Professional Documents

Culture Documents

CH 08 A Solution SET 1

CH 08 A Solution SET 1

Uploaded by

kolidishant692Copyright:

Available Formats

You might also like

- Short Paper Week 8 FIN 630Document4 pagesShort Paper Week 8 FIN 630jjjjj100% (1)

- Revenue From Contracts With Customers: Problem 1: True or FalseDocument12 pagesRevenue From Contracts With Customers: Problem 1: True or FalsePaula Bautista88% (8)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Notes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsDocument13 pagesNotes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsPaula Bautista100% (2)

- Solution Maf503 - Jan 2018Document8 pagesSolution Maf503 - Jan 2018anis izzatiNo ratings yet

- Macaulay Duration Formula Excel TemplateDocument6 pagesMacaulay Duration Formula Excel TemplateMustafa Ricky Pramana SeNo ratings yet

- Chapter 4 Management of WCDocument15 pagesChapter 4 Management of WCAbhishek TiwariNo ratings yet

- Intermediate - FM - Suggested Answer PaperDocument4 pagesIntermediate - FM - Suggested Answer Paperchromabooka111No ratings yet

- Answer The Following Questions and Provide The Necessary RequirementsDocument11 pagesAnswer The Following Questions and Provide The Necessary RequirementsKervin Rey JacksonNo ratings yet

- Exercise Working CapitalDocument4 pagesExercise Working CapitalShafiul AzamNo ratings yet

- Financial Accounting - Reporting November 2021 Suggested SolutionsDocument6 pagesFinancial Accounting - Reporting November 2021 Suggested SolutionsMunodawafa ChimhamhiwaNo ratings yet

- CAF 1 Autumn 2021Document7 pagesCAF 1 Autumn 2021Ahmed AsifNo ratings yet

- FM & SM-AnswerDocument16 pagesFM & SM-AnswerjunaidNo ratings yet

- CAF 1 Spring 2024Document6 pagesCAF 1 Spring 2024saadiimalik08No ratings yet

- Working CapitalDocument3 pagesWorking Capitalfxn fndNo ratings yet

- 08 Management of Receivables 7bDocument4 pages08 Management of Receivables 7bChartered Accountant YASHNo ratings yet

- Paper-12: Management Accounting Suggested Answers Section - ADocument5 pagesPaper-12: Management Accounting Suggested Answers Section - AQuestion BankNo ratings yet

- COURSE CODE: ACC117/106/100: Declaration Form of Group AssignmentDocument5 pagesCOURSE CODE: ACC117/106/100: Declaration Form of Group AssignmentMARLINDAH RAHIMNo ratings yet

- MTP 19 53 Answers 1713511058Document19 pagesMTP 19 53 Answers 1713511058prathammishra1809No ratings yet

- FN502 Additional ProblemsDocument3 pagesFN502 Additional Problemsdpr7033No ratings yet

- BCC620 Business Financial Management Main (NOV) E1 21-22Document9 pagesBCC620 Business Financial Management Main (NOV) E1 21-22Rukshani RefaiNo ratings yet

- Mock SFM Answer MarchDocument12 pagesMock SFM Answer MarchMenuka SiwaNo ratings yet

- Project Acc117Document2 pagesProject Acc117Afiqah AliaNo ratings yet

- Wolfe (South Western) LTDDocument28 pagesWolfe (South Western) LTDМөнхбат НАНДИН-ЭРДЭНЭNo ratings yet

- Capital Budgeting AnswerDocument18 pagesCapital Budgeting AnswerPiyush ChughNo ratings yet

- Ebook Cost Management A Strategic Emphasis 6Th Edition Blocher Solutions Manual Full Chapter PDFDocument67 pagesEbook Cost Management A Strategic Emphasis 6Th Edition Blocher Solutions Manual Full Chapter PDFCherylHorngjmf100% (15)

- Master Question, Additional Questions-2Document4 pagesMaster Question, Additional Questions-2anshikajain3474No ratings yet

- Assessment 2 - Exam Paper - April 2022 CohortDocument8 pagesAssessment 2 - Exam Paper - April 2022 CohortRamona GabrielaNo ratings yet

