Professional Documents

Culture Documents

Act ch10 l04 English

Act ch10 l04 English

Uploaded by

Linds RiveraCopyright:

Available Formats

You might also like

- Act ch10 l02 EnglishDocument4 pagesAct ch10 l02 EnglishLinds Rivera100% (3)

- Civilian Leave and Earnings Statement LesDocument1 pageCivilian Leave and Earnings Statement LesStefhanie ClaireNo ratings yet

- Act ch10 l06 EnglishDocument5 pagesAct ch10 l06 EnglishLinds Rivera100% (1)

- Building Wealth Chart #1Document4 pagesBuilding Wealth Chart #1Caleb ReynoldsNo ratings yet

- SMChap004 PDFDocument57 pagesSMChap004 PDFhshNo ratings yet

- Reliance Retail Limited: Sangeetha MDocument3 pagesReliance Retail Limited: Sangeetha MHariharan RNo ratings yet

- 2016 1040 Individual Tax Return Engagement LetterDocument11 pages2016 1040 Individual Tax Return Engagement LettersarahvillalonNo ratings yet

- Act ch10 l03 EnglishDocument5 pagesAct ch10 l03 EnglishLinds RiveraNo ratings yet

- PDF VDocument1 pagePDF Vgloria whiteNo ratings yet

- IRS Form f1040sDocument4 pagesIRS Form f1040sofficeNo ratings yet

- 2021 TaxReturnDocument11 pages2021 TaxReturnHa AlNo ratings yet

- P21 Balancing Statement 2022 772641628035Document3 pagesP21 Balancing Statement 2022 772641628035Conor O' SullivanNo ratings yet

- 2019 TaxReturnDocument12 pages2019 TaxReturnjbanuelosv73No ratings yet

- February 2024 StatementDocument2 pagesFebruary 2024 StatementdrikiddoNo ratings yet

- 2016 540 California Resident Income Tax ReturnDocument5 pages2016 540 California Resident Income Tax Returnapi-351213976No ratings yet

- STF 2022-04-19 1650352164138Document3 pagesSTF 2022-04-19 1650352164138Charles GoodwinNo ratings yet

- Your Account Balance: SalfordDocument1 pageYour Account Balance: SalfordAlex NeziNo ratings yet

- 2015 Tax ReturnDocument3 pages2015 Tax ReturnHeidi LambNo ratings yet

- 2009 Balderas Puentes S Form 1040 Individual Tax ReturnDocument9 pages2009 Balderas Puentes S Form 1040 Individual Tax ReturnJaqueline LeslieNo ratings yet

- 1 5136803172601299942 PDFDocument3 pages1 5136803172601299942 PDFnurulamin00023No ratings yet

- US1099Forms - Form 1099-NEC Copy BDocument2 pagesUS1099Forms - Form 1099-NEC Copy BSaurabh ChandraNo ratings yet

- PDF DocumentDocument1 pagePDF DocumentmaliktaimoorsurahNo ratings yet

- FederalDocument15 pagesFederalNeil NitinNo ratings yet

- 12:29 GW PaystubDocument1 page12:29 GW Paystubdonbabich8No ratings yet

- Canadian Onlinestatement-1Document2 pagesCanadian Onlinestatement-1عبد الالهNo ratings yet

- Non-Negotiable: EarningsDocument1 pageNon-Negotiable: EarningsAvya BrutusNo ratings yet

- Form 1040 R.I.P.Document1 pageForm 1040 R.I.P.Landmark Tax Group™No ratings yet

- Receipts Expenditures: WarningDocument3 pagesReceipts Expenditures: WarningParents' Coalition of Montgomery County, MarylandNo ratings yet

- Tax ReturnsDocument1 pageTax Returnshuss eynNo ratings yet

- Keough CFR 6-12 2017Document133 pagesKeough CFR 6-12 2017Houston ChronicleNo ratings yet

- Qualified Dividends and Capital Gains WorksheetDocument1 pageQualified Dividends and Capital Gains WorksheetBetty Ann LegerNo ratings yet

- AB Limited Form Schedule K-1 DonDocument1 pageAB Limited Form Schedule K-1 Donsarah.gleasonNo ratings yet

- 2022 Individual Tax Organizer FillableDocument6 pages2022 Individual Tax Organizer FillableTham DangNo ratings yet

- 6670 Alexis 12-30-2022Document1 page6670 Alexis 12-30-2022Nego da NagaNo ratings yet

- Return 2019 BOY FIRST MAKEDocument6 pagesReturn 2019 BOY FIRST MAKEshahabNo ratings yet

- Delores Douglas Paystub 091222-092522Document1 pageDelores Douglas Paystub 091222-092522Otega Overere VictorNo ratings yet

- Pyw223s EeDocument1 pagePyw223s Eedanielman956No ratings yet

- Borrower Information: Disclosure Statement William D. Ford Federal Direct Loan ProgramDocument3 pagesBorrower Information: Disclosure Statement William D. Ford Federal Direct Loan ProgramNathan BurrisNo ratings yet

- Tax Return TranscriptDocument2 pagesTax Return TranscriptfoyefellerNo ratings yet

- 2022TaxReturn StarnesDocument17 pages2022TaxReturn StarnesjpneebNo ratings yet

- State OregonDocument18 pagesState OregonNeil NitinNo ratings yet

- Liz Martyr May April 2020 FECDocument26 pagesLiz Martyr May April 2020 FECPat PowersNo ratings yet

