Professional Documents

Culture Documents

Ecorrespondence726707662 Do

Ecorrespondence726707662 Do

Uploaded by

16baezmcCopyright:

Available Formats

You might also like

- 5 23 1CP575Notice - 1684772891148Document3 pages5 23 1CP575Notice - 1684772891148FGHJJ FDJFHDNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Classification Election. See Form 8832 and Its Instructions For Additional InformationDocument3 pagesClassification Election. See Form 8832 and Its Instructions For Additional InformationSamuel RodriguezNo ratings yet

- By Laws - KaoaDocument13 pagesBy Laws - KaoaSaurabh KumarNo ratings yet

- CP575Notice 1524079257204Document2 pagesCP575Notice 1524079257204Pein AngelNo ratings yet

- PHD African Continental Free Trade PDFDocument31 pagesPHD African Continental Free Trade PDFOrlando ArchieNo ratings yet

- DocumentsDocument2 pagesDocumentsswanbernard56No ratings yet

- Tax 10986Document2 pagesTax 10986Maikeru ShogunnateMusa MNo ratings yet

- 1098-T Copy B: Tuition StatementDocument2 pages1098-T Copy B: Tuition Statemented redfNo ratings yet

- Please To Do Not Use The Back ButtonDocument2 pagesPlease To Do Not Use The Back ButtonDavid MillerNo ratings yet

- TWCCorrespondence 2Document1 pageTWCCorrespondence 2geeterbob123No ratings yet

- Six LLC (EIN - 84-4408052) - Form 1099-NEC - 2023Document1 pageSix LLC (EIN - 84-4408052) - Form 1099-NEC - 2023nansolokoNo ratings yet

- DocumentsDocument2 pagesDocumentstracyreneejonesemailNo ratings yet

- ShowDocument2 pagesShowPaige BurgosNo ratings yet

- ShowDocument2 pagesShowBrian williamNo ratings yet

- US Internal Revenue Service: F1098e - 1998Document5 pagesUS Internal Revenue Service: F1098e - 1998IRSNo ratings yet

- 1098-T Copy B: Tuition StatementDocument2 pages1098-T Copy B: Tuition StatementVampire LadyNo ratings yet

- f1098t PDFDocument6 pagesf1098t PDFLou DraitNo ratings yet

- Ashley Dixon-Harrison 293 Whittenton ST Apt 1Ft TAUNTON MA 02780-1305Document2 pagesAshley Dixon-Harrison 293 Whittenton ST Apt 1Ft TAUNTON MA 02780-1305ashcat227 DNo ratings yet

- Copy B For Student 1098-T: Tuition StatementDocument1 pageCopy B For Student 1098-T: Tuition Statementqqvhc2x2prNo ratings yet

- Corrected: Brigham Young University 7195.00 Brigham Young University A153A ASBDocument2 pagesCorrected: Brigham Young University 7195.00 Brigham Young University A153A ASBNathan MonsonNo ratings yet

- Ilq 1 Bjxrypizq 2 Lvy 3 SMTBTWDocument1 pageIlq 1 Bjxrypizq 2 Lvy 3 SMTBTWMark Aaron WilsonNo ratings yet

- 104722130ilq1bjxrypizq2lvy3smtbtw PDFDocument1 page104722130ilq1bjxrypizq2lvy3smtbtw PDFMark Aaron WilsonNo ratings yet

- Student's 1098T Form PDFDocument1 pageStudent's 1098T Form PDFVexel 22No ratings yet

- SSF SS 1098TDocument2 pagesSSF SS 1098TlinhngcphamNo ratings yet

- f1098t 2022 PDFDocument6 pagesf1098t 2022 PDFLou DraitNo ratings yet

- 1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Document2 pages1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Lane ElliottNo ratings yet

- Tax Form 1099nec 20230121Document2 pagesTax Form 1099nec 20230121God Is GreatNo ratings yet

- D093784809 - 2812507270851848 - Tpschedulesc 2Document2 pagesD093784809 - 2812507270851848 - Tpschedulesc 2Rajat Singh RathiNo ratings yet

