Professional Documents

Culture Documents

Order Flow

Order Flow

Uploaded by

Rajendra DhakadOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Order Flow

Order Flow

Uploaded by

Rajendra DhakadCopyright:

Available Formats

Meta ve r s e ' s

ORDER

FLOW

Full Guide

Copyright ©2023 Metaverse Trading Academy | www.metaversetradingacademy.in

Metaverse Trading Academy is a NISM Certified by SEBI and one of the

Best Trading Academy in India, offering world-class education and

training to traders of all levels. With a wealth of experience in the industry,

the academy is renowned for its expert training, cutting-edge trading

tools, and unparalleled support.

One of the key areas of expertise at Metaverse Trading Academy is share

market trading. The academy's instructors provide students with a deep

understanding of the stock market, helping them to navigate complex

financial instruments, such as futures, options, and derivatives. The

academy's comprehensive curriculum includes a range of trading

strategies and techniques, including order flow, market profile, volume

profile, option chain profile, VWAP theory, and Delta Secret.

In addition to share market trading, Metaverse Trading Academy also

provides training in commodity market, crypto market, and forex market

trading. The academy's instructors are experts in their respective fields,

and are dedicated to providing students with a comprehensive

understanding of the markets they trade in. Whether you're interested in

trading gold, bitcoin, or forex, Metaverse Trading Academy has the tools

and expertise you need to succeed.

What sets Metaverse Trading Academy apart from other trading

academies is its commitment to using institutional-grade tools and

software. The academy provides students with access to cutting-edge

trading platforms, advanced charting tools, and real-time market data,

helping them to make informed trading decisions based on the latest

market trends.

Furthermore, Metaverse Trading Academy is dedicated to providing its

students with unparalleled support. The academy's instructors are

available to answer questions and provide guidance, and the academy

also offers a range of support services, including access to a community

of like-minded traders and ongoing education and training.

In conclusion, if you're looking for the best trading academy in India, look

no further than Metaverse Trading Academy. With its expert instructors,

cutting-edge trading tools, and unwavering commitment to student

success, Metaverse Trading Academy is the ideal choice for traders of all

levels.

Copyright ©2023 Metaverse Trading Academy | www.metaversetradingacademy.in

WHAT IS ORDER FLOW?

Order flow is a footprint chart showing only the real-time market order

executed trades to study the momentum and strength of the aggressive

buyers and aggressive sellers. If the market buy order is hit, then the OFA

is printed on the buy-side where the seller had a limit order and if the

market sell order is hit, then the OFA is printed on the sell-side where the

buyer had limit order.

Please note, a limit order during the execution will get converted into a

market order when the price reaches the limit level. For example, if the

price of XYZ is 100, if you keep a Limit Sell order at 105 when the price

reaches 105, then this limit order will be converted into a market order,

and it will be released into the system. An order flow chart will include all

the executed market orders.

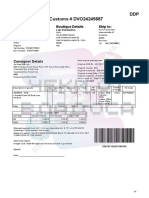

Image: A typical Order flow imbalance chart

A standard order flowchart is shown in the above picture. One can

add/delete/amend any features of the order flow using the ‘Totals’ option.

Besides, you can also add volume profile or volume histogram delta bar

etc .using the same choice.

Ask – It shows the total ‘Ask’ quantity for the selected time across the price

range. If you view 15-minute order flow chart, then it shows the total ask

quantities executed at market rates in that 15-minute window across the

price range.

Copyright ©2023 Metaverse Trading Academy | www.metaversetradingacademy.in

Bid – It shows the total ‘Bid’ quantity executed at market rates for the

selected time across the price range. If you view 15-minute order flow

chart, then it shows the total bid quantities in that 15-minute window

across the price range.

Delta – It is the net difference between the Ask and Bid in that respective

time window. It is calculated by subtracting the market order volumes

transacted at the bid price from the market order volumes transacted at

the ask price.

Cumulative Delta – In this case, the ‘Delta’ of every selected timeframe is

added to the Current window, and it will be displayed. It is the total

volume of market orders traded till that time.

It provides the broader dimension of the delta as it spans over the entire

day. So, irrespective of your timeframe, the software totals the entire delta

across the total time interval and displays a running total. When

cumulative delta is positive, it reflects the aggressive buyer’s strength

over the course of the session.

When cumulative delta is negative, it indicates the aggressive seller’s

strength over the course of the session. Cumulative delta should never be

studied in isolation. Up move in price with an increase in Cumulative

delta’s positiveness indicate upmove supported by aggressive buyers.

