Professional Documents

Culture Documents

Company Financial Health Analysis

Company Financial Health Analysis

Uploaded by

Syarif SurbaktiCopyright:

Available Formats

You might also like

- CFI - FMVA Practice Exam Case Study ADocument18 pagesCFI - FMVA Practice Exam Case Study AWerfelli MaramNo ratings yet

- CFI FMVA Final Assessment Case Study 1ADocument12 pagesCFI FMVA Final Assessment Case Study 1Apadre pio kone100% (1)

- Chapter 3 Problem 9: R&E Supplies Facts and Assumptions ($ Thousands) Actual Forecast Forecast 2017 2018 2019Document5 pagesChapter 3 Problem 9: R&E Supplies Facts and Assumptions ($ Thousands) Actual Forecast Forecast 2017 2018 2019阮幸碧No ratings yet

- Cases in Finance 3rd Edition Demello Solutions ManualDocument11 pagesCases in Finance 3rd Edition Demello Solutions ManualJanice Kahalehoe100% (41)

- Harvard Case Study - Flash Inc - AllDocument40 pagesHarvard Case Study - Flash Inc - All竹本口木子100% (1)

- Chapter 9. CH 09-10 Build A Model: Growth SalesDocument6 pagesChapter 9. CH 09-10 Build A Model: Growth SalesMatt SlowickNo ratings yet

- Mid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121Document10 pagesMid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121rabab balochNo ratings yet

- NEW TUTORIAL INSTALMENT PURCHASES - AnsSchemeDocument7 pagesNEW TUTORIAL INSTALMENT PURCHASES - AnsSchemeDiana Yunus DianaNo ratings yet

- Anthem IncDocument28 pagesAnthem IncHans WeirlNo ratings yet

- Q3 2022 Earnings Release SnowDocument14 pagesQ3 2022 Earnings Release SnowCode BeretNo ratings yet

- Presented To:-: Ms. Khushboo SherwaniDocument19 pagesPresented To:-: Ms. Khushboo SherwaniArchit Goel100% (1)

- MBA 640 - Week 4 - Final Project Milestone OneDocument3 pagesMBA 640 - Week 4 - Final Project Milestone Onewilhelmina baxterNo ratings yet

- Business AccountingDocument14 pagesBusiness AccountingLoguNo ratings yet

- YHOO Q409EarningsPresentation FinalDocument22 pagesYHOO Q409EarningsPresentation Finalhblodget6728No ratings yet

- NETFLIX 17-21-Website-FinacialsDocument6 pagesNETFLIX 17-21-Website-FinacialsGreta RiveraNo ratings yet

- Financial Forecast, AFNDocument3 pagesFinancial Forecast, AFNayesha akhtarNo ratings yet

- Steinberg Alexandra 4536 A3Document136 pagesSteinberg Alexandra 4536 A3Yong RenNo ratings yet

- Finance Final Pitch General ElectricDocument8 pagesFinance Final Pitch General Electricbquinn08No ratings yet

- Income StatementDocument7 pagesIncome StatementaffrinahNo ratings yet

- Proj FinanceDocument24 pagesProj FinanceninaNo ratings yet

- Menahga FY24 Revised Budget All FundsDocument8 pagesMenahga FY24 Revised Budget All FundsShannon GeisenNo ratings yet

- Annual Report 2018Document7 pagesAnnual Report 2018Anika RieweNo ratings yet

- YHOO Q110EarningsPresentation FinalDocument23 pagesYHOO Q110EarningsPresentation Finalhblodget6728No ratings yet

- Financial Statement Analysis Problems Overview - TemplateDocument11 pagesFinancial Statement Analysis Problems Overview - Templatewushuyouqi1116No ratings yet

- Micro Shots 2010Document158 pagesMicro Shots 2010Arifin MasruriNo ratings yet

- Assignment 2Document5 pagesAssignment 2Ahmad SaleemNo ratings yet

- 5 Year Financial Plan ManufacturingDocument30 pages5 Year Financial Plan ManufacturingLiza GeorgeNo ratings yet

- Presentation 1Document13 pagesPresentation 1Kaleab TadesseNo ratings yet

- Colgate Ratio Analysis SolvedDocument7 pagesColgate Ratio Analysis SolvedKavitha RagupathyNo ratings yet

