Professional Documents

Culture Documents

ABC Manufacturing

ABC Manufacturing

Uploaded by

jmbaezfCopyright:

Available Formats

You might also like

- Franchise Agreement Jollibee YumburgerDocument26 pagesFranchise Agreement Jollibee YumburgerEmiru Kun78% (9)

- Soapbox Whirlpool VFINALDocument15 pagesSoapbox Whirlpool VFINALAnonymous Ecd8rCNo ratings yet

- Ib TurnoverDocument6 pagesIb TurnoverThu Huyền LêNo ratings yet

- Evaluation of Financial PositionDocument1 pageEvaluation of Financial PositionJoy ConstantinoNo ratings yet

- FSAV 6e - PPT - Mod 11 - 111120 (2)Document44 pagesFSAV 6e - PPT - Mod 11 - 111120 (2)1234778No ratings yet

- Burberry Annual Report 2015-16Document188 pagesBurberry Annual Report 2015-16Siddharth Shekhar100% (1)

- Ratio Analysis: Mari Perolum Company LimitiedDocument5 pagesRatio Analysis: Mari Perolum Company LimitiedNuman AhmedNo ratings yet

- Nestle AnanlysisDocument18 pagesNestle AnanlysisSLUG GAMINGNo ratings yet

- O.M. Scott & SonsDocument7 pagesO.M. Scott & Sonsstig2lufetNo ratings yet

- Group Project - Ambuja Cement - ReportDocument4 pagesGroup Project - Ambuja Cement - ReportLovie GuptaNo ratings yet

- Finding Patterns Through Analysis of Financial RatiosDocument4 pagesFinding Patterns Through Analysis of Financial Ratiosmadam iqraNo ratings yet

- I. FPT 1. Operating CycleDocument8 pagesI. FPT 1. Operating CyclePhạm Như HậuNo ratings yet

- San Miguel Corporation - Business Life Cycle Analysis ReportDocument2 pagesSan Miguel Corporation - Business Life Cycle Analysis ReportPastel Rose CloudNo ratings yet

- Window DressingDocument3 pagesWindow Dressingkriti_a100% (2)

- Result GJwZP5hborGD5FkSshEUDocument22 pagesResult GJwZP5hborGD5FkSshEUurbansmileindiaNo ratings yet

- Management Accounting On Interpretation of Position Statement and Income Statement of COCA COLA and Subsidiaries' For The Year 2006-2007Document7 pagesManagement Accounting On Interpretation of Position Statement and Income Statement of COCA COLA and Subsidiaries' For The Year 2006-2007durgesh varunNo ratings yet

- Finman ScriptDocument3 pagesFinman ScriptREA ANGELINE BARDOSNo ratings yet

- Aberdeen Asset Management PLC - Ar - 09!30!2015Document168 pagesAberdeen Asset Management PLC - Ar - 09!30!2015Tanu ChaurasiaNo ratings yet

- Bhel Ratio AnalysisDocument9 pagesBhel Ratio Analysissumit mittalNo ratings yet

- Financial Accounting - Starbucks CaseDocument14 pagesFinancial Accounting - Starbucks CaseHạnh TrầnNo ratings yet

- Article 2 Roe Nippon 2013 2pDocument2 pagesArticle 2 Roe Nippon 2013 2pRicardo Jáquez CortésNo ratings yet

- Name Sumalatha Patil: Investing Activities Cash Flow ChangesDocument6 pagesName Sumalatha Patil: Investing Activities Cash Flow ChangessumaNo ratings yet

- Hillsburg Hardware CompanyDocument3 pagesHillsburg Hardware Companykassaye aragawNo ratings yet

- Financial Analysis For Sapphire Fibres LimitedDocument6 pagesFinancial Analysis For Sapphire Fibres LimitedRashmeen NaeemNo ratings yet

- Cash Flow Statement AnalysisDocument4 pagesCash Flow Statement AnalysisLovie GuptaNo ratings yet