- Copy B For Student 1098-T: Tuition StatementDocument1 pageCopy B For Student 1098-T: Tuition Statementqqvhc2x2prNo ratings yet

- ShowDocument2 pagesShowDavid GouiranNo ratings yet

- SSF SS 1098T PDFDocument1 pageSSF SS 1098T PDFJoseph FabreNo ratings yet

- SSF 2023-06-11 1686467975197Document1 pageSSF 2023-06-11 1686467975197Sato KasuNo ratings yet

- Shared Temp ELA0Request For Transcript of Tax Ret B 2 11 OutputDocument1 pageShared Temp ELA0Request For Transcript of Tax Ret B 2 11 OutputBlessing Nel GuillaumeNo ratings yet

- Mortgage Interest Statement: Copy B For Payer/ BorrowerDocument2 pagesMortgage Interest Statement: Copy B For Payer/ BorrowerdndvalleyNo ratings yet

- BDSMDocument2 pagesBDSMmathewshallom77No ratings yet

- f1098t 2021Document6 pagesf1098t 2021Batman Arkham Kinght™️No ratings yet

- EIN Confirmation Letter Fitzpatrick LLCDocument2 pagesEIN Confirmation Letter Fitzpatrick LLCJhonel PauloNo ratings yet

- US Internal Revenue Service: f1098t - 1998Document5 pagesUS Internal Revenue Service: f1098t - 1998IRSNo ratings yet

- DocumentDocument4 pagesDocumentMichele PadillaNo ratings yet

- Attention:: IRS - Gov/form1099Document4 pagesAttention:: IRS - Gov/form1099nantenaina randrianarisonNo ratings yet

- Attention:: WWW - Irs.gov/form1099Document6 pagesAttention:: WWW - Irs.gov/form1099Trevor BurnettNo ratings yet

- ShowDocument2 pagesShowBrianna Jean-BaptisteNo ratings yet

- CORRECTED (If Checked) : Mortgage Interest StatementDocument2 pagesCORRECTED (If Checked) : Mortgage Interest StatementScott DoeNo ratings yet

- 1098-T Copy B: Tuition StatementDocument2 pages1098-T Copy B: Tuition StatementJonathan EllisNo ratings yet

- Naresh Advani 3049987365Document2 pagesNaresh Advani 3049987365Thomas Sheffield100% (1)

- 2023 1099necDocument2 pages2023 1099necjose.oliverosflacNo ratings yet

- Request To Reduce Tax Deductions at Source Year: IdentificationDocument2 pagesRequest To Reduce Tax Deductions at Source Year: IdentificationmikeNo ratings yet

- Fs7869 - FCW Super App FormDocument17 pagesFs7869 - FCW Super App FormBeverly Anne dela CruzNo ratings yet

- U.S. Individual Income Tax Transmittal For An IRS E-File ReturnDocument2 pagesU.S. Individual Income Tax Transmittal For An IRS E-File ReturnSeniorNo ratings yet

- Adrian LLCDocument3 pagesAdrian LLCfunny videosNo ratings yet

- CP575Notice 1713807363521Document2 pagesCP575Notice 1713807363521ngochungth6391No ratings yet

- 2307v2018-Sample For UploadDocument25 pages2307v2018-Sample For Uploadernestaguilar.valentinoNo ratings yet

- Show 2Document2 pagesShow 2Lexi BrownNo ratings yet

- f1098t PDFDocument6 pagesf1098t PDFashley valdiviaNo ratings yet

- 1098 T UWM 2017 PDFDocument2 pages1098 T UWM 2017 PDFsolrak9113No ratings yet

- Form W-8 BEN (Rev. October 2021)Document1 pageForm W-8 BEN (Rev. October 2021)rachelNo ratings yet

- TY2020 - Fair Fight Action - Form 990-PDocument78 pagesTY2020 - Fair Fight Action - Form 990-PWashington ExaminerNo ratings yet

- Trust Treated As Private Foundation - Open SocietyDocument200 pagesTrust Treated As Private Foundation - Open SocietyMatias SmithNo ratings yet

