Professional Documents

Culture Documents

Nov2010 Paper2 Q2 Olevel

Nov2010 Paper2 Q2 Olevel

Uploaded by

Abid faisal AhmedCopyright:

Available Formats

You might also like

- CTS India On Call Allowance PolicyDocument6 pagesCTS India On Call Allowance PolicyshaannivasNo ratings yet

- Complaint For Wrongful Foreclosure, Fraud, Negligence, Quiet Title and Unfair Business PracticesDocument25 pagesComplaint For Wrongful Foreclosure, Fraud, Negligence, Quiet Title and Unfair Business PracticesDinSFLA85% (13)

- CH 10Document9 pagesCH 10Tien Thanh DangNo ratings yet

- Content Analysis of Textbook From Human Rights Perspective - RukhsanaDocument13 pagesContent Analysis of Textbook From Human Rights Perspective - RukhsanaWaseem Khan67% (3)

- Chapter 11 Online TestDocument3 pagesChapter 11 Online TestGodfreyFrankMwakalingaNo ratings yet

- Week 1 - AssignmentDocument27 pagesWeek 1 - AssignmentTeresa ManNo ratings yet

- Accountancy Sample Question PaperDocument8 pagesAccountancy Sample Question PaperSoNam ZaNgmoNo ratings yet

- Week 2 - Assignment (20200905)Document6 pagesWeek 2 - Assignment (20200905)Teresa ManNo ratings yet

- CAPE Accounting 2018 U1 P2Document9 pagesCAPE Accounting 2018 U1 P2Kimberly MNo ratings yet

- Adv Accounts MTP M19 S2Document22 pagesAdv Accounts MTP M19 S2Harshwardhan PatilNo ratings yet

- Cainterseries 2 CompleteDocument70 pagesCainterseries 2 CompleteNishanthNo ratings yet

- 5 Financial Statements of CompaniesDocument11 pages5 Financial Statements of Companiessunil.h68 SunilNo ratings yet

- Exam June 2008Document9 pagesExam June 2008kalowekamoNo ratings yet

- Poa 2010 P2Document10 pagesPoa 2010 P2Jam Bab100% (2)

- Correction of Errors and Suspense.Document54 pagesCorrection of Errors and Suspense.SameerNo ratings yet

- Examination: Subject ST7 - General Insurance: Reserving and Capital Modelling Specialist TechnicalDocument5 pagesExamination: Subject ST7 - General Insurance: Reserving and Capital Modelling Specialist Technicaldickson phiriNo ratings yet

- 57 International Financial Reporting Standards May 2022Document8 pages57 International Financial Reporting Standards May 2022premium info2222No ratings yet

- Depreciation Practice ProblemDocument3 pagesDepreciation Practice ProblemPratibha Jaggan-MartinNo ratings yet

- CAPE Accounting 2016 U1 P1Document10 pagesCAPE Accounting 2016 U1 P1DinaNo ratings yet

- CAPE Accounting MCQDocument10 pagesCAPE Accounting MCQBradlee Singh100% (1)

- Accountancy & Auditing-II 2021Document2 pagesAccountancy & Auditing-II 2021Zeeshan Ashraf MalikNo ratings yet

- Worksheet 02Document2 pagesWorksheet 02LuckyNo ratings yet

- Alpa Bravo 123Document16 pagesAlpa Bravo 123adnan khanNo ratings yet

- Chapter 4 Quick StudyDocument11 pagesChapter 4 Quick StudyPhạm Hồng Trang Alice -No ratings yet

- Exam Dec 2007Document9 pagesExam Dec 2007kalowekamoNo ratings yet

- Befa Regular 22019Document2 pagesBefa Regular 22019reddy reddyNo ratings yet

- (4870) - 2002 M.B.A. 202: Financial Management (CBCS) (2013 Pattern) (Semester - II)Document5 pages(4870) - 2002 M.B.A. 202: Financial Management (CBCS) (2013 Pattern) (Semester - II)AK Aru ShettyNo ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- 7110 s09 QP 2Document20 pages7110 s09 QP 2meelas123No ratings yet

- 12 Accounts 2020 21 Practice Paper 2Document8 pages12 Accounts 2020 21 Practice Paper 2Vijey RamalingamNo ratings yet

- Part A': Winter Exam-2013Document29 pagesPart A': Winter Exam-2013fareha riazNo ratings yet

