Professional Documents

Culture Documents

June13 P43 Q1

June13 P43 Q1

Uploaded by

Abid faisal AhmedOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

June13 P43 Q1

June13 P43 Q1

Uploaded by

Abid faisal AhmedCopyright:

Available Formats

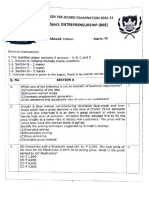

June13/P43/Q1

1 Kaunus plc was formed on 1 January 2010. On that day the company issued 200 000 ordinary

shares of $1.00 each at a premium of $0.25 and issued 150 000 redeemable preference shares

of $1.00 at a premium of $0.10. The company also issued $100 000 6% debentures redeemable

on 1 January 2013.

The following information is available:

1 The company has been trading profitably and at 1 January 2012 had retained earnings

of $80 000.

2 The company made a profit of $140 000 for the year ended 31 December 2012.

3 The net book value of the company’s non-current assets at 31 December 2012 was

$305 000. Included in this figure was land which had increased in value at

31 December 2012 by $10 000.

4 At 31 December 2012 the company had net current assets made up of cash and cash

equivalents of $440 000.

On 1 January 2013 the following transactions were completed:

The 6% debentures were repaid in full at par.

The redeemable preference shares were redeemed at a premium of $0.30 each.

A rights issue of 1 new ordinary $1.00 share for every 2 ordinary shares held at a price of

$1.10 per share was fully subscribed.

REQUIRED

(a) Prepare the company’s statement of financial position at 1 January 2010 immediately after

issuing the shares and debentures. [6]

(b) Prepare a statement showing the movement in the company’s cash and cash equivalents on

1 January 2013 after completing the above transactions. [5]

(c) (i) Calculate the amount to be shown as a capital redemption reserve in the company’s

statement of financial position on 1 January 2013. [4]

(ii) Calculate the amount of share premium arising on the rights issue of new ordinary

shares on 1 January 2013. [2]

(d) Prepare a statement to show the changes in retained earnings for the period from

1 January 2012 to 1 January 2013 inclusive, after completing the transactions which

occurred on that date. [7]

(e) Prepare the company’s statement of financial position at 1 January 2013 after completing the

above transactions. [12]

(f) Explain for what purposes the following balances may be used:

(i) the share premium account [2]

(ii) the retained earnings. [2]

[Total: 40]

© UCLES 2013 9706/43/M/J/13 [Turn over

You might also like

- CH 10Document9 pagesCH 10Tien Thanh DangNo ratings yet

- Chapter 14Document5 pagesChapter 14RahimahBawaiNo ratings yet

- PL Financial Accounting and Reporting Sample Paper 1Document11 pagesPL Financial Accounting and Reporting Sample Paper 1karlr9No ratings yet

- Financial Accounting and Reporting: Blank PageDocument28 pagesFinancial Accounting and Reporting: Blank PageMehtab NaqviNo ratings yet

- Marketing Plan TemplateDocument5 pagesMarketing Plan TemplateSami GarciaNo ratings yet

- Nov2013/P43/Q2: © UCLES 2013 9706/43/O/N/13Document2 pagesNov2013/P43/Q2: © UCLES 2013 9706/43/O/N/13Abid faisal AhmedNo ratings yet

- Bad Debts and Pfbd..Document6 pagesBad Debts and Pfbd..rizwan ul hassanNo ratings yet

- Universitas Indonesia Fakultas Ekonomi Dan BisnisDocument2 pagesUniversitas Indonesia Fakultas Ekonomi Dan BisnisGamesnEntertainment OnlyNo ratings yet

- Topical Depreciation Q 2014-2019Document48 pagesTopical Depreciation Q 2014-2019ibbbi shkhNo ratings yet

- ECO-14 - ENG - CompressedDocument4 pagesECO-14 - ENG - CompressedYzNo ratings yet

- Ujjal Corporation A Publicly Traded Company Is Authorized To IssueDocument2 pagesUjjal Corporation A Publicly Traded Company Is Authorized To IssueMiroslav GegoskiNo ratings yet

- H1 ReviewFinancialStatementsDocument2 pagesH1 ReviewFinancialStatementsLim Kuan YiouNo ratings yet

- 9706 June 2011 Paper 41Document8 pages9706 June 2011 Paper 41Diksha KoossoolNo ratings yet

- 2 PDocument238 pages2 Pbillyryan1100% (3)

- Solved Kouchibouguac Inc Reports The Following Costs and Fair Values ForDocument1 pageSolved Kouchibouguac Inc Reports The Following Costs and Fair Values ForAnbu jaromiaNo ratings yet

