Professional Documents

Culture Documents

Carteira Dividendos Marco 2021

Carteira Dividendos Marco 2021

Uploaded by

Bruno Yamashita0 ratings0% found this document useful (0 votes)

5 views11 pagesThe document lists the top 30 stocks according to certain criteria. It provides the ticker, name, current yield, payout ratio, valuation metrics, and growth rates for each stock. The portfolio is rebalanced monthly to select the best performing stocks according to the specified criteria.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document lists the top 30 stocks according to certain criteria. It provides the ticker, name, current yield, payout ratio, valuation metrics, and growth rates for each stock. The portfolio is rebalanced monthly to select the best performing stocks according to the specified criteria.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

5 views11 pagesCarteira Dividendos Marco 2021

Carteira Dividendos Marco 2021

Uploaded by

Bruno YamashitaThe document lists the top 30 stocks according to certain criteria. It provides the ticker, name, current yield, payout ratio, valuation metrics, and growth rates for each stock. The portfolio is rebalanced monthly to select the best performing stocks according to the specified criteria.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 11

Carteira recalculada todos os meses.

Selecionamos as 10 melhores de acordo os criterios

Não tem preço máximo nem Margem de Segurança

Sigla Nome VDY atual

WIZS3 WIZ S.A. ON ### 10.7%

TAEE11 TAESA UNT ### 10.5%

TAEE4 TAESA PN ### 10.4%

TAEE3 TAESA ON ### 10.3%

DOHL4 DOHLER PN ### 8.4%

TRPL4 TRAN PAULIST PN ### 7.3%

SULA4 SUL AMERICA PN ### 6.4%

CPFE3 CPFL ENERGIA ON ### 6.2%

SULA11 SUL AMERICA UNT ### 6.1%

TRPL3 TRAN PAULIST ON ### 5.9%

SULA3 SUL AMERICA ON ### 5.4%

CPLE6 COPEL PNB ### 5.3%

BRSR6 BANRISUL PNB ### 5.2%

SAPR4 SANEPAR PN ### 5.1%

CGRA4 GRAZZIOTIN PN ### 5.0%

PSSA3 PORTO SEGURO ON ### 4.9%

CPLE3 COPEL ON ### 4.9%

BRSR3 BANRISUL ON ### 4.8%

SAPR3 SANEPAR ON ### 4.5%

COCE5 COELCE PNA ### 4.2%

EGIE3 ENGIE BRASIL ON ### 4.2%

BEES3 BANESTES ON ### 4.2%

SHUL4 SCHULZ PN ### 4.1%

MRVE3 MRV ON ### 4.0%

B3SA3 B3 ON ### 3.9%

ODPV3 ODONTOPREV ON ### 3.9%

SBSP3 SABESP ON ### 3.7%

BBAS3 BRASIL ON ### 3.7%

CMIG4 CEMIG PN ### 3.1%

ALUP4 ALUPAR PN ### 3.0%

ABEV3 AMBEV S/A ON ### 2.9%

HGTX3 CIA HERING ON ### 2.9%

ALUP11 ALUPAR UNT ### 2.9%

ALUP3 ALUPAR ON ### 2.8%

BBDC4 BRADESCO PN ### 2.8%

EMAE4 EMAE PN ### 2.7%

GRND3 GRENDENE ON ### 2.7%

BBDC3 BRADESCO ON ### 2.7%

