Professional Documents

Culture Documents

4.28.20 - OXF Wealth Trim - Intro 1 - Wistia Captions

4.28.20 - OXF Wealth Trim - Intro 1 - Wistia Captions

Uploaded by

curiosityunshackledfranceOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

4.28.20 - OXF Wealth Trim - Intro 1 - Wistia Captions

4.28.20 - OXF Wealth Trim - Intro 1 - Wistia Captions

Uploaded by

curiosityunshackledfranceCopyright:

Available Formats

This transcript was exported on Sep 03, 2020 - view latest version here.

Speaker 1:

Turn your speakers up. This is the biggest online event of the century, hosted by a living legend, the

epitome of the American dream. From the humblest of beginnings in tiny Levittown, New York. He

earned a master's degree in Public Administration from the John F. Kennedy School of Government at

Harvard University. He quickly rose to prominence and prosperity, becoming the most powerful man in

the history of television. He hosted the highest rated TV show for 16 straight years, won multiple Emmy

Awards. He's written 15 number one bestsellers, and his newest can be yours free just for watching

today.

Speaker 1:

You'll know him from Inside Edition, The No Spin Zone and The O'Reilly Factor. I am who I am, he says.

An Irish Catholic kid, working class from Long Island and I made it big. He's here to tell you today you can

too. In fact, you can make so much money that you'll be able to live out the retirement of your dreams.

Folks, here's your host, Bill O'Reilly.

Bill O'Reily:

Hey, Bill O'Reilly here. Welcome to The Great American Wealth Project. I'm here today to talk to you

about achieving the American dream. That is something I talked about for decades, but what exactly is

the American dream? Well, to me, it's about living where you want to live, doing what you want to do

and when you want to do it. It's often been said that the best things in life are free and that's true, but

it's not the whole story. You cannot reach your potential or live life to the fullest if you spend your days

worrying about money. Money liberates you from want, from work that's miserable, from relationships

that can find you

Bill O'Reily:

No one is truly free, who is a slave to his job, his creditors his circumstance or his bills. Wealth is the

great equalizer in the world. Wealth is freedom, security, peace of mind. It allows you to do and be what

you want, to support worthy causes to help those and this is important, closest to you. It enables you to

follow your dreams to spend your life the way you choose to spend it. All of that is money. Money gives

you dignity. It's not an evil. It gives you choices.

Bill O'Reily:

That's why every man and woman should strive to achieve some level of financial freedom. Today, one

of the nation's top financial minds and I are going to talk about how to make Americans rich again, and

not in a theoretical way. I'm talking about greatly increasing your wealth beginning today. Here's a

shocking stat. American mints 1,917 newfound millionaires every day, 365 days a year, yet millions of

other Americans are not doing so well. We want to change that.

Bill O'Reily:

Joining me on this mission is a man who's responsible for showing hundreds of thousands of Americans

just how to achieve their financial goals. He is a four time New York Times bestselling author. He's been

a guest on The Factor. And I've quoted him on the air over the years because I respect his views. In fact, I

pay for his views. I've been following his work for more than 15 years. His writing and research are

direct, concise, straight to the point even I can understand that.

4.28 (Completed 09/01/20) Page 1 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

Bill O'Reily:

Many have begun to call him the millionaire maker, because he's taught so many regular investors, how

to create a seven figure net worth. He is Alexander Green, chief investment strategist of the Oxford

Club, America's oldest financial think tank. You'll hear directly from some of the millionaires Alex has

helped create today. These are everyday Americans who have gone from worrying about their bills and

their futures to becoming freshly minted millionaires. Alex should be commended for what he's done to

help the folks.

Bill O'Reily:

As I said earlier, I've personally been following Alex's work for more than 15 years. He's helped me make

a ton of money. I'll admit it, and I'm going to tell you how he did that in just a few minutes. Alex is going

to tell you about his number one stock in America right now. I'll bring in Alex in just a moment, but first,

I want to mention as a thank you for watching today, you'll get a chance to claim a free copy of my

upcoming new book, The United States of Trump.

Bill O'Reily:

It could be the big seller of the year. We're running off about 750,000 copies, which is unheard of in

today's world and I think it's my best piece of history writing. Five interviews with the President. No

anonymous sources in the book. People are happily paying me a lot of money for the Collector's Edition,

but you can get the hardcover free. Just stick with us during this program, and I'll explain how to get

your copy.

Bill O'Reily:

That's not all you're going to receive. The book will be part of a much larger, great American wealth

blueprint, which contains all the key items to begin supercharging your wealth. It will include all the

details on Alex's number one stock in America right now. Plus, there'll be details on his proven three

step system to achieve a seven figure net worth. So let's get started. Let me introduce you to Alexander

Green. Come on in here, Alex. Expensive suit, notice that. Nice to see you. Have a seat.

Bill O'Reily:

Okay, Alex, we got a lot to get to today. I've got some tough questions about what it will take to help the

folks, and that includes me. I'm one of the folks here. I'm not an expert in finance. So, what it's going to

take to get you to achieve a seven figure portfolio.

Alex Green:

Sure Bill. Fire away.

Bill O'Reily:

A brief introduction to Alex, first for those who may not know him. Oxford Club's chief investment

strategist. You may have seen him profiled in the Wall Street Journal for beating the markets, which he

did for 16 straight years. He's famous for predicting the success of some of the biggest stock winners in

history. Apple, Intuitive Surgical, Netflix, Celgene and Amazon, and he's one of the most respected stock

pickers on the planet. In fact, in preparation for this event, we went back and looked at his track record

and here's what we found.

4.28 (Completed 09/01/20) Page 2 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

Bill O'Reily:

By following Alex's recommendations at the Oxford Club from the time he took over as chief investment

strategist in 2001, to today, you could have turned $150,000 into 1,082,000. By comparison, if you put

that same money in the S&P 500 over the same period, you'd have made just $406,000. It's complete

outperformance, there's no other way to state. One is a millionaire's portfolio, the other not even close

and as you'll see in today's program, even if you're starting with a much smaller amount, as most of us

will, Alex has a proven track record of helping people retire rich.

Bill O'Reily:

Here's what I love most about Alex. He doesn't just give money making recommendations. He puts his

money where his mouth is. The guy is a prolific investor himself, and some of his personal wins will blow

you away. You'll see some of his personal investment coming up. Okay, Alex, a select number of

Americans are getting wealthier in the booming Trump economy. Thousands are becoming millionaires

as we stated every single week, but many more get left behind. Let me ask you first about the wealthy.

Why is it that the USA is creating so many new millionaires?

Alex Green:

Well, Bill you would know this by listening to the mainstream media but we live in the most prosperous

time in American history. Household income and net worths are both at record highs. We have a record

number of Americans with a million dollar more net worth and everyday people, teachers, nurses,

construction workers who invest in booming stocks are also getting richer. So take a look at a company

like Square. You've almost certainly paid for something using your little Square technology attached to

an iPod or an iPhone and if you've been to a farmers market or a coffee shop in the last few years,

you've probably seen this. Thousands of small businesses use Square to take credit card payments, and

this company has a phenomenal leadership team.

Alex Green:

It's CEO has been referred to as a genius. The CEO and President Trump have held meetings together

since the election, and the company's stock shot up eight fold since Trump was voted in. You could have

turned every $1,0000 into about $8,500 and every $10,000 of course into 85,000. No matter whether

you're young or old, rich or poor, man or woman, if you own shares on a stock like Square you can get

rich fast. Let's look at another company Restoration Hardware. It creates top of the line home

furnishings.

Alex Green:

Restoration's stock was trading for about $30 this year when Trump was elected. As the economy and

the real estate market began to soar into Trump, so did restoration. From $30, it topped $160 a share

within the first 16 months of the Trump presidency. Now smart investors who recognize stocks like

these are making out like bandits quite frankly.

Bill O'Reily:

So who exactly got rich?