- Thirteen Foundation 2013Document127 pagesThirteen Foundation 2013cmf8926No ratings yet

- Document 932023 103600 AM Pd1VYJRDDocument4 pagesDocument 932023 103600 AM Pd1VYJRDBoeroNo ratings yet

- Maria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 07712Document2 pagesMaria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 0771216baezmcNo ratings yet

- 1099-INT 2023 - Tax FormDocument3 pages1099-INT 2023 - Tax Form16baezmcNo ratings yet

- Annotated-Professional Pich Thank YouDocument1 pageAnnotated-Professional Pich Thank You16baezmcNo ratings yet

- DiplomaDocument2 pagesDiploma16baezmcNo ratings yet

- Round Trip To St. Louis Google Flights 2Document1 pageRound Trip To St. Louis Google Flights 216baezmcNo ratings yet

- Capital One TaxDocument2 pagesCapital One Tax16baezmcNo ratings yet

- Reports - Lim WM TranscriptDocument1 pageReports - Lim WM Transcript16baezmcNo ratings yet

- Resume Prabesh Chandra AdhikariDocument2 pagesResume Prabesh Chandra AdhikariSrirama SrinivasanNo ratings yet

- Nestle Compensation Policies: by Humsi SinghDocument11 pagesNestle Compensation Policies: by Humsi SinghPayal KulkarniNo ratings yet

- ESAP FormsDocument17 pagesESAP FormsKa PuringNo ratings yet

- Invoice 2376 - Allied School Faiz Campus FatehpurDocument1 pageInvoice 2376 - Allied School Faiz Campus FatehpurSheraz AhmadNo ratings yet

- Letter Request For Cash Advance 2020Document2 pagesLetter Request For Cash Advance 2020toni annNo ratings yet

- Module 1 Em3210Document13 pagesModule 1 Em3210Claire GigerNo ratings yet

- STAFF REGULATIONS AND RULES - 6 July 2018Document140 pagesSTAFF REGULATIONS AND RULES - 6 July 2018FRAMNo ratings yet

- RPA in Business FunctionsDocument16 pagesRPA in Business FunctionsPeter HertensteinNo ratings yet

- AdvancePaymentGuarantee (APG)Document5 pagesAdvancePaymentGuarantee (APG)FREDERICKIENo ratings yet

- A Note On Agro-Based Industry, Rural-Urban Migration IMPDocument5 pagesA Note On Agro-Based Industry, Rural-Urban Migration IMPGS KhatriNo ratings yet

- The Rise and Fall of Pakistan's Textile Industry: An Analytical ViewDocument7 pagesThe Rise and Fall of Pakistan's Textile Industry: An Analytical ViewPIR AIZAZ ALI SHAHNo ratings yet

- PAGINA 47 Proceedings Iniic Conference 1 2020Document60 pagesPAGINA 47 Proceedings Iniic Conference 1 2020Leandro TorricelliNo ratings yet

- Revised - Approved (With Reminders) CAE-BSA BSMA BSAIS BSIA-2ND SEM-ACC 213 Strategic Cost ManagementDocument149 pagesRevised - Approved (With Reminders) CAE-BSA BSMA BSAIS BSIA-2ND SEM-ACC 213 Strategic Cost ManagementCabatingan Alecza JadeNo ratings yet

- Module 5. Managing Service Failure (T & H Service Quality MGMT)Document4 pagesModule 5. Managing Service Failure (T & H Service Quality MGMT)MARITONI MEDALLA100% (1)

- GCC - Construction - 2019-Session 5&6. - 18th & 25th May'22Document25 pagesGCC - Construction - 2019-Session 5&6. - 18th & 25th May'22rohit16mayNo ratings yet

- General Ledger Master Data MaintenanceDocument12 pagesGeneral Ledger Master Data MaintenanceRavi Kumar JS100% (1)

- Black SwanDocument16 pagesBlack SwanNishant SolankiNo ratings yet

- PMI Course Catalog-5.17Document19 pagesPMI Course Catalog-5.17meliNo ratings yet

