.17 GHS 7,687.50 GHS 1,007.92

4 GHS 7,687.50 GHS 153.75 GHS 854.17 GHS 6,833.33 GHS 1,007.92

5 GHS 6,833.33 GHS 153.75 GHS 854.17 GHS 5,979.17 GHS 1,007.92

6 GHS 5,979.17 GHS 153.75 GHS 854.17 GHS 5,125.00 GHS 1,007.92

7 GHS 5,125.00 GHS 153.75 GHS 854.17 GHS 4,270.83 GHS 1,007.92

8 GHS 4,270.83 GHS 153.75 GHS 854.17 GHS 3,416.67 GHS 1,007.92

9 GHS 3,416.67 GHS 153.75 GHS 854.17 GHS 2,562.50 GHS 1,007.92

10 GHS 2,562.50 GHS 153.75 GHS 854.17 GHS 1,708.33 GHS 1,007.92

11 GHS 1,708.33 GHS 153.75 GHS 854.17 GHS 854.17 GHS 1,007.92

12 GHS 854.17 GHS 153.75 GHS 854.17 GHS - GHS 1,007.92

13 GHS - GHS - GHS - GHS - GHS -

14 GHS - GHS - GHS - GHS - GHS -

15 GHS - GHS - GHS - GHS - GHS -

16 GHS - GHS - GHS - GHS - GHS -

17 GHS - GHS - GHS - GHS - GHS -

18 GHS - GHS - GHS - GHS - GHS -

19 GHS - GHS - GHS - GHS - GHS -

20 GHS - GHS - GHS - GHS - GHS -

21 GHS - GHS - GHS - GHS - GHS -

22 GHS - GHS - GHS - GHS - GHS -

23 GHS - GHS - GHS - GHS - GHS -

24 GHS - GHS - GHS - GHS - GHS -

25 GHS - GHS - GHS - GHS - GHS -

26 GHS - GHS - GHS - GHS - GHS -

27 GHS - GHS - GHS - GHS - GHS -

28 GHS - GHS - GHS - GHS - GHS -

29 GHS - GHS - GHS - GHS - GHS -

30 GHS - GHS - GHS - GHS - GHS -

31 GHS - GHS - GHS - GHS - GHS -

32 GHS - GHS - GHS - GHS - GHS -

33 GHS - GHS - GHS - GHS - GHS -

34 GHS - GHS - GHS - GHS - GHS -

35 GHS - GHS - GHS - GHS - GHS -

36 GHS - GHS - GHS - GHS - GHS -

37 GHS - GHS - GHS - GHS - GHS -

38 GHS - GHS - GHS - GHS - GHS -

39 GHS - GHS - GHS - GHS - GHS -

40 GHS - GHS - GHS - GHS - GHS -

41 GHS - GHS - GHS - GHS - GHS -

42 GHS - GHS - GHS - GHS - GHS -

43 GHS - GHS - GHS - GHS - GHS -

44 GHS - GHS - GHS - GHS - GHS -

45 GHS - GHS - GHS - GHS - GHS -

46 GHS - GHS - GHS - GHS - GHS -

47 GHS - GHS - GHS - GHS - GHS -

48 GHS - GHS - GHS - GHS - GHS -

TOTAL GHS 1,845.00 GHS 10,250.00 GHS 12,095.00

PRE-AGREEMENT TRUTH IN LENDING DISCLOSURE STATEMENT

Lender's Name: Applicant Name: Date prepared:

Prepared by: Address: Application No:

KEY TERMS & CONDITIONS - Review Carefully Before Agreeing to Loan

Loan Amount All Interest and Other Fees Amount you will pay

GHS 10,000.00 + GHS 2,095.00 = GHS 12,095.00

LOAN SUMMARY FEES & COMMISSIONS REPAYMENT SCHEDULE

Amount of Loan Interest charges

The value of the loan you are GHS 1,007.92

GHS 1,845.00 Amount of each payment

signing for

Other charges and fees (see

GHS 10,000.00 below for details) GHS 250.00 Payment frequency Monthly

Amount Received Number of payments 12

The actual amount the lender

provides you at beginning of loan GHS 10,000.00 APR* 36.66%

*APR reflects the cost of the credit you are taking on a yearly basis. It is a

Required Compulsory Deposit useful tool to compare costs of similar loans and credits.