- Annual and Sustainability ReportDocument94 pagesAnnual and Sustainability Reportvisutsi100% (1)

- Kezi Juice Company FinancialsDocument3 pagesKezi Juice Company FinancialsTendai SixpenceNo ratings yet

- Under Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Document14 pagesUnder Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Iqbal YusufNo ratings yet

- Current Assets: Liabilities and Stockholders' EquityDocument9 pagesCurrent Assets: Liabilities and Stockholders' EquityIrakli SaliaNo ratings yet

- Financial Analysis of Ebay IncDocument8 pagesFinancial Analysis of Ebay Incshepherd junior masasiNo ratings yet

- Instruksi: Baca Cara Penggunaan Software Secara SeksamaDocument24 pagesInstruksi: Baca Cara Penggunaan Software Secara SeksamaditaNo ratings yet

- RUNNING HEAD: Nestle Internal Analysis 0Document7 pagesRUNNING HEAD: Nestle Internal Analysis 0VânAnhNo ratings yet

- Financial Plan:: The Following Sections Will Outline Important Financial InformationDocument17 pagesFinancial Plan:: The Following Sections Will Outline Important Financial InformationpalwashaNo ratings yet

- Variance Analysis: Assignment Line ItemDocument18 pagesVariance Analysis: Assignment Line Itemfatima khurramNo ratings yet

- Financial Plan: 7.1 Important AssumptionsDocument21 pagesFinancial Plan: 7.1 Important Assumptionsaira eau claire orbeNo ratings yet

- Sample Financial PlanDocument12 pagesSample Financial PlanSneha KhuranaNo ratings yet

- Financial PlanDocument5 pagesFinancial PlanVivian CorpuzNo ratings yet

- Cuarto Trimestre Del 2019Document17 pagesCuarto Trimestre Del 2019CINDY NAOMI APAZA LAYMENo ratings yet

- Problems 1 and 2: Balance Sheet 2015Document11 pagesProblems 1 and 2: Balance Sheet 2015Mohamed Al-aNo ratings yet

- Order #440942254Document9 pagesOrder #440942254David ComeyNo ratings yet

- Financial Plan: 7.1 Break-Even AnalysisDocument41 pagesFinancial Plan: 7.1 Break-Even AnalysisnahidasumbalsundasNo ratings yet

- Homework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Document3 pagesHomework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Caroline OktavianiNo ratings yet

- Analisis Rasio P14-2Document4 pagesAnalisis Rasio P14-2Yoga Arif PratamaNo ratings yet

- January Meeting InfoDocument7 pagesJanuary Meeting InfoBrendaBrowningNo ratings yet

- BMK1Document161 pagesBMK1sagni desalegnNo ratings yet

- Group 4 OL-groupproject Mar 26Document19 pagesGroup 4 OL-groupproject Mar 26Jessica HummelNo ratings yet

- SPGlobal InternationalBusinessMachinesCorporation KeyStats 13-May-2024Document7 pagesSPGlobal InternationalBusinessMachinesCorporation KeyStats 13-May-2024g00091714No ratings yet

- Quarterly Financial Report: Q4 Expenditure / Obligated Funds Level Estimated Next Quarter Exp. / Obligated Funds BalanceDocument5 pagesQuarterly Financial Report: Q4 Expenditure / Obligated Funds Level Estimated Next Quarter Exp. / Obligated Funds BalancetommyNo ratings yet

- Business Plan TemplateDocument10 pagesBusiness Plan Templateakinade busayoNo ratings yet

- Managerial Accounting - BADM 2010 F18 Assignment 6 Chapter 11Document4 pagesManagerial Accounting - BADM 2010 F18 Assignment 6 Chapter 11Judy1928No ratings yet

- Business DescriptionDocument8 pagesBusiness DescriptionPreacher Of IslamNo ratings yet

- SampleFinancialModel 5 Years Long VersionDocument56 pagesSampleFinancialModel 5 Years Long Versionadamnish8812No ratings yet

- Assignement 5Document4 pagesAssignement 5Valentin Florin Drezaliu100% (1)

