Professional Documents

Culture Documents

The Game of Investing (Handbook)

The Game of Investing (Handbook)

Uploaded by

brianvo1901Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Game of Investing (Handbook)

The Game of Investing (Handbook)

Uploaded by

brianvo1901Copyright:

Available Formats

THE REAL INVESTING COURSE // THE GAME OF INVESTING PAGE: 1 // 4

PART ONE: THE GAME OF INVESTING

TAKEAWAYS

This is a quick summary of the entire module, highlighting the core concepts, ideas, and principles.

If you ever need to refer back to a specific point, this is where you should start.

1. THE GAME

a. Markets are hard to quantify. Investing isn’t an exact science like physics. There are

rarely any formulas that tell you the right thing to do.

i. You need to find the answers applicable to you and develop your own investing style

and process.

b. Markets are constantly changing. What matters today will change at some point without

any notice, which might affect your portfolio.

i. You need to be mindful of such changes and build a portfolio that incorporates them.

c. The market doesn’t have a start or an endpoint. Each investor decides when to play and

for how long.

i. You need to proactively manage your portfolio to control risk.

d. The market is indifferent to what happens because it’s not a person with feelings. Try not

to take the game too personally, and instead use your emotions as valuable insights.

i. Avoid trying to prove a point or to be right and teach the market a lesson. Focus on positive

returns, not on being right.

ii. Emotions are not the enemy and can be a valuable source of information about ourselves.

Emotional choices and behavior are what we definitely want to prevent.

PAGE: 2 // 4 THE REAL INVESTING COURSE // THE GAME OF INVESTING

2. YOUR GAME

a. Investors need to understand who they are and what their goals are.

i. Self-awareness around who you are as an investor will help you make investment decisions

that fit with your goals and lifestyle.

b. Some of the important variables to determine an appropriate investing style are: motivation

for investing, preferred time horizon, asset classes, markets, instruments, and risk tolerance.

i. Finding the answers to those questions will narrow down the investments you should be

making (based on your preferences).

c. To be a better investor, you also need to look outside of the realm of markets and improve

your mental game.

i. A holistic approach to investing also means focusing on your physical and mental health

and relationships. Neglecting any of these will likely at some point result in poor investing.

3. IDEA GENERATION

a. If you want to become a better investor, you will have to take ownership of your investments

and constantly apply judgment to the ideas you generate from other sources.

b. Learn how to leverage social media to generate ideas and meet new and

interesting people.

c. Traditional media is a lagging indicator most of the time. Be mindful when using for your

research process.

d. Most information is noise. There is always more of it. Be specific about what you need to

know to make a certain investment.

e. Many investments need a catalyst to make them move in your direction. Something being

cheap or expensive is not a catalyst.

THE REAL INVESTING COURSE // THE GAME OF INVESTING PAGE: 3 // 4

PAGE: 4 // 4 THE REAL INVESTING COURSE // THE GAME OF INVESTING

You might also like

- The Advanced Day Trading Guide: Learn Secret Step by Step Strategies on How You Can Day Trade Forex, Options, Stocks, and Futures to Become a Successful Day Trader for a Living!From EverandThe Advanced Day Trading Guide: Learn Secret Step by Step Strategies on How You Can Day Trade Forex, Options, Stocks, and Futures to Become a Successful Day Trader for a Living!Rating: 4.5 out of 5 stars4.5/5 (9)

- Soalan Tugasan Jan 2023Document19 pagesSoalan Tugasan Jan 2023NURUL AIN BINTI RAPIAN STUDENTNo ratings yet

- Multi-Asset Investing: A practical guide to modern portfolio managementFrom EverandMulti-Asset Investing: A practical guide to modern portfolio managementRating: 3 out of 5 stars3/5 (4)

- Info Fivesstein Missing: TrackballDocument2 pagesInfo Fivesstein Missing: TrackballSaurabh BhandariNo ratings yet

- Cashflow Quadrant by Robert KiyosakiDocument25 pagesCashflow Quadrant by Robert Kiyosakishriyaloves_55586196No ratings yet

- Stock Market For Beginners Book: Stock Market Basics Explained for Beginners Investing in the Stock MarketFrom EverandStock Market For Beginners Book: Stock Market Basics Explained for Beginners Investing in the Stock MarketRating: 4 out of 5 stars4/5 (12)