- Contract TemplateDocument2 pagesContract Templatejim125No ratings yet

- Cost AccountingDocument9 pagesCost AccountinghiroxhereNo ratings yet

- Fragmented Contract Management: Challenges, Impacts and SolutionsDocument22 pagesFragmented Contract Management: Challenges, Impacts and SolutionsOrlando NettoNo ratings yet

- Insurance Proposal DefinitionDocument5 pagesInsurance Proposal DefinitionAnand RathiNo ratings yet

- Base Rate Percentage ModuleDocument6 pagesBase Rate Percentage ModuleColeen VistoNo ratings yet

- Factors Affecting The Development of Women Entrepreneurship in Beauty Parlour - Industry of Sukkur Sindh Pakistan.Document18 pagesFactors Affecting The Development of Women Entrepreneurship in Beauty Parlour - Industry of Sukkur Sindh Pakistan.Sayed Faraz Ali ShahNo ratings yet

- Project Definition and DescriptionDocument9 pagesProject Definition and DescriptionEileen VelasquezNo ratings yet

- TEDx ProposalDocument20 pagesTEDx ProposalShubham KenekarNo ratings yet

- A Project Report On Agri-Input Supply CentreDocument14 pagesA Project Report On Agri-Input Supply CentreSuresh Varma0% (1)

- Instructor: FAISAL SARWAR: Ushair Fareed Zahra Sadiq Abdul MoizDocument42 pagesInstructor: FAISAL SARWAR: Ushair Fareed Zahra Sadiq Abdul MoizushairNo ratings yet

Ecorrespondence726707662 Do

Ecorrespondence726707662 Do

Uploaded by

16baezmcOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ecorrespondence726707662 Do

Ecorrespondence726707662 Do

Uploaded by

16baezmcCopyright:

Available Formats

LetterCode:^K135^|SelectInsertBins:^000000^|IgnoreBins:^000100^|SystemID:^ED^|BarCode:^*9247339405105469399*^|Placeholder:^ECC-Batch-Class^|^StartofRecord^

PO BOX 300001

GREENVILLE, TX 75403-3001 (800) 722-1300

MARIA C BAEZ

1408 RUSTIC DR APT 5

OCEAN NJ 07712-7424

Account Number: 9247339405-1

Important Tax Information 01/17/24

While we cannot offer tax advice, you may be able to deduct student loan interest that you paid in 2023 on your income tax return, and other amounts paid such as loan

origination fees. If you have questions about filing your taxes, see either IRS Pub. 970, Tax Benefits for Education, or the Student Loan Interest Deduction Worksheet in your

1040 or 1040A instructions. You can call the IRS at 800-829-1040, visit irs.gov, or consult your tax advisor. For questions about your Aidvantage - Official Servicer of Federal

Student Aid account, visit us online at Aidvantage.com or call us at 800-722-1300, Monday 8am-9pm, Tuesday-Wednesday 8am-8pm Thursday-Friday 8am-6pm Eastern.

Instructions for Borrower

A person (including a financial institution, a governmental unit, and an educational institution) that receives interest payments of $600 or more during the year on one or more

qualified student loans must furnish this statement to you.

You may be able to deduct student loan interest that you actually paid in 2023 on your income tax return. However, you may not be able to deduct the full amount of interest

reported on this statement. Do not contact the recipient/lender for explanations of the requirements for (and how to figure) any allowable deduction for the interest paid.

Instead, for more information, see Pub. 970, Tax Benefits for Education, and the Student Loan Interest Deduction Worksheet in your Form 1040 or 1040A instructions.

Borrower's identification number. For your protection, this form may show only the last four digits of your social security number (SSN), individual taxpayer identification

number (ITIN), adoption taxpayer identification number (ATIN), or employer identification number (EIN). However, the issuer has reported your complete identification number

to the IRS.

Account number. May show an account or other unique number the lender assigned to distinguish your account.