- Menahga FY25 Budget All FundsDocument8 pagesMenahga FY25 Budget All FundsShannon GeisenNo ratings yet

- Case 1 Format IdeaDocument5 pagesCase 1 Format IdeaMarina StraderNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- OECD Publishes Model Rules For Tax Reporting by Gig Economy Platform OperatorsDocument2 pagesOECD Publishes Model Rules For Tax Reporting by Gig Economy Platform OperatorsRachit SethNo ratings yet

- Indicators of Economic GrowthDocument20 pagesIndicators of Economic Growthchad23No ratings yet

- Free Critical Thinking Test Inferences QuestionsDocument9 pagesFree Critical Thinking Test Inferences QuestionsJosiah MwashitaNo ratings yet

- PSA ACCOUNTS - MR Desmond AboagyeDocument17 pagesPSA ACCOUNTS - MR Desmond AboagyeGen AbulkhairNo ratings yet

- Sri Mahila Griha Udyog Lijjat Papad: Strategic Management CourseDocument23 pagesSri Mahila Griha Udyog Lijjat Papad: Strategic Management CoursePrachit ChaturvediNo ratings yet

- This Is Why Italy Is DyingDocument9 pagesThis Is Why Italy Is Dyingjorameugenio.eduNo ratings yet

- Tara ProjectDocument9 pagesTara ProjectALEX D LOPEZ RNo ratings yet

- Orders - Kite User ManualDocument18 pagesOrders - Kite User ManualHaseebNo ratings yet

- What Is UnemploymentDocument18 pagesWhat Is UnemploymentHarendra TeotiaNo ratings yet

- Steps To Pass Dangote Group Interview Questions - Graduate Job PortalDocument14 pagesSteps To Pass Dangote Group Interview Questions - Graduate Job PortalWaleed AlzoudNo ratings yet

- 2020-02-29 IFR Asia - UnknownDocument42 pages2020-02-29 IFR Asia - UnknownqbichNo ratings yet

- Economics Commentary (Macro - Economics)Document4 pagesEconomics Commentary (Macro - Economics)ariaNo ratings yet

- 07 Dublin - SligoDocument6 pages07 Dublin - SligoLouise GalliganNo ratings yet

- Tenaris Hydril TN70 BlueDocument1 pageTenaris Hydril TN70 BlueJorge GrijalvaNo ratings yet

- African Tabata Secondary SchoolDocument2 pagesAfrican Tabata Secondary SchoolOmmh ArriyNo ratings yet

- Day 11 - IELTS WritingDocument12 pagesDay 11 - IELTS WritingELSA SHABRINA QAMARANINo ratings yet

- Iron Ore Price HistoryDocument12 pagesIron Ore Price HistoryPhilalaNo ratings yet

- Previous 2020-2021Document26 pagesPrevious 2020-2021syedsajjadaliNo ratings yet

- Ing-5°-Ib-W1-Session 1Document33 pagesIng-5°-Ib-W1-Session 1Mya Nicole Armestar RamosNo ratings yet

- 2020.Q3 Goehring & Rozencwajg Market CommentaryDocument33 pages2020.Q3 Goehring & Rozencwajg Market Commentarygenid.ssNo ratings yet

- Trading in BinanceDocument11 pagesTrading in BinancededithegamingNo ratings yet

- TA Global Technology Fund - July 2020Document3 pagesTA Global Technology Fund - July 2020mulder95No ratings yet

- 05-KP - Analisis Cost and Effectivity Program Kartu Prakerja Di IndonesiaDocument22 pages05-KP - Analisis Cost and Effectivity Program Kartu Prakerja Di IndonesiaAz-Zahra Raudya RamadhaniNo ratings yet

- JKUAT Admission Letter Fri-Aug-2023Document2 pagesJKUAT Admission Letter Fri-Aug-2023obura.abingoNo ratings yet

- Selected Answer: Tru e Correct Answer: Tru E: 2 Out of 2 PointsDocument24 pagesSelected Answer: Tru e Correct Answer: Tru E: 2 Out of 2 PointsKesarapu Venkata ApparaoNo ratings yet