- 1098-T Copy B: Tuition StatementDocument2 pages1098-T Copy B: Tuition Statemented redfNo ratings yet

- Hong Thien PhuocBui2018Document6 pagesHong Thien PhuocBui2018Thien BaoNo ratings yet

- Mund Oct. QuarterlyDocument24 pagesMund Oct. QuarterlyRob PortNo ratings yet

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument3 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetLabNo ratings yet

- Paycheck - 2022 05 15 - 2022 05 21Document1 pagePaycheck - 2022 05 15 - 2022 05 21Sandra RíosNo ratings yet

- CEU Balance SheetDocument1 pageCEU Balance SheetmadhuNo ratings yet

- NYSE - BX. Dear Unit Holder - PDFDocument9 pagesNYSE - BX. Dear Unit Holder - PDFEugene FrancoNo ratings yet

- Rounds July FECDocument119 pagesRounds July FECPat PowersNo ratings yet

- A218 DocumentDocument9 pagesA218 DocumentJose AlmonteNo ratings yet

- 2007 Carl & Ruth Shapiro Family Foundation 990 (Includes Madoff Investment)Document42 pages2007 Carl & Ruth Shapiro Family Foundation 990 (Includes Madoff Investment)jpeppard100% (4)

- 2020 Federal Tax Return Documents (PATEL ASHOKBHAI and CHE)Document7 pages2020 Federal Tax Return Documents (PATEL ASHOKBHAI and CHE)atul0070No ratings yet

- Kia Lopez Form 1040Document2 pagesKia Lopez Form 1040Stephanie RobinsonNo ratings yet

- Paycheck - 2022 04 24 - 2022 04 30Document1 pagePaycheck - 2022 04 24 - 2022 04 30Sandra RíosNo ratings yet

- Usabank Statement 1Document3 pagesUsabank Statement 1Adnan HussainNo ratings yet

- Individual Income Tax ReturnsDocument2 pagesIndividual Income Tax ReturnsZen1No ratings yet

- Main - Form Pa 8453 2018 Pennsylvania Individual Income Tax Declaration Electronic Filing PennsylvaniaDocument4 pagesMain - Form Pa 8453 2018 Pennsylvania Individual Income Tax Declaration Electronic Filing PennsylvaniaDiana JuanNo ratings yet

- Rounds April 2020 FecDocument160 pagesRounds April 2020 FecPat PowersNo ratings yet

- Instructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDocument72 pagesInstructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDiego12001No ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatuspeachyNo ratings yet

- TAXES w2 REGAL HospitalityDocument2 pagesTAXES w2 REGAL Hospitalityoskar_herrera2012No ratings yet

- Scaffolding FormatDocument7 pagesScaffolding Formatsadashiv puneNo ratings yet

- Module 2 DEDUCTION FROM GROSS ESTATE AND ESTATE TAX - Part 2Document33 pagesModule 2 DEDUCTION FROM GROSS ESTATE AND ESTATE TAX - Part 2Venice Marie ArroyoNo ratings yet

- Scope of Income Tax Basis of Charge Concept of Income 2nd July 2012 CA Harish MotiwalaDocument16 pagesScope of Income Tax Basis of Charge Concept of Income 2nd July 2012 CA Harish Motiwalasyed junaid sultanNo ratings yet

- Cruz Suzanne P. Case Digest No. 5 HSBC Vs CirDocument1 pageCruz Suzanne P. Case Digest No. 5 HSBC Vs CirSuzanne Pagaduan CruzNo ratings yet

- QuestionsDocument2 pagesQuestionsBong BaybinNo ratings yet

- Tamil Nadu Motor Vehicles (Taxation of Passengers and Goods) Amendment Act, 1966Document3 pagesTamil Nadu Motor Vehicles (Taxation of Passengers and Goods) Amendment Act, 1966Latest Laws TeamNo ratings yet

- TV M 3111235015874283 R PosDocument2 pagesTV M 3111235015874283 R Postdarshil.123No ratings yet

- IndividualsDocument12 pagesIndividualsdarlene floresNo ratings yet

- SSPUSADVDocument1 pageSSPUSADVgunashekarkalluriNo ratings yet

- Invoice: Tesla Norway ASDocument1 pageInvoice: Tesla Norway ASThomas LingottNo ratings yet

- Accounting VoucherDocument1 pageAccounting Vouchersuplex suryaNo ratings yet

- GSTR3B 21aywpa7472l1zz 042023Document2 pagesGSTR3B 21aywpa7472l1zz 042023prateek gangwaniNo ratings yet

- Salary Jan 2001Document2 pagesSalary Jan 2001Kharde HrishikeshNo ratings yet

- BTS Asst Details Cat C FY 2022-23Document5 pagesBTS Asst Details Cat C FY 2022-23kanishkasrivastava7No ratings yet

- 0153 0166 TradeportDocument5 pages0153 0166 TradeportHARSHAL MITTALNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruGanesh DasaraNo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 273151Document3 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 273151AVINASH TIWASKARNo ratings yet

- Supply Outward - 34Document3 pagesSupply Outward - 34DIVYANSHI PHOTO STATENo ratings yet

- 1701 Annual Income Tax Return: Rogelio D. GonzalesDocument1 page1701 Annual Income Tax Return: Rogelio D. GonzalesJoshua CarzaNo ratings yet