MTSA4 METISA PN ### 2.6%

CMIG3 CEMIG ON ### 2.5%

SLCE3 SLC AGRICOLA ON ### 2.4%

MULT3 MULTIPLAN ON ### 2.3%

TRIS3 TRISUL ON ### 2.3%

UNIP6 UNIPAR PNB ### 2.2%

JBSS3 JBS ON ### 2.1%

ITSA4 ITAUSA PN ### 2.0%

CARD3 CSU CARDSYST ON ### 2.0%

SANB4 SANTANDER BR PN ### 2.0%

SANB3 SANTANDER BR ON ### 1.9%

SANB11 SANTANDER BR UNT ### 1.9%

UNIP3 UNIPAR ON ### 1.9%

ITSA3 ITAUSA ON ### 1.9%

POMO3 MARCOPOLO ON ### 1.9%

CSAN3 COSAN ON ### 1.8%

POMO4 MARCOPOLO PN ### 1.8%

SMTO3 SAO MARTINHO ON ### 1.7%

DTEX3 DURATEX ON ### 1.7%

YDUQ3 YDUQS PART ON ### 1.7%

SEER3 SER EDUCA ON ### 1.7%

MDIA3 M.DIASBRANCO ON ### 1.6%

EQTL3 EQUATORIAL ON ### 1.6%

CIEL3 CIELO ON ### 1.6%

LCAM3 LOCAMERICA ON ### 1.6%

FRAS3 FRAS-LE ON ### 1.5%

NEOE3 NEOENERGIA ON ### 1.4%

ITUB3 ITAUUNIBANCO ON ### 1.3%

ITUB4 ITAUUNIBANCO PN ### 1.2%

ENBR3 ENERGIAS BR ON ### 1.1%

ABCB4 ABC BRASIL PN ### 1.0%

EZTC3 EZTEC ON ### 0.9%

BAUH4 EXCELSIOR PN ### 0.9%

LREN3 LOJAS RENNER ON ### 0.9%

PNVL4 DIMED PN ### 0.9%

ENGI4 ENERGISA PN ### 0.8%

PNVL3 DIMED ON ### 0.7%

BPAC5 BTGP BANCO PNA ### 0.7%

TOTS3 TOTVS ON ### 0.7%

IGTA3 IGUATEMI ON ### 0.7%

ENGI11 ENERGISA UNT ### 0.6%

BSLI3 BRB BANCO ON ### 0.6%

RENT3 LOCALIZA ON ### 0.6%

RADL3 RAIADROGASIL ON ### 0.6%

PTBL3 PORTOBELLO ON ### 0.5%

BPAC3 BTGP BANCO ON ### 0.4%

ENGI3 ENERGISA ON ### 0.4%

WEGE3 WEG ON ### 0.3%

SCAR3 SAO CARLOS ON ### 0.2%

VALIDADE DE 01/03/2021 a 26/03/20

Payout atual Critério 2 Critério 3 P/L

49.3% 51.7% 7 4.62

68.7% 68.7% 7 6.53

68.7% 68.7% 7 6.58

68.7% 68.7% 7 6.64

91.3% 65.1% 7 10.87

33.9% 58.2% 7 4.66

34.3% 28.8% 7 5.33

58.1% 37.7% 7 9.30

34.3% 28.8% 7 5.65

33.9% 58.2% 7 5.76

34.3% 28.8% 7 6.39

21.8% 24.7% 7 4.12

36.9% 53.3% 7 7.11

30.7% 35.2% 7 6.01

25.3% 28.2% 7 5.06

41.0% 57.9% 7 8.35

19.8% 22.5% 7 4.05

36.9% 53.3% 7 7.74

27.9% 32.0% 7 6.14

62.4% 46.0% 7 14.73

50.3% 70.1% 7 12.00

28.6% 39.2% 7 6.84

57.9% 38.1% 7 14.19

57.5% 61.7% 7 14.22

115.9% 94.5% 7 29.53

77.6% 65.2% 7 19.97

78.5% 51.2% 7 20.98

23.8% 31.3% 7 6.42

27.3% 36.3% 7 8.95

14.8% 16.4% 7 4.98

55.5% 62.6% 7 18.80

20.4% 40.5% 7 6.91

14.8% 16.4% 7 5.06

14.8% 16.4% 7 5.24

34.3% 48.9% 7 12.33

47.6% 38.6% 7 17.47

56.4% 60.7% 7 20.94

29.3% 43.7% 7 11.04

14.3% 26.6% 7 5.53

27.3% 26.0% 7 10.93

46.3% 46.4% 7 19.26

28.3% 43.2% 7 12.26

23.4% 20.9% 7 10.21

52.6% 30.5% 7 24.47

45.1% 37.2% 7 21.54

23.1% 68.5% 7 11.40

30.0% 35.8% 7 14.79

19.9% 50.5% 7 10.03

18.1% 45.9% 7 9.40

19.0% 48.2% 7 9.97

47.8% 27.8% 7 25.16

23.1% 68.5% 7 12.44

47.0% 56.5% 7 25.26

