Professional Documents

Culture Documents

Unknown

Unknown

Uploaded by

nayla marie santiago cuadradoCopyright:

Available Formats

You might also like

- Scan 0001Document5 pagesScan 0001Monica Padilla71% (21)

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnmaliktaimoorsurahNo ratings yet

- Psav Encore Global W-2Document5 pagesPsav Encore Global W-2Vincent NewsonNo ratings yet

- 3.31 Paystub 1Document1 page3.31 Paystub 1disipiw20No ratings yet

- Return Postage Guaranteed: Employee Reference Copy Wage and Tax StatementDocument2 pagesReturn Postage Guaranteed: Employee Reference Copy Wage and Tax StatementEvelin De NunezNo ratings yet

- Dan Simon 2016 W2 PDFDocument2 pagesDan Simon 2016 W2 PDFAnonymous ndTTXL80MnNo ratings yet

- PPDocument2 pagesPPSNG RYKNo ratings yet

- OMB No. 1545-0008 OMB No. 1545-0008Document2 pagesOMB No. 1545-0008 OMB No. 1545-0008Robert Taylor50% (2)

- Fine Print Pay Stub 1Document3 pagesFine Print Pay Stub 1api-584843897No ratings yet

- Devin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptDocument2 pagesDevin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptemtteachNo ratings yet

- Resume of Msnetty42Document2 pagesResume of Msnetty42api-25122959No ratings yet

- Wage and Tax StatementDocument4 pagesWage and Tax StatementMark OasayNo ratings yet

- Wage and Tax StatementDocument4 pagesWage and Tax StatementRich1781No ratings yet

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City, or Local Income Tax Returnlucasortegabrandonarturo24No ratings yet

- Wage and Tax Statement: Page 1 / 4Document4 pagesWage and Tax Statement: Page 1 / 44kbzdsfw8kNo ratings yet

- US Internal Revenue Service: fw2 - 2000Document12 pagesUS Internal Revenue Service: fw2 - 2000IRSNo ratings yet

- Wage and Tax Statement Wage and Tax StatementDocument1 pageWage and Tax Statement Wage and Tax StatementFabiola UrgilésNo ratings yet

- Morehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsDocument1 pageMorehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsCorey GarrisNo ratings yet

- Atla - Adn SplashDocument1 pageAtla - Adn Splashnatali jimenezNo ratings yet

- TWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772Document2 pagesTWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772sana shahidNo ratings yet

- US Internal Revenue Service: Fw2as - 1992Document10 pagesUS Internal Revenue Service: Fw2as - 1992IRSNo ratings yet

- Omb No. 1545-0008 Omb No. 1545-0008Document2 pagesOmb No. 1545-0008 Omb No. 1545-0008Luke NyeNo ratings yet

- W2 W2taxdocument 2023Document3 pagesW2 W2taxdocument 2023sywwvpdnp7No ratings yet

- Evans W-2sDocument2 pagesEvans W-2sAlmaNo ratings yet

- DNSP 0000003971Document2 pagesDNSP 0000003971negrapujolsNo ratings yet

- Wage and Tax Statement: Page 1 / 4Document4 pagesWage and Tax Statement: Page 1 / 4blon majorsNo ratings yet

- 21 Il 00126975270200012690Document2 pages21 Il 00126975270200012690harryNo ratings yet

- PDF 1Document1 pagePDF 1manolo IamanditaNo ratings yet

- 2 41923892Document1 page2 41923892spurlock90No ratings yet

- Employee W-2 Report 20240115172542Document1 pageEmployee W-2 Report 20240115172542ANAYELI GUTIERREZNo ratings yet

- James Melvin Anderson W2Document1 pageJames Melvin Anderson W2matheus.alcantara014No ratings yet

- US Internal Revenue Service: Fw2as - 2000Document10 pagesUS Internal Revenue Service: Fw2as - 2000IRSNo ratings yet

- W2 ExportDocument1 pageW2 ExportenderjosNo ratings yet

- Ioana w2 PDFDocument1 pageIoana w2 PDFBlueberry13KissesNo ratings yet

- W-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsDocument2 pagesW-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsChantale0% (1)

- Kenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. DeptDocument2 pagesKenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. Depttaylorizabella1No ratings yet

- 5 MTihh 4271 H 1914120242901191102202Document2 pages5 MTihh 4271 H 1914120242901191102202elena.69.mxNo ratings yet

- W2 2010Document2 pagesW2 2010Rick Nunns100% (2)

- US Internal Revenue Service: Fw2gu - 2000Document10 pagesUS Internal Revenue Service: Fw2gu - 2000IRSNo ratings yet

- PDF DocumentDocument1 pagePDF DocumentAngelo DiloneNo ratings yet

- Documents PDFDocument2 pagesDocuments PDFNeena KumarNo ratings yet

- 20 TR 08894502584200889450Document2 pages20 TR 08894502584200889450Josh JasperNo ratings yet