- 3.4 Practice Problems: Rodrigues Traders (RT)Document6 pages3.4 Practice Problems: Rodrigues Traders (RT)SOURAV MONDALNo ratings yet

- Second Periodic Examination 2019Document11 pagesSecond Periodic Examination 2019madhudevi06435No ratings yet

- PGDT Assignment QP TEE Jun18Document10 pagesPGDT Assignment QP TEE Jun18abhishekchavda20No ratings yet

- Sem5 Acyg CC9Document3 pagesSem5 Acyg CC9Amrita RoyNo ratings yet

- Facacor03T-B.C - (CC3) C M A - I: West Bengal State UniversityDocument4 pagesFacacor03T-B.C - (CC3) C M A - I: West Bengal State UniversityAbhayNo ratings yet

- Cbleacpu 01Document10 pagesCbleacpu 01tripatjotkaur757No ratings yet

- Class 12 Pre Board SQP Accountancy 01Document21 pagesClass 12 Pre Board SQP Accountancy 01Mayank SharmaNo ratings yet

- FR 2018 Sepdec Sample QDocument5 pagesFR 2018 Sepdec Sample QfatehsalehNo ratings yet

- Finance Quantitative Worksheets - Profitability and Liquidity RatiosDocument3 pagesFinance Quantitative Worksheets - Profitability and Liquidity Ratiosrebeccapegoraro06No ratings yet

- Solution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Document10 pagesSolution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Shaindra SinghNo ratings yet

- Eco 02Document6 pagesEco 02rykaNo ratings yet

- 134 Accounting Managers FreshersDocument4 pages134 Accounting Managers Freshersdchandru271No ratings yet

- II PUC ACC REVISED POQs FOR 2022-23Document3 pagesII PUC ACC REVISED POQs FOR 2022-23Shree Lakshmi vNo ratings yet

- Paper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaDocument31 pagesPaper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaVarun reddyNo ratings yet

- Accountancy Sample Paper Class 11 PDFDocument6 pagesAccountancy Sample Paper Class 11 PDFAnkit JhaNo ratings yet

- F1 Economics AprilDocument8 pagesF1 Economics Aprilஆக்ஞா கிருஷ்ணா ஷர்மாNo ratings yet

- CA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersDocument25 pagesCA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersIshmael FofanahNo ratings yet

- CH 10 - Trade ReceivablesDocument8 pagesCH 10 - Trade Receivablesmarksman471No ratings yet

- MBA193F3: RamaiahDocument4 pagesMBA193F3: Ramaiahvijay shetNo ratings yet

- Model Test Paper-1Document24 pagesModel Test Paper-1Rupali RoyNo ratings yet

- R2.TAXM - .L Question CMA June 2021 Exam.Document7 pagesR2.TAXM - .L Question CMA June 2021 Exam.Pavel DhakaNo ratings yet

- FM Paper1Document4 pagesFM Paper1majinkya61No ratings yet

- P17.PDF For PrintDocument2 pagesP17.PDF For PrintRohit KunduNo ratings yet

- Financial Accounting-Iii - HonoursDocument7 pagesFinancial Accounting-Iii - HonoursAlankrita TripathiNo ratings yet

- Commerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Document4 pagesCommerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Sanaullah M SultanpurNo ratings yet

- 12th Accounts SD Test (CH 1, 2 and 3) SET ADocument4 pages12th Accounts SD Test (CH 1, 2 and 3) SET Apriyasoni4845No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- Al Accounting 2020-VfDocument22 pagesAl Accounting 2020-VfIdrak & Idris FaroukNo ratings yet

- Viray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsDocument6 pagesViray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsZeeNo ratings yet

- Ereta Education Cons P2Document2 pagesEreta Education Cons P2Ayen Geoffrey AlexanderNo ratings yet

- Ecomomics TestDocument1 pageEcomomics TestHarsh ShahNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Nov11 3Document2 pagesNov11 3Abid faisal AhmedNo ratings yet

- Nov11 4Document2 pagesNov11 4Abid faisal AhmedNo ratings yet

- Nov2010 Paper2 Q3 OlevelDocument5 pagesNov2010 Paper2 Q3 OlevelAbid faisal AhmedNo ratings yet

- 2019 Nov DepreciationDocument3 pages2019 Nov DepreciationAbid faisal AhmedNo ratings yet

- Nov2018 Paper1 Part2 OlevelDocument6 pagesNov2018 Paper1 Part2 OlevelAbid faisal AhmedNo ratings yet