- Case Study 1 Muhammad JanjuaDocument6 pagesCase Study 1 Muhammad JanjuaAmeer Hamza JanjuaNo ratings yet

- Financial Statement Analysis - Marks & SpencerDocument8 pagesFinancial Statement Analysis - Marks & Spencermuhammad.salmankhanofficial01No ratings yet

- Pepsico Announces Strategic Investments To Drive GrowthDocument9 pagesPepsico Announces Strategic Investments To Drive GrowthSyed Ali Humza RizviNo ratings yet

- FM Cia 3Document6 pagesFM Cia 3Priyanshu ChhabariaNo ratings yet

- Accounting Control Research TaskDocument12 pagesAccounting Control Research TaskAgamdeep SinghNo ratings yet

- Chapter-V: Findings, Suggestions & Conclusion FindingsDocument4 pagesChapter-V: Findings, Suggestions & Conclusion FindingsGLOBAL INFO-TECH KUMBAKONAMNo ratings yet

- Jollibee Food CorpsDocument7 pagesJollibee Food CorpsSorn PonceNo ratings yet

- Analyzing Voltas Limited's Profitability Ratios: A 2023 Financial AssessmentDocument8 pagesAnalyzing Voltas Limited's Profitability Ratios: A 2023 Financial AssessmentAbhishek PandeyNo ratings yet

- Management Accounting 200819Document21 pagesManagement Accounting 200819Akriti ThakurNo ratings yet

- Solution For The Assignment - FMDocument9 pagesSolution For The Assignment - FMkishor kumarNo ratings yet

- Aetna Financial AnalysisDocument11 pagesAetna Financial AnalysisKimberlyHerringNo ratings yet

- Senior High SchoolDocument9 pagesSenior High SchoolCharlyn CastroNo ratings yet

- Q1. What Inference Do You Draw From The Trends in The Free Cash Flow of The Company?Document6 pagesQ1. What Inference Do You Draw From The Trends in The Free Cash Flow of The Company?sridhar607No ratings yet

- Pinhome CaseDocument3 pagesPinhome CaseDean ErlanggaNo ratings yet

- 8.scrutiniztion of The Auditors Report, Notes To Account, Significant Accounting Policies &various Schedules & AnnexuresDocument28 pages8.scrutiniztion of The Auditors Report, Notes To Account, Significant Accounting Policies &various Schedules & AnnexuresNeeraj BhartiNo ratings yet

- Nyse FC 2023Document172 pagesNyse FC 2023Boban CelebicNo ratings yet

- Star RiverDocument8 pagesStar Riverjack stauberNo ratings yet

- Rohit Corporate AccountingDocument11 pagesRohit Corporate AccountingMah Noor FastNUNo ratings yet

- Interpretation and Comments Capital StructureDocument2 pagesInterpretation and Comments Capital StructureMarcel JonathanNo ratings yet

- FRA - IV (Tarsons Products)Document9 pagesFRA - IV (Tarsons Products)RR AnalystNo ratings yet

- Chapter 2 Review of Financial Statement Preparation Analysis InterpretationDocument46 pagesChapter 2 Review of Financial Statement Preparation Analysis InterpretationMark DavidNo ratings yet

- DKNG 2Q 2023 Business Update - VFDocument15 pagesDKNG 2Q 2023 Business Update - VFrchatabNo ratings yet

- Rashmeen NaeemDocument7 pagesRashmeen NaeemRashmeen NaeemNo ratings yet

- Adithya C S - Ceres Gardening CompanyDocument8 pagesAdithya C S - Ceres Gardening Companyaditya c sNo ratings yet

- Basic Earnings Per ShareDocument4 pagesBasic Earnings Per ShareshreyaNo ratings yet

- Barnes Group IncDocument15 pagesBarnes Group IncRicardo PuyolNo ratings yet

- Order Number 550 Final (Edited)Document27 pagesOrder Number 550 Final (Edited)Joseph KariukiNo ratings yet