Alex Green:

4.28 (Completed 09/01/20) Page 3 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

Well, one person is Restoration CEO Gary Friedman. He grew up without a dad, went to a community

college, started out as a stock boy at the gap but always had a passion to get rich. Now he runs

Restoration Hardware. That's America for you. In fact, he believes so much in this economy that he's

pouring his own money into shares of Restoration. Friedman purchased 33,000 shares at 27 bucks back

in July, of 2016 and he just kept on buying along the way. He bought 4,600 more shares when the stock

hit 70, he bought 25,000 more shares at 71. He bought 10,000 more when the stock hit 97. He's sitting

on more than $5 million in profit in just a couple of years on the single stock alone.

Bill O'Reily:

What about the average guy though? He doesn't have that kind of cash to throw around.

Alex Green:

Well, that's the thing. Anyone investing alongside a guy like Friedman can get rich too. That's the beauty

of the stock market. You can get the exact same returns as Friedman, or Amazon Chairman, Jeff Bezos or

Microsoft founder Bill Gates. If you own their stock, you'll get the same return as the world's richest

men. Sure, they may own a few more shares than you do, but the percentage returns are exactly the

same and they're available to anyone, but too often regular investors just don't know what to do.

Bill O'Reily:

Why not? Why don't they know what to do? What's keeping the regular folks from becoming wealthy?

Alex Green:

Well, one reason is just a basic lack of financial literacy. Schools don't teach it and most parents don't

know enough to instruct their kids either. The number one reason is that the media is failing at its job to

inform the public about the incredible wealth building opportunities available right now. The media

scares the hell out of people to the point where they're afraid to put their money in the markets, and

the average bank currently pays just 0.5% on deposits. At that rate Bill, your savings will double in just

144,000 years.

Alex Green:

Clearly, no one is getting rich that way. So as a result, there are three major problems facing most

Americans. One, people aren't prepared for retirement. Two, they may be saving but they aren't

investing, and three, the few who are not doing it the right way. Surveys show that fewer people are

currently invested in stocks now than before the financial crisis back in 2008.

Bill O'Reily:

That's because you're afraid. It's sad but true. We've been in the greatest bull market in history, yet half

of Americans are still sitting on the sidelines. The few war investing constantly shoot themselves in the

foot though. Recent Dalbar study shows the average investor getting pummeled by the S&P, and

according to Forbes, over the past 30 years, investors have only made 1.9% per year. It's not even

keeping up with inflation.

Alex Green:

That's why people constantly tell me their number one concern is running out of money in retirement.

4.28 (Completed 09/01/20) Page 4 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

Bill O'Reily:

Stats show that. 78% of Americans are living paycheck to paycheck right now. 36% say they haven't even

begun to start saving for retirement. 25% say they plan to never retire because they won't have any

money, and it gets even worse. The average Social Security payout just $18,000 a year. You had millions

of seniors relies solely on social security for nearly all of their retirement income. That's scary because

the Social Security Administration issued a recent report showing the cost exceeding income in the

program next year, and the system will be insolvent in 16 years. That's a real threat.

Alex Green:

Yeah, and of course, Americans are also living longer than ever, which is a good thing, of course, except

that living longer also means your money needs to last longer too. A 65 year old needs to prepare for

three full decades of food, housing, medical expenses, and hopefully an enjoyable lifestyle.

Bill O'Reily:

Well, according to one Schwab report, people need as much as $1.7 million in order to make sure they

don't run out of money. So how do you do that?

Alex Green:

Well, there's only one surefire way to retire wealthy in America and that's by owning shares in a

breakout business that's crushing sales records, creating innovative new products, and rewarding

investors with massive paydays. Sometimes just one great company, one single stock can pay for your

entire retirement. I've got the details on the new number one stock in America right now.

Bill O'Reily:

Our viewers will get the chance to get Alex's details on your number one stock as part of The Great

American Wealth Blueprint. They'll also receive your three step system to a seven figure portfolio. Plus,

viewers can receive a free copy of my book the United States of Trump. Now, I'm not sure that's a great

deal for me, but you'll like it. We'll have information on how to get all of that coming up. Alex, let's get

back to what you were saying. What I take away from this is this, great investing comes down to one

thing. Buying up shares of great companies that create breakthrough products for millions of people and

watching the profits come to you.

Alex Green:

Yes, the rich know this. They've been making millions as the economy soars by investing in great

companies. Look at Bill Ackman for instance. He saw millions of people lining up at Chipotles all across

the land. So the billionaire hedge fund manager started investing in Chipotle himself. The stock went up

to more than $800 in a little more than a year, and he closed the trade for $36 million in February.

Bill O'Reily:

This is really the essence of income inequality in a nutshell, isn't it? The rich invest in great companies

like Chipotle, while most Americans get left out.

Alex Green:

You're exactly right, Bill. Mark Grinblatt, a finance professor at UCLA's Anderson School of Management

studied this and he said there is income inequality because and I quote, "There is a group of people who

4.28 (Completed 09/01/20) Page 5 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

participated in the stock market over a period where it nearly tripled and there's another group of

people who didn't. It's that simple." Let me give you a perfect example of one person who did choose to

participate rather than sit on the sidelines. I think this will help explain the difference. That person is me.

Let me tell you about one stock I uncovered around 2005, I'll never forget the day I saw a bright red

envelope in my next door neighbor's hand.

Alex Green:

He was putting it in his mailbox and I asked him, "What's that?" "You haven't heard about Netflix?" he

responded. Then he gushed about the online video rental company that delivered movies right to your

doorstep and did not charge late fees. Now, like everyone else, I personally hated getting hounded by

blockbuster to pay late fees every time I took a movie back. Returning a late movie could cost you more

than buying the damn thing out right. You remember that?

Bill O'Reily:

I do. I remember that really well.

Alex Green:

I have a unique approach to investing. Whenever I hear about a new company that everybody is raving

about, I don't immediately become a customer. Instead, I become an investor and it didn't take much. A

few thousand dollars. After all, Netflix was still trading for a split adjusted two bucks a share back then,

and today, Netflix was trading closer to $300. I still hold every share with no plans to sell. That stock

alone is more than enough for me to retire on and it was just one stock, but that's all it took.

Bill O'Reily:

That's a good point you make here, Alex. If everyone had done what you did, we'd have millions more

rich people in America.

Alex Green:

That's right. If each of Netflix, his customers put just $1,000 into Netflix, they'd all have an extra

$286,000 today.

Bill O'Reily:

To me, that gets us back to the income inequality issue, and I think that's where our education system

fails us. Our kids know how to download Netflix onto an iPad. They know how to search for movies and

TV programs, but they don't know the first thing about how to make money by investing in Netflix.

Alex Green:

Which is too bad because the few investors who did buy Netflix like me, made a fortune. That's the

power of a single great stock. So just to quickly sum it up. If you identify those great companies that are

bringing in millions of customers, creating new breakthrough ideas and breaking revenue records, you

absolutely can retire rich. Now, I recently uncovered a stock that reminds me exactly of Netflix when I

first bought shares many years ago.

Bill O'Reily:

4.28 (Completed 09/01/20) Page 6 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

Essentially what you're looking for here is the perfect stock, right? What criteria would a perfect stock

possess?

Alex Green:

Well, it would be a leader in cutting edge technology that changes the way we live just like Apple,

Amazon, Google, Facebook and yes, Netflix did. It would have breakthrough products used by millions of

customers around the world, patents and trademarks would protect its profit margins. It would have

hundreds of millions of dollars, if not billions of dollars in future sales and profits, not just expected but

contractually guaranteed. It would be relatively undiscovered and trading for a very low price.

Bill O'Reily:

The new stock you're recommending meets all of that?

Alex Green:

Yes, it does. First of all, my new number one stock in America is opening in the fastest growing and most

exciting sector in the markets today. I'm talking about the $17 trillion, 5G revolution, which is going to

be one of the biggest investment opportunities of our lifetimes. 5G will make wireless technology so

lightning quick, it'll make your head spin. It's 100 times faster than current 4G networks. For example, a

full length High Definition movie can be downloaded on your phone or laptop on a 5G network in just six

seconds, compared to the seven minutes it takes to download on 4G right now, or the one hour it takes

on the outdated 3G markets.