- First Natural - Annual Results For The Year Ended 31 December 2012 PDFDocument22 pagesFirst Natural - Annual Results For The Year Ended 31 December 2012 PDFalan888No ratings yet

- Solved On July 1 2012 Nakhooda Company Purchased A Truck ForDocument1 pageSolved On July 1 2012 Nakhooda Company Purchased A Truck ForAnbu jaromiaNo ratings yet

- ACCT551 - Week 7 HomeworkDocument10 pagesACCT551 - Week 7 HomeworkDominickdadNo ratings yet

- 8 Source A4: 9706/33/INSERT/O/N/21 © UCLES 2021Document2 pages8 Source A4: 9706/33/INSERT/O/N/21 © UCLES 2021Ayesha sheikhNo ratings yet

- Investment in Associate (Final)Document3 pagesInvestment in Associate (Final)Laut Bantuas IINo ratings yet

- Questions On Accounting StandardsDocument6 pagesQuestions On Accounting StandardsDEENo ratings yet

- F2 - Financial ManagementDocument20 pagesF2 - Financial ManagementRobert MunyaradziNo ratings yet

- Af 311 Exam ReviewDocument10 pagesAf 311 Exam ReviewTedy MuliyaNo ratings yet

- Provided by Dse - Life: SECTION A (30 Marks)Document7 pagesProvided by Dse - Life: SECTION A (30 Marks)bloosmxeditNo ratings yet

- Debentures TestDocument2 pagesDebentures TestVarun BhomiaNo ratings yet

- ADVANCED FINANCIAL REPORTING - PDF Nov 2012Document10 pagesADVANCED FINANCIAL REPORTING - PDF Nov 2012Nitin ChoudharyNo ratings yet

- Financial Accounting June 2013 Exam Paper ICAEWDocument8 pagesFinancial Accounting June 2013 Exam Paper ICAEWMuhammad Ziaul HaqueNo ratings yet

- Rrhttps:/doc 00 5g Prod 03 Apps Viewer - Googleusercontent.com/viewer2/prod 03Document14 pagesRrhttps:/doc 00 5g Prod 03 Apps Viewer - Googleusercontent.com/viewer2/prod 03mdparvez1340No ratings yet

- Financial StatementsDocument16 pagesFinancial StatementsEuniceChungNo ratings yet

- Singh Company Started Business On January 1 2011 The FollowingDocument1 pageSingh Company Started Business On January 1 2011 The FollowingTaimour HassanNo ratings yet

- Accgr12ssipsessions12 15ln2013book3Document40 pagesAccgr12ssipsessions12 15ln2013book3Cecilia MwaleNo ratings yet

- CH 13Document6 pagesCH 13Saleh RaoufNo ratings yet

- Introduction To Financial Accounting: T I C A PDocument5 pagesIntroduction To Financial Accounting: T I C A PadnanNo ratings yet

- Icmap Past QuestionsDocument11 pagesIcmap Past QuestionsJahanzaib ButtNo ratings yet

- Chapter 02 Stock Investment Investor Accounting and ReportingDocument3 pagesChapter 02 Stock Investment Investor Accounting and Reportingprins kyla SaboyNo ratings yet

- Earnhart Corporation Has Outstanding 3 000 000 Shares of Common PDFDocument1 pageEarnhart Corporation Has Outstanding 3 000 000 Shares of Common PDFAnbu jaromiaNo ratings yet

- Cambridge International Examinations Cambridge International Advanced LevelDocument8 pagesCambridge International Examinations Cambridge International Advanced LevelIlesh DinyaNo ratings yet

- MBA 503 - Exam 1Document6 pagesMBA 503 - Exam 1Harshitha AnudeepNo ratings yet

- Contoh Soal Dan Kunci Jawaban Financial Accounting Akun Jessica - Compressed 1Document9 pagesContoh Soal Dan Kunci Jawaban Financial Accounting Akun Jessica - Compressed 1Mega LengkongNo ratings yet

- © Ucles 2014 0452/12/M/J/14Document15 pages© Ucles 2014 0452/12/M/J/14Aung Zaw HtweNo ratings yet

- 3492 KFC QR 2012-06-30 BMSB-KFCH (Notes) 0612 132300790Document14 pages3492 KFC QR 2012-06-30 BMSB-KFCH (Notes) 0612 132300790miso maksimNo ratings yet

- 1 Af 101 Ffa Icmap 2013 PaperDocument4 pages1 Af 101 Ffa Icmap 2013 PaperZulfiqar AliNo ratings yet