- 2019 June P31 Q3Document1 page2019 June P31 Q3Abid faisal AhmedNo ratings yet

- 2018 March P32 Q2Document1 page2018 March P32 Q2Abid faisal AhmedNo ratings yet

- Stock MarketDocument67 pagesStock MarketAbid faisal AhmedNo ratings yet

- Nov2016/P33/Q4: © UCLES 2016 9706/33/O/N/16Document1 pageNov2016/P33/Q4: © UCLES 2016 9706/33/O/N/16Abid faisal AhmedNo ratings yet

- Mortgage-Backed SecuritiesDocument18 pagesMortgage-Backed SecuritiesAbid faisal AhmedNo ratings yet

- Ancient GreeceDocument19 pagesAncient GreeceAbid faisal AhmedNo ratings yet

- PartnershipDocument8 pagesPartnershipAbid faisal AhmedNo ratings yet

- Price RationingDocument2 pagesPrice RationingAbid faisal AhmedNo ratings yet

- Money MarketDocument17 pagesMoney MarketAbid faisal AhmedNo ratings yet

- Python ExercisesDocument2 pagesPython ExercisesAbid faisal AhmedNo ratings yet

- Moral StudiesDocument2 pagesMoral StudiesAbid faisal AhmedNo ratings yet

- Long Run and Short RunDocument3 pagesLong Run and Short RunAbid faisal AhmedNo ratings yet

- Practice Worksheet On Other Receivables & PayablesDocument1 pagePractice Worksheet On Other Receivables & PayablesAbid faisal AhmedNo ratings yet

- PhysicsDocument29 pagesPhysicsdafwfdwNo ratings yet

- Chapter 1Document10 pagesChapter 1intanNo ratings yet

- Chapter - 6 Work Energy and PowerDocument34 pagesChapter - 6 Work Energy and PowerNafees FarheenNo ratings yet

- Nicolas Berdyaev 49Document9 pagesNicolas Berdyaev 49jobox1No ratings yet

- PCI-DSS-v4 0 1Document397 pagesPCI-DSS-v4 0 1haitam lfridiNo ratings yet

- Political Reporting in The Nigerian Media AnDocument5 pagesPolitical Reporting in The Nigerian Media AnJohn Francis KanwaiNo ratings yet

- Nicholas Patrick HendrixDocument8 pagesNicholas Patrick HendrixNEWS CENTER MaineNo ratings yet

- Bishop of Nueva Segovia Vs Provincial BoardDocument1 pageBishop of Nueva Segovia Vs Provincial BoardJan Carlo SanchezNo ratings yet

- Zamboanga Social Studies - 0 PDFDocument39 pagesZamboanga Social Studies - 0 PDFPhilBoardResultsNo ratings yet

- Cenita M. Cariaga V. People of The PhilippinesDocument2 pagesCenita M. Cariaga V. People of The PhilippinesShella Hannah Salih100% (1)

- CD Labor 1 Jimenez Vs NLRCDocument2 pagesCD Labor 1 Jimenez Vs NLRCJay B. Villafria Jr.No ratings yet

- Midterm Utp Malaysian StudiesDocument8 pagesMidterm Utp Malaysian StudiesNurul AishahNo ratings yet

- Artículo InterseccionalidadDocument6 pagesArtículo InterseccionalidadGabiNo ratings yet

- Air Transport SecurityDocument297 pagesAir Transport Securitytangoenak100% (2)

- Swagatam Letter of Quess CompanyDocument6 pagesSwagatam Letter of Quess Companydubey.princesriNo ratings yet

- Chua vs. TorresDocument3 pagesChua vs. Torresjoselle gaviolaNo ratings yet

- Manual MB491 Ba EN tcm3-166592 PDFDocument203 pagesManual MB491 Ba EN tcm3-166592 PDFTech Support CW HIRAMNo ratings yet

- HOAC-DNR-31958 Combined 11 - 02 - 20 PDFDocument153 pagesHOAC-DNR-31958 Combined 11 - 02 - 20 PDFNdaba ZamsNo ratings yet

- Public International Law CasesDocument479 pagesPublic International Law CasesMaria Margaret MacasaetNo ratings yet

- Fundamentals of Construction Law in Malaysia: - Pam - PWD 203ADocument9 pagesFundamentals of Construction Law in Malaysia: - Pam - PWD 203AAstiger IshakNo ratings yet