63.3% 41.1% 7 34.41

47.0% 56.5% 7 26.20

22.2% 26.6% 7 12.82

47.9% 71.6% 7 28.05

60.9% 56.4% 7 35.96

64.6% 85.2% 7 38.64

18.9% 15.9% 7 11.84

9.9% 12.0% 7 6.21

31.0% 63.3% 7 19.95

48.9% 58.5% 7 31.48

77.7% 89.1% 7 53.24

9.6% 22.7% 7 6.83

19.3% 71.4% 7 15.21

19.3% 71.4% 7 16.63

6.9% 21.0% 7 6.38

10.9% 31.4% 7 10.53

17.5% 33.9% 7 18.72

19.1% 17.8% 7 20.94

23.5% 29.7% 7 26.62

40.4% 34.4% 7 46.82

5.8% 29.1% 7 7.03

36.7% 32.0% 7 50.73

16.8% 33.9% 7 24.39

41.8% 55.4% 7 61.48

15.6% 35.3% 7 24.00

5.8% 29.1% 7 8.96

31.5% 29.4% 7 50.86

25.1% 29.0% 7 41.97

50.8% 42.6% 7 91.32

6.0% 54.2% 7 13.10

16.8% 33.9% 7 38.78

5.8% 29.0% 7 16.57

23.4% 38.6% 7 68.37

4.2% 22.9% 7 22.00

021 a 26/03/2021

Cresc Div 3a Cresc Div 5a Preço DPA

2.6% 27.1% 6.26 0.67

22.1% 7.9% 30.55 3.21

19.8% 4.0% 10.26 1.07

35.1% 75.9% 10.35 1.07

39.7% 40.4% 5.04 0.42

31.8% 25.1% 23.90 1.74

50.2% 32.3% 10.39 0.67

102.2% 28.86 1.80

53.2% 36.6% 33.03 2.01

31.8% 25.1% 29.55 1.74

50.2% 32.3% 12.45 0.67

1.5% 27.3% 58.58 3.10

-2.8% -6.1% 12.64 0.66

-2.9% 3.1% 3.96 0.20

10.0% 15.2% 34.23 1.71

12.5% 4.2% 43.59 2.14

1.6% 27.3% 57.50 2.82

-2.8% -6.1% 13.77 0.66

-2.9% 3.1% 4.05 0.18

2.2% 31.7% 50.17 2.12

-7.4% 12.0% 41.15 1.72

5.4% 6.5% 5.02 0.21

66.5% 23.7% 12.89 0.53

8.3% 16.0% 16.82 0.68

67.6% 21.7% 54.30 2.13

-1.3% 3.4% 13.03 0.51

5.4% 30.8% 36.80 1.38

16.0% -6.5% 28.05 1.04

15.6% -9.2% 11.96 0.36

10.4% -9.3% 7.77 0.23

-8.5% -6.7% 14.02 0.41

-35.1% -12.9% 14.90 0.44

10.4% -8.3% 23.69 0.69

10.4% -9.3% 8.17 0.23

-5.0% -1.5% 23.00 0.64

47.8% 53.00 1.44

-22.9% -7.9% 7.11 0.19

-6.7% -2.5% 20.59 0.55

11.3% 6.6% 29.38 0.76

-9.4% 14.61 0.36

-2.3% 49.2% 40.98 0.99

4.3% 1.0% 19.68 0.46

50.3% 27.8% 9.36 0.21

-22.4% 57.7% 56.79 1.22

154.0% 26.4% 25.82 0.54

10.8% 6.9% 9.95 0.20

-5.7% 12.4% 15.00 0.30

19.0% 11.2% 18.81 0.37

19.0% 11.2% 17.62 0.34

19.0% 11.2% 37.39 0.71

-24.7% 54.2% 58.38 1.11

10.8% 7.0% 10.86 0.20

71.3% 2.4% 2.42 0.05

17.2% 17.2% 81.40 1.50

71.3% 2.4% 2.51 0.05

24.8% 22.0% 31.22 0.54

48.0% -3.6% 18.41 0.31

21.6% 9.2% 30.12 0.51

-9.2% 34.2% 12.29 0.21

-6.6% 2.4% 28.63 0.46

40.2% 14.0% 20.10 0.32

-57.4% -32.9% 3.60 0.06

56.6% 36.5% 23.86 0.37

-13.4% 7.9% 11.98 0.17

2.0% 1.2% 16.35 0.23

9.7% 7.8% 23.37 0.30

9.7% 7.8% 25.55 0.30

17.4% 3.5% 18.01 0.19

-47.3% -28.8% 15.36 0.16

-53.9% -15.9% 31.50 0.29

32.6% 13.5% 93.98 0.86

-2.7% 1.8% 36.66 0.32

2.4% 4.8% 17.35 0.15

2.0% -8.7% 6.85 0.06

2.4% 4.8% 18.80 0.14

2.0% 3.1% 28.61 0.20

21.9% -10.9% 31.38 0.21