- Vinod Pottayil - What Every Indian Should Know Before Investing - Edition 2017-Imagine Books Pvt. Ltd. (2017)Document321 pagesVinod Pottayil - What Every Indian Should Know Before Investing - Edition 2017-Imagine Books Pvt. Ltd. (2017)Navya Sree Tirunagari100% (1)

- A Persuasive Speech On Limiting The Production and Use of PlasticDocument2 pagesA Persuasive Speech On Limiting The Production and Use of PlasticKemberly Semaña Penton100% (1)

- EdelweissMF BookSummary TheEducationofaValueInvestor IDocument4 pagesEdelweissMF BookSummary TheEducationofaValueInvestor IVaishnaviRavipatiNo ratings yet

- Why A Lot of Investors Fail by HiteshPatelDocument2 pagesWhy A Lot of Investors Fail by HiteshPatelfaleela IsmailNo ratings yet

- Full Time TraderDocument7 pagesFull Time TraderVishal ZambareNo ratings yet

- EMF BookSummary VolumeII DigitalDocument34 pagesEMF BookSummary VolumeII DigitalVaishnaviRavipatiNo ratings yet

- Share Trading Investment Lesson 1 NotesDocument8 pagesShare Trading Investment Lesson 1 Notestrisha ramnunanNo ratings yet

- The Busy Person’s Guide to Stock Investing - How to Get Rich in Stock Market Without Reading Financial Report and Technical AnalysisFrom EverandThe Busy Person’s Guide to Stock Investing - How to Get Rich in Stock Market Without Reading Financial Report and Technical AnalysisNo ratings yet

- The Joys of Compounding: Book SummaryDocument3 pagesThe Joys of Compounding: Book SummaryASHISH KANYALNo ratings yet

- Taming the Money Sharks: 8 Super-Easy Stock Investment MaximsFrom EverandTaming the Money Sharks: 8 Super-Easy Stock Investment MaximsNo ratings yet

- Tony Robbins 18082023 045140 PMDocument3 pagesTony Robbins 18082023 045140 PMVaishnaviRavipatiNo ratings yet

- Stock MarketDocument68 pagesStock Marketprem sagarNo ratings yet

- How To Make Money in Value Stocks - First Edition PDFDocument70 pagesHow To Make Money in Value Stocks - First Edition PDFNitin Kumar100% (1)

- School of Indian Stock MarketDocument492 pagesSchool of Indian Stock Marketfris100% (1)

- Investors PerceptionDocument16 pagesInvestors Perceptionsuman v bhatNo ratings yet

- Avoiding Common Investor MistakesDocument2 pagesAvoiding Common Investor MistakesMuhammad KhalifaNo ratings yet

- EdelweissMF ValueInvestingDocument3 pagesEdelweissMF ValueInvestingVaishnaviRavipatiNo ratings yet

- The Five Questions You Must Answer If You Want To Be A Value InvestorDocument15 pagesThe Five Questions You Must Answer If You Want To Be A Value InvestorVenkat YerubandiNo ratings yet

- Issue 02Document23 pagesIssue 02abhishek basakNo ratings yet

- Santos BFN 3101 - B2e - PH1Document2 pagesSantos BFN 3101 - B2e - PH1Mark SantosNo ratings yet

- Unshakable - Tony Robbins (Summary)Document6 pagesUnshakable - Tony Robbins (Summary)Azim Arif HashmiNo ratings yet

- RichdadDocument9 pagesRichdadletmelieiamdhairyaNo ratings yet

- Charlie Munger - The Complete Investor by Tren Griffin - Edelweiss MFDocument4 pagesCharlie Munger - The Complete Investor by Tren Griffin - Edelweiss MFBanderlei SilvaNo ratings yet

- Ch01 - OverviewDocument48 pagesCh01 - Overviewledinhnhan119No ratings yet

- Growth Investing - Finding The P - Philip SaglimbeniDocument55 pagesGrowth Investing - Finding The P - Philip SaglimbeniNarendra SavanagiriNo ratings yet

- Tony Robbins Money QuotesDocument21 pagesTony Robbins Money QuotesSpanu AlexNo ratings yet