- Chapter 1: Introduction of The Project: (A) UBLDocument6 pagesChapter 1: Introduction of The Project: (A) UBLRamzanNo ratings yet

- Engineering Economics McqsDocument26 pagesEngineering Economics McqsMr. CoolNo ratings yet

- Rural Marketing: Opportunities, Challenges & StrategiesDocument4 pagesRural Marketing: Opportunities, Challenges & StrategiesRajaRajeswari.LNo ratings yet

- RThe Impact of The War in Northern Ethiopia On Micro Small and Medium Sized Enterprises MSMEs and Marginal Economic Actors MEAspdfDocument17 pagesRThe Impact of The War in Northern Ethiopia On Micro Small and Medium Sized Enterprises MSMEs and Marginal Economic Actors MEAspdfnani100% (1)

Company Financial Health Analysis

Company Financial Health Analysis

Uploaded by

Syarif SurbaktiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Company Financial Health Analysis

Company Financial Health Analysis

Uploaded by

Syarif SurbaktiCopyright:

Available Formats

Nonprofit Financial Health Analysis: SAMPLE

Organization Name: Example Nonprofit, Inc.

End of Current Fiscal Year: 12/31/2016

1. Three Years 2. Two Years 3. Last Year 4. Current Year

Ago Ago (Actuals) (Budget)

Fiscal Year Ending: 12/31/2013 12/31/2014 12/31/2015 12/31/2016

Did your organization have an operating surplus or deficit?

Statement of Activities

Unrestricted Revenue & Support $1,211,710 $1,219,603 $1,252,965 $1,300,500

Less:

Total Expenses

$1,428,868 $1,372,447 $1,189,573 $1,200,750

Change in Unrestricted Net Assets or “Operating Surplus or (Deficit)” ($217,158) ($152,844) $63,392 $99,750

What was the mix of unrestricted revenue? (use only unrestricted in calculations)

Individual Contributions Revenue $100,500 $98,759 $85,469 $91,000

Individual Contributions Revenue

Individual Contributions Revenue % Total Revenue 8% 8% 7% 7%

Foundation/Corporate Revenue $326,982 $323,930 $362,647 $375,500

Plus:

Satisfaction of Restrictions

$120,000 $110,000 $98,000 $135,000

Statement of Activities

Foundation/Corporate Revenue

Foundation/Corporate Revenue % Total Revenue 37% 36% 37% 39%

Government Funding $559,700 $592,450 $592,390 $600,000

Government Funding

Government Funding % Total Revenue 46% 49% 47% 46%

Earned Income $88,578 $79,529 $90,895 $82,908

Earned Income

Earned Income % Total Revenue 7% 7% 7% 6%

Other Income (self calculating ) $15,950 $14,935 $23,564 $16,092

Other Income

Other Income % Total Revenue 1% 1% 2% 1%

How are resources allocated across programs and supporting services?

Total Program Expense

Statement of Functional Expenses

$1,129,323 $1,087,430 $985,614 $950,650

Program Expenses

Program Expense % Total Expenses 79% 79% 83% 79%

Total Management & General Expense $128,765 $118,058 $115,894 $115,850

Management & General Expenses

Management & General Expense % Total Expenses 9% 9% 10% 10%

Total Fundraising Expense $170,780 $166,959 $88,065 $134,250

Fundraising Expenses

Fundraising Expense % Total Expenses 12% 12% 7% 11%

How liquid are the organization’s reserves?

Unrestricted Net Assets (A) $114,417 $30,000 $24,965

Board Designated Net Assets (B) $0 $0 $0

Balance Sheet

Fixed Assets, net of depreciation $64,393 $39,393 $14,393

Less:

Mortgages or other debt associated with fixed assets

$0 $0 $0

Fixed Assets, net of related debt (C) $64,393 $39,393 $14,393

LUNA: Liquid Unrestricted Net Assets (A‐B‐C) $50,024 ($9,393) $10,572

Nonprofit Financial Health Analysis: SAMPLE

Organization Name: Example Nonprofit, Inc.

End of Current Fiscal Year: 12/31/2016

1. Three Years 2. Two Years 3. Last Year 4. Current Year

Ago Ago (Actuals) (Budget)

Fiscal Year Ending: 12/31/2013 12/31/2014 12/31/2015 12/31/2016

How many months of operations can be covered with liquid operating reserves?