-15.0% 4.2% 31.55 0.21

2.0% -8.7% 43.67 0.28

2.7% 36.8% 62.98 0.39

13.9% 9.0% 58.00 0.35

1.7% 3.5% 23.23 0.13

-18.6% -32.4% 8.69 0.04

-4.6% 1.9% 45.49 0.20

2.6% -8.4% 16.15 0.06

16.4% 7.7% 78.05 0.27

-61.8% -39.3% 33.08 0.06

Dividendos

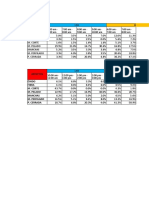

Ativos Preço inicial Preço Final Remuneração Percentual

TAEE11 R$ 30.55 R$ 30.55 0.00% 10%

WIZS3 R$ 6.26 R$ 6.26 0.00% 10%

DOHL4 R$ 5.04 R$ 5.04 0.00% 10%

TRPL4 R$ 23.90 R$ 23.90 0.00% 10%

ITSA4 R$ 9.95 R$ 9.95 0.00% 10%

CPFE3 R$ 28.86 R$ 28.86 0.00% 10%

SULA4 R$ 10.39 R$ 10.39 0.00% 10%

ITUB3 R$ 23.37 R$ 23.37 0.00% 10%

BRSR6 R$ 12.64 R$ 12.64 0.00% 10%

CPLE6 R$ 58.58 R$ 58.58 0.00% 10%

Media Março 2021 0.00%

VALIDADE DE 01/03/2021 a 26/03/2021

Saíram ITUB3 e ITSA4 e Entraram SAPR4 e CGRA4

Essas duas ações que entraram terão seus preços ajustados pela abertura de 01/03/2021

TAEE11 WIZS3 s

WIZS3 TAEE11 s

DOHL4 DOHL4 s

TRPL4 TRPL4 s

ITSA4 SULA4 s

CPFE3 CPFE3 s

SULA4 CPLE6 s

ITUB3 BRSR6 s

BRSR6 SAPR4 n

CPLE6 CGRA4 n

You might also like

- Au Abhi Bank StatementDocument1 pageAu Abhi Bank StatementAjit RawalNo ratings yet

- Loan Agreement Template 03Document2 pagesLoan Agreement Template 03Yusuf WahidNo ratings yet

- Accounting Level 3 Assessment - Cluster 8Document8 pagesAccounting Level 3 Assessment - Cluster 8Stephen PommellsNo ratings yet

- Carteira Dividendos Janeiro 2023 2Document14 pagesCarteira Dividendos Janeiro 2023 2Sabrina Lais de SiqueiraNo ratings yet

- 6102 SRI AbtDocument160 pages6102 SRI AbtMariaIsabelRodriguesNo ratings yet

- Productos ObservadosDocument6 pagesProductos Observadosyeny acosta riosNo ratings yet

- 2-1 Modelo FCDDocument12 pages2-1 Modelo FCDPaolaRamosAlbarracinNo ratings yet

- Laporan Bulanan Hasil Imunisasi Rutin Bayi Puskesmas: BLN September S/D BLN SeptemberDocument9 pagesLaporan Bulanan Hasil Imunisasi Rutin Bayi Puskesmas: BLN September S/D BLN SeptemberajikabasiranNo ratings yet

- Absen PTTDocument43 pagesAbsen PTTAnonymous UvQytd7zNo ratings yet

- Absen PTTDocument43 pagesAbsen PTTAnonymous UvQytd7zNo ratings yet

- Investimentos B F Pit MoneyDocument18 pagesInvestimentos B F Pit MoneyDeyvison GonçalvesNo ratings yet

- Laporan Rotavirus 3Document5 pagesLaporan Rotavirus 3sidaurukrideNo ratings yet

- Preparatory Examination Provincial Results Analysis 2023Document5 pagesPreparatory Examination Provincial Results Analysis 2023Agnes MmathaboNo ratings yet

- 2007 2018 PIT Counts by StateDocument219 pages2007 2018 PIT Counts by StateGus BovaNo ratings yet

