Professional Documents

Culture Documents

2023-2024 FormNo12BB

2023-2024 FormNo12BB

Uploaded by

vivek070176Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2023-2024 FormNo12BB

2023-2024 FormNo12BB

Uploaded by

vivek070176Copyright:

Available Formats

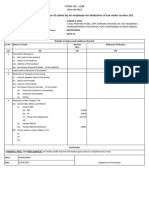

FORM NO.

12BB

[See rule 26C]

Statement showing particulars of claims by an employee for deduction of tax under section 192

1. Name and address of the employee: Vivek Gupta, 1,1

2. [Permanent Account Number or Aadhaar Number] of the employee: BDBPG8034M

3. Financial year: 20232024

DETAILS OF CLAIMS AND EVIDENCE THEREOF

Sl.No Nature of claim Amount (Rs.) Evidence/ particulars

(1) (2) (3) (4)

1. House Rent Allowance:

(i) Rent paid to the landlord 360000

(ii) Name of the landlord Sharry Goyal

3445, SAI ENCLAVE, SECTOR

(iii) Address of the landlord

49D, CHANDIGARH

(iv) [Permanent Account Number or AadhaarNumber] of the landlord

JLVPS3607E

Note : [Permanent Account Number or Aadhaar Number] shall be furnished if the aggregate

rent paid during the previous year exceeds one lakh rupees

2. Section 10 Exemption

Leave Travel Allowance 61159

3. Deduction of interest on borrowing:

(a) Financial Institutions (if available)

(b) Employer (if available)

(c) Others

4. Deduction under Chapter VIA

(A) Sections 80C, 80CCC and 80CCD

(i) Section 80C

Public Provident Fund(PPF) 150000

(ii) Section 80CCC

(iii) Section 80CCD

Additional Contribution to NPS 50000

(B) Other sections (e.g. 80E, 80G, 80TTA, etc.) under Chapter VIA

Medical Insurance Parents above 60 yrs of age 102576

Interest on Home Loan 200000

Verification

I, Vivek Gupta son/daughter of PAWAN KUMAR GUPTA do hereby certify that the information given above is complete and correct

Place :

Date : 06/02/2024 (Signature of the employee)

Designation : Faculty Full Name: Vivek Gupta

You might also like

- Zipcar: Influencing Customer BehaviorDocument4 pagesZipcar: Influencing Customer BehaviorSashitaroor100% (1)

- Bangladesh Bank Circular - FinalDocument2 pagesBangladesh Bank Circular - Finalmaka007No ratings yet

- Cisco India Payroll: TAX Proof Submission FormDocument3 pagesCisco India Payroll: TAX Proof Submission FormDHANANJOY DEBNo ratings yet

- Section 12BBDocument2 pagesSection 12BBbhaskar ghoshNo ratings yet

- Section 12BB IT ExampleDocument2 pagesSection 12BB IT Examplebhaskar ghoshNo ratings yet

- Form 12BB-2021-22 (Final)Document1 pageForm 12BB-2021-22 (Final)Rohan BharadwajNo ratings yet

- IT DeclarationDocument1 pageIT Declarationsiva kumaarNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192basha rasulNo ratings yet

- Form12bb Aug 22Document2 pagesForm12bb Aug 22Gokul KrishNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationprasathNo ratings yet

- Form 12BBDocument3 pagesForm 12BBAndroid TricksNo ratings yet

- 2023 Tax DeclarationDocument2 pages2023 Tax Declarationmanikandan BalasubramaniyanNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Epsf Form12bb 215322Document1 pageEpsf Form12bb 215322anil sangwanNo ratings yet

- Serv Let ControllerDocument2 pagesServ Let ControllerAbhishekShuklaNo ratings yet

- Investment Declaration Form - 2023-24Document2 pagesInvestment Declaration Form - 2023-24shrlsNo ratings yet

- Form12BB-258 (HARDIK K - PATEL)Document1 pageForm12BB-258 (HARDIK K - PATEL)Automobile EngineeringNo ratings yet

- HDFC Ltd.Document3 pagesHDFC Ltd.Parag KusalkarNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Guru RajNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Form 12BB (See Rule 26C)Document2 pagesForm 12BB (See Rule 26C)Biswadip BanerjeeNo ratings yet

- Mercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document1 pageMercer Consulting (India) Private Limited Form No. 12Bb (See Rule 26C) Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Shubham ShrivastavaNo ratings yet

- Form 12BB Oz-2756Document4 pagesForm 12BB Oz-2756alankarmcNo ratings yet

- IT DeclarationDocument1 pageIT DeclarationKranthi kakumanuNo ratings yet

- Form 12BB and POI Report-1574532776601Document2 pagesForm 12BB and POI Report-1574532776601Akshay RahatwalNo ratings yet

- ReportPrintDlg PageDocument2 pagesReportPrintDlg Pagealok yadavNo ratings yet

- IT DeclarationDocument1 pageIT Declarationswapna vijayNo ratings yet

- Form 12BBDocument1 pageForm 12BBshaileshNo ratings yet

- Form 12bb NewDocument1 pageForm 12bb NewYogaraj SNo ratings yet

- Form12bb 5663202Document2 pagesForm12bb 5663202uttamraochopade52No ratings yet

- (See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbDocument1 page(See Rule 26C of Income Tax Rules, 1962) : Form No. 12BbSaad YusufNo ratings yet

- FORM12BBDocument1 pageFORM12BBBotla RajaNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportKabir's World dinoloverNo ratings yet

- Statement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Document2 pagesStatement Showing Particulars of Claims by An Employee For Deduction of Tax Under Section 192Chandra ShekarNo ratings yet

- Form 12BB 270491Document2 pagesForm 12BB 270491ShreeKrishnaGuptaNo ratings yet

- Epsf Form12bb 93445Document1 pageEpsf Form12bb 93445dasari.samratNo ratings yet

- Form 12BB Qqa0345Document6 pagesForm 12BB Qqa0345Santosh UlpiNo ratings yet

- Form 12BB and POI ReportDocument2 pagesForm 12BB and POI ReportMulpuri Vijaya KumarNo ratings yet

- 02 Form-12BBDocument2 pages02 Form-12BByalla1No ratings yet

- Income-Tax Rules, 1962Document2 pagesIncome-Tax Rules, 1962Henna KadyanNo ratings yet

- HH 1Document1 pageHH 1theartcave03No ratings yet

- Form-12BB 2019-20Document1 pageForm-12BB 2019-20sabir aliNo ratings yet

- Form 12BBDocument2 pagesForm 12BBBasavaraj NNo ratings yet

- VBRViewer PDFDocument1 pageVBRViewer PDFAshokdheena 619No ratings yet

- Form12bb 23-24Document1 pageForm12bb 23-24hanu549549No ratings yet

- Form 12BB in Excel FormatDocument9 pagesForm 12BB in Excel FormatAnonymous gG31dZ9ONo ratings yet

- 12BBDocument3 pages12BBcont2chanduNo ratings yet

- Form-12BB FY 2021-22Document2 pagesForm-12BB FY 2021-22Vinay JadhavNo ratings yet

- 002WZ3744Document3 pages002WZ3744DrVarsha Priya SinghNo ratings yet

- Form12-PQB0286280-C19088-Karthi Subramanian-2021-2022Document1 pageForm12-PQB0286280-C19088-Karthi Subramanian-2021-2022Karthi SubramanianNo ratings yet

- Form 12BBDocument1 pageForm 12BBGopala KrishnanNo ratings yet

- Sample of Form 12BBDocument1 pageSample of Form 12BBphaniranjanNo ratings yet

- Form 12BDocument2 pagesForm 12BNageswar MakalaNo ratings yet

- Epsf Form12bb 10006980Document2 pagesEpsf Form12bb 10006980Vikas SoniNo ratings yet

- Form 12BBDocument2 pagesForm 12BBsumitgp87No ratings yet

- Form 12BBDocument3 pagesForm 12BBAmitNo ratings yet

- Form 12BBDocument2 pagesForm 12BBNithin B HNo ratings yet

- Form 12 BB MsirDocument1 pageForm 12 BB MsirrajeshNo ratings yet

- Cisco India Payroll: TAX Proof Submission FormDocument4 pagesCisco India Payroll: TAX Proof Submission FormDHANANJOY DEBNo ratings yet

- Form12bb 246 (Yagnesh V Anavadiya)Document1 pageForm12bb 246 (Yagnesh V Anavadiya)chanduNo ratings yet