- ACC314 Practise Paper SolutionsDocument7 pagesACC314 Practise Paper SolutionsRukshani RefaiNo ratings yet

- Sol. Man. - Chapter 4 - Accounts Receivable - Ia Part 1a - 2020 EditionDocument20 pagesSol. Man. - Chapter 4 - Accounts Receivable - Ia Part 1a - 2020 EditionJapon, Jenn RossNo ratings yet

- Coverage of Learning ObjectivesDocument50 pagesCoverage of Learning ObjectivesMeNo ratings yet

- Finacial Management MockDocument12 pagesFinacial Management MockRomaric DjokoNo ratings yet

- Acctg523-B1-Practice Midterm-W2022-SolutionDocument8 pagesAcctg523-B1-Practice Midterm-W2022-Solutionmakan94883No ratings yet

- CA-Inter-Costing-A-MTP-2-May 2023Document13 pagesCA-Inter-Costing-A-MTP-2-May 2023karnimasoni12No ratings yet

- Test 1 Answer SheetDocument12 pagesTest 1 Answer SheetNaveen R HegadeNo ratings yet

- Assignment For Finanacial Management IDocument12 pagesAssignment For Finanacial Management IHailu DemekeNo ratings yet

- UntitledDocument13 pagesUntitledAbhinav SharmaNo ratings yet

- Chapter 3 Revenue From Contracts With CustomersDocument4 pagesChapter 3 Revenue From Contracts With CustomersbwimeeeNo ratings yet

- CA Inter FM SM A MTP 2 May 2024 Castudynotes ComDocument19 pagesCA Inter FM SM A MTP 2 May 2024 Castudynotes ComsanjanavijjapuNo ratings yet

- Chapter 39 - Teacher's ManualDocument14 pagesChapter 39 - Teacher's ManualHohoho100% (1)

- Coverage of Learning ObjectivesDocument50 pagesCoverage of Learning ObjectivesReyansh SharmaNo ratings yet

- Acc AssignmentDocument8 pagesAcc AssignmentKashémNo ratings yet

- Cost Management Accounting Test 2 CH 4 5 6 May 2024 Solution 1702883162Document15 pagesCost Management Accounting Test 2 CH 4 5 6 May 2024 Solution 1702883162jin031543No ratings yet

- Bhpo Part B Coursework Online Tr2 2016-17Document6 pagesBhpo Part B Coursework Online Tr2 2016-17Furqan Ashraf0% (2)

- ACCA P2 Corporate Reporting - Mock Exam Answers 1 PDFDocument24 pagesACCA P2 Corporate Reporting - Mock Exam Answers 1 PDFමිලන්No ratings yet

- MTP-1 6 KeyDocument16 pagesMTP-1 6 KeynazcomputersitsNo ratings yet

- Lebanese Association of Certified Public Accountants KEY - IFRS February Exam 2020 - Extra SessionDocument6 pagesLebanese Association of Certified Public Accountants KEY - IFRS February Exam 2020 - Extra Sessionjad NasserNo ratings yet

- Question 5 of 9 - BUS 247 Pre-Mid Term Exam Marked Quiz 1 - Chapters 1, 2, 3 and 5Document4 pagesQuestion 5 of 9 - BUS 247 Pre-Mid Term Exam Marked Quiz 1 - Chapters 1, 2, 3 and 5guruphargillNo ratings yet

- F 2 Nov 09 Specimen AnswersDocument9 pagesF 2 Nov 09 Specimen AnswersRobert MunyaradziNo ratings yet

- Activity Based-WPS (Number 1 C)Document9 pagesActivity Based-WPS (Number 1 C)Takudzwa BenjaminNo ratings yet

- UntitledfgddDocument7 pagesUntitledfgddBabawale KehindeNo ratings yet

- Out Come RPL 22052024Document24 pagesOut Come RPL 22052024ronitvermaphotosNo ratings yet

- Chu de 3 Nhom 6 Hay PDFDocument10 pagesChu de 3 Nhom 6 Hay PDFNhư NhưNo ratings yet