Thus you can believe the uptrend. However, a fall in Cumulative delta with

upmove in price indicates long liquidation or profit booking. Similarly, if

prices fall with increasing negative cumulative delta, that indicates a fall

in prices supported by aggressive sellers. However, if market prices fall

without an increase in negative cumulative delta, it indicates short-

covering and profit- booking by bears.

Cumulative Delta/Volume – In this case, cumulative Delta is represented

as a percentage of total volume.

Volume – It shows the total volume for the selected period.

Cumulative Volume – In this case, the volume of every period is added to

the current window, and it will be displayed.

Copyright ©2023 Metaverse Trading Academy | www.metaversetradingacademy.in

The above picture shows the order flow chart for the last 30-minute

timeframe. In this case, the price range is from 27490 to 27525.

If a market buy order is hit, then the OFA is printed on the buy-side where

the seller had a limit order, and if a market sell order is hit, then the OFA is

printed on the sell-side where the buyer had limit order.

On the left side, you can see all the executed ‘Sell’ orders at different price

levels. Similarly, on the right side, you can see all the executed ‘Buy’ orders.

The price has seen the close below 27490 which indicates sellers were

active in this time frame.

It can also be seen on the chart. In this case, sell orders are more (even at

first look) and a negative delta of 9440 and -5.2% cumulative delta

indicates sellers are in precise control with the clear fall in price action.

Delta Divergence occurs when prices are moving up, but Delta is coming

down or vice versa. It is similar to the RSI divergence concept. If prices are

going up and Delta reducing, it is an early indication of exhaustion of

uptrend and reversal can happen anytime. Similarly, if prices are falling

and Delta is decreasing, it is the first indication of exhaustion of downtrend,

and reversal can happen anytime. By catching divergent moves, you can

avoid getting trapped by a false move.

Copyright ©2023 Metaverse Trading Academy | www.metaversetradingacademy.in

A word of caution - Use Orderflow as a confirmation tool,

but don’t use this to initiate a new trade!

WHAT IS THE LEVEL 2 NSE DATA?

Level 1 provides best bid and ask price; Level 2 provides market depth data

upto 5 best bid and ask prices and Level 3 provides market depth data

unto 20 best bid and ask prices. Tick by tick data offers full order book. The

real time data feed is provided in multicast format.

WHAT IS VPOC ZONE?

VPOC (Volume Point of Control) – is the price, where most of the volume

traded over the day. Market Profile with prominent VPOC – profile, that has

clearly one significant VPOC. Value Area (Value) – is the range, where most

of the volume (70% of the volume) has traded for the day.

WHAT IS VOLUME POINT OF CONTROL?

The price level that has the highest volume (widest horizontal row) is

referred to as the point of control (POC), which identifies the price level

where most trades took place. The range of prices around the POC that

contain 70% of total volume for the period is called the value area.

Copyright ©2023 Metaverse Trading Academy | www.metaversetradingacademy.in

DO PROFESSIONAL TRADERS USE VOLUME PROFILE?

A professional trader looks at the volume profile and realizes the stock is

far away from the current “value area” (VA). Thus, they will put a limit order

down near the 37700 area, to pick up the long position near the top of the

value area high (VAH).

Hope you liked this information and to know more, contact

us today, we assure you that this tool will make your

trading more effective so that you can earn maximum.

VIKAS SINGH GAHLOT

(NISM Certified by SEBI)

For regular information about this tool join our telegram channel today

and subscribe our youtube channel https://t.me/MetaverseTA

Metaverse Trading Academy

Creating Successful Traders

That’s our vision. Often referred to as MTA, Metaverse Trading Academy, is a

financial education and training company based in Rajkot, India. We provide

education to beginner, intermediate, and advanced traders.

For many, MTA is synonymous with high standards, effective teaching, sound

instructional materials, and a dedicated commitment to performance-

oriented results. for more information, visit Metaversetradingacademy.in

Copyright ©2023 Metaverse Trading Academy

Trading India exchange on margin carries a high level of risk, and may not be

suitable for everyone. Past performance is not indicative of future results. The

high degree of leverage can work against you as well as for you. Before getting

MarketTraders.com involved in foreign exchange you should carefully consider your personal venture

3900 Millenia Boulevard objectives, level of experience, and risk appetite. The possibility exists that you

Orlando, Fl. 32839 could sustain a loss of some or all of your initial deposit and therefore you should

Ph: 800-866-7431 not place funds that you cannot afford to lose. You should be aware of all the

risks associated with foreign exchange trading, and seek advice from an

independent financial advisor if you have any doubts. The information contained

in this web page does not constitute financial advice or a solicitation to buy or sell

any Forex contract or securities of any type. MTA will not accept liability for any

loss or damage, including without limitation any loss of profit, which may arise

directly or indirectly from use of or reliance on such information.