- GR 95533 Republic Vs CADocument5 pagesGR 95533 Republic Vs CAmaria lourdes lopenaNo ratings yet

- Art. VI Sec. 27 32Document180 pagesArt. VI Sec. 27 32John Henry GramaNo ratings yet

- EN - CVE DetailsDocument4 pagesEN - CVE DetailsGiorgi RcheulishviliNo ratings yet

- Form - I (A) : Department of Commercial Taxes, Government of Uttar PradeshDocument4 pagesForm - I (A) : Department of Commercial Taxes, Government of Uttar PradeshPrakhar JainNo ratings yet

- Calcium Nitrate Fertilizer PDFDocument2 pagesCalcium Nitrate Fertilizer PDForangebig100% (1)

- Tbilisi City Council Performance ReportDocument42 pagesTbilisi City Council Performance ReportTIGeorgiaNo ratings yet

- 25 People V Balmores DigestDocument2 pages25 People V Balmores Digestjacaringal1No ratings yet

Nov2010 Paper2 Q2 Olevel

Nov2010 Paper2 Q2 Olevel

Uploaded by

Abid faisal AhmedOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nov2010 Paper2 Q2 Olevel

Nov2010 Paper2 Q2 Olevel

Uploaded by

Abid faisal AhmedCopyright:

Available Formats

5

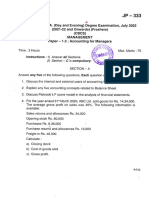

2 Jayani prepared a trial balance at 30 September 2010, which balanced. For

Examiner's

Use

A draft income statement (trading and profit and loss account) was then prepared and a

gross profit of $60 000 and a profit for the year (net profit) of $15 000 was calculated.

Jayani then discovered the following errors:

1 A sale of office equipment at net book vaule, $3 000, had been recorded in the

sales account.

2 Purchases of goods, $650, on credit from Alana had been credited to the

purchases account and debited to Alana’s account.

3 An invoice from JGL Insurance, $425, for buildings insurance, had not been

recorded in the books.

REQUIRED

(a) Prepare journal entries to correct the errors in 1 to 3 above.

Narratives are not required.

Journal

Dr Cr

[6]

(b) Name the type of error made in 1 to 3 above.

3 [3]

© UCLES 2010 7110/02/O/N/10 [Turn over

6

For

(c) Calculate the revised gross profit and profit for the year (net profit) for Jayani, following Examiner's

Use

the correction of the errors 1 to 3 above.

Where the error would have no effect on the gross profit or profit for the year (net profit),

state ‘no effect’.

Profit for the year

Gross profit

(Net profit)

$ $

Draft profit 60 000 15 000

Error 1

Error 2

Error 3

Revised profit

[8]

(d) Jayani is considering the purchase of a new computerised book-keeping system.

State two benefits that Jayani will gain from using Information and Communications

Technology (ICT) in book-keeping.

(i)

(ii)

[2]

[Total: 19]

© UCLES 2010 7110/02/O/N/10

You might also like

- CTS India On Call Allowance PolicyDocument6 pagesCTS India On Call Allowance PolicyshaannivasNo ratings yet

- Complaint For Wrongful Foreclosure, Fraud, Negligence, Quiet Title and Unfair Business PracticesDocument25 pagesComplaint For Wrongful Foreclosure, Fraud, Negligence, Quiet Title and Unfair Business PracticesDinSFLA85% (13)

- CH 10Document9 pagesCH 10Tien Thanh DangNo ratings yet

- Content Analysis of Textbook From Human Rights Perspective - RukhsanaDocument13 pagesContent Analysis of Textbook From Human Rights Perspective - RukhsanaWaseem Khan67% (3)

- Chapter 11 Online TestDocument3 pagesChapter 11 Online TestGodfreyFrankMwakalingaNo ratings yet

- Week 1 - AssignmentDocument27 pagesWeek 1 - AssignmentTeresa ManNo ratings yet

- Accountancy Sample Question PaperDocument8 pagesAccountancy Sample Question PaperSoNam ZaNgmoNo ratings yet

- Week 2 - Assignment (20200905)Document6 pagesWeek 2 - Assignment (20200905)Teresa ManNo ratings yet

- CAPE Accounting 2018 U1 P2Document9 pagesCAPE Accounting 2018 U1 P2Kimberly MNo ratings yet

- Adv Accounts MTP M19 S2Document22 pagesAdv Accounts MTP M19 S2Harshwardhan PatilNo ratings yet