- Cir vs. TMX Sales and CtaDocument3 pagesCir vs. TMX Sales and CtaD De LeonNo ratings yet

- Requirements and Procedures in Paying Capital Gain TaxDocument2 pagesRequirements and Procedures in Paying Capital Gain TaxDrizza FerrerNo ratings yet

- Employee 1 PayslipDocument6 pagesEmployee 1 PayslipJeric Lagyaban AstrologioNo ratings yet

- PAYROLL - ProblemDocument3 pagesPAYROLL - Problemshaipink2000No ratings yet

- Debit Note Edited TemplateDocument4 pagesDebit Note Edited TemplateDilleshNo ratings yet

- Application For Registration: Kawanihan NG Rentas InternasDocument4 pagesApplication For Registration: Kawanihan NG Rentas InternasCarl PedreraNo ratings yet

- TAX Quiz 30Document2 pagesTAX Quiz 30LanceNo ratings yet

- Lousianna Tax InstructionDocument17 pagesLousianna Tax Instructionchuckhsu1248No ratings yet

- Tax Invoice: % Rate CGST Sr. Product Description Gms HSN Code MRP Return QtyDocument4 pagesTax Invoice: % Rate CGST Sr. Product Description Gms HSN Code MRP Return QtyJai GaneshNo ratings yet

Act ch10 l04 English

Act ch10 l04 English

Uploaded by

Linds RiveraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Act ch10 l04 English

Act ch10 l04 English

Uploaded by

Linds RiveraCopyright:

Available Formats

Filing Your Taxes

CHAPTER 10, LESSON 4

NAME DATE

DIRECTIONS

Review the following key terms. Then use the sample Form W-2 and the sample tax table to complete the

Form 1040 tax return. After calculating the tax on the taxable income using the tax table, calculate what the

tax would be using the tax bracket chart. After completing the tax return and the tax bracket calculations,

answer the questions.

Key Terms

• W-2 (Wage and Tax Statement): a form used to report wages paid to employees and

taxes withheld from their wages; should be completed for each employee on or before

January 31 of each year

• 1099 (MISC Statement for Recipients of Non-Employee Compensation): used to

report earnings of $600 or more paid per calendar year, for which no withholding of

social security taxes and income tax was made over the year

• 1040: the basic form used for personal income tax returns filed with the IRS

• IRS (Internal Revenue Service): United States government agency that is responsible

for the collection and enforcement of taxes

• Head of Household: a filing status that is used for individuals who are not married; this

person must pay more than half of the costs for the household in which they live

• Joint Return: income taxes that are filed for a married couple; the income, tax credits,

tax deductions, and tax exemptions are combined on one tax return

• FICA (Federal Insurance Contributions Act): payroll taxes that are used to pay for

Social Security and Medicare programs

• Income Tax Withholdings: money an employer legally has to withhold (take out,

deduct) from an employee’s earnings, and it is sent to the city, state, and federal

governments; this money is applied toward the amount of money an employee will

owe the government agency when income taxes are filed

FO U NDATI O N S I N PERSONAL FI NANCE PAGE 1 O F 7

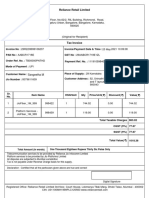

2022 Form W-2

a Employee's social security number This is a recreation of a W-2 for education purposes only.

22222 123-45-6789 OMB No. 1545-0008

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

12-3456789 $42,802.50

$20,000.00 $3,852.20

$1,520.00

c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

$20,000.00

$42,802.50 $1,240.00

$2,568.15

Personal

Clean Finance

Wash Car Wash Media, LLC 5 Medicare wages and tips 6 Medicare tax withheld

321123 East Main

Working Road St. $20,000.00

$42,802.50 $290.00

$684.84

New York,

Somewhere US, NY 12345

54321 7 Social security tips 8 Allocated tips

d Control number 9 Verification Code 10 Dependent Care benefits

12345-678910 1a2b-3c4d-567d-8910

e Employees first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12

|

Rebecca

Employee A. K. Foster 13 Statutory Retirement Third-party 12b

1231234 Main

Address St.

Lane Employee plan sick pay

|

Somewhere US, NY

New York, 54321

12345 14 Other 12c

|

f Employee's address and ZIP code 12d

State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips |

Local income tax

Form W-2 Wage and Tax Statement 2022 This is not a real Form W-2 but a recreation

of a W-2 for education purposes only.

Copy C- for Employee’s Records

a Employee's social security number This is a recreation of a W-2 for education purposes only

22222 000-00-0000 OMB No. 1545-0008

b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld

62-0000XXX $37,000.00 $5,431.25

c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld

$37,000.00 $2,294.00

Fred's Financial Consulting 5 Medicare wages and tips 6 Medicare tax withheld

456 Dollar street $37,000.00 $536.50

Somewhere US, 54321 7 Social security tips 8 Allocated tips

d Control number 9 10 Dependent Care benefits

e Employees first name and initial Last name Suff. 11 Nonqualified plans 12a See instructions for box 12

|

Employee A. Sample 13 Statutory Retirement Third-party 12b

Employee plan sick pay

123 Address Lane |

Somewhere US, 54321 14 Other 12c

|

f Employee's address and ZIP code 12d

State Employer's state ID number 16 State wages, tips, etc. 17 State income tax 18 Local wages, tips |