- Print PreviewDocument4 pagesPrint PreviewDerrin Lee100% (1)

- US Internal Revenue Service: Fw2vi - 2000Document10 pagesUS Internal Revenue Service: Fw2vi - 2000IRSNo ratings yet

- Dennis w2Document5 pagesDennis w2Dennis GieselmanNo ratings yet

- Gwmain RDocument1 pageGwmain Rfznq9n4rkrNo ratings yet

- US Internal Revenue Service: Fw2as - 1995Document10 pagesUS Internal Revenue Service: Fw2as - 1995IRSNo ratings yet

- Wage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnDocument7 pagesWage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnLovely HeartNo ratings yet

- Tax File 2106 Ss FileingDocument5 pagesTax File 2106 Ss FileingWALLAUERNo ratings yet

- PE7 Ihh 72036 H 1914320215440222104202Document2 pagesPE7 Ihh 72036 H 1914320215440222104202Joali uwuNo ratings yet

- Myadp Prefixpayrollv1workersG30T031WTT2X4JSDtax Statements06Tihh00018984h1914320233800052104202imagesDocument2 pagesMyadp Prefixpayrollv1workersG30T031WTT2X4JSDtax Statements06Tihh00018984h1914320233800052104202imagesnxtbh6xy6yNo ratings yet

- 20212Document2 pages20212carriemccabe0% (1)

- W2 Hyatt PLaceDocument5 pagesW2 Hyatt PLaceJuan Diego Velandia DuarteNo ratings yet

- Kenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. DeptDocument2 pagesKenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. Depttaylorizabella1No ratings yet

- W21225760934 0 PDFDocument2 pagesW21225760934 0 PDFAnonymous czHLQeLPB4No ratings yet

- Timothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052Document2 pagesTimothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052TJ JanssenNo ratings yet

- US Internal Revenue Service: Fw2gu - 1998Document10 pagesUS Internal Revenue Service: Fw2gu - 1998IRSNo ratings yet

- W 2Document6 pagesW 2prads1259No ratings yet

- StatementDocument2 pagesStatementLuis HarrisonNo ratings yet

- Procoleman, Tia: Tia Coleman 820 Fotis DR Unit 2 Dekalb, Il 60115Document2 pagesProcoleman, Tia: Tia Coleman 820 Fotis DR Unit 2 Dekalb, Il 60115Myt WovenNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Your Income Tax 2024, Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNo ratings yet

- Tax - Nature of BusinessDocument69 pagesTax - Nature of BusinessDhiraj MAkwanaNo ratings yet

- Tax Planning and Management TaxDocument5 pagesTax Planning and Management TaxHarsha HarshaNo ratings yet

- Tax Exempt FormDocument1 pageTax Exempt Formjuan camaneyNo ratings yet

- Progressive System of Taxation vs. Regressive System of TaxationDocument2 pagesProgressive System of Taxation vs. Regressive System of TaxationKidMonkey2299No ratings yet

- Determination: of Vat Still DueDocument31 pagesDetermination: of Vat Still DueTokis SabaNo ratings yet

- Monthly Value-Added Tax DeclarationDocument2 pagesMonthly Value-Added Tax DeclarationJa'maine ManguerraNo ratings yet

- Role of TaxationDocument5 pagesRole of TaxationCarlo Francis Palma100% (1)

- Chapter 1 Introduction To Consumption TaxesDocument38 pagesChapter 1 Introduction To Consumption TaxesGenie Gonzales DimaanoNo ratings yet

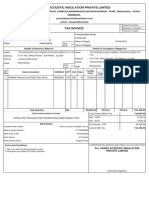

- InvoiceDocument1 pageInvoicenjatoliya123No ratings yet

- TablesDocument3 pagesTablesJPNo ratings yet

- Barangay Budget ExecutionDocument6 pagesBarangay Budget Executionlinden_07100% (1)

- Technosales Multimedia Technologies PVT LTD - 36Document1 pageTechnosales Multimedia Technologies PVT LTD - 36Fbsix ApNo ratings yet

- Signature Not VerifiedDocument3 pagesSignature Not Verifiedarunshinde408No ratings yet

- A1C019118 Jurati Latihan10Document6 pagesA1C019118 Jurati Latihan10juratiNo ratings yet

- ISC EconomicsDocument7 pagesISC EconomicsJayant TechyNo ratings yet

- Levels of Decision-Making in Curriculum DevelopmentDocument5 pagesLevels of Decision-Making in Curriculum DevelopmentJanice Garcia100% (3)

- Chapter 3 - Deferred TaxDocument61 pagesChapter 3 - Deferred Taxansath193No ratings yet

- Tax 2 Quizbowl FinalDocument18 pagesTax 2 Quizbowl FinalExequielCamisaCrusperoNo ratings yet