- The Bhfs Way: Investment Advising From The Psychological PerspectiveDocument4 pagesThe Bhfs Way: Investment Advising From The Psychological Perspectivesatish sNo ratings yet

- Top Tips For Choosing InvestmentsDocument6 pagesTop Tips For Choosing InvestmentsBey Bi NingNo ratings yet

- Beginner Mistakes: How To Avoid ThemDocument8 pagesBeginner Mistakes: How To Avoid Themambasyapare1No ratings yet

- Business Finance LM5Document13 pagesBusiness Finance LM5Joana RoseteNo ratings yet

- The Only Guide to a Winning Bond Strategy You'll Ever Need: The Way Smart Money Preserves Wealth TodayFrom EverandThe Only Guide to a Winning Bond Strategy You'll Ever Need: The Way Smart Money Preserves Wealth TodayRating: 4 out of 5 stars4/5 (7)

- Simply Invest: Naked Truths to Grow Your MoneyFrom EverandSimply Invest: Naked Truths to Grow Your MoneyRating: 5 out of 5 stars5/5 (1)

- RD pdf49-8 Proven Investing Secrets 1023Document9 pagesRD pdf49-8 Proven Investing Secrets 1023belmort28No ratings yet

- Submitted To:: Sir Umar UsmanDocument8 pagesSubmitted To:: Sir Umar UsmanhamzaNo ratings yet

- Submitted To:: Sir Umar UsmanDocument8 pagesSubmitted To:: Sir Umar UsmanHumza BariNo ratings yet

- Abhinav Anirudhan - MBA - Finance - A54Document8 pagesAbhinav Anirudhan - MBA - Finance - A54Abhinav AnirudhanNo ratings yet

- If You're So Smart, Why Aren't You RichDocument297 pagesIf You're So Smart, Why Aren't You RichRixiuNo ratings yet

- Business Finance Module 5-PagesDocument12 pagesBusiness Finance Module 5-PagesJosie PassolNo ratings yet

- Business SolutionDocument7 pagesBusiness SolutionYogesh PanwarNo ratings yet

- Accounting Theory - W3 - Group1Document5 pagesAccounting Theory - W3 - Group1animecrushNo ratings yet

- Zero Float EntryDocument378 pagesZero Float Entrysandrine perrinNo ratings yet

- 7 Steps To Understanding The Stock Market Ebook v3 PDFDocument40 pages7 Steps To Understanding The Stock Market Ebook v3 PDFRiyasNo ratings yet

- RD Pdf12-Exploring The Top Asset Classes July 2023Document4 pagesRD Pdf12-Exploring The Top Asset Classes July 2023belmort28No ratings yet

- 7 Stock Buying Mistakes and How To Avoid ThemDocument5 pages7 Stock Buying Mistakes and How To Avoid ThemMohammad IskandarNo ratings yet

- Think, Act and Invest Like Warren BuffetDocument4 pagesThink, Act and Invest Like Warren Buffetanandbajaj00% (1)

- Ten Lessons For Investors: Lesson 1: The More Things Change, The More They Stay The SameDocument5 pagesTen Lessons For Investors: Lesson 1: The More Things Change, The More They Stay The Samejann_nittNo ratings yet

- Ten Lessons For Investors: Lesson 1: The More Things Change, The More They Stay The SameDocument5 pagesTen Lessons For Investors: Lesson 1: The More Things Change, The More They Stay The Samejann_nittNo ratings yet

- Entrepreneurship CHAPTER 1Document12 pagesEntrepreneurship CHAPTER 1DanielNo ratings yet

- If You'Re So Smart, Why Aren't You Rich - A Guide To Investing FundamentalsDocument297 pagesIf You'Re So Smart, Why Aren't You Rich - A Guide To Investing Fundamentalsik001100% (3)

- Millionaires Simple Guide to Big Money and Wealth Building For BeginnersFrom EverandMillionaires Simple Guide to Big Money and Wealth Building For BeginnersNo ratings yet

- MBBR Pack - GB - 1.0 - 06-10-2015Document8 pagesMBBR Pack - GB - 1.0 - 06-10-2015SvetlanaNo ratings yet