Alex Green:

Right now telecom operators are spending 1.7 trillion on equipment upgrades in order to implement 5G

from coast to coast. South Korea, United States and Japan are rolling it out as we speak.

Bill O'Reily:

So we're seeing 5G all over the world?

Alex Green:

Yes.

Bill O'Reily:

Actually, the first 5G network in the USA was just launched a few miles from where we are right now, in

New York. There's no doubt this is a huge growth area of the economy.

Alex Green:

That's right, we're looking at trillions of dollars flowing into the companies putting the network in place,

and that gets me to my number one stock in America right now. The company is perhaps the most

important linchpin to the entire 5G network. It makes the 5G microchips necessary for the system to

work and to put it bluntly, any business that wants to be involved in this coming 5G revolution has to

own this company's product and the big businesses are already lining up.

Alex Green:

4.28 (Completed 09/01/20) Page 7 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

For example, you will find the company's microchips in Google's 5G Chromecast, Samsung's Galaxy 5G

smartphones and Audi's mobile 5G WiFi hotspots. Without this company, none of those businesses

could implement 5G. This company also just did a deal with SoftBank Group whose founder is billionaire

Masayoshi Son.

Bill O'Reily:

Son is one of the 50 richest people in the world. Through SoftBank, he made a $20 million investment in

Alibaba back in 1999. It's now worth some 116 billion with a B. He made huge money on Uber, WeWork,

DoorDash and several others. According to CNN Money, Masayoshi Son is pursuing bold, almost brash

deals designed to keep SoftBank at the center of any trend he believes will fundamentally shape the

world. So let me restate this guy is pursuing deals at the center of any trend that will fundamentally

shape the world and now this billionaire is targeting the 5G company you're recommending?

Alex Green:

He is. I think he's probably seeing this very same potential I am. He recognizes that 5G is in fact, one of

those trends that will reshape the world. However, this is the good news for our viewers. This trend is

only just beginning. My 5G company's founder says we're not even in the first inning yet and I'll tell you,

he's not kidding. This company's microchips will soon be found in 2.3 billion products worldwide, and

we're already seeing this company's 5G microchips used in the Internet of Things, automotive

technology and big data. Processing storage, networking and security too. It's in routers, switches,

appliances, data storage and servers. It's in circuits and adapters too.

Bill O'Reily:

So what you're saying is that this company matches your first two criteria. It's certainly a leader in

cutting edge technology, and its microchips are found in products that millions of customers are buying.

How can you be sure that another company won't swoop in and take over its market?

Alex Green:

Well, that's comes to my third criterion. I want the companies I recommend to have patents that protect

them, and this company has 10,000 patents to protect its intellectual property, and perhaps more

importantly, its profit margins. Because of that, sales are skyrocketing. It's got 1.7 billion coming in 2020

after signing a new deal with NXP Semiconductors, and it's sitting on 500 million right now that its CEO

says it's prepared to distribute to shareholders. You want to be in before that happens.

Bill O'Reily:

That's your fourth criterion. Billions of dollars in sales.

Alex Green:

Correct, and finally, we have a fifth criteria. We want it to be unknown with a cheap share price. Now, I'd

be shocked if one in 1,000 people knew this company's name. It's not a household name at all yet, which

is why it's available at such a great price. It reminds me of a similar tech stock, Mitek Systems which is

up 9,200% over the past decade. Now, I've written up a full length report detailing exactly how our

viewers can profit from the stock, and I'm prepared to send copies of it to everyone watching so they

can get in it right away. Because I can tell you now, if you want to retire rich, it's finding these single

stocks with great fundamentals that are going to get you there.

4.28 (Completed 09/01/20) Page 8 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

Bill O'Reily:

Okay, Alex, I know your report will come as part of The Great American Wealth Blueprint, along with my

new book. We're giving everyone the chance to claim the blueprint at the end of the broadcast, but a lot

of people out there don't feel they have the money to invest, and many more just don't know which

stocks to invest in. What do you say to that?

Alex Green:

Well, I believe that's true, but what I love about the stock market is that if you find the right stocks, you

don't need to be rich to change your life. You can actually do it with as little as $10 a month. Think about

this Bill, how much does the average person pay for their Netflix account?

Bill O'Reily:

About 10 bucks a month?

Alex Green:

Yeah, well, if you took that same $10 a month for your Netflix subscription and put that instead into the

stock when it launched, you'd have more than a half million dollars today. Again, we're talking about

$10 a month. That's nothing, and if you put the equivalent of 20 bucks a month into Netflix, you'd be

sitting on over $1 million, and this is true of many stocks. For example, if you put the equivalent of just

20 bucks a week into a few exceptional stocks over the past decade, you'd have made up to $117,000 on

exact sciences, $108,000 on MGP ingredients, $29,000 on Sleep Number stock, you'd have made

$94,000 on Nexstar, $43,000 on Jazz Pharmaceuticals, and $197,000 on Patrick Industries.

Bill O'Reily:

I know when I started out investing, I didn't have very much. Zero dollars and zero idea of what I was

supposed to do with the money I was making, but my father always taught me to save at least 10% of

my take home pay and that was really good advice. I was putting myself first, and my future and 20

bucks a week certainly seems like something everybody in our audience can handle. So let me ask you

this. How expensive is your number one stock in America?

Alex Green:

It trades for 25 bucks.

Bill O'Reily:

Is that too expensive?

Alex Green:

No, it's actually a low price based on the company's fundamental and it's about what I paid when I

bought Amazon back in 2005.

Bill O'Reily:

Now, I can imagine what these shares are worth today. Stocks got to be up around $2,000 a share by

now, right?

4.28 (Completed 09/01/20) Page 9 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

Alex Green:

Yeah, Amazon. That's right. It's actually up 6,000% since I bought it. When a stock goes up that much,

you don't need to put a lot in it and the 5G mega stock that recommending now has the same sort of

upside potential.

Bill O'Reily:

Alex, there's no question that finding a great stock can help our viewers make a lot of money, but the

fact is, stocks like Amazon, Netflix, Square and others don't come around very often. Obviously, you've

had some very good luck in identifying them, but my question is how do you know when to pull the

trigger, get out or get in on these stocks?

Alex Green:

The first step is always making sure a company I'm recommending meets my first criterion, but then the

next part is almost as important. I'm always looking for a big upcoming catalyst that's going to make the

company a household name. Some of these catalysts to propel stocks are the launch of a revolutionary

new product, a surprising earnings beat, a great report, for instance, can drive a stock into overdrive.

New deals, signing other contracts with other companies can mean guaranteed revenue for years to

come. New leadership. Just like every sports franchise needs a great coach at the top, a great new

executive hire can launch a stock or the launch of an entire new type of technology.

Alex Green:

Examples, Apple meets almost every one of them. It launched a brand new product, the iPod in 2001, in

a 10 year span it's sold more than 300 million of those. The launch of that groundbreaking product

propelled Apple stock higher for years and years. I picked up shares myself back in the 90s and I still hold

them today.

Alex Green:

My retirement has been built on finding just a few powerful stocks early, long before they became

household names and quite often, it's not even the big names that give you the biggest paydays. The

best stock of the past 20 years actually wasn't Apple, or Netflix, or Amazon. It was monster beverage.

Monster was the first company to ever launch an energy drink in a 16 ounce can back in 2002 and as

simple as that sounds, that new product launch was a major catalyst.

Alex Green:

Today, you can find Monster beverages in almost every single gas, station grocery store across the

country and you could have made 70,000% gain on it stock over the past two decades. That's enough to

turn every $1,000 into $700,000 and these are the types of opportunities that are out there, Bill.

Bill O'Reily:

Monster beverage if I had only known.

Alex Green:

I should have called you.

Bill O'Reily:

4.28 (Completed 09/01/20) Page 10 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

That's right. So is an upcoming catalyst for the stock that you're recommending now, the number one

stock, what is?

