Professional Documents

Culture Documents

FA7

FA7

Uploaded by

KirosTeklehaimanot0 ratings0% found this document useful (0 votes)

5 views2 pagesThe document contains 9 multiple choice questions related to accounting and payroll concepts. Question 1 asks about calculating wages expense using accrual accounting given wages paid and unpaid during the year. Question 2 asks about the adjusting entry for depreciation expense on vehicles purchased for a business. Question 3 asks about the classification of accrued but unpaid expenses at the end of a fiscal period.

Original Description:

exam

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document contains 9 multiple choice questions related to accounting and payroll concepts. Question 1 asks about calculating wages expense using accrual accounting given wages paid and unpaid during the year. Question 2 asks about the adjusting entry for depreciation expense on vehicles purchased for a business. Question 3 asks about the classification of accrued but unpaid expenses at the end of a fiscal period.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

5 views2 pagesFA7

FA7

Uploaded by

KirosTeklehaimanotThe document contains 9 multiple choice questions related to accounting and payroll concepts. Question 1 asks about calculating wages expense using accrual accounting given wages paid and unpaid during the year. Question 2 asks about the adjusting entry for depreciation expense on vehicles purchased for a business. Question 3 asks about the classification of accrued but unpaid expenses at the end of a fiscal period.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

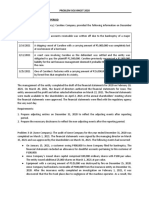

1. During 2017 the Style Hairdressing Salon paid out Br.41 000 in wages from its bank account.

At

year-end 2017 wages owing but unpaid were Br.2400. The salon uses accrual accounting. How

much would be reported as wages expense for 2017?

a. Br.38 600 d. Br.42 600

b. Br.41 000 e. None of the above

c. Br.43 400

2. Michael purchased two vehicles for his business on 1 January 2018. These vehicles cost

Br.50 000 each and have a useful life of 5 years with an expected residual of Br.20 000 each. The

adjusting entry for depreciation on 31 December 2018, using the straight-line method, is:

a. Dr Accumulated Depreciation Br.6000; Cr Depreciation Expense Br.6000

b. Dr Depreciation Expense Br.6000; Cr Accumulated Depreciation Br.6000

c. Dr Accumulated Depreciation Br.12 000; Cr Depreciation Expense Br.12 000

d. Dr Depreciation Expense Br.12 000 Cr Accumulated Depreciation Br.12 000

e. None of the above

3. The amount of accrued but unpaid expenses at the end of the fiscal period is both an expense

and a(n):

a. liability c. deferral

b. asset d. revenue

4. Which of the following is correct about overtime earning?

a. Payment for additional work other than the regular/normal working hours

b. Payment in excess of forty hours per week

c. Under any circumstance, a worker cannot be compelled to work overtime

d. None of the above

5. One of the following is not required to calculate overtime earning:

a. Overtime pay rate c. Overtime hours worked

b. Allowance d. Regular hourly salary rate

6. Which of the following is true about bad climate allowance?

a. Does not vary from one employer to another employer

b. All the hot regions of the country are entitled to this type of allowance

c. May vary from one temperature area to another temperature area

d. Does not vary from one temperature area to another temperature area

7. _____ is payment for carrying out a particular office responsibility in addition to normal work

a. Representation allowance c. Per-diem

b. Position allowance d. None of the above

8. One of the following is not true about basic salary (wage):

a. A fixed amount payable regularly on a certain interval

b. Doesn’t change from one payroll period to the other

c. The base for calculating overtime earning, allowance, per-diem, bonus, severance pay, etc

d. Not changed based on performance evaluation or position adjustment

9. One of the following is not required to calculate overtime earning:

a. Basic Salary d. Hours worked

b. Overtime Situation e. None of the above

c. Allowances

You might also like

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Multiple Choice: Principles of Accounting, Volume 2: Managerial AccountingDocument46 pagesMultiple Choice: Principles of Accounting, Volume 2: Managerial Accountingquanghuymc100% (2)

- Jackson AutomotiveDocument3 pagesJackson AutomotiveErika Theng25% (4)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Fin 300 Exam PracticeDocument6 pagesFin 300 Exam PracticePhillip Lee0% (1)

- Finance101 Sample Questions 3a08Document19 pagesFinance101 Sample Questions 3a08Eve LNo ratings yet

- Adjusting Entry Multiple Choice Question and Answer KeyDocument9 pagesAdjusting Entry Multiple Choice Question and Answer Keygnzg.bela50% (2)