- Comisiones Multiproductos.Document3 pagesComisiones Multiproductos.larry.01.laysNo ratings yet

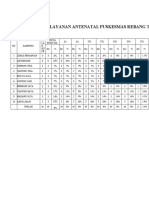

- Analisa Pelayanan Antenatal Puskesmas Rebang Tangkas Tahun 2021Document19 pagesAnalisa Pelayanan Antenatal Puskesmas Rebang Tangkas Tahun 2021sasmita melliNo ratings yet

- Ret 2016 SirDocument36 pagesRet 2016 SirMariaIsabelRodriguesNo ratings yet

- Parametros de Calificacion Y Verificacion: #Cedula Aspirantes Foto Presentacion Firma de La Hoja de VidaDocument3 pagesParametros de Calificacion Y Verificacion: #Cedula Aspirantes Foto Presentacion Firma de La Hoja de VidaJOSE ANDRES PUERTO LOZANONo ratings yet

- PWS ImunisasiDocument8 pagesPWS ImunisasiRosmi AtiNo ratings yet

- X - Modelo FCD (Alumno)Document22 pagesX - Modelo FCD (Alumno)Ariel Fernando Rodriguez OrellanaNo ratings yet

- Copia de Flujo de Caja DescontadoDocument12 pagesCopia de Flujo de Caja DescontadoAndrea Torres EchevarríaNo ratings yet

- November 2018 County UnemploymentDocument4 pagesNovember 2018 County UnemploymentWKYTNo ratings yet

- Sol 3.1 - Flujo de Caja DescontadoDocument12 pagesSol 3.1 - Flujo de Caja DescontadoAndrea Torres EchevarríaNo ratings yet

- Markowitz 2ativosDocument84 pagesMarkowitz 2ativosCarlos RostonNo ratings yet

- Benitez, Jewel Ann Q. Analysis #1Document2 pagesBenitez, Jewel Ann Q. Analysis #1MIKASANo ratings yet

- Nielsen Market Pulse Q3 2016Document8 pagesNielsen Market Pulse Q3 2016K57.CTTT BUI NGUYEN HUONG LYNo ratings yet

- Ativo Preço Nota Tenho % Carteira IdealDocument12 pagesAtivo Preço Nota Tenho % Carteira IdealDeyvison GonçalvesNo ratings yet

- Kpbsalesring - 2023SCYA KPB 4Document3 pagesKpbsalesring - 2023SCYA KPB 4Diaz SatriaNo ratings yet

- Kpbsalesring - 2023SCYA KPB 4Document3 pagesKpbsalesring - 2023SCYA KPB 4Diaz SatriaNo ratings yet

- Kpbsalesring - 2023SCYA KPB 3Document3 pagesKpbsalesring - 2023SCYA KPB 3Diaz SatriaNo ratings yet

- Salinan REVISI Window Dressing CalcDocument148 pagesSalinan REVISI Window Dressing CalcPTPN XIIINo ratings yet

- 2011 Data SheetDocument2 pages2011 Data SheetAlabama PossibleNo ratings yet

- Tiempos Averias 2-DrojassDocument1 pageTiempos Averias 2-DrojassDiego Rojas SeguraNo ratings yet

- Kpbsalesring - 2023SCYA KPB 2Document3 pagesKpbsalesring - 2023SCYA KPB 2Diaz SatriaNo ratings yet

- Cohort Analysis TemplateDocument117 pagesCohort Analysis TemplateKalpesh JajuNo ratings yet

- MES No. AT (Frec Abs) AT Acum FR at FR at Acum No. Dias Perdidos (FA)Document2 pagesMES No. AT (Frec Abs) AT Acum FR at FR at Acum No. Dias Perdidos (FA)Julian AlmarioNo ratings yet

- Table 531 2Document15 pagesTable 531 2UfficioNo ratings yet

- 01-3 Plan Lineal VendedorDocument26 pages01-3 Plan Lineal VendedorJefer AnHe VelezNo ratings yet

- Interest 2Document1 pageInterest 2Vivienne Rozenn LaytoNo ratings yet

- Ejercicio 15Document4 pagesEjercicio 15ShiliNo ratings yet

- Stress Test 032020Document4 pagesStress Test 032020Nayro RodriguesNo ratings yet

