Professional Documents

Culture Documents

MAE QP May - 2023

MAE QP May - 2023

Uploaded by

Deepali Koirala0 ratings0% found this document useful (0 votes)

17 views4 pagesOriginal Title

MAE-QP-May_-_2023

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

17 views4 pagesMAE QP May - 2023

MAE QP May - 2023

Uploaded by

Deepali KoiralaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 4

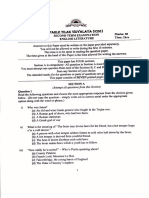

SVKM’S NMIMS

MUKESH PATEL SCHOOL OF TECHNOLOGY MANAGEMENT& ENGINEERING

Academic Year: 2022-2023

Program: B Tech/MBA Tech (CEICS) Year: L_ Semester: I

Subject: Management Accounting for Engineers Time: Shs. ({4r00anto 2:00pm)

Date: 1% /05/23 ‘No, of Pages: 04

‘Marks: 100 Marks

Final Examination

Instructions: Candidates should read carefully the instructions printed om the question paper and on the cover of the

‘Answer Book, which is provided for their use.

1) Question No. _1__ is compulsory.

2) Out of remaiaing questions, attempt any _4__questions,

3)Inall__5_ questions to be attempted.

4) All questions carry equal marks.

5) Answer to each new question to be started on a fresh page.

6) Figures in brackets on the right hand side indicate full marks.

7) Assume Suitable data if necessary.

eH ‘Answer briefly 20

CO-1;50-; [| explain any five differences between Financial Accounting & Cost Accounting. | 5

BL- Remember stu

Given that, the total sales of @ product is RS, 1,00,000 and the fixed cost is

> | Rs, 20,000 during the year 2022. If the product's variable cost and selling price per

ee seit ‘unit are Rs.15 and Rs.20 respectively, ind out the P/V Ratio, BEP and Margin of | 5

Safety.

“The following information is available in respect of material Az

Maximum usage - 300 units

Minimum usage —200 units

Normal usage ~ 225 units

0-2; 80-5 ‘Time lag in procurement of material - Maximum 6 months , Minimum 2months | 5 |

BL- Evaluate Reorder quantity - 750 units

Calculate:

| (@) Re-order level (¢) Maximum level

(0) Minianom level (@ Average level

©02;803 14 pias a

aan Explain the steps followed in Activity Based Costing. s |

Page 1of4

Following are the details furnished by ABC Ltd. about its activity during the year

ended 31st March, 2022. You are required to prepare a Cost Sheet showing various

elements of cost and calculate the Profit.

Raw Material consumed - 40,000 units @ 8 7 per unit.

Direct Wages:

(a) Skilled worker % 9 per unit,

Qn (b) Unskilled worker @ 6 per unit.

€0.2; $05 Royalty on raw material consumed) @¥ 3 per unit.

BL- Evaluate ‘Works overheads @€ 8 per machine hour. 15

Machine Hours Worked 25,000

Office Overheads @ 1/3rd of works cast

Sales Commission @% 4 per unit.

: Units produced 40,000.

Stock of units at the end 4,000 units to be valued at cost of production per unit.

Selling price is & 60 per unit,

Q2

Gos 805 ia Explain with examples, the classification of costs according to variability, 5

XYZ Ld, manufactured and sold 10,000 units and 15,000 units inthe First

Year and the Second Year respectively. The selling price per unit was & 60

in both the years. In the first year it suffered a loss of € 30.000 and in the

second year eamed profit of & 30,000. Considering the above information,

polea! calculate the followings: 7

oe atte a) Profit Volume Ratio

») The amount of Fixed Cost

o) The BEP in value and units

4) Profit when 20.000 units are sold

©) The number of units to be sold to eam a profit of & 1,00,000. |

00-480: BL- ‘What is Margin of Safty? Explain the calculation with an example, 5

Understand 2

Page 20f 4

The following data is given:

Product A Product B

Direct materials Rs. 35 Rs. 20

Direct labour @ Rs. 2 per hour Rs8 Rs. 10

Variable overhead Rs. Rs.6

Selling price per unit Rs. 120 Rs. 110

‘State which product you would recommend to manufacture when:

a) Labour time is the key factor;

) Sales value is the key factor;

©). Sales quantity is the key factor;

15

The standard mix producing a product X is as follows:

Material A 60 tonnes @ Rs 10

Material B 90 tonnes @ Rs 20

ea asec ‘The actual mix was as follows: .

Pea Material A 80 tonnes @ Rs 12

Material B 60 tonnes @ Rs 25

Calculate all Matertal Variances

The details of expenses for production of 20,000 units at 100% capacity in a

factory are given es follows:

Particulars z

Materials 5,00,000

as

0-3; 805 Labour 4,00,000 15

BL-Apply

Factory overhead (20% variable) 3,00,000

Office and administrative overhead (30% fixed) 2,50,000

Selling and distribution overheads (40% variable) 1,50,000

Prepare a Flexible Budget at 70% and 90% capacity level

haps Define Budgeting and explain its benefits for a business organization, 5

BL- Evaluate

Page of 4

Qs

CO-5, S05

BL- Apply

‘The following are the particulars of two products P and Q:

Product P Product Q

Rs, Per unit Rs, Per unit

Direct Materials 100 150

Direct Labour 140 249

Direct expenses 140 210

Selling price per unit 500 700

‘Total Fixed overheads is Rs.25000.

‘The new sales manager has proposed the following two sales mixes

1, Mix A~300 units of P and 300 units of

2, Mix B-200 units of P and 400 units of Q.

