Professional Documents

Culture Documents

The Sources and Uses of Funds Approach

The Sources and Uses of Funds Approach

Uploaded by

fateh.fitness123Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Sources and Uses of Funds Approach

The Sources and Uses of Funds Approach

Uploaded by

fateh.fitness123Copyright:

Available Formats

Sources and Uses of Funds Approach

One of the key challenges and goals of financial institutions is to stay liquid and provide liquidity

even through turbulent economic times. A financial firm has to estimate the foreseeable supply

and demand of liquidity throughout a given timeframe and has to ensure that the financial

institution will have a surplus of liquidity. One of the tools the liquidity managers of such

institutions have is called the sources and uses of funds.

The sources and uses of funds is essentially a cash flow statement for financial firms, that states

all of the cash inflows and outflaws. In terms of liquidity, the biggest items on the list in the case

of liquidity inflows are deposits and for liquidity outflaws they are loans. A bank (or any other

financial institution dealing with loans and deposits) has to adequately manage these inflows and

outflows to achieve a surplus of liquidity in a similiar way such firms have to manage and strive

for a positive IS GAP. The first step a liquidity manager has to take in ensuring proper liquidity

is to carefully asess the upcoming economic period and the changes in supply and demand for

funds. The first and foremost factor affecting loans is the GDP growth of the given economy. If

the economy is growing, participants are more motivated and inclined to take out loans to start

businesses or to invest into already booming ones. A healthy and growing economy promotes

loans, and it is up to the financial firm to decide how much of the liquidity inflows will be

converted into deposits. However, an increase in corporate earnings can take away from the

willingness to take on loans, as businesses with enough retained earnings might avoid taking the

added risk of debt and leverage and finance their expansions from their own equity. Also,

liquidity inflows and outflows are also extremely susceptible to changes in interest rates and

inflation. In a low interest rate environment, people are more than happy to take out loans

because of the cheap credit available, however less deposits will be made as a low interest rate

environment means that money sitting in financial institutions as deposit yield less, meaning that

people will chase after higher yielding, more riskier investments. Overall, the monetary policy of

the central bank and the growth/stagnation/decline of the economy all have a great impact on the

supply and demand for both loans and deposits, and liquidity managers have to accurately

predict and hedge against these possible interferences and events.

After taking all factors into consideration and asessing the foreseeable changes in loans and

deposits, the final step in finding out the liquidity position of the financial institution is

calculating the difference between the estimated changes in deposits and loans. Of course, to get

the most accurate and complete cash flow statement, liquidity managers must take all sources of

cash inflows and outflaws into consideration and not just loans and deposits, even though these

two have the biggest impact on liquidity position of the bank.

Sources:

Rose, P. S. and Hudgins, S. C. (2012). Bank Management and Financial Services. 9th ed.

Boston: McGraw-Hill.

Chapter 11 Slides on Moodle

You might also like

- European Data Strategy en PDFDocument3 pagesEuropean Data Strategy en PDFjoanluijkx100% (1)

- Liquidity Management of Citi BankDocument8 pagesLiquidity Management of Citi BankGanesh AppNo ratings yet

- Asset Liability Management in BanksDocument29 pagesAsset Liability Management in Bankseknath2000No ratings yet

- Final Project On Cash Flow Analysis For Union Bank of IndiaDocument107 pagesFinal Project On Cash Flow Analysis For Union Bank of IndiaKarthik Sp79% (47)

- Liquidity ManagementDocument60 pagesLiquidity ManagementRomil Parikh100% (1)

- For Exam Bank ManagementDocument215 pagesFor Exam Bank ManagementAung phyoe Thar OoNo ratings yet

- Treasury Researched AssignDocument9 pagesTreasury Researched AssignChristian SalazarNo ratings yet

- Banking Credit ManagementDocument7 pagesBanking Credit ManagementashwatinairNo ratings yet

- Liquidity - Part 1Document5 pagesLiquidity - Part 1Mis Alina DenisaNo ratings yet

- L-5&6 642 ReserveDocument44 pagesL-5&6 642 ReserveNiloy AhmedNo ratings yet

- Literature ReviewDocument9 pagesLiterature ReviewAnkur Upadhyay0% (1)

- Monetary Policy LecDocument30 pagesMonetary Policy LecsofiaNo ratings yet

- Capital Adequacy: Credit ExposureDocument10 pagesCapital Adequacy: Credit ExposureHimani DhingraNo ratings yet

- Cash ManagementDocument15 pagesCash ManagementChristopher Anniban SalipioNo ratings yet

- Savings: Role of The Financial System in Economic DevelopmentDocument6 pagesSavings: Role of The Financial System in Economic DevelopmentMurari NayuduNo ratings yet

- 2013 RacrDocument10 pages2013 RacrTMNo ratings yet

- Liquidity Risk Management Practices in Banking and Corporate WorldDocument5 pagesLiquidity Risk Management Practices in Banking and Corporate WorldmohasNo ratings yet