- CAF 1 Autumn 2023Document7 pagesCAF 1 Autumn 2023Asim MahmoodNo ratings yet

- Paper19 - Set2 Question Cma FinalDocument5 pagesPaper19 - Set2 Question Cma Finalrehaliya15No ratings yet

- Ca Inter Cost Management Accounting Test 2 Unscheduled Solution 598020012022Document14 pagesCa Inter Cost Management Accounting Test 2 Unscheduled Solution 598020012022Deppanshu KhandelwalNo ratings yet

- Chapter 22. Model For Managing and Financing Current AssetsDocument8 pagesChapter 22. Model For Managing and Financing Current AssetsSantos JdNo ratings yet

- 3A Page No 16Document21 pages3A Page No 16gaurav jainNo ratings yet

- CH 17 Tool Kit - Brigham3CeDocument8 pagesCH 17 Tool Kit - Brigham3CeChad OngNo ratings yet

- CH 28: Receivables Management & Factoring Chapter 28: Accounts Receivable Management and FactoringDocument5 pagesCH 28: Receivables Management & Factoring Chapter 28: Accounts Receivable Management and FactoringMukul KadyanNo ratings yet

- WBSLive Lecture 5 Slides Pres VevoxDocument25 pagesWBSLive Lecture 5 Slides Pres VevoxabhirejanilNo ratings yet

- Subject:-Business Environment: Topic:-Consumer Protection Act 1986Document21 pagesSubject:-Business Environment: Topic:-Consumer Protection Act 1986hardeep waliaNo ratings yet

- Daftar Nama Dosen Pembimbing Periode 2020-1 PagiDocument3 pagesDaftar Nama Dosen Pembimbing Periode 2020-1 PagiNufita Twandita DewiNo ratings yet

- Swades Case Study - International Marketing - 1may19Document16 pagesSwades Case Study - International Marketing - 1may19NIKHIL KUMAR AGRAWALNo ratings yet

- OG200C Rev 3 TG5Document2 pagesOG200C Rev 3 TG5ИгорьNo ratings yet

- CA Journal August 2012Document141 pagesCA Journal August 2012Thiruvengadathan ParthasarathiNo ratings yet

- Case CASE 4-1 4-1 PC PC Depot DepotDocument7 pagesCase CASE 4-1 4-1 PC PC Depot DepotJourast LadzuardyNo ratings yet

- Company Law R.Kit-1Document246 pagesCompany Law R.Kit-1Peter Osundwa KitekiNo ratings yet

- Cheg - 22 Jan 2024 at 11.14Document1 pageCheg - 22 Jan 2024 at 11.14fayyasin99No ratings yet

- NIKE Presentation BMS (12396)Document24 pagesNIKE Presentation BMS (12396)Shehan PereraNo ratings yet

- Busi 1714 RUBRIC - Report 7000 Words - 21,22Document3 pagesBusi 1714 RUBRIC - Report 7000 Words - 21,22Yt HuongNo ratings yet

- Strategic Analysis of Synergistic Effect On M&A of Volvo Car Corporation by Geely AutomobileDocument11 pagesStrategic Analysis of Synergistic Effect On M&A of Volvo Car Corporation by Geely AutomobileDaniNo ratings yet

- Giai BT QTTC Quan Tri Tai Chinh Doanh NghiepDocument6 pagesGiai BT QTTC Quan Tri Tai Chinh Doanh Nghiep2154011008trangNo ratings yet

- Chapter 1Document9 pagesChapter 1Kanaga LakshmiNo ratings yet

- Accounting Error QNSDocument3 pagesAccounting Error QNSGerald MagaitaNo ratings yet

- BrandZ Global Top 100 2020 InfographicDocument1 pageBrandZ Global Top 100 2020 InfographicKaran MusaleNo ratings yet

- Precalculus Graphs and Models A Right Triangle Approach 6th Edition Bittinger Solutions ManualDocument24 pagesPrecalculus Graphs and Models A Right Triangle Approach 6th Edition Bittinger Solutions ManualNatalieRojasykebg100% (38)