- Submitted by Ramesh Babu Sadda (2895538) : Word Count: 2800Document18 pagesSubmitted by Ramesh Babu Sadda (2895538) : Word Count: 2800Ramesh BabuNo ratings yet

- Financial Analysis of Divi's LaboratoriesDocument15 pagesFinancial Analysis of Divi's LaboratoriesShivani DesaiNo ratings yet

- MC200110507 - GSFM7514 - Reflective Task 1Document6 pagesMC200110507 - GSFM7514 - Reflective Task 1Devi SengodanNo ratings yet

- Managerial Accounting Ch07 HW SolutionsDocument40 pagesManagerial Accounting Ch07 HW Solutionsgilli1trNo ratings yet

- FSAV+6e PPT Mod+03Document89 pagesFSAV+6e PPT Mod+03lubna.attariNo ratings yet

- ExamView - Homework CH 4Document9 pagesExamView - Homework CH 4Brooke LevertonNo ratings yet

- Liquidity PositionDocument16 pagesLiquidity PositionNuqman AmranNo ratings yet

- Business Competitor Analysis: Finance For MarketersDocument17 pagesBusiness Competitor Analysis: Finance For MarketersMuhammad Ramiz AminNo ratings yet

- Four Budgeting MethodsDocument3 pagesFour Budgeting MethodsjmbaezfNo ratings yet

- 10 KPIs CashDocument2 pages10 KPIs CashjmbaezfNo ratings yet

- Accounts Receivables Playbook 101Document1 pageAccounts Receivables Playbook 101jmbaezfNo ratings yet

- 10 Crucial Investing RatiosDocument3 pages10 Crucial Investing RatiosjmbaezfNo ratings yet

- Hiring Manager Satisfaction Survey PDFDocument2 pagesHiring Manager Satisfaction Survey PDFSara LoneNo ratings yet

- Notes: Taxation On Individuals: Individual Taxpayers Are Natural Persons With Income Derived From WithinDocument10 pagesNotes: Taxation On Individuals: Individual Taxpayers Are Natural Persons With Income Derived From WithinJohn BanzonNo ratings yet

- ACC114 P3 Exam Answer KeyDocument14 pagesACC114 P3 Exam Answer KeyVincenzo CassanoNo ratings yet

- Infographic - Effect of Access To Finance On Financial Performance of Small and Medium Enterprises in Batangas CityDocument1 pageInfographic - Effect of Access To Finance On Financial Performance of Small and Medium Enterprises in Batangas CityBen TorejaNo ratings yet

- Course 1.2: What You Should KnowDocument27 pagesCourse 1.2: What You Should KnowGeorgios MilitsisNo ratings yet

- Retailing Chapter 4Document7 pagesRetailing Chapter 4Richard AquinoNo ratings yet

- M1 Group4 Econ02PT01Document11 pagesM1 Group4 Econ02PT01josonninoangeloNo ratings yet

- Implementation Guideline 5Document128 pagesImplementation Guideline 5வேணிNo ratings yet

- Case StudyDocument15 pagesCase StudyCaleb LangatNo ratings yet

- Roland Berger - Bridging The Digital Divide - 2020Document24 pagesRoland Berger - Bridging The Digital Divide - 2020AKNo ratings yet

- HBR IntroDocument3 pagesHBR IntroNeo4u44No ratings yet

- 2 (1) - Form 102 - PrintDocument4 pages2 (1) - Form 102 - PrintPraveen SehgalNo ratings yet

- From Sweden 2013: Green SolutionsDocument31 pagesFrom Sweden 2013: Green Solutionswowboys2001No ratings yet

- 44 IPA AGM 2015 Report BookDocument112 pages44 IPA AGM 2015 Report BookCah Ndeso KlutukNo ratings yet

- SWOT Analysis: January 2015Document9 pagesSWOT Analysis: January 2015waw wawNo ratings yet