Alex Green:

Absolutely, it's perhaps the biggest global catalyst we'll see over the next decade. I'm talking, of course,

about the coming global 5G rollout. Look at these mammoth projections. One study estimates that the

number of 5G connections will grow from fewer than 1 million in 2019 to 37 million in 2020. It will then

increase exponentially up to 500 million in 2022 and 1.3 billion the next year, and the 5G company in my

crosshairs is involved in everything related to the rollout. The International Data Corp forecasted 5G

related spending will grow at a compound annual rate of 118% through 2022. So the company is

perfectly positioned to take advantage of this opportunity for a long time.

Bill O'Reily:

Well, I can see why you've named it your number one stock in America. I've been following the 5G story

pretty closely and it's one of the most interesting things to me that I can imagine that your 5G company

is heavily involved in this is how these little 5G devices are going to be everywhere. I've already seen

them. My dry cleaner has one. The 5G small cell antennas are going to be found on streetlights, utility

poles, bus stops, sides of buildings, mailboxes, everywhere.

Alex Green:

That's right, and this one company's microchips are likely to be found in all of those devices. Remember,

we're talking about 2.3 billion products containing this company's microchips. It's massive, and again,

I've got all the details on this company, including the ticker symbol and how to buy it in a special report

that everyone watching today can receive. It's called How to Profit From The #1 5G Megastock, and our

audience can get it as part of The Great American Wealth Blueprint.

Bill O'Reily:

Now, Alex, I've been following your investment recommendations for a long time. I think you do a great

job of identifying the key reasons stocks go up in value, which are not always perfect. More often than

not, you seem to find the big winners. Here's one from just around the time I first started following your

work. So I have this old newsletter, and look at Alex. Alex looks like he's Ricky Nelson here. He's like 12

years old. So this is December 2003, and a feature to cancer fighting company called Celgene bursting

onto the scene.

Bill O'Reily:

You saw the results of an ongoing Harvard study on one of its prized drugs. You predicted a wonderful

opportunity for investors. Months later, Celgene won a key approval by the FDA. Celgene then went on

to become one of the most epic runs in stock market history.

Alex Green:

Yep, it's gone from around $5 a share to over $140 at its peak. One reader who took a recommendation

of Celgene wrote to say, my original $25,000 investment generated more than 800,000 in total, and I'm

still holding a good chunk of it. What I still hold is now up 2,440%. So there's no telling just how much

total profit he'll make when it's all said and done. Maybe a million plus.

4.28 (Completed 09/01/20) Page 11 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

Bill O'Reily:

You also recommended Intuitive Surgical when it was under three bucks a share.

Alex Green:

Oh, yeah. That was a big one.

Bill O'Reily:

Now we have this proof of what we're saying, this headline. So this is in bull. I mean, we're bullish on

robotic surgery, but Alex is, his record speaks for itself and you should know that. The company was way

ahead of the curve. Within eight months of your recommendation, Intuitive Surgical won FDA approval

for robotic procedures. It's exploded about $3 a share at around 500 a share today.

Alex Green:

Bill that was another life changing experience for some of my readers and I got a chance to meet one Sal

Campisi of Lakeland, Florida who told me that he made more than a million dollars from the single stock

recommendation. Well, we've got Sal on video. Here's what he had to say.

Sal:

I bought this Intuitive Surgical, ISRG. He recommended when it was $45 a share and I bought it five

different times and I made 1,000,002 on a fifth time.

Alex Green:

1,000,002. How about that?

Bill O'Reily:

That's why you're called the millionaire maker Alex. Can you imagine walking around a block going hey,

the millionaire maker Alex and that's what he's got.

Alex Green:

Well, that's not all. The reason I'm such a big proponent of finding that one stock that changes

everything is not so people can count it all up in their bank accounts. It's simply because of the impact

this money has on people's lives. Sal says he's able to create a charitable foundation. He says all five of

his children have also become millionaires in the stock, and better yet, he set it up so that even his

grandkids will get significant funds once they turn 40. So that's creating a family legacy, which I know

was very important to most people.

Bill O'Reily:

As you know Alex, I've personally also done well following your advice. I made money on Diageo,

Nordstrom, AT&T, all your recommendations, among others. You've also recommended Berkshire

Hathaway B around the time I joined.

Alex Green:

Berkshire Hathaway B, that was one of my earliest recommendations to the club.

4.28 (Completed 09/01/20) Page 12 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

Bill O'Reily:

I made a lot of dough on that, Alex. Don't tell anybody though. I don't want anybody to know. I made a

ton of dough, and I still hold a stock today. Look at that rock and ride of a stock chart. That thing is

straight up. These type of investments are what you recommend, Alex and people should listen.

Alex Green:

Well, there's always risk and things don't always work out perfectly. I've certainly had a lot of success

with this system over the years. I know the future isn't guaranteed. That's why it's so important to block

out the noise and just focus on the best of the best companies. No matter what is going on in the

economy, no matter what the Fed chooses to do with interest rates, no matter what sort of economic

ordeal or political strife is happening out there in the world, even in market downturns, the greatest of

companies generally do well.

Bill O'Reily:

Alex, I know I've enjoyed following your work but before sitting down with you today, I wanted to speak

with some of your readers about their experiences. So we invited a few of them here today to talk

backstage and I asked them to tell us their names, how long they've been following your work and a

little bit about their experiences.

Pat douglas:

I'm Pat Douglas, reader for 10 years. I started with $150,000. Today I have 3.5 million, despite all the

personal and family expenses. All of that growth is due to the recommendation I received from the

Oxford Club.

Ken Hart:

Hi, I'm Ken Hart. Alex gave me the confidence to invest more. The profits allowed me to pay off my

house and leave me with a portfolio valued at over $2 million. His advice gave me and my family security

for the future and helped me retire with peace of mind.

Bret Holder:

I'm Bret holder. I've been a reader for 20 years. I set up trust for my two kids in 2002. Today, each

account is worth over 600,000 with about 13 years left before they gain access to the funds at age 35. I

expect that each account will be well over 1 million by then. I truly appreciate the educational and

optimistic approach taken by everyone at the Oxford Club. My children will thank you too and about 13

years.

Vinny:

Hi, I'm Vinny Affray. When I started in 2013, I invested heavily in Alex's communique recommendations.

One of his stellar recommendations was the Berkshire Fund, which was very profitable. When I retired in

late 2017, I transferred my deferred tax account into my Oxford portfolio. I never dreamed, not even

counting my house, my investments would total over $2 million. I am very grateful for Alex and the

Oxford's Club advice over the years.

Bill O'Reily:

4.28 (Completed 09/01/20) Page 13 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

Obviously people have done well, but that's all in the past Alex. Today, with The Great American Wealth

Blueprint we put together you're giving people a chance to get in on the types of stocks that change

people's lives.

Alex Green:

That's right. Now, the first company have already talked about today. It's the 5G mega stock that is my

number one stock in America right now. It meets each of my five criteria. One, it's got cutting edge

technology and is a top 100 global innovator. Two, it's distributed not just millions but billions of

products worldwide. Three, it's got 10,000 patents protecting its intellectual property. Four, its racking

up deals with major tech firms like Samsung, Google SoftBank, and NXP Semiconductors to ensure more

than 1 billion in future revenue, and five, it's almost entirely undiscovered and trading for around 25

bucks. Bottom line, if there was ever one individual stock to retire on, this could be it.

Bill O'Reily:

So Alex, are you going to tell us the name of this company?

Alex Green:

Unfortunately, I can't do that it's just too cheap to give it out to everyone. We'd risk moving the stock.

So I've reserved it only for my readers, but I've created a special report, How To Profit From The #1 5G

Megastock, where I'm willing to give everyone watching today access to the complete details, including,

of course, the stock ticker, and it will go out to every viewer who signs up to receive The Great American

Wealth Blueprint.

Bill O'Reily:

Now, is this the only company you're recommending or are there others?

Alex Green:

It's my favorite one, for sure but there are actually two more millionaire makers that I'd like to get

people the details on. The second company that could make you a millionaire is a cancer diagnostics

company. It's attacking one of the biggest problems impacting the entire human race, cancer. It actually

reminds me of Seattle Genetics, a similar company of the past that develop treatments for cancer.