Available LUNA from above calcuation $50,024 ($9,393) $10,572

Income Statement & Balance Sheet

Divided by Average Monthly Expenses:

Total Annual Expenses ÷ 12

$119,072 $114,371 $99,131

Months Covered by Liquid Reserves 0.4 (0.1) 0.1

How many months of operations can be covered with the available cash?

Cash & Cash Equivalents $297,389 $274,139 $256,781

Divided by Average Monthly Expenses:

Total Annual Expenses ÷ 12

$119,072 $114,371 $99,131

Months of Cash on Hand 2.5 2.4 2.6

Additional Resources

Balance Sheet

Board Designated Net Assets (aka Board Designated Reserves) $235,843 $578,346 $456,246

Temporarily Restricted Net Assets $210,000 $190,763 $165,900

Permanently Restricted Net Assets $100,000 $100,000 $100,000

© 2016 Fiscal Management Associates, LLC. All rights reserved. www.fmaonline.net

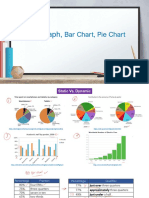

Operating Results

Operating Surplus (Deficit) Operating Revenue Mix Functional Expense Mix

$1,600,000 100%

100%

90% 90%

$1,400,000

80% Individual Contributions 80%

$1,200,000

Unrestricted Revenue & Revenue 70%

70%

$1,000,000 Support Foundation/Corporate 60%

60%

Revenue 50%

$800,000

Total Expenses 50% 40%

Government Funding

$600,000 30%

40%

$400,000 30% Earned Income 20%

Change in Unrestricted Net 10%

$200,000 Assets or “Operating 20%

Other Income 0%

Surplus or (Deficit)”

$0 10% Dec‐13 Dec‐14 Dec‐15 Dec‐16

($200,000) 0%

Dec‐13 Dec‐14 Dec‐15 Dec‐16 Total Program Expense Total Management & General Expense

Dec‐13 Dec‐14 Dec‐15 Dec‐16

($400,000) Total Fundraising Expense

Net Assets Cash on Hand

LUNA Balance Months of LUNA Cash Balance

$60,000 0.5 $350,000

$50,024 $297,389

$50,000 0.4

0.4

$300,000

$274,139

$256,781

$40,000

0.3 $250,000

$30,000

0.2 $200,000

$20,000

$10,572 0.1 0.1 $150,000

$10,000

$0 0 0

0.0 $100,000

$100 000

Dec‐13 Dec‐14 Dec‐15 Dec‐13 Dec‐14 Dec‐15

($10,000) (0.1) (0.1) $50,000

($9,393)

($20,000) (0.2) $0

Dec‐13 Dec‐14 Dec‐15

Net Assets, Including Temp. & Perm. Restricted Board Designated Net Assets Months of Cash on Hand

$700,000 3.0

$450,000

2.6

$400,000 2.5

$600,000 $578,346 2.4

2.5

$350,000

$300,000 $500,000 $456,246

2.0

$250,000

$200,000 $400,000

1.5

$150,000

$300,000

$100,000 $235,843

1.0

$50,000 $200,000

$0

0.5

Dec‐13 Dec‐14 Dec‐15 $100,000

Permanently Restricted Net Assets Temporarily Restricted Net Assets

$0 0.0

Unrestricted Net Assets (A) Dec‐13 Dec‐14 Dec‐15 Dec‐13 Dec‐14 Dec‐15

You might also like

- CFI - FMVA Practice Exam Case Study ADocument18 pagesCFI - FMVA Practice Exam Case Study AWerfelli MaramNo ratings yet

- CFI FMVA Final Assessment Case Study 1ADocument12 pagesCFI FMVA Final Assessment Case Study 1Apadre pio kone100% (1)

- Chapter 3 Problem 9: R&E Supplies Facts and Assumptions ($ Thousands) Actual Forecast Forecast 2017 2018 2019Document5 pagesChapter 3 Problem 9: R&E Supplies Facts and Assumptions ($ Thousands) Actual Forecast Forecast 2017 2018 2019阮幸碧No ratings yet