- A. Money Market FundsDocument2 pagesA. Money Market FundsMelch Yvan Racasa MarbellaNo ratings yet

- 05 Impact of A Sharing Economy and Green Energy On Achievin 2023 Journal of InnDocument8 pages05 Impact of A Sharing Economy and Green Energy On Achievin 2023 Journal of InnFachry ArifinNo ratings yet

- Roland Berger Report On Key Enablers For Hydrogen in MENA 1673535736Document16 pagesRoland Berger Report On Key Enablers For Hydrogen in MENA 1673535736MohamedNo ratings yet

- An Empirical Study On The Performance Evaluation of Public Sector Banks in IndiaDocument16 pagesAn Empirical Study On The Performance Evaluation of Public Sector Banks in Indiapratik053No ratings yet

- 02.mechanics of Futures MarketDocument8 pages02.mechanics of Futures MarketNg Jian LongNo ratings yet

- The Foreclosure Secrets GuideDocument146 pagesThe Foreclosure Secrets GuideAkil BeyNo ratings yet

- SIP Return CalculatorDocument6 pagesSIP Return CalculatorAnuj MasareNo ratings yet

- TDP - Agro Tech Format 2019Document21 pagesTDP - Agro Tech Format 2019sajalkrsahaNo ratings yet

- Student Copy Assignments On Money and Banking NewDocument12 pagesStudent Copy Assignments On Money and Banking Newtanishweta26No ratings yet

- Production and Operations ManagementDocument29 pagesProduction and Operations ManagementAyush SinghNo ratings yet

- Presentation Product PLC240228 A02Document8 pagesPresentation Product PLC240228 A02Crazed NinjaNo ratings yet

- Multiple Choice Questions (MCQ) : Session No 01Document12 pagesMultiple Choice Questions (MCQ) : Session No 01sameerNo ratings yet

- MIDCDocument5 pagesMIDCAtharvaNo ratings yet

- A COMPARATIVE STUDY OF HOME LOANS OF STATE BANK OF INDIA S B I AND HOUSING DEVELOPMENT FINANCE CORPORATION H D F C BANKS AN EMPERICAL STUDY OF BATHINDA PUNJAB Ijariie6205Document10 pagesA COMPARATIVE STUDY OF HOME LOANS OF STATE BANK OF INDIA S B I AND HOUSING DEVELOPMENT FINANCE CORPORATION H D F C BANKS AN EMPERICAL STUDY OF BATHINDA PUNJAB Ijariie6205prakash kambleNo ratings yet

ABC Manufacturing

ABC Manufacturing

Uploaded by

jmbaezfOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ABC Manufacturing

ABC Manufacturing

Uploaded by

jmbaezfCopyright:

Available Formats

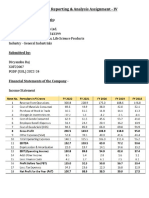

ABC MANUFACTURING - PROJECTED CONSOLIDATED FINANCIAL STATEMENTS 2024-2033

REVENUE GROWTH

The company projects consistent revenue growth, starting from $915 million in 2024 to

approximately $2.506 billion in 2033.

This is matched by an increase in units produced, indicating scalability in production and sales.

COST OF GOODS SOLD AND GROSS PROFIT

COGS also increases, but gross profit consistently grows, suggesting that the company is

maintaining or improving its gross margin over time.

Gross profit margin starts at approximately 34% in 2024 and maintains a similar level

throughout the projection, a positive sign for the company's cost management.

OPERATING EXPENSES

Operating expenses are increasing but at a slower pace compared to revenue, which is a good

indicator of operational efficiency.

Employment expenses and rental expenses are significant contributors to operating expenses,

which management should monitor to maintain profitability.

NET INCOME

Net income shows a healthy upward trend from $202.6 million in 2024 to $700 million by 2033.

The projections suggest a robust bottom line, with earnings per share (EPS) growing from 119

to 412, which could be attractive to investors.