Seattle Genetics ran from $2 and 30 cents a share to about $76 today. It turned every $10,000

investment into over $330,000 in this company doesn't just want to fight cancer, it wants to wipe it out.

Alex Green:

It's the very first company to develop proprietary genetic testing tools that help doctors identify small

clusters of cancer cells in their earliest stages before they're even a threat. This alone could increase

survival rates by as much as 18 fold. So that's criterion number one. It's certainly a leader in cutting edge

technology. Now, keep in mind, the reason a company like Seattle Genetics shot up 3,200% is that it was

creating a solution to a problem affecting millions of people and that's what this company is doing as

well.

Alex Green:

The market for cancer testing is 144 billion annually and growing. In other words, it meets the second

criteria, it has the potential to help millions of people. This company also holds nine different key

4.28 (Completed 09/01/20) Page 14 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

patents and 700 trademarks to protect its technology. For example, one patent is a brand new method

to determine whether or not a patient needs a prostate biopsy. Another patent protects an early

detection method for screening and provides a prognosis for esophageal cancer, and that's criteria

number three, and the sales are now rolling in.

Alex Green:

It recently announced deals with Qiagen and drug giant, Novartis to offer testing to breast cancer

patients. It's got a backlog of 100 million dollars in deals signed with drug companies and as a result,

sales soared 51% over the past year to record high revenue. Both sales and earnings are up double digits

in three straight quarters as it continues to smash estimates. In short, it's making a ton of money and

that's criteria number four, hundreds of millions in sales.

Alex Green:

Finally, five, this company is unknown and trading very cheap. 99.9% of investors don't know its name,

but it's perfectly positioned to take advantage of the massive growth that lies ahead in the sector. In

fact, according to Market Watch, this company is projected to be a key player in development in the

global cancer profiling market from now, all the way through the year 2023.

Bill O'Reily:

It's not an expensive stock.

Alex Green:

No, it's only about 20 bucks a share.

Bill O'Reily:

And last but not least.

Alex Green:

The third company combines two industries that rewarded investors with huge wins in the past, finance

and tech. We call this type of company, a FinTech. Square, for example, the company I mentioned earlier

that's rewarded investors with a 750% gain is a FinTech. This new company I'm recommending now has

the same sort of upside potential, except instead of revolutionizing the way people pay for products like

Square, this company instead is tackling the way people finance major purchases. It's created a fast and

secure way to get financing online. So it checks the first box.

Alex Green:

It's a cutting edge technology, and it also passes the second test. It's developed a breakthrough product

used by millions. It doubled its user base in a year, up to 24 million and its technology is backed by 55

software copyrights and it has 53 patents pending. So that's criterion three.

Alex Green:

Of course, the company is doing billions in business. It originated more than $11 billion worth of loans in

a single year on which it is collecting a monstrous profit, but it's on the verge of getting much bigger.

Think about this, the FinTech market could end up being 100 trillion, trillion with a T, according to one

industry Insider. That's 50 times bigger than Apple, Amazon and Netflix combined. So obviously, this

4.28 (Completed 09/01/20) Page 15 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

company matches criterion four, hundreds of millions, perhaps billions in sales. Yet this company has

been trading publicly for only two years, so almost no one even knows about it.

Bill O'Reily:

I imagine this stock trades at a great price, too.

Alex Green:

That's right, about 10 bucks. So this has all the hallmarks of a millionaire making stock. It's got the

trajectory of Square or even MasterCard, another FinTech stock that went from five bucks to nearly

$300 a share that turned every $10,000 investment into over 616,000.

Bill O'Reily:

Alex every one of these stocks sounds like a great pick. So how do people get all the details on these

companies with ticker symbols and buy instructions?

Alex Green:

As I mentioned, I prepared three free special reports that include the names and ticker symbols of all

these stocks, which also include easy to follow buy now instructions and the first report is on my

number one stock in America. It's called How to Profit From The #1 5G Megastock. The second is an

early detection biotech, it's called The Millionaire Making Diagnostics company and the third is my

favorite play on financial technology. It's called The Top FinTech in a $100 Trillion Market. All these

reports are included in The Great American Wealth Blueprint.

Bill O'Reily:

And it's part of The Great American Wealth Blueprint, which everyone can receive today. You'll also

receive, as I mentioned, my book the United States of Trump. That's not all, Alex has also created an

additional video series to send you Three Steps To a Seven Figure Portfolio, in which he lays out his

entire wealth building strategy. If you've never bought a stock in your life, Alex will show you the easiest

way to do it in the video series.

Bill O'Reily:

If you don't know the first thing about creating a portfolio, you'll get the paint by numbers instructions

on how to do it. You'll be off and running with the training you'll get in this video series. Now, Alex has

promised me, our viewers will get everything that we've mentioned in this great American wealth

blueprint, straight ahead but first, I have a question for you, Alex. How can you be sure markets will go

into a tailspin and that these stocks you're recommending will not perform poorly?

Alex Green:

Well, we definitely have had some losing positions from time to time in the past. So there are no

guarantees, that's just part of investing but these three particular stocks, I believe are some of the best

I've ever researched. I believe they will perform well in any market, but even if the markets do turn

against us, we have also built a system to get people out in extreme situations. We set up what we call

safety switch alerts for our readers to get them out before any big losses. That allows us to have strictly

limited downside risk with unlimited upside potential.

4.28 (Completed 09/01/20) Page 16 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

Alex Green:

For example, when the Great Recession struck, this system was triggered and rather than getting out

with major losses, we ended up closing out 45 plays for an average gain of 28%. Meanwhile, the market

fell by 37% that year.

Bill O'Reily:

That is incredible. Not to mention you will one of the first financial gurus to tell people to get back in at

the bottom. Now I remember at the beginning of 2009, you sent out a message to all of us following

your work saying, '09 will be a terrible year for the economy but surprising and shocking most investors,

should be an excellent year for the stock market. The market went on to jump 65% by year's end.

Alex Green:

That's true. I'm a big believer in the idea that when you do get out of the market, you shouldn't do it for

long and we jumped right back in at the perfect time. Reader Joe Martin of California wrote to tell us,

the bottom in 2008 was 1.4 million. Yesterday I was at 2.7 million.

Bill O'Reily:

Now I've been reading Alex's work myself since 2003 as I mentioned. I'm not a spokesman for Alex's

Research Service, mind you, I'm merely a happy guy. I'm a lifetime subscriber. Now, I've been in the

game for 15 years with Alex. His work is clear, concise, and as he'll tell you 15 million times, he's an

award winning researcher. So the stock selections that Alex puts out are good, and everything is

manageable. That's very important to me. So let me tell you a personal story about how I discovered,

why I came to be a big fan of Alex and his publication, the Oxford Communique. When I started investing

many years ago, I didn't have any money, zero, but I was determined to save as much money as I could

and put it into retirement.

Bill O'Reily:

10% here, 10% there every paycheck. That's what my father told me to do and I did it, one of the few

things I told him that I did that he said. So as I started making bigger money, I had trouble finding

investment experts I could trust. I had a few newsletters and I got hammered. Now some of the guys

that I followed led me to investments that went bankrupt, like Global Crossing.

Bill O'Reily:

Others would recommend 120 stocks. I mean, come on, as if I could do that, and other guys would

certainly disappear when you needed the most. This sort of thing is common on Wall Street. A lot of

charlatans run around. Look what happened to my pal Billy Joel. We were rowdy guys in the same

neighborhood in Levittown, Long Island, and as soon as Billy got famous, he hired some investment guys

to manage his money. Well, they stole him blind. Big court lawsuits followed.

Bill O'Reily:

I knew what happened to Billy and from my own experience, I didn't want it to happen to me. So I was

very methodical in how I went about selecting the people that I trusted. I made a decision that I would

be the one controlling my money, with a little help from a small inner circle of guys I trust. Then I started

to hear about Alex in about 2003. What I liked about him, first of all, is that he kept the

recommendations manageable, I could understand it.