- F2 - Financial ManagementDocument20 pagesF2 - Financial ManagementFahadNo ratings yet

- The Following Is Taken From The Magana Corp Balance SheetDocument1 pageThe Following Is Taken From The Magana Corp Balance SheetM Bilal SaleemNo ratings yet

- Indicate Which of These Items Would Typically Be Reported As Inventory in The Financial StatementsDocument5 pagesIndicate Which of These Items Would Typically Be Reported As Inventory in The Financial StatementsBONNo ratings yet

- Ecomprehensiveexam eDocument12 pagesEcomprehensiveexam eDominic SociaNo ratings yet

- Nov2010 Paper2 Q1 OlevelDocument3 pagesNov2010 Paper2 Q1 OlevelAbid faisal AhmedNo ratings yet

- c6 Question BankDocument25 pagesc6 Question BankWaseem Ahmad QurashiNo ratings yet

- Dupage Company Started Operations On January 1 2010 It IsDocument1 pageDupage Company Started Operations On January 1 2010 It IsM Bilal SaleemNo ratings yet

- CH 14Document71 pagesCH 14Febriana Nurul HidayahNo ratings yet

- ComfortDelGro - Audited Financial Statement FY31.12.2022Document31 pagesComfortDelGro - Audited Financial Statement FY31.12.2022Genevieve TayNo ratings yet

- Consolidation 2Document5 pagesConsolidation 2Tay?No ratings yet

- 5 Financial Statements of CompaniesDocument11 pages5 Financial Statements of Companiessunil.h68 SunilNo ratings yet

- Assignment Questions Jan 2012 Non-BentleyDocument10 pagesAssignment Questions Jan 2012 Non-Bentleyvaisag_01No ratings yet

- The Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Debentures & Financial Statements of A Company (AC - 06)Document11 pagesThe Commerce Villa: Time: 1.5 Hour Marks: 40 Topic: Debentures & Financial Statements of A Company (AC - 06)Shreyas PremiumNo ratings yet

- Solved An Analysis of The Transactions of Rutherford Company For The PDFDocument1 pageSolved An Analysis of The Transactions of Rutherford Company For The PDFAnbu jaromiaNo ratings yet

- Adjusting EntriesDocument2 pagesAdjusting EntriesShang BugayongNo ratings yet

- AC - IntAcctg1 Quiz 04 With AnswersDocument2 pagesAC - IntAcctg1 Quiz 04 With AnswersSherri Bonquin100% (1)

- Financial Accounting Mock Test PaperDocument7 pagesFinancial Accounting Mock Test PaperBharathFrnzbookNo ratings yet

- 0452 s13 QP 11Document20 pages0452 s13 QP 11Naðooshii AbdallahNo ratings yet

- Nov11 4Document2 pagesNov11 4Abid faisal AhmedNo ratings yet

- Nov2018 Paper1 Part2 OlevelDocument6 pagesNov2018 Paper1 Part2 OlevelAbid faisal AhmedNo ratings yet

- Nov2010 Paper2 Q3 OlevelDocument5 pagesNov2010 Paper2 Q3 OlevelAbid faisal AhmedNo ratings yet

- 2019 Nov DepreciationDocument3 pages2019 Nov DepreciationAbid faisal AhmedNo ratings yet

- Nov11 3Document2 pagesNov11 3Abid faisal AhmedNo ratings yet

- 2019 June P31 Q3Document1 page2019 June P31 Q3Abid faisal AhmedNo ratings yet

- Moral StudiesDocument2 pagesMoral StudiesAbid faisal AhmedNo ratings yet

- 2018 March P32 Q2Document1 page2018 March P32 Q2Abid faisal AhmedNo ratings yet

- Nov2016/P33/Q4: © UCLES 2016 9706/33/O/N/16Document1 pageNov2016/P33/Q4: © UCLES 2016 9706/33/O/N/16Abid faisal AhmedNo ratings yet

- Stock MarketDocument67 pagesStock MarketAbid faisal AhmedNo ratings yet

- Price RationingDocument2 pagesPrice RationingAbid faisal AhmedNo ratings yet

- Mortgage-Backed SecuritiesDocument18 pagesMortgage-Backed SecuritiesAbid faisal AhmedNo ratings yet

- Ancient GreeceDocument19 pagesAncient GreeceAbid faisal AhmedNo ratings yet

- PartnershipDocument8 pagesPartnershipAbid faisal AhmedNo ratings yet

- Money MarketDocument17 pagesMoney MarketAbid faisal AhmedNo ratings yet

- Long Run and Short RunDocument3 pagesLong Run and Short RunAbid faisal AhmedNo ratings yet

