Professional Documents

Culture Documents

Proofofcash 223

Proofofcash 223

Uploaded by

Maliha KansiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Proofofcash 223

Proofofcash 223

Uploaded by

Maliha KansiCopyright:

Available Formats

Proof of Cash

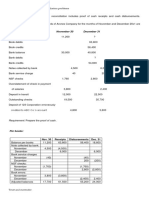

Lazer Company had the following bank reconciliation on June 30:

Balance per bank statement, June 30 3,000,000

Deposit in Transit 400,000

Total 3,400,000

Outstanding Checks -900,000

Balance per book, June 30 2,500,000

The bank statement for the month of July showed the following:

Deposits, including P200,000 note collected for Lazer- P9,000,000

Disbursements, including P140,000 NSF check and P10,000 servce charge- P7,000,000

All reconciling items on June 30 cleared through the bank in July. The outstanding checks totaled P600,000 and the deposit in

transit amounted to P1,000,000 on July 31.

1. What is the adjusted cash in bank on July 31?

A. 2,500,000 B. 5,400,000 C. 2,900,000 D. 5,000,000

2. What is the unadjusted cash balance per book on July 31?

A. 5,400,000 B. 5,350,000 C. 5,550,000 D. 4,500,000

3. What is the amount of cash receipts per book in July?

A. 9,400,000 B. 9,600,000 C. 8,600,000 D. 9,800,000

4. What is the amount of cash disbursements per book in July?

A. 6,550,000 B. 6,700,000 C. 7,300,000 D. 6,850,000

Chris Company presented the following bank reconciliation for the month of November:

Balance per bank statement, November 30 3,600,000

Add: Deposit in Transit 800,000

Total 4,400,000

Less: Outstanding Checks 1,200,000

Bank erroneously credited 200,000 1,400,000

Balance per book, November 30 3,000,000

Data per bank statement for the month of December follow:

December deposits, including note collected of P1,000,000 for Chris 5,500,000

December disbursements, including NSF customer check P350,000 and service charge P50,000 4,400,000

All items that were outstanding on November 30 cleared through the bank in December, including the bank credit.

In addition, checks amounting to P500,000 were outstanding and deposits of P700,000 were in transit on December 31.

1. What is the adjusted cash in bank on December 31?

A. 4,700,000 B. 4,900,000 C. 4,500,000 D. 3,200,000

2. What is the cash balance per ledger on December 31?

A. 4,100,000 B. 4,900,000 C. 4,700,000 D. 4,300,000

3. What is the amount of cash receipts per book in December?

A. 5,400,000 B. 4,400,000 C. 5,500,000 D. 6,400,000

4. What is the amount of cash disbursement per book in December?

A. 3,700,000 B. 3,300,000 C. 3,100,000 D. 3,500,000

Lira Company prepared the following bank reconciliation on June 30:

Balance per bank statement 9,800,000

Add: Deposit in Transit 400,000

Less: Outstanding Checks 1,400,000

Balance per book, November 30 8,800,000

There were total deposits of P6,500,000 and charges for disbursements of P9,000,000 forJuly per bank statement. All

reconciliation items on June 30 were cleared in the bank on July 31.

Checks outstanding amounted to P1,000,000 and deposits in transit totaled P1,200,000 on July 31.

1. What is the amount of cash disbursements per book in July?

A. 8,600,000 B. 7,600,000 C. 9,400,000 D. 8,400,000

2. What is the adjusted cash in bank on July 31?

A. 7,300,000 B. 6,300,000 D. 7,500,000 D. 6,500,000

end

You might also like

- Pelita AirDocument2 pagesPelita AirYonathan Manalu100% (2)

- Question 1: SolutionDocument15 pagesQuestion 1: Solutiondebate dd0% (1)

- PS-2 (Proof of Cash)Document1 pagePS-2 (Proof of Cash)jazonvaleraNo ratings yet