Box 1. Shows the interest received by the lender during the year on one or more student loans made to you. For loans made on or after September 1, 2004, box 1 must

include loan origination fees and capitalized interest received in 2023. If your loan was made before September 1, 2004, you may be able to deduct loan origination fees and

capitalized interest not reported in box 1.

Box 2. If checked, indicates that loan origination fees and/or capitalized interest are not included in box 1 for loans made before September 1, 2004. See Pub. 970 for how

to figure any deductible loan origination fees or capitalized interest.

Future developments. For the latest information about developments related to Form 1098-E and its instructions, such as legislation enacted after they were published, go

to IRS.gov/Form1098E.

Free File Program. Go to irs.gov/FreeFile to see if you qualify for no-cost online federal tax preparation, e-filing, and direct deposit or payment options.

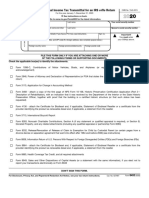

¨ CORRECTED (if checked)

RECIPIENT’S/LENDER’S name, address, city or town, state or province, country, ZIP or foreign postal OMB No. 1545-1576

code, and telephone number

Student Loan

Aidvantage - Official Servicer of Federal Student Aid

P.O. Box 300001

Greenville, TX 75403-3001

2023 Interest

Statement

800-722-1300 Form 1098-E

RECIPIENT’S TIN BORROWER’S TIN 1 Student loan interest received by lender Copy B

52-1198289 ***-**-3049 $ 434.56 For Borrower

This is important tax

BORROWER’S name, street address (including apt. no.), City or town, state or province, country, and

information and is being

ZIP or foreign postal code

furnished to the IRS. If you

are required to file a

MARIA C BAEZ

return, a negligence

1408 RUSTIC DR APT 5 penalty or other

OCEAN NJ 07712-7424 sanction may be

imposed on you if the

IRS determines that an

underpayment of tax

results because you

Account number (see instructions) 2 If checked, box 1 does not include loan origination fees and/or capitalized overstated a deduction

9247339405-1 interest for loans made before for student loan interest.

September 1, 2004 . . . . . . . . . . . . . .

Form 1098-E (keep for your records) www.irs.gov/form1098e Department of the Treasury – Internal Revenue Service

Privacy Notice – Federal law requires the U.S. Department of Education (Dept. of Ed) to tell you how it collects, shares, and protects your personal information. The Dept. of

Ed’s privacy policy has not changed and you may review its policy and practices with respect to your personal information at Aidvantage.com/EDPrivacyNotice or we will mail

you a free copy upon request if you call us at 800-428-1039.

*9247339405105469399*

K135 SYSTEM ED 0001 *9247339405105469399*

You might also like

- 5 23 1CP575Notice - 1684772891148Document3 pages5 23 1CP575Notice - 1684772891148FGHJJ FDJFHDNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Classification Election. See Form 8832 and Its Instructions For Additional InformationDocument3 pagesClassification Election. See Form 8832 and Its Instructions For Additional InformationSamuel RodriguezNo ratings yet

- By Laws - KaoaDocument13 pagesBy Laws - KaoaSaurabh KumarNo ratings yet

- CP575Notice 1524079257204Document2 pagesCP575Notice 1524079257204Pein AngelNo ratings yet

- PHD African Continental Free Trade PDFDocument31 pagesPHD African Continental Free Trade PDFOrlando ArchieNo ratings yet

- DocumentsDocument2 pagesDocumentsswanbernard56No ratings yet

- Tax 10986Document2 pagesTax 10986Maikeru ShogunnateMusa MNo ratings yet

- 1098-T Copy B: Tuition StatementDocument2 pages1098-T Copy B: Tuition Statemented redfNo ratings yet

- Please To Do Not Use The Back ButtonDocument2 pagesPlease To Do Not Use The Back ButtonDavid MillerNo ratings yet

- TWCCorrespondence 2Document1 pageTWCCorrespondence 2geeterbob123No ratings yet

- Six LLC (EIN - 84-4408052) - Form 1099-NEC - 2023Document1 pageSix LLC (EIN - 84-4408052) - Form 1099-NEC - 2023nansolokoNo ratings yet