- Cases in Finance 3rd Edition Demello Solutions ManualDocument11 pagesCases in Finance 3rd Edition Demello Solutions ManualJanice Kahalehoe100% (41)

- Harvard Case Study - Flash Inc - AllDocument40 pagesHarvard Case Study - Flash Inc - All竹本口木子100% (1)

- Chapter 9. CH 09-10 Build A Model: Growth SalesDocument6 pagesChapter 9. CH 09-10 Build A Model: Growth SalesMatt SlowickNo ratings yet

- Mid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121Document10 pagesMid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121rabab balochNo ratings yet

- NEW TUTORIAL INSTALMENT PURCHASES - AnsSchemeDocument7 pagesNEW TUTORIAL INSTALMENT PURCHASES - AnsSchemeDiana Yunus DianaNo ratings yet

- Anthem IncDocument28 pagesAnthem IncHans WeirlNo ratings yet

- Q3 2022 Earnings Release SnowDocument14 pagesQ3 2022 Earnings Release SnowCode BeretNo ratings yet

- Presented To:-: Ms. Khushboo SherwaniDocument19 pagesPresented To:-: Ms. Khushboo SherwaniArchit Goel100% (1)

- MBA 640 - Week 4 - Final Project Milestone OneDocument3 pagesMBA 640 - Week 4 - Final Project Milestone Onewilhelmina baxterNo ratings yet

- Business AccountingDocument14 pagesBusiness AccountingLoguNo ratings yet

- YHOO Q409EarningsPresentation FinalDocument22 pagesYHOO Q409EarningsPresentation Finalhblodget6728No ratings yet

- NETFLIX 17-21-Website-FinacialsDocument6 pagesNETFLIX 17-21-Website-FinacialsGreta RiveraNo ratings yet

- Financial Forecast, AFNDocument3 pagesFinancial Forecast, AFNayesha akhtarNo ratings yet

- Steinberg Alexandra 4536 A3Document136 pagesSteinberg Alexandra 4536 A3Yong RenNo ratings yet

- Finance Final Pitch General ElectricDocument8 pagesFinance Final Pitch General Electricbquinn08No ratings yet

- Income StatementDocument7 pagesIncome StatementaffrinahNo ratings yet

- Proj FinanceDocument24 pagesProj FinanceninaNo ratings yet

- Menahga FY24 Revised Budget All FundsDocument8 pagesMenahga FY24 Revised Budget All FundsShannon GeisenNo ratings yet

- Annual Report 2018Document7 pagesAnnual Report 2018Anika RieweNo ratings yet

- YHOO Q110EarningsPresentation FinalDocument23 pagesYHOO Q110EarningsPresentation Finalhblodget6728No ratings yet

- Financial Statement Analysis Problems Overview - TemplateDocument11 pagesFinancial Statement Analysis Problems Overview - Templatewushuyouqi1116No ratings yet

- Micro Shots 2010Document158 pagesMicro Shots 2010Arifin MasruriNo ratings yet

- Assignment 2Document5 pagesAssignment 2Ahmad SaleemNo ratings yet

- 5 Year Financial Plan ManufacturingDocument30 pages5 Year Financial Plan ManufacturingLiza GeorgeNo ratings yet

- Presentation 1Document13 pagesPresentation 1Kaleab TadesseNo ratings yet

- Colgate Ratio Analysis SolvedDocument7 pagesColgate Ratio Analysis SolvedKavitha RagupathyNo ratings yet

- Annual and Sustainability ReportDocument94 pagesAnnual and Sustainability Reportvisutsi100% (1)

- Kezi Juice Company FinancialsDocument3 pagesKezi Juice Company FinancialsTendai SixpenceNo ratings yet

- Under Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Document14 pagesUnder Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Iqbal YusufNo ratings yet

- Current Assets: Liabilities and Stockholders' EquityDocument9 pagesCurrent Assets: Liabilities and Stockholders' EquityIrakli SaliaNo ratings yet

- Financial Analysis of Ebay IncDocument8 pagesFinancial Analysis of Ebay Incshepherd junior masasiNo ratings yet