4.28 (Completed 09/01/20) Page 17 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

Bill O'Reily:

Not 120 stocks, more like 20. I also liked that Alex emphasized, nobody cares more about your money

than you do and you should be in charge of it. Alex's research was really clear. He gave you all the details

you needed to make a decision, whether you want to buy the stock or not. So then I could decide, I was

in control and I liked that. Not to mention, you always had a clear plan for how to get out of the

positions.

Bill O'Reily:

So Alex, we talked about those safety switch alerts earlier, they protected your readers during the

financial crisis of 2008. That's a type of planning that I really appreciate. It's the reason I've had success

following your Communique. I made good money following your picks, especially that Berk B play. That

was a home run, and it appears you're getting better with age. Now, how do I know that? Because here's

the new newsletter.

Bill O'Reily:

January 1, 2019 you said, '19 would be a stock pickers market and the first stock you picked was Planet

Fitness. That stock has gone straight up. So Planet Fitness big winner. Next on June 1, 2019. You wrote

the readers showing them how to profit from the world's greatest masterpieces to play with Sotheby's,

one of the world's two largest auctioneers of fine art jewelry and collectibles. Within weeks of writing

that article, Sotheby's got an offer from a French billionaire to go private and your readers got a chance

to pocket an instant 61% gain in a single day. Now, Alex is not always right, but the facts are the facts,

correct?

Alex Green:

Yes, and it's important to be more right than wrong.

Bill O'Reily:

That's exactly it, and what you've done for my own finances and for the portfolio is there's so many

everyday American folks is unlike anything that I've seen. So that's why I'm here today. Because as part

of this great American wealth project, I want to see hardworking folks achieve the American dream. So if

you want to access the next millionaire making stocks, like Celgene, Intuitive Surgical, Planet Fitness,

Sotheby's types of stocks second single handedly supercharge your entire portfolio.

Bill O'Reily:

If you want to make a lot of money for your retirement, you need to follow Alex Green's program. It's

not just my opinion either. The Independent Hulbert Financial Digest has ranked your newsletter among

the top 10 in the nation for low risk, max reward performance for 16 consecutive years. If you had

beaten the market one year, two years, five years, people would say, well, you're just lucky, but you've

surpassed 16, straight years of outperformance.

Bill O'Reily:

The people who consistently beat their benchmarks are not just lucky. If you do it long enough, it's

clearly evidence of skill. If you feel stuck, Alex is the guy who can help you achieve great wealth. So how

can we get viewers to get your next stock picks and follow your recommendations?

4.28 (Completed 09/01/20) Page 18 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

Alex Green:

All right. Well, I alert my readers to every single recommendation in my monthly publication, the Oxford

Communique which you've been taking for over 15 years as you state. The goals of the communique are

simple and straightforward. I want to help readers maximize their income, minimize their taxes, at least

double the broad market returns, minimize market risk and live a financially free life without swimming

in concerns about money. My philosophy is simple when it comes to investing. I don't try to jump in and

out of the markets constantly based on the media driven news cycle.

Alex Green:

I don't try to predict what crazy moves the Fed will make next. Rather, I find perfect stocks that match

my five criteria, companies that are truly changing our world by inventing new products, gaining

worldwide market share and increasing revenue quarter after quarter. That approach has led to massive

returns like the $800,000 profit one reader made on Celgene, the 1.2 million another made on Intuitive

Surgical and the 3 million in total profit and other reader made by listening to all of my

recommendations over the long haul.

Alex Green:

Getting your shot at big winners like this is easy if you follow my system. So I'll tell you which new stock

to buy each month in each new issue of the communique.

Bill O'Reily:

In preparation for this event, we went back to look at the long term performance of your organization

and it's impressive. Since 1993 $100,000 portfolio following only the Communique picks would have

grown to about $3 million. Wow. By comparison, that same 100,000 put in the S&P 500 would only be

worth 877,000. So that's more than a $2 million difference. I think that's worth the price of a

subscription.

Bill O'Reily:

My understanding is that along with everything else you promised, you're going to give everyone

watching today a risk free trial of the Oxford Communique. Is that right?

Alex Green:

That's absolutely correct, Bill.

Bill O'Reily:

So all together in The Great American Wealth Blueprint, this is a huge package. You're going to get a 365

day risk free trial run in the Oxford Communique. Along with it, you get Alex's three part video series,

Three Steps To a Seven Figure Portfolio, as well as Alex's special reports. How To Profit From The #1 5G

Megastock, The Millionaire Making Diagnostics company and The Top FinTech In a 100 Trillion Dollar

Market. Plus, I am also going to give you my brand new book the United States of Trump, not pro

Trump, not anti Trump, history book.

Bill O'Reily:

I believe it's my best piece of writing ever. It'll be the most talked about book leading up to the next

election without a doubt. One woman I gave the book to couldn't go to sleep until she read it cover to

4.28 (Completed 09/01/20) Page 19 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

cover, she told me. 10PM to 7AM. So I think it's a page turner. No anonymous sources in the book, five

interviews with the President. Have known him for 30 years. He gave me an interview on Air Force One.

I really appreciated his time, busiest guy on Earth.

Bill O'Reily:

Now all five of the interviews that I did with President Trump are in book, but I don't owe him anything

other than telling the truth, which is what I always do. The United States of Trump is a history book. As I

said, not pro, not anti. Everyone watching can get it free today along with the entire Great American

wealth blueprint. In a moment, one of the key executives at Alex's organization, George Rayburn is going

to explain how to get everything we've mentioned today.

Bill O'Reily:

Alex assures me he set up a 365 day risk free guarantee that ensures you all the risk is on his shoulders.

You're going to get the details on that in a moment, but before we hand it over to George, let me say

this. Maybe be thinking that this project and getting started with someone like Alex Green is expensive.

Well, it should be, but I want everyone to know that I asked Alex to give viewers, the folks the best deal

his team, the Oxford Club has ever given. As you'll see, we're talking about getting you started with

Alex's prize newsletter for less than a buck a week. Come on. $1 a week. Incredibly inexpensive. It's one

of the things that I like about Alex. He's a caring guy.

Bill O'Reily:

He cares about helping people. He doesn't need to charge you a big fee, and for watching today, you

also get, as I mentioned, what? 85 times? My new books for free, and you're not going to find a better

deal than that. All in all, it's just a phenomenal deal. Has been put together for The Great American

Wealth Project. Thank you to everybody who's watching this report and taking part. Mr. Alex Green,

chief investment strategist of the Oxford Club. I am Bill O'Reilly in New York. We're turning it over to

George Rayburn, Executive Vice President of the Oxford club. George.

George Rayburn:

Thank you, Bill. Thank you, Alex. That was simply fantastic, incredible stuff. Thanks again. Thank you for

taking part in The Great American Wealth Project today. As Bill said, he insisted upon the best deal we

can possibly give on everything promised in the blueprint today, including a one year subscription to the

Oxford Communique, The United States of Trump by Bill O'Reilly, Three Steps To a Seven Figure Portfolio

video series, How To Profit From The #1 Megastock, The Millionaire Making Diagnostics Company and

The Top FinTech in a $100 Trillion Market.

George Rayburn:

Momentarily, you're going to see a button pop up beneath this video. It'll say get my great American

wealth blueprint now. When you see it, click it. You've heard from people who've become millionaires

just by following Alex's recommendations in the Communique. One gentleman made $1.2 million on a

single recommendation, and all five of his adult children became millionaires on the stock too.

George Rayburn:

It is simply unbelievable. With a one year Communique subscription, you'll get 24/7 365 day access to

the Oxford trading portfolio, password protected access to the Oxford Communique website, weekly

4.28 (Completed 09/01/20) Page 20 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

model portfolio updates, Oxford insights issues four times per week, access to the Oxfordian Hotel

collection, where you can receive special discounts on luxurious hotels around the world. VIP invitations

to attend conferences at Five Star locations.

George Rayburn:

That'll give me a chance to get to meet you personally. All told the total value of your package of The

Great American Wealth Blueprint, along with Bill O'Reily's book, The United States of Trump, is $1,485.