- Problem 3-3 Ajusted Book Balance Checks Drawn: Bank Statement Balance Per BankDocument3 pagesProblem 3-3 Ajusted Book Balance Checks Drawn: Bank Statement Balance Per BankNika Bautista100% (2)

- Proof of CashDocument7 pagesProof of CashMARIAN POLANCONo ratings yet

- MOD 03 - Bank ReconDocument3 pagesMOD 03 - Bank ReconIrish VargasNo ratings yet

- This Study Resource WasDocument4 pagesThis Study Resource Wasmonmon kim100% (4)

- Proof of Cash and Bank Recon StatementDocument7 pagesProof of Cash and Bank Recon StatementJean BritoNo ratings yet

- FAR Practical Exercises Proof of CashDocument3 pagesFAR Practical Exercises Proof of CashAB CloydNo ratings yet

- Quizzer Cash - Solution Printed KoDocument119 pagesQuizzer Cash - Solution Printed Kogoerginamarquez80% (10)

- Accounting (PT - Financial Assets)Document66 pagesAccounting (PT - Financial Assets)Micko Lagundino33% (3)

- All About CASHDocument18 pagesAll About CASHAshley Levy San Pedro100% (1)

- This Study Resource Was: 17 Proof of CashDocument6 pagesThis Study Resource Was: 17 Proof of CashXNo ratings yet

- Proof of CashDocument20 pagesProof of CashKristen StewartNo ratings yet

- Proof of Cash by Lailane PPTXDocument19 pagesProof of Cash by Lailane PPTXAnna Marie RevisadoNo ratings yet

- Proofofcashbylailanepptxpdf PDF FreeDocument19 pagesProofofcashbylailanepptxpdf PDF Freedanica gomezNo ratings yet

- Proof of Cash: By: LailaneDocument19 pagesProof of Cash: By: LailaneHeart Erica AbagNo ratings yet

- Proof of Cash by LailaneDocument19 pagesProof of Cash by Lailanenaruto uzumakiNo ratings yet

- Proof of Cash - 02Document19 pagesProof of Cash - 02Royu BreakerNo ratings yet

- Proof of CashDocument2 pagesProof of CashJanella PatriziaNo ratings yet

- Proof of Cash: By: LailaneDocument19 pagesProof of Cash: By: LailaneGianJoshuaDayrit100% (1)

- Proof of Cash: By: LailaneDocument19 pagesProof of Cash: By: LailaneKyle BrianNo ratings yet

- Problem 1Document13 pagesProblem 1Ghaill CruzNo ratings yet

- Inacc 1 Chap 3 Act PDFDocument12 pagesInacc 1 Chap 3 Act PDFSharmin Reula50% (2)

- Bank ReconDocument2 pagesBank Reconyjkq4byrj6No ratings yet

- Mock Midterm Exam - QuestionnaireDocument13 pagesMock Midterm Exam - QuestionnaireMaeNo ratings yet

- Proof of Cash ProblemDocument4 pagesProof of Cash ProblemHtiduj Oretubag50% (4)

- Proof of CashDocument9 pagesProof of CashEDGAR ORDANELNo ratings yet

- ProblemsDocument28 pagesProblemsYou Knock On My DoorNo ratings yet

- Proof of Cash Problem 3-1Document5 pagesProof of Cash Problem 3-1Coleen Lara SedillesNo ratings yet

- Proof of CashDocument11 pagesProof of CashAndrea FontiverosNo ratings yet

- Ia 2Document2 pagesIa 2Nadine SofiaNo ratings yet

- 1905 Cash and Accounts ReceivableDocument9 pages1905 Cash and Accounts ReceivableCykee Hanna Quizo LumongsodNo ratings yet

- Answer Sample Problems Cash1-12Document4 pagesAnswer Sample Problems Cash1-12Anonymous wwLoDau1aNo ratings yet