Local income tax

Form W-2 Wage and Tax Statement 2011 This is not a real W-2 form but a recreation

of a W-2 for education purposes only

CH A P TER 11 Foundations in Personal Finance High School Edition

FO U NDATI O N S I N PERSONAL FI NANCE PAGE 2 O F 7

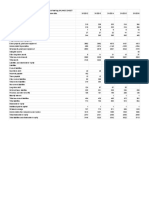

2022 Form 1040

Rebecca K Foster 123 45 6789

1234 Main st.

New York NY 12345

$19,400

$23,402.50

FO U NDATI O N S I N PERSONAL FI NANCE PAGE 3 O F 7

2022 Form 1040 (continued)

$2,518

$2,518

$3,852.20

$3,852.20

$3,852.20

$1,344.50

FO U NDATI O N S I N PERSONAL FI NANCE PAGE 4 O F 7

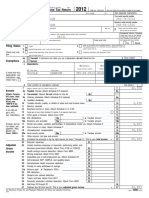

Page 6 of 26 Fileid: … -tax-table/2022/a/xml/cycle02/source 13:19 - 28-Nov-2022

The type and rule above prints on all proofs including departmental reproduction proofs. MUST be removed before printing.

2022 Tax Table 2022 Tax Table — Continued

If line 15 If line 15 If line 15

(taxable And you are— (taxable And you are— (taxable And you are—

income) is— income) is— income) is—

At But Single Married Married Head of At But Single Married Married Head of At But Single Married Married Head of

least less filing filing a least less filing filing a least less filing filing a

than jointly * sepa- house- than jointly * sepa- house- than jointly * sepa- house-

rately hold rately hold rately hold

Your tax is— Your tax is— Your tax is—

21,000 24,000 27,000

21,000 21,050 2,318 2,112 2,318 2,230 24,000 24,050 2,678 2,472 2,678 2,590 27,000 27,050 3,038 2,832 3,038 2,950

21,050 21,100 2,324 2,118 2,324 2,236 24,050 24,100 2,684 2,478 2,684 2,596 27,050 27,100 3,044 2,838 3,044 2,956

21,100 21,150 2,330 2,124 2,330 2,242 24,100 24,150 2,690 2,484 2,690 2,602 27,100 27,150 3,050 2,844 3,050 2,962

21,150 21,200 2,336 2,130 2,336 2,248 24,150 24,200 2,696 2,490 2,696 2,608 27,150 27,200 3,056 2,850 3,056 2,968

21,200 21,250 2,342 2,136 2,342 2,254 24,200 24,250 2,702 2,496 2,702 2,614 27,200 27,250 3,062 2,856 3,062 2,974

21,250 21,300 2,348 2,142 2,348 2,260 24,250 24,300 2,708 2,502 2,708 2,620 27,250 27,300 3,068 2,862 3,068 2,980

21,300 21,350 2,354 2,148 2,354 2,266 24,300 24,350 2,714 2,508 2,714 2,626 27,300 27,350 3,074 2,868 3,074 2,986

21,350 21,400 2,360 2,154 2,360 2,272 24,350 24,400 2,720 2,514 2,720 2,632 27,350 27,400 3,080 2,874 3,080 2,992

21,400 21,450 2,366 2,160 2,366 2,278 24,400 24,450 2,726 2,520 2,726 2,638 27,400 27,450 3,086 2,880 3,086 2,998

21,450 21,500 2,372 2,166 2,372 2,284 24,450 24,500 2,732 2,526 2,732 2,644 27,450 27,500 3,092 2,886 3,092 3,004

21,500 21,550 2,378 2,172 2,378 2,290 24,500 24,550 2,738 2,532 2,738 2,650 27,500 27,550 3,098 2,892 3,098 3,010

21,550 21,600 2,384 2,178 2,384 2,296 24,550 24,600 2,744 2,538 2,744 2,656 27,550 27,600 3,104 2,898 3,104 3,016

21,600 21,650 2,390 2,184 2,390 2,302 24,600 24,650 2,750 2,544 2,750 2,662 27,600 27,650 3,110 2,904 3,110 3,022

21,650 21,700 2,396 2,190 2,396 2,308 24,650 24,700 2,756 2,550 2,756 2,668 27,650 27,700 3,116 2,910 3,116 3,028

21,700 21,750 2,402 2,196 2,402 2,314 24,700 24,750 2,762 2,556 2,762 2,674 27,700 27,750 3,122 2,916 3,122 3,034

21,750 21,800 2,408 2,202 2,408 2,320 24,750 24,800 2,768 2,562 2,768 2,680 27,750 27,800 3,128 2,922 3,128 3,040

21,800 21,850 2,414 2,208 2,414 2,326 24,800 24,850 2,774 2,568 2,774 2,686 27,800 27,850 3,134 2,928 3,134 3,046

21,850 21,900 2,420 2,214 2,420 2,332 24,850 24,900 2,780 2,574 2,780 2,692 27,850 27,900 3,140 2,934 3,140 3,052

21,900 21,950 2,426 2,220 2,426 2,338 24,900 24,950 2,786 2,580 2,786 2,698 27,900 27,950 3,146 2,940 3,146 3,058

21,950 22,000 2,432 2,226 2,432 2,344 24,950 25,000 2,792 2,586 2,792 2,704 27,950 28,000 3,152 2,946 3,152 3,064