- Solution Problem 1Document6 pagesSolution Problem 1Michelle Joy Nuyad-PantinopleNo ratings yet

- Problem IntxDocument7 pagesProblem IntxSophia KeratinNo ratings yet

- GST (Goods and Services Tax) - Introduction and Tax Calculation - in ClassDocument4 pagesGST (Goods and Services Tax) - Introduction and Tax Calculation - in ClassShubhendu KambleNo ratings yet

- COLLINS N OKONKWO Paystub Feb 12 2024Document1 pageCOLLINS N OKONKWO Paystub Feb 12 2024ellamaekitchensNo ratings yet

- Bir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of August, 2018Document10 pagesBir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of August, 2018MaricrisNo ratings yet

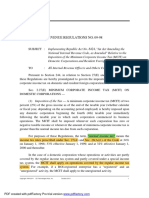

- RR No. 9-1998Document10 pagesRR No. 9-1998Rhinnell RiveraNo ratings yet

- Series 1: Table 3.1 Gender Wise Classification of Respondents Gender No of Respondents Percentage (%)Document21 pagesSeries 1: Table 3.1 Gender Wise Classification of Respondents Gender No of Respondents Percentage (%)BOBBY THOMASNo ratings yet

- 2316Document13 pages2316Ariel BarkerNo ratings yet

- Nature of Power of TaxationDocument2 pagesNature of Power of TaxationPamela AcostaNo ratings yet

- Unka VAT Withholding Attach.Document2 pagesUnka VAT Withholding Attach.abrahimabduselam07No ratings yet

Unknown

Unknown

Uploaded by

nayla marie santiago cuadradoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unknown

Unknown

Uploaded by

nayla marie santiago cuadradoCopyright:

Available Formats

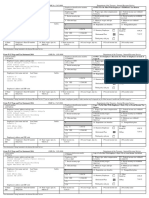

a. Employee's Social Security Number OMB No.

1545-0008

*****8634

b. Employer's Identification Number (EIN) d. Control number 1 Wages, Tips, and other compensation 2 Federal Income Tax withheld

35-1819323 13952.81

c. Employer's Name, Address, and ZIP Code 3 Social Security Wages 4 Social Security Tax withheld

DFAS ATTN:DFASIN/JAREA 14687.20 910.61

8899 EAST 56TH STREET 5 Medicare Wages and Tips 6 Medicare Tax withheld

INDIANAPOLIS IN 46249 14687.20 212.96

7 Social Security tips 8 Allocated Tips

e/f. Employee's Name, Address, and ZIP Code 9 10 Dependent Care Benefits

CUADRADO NAYLA MAR SANTIAGO

116 EMILIO BUITRAGO 12 See instructions for box 12 14 See instructions for box 14

SAN LORENZO PR 00754

D 23 734.39

13

Statutory Retirement Third-party

Employee Plan sick pay

15 State Employer's State ID Number 16 State Wages, Tips, etc 17 State Income Tax 18 Local wages, tips, etc 19 Local Income Tax 20 Locality name

PR 35-1819323 13952.81 549.12

15 State Employer's State ID Number 16 State Wages, Tips, etc 17 State Income Tax 18 Local wages, tips, etc 19 Local Income Tax 20 Locality name

Wage and Tax Department of the Treasury - Internal Revenue Service

Form

W-2 Statement 2023 Copy B To Be Filed With Employee's FEDERAL Tax Return

This information is being furnished to the Internal Revenue Service

a. Employee's Social Security Number OMB No. 1545-0008 This information is being furnished to the Internal Revenue Service. If you are required to file a tax

*****8634 return, a negligence penalty or other sanction may be imposed on you if this income is taxable and you fail to report it.

b. Employer's Identification Number (EIN) d. Control Number 1 Wages, Tips, other compensation 2 Federal Income Tax withheld

35-1819323 13952.81

c. Employer's Name, Address, and ZIP Code 3 Social Security Wages 4 Social Security Tax withheld

DFAS ATTN:DFASIN/JAREA 14687.20 910.61

8899 EAST 56TH STREET 5 Medicare Wages and Tips 6 Medicare Tax withheld

INDIANAPOLIS IN 46249 14687.20 212.96

7 Social Security tips 8 Allocated Tips

e/f. Employee's Name, Address, and ZIP Code 9 10 Dependent Care Benefits

CUADRADO NAYLA MAR SANTIAGO

116 EMILIO BUITRAGO 12 See instructions for box 12 14 See instructions for box 14

SAN LORENZO PR 00754

D 23 734.39

13

Statutory Retirement Third-party

Employee Plan sick pay

15 State Employer's State ID Number 16 State Wages, Tips, etc 17 State Income Tax 18 Local wages, tips, etc 19 Local Income Tax 20 Locality name