- Business Process Reeingeenirig of An Air Cargo Handling Process PDFDocument54 pagesBusiness Process Reeingeenirig of An Air Cargo Handling Process PDFademaj08100% (1)

- Oil Free Scroll Compressors 2 30 KW Brochure NADocument8 pagesOil Free Scroll Compressors 2 30 KW Brochure NAKervin CoronadoNo ratings yet

- Copy of Cma For Less Than 1 Crore With CalculationDocument18 pagesCopy of Cma For Less Than 1 Crore With CalculationRajesh BogulNo ratings yet

- Chapter 9 - Dealing With The Competition Multiple Choice QuestionsDocument19 pagesChapter 9 - Dealing With The Competition Multiple Choice QuestionsMutya Neri CruzNo ratings yet

- Whitepaper: Cross-Chain Platform For Developers, Powered by Binance Smart ChainDocument25 pagesWhitepaper: Cross-Chain Platform For Developers, Powered by Binance Smart ChainIsroqi FarisNo ratings yet

- DT Combined CA INTERDocument203 pagesDT Combined CA INTERkarthick rajNo ratings yet

- VANITHADocument3 pagesVANITHAnatashah designNo ratings yet

- ArchiMate Case Study BMVDocument8 pagesArchiMate Case Study BMVMarwan SaadNo ratings yet

- Data Extract From World Development IndicatorsDocument14 pagesData Extract From World Development IndicatorsJohanna Milena RuizNo ratings yet

- (Download PDF) Basic Mathematics For Economists 3Rd Edition Mike Rosser Ebook Online Full ChapterDocument53 pages(Download PDF) Basic Mathematics For Economists 3Rd Edition Mike Rosser Ebook Online Full Chapterazhurazarre100% (8)

- ECON 200 F. Introduction To Microeconomics Homework 3 Name: - (Multiple Choice)Document11 pagesECON 200 F. Introduction To Microeconomics Homework 3 Name: - (Multiple Choice)Phan Hồng VânNo ratings yet

- Frank8e Chapter03 PPT FinalDocument50 pagesFrank8e Chapter03 PPT Finalsanwal agrawalNo ratings yet

CH 08 A Solution SET 1

CH 08 A Solution SET 1

Uploaded by

kolidishant692Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 08 A Solution SET 1

CH 08 A Solution SET 1

Uploaded by

kolidishant692Copyright:

Available Formats

AKASH AGARWAL

CLASSES

SOLUTION

CMA INTER GROUP 2 TEST SERIES

FINANCIAL MANAGEMENT MARKS: 20

SOLUTION 1 )

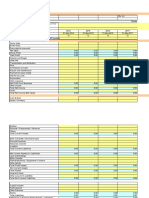

Evaluation of proposed credit policies

Present Proposed (Number of

days)

(20) I (30) II (40) III (50)

(a) Sales revenue 60 65 70 74

Less: Variable costs (VC) 42 45.5 49 51.8

Total Contribution 18 19.5 21 22.2

Less: Fixed Cost (FC) 8 8 8 8

Profit 10 11.5 13 14.2

Increase in profit due to increase in total

contribution compared to present profit --- 1.5 3 4.2

(b) Investment in debtors/receivables:

Total costs (V+FC) 50 53.5 57 59.8

Debtors turnover ratio (DT)

(360Average collection period) 18 12 9 7.2

Average investment in debtors

(Total costDT) 2.78 4.46 6.33 8.31

Additional investment compared to

present level -- 1.68 3.55 5.52

Cost of additional investment @25% -- 0.42 0.89 1.38

(c) Incremental profit [(a) (b)] -- 1.08 2.11 2.82

Recommendation: Policy III (average collection period 50 days) is recommended as it yields

maximum profit.

SOLUTION 3:

The costs with respect to maintenance of receivables can be identified as follows:

(i) Capital Costs: Maintenance of accounts receivable results in blocking of the firm’s

financial resources in them. This is because there is a time lag between the sale of goods

to customers, the payments by them. The firm has, therefore, to arrange for additional

funds to meet its own obligations, such as payment to employees, suppliers of raw

materials, etc.