22,000 25,000 28,000

22,000 22,050 2,438 2,232 2,438 2,350 25,000 25,050 2,798 2,592 2,798 2,710 28,000 28,050 3,158 2,952 3,158 3,070

22,050 22,100 2,444 2,238 2,444 2,356 25,050 25,100 2,804 2,598 2,804 2,716 28,050 28,100 3,164 2,958 3,164 3,076

22,100 22,150 2,450 2,244 2,450 2,362 25,100 25,150 2,810 2,604 2,810 2,722 28,100 28,150 3,170 2,964 3,170 3,082

22,150 22,200 2,456 2,250 2,456 2,368 25,150 25,200 2,816 2,610 2,816 2,728 28,150 28,200 3,176 2,970 3,176 3,088

22,200 22,250 2,462 2,256 2,462 2,374 25,200 25,250 2,822 2,616 2,822 2,734 28,200 28,250 3,182 2,976 3,182 3,094

22,250 22,300 2,468 2,262 2,468 2,380 25,250 25,300 2,828 2,622 2,828 2,740 28,250 28,300 3,188 2,982 3,188 3,100

22,300 22,350 2,474 2,268 2,474 2,386 25,300 25,350 2,834 2,628 2,834 2,746 28,300 28,350 3,194 2,988 3,194 3,106

22,350 22,400 2,480 2,274 2,480 2,392 25,350 25,400 2,840 2,634 2,840 2,752 28,350 28,400 3,200 2,994 3,200 3,112

22,400 22,450 2,486 2,280 2,486 2,398 25,400 25,450 2,846 2,640 2,846 2,758 28,400 28,450 3,206 3,000 3,206 3,118

22,450 22,500 2,492 2,286 2,492 2,404 25,450 25,500 2,852 2,646 2,852 2,764 28,450 28,500 3,212 3,006 3,212 3,124

22,500 22,550 2,498 2,292 2,498 2,410 25,500 25,550 2,858 2,652 2,858 2,770 28,500 28,550 3,218 3,012 3,218 3,130

22,550 22,600 2,504 2,298 2,504 2,416 25,550 25,600 2,864 2,658 2,864 2,776 28,550 28,600 3,224 3,018 3,224 3,136

22,600 22,650 2,510 2,304 2,510 2,422 25,600 25,650 2,870 2,664 2,870 2,782 28,600 28,650 3,230 3,024 3,230 3,142

22,650 22,700 2,516 2,310 2,516 2,428 25,650 25,700 2,876 2,670 2,876 2,788 28,650 28,700 3,236 3,030 3,236 3,148

22,700 22,750 2,522 2,316 2,522 2,434 25,700 25,750 2,882 2,676 2,882 2,794 28,700 28,750 3,242 3,036 3,242 3,154

22,750 22,800 2,528 2,322 2,528 2,440 25,750 25,800 2,888 2,682 2,888 2,800 28,750 28,800 3,248 3,042 3,248 3,160

22,800 22,850 2,534 2,328 2,534 2,446 25,800 25,850 2,894 2,688 2,894 2,806 28,800 28,850 3,254 3,048 3,254 3,166

22,850 22,900 2,540 2,334 2,540 2,452 25,850 25,900 2,900 2,694 2,900 2,812 28,850 28,900 3,260 3,054 3,260 3,172

22,900 22,950 2,546 2,340 2,546 2,458 25,900 25,950 2,906 2,700 2,906 2,818 28,900 28,950 3,266 3,060 3,266 3,178

22,950 23,000 2,552 2,346 2,552 2,464 25,950 26,000 2,912 2,706 2,912 2,824 28,950 29,000 3,272 3,066 3,272 3,184

23,000 26,000 29,000

23,000 23,050 2,558 2,352 2,558 2,470 26,000 26,050 2,918 2,712 2,918 2,830 29,000 29,050 3,278 3,072 3,278 3,190

23,050 23,100 2,564 2,358 2,564 2,476 26,050 26,100 2,924 2,718 2,924 2,836 29,050 29,100 3,284 3,078 3,284 3,196

23,100 23,150 2,570 2,364 2,570 2,482 26,100 26,150 2,930 2,724 2,930 2,842 29,100 29,150 3,290 3,084 3,290 3,202

23,150 23,200 2,576 2,370 2,576 2,488 26,150 26,200 2,936 2,730 2,936 2,848 29,150 29,200 3,296 3,090 3,296 3,208

23,200 23,250 2,582 2,376 2,582 2,494 26,200 26,250 2,942 2,736 2,942 2,854 29,200 29,250 3,302 3,096 3,302 3,214

23,250 23,300 2,588 2,382 2,588 2,500 26,250 26,300 2,948 2,742 2,948 2,860 29,250 29,300 3,308 3,102 3,308 3,220

23,300 23,350 2,594 2,388 2,594 2,506 26,300 26,350 2,954 2,748 2,954 2,866 29,300 29,350 3,314 3,108 3,314 3,226

23,350 23,400 2,600 2,394 2,600 2,512 26,350 26,400 2,960 2,754 2,960 2,872 29,350 29,400 3,320 3,114 3,320 3,232

23,400 23,450 2,606 2,400 2,606 2,518 26,400 26,450 2,966 2,760 2,966 2,878 29,400 29,450 3,326 3,120 3,326 3,238