- DocumentsDocument2 pagesDocumentstracyreneejonesemailNo ratings yet

- ShowDocument2 pagesShowPaige BurgosNo ratings yet

- ShowDocument2 pagesShowBrian williamNo ratings yet

- US Internal Revenue Service: F1098e - 1998Document5 pagesUS Internal Revenue Service: F1098e - 1998IRSNo ratings yet

- 1098-T Copy B: Tuition StatementDocument2 pages1098-T Copy B: Tuition StatementVampire LadyNo ratings yet

- f1098t PDFDocument6 pagesf1098t PDFLou DraitNo ratings yet

- Ashley Dixon-Harrison 293 Whittenton ST Apt 1Ft TAUNTON MA 02780-1305Document2 pagesAshley Dixon-Harrison 293 Whittenton ST Apt 1Ft TAUNTON MA 02780-1305ashcat227 DNo ratings yet

- Copy B For Student 1098-T: Tuition StatementDocument1 pageCopy B For Student 1098-T: Tuition Statementqqvhc2x2prNo ratings yet

- Corrected: Brigham Young University 7195.00 Brigham Young University A153A ASBDocument2 pagesCorrected: Brigham Young University 7195.00 Brigham Young University A153A ASBNathan MonsonNo ratings yet

- Ilq 1 Bjxrypizq 2 Lvy 3 SMTBTWDocument1 pageIlq 1 Bjxrypizq 2 Lvy 3 SMTBTWMark Aaron WilsonNo ratings yet

- 104722130ilq1bjxrypizq2lvy3smtbtw PDFDocument1 page104722130ilq1bjxrypizq2lvy3smtbtw PDFMark Aaron WilsonNo ratings yet

- Student's 1098T Form PDFDocument1 pageStudent's 1098T Form PDFVexel 22No ratings yet

- SSF SS 1098TDocument2 pagesSSF SS 1098TlinhngcphamNo ratings yet

- f1098t 2022 PDFDocument6 pagesf1098t 2022 PDFLou DraitNo ratings yet

- 1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Document2 pages1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Lane ElliottNo ratings yet

- Tax Form 1099nec 20230121Document2 pagesTax Form 1099nec 20230121God Is GreatNo ratings yet

- D093784809 - 2812507270851848 - Tpschedulesc 2Document2 pagesD093784809 - 2812507270851848 - Tpschedulesc 2Rajat Singh RathiNo ratings yet

- Copy B For Student 1098-T: Tuition StatementDocument1 pageCopy B For Student 1098-T: Tuition Statementqqvhc2x2prNo ratings yet

- ShowDocument2 pagesShowDavid GouiranNo ratings yet

- SSF SS 1098T PDFDocument1 pageSSF SS 1098T PDFJoseph FabreNo ratings yet

- SSF 2023-06-11 1686467975197Document1 pageSSF 2023-06-11 1686467975197Sato KasuNo ratings yet

- Shared Temp ELA0Request For Transcript of Tax Ret B 2 11 OutputDocument1 pageShared Temp ELA0Request For Transcript of Tax Ret B 2 11 OutputBlessing Nel GuillaumeNo ratings yet

- Mortgage Interest Statement: Copy B For Payer/ BorrowerDocument2 pagesMortgage Interest Statement: Copy B For Payer/ BorrowerdndvalleyNo ratings yet

- BDSMDocument2 pagesBDSMmathewshallom77No ratings yet

- f1098t 2021Document6 pagesf1098t 2021Batman Arkham Kinght™️No ratings yet

- EIN Confirmation Letter Fitzpatrick LLCDocument2 pagesEIN Confirmation Letter Fitzpatrick LLCJhonel PauloNo ratings yet

- US Internal Revenue Service: f1098t - 1998Document5 pagesUS Internal Revenue Service: f1098t - 1998IRSNo ratings yet

- DocumentDocument4 pagesDocumentMichele PadillaNo ratings yet

- Attention:: IRS - Gov/form1099Document4 pagesAttention:: IRS - Gov/form1099nantenaina randrianarisonNo ratings yet