- FE101 Topic7 SourceDocument4 pagesFE101 Topic7 SourceYan DelfinNo ratings yet

- F.M Unit 1Document6 pagesF.M Unit 1Karan Veer SinghNo ratings yet

- CH 1 - Cash FlowDocument7 pagesCH 1 - Cash Flow李承翰No ratings yet

- Portofilo Quality and Delinquency ManagementDocument15 pagesPortofilo Quality and Delinquency ManagementILDEFONSO DEL ROSARIONo ratings yet

- WegagenDocument63 pagesWegagenYonas100% (1)

- What Is Asset and Liability ManagementDocument18 pagesWhat Is Asset and Liability ManagementRuhi KapoorNo ratings yet

- V JNLJNLJR X H/XV - V: Pit A Ptt7D /TDocument10 pagesV JNLJNLJR X H/XV - V: Pit A Ptt7D /TAkhil SablokNo ratings yet

- End Term Examination Third Semester (Mba) December 2009 PAPER CODE: - MS219 SUBJECT: Financial Markets and InstitutionsDocument23 pagesEnd Term Examination Third Semester (Mba) December 2009 PAPER CODE: - MS219 SUBJECT: Financial Markets and InstitutionsKaran GuptaNo ratings yet

- Role of Treasury ManagementDocument3 pagesRole of Treasury ManagementcharrygabornoNo ratings yet

- ContentDocument94 pagesContentsowmya chalumuruNo ratings yet

- CH 16 - Narrative Report-Short Term Business FinancingDocument13 pagesCH 16 - Narrative Report-Short Term Business Financingjomarybrequillo20No ratings yet

- Introduction To Financial IntermediationDocument10 pagesIntroduction To Financial IntermediationbugmenomoreNo ratings yet

- Introduction To Corporate Treasury HTTPDocument3 pagesIntroduction To Corporate Treasury HTTPYAKUBU ISSAHAKU SAIDNo ratings yet

- Assignment - Credit PolicyDocument10 pagesAssignment - Credit PolicyNilesh VadherNo ratings yet

- Corporate Bonds Vs Bank LoansDocument7 pagesCorporate Bonds Vs Bank LoansYssa MallenNo ratings yet

- Asset Liability Management in BanksDocument36 pagesAsset Liability Management in BanksHoàng Trần HữuNo ratings yet

- Cash Flow AnalysisDocument7 pagesCash Flow AnalysisDeepalaxmi BhatNo ratings yet

- Lender Borrower: Loan Is The Lending of Money From One Individual, Organization or Entity To AnotherDocument12 pagesLender Borrower: Loan Is The Lending of Money From One Individual, Organization or Entity To AnotherFaisal C. LivaraNo ratings yet

- Lender Borrower: Loan Is The Lending of Money From One Individual, Organization or Entity To AnotherDocument12 pagesLender Borrower: Loan Is The Lending of Money From One Individual, Organization or Entity To AnotherFaisal C. LivaraNo ratings yet

- Cash Flow StatementDocument103 pagesCash Flow StatementMBA Boys100% (1)

- Liquidity ManagementDocument51 pagesLiquidity Managementnikhil198924100% (2)

- PricewaterhouseCoopers - Liquidity Risk ManagementDocument6 pagesPricewaterhouseCoopers - Liquidity Risk ManagementbluepperNo ratings yet

- Unit 1 Finacial CreditDocument21 pagesUnit 1 Finacial Creditsaurabh thakurNo ratings yet

- Corporate Banking - FaisalDocument27 pagesCorporate Banking - FaisalVijender SinghNo ratings yet

- DocumentDocument16 pagesDocumentyared girmaNo ratings yet

- FINANCIAL MARKETS AND INSTITUTIONS (AutoRecovered)Document8 pagesFINANCIAL MARKETS AND INSTITUTIONS (AutoRecovered)dickens omondiNo ratings yet

- Debt ManagementDocument2 pagesDebt ManagementpascuallizelNo ratings yet

- Credit Risk Mgmt. at ICICIDocument60 pagesCredit Risk Mgmt. at ICICIRikesh Daliya100% (1)

- Philippine Financial SystemDocument14 pagesPhilippine Financial SystemMarie Sheryl FernandezNo ratings yet

- Central Bank Is The Lender of Last ResortDocument5 pagesCentral Bank Is The Lender of Last ResortchstuNo ratings yet

- Managemnt of Capital in BanksDocument8 pagesManagemnt of Capital in Banksnrawat12345No ratings yet

- Duke Fed Speech 9.14.09Document7 pagesDuke Fed Speech 9.14.09mrericwangNo ratings yet

- Funds Flow Statement LancoDocument86 pagesFunds Flow Statement Lancothella deva prasadNo ratings yet

- TMIF Chapter OneDocument46 pagesTMIF Chapter OneYibeltal AssefaNo ratings yet

- What Is A Cash Flow Forecast?: Financial DistressDocument5 pagesWhat Is A Cash Flow Forecast?: Financial DistressSai TejaNo ratings yet

- Tutorial Solution Week 2Document4 pagesTutorial Solution Week 2Arlene Lan100% (1)

- Money and The Banking System l3Document51 pagesMoney and The Banking System l3mumbi makangaNo ratings yet