23,450 23,500 2,612 2,406 2,612 2,524 26,450 26,500 2,972 2,766 2,972 2,884 29,450 29,500 3,332 3,126 3,332 3,244

23,500 23,550 2,618 2,412 2,618 2,530 26,500 26,550 2,978 2,772 2,978 2,890 29,500 29,550 3,338 3,132 3,338 3,250

23,550 23,600 2,624 2,418 2,624 2,536 26,550 26,600 2,984 2,778 2,984 2,896 29,550 29,600 3,344 3,138 3,344 3,256

23,600 23,650 2,630 2,424 2,630 2,542 26,600 26,650 2,990 2,784 2,990 2,902 29,600 29,650 3,350 3,144 3,350 3,262

23,650 23,700 2,636 2,430 2,636 2,548 26,650 26,700 2,996 2,790 2,996 2,908 29,650 29,700 3,356 3,150 3,356 3,268

23,700 23,750 2,642 2,436 2,642 2,554 26,700 26,750 3,002 2,796 3,002 2,914 29,700 29,750 3,362 3,156 3,362 3,274

23,750 23,800 2,648 2,442 2,648 2,560 26,750 26,800 3,008 2,802 3,008 2,920 29,750 29,800 3,368 3,162 3,368 3,280

23,800 23,850 2,654 2,448 2,654 2,566 26,800 26,850 3,014 2,808 3,014 2,926 29,800 29,850 3,374 3,168 3,374 3,286

23,850 23,900 2,660 2,454 2,660 2,572 26,850 26,900 3,020 2,814 3,020 2,932 29,850 29,900 3,380 3,174 3,380 3,292

23,900 23,950 2,666 2,460 2,666 2,578 26,900 26,950 3,026 2,820 3,026 2,938 29,900 29,950 3,386 3,180 3,386 3,298

23,950 24,000 2,672 2,466 2,672 2,584 26,950 27,000 3,032 2,826 3,032 2,944 29,950 30,000 3,392 3,186 3,392 3,304

(Continued)

* This column must also be used by a qualifying surviving spouse.

FO U NDATI O N S I N PERSONAL FI NANCE PAGE 5 O F 7

-6-

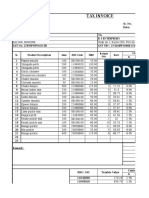

2022 Tax Brackets

FOR MARRIED

FOR SINGLE FOR HEADS OF

RATE INDIVIDUALS FILING

INDIVIDUALS HOUSEHOLDS

JOINT RETURNS

10% Up to $10,275 $0 to $20,550 $0 to $14,650

12% $10,276 to $41,775 $20,551 to $83,550 $14,651 to $55,900

22% $41,776 to $89,075 $83,551 to $178,150 $55,901 to $89,050

24% $89,076 to $170,050 $178,151 to $340,100 $89,051 to $170,050

32% $170,051 to $215,950 $340,101 to $431,900 $170,051 to $215,950

35% $215,951 to $539,900 $431,901 to $647,850 $215,951 to $539,900

37% $539,901 or more $647,851 or more $539,901 or more

Source:

Tax forms and tax tables are from www.irs.gov.

FO U NDATI O N S I N PERSONAL FI NANCE PAGE 6 O F 7

Filing Your Taxes

CHAPTER 10, LESSON 4

1. How much income tax was legally due (using the tax table) as a head of household filer?

$14,650

2. How much income tax (rounded to the nearest dollar) was withheld from the

employee’s income?

$3850

3. How much is still owed in taxes or expected as a refund?

$1344.50

4. How much more or less of a refund would this person get if filing as a single filer?

she woud get a smaller refund, because she is not filling as for two but just for one.

5. What should this person do as a result of this tax return?

she should analyze what she has pseant on and how she needs to spend her money to improve her

tax return next tax filling period.

6. When you calculated the tax on the taxable income using the tax bracket approach,

what was the total tax?

when I calculated it it was 1,250.

FO U NDATI O N S I N PERSONAL FI NANCE PAGE 7 O F 7

You might also like

- Act ch10 l02 EnglishDocument4 pagesAct ch10 l02 EnglishLinds Rivera100% (3)

- Civilian Leave and Earnings Statement LesDocument1 pageCivilian Leave and Earnings Statement LesStefhanie ClaireNo ratings yet

- Act ch10 l06 EnglishDocument5 pagesAct ch10 l06 EnglishLinds Rivera100% (1)

- Building Wealth Chart #1Document4 pagesBuilding Wealth Chart #1Caleb ReynoldsNo ratings yet

- SMChap004 PDFDocument57 pagesSMChap004 PDFhshNo ratings yet

- Reliance Retail Limited: Sangeetha MDocument3 pagesReliance Retail Limited: Sangeetha MHariharan RNo ratings yet

- 2016 1040 Individual Tax Return Engagement LetterDocument11 pages2016 1040 Individual Tax Return Engagement LettersarahvillalonNo ratings yet

- Act ch10 l03 EnglishDocument5 pagesAct ch10 l03 EnglishLinds RiveraNo ratings yet

- PDF VDocument1 pagePDF Vgloria whiteNo ratings yet

- IRS Form f1040sDocument4 pagesIRS Form f1040sofficeNo ratings yet

- 2021 TaxReturnDocument11 pages2021 TaxReturnHa AlNo ratings yet

- P21 Balancing Statement 2022 772641628035Document3 pagesP21 Balancing Statement 2022 772641628035Conor O' SullivanNo ratings yet