- Attention:: WWW - Irs.gov/form1099Document6 pagesAttention:: WWW - Irs.gov/form1099Trevor BurnettNo ratings yet

- ShowDocument2 pagesShowBrianna Jean-BaptisteNo ratings yet

- CORRECTED (If Checked) : Mortgage Interest StatementDocument2 pagesCORRECTED (If Checked) : Mortgage Interest StatementScott DoeNo ratings yet

- 1098-T Copy B: Tuition StatementDocument2 pages1098-T Copy B: Tuition StatementJonathan EllisNo ratings yet

- Naresh Advani 3049987365Document2 pagesNaresh Advani 3049987365Thomas Sheffield100% (1)

- 2023 1099necDocument2 pages2023 1099necjose.oliverosflacNo ratings yet

- Request To Reduce Tax Deductions at Source Year: IdentificationDocument2 pagesRequest To Reduce Tax Deductions at Source Year: IdentificationmikeNo ratings yet

- Fs7869 - FCW Super App FormDocument17 pagesFs7869 - FCW Super App FormBeverly Anne dela CruzNo ratings yet

- U.S. Individual Income Tax Transmittal For An IRS E-File ReturnDocument2 pagesU.S. Individual Income Tax Transmittal For An IRS E-File ReturnSeniorNo ratings yet

- Adrian LLCDocument3 pagesAdrian LLCfunny videosNo ratings yet

- CP575Notice 1713807363521Document2 pagesCP575Notice 1713807363521ngochungth6391No ratings yet

- 2307v2018-Sample For UploadDocument25 pages2307v2018-Sample For Uploadernestaguilar.valentinoNo ratings yet

- Show 2Document2 pagesShow 2Lexi BrownNo ratings yet

- f1098t PDFDocument6 pagesf1098t PDFashley valdiviaNo ratings yet

- 1098 T UWM 2017 PDFDocument2 pages1098 T UWM 2017 PDFsolrak9113No ratings yet

- Form W-8 BEN (Rev. October 2021)Document1 pageForm W-8 BEN (Rev. October 2021)rachelNo ratings yet

- TY2020 - Fair Fight Action - Form 990-PDocument78 pagesTY2020 - Fair Fight Action - Form 990-PWashington ExaminerNo ratings yet

- Trust Treated As Private Foundation - Open SocietyDocument200 pagesTrust Treated As Private Foundation - Open SocietyMatias SmithNo ratings yet

- Thirteen Foundation 2013Document127 pagesThirteen Foundation 2013cmf8926No ratings yet

- Document 932023 103600 AM Pd1VYJRDDocument4 pagesDocument 932023 103600 AM Pd1VYJRDBoeroNo ratings yet

- Maria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 07712Document2 pagesMaria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 0771216baezmcNo ratings yet

- 1099-INT 2023 - Tax FormDocument3 pages1099-INT 2023 - Tax Form16baezmcNo ratings yet

- Annotated-Professional Pich Thank YouDocument1 pageAnnotated-Professional Pich Thank You16baezmcNo ratings yet

- DiplomaDocument2 pagesDiploma16baezmcNo ratings yet

- Round Trip To St. Louis Google Flights 2Document1 pageRound Trip To St. Louis Google Flights 216baezmcNo ratings yet

- Capital One TaxDocument2 pagesCapital One Tax16baezmcNo ratings yet

- Reports - Lim WM TranscriptDocument1 pageReports - Lim WM Transcript16baezmcNo ratings yet

- Resume Prabesh Chandra AdhikariDocument2 pagesResume Prabesh Chandra AdhikariSrirama SrinivasanNo ratings yet

- Nestle Compensation Policies: by Humsi SinghDocument11 pagesNestle Compensation Policies: by Humsi SinghPayal KulkarniNo ratings yet

- ESAP FormsDocument17 pagesESAP FormsKa PuringNo ratings yet

- Invoice 2376 - Allied School Faiz Campus FatehpurDocument1 pageInvoice 2376 - Allied School Faiz Campus FatehpurSheraz AhmadNo ratings yet