- Instruksi: Baca Cara Penggunaan Software Secara SeksamaDocument24 pagesInstruksi: Baca Cara Penggunaan Software Secara SeksamaditaNo ratings yet

- RUNNING HEAD: Nestle Internal Analysis 0Document7 pagesRUNNING HEAD: Nestle Internal Analysis 0VânAnhNo ratings yet

- Financial Plan:: The Following Sections Will Outline Important Financial InformationDocument17 pagesFinancial Plan:: The Following Sections Will Outline Important Financial InformationpalwashaNo ratings yet

- Variance Analysis: Assignment Line ItemDocument18 pagesVariance Analysis: Assignment Line Itemfatima khurramNo ratings yet

- Financial Plan: 7.1 Important AssumptionsDocument21 pagesFinancial Plan: 7.1 Important Assumptionsaira eau claire orbeNo ratings yet

- Sample Financial PlanDocument12 pagesSample Financial PlanSneha KhuranaNo ratings yet

- Financial PlanDocument5 pagesFinancial PlanVivian CorpuzNo ratings yet

- Cuarto Trimestre Del 2019Document17 pagesCuarto Trimestre Del 2019CINDY NAOMI APAZA LAYMENo ratings yet

- Problems 1 and 2: Balance Sheet 2015Document11 pagesProblems 1 and 2: Balance Sheet 2015Mohamed Al-aNo ratings yet

- Order #440942254Document9 pagesOrder #440942254David ComeyNo ratings yet

- Financial Plan: 7.1 Break-Even AnalysisDocument41 pagesFinancial Plan: 7.1 Break-Even AnalysisnahidasumbalsundasNo ratings yet

- Homework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Document3 pagesHomework Session 1 Caroline Oktaviani - 01619190059 Exercise 1.1Caroline OktavianiNo ratings yet

- Analisis Rasio P14-2Document4 pagesAnalisis Rasio P14-2Yoga Arif PratamaNo ratings yet

- January Meeting InfoDocument7 pagesJanuary Meeting InfoBrendaBrowningNo ratings yet

- BMK1Document161 pagesBMK1sagni desalegnNo ratings yet

- Group 4 OL-groupproject Mar 26Document19 pagesGroup 4 OL-groupproject Mar 26Jessica HummelNo ratings yet

- SPGlobal InternationalBusinessMachinesCorporation KeyStats 13-May-2024Document7 pagesSPGlobal InternationalBusinessMachinesCorporation KeyStats 13-May-2024g00091714No ratings yet

- Quarterly Financial Report: Q4 Expenditure / Obligated Funds Level Estimated Next Quarter Exp. / Obligated Funds BalanceDocument5 pagesQuarterly Financial Report: Q4 Expenditure / Obligated Funds Level Estimated Next Quarter Exp. / Obligated Funds BalancetommyNo ratings yet

- Business Plan TemplateDocument10 pagesBusiness Plan Templateakinade busayoNo ratings yet

- Managerial Accounting - BADM 2010 F18 Assignment 6 Chapter 11Document4 pagesManagerial Accounting - BADM 2010 F18 Assignment 6 Chapter 11Judy1928No ratings yet

- Business DescriptionDocument8 pagesBusiness DescriptionPreacher Of IslamNo ratings yet

- SampleFinancialModel 5 Years Long VersionDocument56 pagesSampleFinancialModel 5 Years Long Versionadamnish8812No ratings yet

- Assignement 5Document4 pagesAssignement 5Valentin Florin Drezaliu100% (1)

- Menahga FY25 Budget All FundsDocument8 pagesMenahga FY25 Budget All FundsShannon GeisenNo ratings yet

- Case 1 Format IdeaDocument5 pagesCase 1 Format IdeaMarina StraderNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- OECD Publishes Model Rules For Tax Reporting by Gig Economy Platform OperatorsDocument2 pagesOECD Publishes Model Rules For Tax Reporting by Gig Economy Platform OperatorsRachit SethNo ratings yet

- Indicators of Economic GrowthDocument20 pagesIndicators of Economic Growthchad23No ratings yet

- Free Critical Thinking Test Inferences QuestionsDocument9 pagesFree Critical Thinking Test Inferences QuestionsJosiah MwashitaNo ratings yet