GHS 500.00 Loan Term ____ Months

DETAILED DESCRIPTION OF PENALTIES AND CHARGES AND ADDITIONAL REQUIREMENTS

PENALTY CHARGES OTHER CHARGES & FEES

Late Payment: If a payment is more than [ ] days late, you Prepayment: If you pay the loan off early you: Credit history consultation fee GHS -

will be charged ___% on the remaining balance of the loan. * Will have to pay a penalty of ____________ Commitment fee GHS -

* May be entitled to a refund of part of the interest fees and other Processing fees GHS 100.00

charges Other charges GHS -

Insurance fees GHS 100.00

PAYMENT SCHEDULE

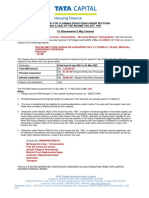

Date First Payment Due 31/01/2016

Payment Due Date Payment Amount Interest Charges Principal Remaining Balance

31/01/2016 GHS 1,007.92 GHS 153.75 GHS 854.17 GHS 9,395.83

28/02/2016 GHS 1,007.92 GHS 153.75 GHS 854.17 GHS 8,541.67

31/03/2016 GHS 1,007.92 GHS 153.75 GHS 854.17 GHS 7,687.50

30/04/2016 GHS 1,007.92 GHS 153.75 GHS 854.17 GHS 6,833.33

31/05/2016 GHS 1,007.92 GHS 153.75 GHS 854.17 GHS 5,979.17

30/06/2016 GHS 1,007.92 GHS 153.75 GHS 854.17 GHS 5,125.00

31/07/2016 GHS 1,007.92 GHS 153.75 GHS 854.17 GHS 4,270.83

31/08/2016 GHS 1,007.92 GHS 153.75 GHS 854.17 GHS 3,416.67

30/09/2016 GHS 1,007.92 GHS 153.75 GHS 854.17 GHS 2,562.50

31/10/2016 GHS 1,007.92 GHS 153.75 GHS 854.17 GHS 1,708.33

30/11/2016 GHS 1,007.92 GHS 153.75 GHS 854.17 GHS 854.17

31/12/2016 GHS 1,007.92 GHS 153.75 GHS 854.17 GHS -

TOTAL GHS 12,095.00 $1,845.00 $10,250.00 GHS -

Cooling Off Period: You may, up to 10 days after signing the loan agreement, cancel the loan, and only pay any disbursements to date, as well as an administrative fee of _____% of the Amount of

Loan. To exercise such right, you shall give a written notice through this address :

For any questions or complaints, please contact the Telephone: Address: Email: Complaints Unit Manager:

customer service hotline:

Signature of Customer _________________________ Signature of Loan Officer _________________________

Date _________________________ Date _________________________

You might also like

- Full Credit Report - Credit Karma PDFDocument13 pagesFull Credit Report - Credit Karma PDFmolly brown0% (1)

- Chequing Statement-1606 2023-07-04Document2 pagesChequing Statement-1606 2023-07-04Kashif AhmedNo ratings yet

- Statement20230921 2Document8 pagesStatement20230921 2Connie ForsythNo ratings yet

- Quiz 1 InstructionsDocument6 pagesQuiz 1 Instructionssyed mujtubaNo ratings yet

- INV91509602 Zoom KSKK Juli 2021 PDFDocument3 pagesINV91509602 Zoom KSKK Juli 2021 PDFSamsul Arifin0% (1)

- Tax Liens: How To Generate Income From Property Tax Lien CertificatesFrom EverandTax Liens: How To Generate Income From Property Tax Lien CertificatesNo ratings yet

- Truth-in-Lending Disclosures Annual Percentage Rate Finance ChargeDocument6 pagesTruth-in-Lending Disclosures Annual Percentage Rate Finance ChargeHuy HuynhNo ratings yet

- Inv102710174 A14348893 08172021Document2 pagesInv102710174 A14348893 08172021Muna KhanNo ratings yet

- Term Sheet (Annex A) : A. Computations (DP So 6 Months at 0% Interest)Document1 pageTerm Sheet (Annex A) : A. Computations (DP So 6 Months at 0% Interest)Jp BorromeoNo ratings yet

- Loan AgreementDocument10 pagesLoan AgreementRunToLiveHDNo ratings yet

- Jan2024Document9 pagesJan2024Riffs MusicNo ratings yet

- INV157064139Document3 pagesINV157064139pramana41No ratings yet

- T Mobile Receipt RK PDFDocument6 pagesT Mobile Receipt RK PDFbesnik besnik100% (1)

- EIPAgreementDocument6 pagesEIPAgreementmwn5vkrcjbNo ratings yet

- Rahul NewDocument1 pageRahul NewArman TamboliNo ratings yet

- Inv252004371 A12715971 04102024Document3 pagesInv252004371 A12715971 04102024santandercarrerNo ratings yet