(ii) Administrative Costs: The firm has to incur additional administrative costs for maintaining

accounts receivable in the form of salaries to the staff kept for maintaining accounting

records relating to customers, cost of conducting investigation regarding potential credit

Akash Agarwal Classes 8007777042 / 043

customers to determine their credit worthiness etc.

(iii) Collection Costs: The firm has to incur costs for collecting the payments from its credit

customers. Sometimes, additional steps may have to be taken to recover money from

defaulting customers.

(iv) Defaulting Costs: Sometimes after making all serious efforts to collect money from

defaulting customers, the firm may not be able to recover the overdues because of the

inability of the customers. Such debts are treated as bad debts and have to be written off

since they cannot be realised.

SOLUTION 4

1. Higer 2. cash

3. minus 4. Operating cycle

5. Operating cycle

SOLUTION 2:

Year 1 Year 2

Current Assets: (20/96) x360 (27/135)x360

1. Raw Material Stock= Stock of raw =75 days =72 days

materials/Purchases x 360

2. W1P turnover=(WlP/COGS)x360 (14/140) x360 (18/180)x360

=36 days =36 days

3. Finished goods turnover= (Finished goods/COGS) (21/140) x360 (24/180)x360

x360 =54 days =48 days

4. Debtors Turnover=(Debtors/Sales) x360 (32/160) x360 (50/200)x360

=72 days =90 days

Total (A) 237 days 246 days

Creditors period =(Creditors/Purchases)x360 (16/96)x360 (18/135)x360

=60 days =48 days

Total (B) 60 days 48 days

Operating Cycle=(A-B) (237-60) (246-48)

=177days =198 days

Abbreviation used: COGS – Cost of Goods Sold.

Akash Agarwal Classes 8007777042 / 043

Akash Agarwal Classes 8007777042 / 043

You might also like

- Short Paper Week 8 FIN 630Document4 pagesShort Paper Week 8 FIN 630jjjjj100% (1)

- Revenue From Contracts With Customers: Problem 1: True or FalseDocument12 pagesRevenue From Contracts With Customers: Problem 1: True or FalsePaula Bautista88% (8)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Notes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsDocument13 pagesNotes (Part 1) : Accounting Policies, Changes in Estimates and ErrorsPaula Bautista100% (2)

- Solution Maf503 - Jan 2018Document8 pagesSolution Maf503 - Jan 2018anis izzatiNo ratings yet

- Macaulay Duration Formula Excel TemplateDocument6 pagesMacaulay Duration Formula Excel TemplateMustafa Ricky Pramana SeNo ratings yet

- Chapter 4 Management of WCDocument15 pagesChapter 4 Management of WCAbhishek TiwariNo ratings yet

- Intermediate - FM - Suggested Answer PaperDocument4 pagesIntermediate - FM - Suggested Answer Paperchromabooka111No ratings yet

- Answer The Following Questions and Provide The Necessary RequirementsDocument11 pagesAnswer The Following Questions and Provide The Necessary RequirementsKervin Rey JacksonNo ratings yet

- Exercise Working CapitalDocument4 pagesExercise Working CapitalShafiul AzamNo ratings yet

- Financial Accounting - Reporting November 2021 Suggested SolutionsDocument6 pagesFinancial Accounting - Reporting November 2021 Suggested SolutionsMunodawafa ChimhamhiwaNo ratings yet

- CAF 1 Autumn 2021Document7 pagesCAF 1 Autumn 2021Ahmed AsifNo ratings yet

- FM & SM-AnswerDocument16 pagesFM & SM-AnswerjunaidNo ratings yet

- CAF 1 Spring 2024Document6 pagesCAF 1 Spring 2024saadiimalik08No ratings yet

- Working CapitalDocument3 pagesWorking Capitalfxn fndNo ratings yet

- 08 Management of Receivables 7bDocument4 pages08 Management of Receivables 7bChartered Accountant YASHNo ratings yet