APPROPRIATION ACCOUNTS

ABC Manufacturing allocates part of its profits to reserves, enhancing stability and supporting

potential growth.

It also reliably pays dividends, demonstrating shareholder commitment and confidence in its

financial future.

ASSETS, LIABILITIES, AND EQUITY

ABC Manufacturing's total assets are increasing significantly due to capital investments and

wealth accumulation.

The rise in retained earnings and reserves boosts equity, illustrating the firm's reinvestment

capacity and potential debt reduction.

CASH FLOW ANALYSIS

ABC Manufacturing shows a rising positive operating cash flow, suggesting effective cash

management.

Financing cash flow varies with debt servicing and dividends.

By 2033, the company anticipates clearing its long-term debt, potentially freeing up cash for

reinvestment or increased dividends.

DECISION-MAKING CONSIDERATIONS

Investment: With increasing net income and operating cash flow, the company could consider

additional investments to further improve efficiency or expand operations.

Debt Management: The company should continue to monitor its debt levels, but the projected

payoff of long-term loans indicates strong debt management.

Dividend Policy: The consistent dividend payments suggest a shareholder-friendly policy but

should be balanced against the need to fund growth initiatives.

Cost Control: Operating expenses should be monitored, especially as the company scales up, to

ensure that margins are maintained.

The projected financials for ABC Manufacturing indicate robust growth, stable profits, and solid

cash flow.

Executives should aim to sustain growth, control costs, make wise investments, and continue

rewarding shareholders.

You might also like

- Franchise Agreement Jollibee YumburgerDocument26 pagesFranchise Agreement Jollibee YumburgerEmiru Kun78% (9)

- Soapbox Whirlpool VFINALDocument15 pagesSoapbox Whirlpool VFINALAnonymous Ecd8rCNo ratings yet

- Ib TurnoverDocument6 pagesIb TurnoverThu Huyền LêNo ratings yet

- Evaluation of Financial PositionDocument1 pageEvaluation of Financial PositionJoy ConstantinoNo ratings yet

- FSAV 6e - PPT - Mod 11 - 111120 (2)Document44 pagesFSAV 6e - PPT - Mod 11 - 111120 (2)1234778No ratings yet

- Burberry Annual Report 2015-16Document188 pagesBurberry Annual Report 2015-16Siddharth Shekhar100% (1)

- Ratio Analysis: Mari Perolum Company LimitiedDocument5 pagesRatio Analysis: Mari Perolum Company LimitiedNuman AhmedNo ratings yet

- Nestle AnanlysisDocument18 pagesNestle AnanlysisSLUG GAMINGNo ratings yet

- O.M. Scott & SonsDocument7 pagesO.M. Scott & Sonsstig2lufetNo ratings yet

- Group Project - Ambuja Cement - ReportDocument4 pagesGroup Project - Ambuja Cement - ReportLovie GuptaNo ratings yet

- Finding Patterns Through Analysis of Financial RatiosDocument4 pagesFinding Patterns Through Analysis of Financial Ratiosmadam iqraNo ratings yet

- I. FPT 1. Operating CycleDocument8 pagesI. FPT 1. Operating CyclePhạm Như HậuNo ratings yet

- San Miguel Corporation - Business Life Cycle Analysis ReportDocument2 pagesSan Miguel Corporation - Business Life Cycle Analysis ReportPastel Rose CloudNo ratings yet

- Window DressingDocument3 pagesWindow Dressingkriti_a100% (2)

- Result GJwZP5hborGD5FkSshEUDocument22 pagesResult GJwZP5hborGD5FkSshEUurbansmileindiaNo ratings yet

- Management Accounting On Interpretation of Position Statement and Income Statement of COCA COLA and Subsidiaries' For The Year 2006-2007Document7 pagesManagement Accounting On Interpretation of Position Statement and Income Statement of COCA COLA and Subsidiaries' For The Year 2006-2007durgesh varunNo ratings yet