PR 35-1819323 13952.81 549.12

15 State Employer's State ID Number 16 State Wages, Tips, etc 17 State Income Tax 18 Local wages, tips, etc 19 Local Income Tax 20 Locality name

Department of the Treasury - Internal Revenue Service

Wage and Tax

Form

W-2 Statement

2023 Copy C For EMPLOYEE'S RECORDS (See Notice to Employee on Back of Copy B)

a. Employee's Social Security Number OMB No. 1545-0008

*****8634

b. Employer's Identification Number (EIN) d. Control number 1 Wages, Tips, and other compensation 2 Federal Income Tax withheld

35-1819323 13952.81

c. Employer's Name, Address, and ZIP Code 3 Social Security Wages 4 Social Security Tax withheld

DFAS ATTN:DFASIN/JAREA 14687.20 910.61

8899 EAST 56TH STREET 5 Medicare Wages and Tips 6 Medicare Tax withheld

INDIANAPOLIS IN 46249 14687.20 212.96

7 Social Security tips 8 Allocated Tips

e/f. Employee's Name, Address, and ZIP Code 9 10 Dependent Care Benefits

CUADRADO NAYLA MAR SANTIAGO

116 EMILIO BUITRAGO 12 See instructions for box 12 14 See instructions for box 14

SAN LORENZO PR 00754

D 23 734.39

13 Statutory Retirement Third-party

Employee Plan sick pay

15 State Employer's State ID Number 16 State Wages, Tips, etc 17 State Income Tax 18 Local wages, tips, etc 19 Local Income Tax 20 Locality name

PR 35-1819323 13952.81 549.12

15 State Employer's State ID Number 16 State Wages, Tips, etc 17 State Income Tax 18 Local wages, tips, etc 19 Local Income Tax 20 Locality name

Wage and Tax Department of the Treasury - Internal Revenue Service

Form

W-2 Statement 2023 Copy 2 To Be Filed With Employee's State, City, or Local Income Tax Return

a. Employee's Social Security Number OMB No. 1545-0008

*****8634

b. Employer's Identification Number (EIN) d. Control Number 1 Wages, Tips, other compensation 2 Federal Income Tax withheld

35-1819323 13952.81

c. Employer's Name, Address, and ZIP Code 3 Social Security Wages 4 Social Security Tax withheld

DFAS ATTN:DFASIN/JAREA 14687.20 910.61

8899 EAST 56TH STREET 5 Medicare Wages and Tips 6 Medicare Tax withheld

INDIANAPOLIS IN 46249 14687.20 212.96

7 Social Security tips 8 Allocated Tips

e/f. Employee's Name, Address, and ZIP Code 9 10 Dependent Care Benefits

CUADRADO NAYLA MAR SANTIAGO

116 EMILIO BUITRAGO 12 See instructions for box 12 14 See instructions for box 14

SAN LORENZO PR 00754

D 23 734.39

13 Statutory Retirement Third-party

Employee Plan sick pay

15 State Employer's State ID Number 16 State Wages, Tips, etc 17 State Income Tax 18 Local wages, tips, etc 19 Local Income Tax 20 Locality name

PR 35-1819323 13952.81 549.12

15 State Employer's State ID Number 16 State Wages, Tips, etc 17 State Income Tax 18 Local wages, tips, etc 19 Local Income Tax 20 Locality name

Department of the Treasury - Internal Revenue Service

Wage and Tax

Form

W-2 Statement

2023 Copy 2 To Be Filed With Employee's State, City, or Local Income Tax Return

Corrections. If your name, SSN, or address is incorrect,

Notice to Employee correct Copies B, C, and 2 and ask your employer to

Do you have to file? Refer to the Form 1040 instructions correct your employment record. Be sure to ask the

to determine if you are required to file a tax return. Even if employer to file Form W-2c, Corrected Wage and Tax

you do not have to file a tax return, you may be eligible for Statement, with the SSA to correct any name, SSN, or

a refund if box 2 shows an amount or if you are eligible for money amount error reported to the SSA on Form W-2.

any credit. Be sure to get your copies of Form W-2c from your

employer for all corrections made so you may file them

Earned income credit (EIC). You may be able to take the

with your tax return. If your name and SSN are correct but

EIC for 2023 if your adjusted gross income (AGI) is less

are not the same as shown on your social security card,

than a certain amount. The amount of the credit is based

you should ask for a new card that displays your correct

on income and family size. Workers without children could

name at any SSA office or by calling 1-800-772-1213. You

qualify for a smaller credit. You and any qualifying children

also may visit the SSA at www.SSA.gov.

must have valid social security numbers (SSNs). You

cannot take the EIC if your investment income is more than Cost of employer-sponsored health coverage (if such

the specified amount for 2023 or if income is earned for cost is provided by the employer). The reporting in box

services provided while you were an inmate at a penal 12, using code DD, of the cost of employer-sponsored

institution. For 2023 income limits and more information, health coverage is for your information only. The amount

visit www.irs.gov/eitc. Also see Pub. 596. reported with code DD is not taxable.