- Letter Request For Cash Advance 2020Document2 pagesLetter Request For Cash Advance 2020toni annNo ratings yet

- Module 1 Em3210Document13 pagesModule 1 Em3210Claire GigerNo ratings yet

- STAFF REGULATIONS AND RULES - 6 July 2018Document140 pagesSTAFF REGULATIONS AND RULES - 6 July 2018FRAMNo ratings yet

- RPA in Business FunctionsDocument16 pagesRPA in Business FunctionsPeter HertensteinNo ratings yet

- AdvancePaymentGuarantee (APG)Document5 pagesAdvancePaymentGuarantee (APG)FREDERICKIENo ratings yet

- A Note On Agro-Based Industry, Rural-Urban Migration IMPDocument5 pagesA Note On Agro-Based Industry, Rural-Urban Migration IMPGS KhatriNo ratings yet

- The Rise and Fall of Pakistan's Textile Industry: An Analytical ViewDocument7 pagesThe Rise and Fall of Pakistan's Textile Industry: An Analytical ViewPIR AIZAZ ALI SHAHNo ratings yet

- PAGINA 47 Proceedings Iniic Conference 1 2020Document60 pagesPAGINA 47 Proceedings Iniic Conference 1 2020Leandro TorricelliNo ratings yet

- Revised - Approved (With Reminders) CAE-BSA BSMA BSAIS BSIA-2ND SEM-ACC 213 Strategic Cost ManagementDocument149 pagesRevised - Approved (With Reminders) CAE-BSA BSMA BSAIS BSIA-2ND SEM-ACC 213 Strategic Cost ManagementCabatingan Alecza JadeNo ratings yet

- Module 5. Managing Service Failure (T & H Service Quality MGMT)Document4 pagesModule 5. Managing Service Failure (T & H Service Quality MGMT)MARITONI MEDALLA100% (1)

- GCC - Construction - 2019-Session 5&6. - 18th & 25th May'22Document25 pagesGCC - Construction - 2019-Session 5&6. - 18th & 25th May'22rohit16mayNo ratings yet

- General Ledger Master Data MaintenanceDocument12 pagesGeneral Ledger Master Data MaintenanceRavi Kumar JS100% (1)

- Black SwanDocument16 pagesBlack SwanNishant SolankiNo ratings yet

- PMI Course Catalog-5.17Document19 pagesPMI Course Catalog-5.17meliNo ratings yet

- Contract TemplateDocument2 pagesContract Templatejim125No ratings yet

- Cost AccountingDocument9 pagesCost AccountinghiroxhereNo ratings yet

- Fragmented Contract Management: Challenges, Impacts and SolutionsDocument22 pagesFragmented Contract Management: Challenges, Impacts and SolutionsOrlando NettoNo ratings yet

- Insurance Proposal DefinitionDocument5 pagesInsurance Proposal DefinitionAnand RathiNo ratings yet

- Base Rate Percentage ModuleDocument6 pagesBase Rate Percentage ModuleColeen VistoNo ratings yet

- Factors Affecting The Development of Women Entrepreneurship in Beauty Parlour - Industry of Sukkur Sindh Pakistan.Document18 pagesFactors Affecting The Development of Women Entrepreneurship in Beauty Parlour - Industry of Sukkur Sindh Pakistan.Sayed Faraz Ali ShahNo ratings yet

- Project Definition and DescriptionDocument9 pagesProject Definition and DescriptionEileen VelasquezNo ratings yet

- TEDx ProposalDocument20 pagesTEDx ProposalShubham KenekarNo ratings yet

- A Project Report On Agri-Input Supply CentreDocument14 pagesA Project Report On Agri-Input Supply CentreSuresh Varma0% (1)

- Instructor: FAISAL SARWAR: Ushair Fareed Zahra Sadiq Abdul MoizDocument42 pagesInstructor: FAISAL SARWAR: Ushair Fareed Zahra Sadiq Abdul MoizushairNo ratings yet