- Finman ScriptDocument3 pagesFinman ScriptREA ANGELINE BARDOSNo ratings yet

- Aberdeen Asset Management PLC - Ar - 09!30!2015Document168 pagesAberdeen Asset Management PLC - Ar - 09!30!2015Tanu ChaurasiaNo ratings yet

- Bhel Ratio AnalysisDocument9 pagesBhel Ratio Analysissumit mittalNo ratings yet

- Financial Accounting - Starbucks CaseDocument14 pagesFinancial Accounting - Starbucks CaseHạnh TrầnNo ratings yet

- Article 2 Roe Nippon 2013 2pDocument2 pagesArticle 2 Roe Nippon 2013 2pRicardo Jáquez CortésNo ratings yet

- Name Sumalatha Patil: Investing Activities Cash Flow ChangesDocument6 pagesName Sumalatha Patil: Investing Activities Cash Flow ChangessumaNo ratings yet

- Hillsburg Hardware CompanyDocument3 pagesHillsburg Hardware Companykassaye aragawNo ratings yet

- Financial Analysis For Sapphire Fibres LimitedDocument6 pagesFinancial Analysis For Sapphire Fibres LimitedRashmeen NaeemNo ratings yet

- Cash Flow Statement AnalysisDocument4 pagesCash Flow Statement AnalysisLovie GuptaNo ratings yet

- Case Study 1 Muhammad JanjuaDocument6 pagesCase Study 1 Muhammad JanjuaAmeer Hamza JanjuaNo ratings yet

- Financial Statement Analysis - Marks & SpencerDocument8 pagesFinancial Statement Analysis - Marks & Spencermuhammad.salmankhanofficial01No ratings yet

- Pepsico Announces Strategic Investments To Drive GrowthDocument9 pagesPepsico Announces Strategic Investments To Drive GrowthSyed Ali Humza RizviNo ratings yet

- FM Cia 3Document6 pagesFM Cia 3Priyanshu ChhabariaNo ratings yet

- Accounting Control Research TaskDocument12 pagesAccounting Control Research TaskAgamdeep SinghNo ratings yet

- Chapter-V: Findings, Suggestions & Conclusion FindingsDocument4 pagesChapter-V: Findings, Suggestions & Conclusion FindingsGLOBAL INFO-TECH KUMBAKONAMNo ratings yet

- Jollibee Food CorpsDocument7 pagesJollibee Food CorpsSorn PonceNo ratings yet

- Analyzing Voltas Limited's Profitability Ratios: A 2023 Financial AssessmentDocument8 pagesAnalyzing Voltas Limited's Profitability Ratios: A 2023 Financial AssessmentAbhishek PandeyNo ratings yet

- Management Accounting 200819Document21 pagesManagement Accounting 200819Akriti ThakurNo ratings yet

- Solution For The Assignment - FMDocument9 pagesSolution For The Assignment - FMkishor kumarNo ratings yet

- Aetna Financial AnalysisDocument11 pagesAetna Financial AnalysisKimberlyHerringNo ratings yet

- Senior High SchoolDocument9 pagesSenior High SchoolCharlyn CastroNo ratings yet

- Q1. What Inference Do You Draw From The Trends in The Free Cash Flow of The Company?Document6 pagesQ1. What Inference Do You Draw From The Trends in The Free Cash Flow of The Company?sridhar607No ratings yet

- Pinhome CaseDocument3 pagesPinhome CaseDean ErlanggaNo ratings yet

- 8.scrutiniztion of The Auditors Report, Notes To Account, Significant Accounting Policies &various Schedules & AnnexuresDocument28 pages8.scrutiniztion of The Auditors Report, Notes To Account, Significant Accounting Policies &various Schedules & AnnexuresNeeraj BhartiNo ratings yet