- Chapter 4-FinanceDocument14 pagesChapter 4-Financesjenkins66No ratings yet

- Usant Accounting 4 Castroverde Final Exam Problem 1: QuestionsDocument8 pagesUsant Accounting 4 Castroverde Final Exam Problem 1: QuestionsRica Catangui100% (1)

- FA8Document2 pagesFA8KirosTeklehaimanotNo ratings yet

- Financial Accounting - All QsDocument21 pagesFinancial Accounting - All QsJulioNo ratings yet

- Online Quiz - PractiseDocument8 pagesOnline Quiz - PractiseKatrina Eustace100% (1)

- Practice 3Document6 pagesPractice 3timothytan3326No ratings yet

- Accounting For Postemplyoment BenefitDocument9 pagesAccounting For Postemplyoment BenefitJoana MarieNo ratings yet

- 6Document2 pages6Carlo ParasNo ratings yet

- Chapter 6Document5 pagesChapter 6Angelita Dela cruzNo ratings yet

- HIGGINS Chapter 7 - Course AidesDocument6 pagesHIGGINS Chapter 7 - Course AidesParul BhavsarNo ratings yet

- c11 (MC) - Cost Accounting by Carter (Part4)Document3 pagesc11 (MC) - Cost Accounting by Carter (Part4)AkiNo ratings yet

- Accounting ProblemDocument27 pagesAccounting ProblemLeo TamaNo ratings yet

- Quiz Capital Budgeting 2018 2019 1st SemDocument6 pagesQuiz Capital Budgeting 2018 2019 1st Semjethro carlobosNo ratings yet

- Accounting and Finance For Bankers - JAIIBDocument19 pagesAccounting and Finance For Bankers - JAIIBAyesha BepariNo ratings yet

- Valix 17 20 MCQ and Theory Emp Ben She PDFDocument48 pagesValix 17 20 MCQ and Theory Emp Ben She PDFMitchie FaustinoNo ratings yet

- Bài tập ôn tập chapter 4 Ms.TrangDocument8 pagesBài tập ôn tập chapter 4 Ms.TrangNgọc Trung Học 20No ratings yet

- Mycbseguide: Class 12 - Accountancy Sample Paper 07Document15 pagesMycbseguide: Class 12 - Accountancy Sample Paper 07sneha muralidharanNo ratings yet

- 2 Financial Accounting 1Document11 pages2 Financial Accounting 1mahendrabpatelNo ratings yet

- CH 3 Multiple SolutionsDocument3 pagesCH 3 Multiple SolutionsSaleema KarimNo ratings yet

- I. Theories. Choose The Letter of The BEST Answer. No Erasures On Final AnswersDocument5 pagesI. Theories. Choose The Letter of The BEST Answer. No Erasures On Final AnswersSheena CalderonNo ratings yet

- Weekly UAS Manacc TUTORKU (Answered)Document8 pagesWeekly UAS Manacc TUTORKU (Answered)Della BianchiNo ratings yet

- Cat/fia (Ma2)Document12 pagesCat/fia (Ma2)theizzatirosli50% (2)

- Joyce Anne Luna BSA401Document12 pagesJoyce Anne Luna BSA401kathpremsNo ratings yet

- 12 Accountancy sp08Document15 pages12 Accountancy sp08sneha muralidharanNo ratings yet

- Tax1 Final Exam 2022 ADocument7 pagesTax1 Final Exam 2022 AEjie MarabeNo ratings yet

- Chapter 05 Net Present Value and Other Investment CriteriaDocument3 pagesChapter 05 Net Present Value and Other Investment CriteriaSaranyieh RamasamyNo ratings yet

- Far by 11 SupernovaDocument17 pagesFar by 11 SupernovaMaybellene VillacastinNo ratings yet

- Far TheoriesDocument4 pagesFar Theoriesfrancis dungcaNo ratings yet

- Orca Share Media1605010109407 6731900321930361605Document37 pagesOrca Share Media1605010109407 6731900321930361605MARY JUSTINE PAQUIBOTNo ratings yet

- MAS Midterm Quiz 2Document4 pagesMAS Midterm Quiz 2Joseph John SarmientoNo ratings yet

- Day 4 Post TestDocument2 pagesDay 4 Post TestcassiopieabNo ratings yet

- ACCTG 11 Management Accounting Part 2: Lyceum-Northwestern UniversityDocument7 pagesACCTG 11 Management Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Final Cash and PayrollDocument6 pagesFinal Cash and PayrollNigus AyeleNo ratings yet

- ACCTG 11 Management Accounting Part 2: Lyceum-Northwestern UniversityDocument7 pagesACCTG 11 Management Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- fm2 mq1Document4 pagesfm2 mq1Ramon Jonathan SapalaranNo ratings yet