- Paper-12: Management Accounting Suggested Answers Section - ADocument5 pagesPaper-12: Management Accounting Suggested Answers Section - AQuestion BankNo ratings yet

- COURSE CODE: ACC117/106/100: Declaration Form of Group AssignmentDocument5 pagesCOURSE CODE: ACC117/106/100: Declaration Form of Group AssignmentMARLINDAH RAHIMNo ratings yet

- MTP 19 53 Answers 1713511058Document19 pagesMTP 19 53 Answers 1713511058prathammishra1809No ratings yet

- FN502 Additional ProblemsDocument3 pagesFN502 Additional Problemsdpr7033No ratings yet

- BCC620 Business Financial Management Main (NOV) E1 21-22Document9 pagesBCC620 Business Financial Management Main (NOV) E1 21-22Rukshani RefaiNo ratings yet

- Mock SFM Answer MarchDocument12 pagesMock SFM Answer MarchMenuka SiwaNo ratings yet

- Project Acc117Document2 pagesProject Acc117Afiqah AliaNo ratings yet

- Wolfe (South Western) LTDDocument28 pagesWolfe (South Western) LTDМөнхбат НАНДИН-ЭРДЭНЭNo ratings yet

- Capital Budgeting AnswerDocument18 pagesCapital Budgeting AnswerPiyush ChughNo ratings yet

- Ebook Cost Management A Strategic Emphasis 6Th Edition Blocher Solutions Manual Full Chapter PDFDocument67 pagesEbook Cost Management A Strategic Emphasis 6Th Edition Blocher Solutions Manual Full Chapter PDFCherylHorngjmf100% (15)

- Master Question, Additional Questions-2Document4 pagesMaster Question, Additional Questions-2anshikajain3474No ratings yet

- Assessment 2 - Exam Paper - April 2022 CohortDocument8 pagesAssessment 2 - Exam Paper - April 2022 CohortRamona GabrielaNo ratings yet

- ACC314 Practise Paper SolutionsDocument7 pagesACC314 Practise Paper SolutionsRukshani RefaiNo ratings yet

- Sol. Man. - Chapter 4 - Accounts Receivable - Ia Part 1a - 2020 EditionDocument20 pagesSol. Man. - Chapter 4 - Accounts Receivable - Ia Part 1a - 2020 EditionJapon, Jenn RossNo ratings yet

- Coverage of Learning ObjectivesDocument50 pagesCoverage of Learning ObjectivesMeNo ratings yet

- Finacial Management MockDocument12 pagesFinacial Management MockRomaric DjokoNo ratings yet

- Acctg523-B1-Practice Midterm-W2022-SolutionDocument8 pagesAcctg523-B1-Practice Midterm-W2022-Solutionmakan94883No ratings yet

- CA-Inter-Costing-A-MTP-2-May 2023Document13 pagesCA-Inter-Costing-A-MTP-2-May 2023karnimasoni12No ratings yet

- Test 1 Answer SheetDocument12 pagesTest 1 Answer SheetNaveen R HegadeNo ratings yet

- Assignment For Finanacial Management IDocument12 pagesAssignment For Finanacial Management IHailu DemekeNo ratings yet

- UntitledDocument13 pagesUntitledAbhinav SharmaNo ratings yet

- Chapter 3 Revenue From Contracts With CustomersDocument4 pagesChapter 3 Revenue From Contracts With CustomersbwimeeeNo ratings yet

- CA Inter FM SM A MTP 2 May 2024 Castudynotes ComDocument19 pagesCA Inter FM SM A MTP 2 May 2024 Castudynotes ComsanjanavijjapuNo ratings yet

- Chapter 39 - Teacher's ManualDocument14 pagesChapter 39 - Teacher's ManualHohoho100% (1)

- Coverage of Learning ObjectivesDocument50 pagesCoverage of Learning ObjectivesReyansh SharmaNo ratings yet

- Acc AssignmentDocument8 pagesAcc AssignmentKashémNo ratings yet

- Cost Management Accounting Test 2 CH 4 5 6 May 2024 Solution 1702883162Document15 pagesCost Management Accounting Test 2 CH 4 5 6 May 2024 Solution 1702883162jin031543No ratings yet