Any EIC that is more than your tax liability is refunded Credit for excess taxes. If you had more than one

to you, but only if you file a tax return. employer in 2023 and more than $9,932.40 in social

Employee’s Social Security Number (SSN). For your security and/or Tier 1 railroad retirement (RRTA) taxes

protection, this form may only show the last four digits of were withheld, you may be able to claim a credit for the

your SSN. However, your employers have reported your excess against your federal income tax. See the Form

complete SSN to the IRS and Social Security 1040 instructions. If you had more than one railroad

Administration (SSA). employer and more than $5,821.20 in Tier 2 RRTA tax

was withheld, you also may be able to claim a refund on

Form 843. See the instructions for Form 843.

(Also see Instructions for Employee on the back of Copy C.)

Instructions for Employee (Also see Notice to Employee M - Uncollected Social Security or RRTA tax on taxable cost of group-term life

insurance over $50,000 (former employees only). See the Form 1040

on the back of Copy B.) instructions.

Box 1. Enter this amount on the wages line of your tax return. N - Uncollected Medicare tax on taxable cost of group-term life insurance over

Box 2. Enter this amount on the federal income tax withheld line of your tax $50,000 (former employees only). See the Form 1040 instructions.

return. P - Excludable moving expense reimbursements paid directly to member of

Box 5. You may be required to report this amount on Form 8959. See the Form Armed Forces (not included in boxes 1, 3, or 5).

1040 instructions to determine if you are required to complete Form 8959. Q - Nontaxable combat pay. See the Form 1040 instructions for details on

Box 6. This amount includes the 1.45% Medicare Tax withheld on all Medicare reporting this amount.

wages and tips shown in box 5, as well as the 0.9% Additional Medicare Tax on R - Employer contributions to your Archer MSA. Report on Form 8853.

any of those Medicare wages and tips above $200,000.

S - Employee salary reduction contributions under a section 408(p) SIMPLE

Box 8. This amount is not included in boxes 1, 3, 5, or 7. For information on plan (not included in box 1).

how to report tips on your tax return, see the Form 1040 instructions. You must

T - Adoption benefits (not included in box 1). Complete Form 8839 to compute

file Form 4137 with your income tax return to report at least the allocated tip

any taxable and nontaxable amounts.

amount unless you can prove with adequate records that you received a smaller

amount. If you have records that show the actual amount of tips you received, W - Employer contributions (including amounts the employee elected to

report that amount even if it is more or less than the allocated tips. Use Form contribute using a section 125 (cafeteria) plan) to your health savings account.

4137 to figure the social security and Medicare tax owed on tips you didn't Report on Form 8889.

report to your employer. By filing Form 4137, your social security tips will be AA - Designated Roth contributions under a section 401(k) plan.

credited to your social security record (used to figure your benefits). BB - Designated Roth contributions under a section 403(b) plan.

Box 10. This amount includes the total dependent care benefits that your DD - Cost of employer-sponsored health coverage. The amount reported with

employer paid to you or incurred on your behalf (including amounts from a Code DD is not taxable.

section 125 (cafeteria) plan). Any amount over your employer’s plan limit is also EE - Designated Roth contributions under a governmental section 457(b) plan.

included in box 1. See Form 2441. This amount does not apply to contributions under a tax-exempt organization

Box 12. The following list explains the codes shown in box 12. You may need section 457(b) plan.

this information to complete your tax return. Elective deferrals (codes D, E, F Box 13. If the “Retirement plan” box is checked, special limits may apply to the

and S) and designated Roth contributions (codes AA, BB and EE) under all amount of traditional IRA contributions you may deduct. See Pub. 590-A.

plans are generally limited to a total of $22,500 ($15,500 if you only have Box 14. Any amount in box 14 should be coded. The following explains the

SIMPLE plans, $25,500 for section 403(b) plans, if you qualify for the 15-year codes.

rule explained in Pub. 571). However, if you were at least age 50 in 2023, your

C - Taxable reimb for Permanent Change of Station (Incl in Box 1)

employer may have allowed an additional deferral of up to $7,500 ($3,500 for

section 401(k)(11) and 408(p) SIMPLE plans). This additional deferral amount is E - Military TSP Contribution (Tax Exempt)

not subject to the overall limit on elective deferrals. Contact your plan F - TIAA/CREF and Fidelity Retirement Contributions

administrator for more information. Amounts in excess of the overall elective G - Pre-Tax Transportation Equity Act Benefits

deferral limit must be included in income. See the Form 1040 instructions. H - Taxable Home to Work and/or MILAIR Benefits (Incl in Box 1)

Note: If a year follows code D through H, S, Y, AA, BB or EE, you made a K - Pretax Vision and Dental Deduction

make-up pension contribution for a prior year(s) when you were in military P - Parking Fringe Benefits/Employer Provided Vehicle. (Incl in Box 1)

service. To figure whether you made excess deferrals, consider these amounts

R - Retirement Deductions. (for Civilian Employees who have wages earned in

for the year shown, not the current year. If no year is shown, the contributions

Puerto Rico)

are for the current year. Your employer does not use codes G, H, K, V, Y, Z, FF,

GG, HH. S - Federal Employee Health Benefit employee deduction for Civilian

Employees who have wages earned in Puerto Rico.