- New Form 12BBDocument2 pagesNew Form 12BBramanNo ratings yet

- SMIF Annual Report 2010-2011Document40 pagesSMIF Annual Report 2010-2011CelticAcesNo ratings yet

- Feasibility Study: Presented byDocument21 pagesFeasibility Study: Presented byTanaka dzapasiNo ratings yet

- Fourth Form Quiz 3 (Consumer Arithmetic) Name: - ClassDocument4 pagesFourth Form Quiz 3 (Consumer Arithmetic) Name: - ClassChet Ack100% (1)

- Basics of Accounting in VEDocument25 pagesBasics of Accounting in VEIpang NoyoNo ratings yet

- Transfer Taxes: Atty. Kim M. Aranas Faculty, USC-SOLGDocument61 pagesTransfer Taxes: Atty. Kim M. Aranas Faculty, USC-SOLGethel hyugaNo ratings yet

- Fa2 BPP Kit 2019Document209 pagesFa2 BPP Kit 2019Zubair RafiqueNo ratings yet

- NIC Corporate PPT PMACDocument19 pagesNIC Corporate PPT PMACAman SinhaNo ratings yet

- Sarthak Enterprises-Sae14420: GST No: 24Aabca2390M1Zp State Code:24Document6 pagesSarthak Enterprises-Sae14420: GST No: 24Aabca2390M1Zp State Code:24Samir ShaikhNo ratings yet

- Micro Economics-I Chapter - One AndThreeDocument41 pagesMicro Economics-I Chapter - One AndThreeYonatanNo ratings yet

- Aracanut Plates 10 LakhsDocument19 pagesAracanut Plates 10 LakhsManju MysoreNo ratings yet

- Brewer 6e Practice Exam - Chapter 7Document3 pagesBrewer 6e Practice Exam - Chapter 7real johnNo ratings yet

- Usdaw Activist 106Document3 pagesUsdaw Activist 106USDAWactivistNo ratings yet

- Gujarat April-2022Document65 pagesGujarat April-2022kamaiiiNo ratings yet

- Value Creation in Global Apparel Industry: Assignment 1Document11 pagesValue Creation in Global Apparel Industry: Assignment 1Shivi Shrivastava100% (1)

- Industrial Growth in MaharashtraDocument18 pagesIndustrial Growth in Maharashtratushak mNo ratings yet

- Watkins Spring Discussion GuideDocument2 pagesWatkins Spring Discussion Guideapi-594514169No ratings yet

- U.S. Power and The Multinational Corporation: The Political Economy of Foreign Direct InvestmentDocument2 pagesU.S. Power and The Multinational Corporation: The Political Economy of Foreign Direct InvestmentVramon EvakoyNo ratings yet

- COA CIRCULAR NO. 2023 008 August 17 2023Document14 pagesCOA CIRCULAR NO. 2023 008 August 17 2023Leah FlorentinoNo ratings yet

- Capital Budgeting 1Document8 pagesCapital Budgeting 1Alyssa Gabrielle SamsonNo ratings yet

- Exam 14 February 2020 Questions and AnswersDocument7 pagesExam 14 February 2020 Questions and AnswersDan Andrei BongoNo ratings yet

- Green Veh OnepagerDocument2 pagesGreen Veh OnepagerRohith RaoNo ratings yet

- Conveyancing Summary Notes - NB Print 1Document43 pagesConveyancing Summary Notes - NB Print 1Phatheka MgingqizanaNo ratings yet

- Rishi Project BookDocument100 pagesRishi Project BookAnvesh Pulishetty -BNo ratings yet

- REG QuestionsDocument133 pagesREG Questionsalisha0104No ratings yet

- Old MembersDocument50 pagesOld MemberssNo ratings yet

- Chap 017Document48 pagesChap 017Farah ThabitNo ratings yet

- Why Cambodia Guide, Introduction To Asia's Emerging Real Estate EconomyDocument42 pagesWhy Cambodia Guide, Introduction To Asia's Emerging Real Estate EconomyAnani SongNo ratings yet

- TT W9 Vietnam's Premier Seeks 'New Ways' To Survive US - China Trade WarDocument5 pagesTT W9 Vietnam's Premier Seeks 'New Ways' To Survive US - China Trade WarNGỌC ĐIỆP TRẦNNo ratings yet