- Aprobación 1er. Sem 2017Document44 pagesAprobación 1er. Sem 2017Paola AndreaNo ratings yet

- Colombia Calendario Lunar: WWW - Vercalendario.infoDocument3 pagesColombia Calendario Lunar: WWW - Vercalendario.infoEduardo MarinoNo ratings yet

- Flop Odds, Probability, Texas Holdem Poker, Tips, Odds, TellsDocument4 pagesFlop Odds, Probability, Texas Holdem Poker, Tips, Odds, TellsJohn IturriNo ratings yet

- Monthly Fact Sheet April 2021Document4 pagesMonthly Fact Sheet April 2021ALNo ratings yet

- Deficit: BUDGET DEFICIT (Excluding Grants) / GDP RATIO IN 2002 AND 2003Document10 pagesDeficit: BUDGET DEFICIT (Excluding Grants) / GDP RATIO IN 2002 AND 2003Mayank GargNo ratings yet

- 9.laporan IM Bulan September 2019Document7 pages9.laporan IM Bulan September 2019Yanto Tri AnNo ratings yet

- Rekapan Material Balance Juli TerbaruDocument4 pagesRekapan Material Balance Juli TerbaruJakaria SaputraNo ratings yet

- HUD BidDocument2 pagesHUD Bidthomasha37985100% (2)

- Rockville Planning Area: Montgomery County, MD. 2005 Census Update SurveyDocument7 pagesRockville Planning Area: Montgomery County, MD. 2005 Census Update SurveyM-NCPPCNo ratings yet

- North Bethesda/Garrett Park Planning Area: Montgomery County, MD. 2005 Census Update SurveyDocument7 pagesNorth Bethesda/Garrett Park Planning Area: Montgomery County, MD. 2005 Census Update SurveyM-NCPPCNo ratings yet

- Perhitungan Kpi/Smk Uko 2020 (Terbaru) PEBR 2020 5013Document11 pagesPerhitungan Kpi/Smk Uko 2020 (Terbaru) PEBR 2020 5013Andi ArianiNo ratings yet

- Project Concept Selection - Paired Comparison - Decision Matrix - Attributes Weighting - Roel SoelemanDocument1 pageProject Concept Selection - Paired Comparison - Decision Matrix - Attributes Weighting - Roel SoelemanRoel SoelemanNo ratings yet

- Tanque AcueductosDocument3 pagesTanque AcueductosplguevarasNo ratings yet

- NO. Uraian Pekerjaan Volume Satuan Harga Satuan Harga Bobot Pek. Persiapan RP 4,375,000.00Document3 pagesNO. Uraian Pekerjaan Volume Satuan Harga Satuan Harga Bobot Pek. Persiapan RP 4,375,000.00Ahmad RiyantoNo ratings yet

- Normalized Balance SheetDocument1 pageNormalized Balance SheetPo_PimpNo ratings yet

- Aspen Hill Planning Area: Montgomery County, MD. 2005 Census Update SurveyDocument42 pagesAspen Hill Planning Area: Montgomery County, MD. 2005 Census Update SurveyM-NCPPCNo ratings yet

- Colesville/White Oak Planning Area: Montgomery County, MD. 2005 Census Update SurveyDocument2 pagesColesville/White Oak Planning Area: Montgomery County, MD. 2005 Census Update SurveyM-NCPPCNo ratings yet

- Columna1 Columna2 Columna3 Tasa de Desempleo Tasa de InflacionDocument7 pagesColumna1 Columna2 Columna3 Tasa de Desempleo Tasa de Inflacionjorge eliecer ibarguen palaciosNo ratings yet

- Bowie, Bryson, Electra, Iowa Park, Jacksboro, & Seymour Spring 2006Document102 pagesBowie, Bryson, Electra, Iowa Park, Jacksboro, & Seymour Spring 2006Texas School Survey of Drug and Alcohol UseNo ratings yet

- Laporan Bulanan Hasil Imunisasi Rutin Bayi PuskesmasDocument14 pagesLaporan Bulanan Hasil Imunisasi Rutin Bayi PuskesmasAnonymous vUHcP0WNo ratings yet

- Aspen Hill Planning Area: Montgomery County, MD. 2005 Census Update SurveyDocument7 pagesAspen Hill Planning Area: Montgomery County, MD. 2005 Census Update SurveyM-NCPPCNo ratings yet