- Nyse FC 2023Document172 pagesNyse FC 2023Boban CelebicNo ratings yet

- Star RiverDocument8 pagesStar Riverjack stauberNo ratings yet

- Rohit Corporate AccountingDocument11 pagesRohit Corporate AccountingMah Noor FastNUNo ratings yet

- Interpretation and Comments Capital StructureDocument2 pagesInterpretation and Comments Capital StructureMarcel JonathanNo ratings yet

- FRA - IV (Tarsons Products)Document9 pagesFRA - IV (Tarsons Products)RR AnalystNo ratings yet

- Chapter 2 Review of Financial Statement Preparation Analysis InterpretationDocument46 pagesChapter 2 Review of Financial Statement Preparation Analysis InterpretationMark DavidNo ratings yet

- DKNG 2Q 2023 Business Update - VFDocument15 pagesDKNG 2Q 2023 Business Update - VFrchatabNo ratings yet

- Rashmeen NaeemDocument7 pagesRashmeen NaeemRashmeen NaeemNo ratings yet

- Adithya C S - Ceres Gardening CompanyDocument8 pagesAdithya C S - Ceres Gardening Companyaditya c sNo ratings yet

- Basic Earnings Per ShareDocument4 pagesBasic Earnings Per ShareshreyaNo ratings yet

- Barnes Group IncDocument15 pagesBarnes Group IncRicardo PuyolNo ratings yet

- Order Number 550 Final (Edited)Document27 pagesOrder Number 550 Final (Edited)Joseph KariukiNo ratings yet

- Submitted by Ramesh Babu Sadda (2895538) : Word Count: 2800Document18 pagesSubmitted by Ramesh Babu Sadda (2895538) : Word Count: 2800Ramesh BabuNo ratings yet

- Financial Analysis of Divi's LaboratoriesDocument15 pagesFinancial Analysis of Divi's LaboratoriesShivani DesaiNo ratings yet

- MC200110507 - GSFM7514 - Reflective Task 1Document6 pagesMC200110507 - GSFM7514 - Reflective Task 1Devi SengodanNo ratings yet

- Managerial Accounting Ch07 HW SolutionsDocument40 pagesManagerial Accounting Ch07 HW Solutionsgilli1trNo ratings yet

- FSAV+6e PPT Mod+03Document89 pagesFSAV+6e PPT Mod+03lubna.attariNo ratings yet

- ExamView - Homework CH 4Document9 pagesExamView - Homework CH 4Brooke LevertonNo ratings yet

- Liquidity PositionDocument16 pagesLiquidity PositionNuqman AmranNo ratings yet

- Business Competitor Analysis: Finance For MarketersDocument17 pagesBusiness Competitor Analysis: Finance For MarketersMuhammad Ramiz AminNo ratings yet

- Four Budgeting MethodsDocument3 pagesFour Budgeting MethodsjmbaezfNo ratings yet

- 10 KPIs CashDocument2 pages10 KPIs CashjmbaezfNo ratings yet

- Accounts Receivables Playbook 101Document1 pageAccounts Receivables Playbook 101jmbaezfNo ratings yet

- 10 Crucial Investing RatiosDocument3 pages10 Crucial Investing RatiosjmbaezfNo ratings yet

- Hiring Manager Satisfaction Survey PDFDocument2 pagesHiring Manager Satisfaction Survey PDFSara LoneNo ratings yet

- Notes: Taxation On Individuals: Individual Taxpayers Are Natural Persons With Income Derived From WithinDocument10 pagesNotes: Taxation On Individuals: Individual Taxpayers Are Natural Persons With Income Derived From WithinJohn BanzonNo ratings yet

- ACC114 P3 Exam Answer KeyDocument14 pagesACC114 P3 Exam Answer KeyVincenzo CassanoNo ratings yet

- Infographic - Effect of Access To Finance On Financial Performance of Small and Medium Enterprises in Batangas CityDocument1 pageInfographic - Effect of Access To Finance On Financial Performance of Small and Medium Enterprises in Batangas CityBen TorejaNo ratings yet