Please read our RISK DISCLAIMER, GENERAL DISCLAIMER and PRIVACY POLICY for

more information.

Copyright ©2023 Metaverse Trading Academy | www.metaversetradingacademy.in

You might also like

- The - Grid Trading - StrategyDocument7 pagesThe - Grid Trading - StrategyKim RiveraNo ratings yet

- Price Flip Trading StrategyDocument17 pagesPrice Flip Trading Strategyspeis100% (4)

- 2022-2023 Price Action Trading Guide for Beginners in 45 MinutesFrom Everand2022-2023 Price Action Trading Guide for Beginners in 45 MinutesRating: 4.5 out of 5 stars4.5/5 (4)

- Liquidity Trading MentorshipDocument71 pagesLiquidity Trading MentorshipElisa DNo ratings yet

- Step by Step Beginner Guide For TradingDocument11 pagesStep by Step Beginner Guide For TradingHeron DanielNo ratings yet

- Farfetch Returns Note For 2Document1 pageFarfetch Returns Note For 2Vladislavs RužanskisNo ratings yet

- CXC Past Questions and Answers P o BDocument80 pagesCXC Past Questions and Answers P o Bjjksadfasjdfsaf50% (6)

- Momentum Trading Strategies: Day Trading Made Easy, #4From EverandMomentum Trading Strategies: Day Trading Made Easy, #4Rating: 4.5 out of 5 stars4.5/5 (3)

- Millan ConsignmentDocument5 pagesMillan Consignmenttonyalmon0% (1)

- Dynamic Cash TrackerDocument23 pagesDynamic Cash TrackerRodrigo OliveiraNo ratings yet

- StokDocument8 pagesStoksadeq100% (1)

- Blindly: Its Time To Adopt Smartest Technology Tool 91 99790 66966Document6 pagesBlindly: Its Time To Adopt Smartest Technology Tool 91 99790 66966Varun VasurendranNo ratings yet

- Random Walk Index IndicatorDocument11 pagesRandom Walk Index IndicatorMahid HasanNo ratings yet

- Supply Demand Indicator Strategy GuideDocument12 pagesSupply Demand Indicator Strategy GuideSk Kebulu Keningau50% (2)

- Value Area Trading StrategyDocument14 pagesValue Area Trading Strategykevin tamayoNo ratings yet

- The Best Average True Range Forex Strategy - An Unorthodox ApproachDocument14 pagesThe Best Average True Range Forex Strategy - An Unorthodox ApproachDoug TrudellNo ratings yet

- Macro Levels Trading StrategyDocument15 pagesMacro Levels Trading StrategyAdil BensellamNo ratings yet

- 3 Indicators ES Traders Need To WatchDocument15 pages3 Indicators ES Traders Need To WatchwutthicsaNo ratings yet

- Smart Money Concept. Section-1 Theory E4c FXDocument9 pagesSmart Money Concept. Section-1 Theory E4c FXkefafxNo ratings yet

- Mean Reversion Day Trading Strategies: Profitable Trading StrategiesFrom EverandMean Reversion Day Trading Strategies: Profitable Trading StrategiesRating: 5 out of 5 stars5/5 (1)

- Profit BandsDocument11 pagesProfit Bandszanzdude50% (2)

- Metaverse EbookDocument17 pagesMetaverse Ebook921rishabhkumarNo ratings yet

- How To Use Volume Oscillator To Boost Your ProfitsDocument15 pagesHow To Use Volume Oscillator To Boost Your ProfitsJoe D100% (2)

- Moda Trendus ManualDocument9 pagesModa Trendus ManualCapitanu IulianNo ratings yet

- M&T IndicatorsDocument12 pagesM&T Indicatorskaaviraj2020No ratings yet

- MACD + RSI Powerful Forex Trading Strategy - Vladimir RibakovDocument13 pagesMACD + RSI Powerful Forex Trading Strategy - Vladimir RibakovReporter553 Reporter553No ratings yet

- Types of Trading Indicators - Wealth SecretDocument4 pagesTypes of Trading Indicators - Wealth Secretqgy7nyvv62100% (2)

- Forex Manual (New)Document22 pagesForex Manual (New)Paschal-Mary EmegwaluNo ratings yet

- Technical Trading Strategies Primer 1Document10 pagesTechnical Trading Strategies Primer 1JonNo ratings yet

- Momentum Strategy Master ThesisDocument6 pagesMomentum Strategy Master Thesisnancyjarjissterlingheights100% (2)