A - Uncollected social security or RRTA tax on tips. Include this tax on Form

1040 or 1040-SR. See the Form 1040 instructions. STT – Oregon Transit Tax

B - Uncollected Medicare tax on tips. Include this tax on Form 1040 or 1040-SR. T - Cost of Living Allowance not included in box 1 or 16 for Civilian Employees

See the Form 1040 instructions. who have COLA included for wages in Alaska, Hawaii, Guam and the Northern

Mariana Islands, Puerto Rico and the U.S. Virgin Islands

C - Taxable cost of group-term life insurance over $50,000 (included in boxes 1,

3 (up to social security wage base), and 5). U - Non-Cash Fringe Benefits (Incl in Box 1)

D - Elective deferrals to a section 401(k) cash or deferred arrangement. Also V - Pretax FEHB Incentive

includes deferrals under a SIMPLE retirement account that is part of a section X - Occupational FEHB Incentive Tax/Local Services Tax (CIVILIAN)

401(k) arrangement. Y - Pretax Flexible Spending Account Employee Contributions

E - Elective deferrals under a section 403(b) salary reduction agreement. Z - Retirement Deductions for Massachusetts Residents Only

F - Elective deferrals under a section 408(k)(6) salary reduction SEP. DX - Sick Leave Wages 1/1/21-3/31/21 $511/day limit

J - Nontaxable sick pay (information only, not included in boxes 1, 3, or 5). DY - Sick Leave Wages 1/1/21-3/31/21 $200/day limit

DZ - Emergency Family Leave Wages 1/121-3/31/21

L - Substantiated employee business expense reimbursements (nontaxable).

EX - Sick Leave Wages 4/1/21-9/30/21 $511/day limit

EY - Sick Leave Wages 4/1/21-9/30/21 $200/day limit

EZ - Emergency Family Leave Wages 4/1/21-9/30/21

Note: Keep Copy C of Form W-2 for at least 3 years after the due date for filing

your income tax return. However, to help protect your social security

benefits, keep Copy C until you begin receiving social security benefits, just in

case there is a question about your work record and/or earnings in a particular

year.

You might also like

- Scan 0001Document5 pagesScan 0001Monica Padilla71% (21)

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City or Local Income Tax ReturnmaliktaimoorsurahNo ratings yet

- Psav Encore Global W-2Document5 pagesPsav Encore Global W-2Vincent NewsonNo ratings yet

- 3.31 Paystub 1Document1 page3.31 Paystub 1disipiw20No ratings yet

- Return Postage Guaranteed: Employee Reference Copy Wage and Tax StatementDocument2 pagesReturn Postage Guaranteed: Employee Reference Copy Wage and Tax StatementEvelin De NunezNo ratings yet

- Dan Simon 2016 W2 PDFDocument2 pagesDan Simon 2016 W2 PDFAnonymous ndTTXL80MnNo ratings yet

- PPDocument2 pagesPPSNG RYKNo ratings yet

- OMB No. 1545-0008 OMB No. 1545-0008Document2 pagesOMB No. 1545-0008 OMB No. 1545-0008Robert Taylor50% (2)

- Fine Print Pay Stub 1Document3 pagesFine Print Pay Stub 1api-584843897No ratings yet

- Devin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptDocument2 pagesDevin J Simon 2004 MOHAWK RD APT. 321 Pueblo, Co 81001: Employer Use Only Corp. DeptemtteachNo ratings yet

- Resume of Msnetty42Document2 pagesResume of Msnetty42api-25122959No ratings yet

- Wage and Tax StatementDocument4 pagesWage and Tax StatementMark OasayNo ratings yet

- Wage and Tax StatementDocument4 pagesWage and Tax StatementRich1781No ratings yet

- Copy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City, or Local Income Tax ReturnDocument1 pageCopy B - To Be Filed With Employee's FEDERAL Tax Return. Copy 2 - To Be Filed With Employee's State, City, or Local Income Tax Returnlucasortegabrandonarturo24No ratings yet

- Wage and Tax Statement: Page 1 / 4Document4 pagesWage and Tax Statement: Page 1 / 44kbzdsfw8kNo ratings yet

- US Internal Revenue Service: fw2 - 2000Document12 pagesUS Internal Revenue Service: fw2 - 2000IRSNo ratings yet