‘Advice the management as to which of the above TWO mixes are to be accepted.

12

CO-1; 805,

BL- Remember &

‘Understand

Write Short Notes on:

1. Accounting Concepts 8

2. VED system of inventory classification

Q7

CO-4; 805;

BL- Evaluate

“Tie following are the details for P Ltd for the month of Jan 2023.

‘The Standard Inbour hours required for manufacture of one article of the finished

product and the rate per hour arc as under:

Category of labour | Labour hours per unit_| Rate per labour hour(Rs.)

Skilled 10 100

Semi-Skilled 7 50

Unskilled 2 20

‘The Actual production ina month was 100 articles.

‘The details of actual hours worked by the different labour categories and the actual } 12

‘rate per labour hour are as under:

Category of labour _| Labour hours per unit | Rate per labour hour(Rs.)

Skilled 1020 410.

Semi-Skilled 690 55,

Unskilled 1220 19

Calculate the following Labour Variances from the given data:

1. Labour cost variance,

2. Labour rate variance

3.__Labour efficiency variance

Q7

C02; $05

BL-Evaluate

Kuber Manufacturing Company estimates that its carrying cost is 15% and it’s

ordering cost is Rs. 9 per order. The estimated annual requirement is 48,000 units

ata price of Rs. 4 per unt. Based on information provided respond to the following

questions;

i. Whatis the most economical aumber of units to order? |

ii, How many orders should be placed in a year?

iti, _ How often should an order be placed?

‘THE END

Page 4of 4

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Game TheoryDocument4 pagesGame TheoryDeepali KoiralaNo ratings yet

- Practice Worksheet 3Document7 pagesPractice Worksheet 3Deepali KoiralaNo ratings yet

- Practice Worksheet 6Document4 pagesPractice Worksheet 6Deepali KoiralaNo ratings yet

- Machine Learning 2. 3rd Year.Document51 pagesMachine Learning 2. 3rd Year.Deepali KoiralaNo ratings yet

- SSRN Id2437936Document43 pagesSSRN Id2437936Deepali KoiralaNo ratings yet

- Practice Worksheet 1Document4 pagesPractice Worksheet 1Deepali KoiralaNo ratings yet

- A Mixed Integer Linear Programing ApproaDocument30 pagesA Mixed Integer Linear Programing ApproaDeepali KoiralaNo ratings yet

- ML Unit3 MultipleLinearRegressionDocument70 pagesML Unit3 MultipleLinearRegressionDeepali KoiralaNo ratings yet

- A Mixed Integer Programming Approach ToDocument29 pagesA Mixed Integer Programming Approach ToDeepali KoiralaNo ratings yet

- 100 PrepositionsDocument9 pages100 PrepositionsDeepali KoiralaNo ratings yet

- English Literature 80 Mark Question Paper 2nd Term PTV ICSEDocument7 pagesEnglish Literature 80 Mark Question Paper 2nd Term PTV ICSEDeepali KoiralaNo ratings yet

- A Mixed Integer Programming Approach To The Patient Admission Scheduling ProblemDocument16 pagesA Mixed Integer Programming Approach To The Patient Admission Scheduling ProblemDeepali KoiralaNo ratings yet

- A Mixed Integer Linear Programming ApproDocument7 pagesA Mixed Integer Linear Programming ApproDeepali KoiralaNo ratings yet

- Grade 10 Lit 2 RevisionDocument2 pagesGrade 10 Lit 2 RevisionDeepali KoiralaNo ratings yet

- Forward & Backward ChainingDocument23 pagesForward & Backward ChainingDeepali KoiralaNo ratings yet

- Guidelines For The ExamDocument4 pagesGuidelines For The ExamDeepali KoiralaNo ratings yet

- 8 Point DFT Using Radix 2 DIT FFTDocument6 pages8 Point DFT Using Radix 2 DIT FFTDeepali KoiralaNo ratings yet

- Cost Sheet ProblemsDocument18 pagesCost Sheet ProblemsZahid RahmanNo ratings yet

- English Literature Prelim PaperDocument5 pagesEnglish Literature Prelim PaperDeepali KoiralaNo ratings yet

- Unit 1 AiDocument68 pagesUnit 1 AiDeepali KoiralaNo ratings yet

- ML Unit2 SimpleLinearRegression pdf-60-97Document38 pagesML Unit2 SimpleLinearRegression pdf-60-97Deepali KoiralaNo ratings yet

- Lesson 1Document52 pagesLesson 1Deepali KoiralaNo ratings yet

- Machine Learning - Lec1Document56 pagesMachine Learning - Lec1Deepali KoiralaNo ratings yet

- Worksheet Comp 2Document2 pagesWorksheet Comp 2Deepali KoiralaNo ratings yet

- Vis Comp Prelim 23Document5 pagesVis Comp Prelim 23Deepali KoiralaNo ratings yet

- Evergreen BookDocument33 pagesEvergreen BookDeepali KoiralaNo ratings yet

- String+Handling+Programs 220408 211628Document10 pagesString+Handling+Programs 220408 211628Deepali KoiralaNo ratings yet

- ExxamDocument3 pagesExxamDeepali KoiralaNo ratings yet

- ICSE Arihant Sample Papers 2024Document96 pagesICSE Arihant Sample Papers 2024Deepali KoiralaNo ratings yet

- 1 A B C D: Find OutputDocument6 pages1 A B C D: Find OutputDeepali KoiralaNo ratings yet