- Bank Recon and Cash and Cash Equivalent and PCF FA ProblemsDocument5 pagesBank Recon and Cash and Cash Equivalent and PCF FA ProblemsCruxzelle BajoNo ratings yet

- Ia1 Midterm ExamDocument9 pagesIa1 Midterm Examjestoni alvezNo ratings yet

- 112.BankReconciliation and Proof of CashDocument1 page112.BankReconciliation and Proof of CashPrincess Escovidal50% (2)

- Bank Recon and CC and PCF ProblemsDocument5 pagesBank Recon and CC and PCF ProblemsCruxzelle BajoNo ratings yet

- On January 1Document6 pagesOn January 1Warren Nahial ValerioNo ratings yet

- Problem 59Document1 pageProblem 59YukidoNo ratings yet

- Zodiac Company: Balance Per Book, April 30Document5 pagesZodiac Company: Balance Per Book, April 30Rhea Sismo-anNo ratings yet

- Chapters 1-3: Cash and Cash Equivalents, Bank Reconciliation and Proof of CashDocument4 pagesChapters 1-3: Cash and Cash Equivalents, Bank Reconciliation and Proof of CashMarco CruzNo ratings yet

- Cash and Cash EquivalentsDocument3 pagesCash and Cash EquivalentsLui100% (1)

- Proof of CashDocument6 pagesProof of CashAlexander ONo ratings yet

- Audprob Cash2 Bsa4 2Document5 pagesAudprob Cash2 Bsa4 2Mark Gelo WinchesterNo ratings yet

- Audit On Cash Lecture ProblemDocument2 pagesAudit On Cash Lecture ProblemAprilyn BatayoNo ratings yet

- INTERMEDIATE ACCOUNTING Vol. 1 (2021 Edition) - Valix, Peralta & Valix - XLSX Chapter 3Document4 pagesINTERMEDIATE ACCOUNTING Vol. 1 (2021 Edition) - Valix, Peralta & Valix - XLSX Chapter 3Rodolfo ManalacNo ratings yet

- Document PDFDocument9 pagesDocument PDFOneil HernandezNo ratings yet

- IA 1 Chap.34Document6 pagesIA 1 Chap.34beamarievidaniaNo ratings yet

- Proof of CashDocument22 pagesProof of CashYen RabotasoNo ratings yet

- Cash and Cash EquivalentsDocument4 pagesCash and Cash Equivalentsattiva jadeNo ratings yet

- Exercises - Bank Recon - 1.16.20Document4 pagesExercises - Bank Recon - 1.16.20Michelle PamplinaNo ratings yet

- This Study Resource Was: Cpa Review School of The PhilippinesDocument5 pagesThis Study Resource Was: Cpa Review School of The PhilippinesKez MaxNo ratings yet

- This Study Resource Was: Cpa Review School of The PhilippinesDocument5 pagesThis Study Resource Was: Cpa Review School of The PhilippinesKez MaxNo ratings yet

- Proof of CashDocument2 pagesProof of CashDanie MNo ratings yet

- Bak ReconDocument1 pageBak ReconFlorimar Lagda100% (1)

- Assignment 3Document4 pagesAssignment 3Bernadeth Adelaine DomingoNo ratings yet

- 1 Review CceDocument10 pages1 Review CceJobelle Candace Flores AbreraNo ratings yet

- Temp 99Document4 pagesTemp 99DaveyNo ratings yet

- ESG Engagement Seeding Energies: September 2016Document48 pagesESG Engagement Seeding Energies: September 2016Rajath BhatNo ratings yet

- Bain Brief Customer Led Supply Chain ManagementDocument12 pagesBain Brief Customer Led Supply Chain ManagementNikhilesh KalavacharlaNo ratings yet

- Revised Curriculum Bachelor of Business Administration in Accounting (FA 2653)Document2 pagesRevised Curriculum Bachelor of Business Administration in Accounting (FA 2653)dipanajnNo ratings yet