- Bhpo Part B Coursework Online Tr2 2016-17Document6 pagesBhpo Part B Coursework Online Tr2 2016-17Furqan Ashraf0% (2)

- ACCA P2 Corporate Reporting - Mock Exam Answers 1 PDFDocument24 pagesACCA P2 Corporate Reporting - Mock Exam Answers 1 PDFමිලන්No ratings yet

- MTP-1 6 KeyDocument16 pagesMTP-1 6 KeynazcomputersitsNo ratings yet

- Lebanese Association of Certified Public Accountants KEY - IFRS February Exam 2020 - Extra SessionDocument6 pagesLebanese Association of Certified Public Accountants KEY - IFRS February Exam 2020 - Extra Sessionjad NasserNo ratings yet

- Question 5 of 9 - BUS 247 Pre-Mid Term Exam Marked Quiz 1 - Chapters 1, 2, 3 and 5Document4 pagesQuestion 5 of 9 - BUS 247 Pre-Mid Term Exam Marked Quiz 1 - Chapters 1, 2, 3 and 5guruphargillNo ratings yet

- F 2 Nov 09 Specimen AnswersDocument9 pagesF 2 Nov 09 Specimen AnswersRobert MunyaradziNo ratings yet

- Activity Based-WPS (Number 1 C)Document9 pagesActivity Based-WPS (Number 1 C)Takudzwa BenjaminNo ratings yet

- UntitledfgddDocument7 pagesUntitledfgddBabawale KehindeNo ratings yet

- Out Come RPL 22052024Document24 pagesOut Come RPL 22052024ronitvermaphotosNo ratings yet

- Chu de 3 Nhom 6 Hay PDFDocument10 pagesChu de 3 Nhom 6 Hay PDFNhư NhưNo ratings yet

- CAF 1 Autumn 2023Document7 pagesCAF 1 Autumn 2023Asim MahmoodNo ratings yet

- Paper19 - Set2 Question Cma FinalDocument5 pagesPaper19 - Set2 Question Cma Finalrehaliya15No ratings yet

- Ca Inter Cost Management Accounting Test 2 Unscheduled Solution 598020012022Document14 pagesCa Inter Cost Management Accounting Test 2 Unscheduled Solution 598020012022Deppanshu KhandelwalNo ratings yet

- Chapter 22. Model For Managing and Financing Current AssetsDocument8 pagesChapter 22. Model For Managing and Financing Current AssetsSantos JdNo ratings yet

- 3A Page No 16Document21 pages3A Page No 16gaurav jainNo ratings yet

- CH 17 Tool Kit - Brigham3CeDocument8 pagesCH 17 Tool Kit - Brigham3CeChad OngNo ratings yet

- CH 28: Receivables Management & Factoring Chapter 28: Accounts Receivable Management and FactoringDocument5 pagesCH 28: Receivables Management & Factoring Chapter 28: Accounts Receivable Management and FactoringMukul KadyanNo ratings yet

- WBSLive Lecture 5 Slides Pres VevoxDocument25 pagesWBSLive Lecture 5 Slides Pres VevoxabhirejanilNo ratings yet

- Subject:-Business Environment: Topic:-Consumer Protection Act 1986Document21 pagesSubject:-Business Environment: Topic:-Consumer Protection Act 1986hardeep waliaNo ratings yet

- Daftar Nama Dosen Pembimbing Periode 2020-1 PagiDocument3 pagesDaftar Nama Dosen Pembimbing Periode 2020-1 PagiNufita Twandita DewiNo ratings yet

- Swades Case Study - International Marketing - 1may19Document16 pagesSwades Case Study - International Marketing - 1may19NIKHIL KUMAR AGRAWALNo ratings yet

- OG200C Rev 3 TG5Document2 pagesOG200C Rev 3 TG5ИгорьNo ratings yet

- CA Journal August 2012Document141 pagesCA Journal August 2012Thiruvengadathan ParthasarathiNo ratings yet