Most people are surprised to discover that a full list price subscription to the Communique with all of

these benefits promised today is normally only $249. That's it, a total bargain at that price. You should

know that the President tweeted about this book with Bill O'Reilly. So it's going to go like hotcakes.

George Rayburn:

Make sure you get your copy for free by clicking the button below. The money you could make from

your millionaire making special reports alone could pay for that subscription cost thousands of times

over, but you won't even pay $249. Alex and Bill have discussed many of the hardships Americans are

facing, even in this booming economy. We refuse to let price be a barrier to entry. That's why we're

making this risk free trial of the Communique available to you for only $49. That's less than $1 per week.

George Rayburn:

Better yet, you'll also get Alex Greene's ironclad 365 day 100% money back guarantee with your

Communique subscription. If for any reason you're not fully satisfied, simply send the book back and

you'll get a full refund of your subscription fee. No questions asked. Plus, you can keep everything else

that you've received along the way, with the exception of your copy of The United States of Trump and

we're going to take it up a level.

George Rayburn:

Alex is going to make you an additional $100,000 portfolio guarantee. We know the goal is to see new

millionaires created through The Great American Wealth Project and we believe it's going to happen.

Alex wants to make sure you're off and running toward that seven figure goal with at least $100,000

added to your name by this time next year. If you don't see the chance to add at least $100,000 to your

model portfolio over the next year, just call us up.

George Rayburn:

Alex will get you another extra year of the Oxford Communique completely free of charge. To sum it all

up, we want you to be happy, we want you to make a lot of money and there's no doubt you will. All you

have to do to get started is to click the button below, get my great American wealth blueprint now. Or

we have a fantastic concierge team at company headquarters. If you'd like to start your subscription

right now by ordering over the phone, simply call them right now at 866-415-8492 or 443-353-4234.

George Rayburn:

We have member representatives standing by from 8AM to 8PM, Monday through Friday Eastern time.

We are at your beck and call should you have any questions. Just give us a call at 866-415-8492 or 443-

353-4234, Monday through Friday, 8AM to 8PM Eastern time. We're fully dedicated to making sure your

subscription runs smoothly. So right now you have two choices. Keep doing the same old things we did

4.28 (Completed 09/01/20) Page 21 of 22

Transcript by Rev.com

This transcript was exported on Sep 03, 2020 - view latest version here.

money and never get ahead in life, or take us up on this no brainer offer today and start taking leaps and

bounds toward financial freedom.

George Rayburn:

Your life can change for the better in an instant. So click that button below to start receiving profit

recommendations like never before, and get all the free gifts we've outlined in The Great American

Wealth Blueprint. You'll be taken to a secure page where you can review everything before placing your

order.

George Rayburn:

On behalf of Bill O'Reilly, Alexander Green and the Oxford Club, I'm George Rayburn. I look forward to

welcoming you as the newest member of the Oxford Club. Go ahead and click that button right now.

Thanks for being with us.

4.28 (Completed 09/01/20) Page 22 of 22

Transcript by Rev.com

You might also like

- Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!From EverandRich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do Not!Rating: 4.5 out of 5 stars4.5/5 (305)

- EB-2 NIW Professional Plan Questionnaire (2022.09) - PROTECTEDDocument8 pagesEB-2 NIW Professional Plan Questionnaire (2022.09) - PROTECTEDAmanda BarbioNo ratings yet

- Chapter 1 - Case Study Apple's iPhone-Not Made in AmericaDocument2 pagesChapter 1 - Case Study Apple's iPhone-Not Made in AmericaOssama Fatehy67% (6)

- GROUP 2 - Analysis of Elon Musk's Leadership and Its Effect On Tesla MotorsDocument27 pagesGROUP 2 - Analysis of Elon Musk's Leadership and Its Effect On Tesla MotorsTam LeNo ratings yet

- Armstrong On GoldDocument5 pagesArmstrong On GoldNathan MartinNo ratings yet

- The Biblical Money CodeDocument39 pagesThe Biblical Money CodePavan Ramakrishna50% (2)

- 49313135809Document4 pages49313135809Adarsh TiwariNo ratings yet

- The New Rules of Money: 10RDG0012 v1 5-10Document5 pagesThe New Rules of Money: 10RDG0012 v1 5-10sheikjimmyNo ratings yet

- The Corruption of AmericaDocument24 pagesThe Corruption of AmericaJoseph GitterNo ratings yet

- Full Interview Transcript Featuring Jim Rogers 2017-02-09Document12 pagesFull Interview Transcript Featuring Jim Rogers 2017-02-09being11No ratings yet

- We Are All ImmigrantsDocument106 pagesWe Are All ImmigrantsHerman Legal Group, LLCNo ratings yet

- Bill Spetrino - The World's Greatest Dividend StockDocument4 pagesBill Spetrino - The World's Greatest Dividend StockJuan Marcos Tripolone Aguirre0% (1)

- 5 Little Guys That Got Rich in Bad Times: by Joshua BoswellDocument5 pages5 Little Guys That Got Rich in Bad Times: by Joshua BoswellElle-MaiNo ratings yet

- The Jere Beasley Report, Feb. 2008Document52 pagesThe Jere Beasley Report, Feb. 2008Beasley AllenNo ratings yet

- Kiyosaki New Rules of MoneyDocument5 pagesKiyosaki New Rules of MoneyJunkEmailtroll100% (5)

- The Gloog Revolution - "It's the Lawyers Stupid!": Get Lawyers Out of GovernmentFrom EverandThe Gloog Revolution - "It's the Lawyers Stupid!": Get Lawyers Out of GovernmentNo ratings yet

- ETR - How To Come Up With A Big Idea Part1Document6 pagesETR - How To Come Up With A Big Idea Part1Tata SarabandaNo ratings yet

- The Almighty Dollar: Follow the Incredible Journey of Single Dollar to See How the Global Economy Really WorksFrom EverandThe Almighty Dollar: Follow the Incredible Journey of Single Dollar to See How the Global Economy Really WorksNo ratings yet

- HalbertopenersDocument10 pagesHalbertopenersXavier Miranda SalvatierraNo ratings yet

- Investing Without Borders: How Six Billion Investors Can Find Profits in the Global EconomyFrom EverandInvesting Without Borders: How Six Billion Investors Can Find Profits in the Global EconomyNo ratings yet

- Election 101: Ron Paul Sets Sights On 2012. Ten Things To Know About HimDocument6 pagesElection 101: Ron Paul Sets Sights On 2012. Ten Things To Know About HimRyan JohanNo ratings yet

- 25-10-11 The Shocking, Graphic Data That Shows Exactly What Motivates The Occupy MovementDocument10 pages25-10-11 The Shocking, Graphic Data That Shows Exactly What Motivates The Occupy MovementWilliam J GreenbergNo ratings yet

- Sites To Help You Become An Expert in Colorado Rockies NHL Hat New Era Jerseys CheapDocument3 pagesSites To Help You Become An Expert in Colorado Rockies NHL Hat New Era Jerseys Cheapo7xcsum052No ratings yet

- Kidz Klub, March 2012 NewsletterDocument2 pagesKidz Klub, March 2012 NewsletterAlliant Credit UnionNo ratings yet

- ConspiracyOfTheRich RobertKiyosaki PDFDocument4 pagesConspiracyOfTheRich RobertKiyosaki PDFElvis OlotonNo ratings yet

- Gates of Hell: Why Bill Gates Is the Most Dangerous Man in the WorldFrom EverandGates of Hell: Why Bill Gates Is the Most Dangerous Man in the WorldNo ratings yet

- Mayor Lori Lightfoot Economic Club of Chicago SpeechDocument32 pagesMayor Lori Lightfoot Economic Club of Chicago SpeechCrains Chicago Business100% (2)

- 6 Minute English Giving Away Your FortuneDocument5 pages6 Minute English Giving Away Your FortuneMatteoBisceglieNo ratings yet

- Japan's Debt Looks Like This - 1,000,000,000,000,000 YenDocument4 pagesJapan's Debt Looks Like This - 1,000,000,000,000,000 YensachinshirnathNo ratings yet