- Cainterseries 2 CompleteDocument70 pagesCainterseries 2 CompleteNishanthNo ratings yet

- 5 Financial Statements of CompaniesDocument11 pages5 Financial Statements of Companiessunil.h68 SunilNo ratings yet

- Exam June 2008Document9 pagesExam June 2008kalowekamoNo ratings yet

- Poa 2010 P2Document10 pagesPoa 2010 P2Jam Bab100% (2)

- Correction of Errors and Suspense.Document54 pagesCorrection of Errors and Suspense.SameerNo ratings yet

- Examination: Subject ST7 - General Insurance: Reserving and Capital Modelling Specialist TechnicalDocument5 pagesExamination: Subject ST7 - General Insurance: Reserving and Capital Modelling Specialist Technicaldickson phiriNo ratings yet

- 57 International Financial Reporting Standards May 2022Document8 pages57 International Financial Reporting Standards May 2022premium info2222No ratings yet

- Depreciation Practice ProblemDocument3 pagesDepreciation Practice ProblemPratibha Jaggan-MartinNo ratings yet

- CAPE Accounting 2016 U1 P1Document10 pagesCAPE Accounting 2016 U1 P1DinaNo ratings yet

- CAPE Accounting MCQDocument10 pagesCAPE Accounting MCQBradlee Singh100% (1)

- Accountancy & Auditing-II 2021Document2 pagesAccountancy & Auditing-II 2021Zeeshan Ashraf MalikNo ratings yet

- Worksheet 02Document2 pagesWorksheet 02LuckyNo ratings yet

- Alpa Bravo 123Document16 pagesAlpa Bravo 123adnan khanNo ratings yet

- Chapter 4 Quick StudyDocument11 pagesChapter 4 Quick StudyPhạm Hồng Trang Alice -No ratings yet

- Exam Dec 2007Document9 pagesExam Dec 2007kalowekamoNo ratings yet

- Befa Regular 22019Document2 pagesBefa Regular 22019reddy reddyNo ratings yet

- (4870) - 2002 M.B.A. 202: Financial Management (CBCS) (2013 Pattern) (Semester - II)Document5 pages(4870) - 2002 M.B.A. 202: Financial Management (CBCS) (2013 Pattern) (Semester - II)AK Aru ShettyNo ratings yet

- Acct1101 Final Examination SEMESTER 2, 2020Document13 pagesAcct1101 Final Examination SEMESTER 2, 2020Yahya ZafarNo ratings yet

- 7110 s09 QP 2Document20 pages7110 s09 QP 2meelas123No ratings yet

- 12 Accounts 2020 21 Practice Paper 2Document8 pages12 Accounts 2020 21 Practice Paper 2Vijey RamalingamNo ratings yet

- Part A': Winter Exam-2013Document29 pagesPart A': Winter Exam-2013fareha riazNo ratings yet

- 3.4 Practice Problems: Rodrigues Traders (RT)Document6 pages3.4 Practice Problems: Rodrigues Traders (RT)SOURAV MONDALNo ratings yet

- Second Periodic Examination 2019Document11 pagesSecond Periodic Examination 2019madhudevi06435No ratings yet

- PGDT Assignment QP TEE Jun18Document10 pagesPGDT Assignment QP TEE Jun18abhishekchavda20No ratings yet

- Sem5 Acyg CC9Document3 pagesSem5 Acyg CC9Amrita RoyNo ratings yet

- Facacor03T-B.C - (CC3) C M A - I: West Bengal State UniversityDocument4 pagesFacacor03T-B.C - (CC3) C M A - I: West Bengal State UniversityAbhayNo ratings yet

- Cbleacpu 01Document10 pagesCbleacpu 01tripatjotkaur757No ratings yet

- Class 12 Pre Board SQP Accountancy 01Document21 pagesClass 12 Pre Board SQP Accountancy 01Mayank SharmaNo ratings yet

- FR 2018 Sepdec Sample QDocument5 pagesFR 2018 Sepdec Sample QfatehsalehNo ratings yet

- Finance Quantitative Worksheets - Profitability and Liquidity RatiosDocument3 pagesFinance Quantitative Worksheets - Profitability and Liquidity Ratiosrebeccapegoraro06No ratings yet

- Solution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Document10 pagesSolution Class 12 - Accountancy Half Syllabus: For Admission Contact 1 / 10Shaindra SinghNo ratings yet