- Manegiral Accounting Unit 4 5 Test BankDocument8 pagesManegiral Accounting Unit 4 5 Test BankJean NestaNo ratings yet

- Exercise For Current LiabilitiesDocument5 pagesExercise For Current LiabilitiesAsyraf AzharNo ratings yet

- P1 QuizzerDocument26 pagesP1 QuizzerLorena Joy AggabaoNo ratings yet

- General Instructions: Read Carefully All The Instructions. Write All Your Answers in CAPITAL LETTERS OnlyDocument2 pagesGeneral Instructions: Read Carefully All The Instructions. Write All Your Answers in CAPITAL LETTERS OnlyRegine BaterisnaNo ratings yet

- 1st QUIZDocument2 pages1st QUIZMary Christen CanlasNo ratings yet

- 50 Multiple Choice, T/F, & Essay QuestionsDocument24 pages50 Multiple Choice, T/F, & Essay QuestionsManal Elkhoshkhany100% (1)

- Quiz Adjusting Entries Multiple Choice WithoutDocument5 pagesQuiz Adjusting Entries Multiple Choice WithoutRakzMagaleNo ratings yet

- KUIS FA 2 Anak AkunDocument4 pagesKUIS FA 2 Anak Akunelaine aureliaNo ratings yet

- FIN350 in Class Work No. 1 First Name - Last NameDocument8 pagesFIN350 in Class Work No. 1 First Name - Last Nameh1ph9pNo ratings yet

- Gross Income and Deductions PDFDocument6 pagesGross Income and Deductions PDFyejiNo ratings yet

- C. The Equity Multiplier, The Profit Margin and The Total Asset TurnoverDocument5 pagesC. The Equity Multiplier, The Profit Margin and The Total Asset Turnoverferoz_bilalNo ratings yet

- Accrual Accounting TheoriesDocument2 pagesAccrual Accounting TheoriesLiwliwa BrunoNo ratings yet

- Fainancial Management I AssignmentDocument8 pagesFainancial Management I AssignmentNitinNo ratings yet

- CFAS-MC Ques - Review of The Acctg. ProcessDocument5 pagesCFAS-MC Ques - Review of The Acctg. ProcessKristine Elaine RocoNo ratings yet

- Cash and AccrualDocument3 pagesCash and AccrualHarvey Dienne Quiambao100% (2)

- Preliminary Examination FINACC3Document6 pagesPreliminary Examination FINACC3Jonabelle C. Biligan0% (1)

- Preliminary Examination FINACC3Document6 pagesPreliminary Examination FINACC3Jonabelle C. BiliganNo ratings yet

- Employee Benefits ExamDocument11 pagesEmployee Benefits ExamLouiseNo ratings yet

- Corporate Finance - Mock ExamDocument5 pagesCorporate Finance - Mock ExamMinh Hạnh NguyễnNo ratings yet

- Hadm 6305 Which of The Following Is Most Likely A Fixed Cost 3Document5 pagesHadm 6305 Which of The Following Is Most Likely A Fixed Cost 3CharlotteNo ratings yet

- FPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)From EverandFPQP Practice Question Workbook: 1,000 Comprehensive Practice Questions (2024 Edition)No ratings yet

- FRANCHISEDocument5 pagesFRANCHISEKirosTeklehaimanotNo ratings yet

- ResearchDocument1 pageResearchKirosTeklehaimanotNo ratings yet

- Exit ExamDocument4 pagesExit ExamKirosTeklehaimanotNo ratings yet

- Chapter Two (2) Review of Related LiteratureDocument2 pagesChapter Two (2) Review of Related LiteratureKirosTeklehaimanotNo ratings yet

- ResearchDocument1 pageResearchKirosTeklehaimanotNo ratings yet

- 2.10. Benefits (Advantages) of Credit Card Payment System For The Different Stakeholders 2.10.1. Benefits For Consumers and MerchantsDocument1 page2.10. Benefits (Advantages) of Credit Card Payment System For The Different Stakeholders 2.10.1. Benefits For Consumers and MerchantsKirosTeklehaimanotNo ratings yet

- Organizations With Partnership Characteristics: Special Partnership Forms AreDocument1 pageOrganizations With Partnership Characteristics: Special Partnership Forms AreKirosTeklehaimanotNo ratings yet

- 4Document2 pages4KirosTeklehaimanotNo ratings yet

- ResearchDocument1 pageResearchKirosTeklehaimanotNo ratings yet

- Ifrs Standards and Long Term InvestmentsDocument26 pagesIfrs Standards and Long Term InvestmentsKirosTeklehaimanotNo ratings yet