- FST Cbse Class-X 2022-23 - Term-2 PlannerDocument2 pagesFST Cbse Class-X 2022-23 - Term-2 PlannerAbhinav KrishNo ratings yet

- Lab 06: Arrays & Functions Objective(s) :: ExercisesDocument4 pagesLab 06: Arrays & Functions Objective(s) :: ExercisesAhsan Ali GopangNo ratings yet

- Department of Computer EngineeringDocument79 pagesDepartment of Computer EngineeringTejaswi SuryaNo ratings yet

- Essay Writing PartsDocument14 pagesEssay Writing PartsPAK JANNo ratings yet

- HSE Calendar 2023 - 221230 - 112723Document13 pagesHSE Calendar 2023 - 221230 - 112723Mkd OfficialNo ratings yet

- Northern Lights - 7 Best Places To See The Aurora Borealis in 2022Document15 pagesNorthern Lights - 7 Best Places To See The Aurora Borealis in 2022labendetNo ratings yet

- CORRELATIONDocument17 pagesCORRELATIONrupaliNo ratings yet

- REXNORD Link Belt CatalogoDocument51 pagesREXNORD Link Belt CatalogoALEXANDER FERREIRA ARENASNo ratings yet

- Eng3-Quarter4-Module3 - Hybrid-Approved For PrintingDocument8 pagesEng3-Quarter4-Module3 - Hybrid-Approved For PrintingJohn Benedict CruzNo ratings yet

- Proc No 548 Multimodal TransportDocument19 pagesProc No 548 Multimodal TransportasdfNo ratings yet

- IRFB59N10D - International RectifierDocument11 pagesIRFB59N10D - International RectifierStevenNo ratings yet

- Brushless DC Motor Project in An Introduction To Electrical Engineering Course PDFDocument9 pagesBrushless DC Motor Project in An Introduction To Electrical Engineering Course PDFArturoDellaMadalenaNo ratings yet

- Maaden MSHEM Safety Documents 8Document143 pagesMaaden MSHEM Safety Documents 8ShadifNo ratings yet

- 8057 Speech Topic and Purpose FFDocument2 pages8057 Speech Topic and Purpose FFLaza R.No ratings yet

- Delhi Public School Secunderabad Mahendra Hills/ Nacharam / Nadergul Nursery Log Sheet-March/April 2019-2020Document3 pagesDelhi Public School Secunderabad Mahendra Hills/ Nacharam / Nadergul Nursery Log Sheet-March/April 2019-2020Khushal ChoudharyNo ratings yet

- Arti Kata CourseworkDocument6 pagesArti Kata Courseworkguj0zukyven2100% (2)

- Extraordinary Construction On GermanyDocument1 pageExtraordinary Construction On Germanyzainulmhd867No ratings yet

- Chapter 06Document43 pagesChapter 06benjaminblakkNo ratings yet

- GEP 2 Speaking (Sep 2021 Updated)Document2 pagesGEP 2 Speaking (Sep 2021 Updated)Nguyễn HoàngNo ratings yet

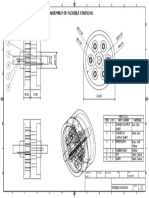

- Flexible Coupling AssemblyDocument1 pageFlexible Coupling AssemblybluebirdNo ratings yet

- This Study Resource Was: and PoliticsDocument5 pagesThis Study Resource Was: and PoliticsMark Kenneth CastilloNo ratings yet

- Assignment: Raihan Rahman ID: 1830006Document4 pagesAssignment: Raihan Rahman ID: 1830006Raihan RahmanNo ratings yet

- Confliect Management - Ogl 220 - ArtifactDocument5 pagesConfliect Management - Ogl 220 - Artifactapi-720145281No ratings yet

- Guidebook For Developing A Zero - or Low-Emissions Roadmap at AirportsDocument107 pagesGuidebook For Developing A Zero - or Low-Emissions Roadmap at AirportsTRUMPET OF GODNo ratings yet

- Unit 1.editedDocument8 pagesUnit 1.editedasia sultanNo ratings yet

- The Effect of Different Heights and Angles of EnerDocument10 pagesThe Effect of Different Heights and Angles of EnersaiNo ratings yet