- Eco 02Document6 pagesEco 02rykaNo ratings yet

- 134 Accounting Managers FreshersDocument4 pages134 Accounting Managers Freshersdchandru271No ratings yet

- II PUC ACC REVISED POQs FOR 2022-23Document3 pagesII PUC ACC REVISED POQs FOR 2022-23Shree Lakshmi vNo ratings yet

- Paper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaDocument31 pagesPaper - 5: Advanced Accounting: © The Institute of Chartered Accountants of IndiaVarun reddyNo ratings yet

- Accountancy Sample Paper Class 11 PDFDocument6 pagesAccountancy Sample Paper Class 11 PDFAnkit JhaNo ratings yet

- F1 Economics AprilDocument8 pagesF1 Economics Aprilஆக்ஞா கிருஷ்ணா ஷர்மாNo ratings yet

- CA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersDocument25 pagesCA Inter - Nov 2018 - F M & Eco For Finance - Suggested AnswersIshmael FofanahNo ratings yet

- CH 10 - Trade ReceivablesDocument8 pagesCH 10 - Trade Receivablesmarksman471No ratings yet

- MBA193F3: RamaiahDocument4 pagesMBA193F3: Ramaiahvijay shetNo ratings yet

- Model Test Paper-1Document24 pagesModel Test Paper-1Rupali RoyNo ratings yet

- R2.TAXM - .L Question CMA June 2021 Exam.Document7 pagesR2.TAXM - .L Question CMA June 2021 Exam.Pavel DhakaNo ratings yet

- FM Paper1Document4 pagesFM Paper1majinkya61No ratings yet

- P17.PDF For PrintDocument2 pagesP17.PDF For PrintRohit KunduNo ratings yet

- Financial Accounting-Iii - HonoursDocument7 pagesFinancial Accounting-Iii - HonoursAlankrita TripathiNo ratings yet

- Commerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Document4 pagesCommerce (Regular) Accounting For Specialised Institutions (Group A: Accounting and Finance) Paper - 3.5 (A)Sanaullah M SultanpurNo ratings yet

- 12th Accounts SD Test (CH 1, 2 and 3) SET ADocument4 pages12th Accounts SD Test (CH 1, 2 and 3) SET Apriyasoni4845No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- Al Accounting 2020-VfDocument22 pagesAl Accounting 2020-VfIdrak & Idris FaroukNo ratings yet

- Viray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsDocument6 pagesViray, Nhicole S. Asynchronous Quiz 1 - Accounting Changes and ErrorsZeeNo ratings yet

- Ereta Education Cons P2Document2 pagesEreta Education Cons P2Ayen Geoffrey AlexanderNo ratings yet

- Ecomomics TestDocument1 pageEcomomics TestHarsh ShahNo ratings yet

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosFrom EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNo ratings yet

- Nov11 3Document2 pagesNov11 3Abid faisal AhmedNo ratings yet

- Nov11 4Document2 pagesNov11 4Abid faisal AhmedNo ratings yet

- Nov2010 Paper2 Q3 OlevelDocument5 pagesNov2010 Paper2 Q3 OlevelAbid faisal AhmedNo ratings yet

- 2019 Nov DepreciationDocument3 pages2019 Nov DepreciationAbid faisal AhmedNo ratings yet

- Nov2018 Paper1 Part2 OlevelDocument6 pagesNov2018 Paper1 Part2 OlevelAbid faisal AhmedNo ratings yet

- 2019 June P31 Q3Document1 page2019 June P31 Q3Abid faisal AhmedNo ratings yet

- 2018 March P32 Q2Document1 page2018 March P32 Q2Abid faisal AhmedNo ratings yet

- Stock MarketDocument67 pagesStock MarketAbid faisal AhmedNo ratings yet

- Nov2016/P33/Q4: © UCLES 2016 9706/33/O/N/16Document1 pageNov2016/P33/Q4: © UCLES 2016 9706/33/O/N/16Abid faisal AhmedNo ratings yet

- Mortgage-Backed SecuritiesDocument18 pagesMortgage-Backed SecuritiesAbid faisal AhmedNo ratings yet