- In Voice PDFDocument3 pagesIn Voice PDFIlham ArifNo ratings yet

- Late Charge. Additional InformationDocument6 pagesLate Charge. Additional InformationnicholasiraNo ratings yet

- New Elections - 2024Document5 pagesNew Elections - 2024Chandra913No ratings yet

- Supreme Transliner, Inc. vs. BPI Family Savings Bank, Inc. 644 SCRA 59, February 25, 2011Document6 pagesSupreme Transliner, Inc. vs. BPI Family Savings Bank, Inc. 644 SCRA 59, February 25, 2011Francise Mae Montilla MordenoNo ratings yet

- BankDocument2 pagesBank5s5sb2qvrcNo ratings yet

- Text 1Document1 pageText 1Ahmed SamirNo ratings yet

- DownloadDocument18 pagesDownloadliljoybug19No ratings yet

- Factura Nov ZoomDocument3 pagesFactura Nov ZoomHéctor QuirozNo ratings yet

- Zpsagreementshowtranid ZMP20201207110122 BC 17 FD 44Document12 pagesZpsagreementshowtranid ZMP20201207110122 BC 17 FD 44Licia BeezNo ratings yet

- INV162671930Document2 pagesINV162671930flexiteam.ssNo ratings yet

- SSP JobAid-AccessoryFinancingDocument5 pagesSSP JobAid-AccessoryFinancingawxcareNo ratings yet

- INV158931011Document3 pagesINV158931011Riski PratamaNo ratings yet

- INV212820156Document2 pagesINV212820156tuditdalfat 2020No ratings yet

- Prev 165896547003461209Document19 pagesPrev 165896547003461209sososolalalaiiNo ratings yet

- S8 45MM (Cell)Document6 pagesS8 45MM (Cell)tyger ndaNo ratings yet

- Hyundai-2022-Elantra-Preferred IVTDocument6 pagesHyundai-2022-Elantra-Preferred IVTGaurav PatilNo ratings yet

- CN22737232400239-Anjaney TyresDocument1 pageCN22737232400239-Anjaney Tyreskumarkishan42322No ratings yet

- HI-solutions: Tax InvoiceDocument1 pageHI-solutions: Tax InvoiceRakesh S RNo ratings yet

- ClosingDocument17 pagesClosingJordan DurandNo ratings yet

- Zoom Enero 2024Document3 pagesZoom Enero 2024Héctor QuirozNo ratings yet

- AprilDocument1 pageAprilRakesh S RNo ratings yet

- AprilDocument1 pageAprilRakesh S RNo ratings yet

- Invoice: Charge DetailsDocument2 pagesInvoice: Charge Detailsthương thuongNo ratings yet

- Invoice: Charge DetailsDocument3 pagesInvoice: Charge Detailsarwani kuNo ratings yet

- Disc - Vida RoseDocument1 pageDisc - Vida Roseev635762No ratings yet

- B9C1CC2E 015B 4D11 A32F F4FB0D467C0D Removebg PreviewDocument1 pageB9C1CC2E 015B 4D11 A32F F4FB0D467C0D Removebg Previewnitavia19No ratings yet

- March InternetDocument1 pageMarch InternetRakesh S RNo ratings yet

- March InternetDocument1 pageMarch InternetRakesh S RNo ratings yet

- Cash-927-2223-14 Jan 23Document1 pageCash-927-2223-14 Jan 23Narendra KelkarNo ratings yet

- Inv TN B1 81676474 103654274972 January 2023Document4 pagesInv TN B1 81676474 103654274972 January 2023ckumarpmkNo ratings yet

- PDFDocument1 pagePDFShankar SumanNo ratings yet

- HDMF 36mosDocument1 pageHDMF 36mosishiegonzales02No ratings yet

- Invoice: Zoom W-9 Question About Your Billing?Document2 pagesInvoice: Zoom W-9 Question About Your Billing?jaime morilloNo ratings yet

- Invoice Zoom (Juni-Juli 2023)Document3 pagesInvoice Zoom (Juni-Juli 2023)YAUMIL HAERIAH TAHIRNo ratings yet

- Invoice: Charge DetailsDocument2 pagesInvoice: Charge DetailsMartin TorresNo ratings yet

- Shahnawaj Bill BSNL)Document1 pageShahnawaj Bill BSNL)Arman TamboliNo ratings yet

- INV221294918Document2 pagesINV221294918tuditdalfat 2020No ratings yet

- Zoom Meeting JuneDocument2 pagesZoom Meeting JuneVIRAMA KARYA - KimtaruNo ratings yet