- 2019 TaxReturnDocument12 pages2019 TaxReturnjbanuelosv73No ratings yet

- February 2024 StatementDocument2 pagesFebruary 2024 StatementdrikiddoNo ratings yet

- 2016 540 California Resident Income Tax ReturnDocument5 pages2016 540 California Resident Income Tax Returnapi-351213976No ratings yet

- STF 2022-04-19 1650352164138Document3 pagesSTF 2022-04-19 1650352164138Charles GoodwinNo ratings yet

- Your Account Balance: SalfordDocument1 pageYour Account Balance: SalfordAlex NeziNo ratings yet

- 2015 Tax ReturnDocument3 pages2015 Tax ReturnHeidi LambNo ratings yet

- 2009 Balderas Puentes S Form 1040 Individual Tax ReturnDocument9 pages2009 Balderas Puentes S Form 1040 Individual Tax ReturnJaqueline LeslieNo ratings yet

- 1 5136803172601299942 PDFDocument3 pages1 5136803172601299942 PDFnurulamin00023No ratings yet

- US1099Forms - Form 1099-NEC Copy BDocument2 pagesUS1099Forms - Form 1099-NEC Copy BSaurabh ChandraNo ratings yet

- PDF DocumentDocument1 pagePDF DocumentmaliktaimoorsurahNo ratings yet

- FederalDocument15 pagesFederalNeil NitinNo ratings yet

- 12:29 GW PaystubDocument1 page12:29 GW Paystubdonbabich8No ratings yet

- Canadian Onlinestatement-1Document2 pagesCanadian Onlinestatement-1عبد الالهNo ratings yet

- Non-Negotiable: EarningsDocument1 pageNon-Negotiable: EarningsAvya BrutusNo ratings yet

- Form 1040 R.I.P.Document1 pageForm 1040 R.I.P.Landmark Tax Group™No ratings yet

- Receipts Expenditures: WarningDocument3 pagesReceipts Expenditures: WarningParents' Coalition of Montgomery County, MarylandNo ratings yet

- Tax ReturnsDocument1 pageTax Returnshuss eynNo ratings yet

- Keough CFR 6-12 2017Document133 pagesKeough CFR 6-12 2017Houston ChronicleNo ratings yet

- Qualified Dividends and Capital Gains WorksheetDocument1 pageQualified Dividends and Capital Gains WorksheetBetty Ann LegerNo ratings yet

- AB Limited Form Schedule K-1 DonDocument1 pageAB Limited Form Schedule K-1 Donsarah.gleasonNo ratings yet

- 2022 Individual Tax Organizer FillableDocument6 pages2022 Individual Tax Organizer FillableTham DangNo ratings yet

- 6670 Alexis 12-30-2022Document1 page6670 Alexis 12-30-2022Nego da NagaNo ratings yet

- Return 2019 BOY FIRST MAKEDocument6 pagesReturn 2019 BOY FIRST MAKEshahabNo ratings yet

- Delores Douglas Paystub 091222-092522Document1 pageDelores Douglas Paystub 091222-092522Otega Overere VictorNo ratings yet

- Pyw223s EeDocument1 pagePyw223s Eedanielman956No ratings yet

- Borrower Information: Disclosure Statement William D. Ford Federal Direct Loan ProgramDocument3 pagesBorrower Information: Disclosure Statement William D. Ford Federal Direct Loan ProgramNathan BurrisNo ratings yet

- Tax Return TranscriptDocument2 pagesTax Return TranscriptfoyefellerNo ratings yet

- 2022TaxReturn StarnesDocument17 pages2022TaxReturn StarnesjpneebNo ratings yet

- State OregonDocument18 pagesState OregonNeil NitinNo ratings yet

- Liz Martyr May April 2020 FECDocument26 pagesLiz Martyr May April 2020 FECPat PowersNo ratings yet

- 1098-T Copy B: Tuition StatementDocument2 pages1098-T Copy B: Tuition Statemented redfNo ratings yet

- Hong Thien PhuocBui2018Document6 pagesHong Thien PhuocBui2018Thien BaoNo ratings yet

- Mund Oct. QuarterlyDocument24 pagesMund Oct. QuarterlyRob PortNo ratings yet

- Please Review The Updated Information Below.: For Begins After This CoversheetDocument3 pagesPlease Review The Updated Information Below.: For Begins After This CoversheetLabNo ratings yet

- Paycheck - 2022 05 15 - 2022 05 21Document1 pagePaycheck - 2022 05 15 - 2022 05 21Sandra RíosNo ratings yet

- CEU Balance SheetDocument1 pageCEU Balance SheetmadhuNo ratings yet

- NYSE - BX. Dear Unit Holder - PDFDocument9 pagesNYSE - BX. Dear Unit Holder - PDFEugene FrancoNo ratings yet

- Rounds July FECDocument119 pagesRounds July FECPat PowersNo ratings yet

- A218 DocumentDocument9 pagesA218 DocumentJose AlmonteNo ratings yet

- 2007 Carl & Ruth Shapiro Family Foundation 990 (Includes Madoff Investment)Document42 pages2007 Carl & Ruth Shapiro Family Foundation 990 (Includes Madoff Investment)jpeppard100% (4)