- Ancient GreeceDocument19 pagesAncient GreeceAbid faisal AhmedNo ratings yet

- PartnershipDocument8 pagesPartnershipAbid faisal AhmedNo ratings yet

- Price RationingDocument2 pagesPrice RationingAbid faisal AhmedNo ratings yet

- Money MarketDocument17 pagesMoney MarketAbid faisal AhmedNo ratings yet

- Python ExercisesDocument2 pagesPython ExercisesAbid faisal AhmedNo ratings yet

- Moral StudiesDocument2 pagesMoral StudiesAbid faisal AhmedNo ratings yet

- Long Run and Short RunDocument3 pagesLong Run and Short RunAbid faisal AhmedNo ratings yet

- Practice Worksheet On Other Receivables & PayablesDocument1 pagePractice Worksheet On Other Receivables & PayablesAbid faisal AhmedNo ratings yet

- PhysicsDocument29 pagesPhysicsdafwfdwNo ratings yet

- Chapter 1Document10 pagesChapter 1intanNo ratings yet

- Chapter - 6 Work Energy and PowerDocument34 pagesChapter - 6 Work Energy and PowerNafees FarheenNo ratings yet

- Nicolas Berdyaev 49Document9 pagesNicolas Berdyaev 49jobox1No ratings yet

- PCI-DSS-v4 0 1Document397 pagesPCI-DSS-v4 0 1haitam lfridiNo ratings yet

- Political Reporting in The Nigerian Media AnDocument5 pagesPolitical Reporting in The Nigerian Media AnJohn Francis KanwaiNo ratings yet

- Nicholas Patrick HendrixDocument8 pagesNicholas Patrick HendrixNEWS CENTER MaineNo ratings yet

- Bishop of Nueva Segovia Vs Provincial BoardDocument1 pageBishop of Nueva Segovia Vs Provincial BoardJan Carlo SanchezNo ratings yet

- Zamboanga Social Studies - 0 PDFDocument39 pagesZamboanga Social Studies - 0 PDFPhilBoardResultsNo ratings yet

- Cenita M. Cariaga V. People of The PhilippinesDocument2 pagesCenita M. Cariaga V. People of The PhilippinesShella Hannah Salih100% (1)

- CD Labor 1 Jimenez Vs NLRCDocument2 pagesCD Labor 1 Jimenez Vs NLRCJay B. Villafria Jr.No ratings yet

- Midterm Utp Malaysian StudiesDocument8 pagesMidterm Utp Malaysian StudiesNurul AishahNo ratings yet

- Artículo InterseccionalidadDocument6 pagesArtículo InterseccionalidadGabiNo ratings yet

- Air Transport SecurityDocument297 pagesAir Transport Securitytangoenak100% (2)

- Swagatam Letter of Quess CompanyDocument6 pagesSwagatam Letter of Quess Companydubey.princesriNo ratings yet

- Chua vs. TorresDocument3 pagesChua vs. Torresjoselle gaviolaNo ratings yet

- Manual MB491 Ba EN tcm3-166592 PDFDocument203 pagesManual MB491 Ba EN tcm3-166592 PDFTech Support CW HIRAMNo ratings yet

- HOAC-DNR-31958 Combined 11 - 02 - 20 PDFDocument153 pagesHOAC-DNR-31958 Combined 11 - 02 - 20 PDFNdaba ZamsNo ratings yet

- Public International Law CasesDocument479 pagesPublic International Law CasesMaria Margaret MacasaetNo ratings yet

- Fundamentals of Construction Law in Malaysia: - Pam - PWD 203ADocument9 pagesFundamentals of Construction Law in Malaysia: - Pam - PWD 203AAstiger IshakNo ratings yet

- GR 95533 Republic Vs CADocument5 pagesGR 95533 Republic Vs CAmaria lourdes lopenaNo ratings yet

- Art. VI Sec. 27 32Document180 pagesArt. VI Sec. 27 32John Henry GramaNo ratings yet

- EN - CVE DetailsDocument4 pagesEN - CVE DetailsGiorgi RcheulishviliNo ratings yet

- Form - I (A) : Department of Commercial Taxes, Government of Uttar PradeshDocument4 pagesForm - I (A) : Department of Commercial Taxes, Government of Uttar PradeshPrakhar JainNo ratings yet

- Calcium Nitrate Fertilizer PDFDocument2 pagesCalcium Nitrate Fertilizer PDForangebig100% (1)

- Tbilisi City Council Performance ReportDocument42 pagesTbilisi City Council Performance ReportTIGeorgiaNo ratings yet

- 25 People V Balmores DigestDocument2 pages25 People V Balmores Digestjacaringal1No ratings yet