- MentorDocument6 pagesMentor921rishabhkumarNo ratings yet

- For Ex Box ProfitDocument29 pagesFor Ex Box Profitnhar15No ratings yet

- Dynamic Cash TrackerDocument23 pagesDynamic Cash TrackerRiefqiamin Loyal100% (1)

- High Win Rate Day Trading Setups High Win Rate Day Trading - Robbinson, Marcel - 2022 - Anna's ArchiveDocument61 pagesHigh Win Rate Day Trading Setups High Win Rate Day Trading - Robbinson, Marcel - 2022 - Anna's ArchiveJulio PazminoNo ratings yet

- Atr ReportDocument23 pagesAtr ReportMuhammad Ali100% (2)

- Technical IndicatorsDocument13 pagesTechnical IndicatorsTraders Advisory100% (1)

- ProficientfxDocument8 pagesProficientfxAuxiliaire ZakariyaouNo ratings yet

- Vertex Indicator - A Successful Combination of IndicatorsDocument4 pagesVertex Indicator - A Successful Combination of IndicatorsMubashirNo ratings yet

- Day 3 IntradayDocument21 pagesDay 3 IntradayNishant100% (1)

- How To Use Trendlines in Your TradingDocument5 pagesHow To Use Trendlines in Your Tradingpeeyush24No ratings yet

- A Practical Guide To Technical Indicators Moving AveragesDocument9 pagesA Practical Guide To Technical Indicators Moving Averagesfarangeston100% (4)

- Penting BoloDocument5 pagesPenting BolowoihoNo ratings yet

- Proficient FXDocument8 pagesProficient FXTaylorNo ratings yet

- PVSRA1Document58 pagesPVSRA1Nathan KaneNo ratings yet

- New Science of Forex Trading Manual PDFDocument9 pagesNew Science of Forex Trading Manual PDFMohammad Akbar Baloch100% (1)

- Forex Trading StrategiesForex Trading StrategiesDocument30 pagesForex Trading StrategiesForex Trading StrategiesIFC Markets90% (31)

- FX FTMM Systems 20Document34 pagesFX FTMM Systems 20emilis galindo80% (5)

- Forex Trading StrategiesDocument30 pagesForex Trading StrategiesKali GallardoNo ratings yet

- Nifty 50 & Stocks - Price Action TradingDocument10 pagesNifty 50 & Stocks - Price Action Tradinghb0232599No ratings yet

- FxprofitboomDocument25 pagesFxprofitboomapi-288217551No ratings yet

- Introduction To Technical Indicators KaizenDocument33 pagesIntroduction To Technical Indicators Kaizennnek7089No ratings yet

- An Introduction To Price Action Trading StrategiesDocument5 pagesAn Introduction To Price Action Trading StrategiesPrem KarthikNo ratings yet

- Iron Program: StrategiesDocument9 pagesIron Program: StrategiesRudi PrayogoNo ratings yet

- Valuecharts For Sierra ChartDocument29 pagesValuecharts For Sierra ChartindyanexpressNo ratings yet

- Trade With Moving Averages: Hantec Research Webinars - Technical Analysis SeriesDocument3 pagesTrade With Moving Averages: Hantec Research Webinars - Technical Analysis Seriessaran21No ratings yet

- Charles Ellis Winning The LosersDocument36 pagesCharles Ellis Winning The Loserssabrinadorsi100% (3)

- The Most Comprehensive Guide To Volume Price Analysis In Forex Trading: Learn The Hidden Secret Of Highly Profitable Forex TradersFrom EverandThe Most Comprehensive Guide To Volume Price Analysis In Forex Trading: Learn The Hidden Secret Of Highly Profitable Forex TradersRating: 1 out of 5 stars1/5 (1)

- High Win Rate Day Trading Setups High Win Rate Book 1 Marcel RobDocument80 pagesHigh Win Rate Day Trading Setups High Win Rate Book 1 Marcel RobBhupesh SinghNo ratings yet

- Brilliant Charts User Manual PDFDocument27 pagesBrilliant Charts User Manual PDFMarcelo PossamaeNo ratings yet

- Brilliant Charts User Manual: © Top Lessons in Forex: Http://toplessons - In/forexDocument27 pagesBrilliant Charts User Manual: © Top Lessons in Forex: Http://toplessons - In/forexpayman zNo ratings yet

- PDFDocument222 pagesPDFAman Jain100% (1)

- Simple Market Flow SystemDocument12 pagesSimple Market Flow SystemHartadiNo ratings yet