- Python ExercisesDocument2 pagesPython ExercisesAbid faisal AhmedNo ratings yet

- Practice Worksheet On Other Receivables & PayablesDocument1 pagePractice Worksheet On Other Receivables & PayablesAbid faisal AhmedNo ratings yet

- Final - Cirque Du SuleilDocument4 pagesFinal - Cirque Du Suleiltomatolulu100% (1)

- Brickstream Fun Facts - 10-28-13Document1 pageBrickstream Fun Facts - 10-28-13asdNo ratings yet

- Spoiled Goods Are Goods That Have Been Damaged Through Imperfect Machining or IllustrationDocument3 pagesSpoiled Goods Are Goods That Have Been Damaged Through Imperfect Machining or IllustrationBuff FaloNo ratings yet

- Equipment Ledger CardDocument5 pagesEquipment Ledger CardDana A Daspit ConteNo ratings yet

- Business Studies P1 May-June 2021 MG EngDocument25 pagesBusiness Studies P1 May-June 2021 MG Engcardo neethlingNo ratings yet

- Part 3Document158 pagesPart 3Lala BubNo ratings yet

- Brand Equity ModelsDocument20 pagesBrand Equity ModelsVarunSinghNo ratings yet

- 2 Ways To Boost Employee Productivity & Cut HR CostsDocument8 pages2 Ways To Boost Employee Productivity & Cut HR CostsMehul TamakuwalaNo ratings yet

- ACCTG7 - 1st - 2ns TermDocument2 pagesACCTG7 - 1st - 2ns TermJessa BeloyNo ratings yet

- A Critique of Porter's Leadership and Differentiation StrategyDocument23 pagesA Critique of Porter's Leadership and Differentiation StrategyLeo Rimjhim Bishnoi67% (3)

- kế toán quản trị bt chap2Document15 pageskế toán quản trị bt chap2Tung DucNo ratings yet

- Top Linkedin InfluencerDocument6 pagesTop Linkedin InfluencerakshatpandeychamNo ratings yet

- Economics MCQ QuestionsDocument7 pagesEconomics MCQ Questionstanmoy sardar100% (1)

- 1st Year - Financial Accounting and Reporting 1 PDFDocument14 pages1st Year - Financial Accounting and Reporting 1 PDFIts SaoirseNo ratings yet

- 2016.06.3 - Lecture 3 - Principles of Marketing - Chapter 3Document39 pages2016.06.3 - Lecture 3 - Principles of Marketing - Chapter 3nipoNo ratings yet

- Managerial Economics - OligopolyDocument24 pagesManagerial Economics - Oligopolyranjitamodak2003No ratings yet

- Fundamentals of Accountancy, Business and Management 2Document12 pagesFundamentals of Accountancy, Business and Management 2Julia ConceNo ratings yet

- Shivendra (Sales 05+)Document1 pageShivendra (Sales 05+)ashish.jugranNo ratings yet

- Topic 10 - Menu Pricing StrategyDocument15 pagesTopic 10 - Menu Pricing StrategySylvester BooNo ratings yet

- 2008410-Maruti Financial ModelDocument52 pages2008410-Maruti Financial ModelhellonandiniyadavNo ratings yet

- The Accounting Education EPFO Accounting MCQ QUIZDocument20 pagesThe Accounting Education EPFO Accounting MCQ QUIZAnmol ChawlaNo ratings yet

- Summary Chapter 6-ACO 201Document8 pagesSummary Chapter 6-ACO 201Andrew PhilipsNo ratings yet

- Business Administration 636: Managerial Economics Homework Set #5 Dr. Adel ZaghaDocument2 pagesBusiness Administration 636: Managerial Economics Homework Set #5 Dr. Adel ZaghaDana TahboubNo ratings yet

- EPS Common QP PDFDocument9 pagesEPS Common QP PDFAdrian D'souzaNo ratings yet

- Act 202 Group ProjectDocument6 pagesAct 202 Group ProjectAsrafia Mim 1813026630No ratings yet

- Accounting For Joint and by ProductsDocument7 pagesAccounting For Joint and by ProductsGian Carlo RamonesNo ratings yet

- Forecasting Revenues For BusinessDocument19 pagesForecasting Revenues For BusinessLiam JNMNo ratings yet

- Cash Flow StatementDocument4 pagesCash Flow StatementNarayan DhunganaNo ratings yet

- Walmart Write UpDocument5 pagesWalmart Write UpKumar RaviNo ratings yet