- Cost II MakeupDocument2 pagesCost II MakeupKirosTeklehaimanotNo ratings yet

- FA!%Document2 pagesFA!%KirosTeklehaimanotNo ratings yet

- A Simple Definition of Income Measurement Is The Calculation of Profit or LossDocument7 pagesA Simple Definition of Income Measurement Is The Calculation of Profit or LossKirosTeklehaimanotNo ratings yet

- FA16Document2 pagesFA16KirosTeklehaimanotNo ratings yet

- FA6Document2 pagesFA6KirosTeklehaimanotNo ratings yet

- FA12Document2 pagesFA12KirosTeklehaimanotNo ratings yet

- FA13Document2 pagesFA13KirosTeklehaimanotNo ratings yet

- Topic 4 Class Discussion QuestionsDocument2 pagesTopic 4 Class Discussion Questionssyedimranmasood100No ratings yet

- Introduction To Cost AccountingfinalDocument26 pagesIntroduction To Cost AccountingfinalLerench james CamposNo ratings yet

- Capital and Revenue ExpenditureDocument23 pagesCapital and Revenue ExpenditureGodfreyFrankMwakalingaNo ratings yet

- Seminar 12 - Intangible Assets and Impairment Testing1Document36 pagesSeminar 12 - Intangible Assets and Impairment Testing1Celine LowNo ratings yet

- T Accounts Trial BalanceDocument7 pagesT Accounts Trial BalanceCamille Pasion100% (1)

- Great 10-Year Record Great Future, RightDocument27 pagesGreat 10-Year Record Great Future, RightrpradeephereNo ratings yet

- Valuation of SecuritiesDocument8 pagesValuation of SecuritiesVinayak SaxenaNo ratings yet

- Week 4 AssignmentDocument6 pagesWeek 4 AssignmentJames Bradley HuangNo ratings yet

- Business Ice CandyDocument19 pagesBusiness Ice CandyBjorn Abubo100% (3)

- MBAC1003Document7 pagesMBAC1003SwaathiNo ratings yet

- Project Managmt Cash Flow Payback PeriodDocument29 pagesProject Managmt Cash Flow Payback PeriodPhebieon MukwenhaNo ratings yet

- Quiz6 - Akm IIIDocument4 pagesQuiz6 - Akm IIIrNo ratings yet

- English For Financial MarketsDocument74 pagesEnglish For Financial MarketsTRANNo ratings yet

- Taranpreet Singh Capstone ProjectDocument79 pagesTaranpreet Singh Capstone Projectasus laptopNo ratings yet

- CH 01Document56 pagesCH 01lalala010899No ratings yet

- JPM Morgan - Setor Financeiro BrasileiroDocument17 pagesJPM Morgan - Setor Financeiro BrasileiroMichel ZambrettiNo ratings yet

- Assignment Open Ended QuestionsDocument11 pagesAssignment Open Ended QuestionsRina Mae Sismar Lawi-an100% (1)

- 6 Chapter7-2 InventoryDocument59 pages6 Chapter7-2 InventoryEvelyn WongNo ratings yet

- Statement of Changes in Equity: Fabm IiDocument12 pagesStatement of Changes in Equity: Fabm IiAlyssa Nikki VersozaNo ratings yet

- FA MMS-FA-pg 107-114Document8 pagesFA MMS-FA-pg 107-114rohit shahNo ratings yet

- Tottenham Case PDF FreeDocument19 pagesTottenham Case PDF Freemaham nazirNo ratings yet

- Management Accounting Basic ConceptsDocument5 pagesManagement Accounting Basic ConceptsAlexandra Nicole IsaacNo ratings yet

- Intermediate Accounting, Volume 1: Donald E. Kieso PH.D., C.P.ADocument9 pagesIntermediate Accounting, Volume 1: Donald E. Kieso PH.D., C.P.AFitriani Alletha100% (1)

- Appraisal - TCS - FinalDocument61 pagesAppraisal - TCS - FinalgetkhosaNo ratings yet

- Activity ThreeDocument2 pagesActivity ThreePrincess CondesNo ratings yet

- Quiz Chapter 10 Investments in Debt Securities Ia 1 2020 EditionDocument7 pagesQuiz Chapter 10 Investments in Debt Securities Ia 1 2020 EditionChristine Jean MajestradoNo ratings yet

- AE 221 Unit 3 Problems PDFDocument5 pagesAE 221 Unit 3 Problems PDFMae-shane SagayoNo ratings yet