- Chapter One: 1.1. Back Ground of The StudyDocument46 pagesChapter One: 1.1. Back Ground of The StudyBobasa S AhmedNo ratings yet

- FMTD - RIsk Management in BanksDocument6 pagesFMTD - RIsk Management in Banksajay_chitreNo ratings yet

- 09 - Chapter 3Document12 pages09 - Chapter 3Akhil SablokNo ratings yet

- General Revision For Treasury Management (Please See That You Can Answer The Following 32 Questions and The MCQS)Document14 pagesGeneral Revision For Treasury Management (Please See That You Can Answer The Following 32 Questions and The MCQS)RoelienNo ratings yet

- Globalisation VocabDocument4 pagesGlobalisation VocabTâm Trần Nguyễn BăngNo ratings yet

- QC Story - Toyota - Handbook of TQM and QCC - V1Document8 pagesQC Story - Toyota - Handbook of TQM and QCC - V1Venkatesh GogineniNo ratings yet

- Unit 1 - IS-LM-PCDocument27 pagesUnit 1 - IS-LM-PCGunjan ChoudharyNo ratings yet

- Monitoring Final Alligment Pump KSB 08-11-21Document1 pageMonitoring Final Alligment Pump KSB 08-11-21MahfudRido'iRonggomaniaNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument4 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledMarc Vergel FuentesNo ratings yet

- Part 1 Social ScienceDocument109 pagesPart 1 Social ScienceRowena CastillanoNo ratings yet

- Electric Vehicles - Latest EditionsDocument5 pagesElectric Vehicles - Latest EditionsSaeedAhmedKhan100% (1)

- Self PracticeDocument1 pageSelf Practiceloislam12345No ratings yet

- Outstanding Entries As On 24 Jan 2023 998Document2 pagesOutstanding Entries As On 24 Jan 2023 998Hussain MerchantNo ratings yet

- Critical Analysis of Marxist TheoryDocument18 pagesCritical Analysis of Marxist TheoryChudap Cell Inc.No ratings yet

- Marketing Environment Are Divided Into Two PartsDocument4 pagesMarketing Environment Are Divided Into Two Partstrinath1No ratings yet

- Wallstreetjournal 20221207 TheWallStreetJournal PDFDocument39 pagesWallstreetjournal 20221207 TheWallStreetJournal PDFRazvan Catalin CostinNo ratings yet

- WINRIP - DOC - MPR - CTC MPR No.48 2016 12 - 2016 12 30 - 00442 PDFDocument173 pagesWINRIP - DOC - MPR - CTC MPR No.48 2016 12 - 2016 12 30 - 00442 PDFazizNo ratings yet

- BSB CSMTDocument2 pagesBSB CSMTHarsh SinghNo ratings yet

- Account Statement: Kristy ProchaskaDocument2 pagesAccount Statement: Kristy ProchaskaImalka PriyadarshaniNo ratings yet

- Inductive Sensor NBB3-V3-Z4: DimensionsDocument2 pagesInductive Sensor NBB3-V3-Z4: DimensionsWebster FungiraiNo ratings yet

- Bir Form 2305Document1 pageBir Form 2305Analyn HernandezNo ratings yet

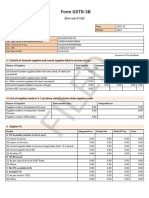

- GSTR3B 03alnpk4728k1zv 042021Document2 pagesGSTR3B 03alnpk4728k1zv 042021Harish VermaNo ratings yet

- Credit-Led Micro Finance in TamaleDocument15 pagesCredit-Led Micro Finance in Tamaledawuda72100% (1)

- EE469 Electric and Hybrid VehiclesDocument2 pagesEE469 Electric and Hybrid VehiclesTanaji Shinde0% (1)

- Glo DGF Ocean Market Update May 2023Document18 pagesGlo DGF Ocean Market Update May 2023Cléber MartinezNo ratings yet

- Excel Demo Diving Into PBIDocument135 pagesExcel Demo Diving Into PBIRahul ChauhanNo ratings yet

- Bukit Darmo Property TBKDocument4 pagesBukit Darmo Property TBKIndoplacesNo ratings yet

- #3 Lesson 2.4-2.6Document3 pages#3 Lesson 2.4-2.6Chelsea A. SADSADNo ratings yet

- Jai BabaDocument1 pageJai BabaShivam KumarNo ratings yet

- GIMS - Logistics and SCM - Personal Master FileDocument40 pagesGIMS - Logistics and SCM - Personal Master FilePreetham SamuelNo ratings yet

- PHD Seminar IIDocument2 pagesPHD Seminar IIDaveNo ratings yet

- Payment Receipt: Six Hundred Seventy-Five Thousand Dollars and Fifty CentsDocument12 pagesPayment Receipt: Six Hundred Seventy-Five Thousand Dollars and Fifty CentsfarukNo ratings yet

- Internal and External Analysis of The Automotive IndustryDocument9 pagesInternal and External Analysis of The Automotive IndustryRohit SoniNo ratings yet