- 2020 Federal Tax Return Documents (PATEL ASHOKBHAI and CHE)Document7 pages2020 Federal Tax Return Documents (PATEL ASHOKBHAI and CHE)atul0070No ratings yet

- Kia Lopez Form 1040Document2 pagesKia Lopez Form 1040Stephanie RobinsonNo ratings yet

- Paycheck - 2022 04 24 - 2022 04 30Document1 pagePaycheck - 2022 04 24 - 2022 04 30Sandra RíosNo ratings yet

- Usabank Statement 1Document3 pagesUsabank Statement 1Adnan HussainNo ratings yet

- Individual Income Tax ReturnsDocument2 pagesIndividual Income Tax ReturnsZen1No ratings yet

- Main - Form Pa 8453 2018 Pennsylvania Individual Income Tax Declaration Electronic Filing PennsylvaniaDocument4 pagesMain - Form Pa 8453 2018 Pennsylvania Individual Income Tax Declaration Electronic Filing PennsylvaniaDiana JuanNo ratings yet

- Rounds April 2020 FecDocument160 pagesRounds April 2020 FecPat PowersNo ratings yet

- Instructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDocument72 pagesInstructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDiego12001No ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatuspeachyNo ratings yet

- TAXES w2 REGAL HospitalityDocument2 pagesTAXES w2 REGAL Hospitalityoskar_herrera2012No ratings yet

- Scaffolding FormatDocument7 pagesScaffolding Formatsadashiv puneNo ratings yet

- Module 2 DEDUCTION FROM GROSS ESTATE AND ESTATE TAX - Part 2Document33 pagesModule 2 DEDUCTION FROM GROSS ESTATE AND ESTATE TAX - Part 2Venice Marie ArroyoNo ratings yet

- Scope of Income Tax Basis of Charge Concept of Income 2nd July 2012 CA Harish MotiwalaDocument16 pagesScope of Income Tax Basis of Charge Concept of Income 2nd July 2012 CA Harish Motiwalasyed junaid sultanNo ratings yet

- Cruz Suzanne P. Case Digest No. 5 HSBC Vs CirDocument1 pageCruz Suzanne P. Case Digest No. 5 HSBC Vs CirSuzanne Pagaduan CruzNo ratings yet

- QuestionsDocument2 pagesQuestionsBong BaybinNo ratings yet

- Tamil Nadu Motor Vehicles (Taxation of Passengers and Goods) Amendment Act, 1966Document3 pagesTamil Nadu Motor Vehicles (Taxation of Passengers and Goods) Amendment Act, 1966Latest Laws TeamNo ratings yet

- TV M 3111235015874283 R PosDocument2 pagesTV M 3111235015874283 R Postdarshil.123No ratings yet

- IndividualsDocument12 pagesIndividualsdarlene floresNo ratings yet

- SSPUSADVDocument1 pageSSPUSADVgunashekarkalluriNo ratings yet

- Invoice: Tesla Norway ASDocument1 pageInvoice: Tesla Norway ASThomas LingottNo ratings yet

- Accounting VoucherDocument1 pageAccounting Vouchersuplex suryaNo ratings yet

- GSTR3B 21aywpa7472l1zz 042023Document2 pagesGSTR3B 21aywpa7472l1zz 042023prateek gangwaniNo ratings yet

- Salary Jan 2001Document2 pagesSalary Jan 2001Kharde HrishikeshNo ratings yet

- BTS Asst Details Cat C FY 2022-23Document5 pagesBTS Asst Details Cat C FY 2022-23kanishkasrivastava7No ratings yet

- 0153 0166 TradeportDocument5 pages0153 0166 TradeportHARSHAL MITTALNo ratings yet

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDocument1 pageIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruGanesh DasaraNo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 273151Document3 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 273151AVINASH TIWASKARNo ratings yet

- Supply Outward - 34Document3 pagesSupply Outward - 34DIVYANSHI PHOTO STATENo ratings yet

- 1701 Annual Income Tax Return: Rogelio D. GonzalesDocument1 page1701 Annual Income Tax Return: Rogelio D. GonzalesJoshua CarzaNo ratings yet

- Cir vs. TMX Sales and CtaDocument3 pagesCir vs. TMX Sales and CtaD De LeonNo ratings yet

- Requirements and Procedures in Paying Capital Gain TaxDocument2 pagesRequirements and Procedures in Paying Capital Gain TaxDrizza FerrerNo ratings yet

- Employee 1 PayslipDocument6 pagesEmployee 1 PayslipJeric Lagyaban AstrologioNo ratings yet

- PAYROLL - ProblemDocument3 pagesPAYROLL - Problemshaipink2000No ratings yet

- Debit Note Edited TemplateDocument4 pagesDebit Note Edited TemplateDilleshNo ratings yet

- Application For Registration: Kawanihan NG Rentas InternasDocument4 pagesApplication For Registration: Kawanihan NG Rentas InternasCarl PedreraNo ratings yet

- TAX Quiz 30Document2 pagesTAX Quiz 30LanceNo ratings yet

- Lousianna Tax InstructionDocument17 pagesLousianna Tax Instructionchuckhsu1248No ratings yet

- Tax Invoice: % Rate CGST Sr. Product Description Gms HSN Code MRP Return QtyDocument4 pagesTax Invoice: % Rate CGST Sr. Product Description Gms HSN Code MRP Return QtyJai GaneshNo ratings yet