- "17-Year-Old Girl Suicide Attempt" PromoDocument8 pages"17-Year-Old Girl Suicide Attempt" PromoMuqaudas AbdulazeezNo ratings yet

- The Entrepreneur: The Way Back for the U.S. EconomyFrom EverandThe Entrepreneur: The Way Back for the U.S. EconomyRating: 2 out of 5 stars2/5 (1)

- GOAL! The Financial Physician's Ultimate Survival Guide for the Professional AthleteFrom EverandGOAL! The Financial Physician's Ultimate Survival Guide for the Professional AthleteNo ratings yet

- Time to Get Tough: Make America Great Again!From EverandTime to Get Tough: Make America Great Again!Rating: 3 out of 5 stars3/5 (8)

- SixthRepublicanDebate 1-14-16Document37 pagesSixthRepublicanDebate 1-14-16Rick BulowNo ratings yet

- Disband the Corrupt Federal Reserve System and the Irs Now!From EverandDisband the Corrupt Federal Reserve System and the Irs Now!Rating: 5 out of 5 stars5/5 (1)

- December 21, 2010postsDocument1,457 pagesDecember 21, 2010postsAlbert L. PeiaNo ratings yet

- Summary: Exporting America: Review and Analysis of Lou Dobbs's BookFrom EverandSummary: Exporting America: Review and Analysis of Lou Dobbs's BookNo ratings yet

- 5 Secrets of Self - Made MillionaireDocument4 pages5 Secrets of Self - Made MillionaireEnzo DomingoNo ratings yet

- Why The US Is CollapsingDocument11 pagesWhy The US Is CollapsingKregener100% (3)

- Bring On The Crash: A 3-Step Practical Survival Guide: Prepare for Economic Collapse and Come Out WealthierFrom EverandBring On The Crash: A 3-Step Practical Survival Guide: Prepare for Economic Collapse and Come Out WealthierNo ratings yet

- Civil Service - English & Essay - 1977, 1997 - 2008Document65 pagesCivil Service - English & Essay - 1977, 1997 - 2008AJEESHKMCNo ratings yet

- Kidz Klub News, June 2011 NewsletterDocument2 pagesKidz Klub News, June 2011 NewsletterAlliant Credit UnionNo ratings yet

- Anyone Know What A BILLION IS..Document5 pagesAnyone Know What A BILLION IS..bustalNo ratings yet

- 13 Steps To Investing FoolishlyDocument33 pages13 Steps To Investing FoolishlyadikesaNo ratings yet

- 55 Reasons Why You Should Buy Products That Are Made in AmericaDocument24 pages55 Reasons Why You Should Buy Products That Are Made in AmericaGracia Thalia TNo ratings yet

- CHARTS: Here's What The Wall Street Protesters Are So Angry About..Document15 pagesCHARTS: Here's What The Wall Street Protesters Are So Angry About..Simply Debt SolutionsNo ratings yet

- August 2007 Charleston Market ReportDocument7 pagesAugust 2007 Charleston Market ReportbrundbakenNo ratings yet

- Personal Accountability: A Grandfather's Plan to Rebuild AmericaFrom EverandPersonal Accountability: A Grandfather's Plan to Rebuild AmericaNo ratings yet

- The Book A Series of Talks On Advertising: J. Walter Thompson CoDocument47 pagesThe Book A Series of Talks On Advertising: J. Walter Thompson CoDJ&Music channelNo ratings yet

- Listening Drill 11Document4 pagesListening Drill 11María Florencia VidelaNo ratings yet

- Obama-Xi Summit: What Happened & What Comes Next in US-China RelationsDocument33 pagesObama-Xi Summit: What Happened & What Comes Next in US-China RelationsUSChinaStrong100% (2)

- 26-05-13 US Economy in Long-Term DeclineDocument5 pages26-05-13 US Economy in Long-Term DeclineWilliam J GreenbergNo ratings yet

- A Billion DollarsDocument4 pagesA Billion DollarsephjuanNo ratings yet

- Summary of Tailspin: The People and Forces Behind America's Fifty-Year Fall--and Those Fighting to Reverse ItFrom EverandSummary of Tailspin: The People and Forces Behind America's Fifty-Year Fall--and Those Fighting to Reverse ItNo ratings yet

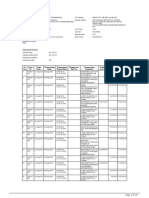

- Detailed StatementDocument18 pagesDetailed Statementwolf8585.inNo ratings yet

- Micro Economics Assignment 3Document2 pagesMicro Economics Assignment 3janette jedidiahNo ratings yet

- Case BriefDocument3 pagesCase BriefcherryNo ratings yet

- Introduction To Organisational Behaviour: Case of AmazonDocument6 pagesIntroduction To Organisational Behaviour: Case of AmazonMoumita RoyNo ratings yet

- Negev LTD Profile Updated-1Document50 pagesNegev LTD Profile Updated-1Joshua NdoloNo ratings yet

- 1.5 EconomicsDocument31 pages1.5 EconomicsKhadija MasoodNo ratings yet

- Design and Fabrication of Drill Press MachineDocument8 pagesDesign and Fabrication of Drill Press MachineSugumar MurthyNo ratings yet

- Inventory Costing ScheduleDocument7 pagesInventory Costing Schedulelala gasNo ratings yet

- rp2022 23Document24 pagesrp2022 23nihalNo ratings yet

- MacdonaldsDocument8 pagesMacdonaldsAhmet BabayevNo ratings yet

- Cambridge International AS & A Level: DC (RW) 207089/1 © UCLES 2021Document4 pagesCambridge International AS & A Level: DC (RW) 207089/1 © UCLES 2021Sraboni ChowdhuryNo ratings yet

- Contract Labour FORM XDocument1 pageContract Labour FORM Xhdpanchal86No ratings yet

- NIST PresentationDocument42 pagesNIST PresentationChris GothnerNo ratings yet

- Unit 3 Risk Management Part 3Document8 pagesUnit 3 Risk Management Part 3Lylegwyneth SuperticiosoNo ratings yet

- 1st Merit List BS Physics E Institute of Physics BAHAWALNAGAR Open Merit Fall 2021 Fall 2021Document1 page1st Merit List BS Physics E Institute of Physics BAHAWALNAGAR Open Merit Fall 2021 Fall 2021Muhammad AhmadNo ratings yet

- Jagriti Khanna Research Paper-1Document10 pagesJagriti Khanna Research Paper-1Utkarsh DwivediNo ratings yet

- 6 Economic GoalsDocument4 pages6 Economic Goalsrohanfyaz00100% (1)

- Introduction To Microeconomics ECON 101 OnlineDocument7 pagesIntroduction To Microeconomics ECON 101 OnlinemikaylaNo ratings yet

- Income Tax Quiz 6Document3 pagesIncome Tax Quiz 6Calix CasanovaNo ratings yet

- Chiến lược tổ chức Strength, weak Bỏ low price, high quality. Điểm mạnh về capability về khả năng mkt, khả năng của doanh nghiệpDocument3 pagesChiến lược tổ chức Strength, weak Bỏ low price, high quality. Điểm mạnh về capability về khả năng mkt, khả năng của doanh nghiệpĐằng TửNo ratings yet

- ContractualappointmentDocument4 pagesContractualappointmentK SachinNo ratings yet

- PDF 3481523479793275364Document1 pagePDF 3481523479793275364Gift Ali IkabongoNo ratings yet

- List of Brokers - IRDAIDocument27 pagesList of Brokers - IRDAIharsh.mohanNo ratings yet

- AC No. 11774, March 21 2018 (Ready Form, Inc. Vs Atty. Castillon, JR.)Document2 pagesAC No. 11774, March 21 2018 (Ready Form, Inc. Vs Atty. Castillon, JR.)Sai PastranaNo ratings yet

- Jatengland Industrial Park SayungDocument1 pageJatengland Industrial Park Sayungembong06041995No ratings yet

- Disney Case DataDocument8 pagesDisney Case DataJustine Rachel YaoNo ratings yet

- ReportDocument7 pagesReportZEHAN IENSNo ratings yet