- Case CASE 4-1 4-1 PC PC Depot DepotDocument7 pagesCase CASE 4-1 4-1 PC PC Depot DepotJourast LadzuardyNo ratings yet

- Company Law R.Kit-1Document246 pagesCompany Law R.Kit-1Peter Osundwa KitekiNo ratings yet

- Cheg - 22 Jan 2024 at 11.14Document1 pageCheg - 22 Jan 2024 at 11.14fayyasin99No ratings yet

- NIKE Presentation BMS (12396)Document24 pagesNIKE Presentation BMS (12396)Shehan PereraNo ratings yet

- Busi 1714 RUBRIC - Report 7000 Words - 21,22Document3 pagesBusi 1714 RUBRIC - Report 7000 Words - 21,22Yt HuongNo ratings yet

- Strategic Analysis of Synergistic Effect On M&A of Volvo Car Corporation by Geely AutomobileDocument11 pagesStrategic Analysis of Synergistic Effect On M&A of Volvo Car Corporation by Geely AutomobileDaniNo ratings yet

- Giai BT QTTC Quan Tri Tai Chinh Doanh NghiepDocument6 pagesGiai BT QTTC Quan Tri Tai Chinh Doanh Nghiep2154011008trangNo ratings yet

- Chapter 1Document9 pagesChapter 1Kanaga LakshmiNo ratings yet

- Accounting Error QNSDocument3 pagesAccounting Error QNSGerald MagaitaNo ratings yet

- BrandZ Global Top 100 2020 InfographicDocument1 pageBrandZ Global Top 100 2020 InfographicKaran MusaleNo ratings yet

- Precalculus Graphs and Models A Right Triangle Approach 6th Edition Bittinger Solutions ManualDocument24 pagesPrecalculus Graphs and Models A Right Triangle Approach 6th Edition Bittinger Solutions ManualNatalieRojasykebg100% (38)

- Business Process Reeingeenirig of An Air Cargo Handling Process PDFDocument54 pagesBusiness Process Reeingeenirig of An Air Cargo Handling Process PDFademaj08100% (1)

- Oil Free Scroll Compressors 2 30 KW Brochure NADocument8 pagesOil Free Scroll Compressors 2 30 KW Brochure NAKervin CoronadoNo ratings yet

- Copy of Cma For Less Than 1 Crore With CalculationDocument18 pagesCopy of Cma For Less Than 1 Crore With CalculationRajesh BogulNo ratings yet

- Chapter 9 - Dealing With The Competition Multiple Choice QuestionsDocument19 pagesChapter 9 - Dealing With The Competition Multiple Choice QuestionsMutya Neri CruzNo ratings yet

- Whitepaper: Cross-Chain Platform For Developers, Powered by Binance Smart ChainDocument25 pagesWhitepaper: Cross-Chain Platform For Developers, Powered by Binance Smart ChainIsroqi FarisNo ratings yet

- DT Combined CA INTERDocument203 pagesDT Combined CA INTERkarthick rajNo ratings yet

- VANITHADocument3 pagesVANITHAnatashah designNo ratings yet

- ArchiMate Case Study BMVDocument8 pagesArchiMate Case Study BMVMarwan SaadNo ratings yet

- Data Extract From World Development IndicatorsDocument14 pagesData Extract From World Development IndicatorsJohanna Milena RuizNo ratings yet

- (Download PDF) Basic Mathematics For Economists 3Rd Edition Mike Rosser Ebook Online Full ChapterDocument53 pages(Download PDF) Basic Mathematics For Economists 3Rd Edition Mike Rosser Ebook Online Full Chapterazhurazarre100% (8)

- ECON 200 F. Introduction To Microeconomics Homework 3 Name: - (Multiple Choice)Document11 pagesECON 200 F. Introduction To Microeconomics Homework 3 Name: - (Multiple Choice)Phan Hồng VânNo ratings yet

- Frank8e Chapter03 PPT FinalDocument50 pagesFrank8e Chapter03 PPT Finalsanwal agrawalNo ratings yet