- Paytm As FintechDocument4 pagesPaytm As FintechShubham SinghNo ratings yet

- Maximum Permissible Bank Finance PDFDocument7 pagesMaximum Permissible Bank Finance PDFitrrustNo ratings yet

- Ifcb2009 37Document176 pagesIfcb2009 37Annamalai NagappanNo ratings yet

- ON Detailed Study and Comparative Analysis of Retail Business of Major Players in The Banking SectorDocument78 pagesON Detailed Study and Comparative Analysis of Retail Business of Major Players in The Banking Sectorkirankaur_waliaNo ratings yet

- Derivatives Markets PPT MBADocument52 pagesDerivatives Markets PPT MBABabasab Patil (Karrisatte)100% (1)

- Íx - " - È1Â Lambunaoânational Âââ Â ÇRJ, Î Lambunao National High SchoolDocument2 pagesÍx - " - È1Â Lambunaoânational Âââ Â ÇRJ, Î Lambunao National High SchoolMark Vincent CatedrillaNo ratings yet

- Internship Report NBPDocument55 pagesInternship Report NBPSidra NaeemNo ratings yet

- Insurance Basics - Part1 by Mudit PandeDocument7 pagesInsurance Basics - Part1 by Mudit PandeJigs PadNo ratings yet

- Alabama Horace Plaintiff MSJ - Securitized Mortgage Has No Standing To ForecloseDocument41 pagesAlabama Horace Plaintiff MSJ - Securitized Mortgage Has No Standing To Foreclosewinstons2311100% (1)

- Research Bank ConsumerDocument26 pagesResearch Bank ConsumerAnisa_RaoNo ratings yet

- Consolidated Companies ListDocument31 pagesConsolidated Companies ListSamir OberoiNo ratings yet

- IBP Journal Nov 2017Document48 pagesIBP Journal Nov 2017qasimNo ratings yet

- Industrial Finance Corporation of India (Ifci)Document2 pagesIndustrial Finance Corporation of India (Ifci)sumit athwaniNo ratings yet

- An Unsavoury Slice of SubprimeDocument3 pagesAn Unsavoury Slice of SubprimeKedar WagholikarNo ratings yet

- Verified Motion To Vacate Final Judgment of Foreclosure and Cancel Sep-19-2017 Foreclosure SaleDocument7 pagesVerified Motion To Vacate Final Judgment of Foreclosure and Cancel Sep-19-2017 Foreclosure SaleNeil GillespieNo ratings yet

- Speed Post Cash On DeliveryDocument4 pagesSpeed Post Cash On Deliveryplr.postNo ratings yet

- HK Listed Company CodeDocument21 pagesHK Listed Company CodeTerence Seah Pei ChuanNo ratings yet

- Ice Works 2016 Registration FormDocument2 pagesIce Works 2016 Registration FormGraham DeNureNo ratings yet

- Digest of Edillon v. Manila Bankers Life Insurance Corp. (G.R. No. 34200)Document1 pageDigest of Edillon v. Manila Bankers Life Insurance Corp. (G.R. No. 34200)Rafael PangilinanNo ratings yet

- Welcome To Punjab & Sind BankDocument2 pagesWelcome To Punjab & Sind BankShubham AgarwalNo ratings yet

- Sukanya Samriddhi YojanaDocument4 pagesSukanya Samriddhi Yojanaparitosh sharmaNo ratings yet

- "When Genius Continues To Fail: What We Didn't Learn From Penn Square Bank, Enron, and Chesapeake Energy," by J. C. Whorton, Jr. and Richard S. ShusterDocument28 pages"When Genius Continues To Fail: What We Didn't Learn From Penn Square Bank, Enron, and Chesapeake Energy," by J. C. Whorton, Jr. and Richard S. ShusterThe International Research Center for Energy and Economic Development (ICEED)No ratings yet

- Fireman's Fund vs. Jamila Co.Document3 pagesFireman's Fund vs. Jamila Co.Ben OriondoNo ratings yet

- RMT Lagi 2021Document13 pagesRMT Lagi 2021nurul_abdullah_70No ratings yet

- 5 Forces ModelDocument1 page5 Forces ModelMirza GalibNo ratings yet

- NHPC Annual Report 13-14Document196 pagesNHPC Annual Report 13-14VARBALNo ratings yet

- DBD 1Document20 pagesDBD 1Par MatyNo ratings yet