- Bii Global Outlook 2024Document16 pagesBii Global Outlook 2024harikevadiya4No ratings yet

- Buying and SellingDocument6 pagesBuying and SellingEnrique RiñosNo ratings yet

- Kpi Ach 27 Desember 2021Document53 pagesKpi Ach 27 Desember 2021Rizki KurniadiNo ratings yet

- NEW Preapproval LA Package NC 2022Document5 pagesNEW Preapproval LA Package NC 2022PamelaNo ratings yet

- Stakeholder Mapping: Step 1 - Identify Your Main StakeholdersDocument4 pagesStakeholder Mapping: Step 1 - Identify Your Main StakeholderstryasihNo ratings yet

- MSL 873: Security Analysis and Portfolio Management Minor AssignmentDocument9 pagesMSL 873: Security Analysis and Portfolio Management Minor AssignmentVasavi MendaNo ratings yet

- A232 MC 5 Biological Assets - QuestionsDocument7 pagesA232 MC 5 Biological Assets - QuestionsDAHLIAH AZIZNo ratings yet

- RedBus Ticket - TQBX34280728Document2 pagesRedBus Ticket - TQBX34280728ameay rajebhosaleNo ratings yet

- Manufacturing of Javadhu PowderDocument2 pagesManufacturing of Javadhu PowderkhsreeharshaNo ratings yet

- 2.digital EraDocument14 pages2.digital Eraandi ilhaNo ratings yet

- 67 5 2 - AccountancyDocument32 pages67 5 2 - Accountancydakshparashar973No ratings yet

- FMA Assignment 01Document5 pagesFMA Assignment 01Dejen TagelewNo ratings yet

- Rs. 200 Draw ResultDocument5 pagesRs. 200 Draw ResultZia PhotostateNo ratings yet

- Common Resource: Hasna Kurnia Ulfah 15311288Document2 pagesCommon Resource: Hasna Kurnia Ulfah 15311288Nia KurniaNo ratings yet

- Profit & Loss - Bimetal Bearings LTDDocument2 pagesProfit & Loss - Bimetal Bearings LTDMurali DharanNo ratings yet

- Silvia Luthfiyah Ghinastri - 195020107111031 - Mini Online ConferenceDocument6 pagesSilvia Luthfiyah Ghinastri - 195020107111031 - Mini Online ConferenceMuhamad Zulhan FikriNo ratings yet

- TEM-8 Test 2018Document4 pagesTEM-8 Test 2018abC AdobeNo ratings yet

- Tprabhakara Rao-0884Document1 pageTprabhakara Rao-0884seshu 2010No ratings yet

- Week 3 Coursera - Inventory Management Graded QuizDocument4 pagesWeek 3 Coursera - Inventory Management Graded QuizMai An MiNo ratings yet

- Quiz - Operating Segments With QuestionsDocument5 pagesQuiz - Operating Segments With Questionsjanus lopezNo ratings yet

- Jarantilla vs. JarantillaDocument2 pagesJarantilla vs. JarantillaAnonymous 8liWSgmINo ratings yet

- Security Analysis and Portfolo Management-Unit-1-Dr-Asma-KhanDocument48 pagesSecurity Analysis and Portfolo Management-Unit-1-Dr-Asma-KhanSHIVPRATAP SINGH TOMARNo ratings yet

- Y Combinator Guide To Seed FundraisingDocument12 pagesY Combinator Guide To Seed FundraisingOluwasegun Oluwaleti100% (1)

- Activity 4 Bank Reconciliation PDFDocument4 pagesActivity 4 Bank Reconciliation PDFSharmin ReulaNo ratings yet

- Ividend Ecisions: Learning OutcomesDocument51 pagesIvidend Ecisions: Learning OutcomesA.KNo ratings yet

- 9-1b PT Pohan, PT Sohan, PT TohanDocument23 pages9-1b PT Pohan, PT Sohan, PT TohanToys AdventureNo ratings yet