- Wage and Tax Statement Wage and Tax StatementDocument1 pageWage and Tax Statement Wage and Tax StatementFabiola UrgilésNo ratings yet

- Morehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsDocument1 pageMorehouse Morehouse Daniel Daniel J J: Copy C - For Employee'S RecordsCorey GarrisNo ratings yet

- Atla - Adn SplashDocument1 pageAtla - Adn Splashnatali jimenezNo ratings yet

- TWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772Document2 pagesTWC LIS01 LIS - B AU20161205 P: Aqeel Haider 1 Maple Ave APT. #106 Patchogue, Ny 11772sana shahidNo ratings yet

- US Internal Revenue Service: Fw2as - 1992Document10 pagesUS Internal Revenue Service: Fw2as - 1992IRSNo ratings yet

- Omb No. 1545-0008 Omb No. 1545-0008Document2 pagesOmb No. 1545-0008 Omb No. 1545-0008Luke NyeNo ratings yet

- W2 W2taxdocument 2023Document3 pagesW2 W2taxdocument 2023sywwvpdnp7No ratings yet

- Evans W-2sDocument2 pagesEvans W-2sAlmaNo ratings yet

- DNSP 0000003971Document2 pagesDNSP 0000003971negrapujolsNo ratings yet

- Wage and Tax Statement: Page 1 / 4Document4 pagesWage and Tax Statement: Page 1 / 4blon majorsNo ratings yet

- 21 Il 00126975270200012690Document2 pages21 Il 00126975270200012690harryNo ratings yet

- PDF 1Document1 pagePDF 1manolo IamanditaNo ratings yet

- 2 41923892Document1 page2 41923892spurlock90No ratings yet

- Employee W-2 Report 20240115172542Document1 pageEmployee W-2 Report 20240115172542ANAYELI GUTIERREZNo ratings yet

- James Melvin Anderson W2Document1 pageJames Melvin Anderson W2matheus.alcantara014No ratings yet

- US Internal Revenue Service: Fw2as - 2000Document10 pagesUS Internal Revenue Service: Fw2as - 2000IRSNo ratings yet

- W2 ExportDocument1 pageW2 ExportenderjosNo ratings yet

- Ioana w2 PDFDocument1 pageIoana w2 PDFBlueberry13KissesNo ratings yet

- W-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsDocument2 pagesW-2 Wage Reconciliation: This Form Details Your Final 2019 Payroll EarningsChantale0% (1)

- Kenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. DeptDocument2 pagesKenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. Depttaylorizabella1No ratings yet

- 5 MTihh 4271 H 1914120242901191102202Document2 pages5 MTihh 4271 H 1914120242901191102202elena.69.mxNo ratings yet

- W2 2010Document2 pagesW2 2010Rick Nunns100% (2)

- US Internal Revenue Service: Fw2gu - 2000Document10 pagesUS Internal Revenue Service: Fw2gu - 2000IRSNo ratings yet

- PDF DocumentDocument1 pagePDF DocumentAngelo DiloneNo ratings yet

- Documents PDFDocument2 pagesDocuments PDFNeena KumarNo ratings yet

- 20 TR 08894502584200889450Document2 pages20 TR 08894502584200889450Josh JasperNo ratings yet

- Print PreviewDocument4 pagesPrint PreviewDerrin Lee100% (1)

- US Internal Revenue Service: Fw2vi - 2000Document10 pagesUS Internal Revenue Service: Fw2vi - 2000IRSNo ratings yet

- Dennis w2Document5 pagesDennis w2Dennis GieselmanNo ratings yet

- Gwmain RDocument1 pageGwmain Rfznq9n4rkrNo ratings yet

- US Internal Revenue Service: Fw2as - 1995Document10 pagesUS Internal Revenue Service: Fw2as - 1995IRSNo ratings yet

- Wage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnDocument7 pagesWage and Tax Statement: Copy B - To Be Filed With Employee's FEDERAL Tax ReturnLovely HeartNo ratings yet

- Tax File 2106 Ss FileingDocument5 pagesTax File 2106 Ss FileingWALLAUERNo ratings yet

- PE7 Ihh 72036 H 1914320215440222104202Document2 pagesPE7 Ihh 72036 H 1914320215440222104202Joali uwuNo ratings yet

- Myadp Prefixpayrollv1workersG30T031WTT2X4JSDtax Statements06Tihh00018984h1914320233800052104202imagesDocument2 pagesMyadp Prefixpayrollv1workersG30T031WTT2X4JSDtax Statements06Tihh00018984h1914320233800052104202imagesnxtbh6xy6yNo ratings yet

- 20212Document2 pages20212carriemccabe0% (1)

- W2 Hyatt PLaceDocument5 pagesW2 Hyatt PLaceJuan Diego Velandia DuarteNo ratings yet

- Kenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. DeptDocument2 pagesKenndal D Crawford 109 Inwood Court Spartanburg, SC 29302: Employer Use Only Corp. Depttaylorizabella1No ratings yet

- W21225760934 0 PDFDocument2 pagesW21225760934 0 PDFAnonymous czHLQeLPB4No ratings yet

- Timothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052Document2 pagesTimothy W Janssen 4812 LITTLE Fox Court Imperial MO 63052TJ JanssenNo ratings yet

- US Internal Revenue Service: Fw2gu - 1998Document10 pagesUS Internal Revenue Service: Fw2gu - 1998IRSNo ratings yet

- W 2Document6 pagesW 2prads1259No ratings yet

- StatementDocument2 pagesStatementLuis HarrisonNo ratings yet

- Procoleman, Tia: Tia Coleman 820 Fotis DR Unit 2 Dekalb, Il 60115Document2 pagesProcoleman, Tia: Tia Coleman 820 Fotis DR Unit 2 Dekalb, Il 60115Myt WovenNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Your Income Tax 2024, Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNo ratings yet

- Tax - Nature of BusinessDocument69 pagesTax - Nature of BusinessDhiraj MAkwanaNo ratings yet

- Tax Planning and Management TaxDocument5 pagesTax Planning and Management TaxHarsha HarshaNo ratings yet

- Tax Exempt FormDocument1 pageTax Exempt Formjuan camaneyNo ratings yet

- Progressive System of Taxation vs. Regressive System of TaxationDocument2 pagesProgressive System of Taxation vs. Regressive System of TaxationKidMonkey2299No ratings yet

- Determination: of Vat Still DueDocument31 pagesDetermination: of Vat Still DueTokis SabaNo ratings yet

- Monthly Value-Added Tax DeclarationDocument2 pagesMonthly Value-Added Tax DeclarationJa'maine ManguerraNo ratings yet

- Role of TaxationDocument5 pagesRole of TaxationCarlo Francis Palma100% (1)

- Chapter 1 Introduction To Consumption TaxesDocument38 pagesChapter 1 Introduction To Consumption TaxesGenie Gonzales DimaanoNo ratings yet

- InvoiceDocument1 pageInvoicenjatoliya123No ratings yet

- TablesDocument3 pagesTablesJPNo ratings yet

- Barangay Budget ExecutionDocument6 pagesBarangay Budget Executionlinden_07100% (1)

- Technosales Multimedia Technologies PVT LTD - 36Document1 pageTechnosales Multimedia Technologies PVT LTD - 36Fbsix ApNo ratings yet

- Signature Not VerifiedDocument3 pagesSignature Not Verifiedarunshinde408No ratings yet

- A1C019118 Jurati Latihan10Document6 pagesA1C019118 Jurati Latihan10juratiNo ratings yet

- ISC EconomicsDocument7 pagesISC EconomicsJayant TechyNo ratings yet

- Levels of Decision-Making in Curriculum DevelopmentDocument5 pagesLevels of Decision-Making in Curriculum DevelopmentJanice Garcia100% (3)

- Chapter 3 - Deferred TaxDocument61 pagesChapter 3 - Deferred Taxansath193No ratings yet

- Tax 2 Quizbowl FinalDocument18 pagesTax 2 Quizbowl FinalExequielCamisaCrusperoNo ratings yet

- Solution Problem 1Document6 pagesSolution Problem 1Michelle Joy Nuyad-PantinopleNo ratings yet

- Problem IntxDocument7 pagesProblem IntxSophia KeratinNo ratings yet

- GST (Goods and Services Tax) - Introduction and Tax Calculation - in ClassDocument4 pagesGST (Goods and Services Tax) - Introduction and Tax Calculation - in ClassShubhendu KambleNo ratings yet

- COLLINS N OKONKWO Paystub Feb 12 2024Document1 pageCOLLINS N OKONKWO Paystub Feb 12 2024ellamaekitchensNo ratings yet

- Bir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of August, 2018Document10 pagesBir Form 1601E - Schedule I Alphabetical List of Payees From Whom Taxes Were Withheld For The Month of August, 2018MaricrisNo ratings yet

- RR No. 9-1998Document10 pagesRR No. 9-1998Rhinnell RiveraNo ratings yet

- Series 1: Table 3.1 Gender Wise Classification of Respondents Gender No of Respondents Percentage (%)Document21 pagesSeries 1: Table 3.1 Gender Wise Classification of Respondents Gender No of Respondents Percentage (%)BOBBY THOMASNo ratings yet

- 2316Document13 pages2316Ariel BarkerNo ratings yet

- Nature of Power of TaxationDocument2 pagesNature of Power of TaxationPamela AcostaNo ratings yet

- Unka VAT Withholding Attach.Document2 pagesUnka VAT Withholding Attach.abrahimabduselam07No ratings yet