- PSA ACCOUNTS - MR Desmond AboagyeDocument17 pagesPSA ACCOUNTS - MR Desmond AboagyeGen AbulkhairNo ratings yet

- Sri Mahila Griha Udyog Lijjat Papad: Strategic Management CourseDocument23 pagesSri Mahila Griha Udyog Lijjat Papad: Strategic Management CoursePrachit ChaturvediNo ratings yet

- This Is Why Italy Is DyingDocument9 pagesThis Is Why Italy Is Dyingjorameugenio.eduNo ratings yet

- Tara ProjectDocument9 pagesTara ProjectALEX D LOPEZ RNo ratings yet

- Orders - Kite User ManualDocument18 pagesOrders - Kite User ManualHaseebNo ratings yet

- What Is UnemploymentDocument18 pagesWhat Is UnemploymentHarendra TeotiaNo ratings yet

- Steps To Pass Dangote Group Interview Questions - Graduate Job PortalDocument14 pagesSteps To Pass Dangote Group Interview Questions - Graduate Job PortalWaleed AlzoudNo ratings yet

- 2020-02-29 IFR Asia - UnknownDocument42 pages2020-02-29 IFR Asia - UnknownqbichNo ratings yet

- Economics Commentary (Macro - Economics)Document4 pagesEconomics Commentary (Macro - Economics)ariaNo ratings yet

- 07 Dublin - SligoDocument6 pages07 Dublin - SligoLouise GalliganNo ratings yet

- Tenaris Hydril TN70 BlueDocument1 pageTenaris Hydril TN70 BlueJorge GrijalvaNo ratings yet

- African Tabata Secondary SchoolDocument2 pagesAfrican Tabata Secondary SchoolOmmh ArriyNo ratings yet

- Day 11 - IELTS WritingDocument12 pagesDay 11 - IELTS WritingELSA SHABRINA QAMARANINo ratings yet

- Iron Ore Price HistoryDocument12 pagesIron Ore Price HistoryPhilalaNo ratings yet

- Previous 2020-2021Document26 pagesPrevious 2020-2021syedsajjadaliNo ratings yet

- Ing-5°-Ib-W1-Session 1Document33 pagesIng-5°-Ib-W1-Session 1Mya Nicole Armestar RamosNo ratings yet

- 2020.Q3 Goehring & Rozencwajg Market CommentaryDocument33 pages2020.Q3 Goehring & Rozencwajg Market Commentarygenid.ssNo ratings yet

- Trading in BinanceDocument11 pagesTrading in BinancededithegamingNo ratings yet

- TA Global Technology Fund - July 2020Document3 pagesTA Global Technology Fund - July 2020mulder95No ratings yet

- 05-KP - Analisis Cost and Effectivity Program Kartu Prakerja Di IndonesiaDocument22 pages05-KP - Analisis Cost and Effectivity Program Kartu Prakerja Di IndonesiaAz-Zahra Raudya RamadhaniNo ratings yet

- JKUAT Admission Letter Fri-Aug-2023Document2 pagesJKUAT Admission Letter Fri-Aug-2023obura.abingoNo ratings yet

- Selected Answer: Tru e Correct Answer: Tru E: 2 Out of 2 PointsDocument24 pagesSelected Answer: Tru e Correct Answer: Tru E: 2 Out of 2 PointsKesarapu Venkata ApparaoNo ratings yet

- Chapter 1: Introduction of The Project: (A) UBLDocument6 pagesChapter 1: Introduction of The Project: (A) UBLRamzanNo ratings yet

- Engineering Economics McqsDocument26 pagesEngineering Economics McqsMr. CoolNo ratings yet

- Rural Marketing: Opportunities, Challenges & StrategiesDocument4 pagesRural Marketing: Opportunities, Challenges & StrategiesRajaRajeswari.LNo ratings yet

- RThe Impact of The War in Northern Ethiopia On Micro Small and Medium Sized Enterprises MSMEs and Marginal Economic Actors MEAspdfDocument17 pagesRThe Impact of The War in Northern Ethiopia On Micro Small and Medium Sized Enterprises MSMEs and Marginal Economic Actors MEAspdfnani100% (1)