- 83540276816Document2 pages83540276816Khefi Salah EddineNo ratings yet

- 20IB-343 Services Operations ManagementDocument4 pages20IB-343 Services Operations ManagementSAUMYA SHARMA-IB 21IB331No ratings yet

- Business Math q3 w5 Markon, Markup, MarkdownDocument9 pagesBusiness Math q3 w5 Markon, Markup, MarkdownJoyce Marie Dichoson0% (1)

- Coca ColaDocument110 pagesCoca ColaDivya KotaNo ratings yet

- Assignment# 1 Porter's Five-Force Model: Sheraz Hassan Mba 1.5 2nd Roll No F-016 - 019 Subject Strategic ManagementDocument4 pagesAssignment# 1 Porter's Five-Force Model: Sheraz Hassan Mba 1.5 2nd Roll No F-016 - 019 Subject Strategic ManagementFaisal AwanNo ratings yet

- New Product Development ProcessDocument33 pagesNew Product Development Processvinaycool12344150100% (1)

- Chapter 11: Inventory Cost Flow Cost Formula PAS 2, Paragraph 25 States That The Cost of Inventory Should Be A. Fifo B. Weighted AverageDocument7 pagesChapter 11: Inventory Cost Flow Cost Formula PAS 2, Paragraph 25 States That The Cost of Inventory Should Be A. Fifo B. Weighted AverageYami HeatherNo ratings yet

- Financial Statement Analysis and Security Valuation: Stephen H. PenmanDocument14 pagesFinancial Statement Analysis and Security Valuation: Stephen H. PenmanIngrid RojasNo ratings yet

- Nccu 239 Manual T11Document13 pagesNccu 239 Manual T11Karol Huertas AlejosNo ratings yet

- Business Finance Introduction To Financial Management 07Document41 pagesBusiness Finance Introduction To Financial Management 07Melvin J. ReyesNo ratings yet

- Alco New SampleDocument2 pagesAlco New SampleCharel Grace ZeñidrapNo ratings yet

- TAXATION 2 Chapter 14 VAT Payable and Compliance RequirementsDocument4 pagesTAXATION 2 Chapter 14 VAT Payable and Compliance RequirementsKim Cristian MaañoNo ratings yet

- Answer 1 Description of The CaseDocument9 pagesAnswer 1 Description of The Casetameen jamshaidNo ratings yet

- Sales & Distribution Management UNIT-1Document18 pagesSales & Distribution Management UNIT-1Shadique ShamsNo ratings yet

- Chapter 10 - SolutionsDocument25 pagesChapter 10 - SolutionsGerald SusanteoNo ratings yet

- Learning Activity Sheet (Q3)Document9 pagesLearning Activity Sheet (Q3)Marlyn LotivioNo ratings yet

- RETAILINGDocument44 pagesRETAILINGMuhammad Salihin Jaafar100% (2)

- How A Robust IT Architecture Improves Value Chain Activities?Document4 pagesHow A Robust IT Architecture Improves Value Chain Activities?malathyNo ratings yet

- Standard Costing and Variance AnalysisDocument19 pagesStandard Costing and Variance AnalysisHardeep KaurNo ratings yet

- CVP Guide Questions - University of San Jose - Recoletos ..Document2 pagesCVP Guide Questions - University of San Jose - Recoletos ..Nielmae PansoyNo ratings yet

- Session 21 Pricing MethodsDocument19 pagesSession 21 Pricing MethodsNarayana ReddyNo ratings yet

- CH - 2Document27 pagesCH - 2divya kalyaniNo ratings yet

- Pillsbury Cookie Challengev7 PDFDocument28 pagesPillsbury Cookie Challengev7 PDFMayank TewariNo ratings yet

- Acca Fa Trial - Exam - 1 - QuestionsDocument18 pagesAcca Fa Trial - Exam - 1 - QuestionsElshan ShahverdiyevNo ratings yet

- Pricing For International Markets: Mcgraw-Hill/IrwinDocument38 pagesPricing For International Markets: Mcgraw-Hill/IrwinMaryam KhaliqNo ratings yet

- Suggested Answers Spring 2015 Examinations 1 of 8: Strategic Management Accounting - Semester-6Document8 pagesSuggested Answers Spring 2015 Examinations 1 of 8: Strategic Management Accounting - Semester-6Abdul BasitNo ratings yet

- Tax 2 On Tax LiabilitiesDocument2 pagesTax 2 On Tax LiabilitiesAlberto NicholsNo ratings yet

- Class Question Cost SheetDocument3 pagesClass Question Cost SheetRachit SrivastavaNo ratings yet