- Course 1.2: What You Should KnowDocument27 pagesCourse 1.2: What You Should KnowGeorgios MilitsisNo ratings yet

- Retailing Chapter 4Document7 pagesRetailing Chapter 4Richard AquinoNo ratings yet

- M1 Group4 Econ02PT01Document11 pagesM1 Group4 Econ02PT01josonninoangeloNo ratings yet

- Implementation Guideline 5Document128 pagesImplementation Guideline 5வேணிNo ratings yet

- Case StudyDocument15 pagesCase StudyCaleb LangatNo ratings yet

- Roland Berger - Bridging The Digital Divide - 2020Document24 pagesRoland Berger - Bridging The Digital Divide - 2020AKNo ratings yet

- HBR IntroDocument3 pagesHBR IntroNeo4u44No ratings yet

- 2 (1) - Form 102 - PrintDocument4 pages2 (1) - Form 102 - PrintPraveen SehgalNo ratings yet

- From Sweden 2013: Green SolutionsDocument31 pagesFrom Sweden 2013: Green Solutionswowboys2001No ratings yet

- 44 IPA AGM 2015 Report BookDocument112 pages44 IPA AGM 2015 Report BookCah Ndeso KlutukNo ratings yet

- SWOT Analysis: January 2015Document9 pagesSWOT Analysis: January 2015waw wawNo ratings yet

- A. Money Market FundsDocument2 pagesA. Money Market FundsMelch Yvan Racasa MarbellaNo ratings yet

- 05 Impact of A Sharing Economy and Green Energy On Achievin 2023 Journal of InnDocument8 pages05 Impact of A Sharing Economy and Green Energy On Achievin 2023 Journal of InnFachry ArifinNo ratings yet

- Roland Berger Report On Key Enablers For Hydrogen in MENA 1673535736Document16 pagesRoland Berger Report On Key Enablers For Hydrogen in MENA 1673535736MohamedNo ratings yet

- An Empirical Study On The Performance Evaluation of Public Sector Banks in IndiaDocument16 pagesAn Empirical Study On The Performance Evaluation of Public Sector Banks in Indiapratik053No ratings yet

- 02.mechanics of Futures MarketDocument8 pages02.mechanics of Futures MarketNg Jian LongNo ratings yet

- The Foreclosure Secrets GuideDocument146 pagesThe Foreclosure Secrets GuideAkil BeyNo ratings yet

- SIP Return CalculatorDocument6 pagesSIP Return CalculatorAnuj MasareNo ratings yet

- TDP - Agro Tech Format 2019Document21 pagesTDP - Agro Tech Format 2019sajalkrsahaNo ratings yet

- Student Copy Assignments On Money and Banking NewDocument12 pagesStudent Copy Assignments On Money and Banking Newtanishweta26No ratings yet

- Production and Operations ManagementDocument29 pagesProduction and Operations ManagementAyush SinghNo ratings yet

- Presentation Product PLC240228 A02Document8 pagesPresentation Product PLC240228 A02Crazed NinjaNo ratings yet

- Multiple Choice Questions (MCQ) : Session No 01Document12 pagesMultiple Choice Questions (MCQ) : Session No 01sameerNo ratings yet

- MIDCDocument5 pagesMIDCAtharvaNo ratings yet

- A COMPARATIVE STUDY OF HOME LOANS OF STATE BANK OF INDIA S B I AND HOUSING DEVELOPMENT FINANCE CORPORATION H D F C BANKS AN EMPERICAL STUDY OF BATHINDA PUNJAB Ijariie6205Document10 pagesA COMPARATIVE STUDY OF HOME LOANS OF STATE BANK OF INDIA S B I AND HOUSING DEVELOPMENT FINANCE CORPORATION H D F C BANKS AN EMPERICAL STUDY OF BATHINDA PUNJAB Ijariie6205prakash kambleNo ratings yet