- Invoice: Charge DetailsDocument2 pagesInvoice: Charge Detailsامة اللهNo ratings yet

- BM 2024 I 001786196Document6 pagesBM 2024 I 001786196Sahil SharmaNo ratings yet

- Build Price SummaryDocument1 pageBuild Price SummaryKitua De VilleNo ratings yet

- Charge DetailsDocument3 pagesCharge DetailsMaths FaccultyNo ratings yet

- Zadia 2 10-12 (Studio A) (10%dpin3mos-90% Balance)Document1 pageZadia 2 10-12 (Studio A) (10%dpin3mos-90% Balance)sapunganljoyNo ratings yet

- Nov2022Document14 pagesNov2022G SNo ratings yet

- Sample BillDocument2 pagesSample BillLim Qing WenNo ratings yet

- Structured Settlements: A Guide For Prospective SellersFrom EverandStructured Settlements: A Guide For Prospective SellersNo ratings yet

- Structured Settlement Basics: Understanding Structured Settlement Buying, Selling and InvestingFrom EverandStructured Settlement Basics: Understanding Structured Settlement Buying, Selling and InvestingRating: 5 out of 5 stars5/5 (1)

- Daycare Tie-Up at TCS Bangalore1Document5 pagesDaycare Tie-Up at TCS Bangalore1nagammaiNo ratings yet

- AIBL Mastercard Dining Offer 2020Document3 pagesAIBL Mastercard Dining Offer 2020Jewel AhmedNo ratings yet

- Demand LetterDocument45 pagesDemand LetterBilly JoeNo ratings yet

- Mercer COL Survey 2008Document5 pagesMercer COL Survey 2008jonbortanoNo ratings yet

- t3p3 Penyelesaian LengkapDocument7 pagest3p3 Penyelesaian Lengkaplinyan129147No ratings yet

- StatementDocument2 pagesStatementtakudzwa92No ratings yet

- En1 UnlockDocument11 pagesEn1 UnlockviphainhumNo ratings yet

- National Pension System One Pager V2Document2 pagesNational Pension System One Pager V2ramboNo ratings yet

- Calculating Different Types of AnnuitiesDocument7 pagesCalculating Different Types of AnnuitiesZohair MushtaqNo ratings yet

- e-StatementBRImo 479601031479508 Aug2023 20240206 095000-2Document6 pagese-StatementBRImo 479601031479508 Aug2023 20240206 095000-2lesehan selerakuNo ratings yet

- Rodriguez, Nico S - Module 10 - Assignments-ActivitiesDocument6 pagesRodriguez, Nico S - Module 10 - Assignments-Activitiesnico rodriguezNo ratings yet

- MPBPL00213180000011849 NewDocument4 pagesMPBPL00213180000011849 NewWorld WebNo ratings yet

- Best High-Yield Savings Account Rates For August 2023-Up To 5.25%Document11 pagesBest High-Yield Savings Account Rates For August 2023-Up To 5.25%Benjamin YokeshNo ratings yet

- Statement XXXXXX1529Document3 pagesStatement XXXXXX1529Ashish kumarNo ratings yet

- 0324XXXXXXX034009 05 2023Document37 pages0324XXXXXXX034009 05 2023pankaj kaushikNo ratings yet

- Yadollahi Dan Paim, 2011Document6 pagesYadollahi Dan Paim, 2011Rania RabbaniNo ratings yet

- Report 20231130172609Document7 pagesReport 20231130172609Rohit RajagopalNo ratings yet

- Assignment 4, Managing Personal FinanceDocument2 pagesAssignment 4, Managing Personal FinancekckotigalaNo ratings yet

- Payroll Sept23Document1 pagePayroll Sept23HERMA YANTINo ratings yet

- OpTransactionHistoryUX524 08 2023Document2 pagesOpTransactionHistoryUX524 08 2023Praveen SainiNo ratings yet

- DataDocument5 pagesDataXevivek PrajapatiNo ratings yet

- Checkbook RegisterDocument10 pagesCheckbook RegisterTechto solveNo ratings yet

- S Alyssa 2021Document6 pagesS Alyssa 2021aamir hayatNo ratings yet

- Interest Rate W.E.F From 01.10.2019Document7 pagesInterest Rate W.E.F From 01.10.2019GaurangNo ratings yet

- ITcertificateDocument1 pageITcertificateV N CharyNo ratings yet

- Sonia Hussain StatementDocument9 pagesSonia Hussain Statementhikamuddin38No ratings yet