Professional Documents

Culture Documents

Chapter 7

Chapter 7

Uploaded by

swapnil tiwariOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 7

Chapter 7

Uploaded by

swapnil tiwariCopyright:

Available Formats

This Document has been modified with Flexcil app (iOS) https://www.flexcil.

com

Additional Topics (Chapter 7)

1 RBI directive vide its circular on December 5, 2018 for large borrowers

In respect of borrowers having aggregate fund based working capital limit of Rs. 1500 million and above from

the banking system, a minimum level of ‘loan component’ of 40 percent shall be effective from April 1, 2019.

Accordingly, for such borrowers, the outstanding ‘loan component’ (Working Capital Loan) must be equal to at

least 40 percent of the sanctioned fund based working capital limit.

Hence, for such borrowers, drawings up to 40 percent of the total fund based working capital limits shall only be

allowed from the ‘loan component’. Drawings in excess of the minimum ‘loan component’ threshold may be

allowed in the form of cash credit facility.

Further, Loan against shares Banks are permitted to provide loan against shares, convertible bonds & deben-

tures, units of equity oriented Mutual funds to individuals subject to a maximum limit of Rs. 10 lakhs per individ-

ual if these securities are held in physical form and Rs. 20 lakhs if the securities are held in Demat form, from the

banking system. Banks stipulate high margins including specified minimum cash margins, on these loans as per

their credit policy – 50 to 60% in case of physical form & 25 to 40% in case of Demat form.

2

Forfaiting

Forfaiting is a mechanism through which exporters can avail finance by discounting their medium term/long

term export receivables with a forfaiter.

Long term receivable can be as long as 10 years where as medium term can be anywhere between three to five

years. Thus receivables on deferred basis evidenced by export bills and commercial documents can be forfeited.

Forfaiting is done on a without recourse basis i.e. if the importer fails to pay, the forfaiter cannot recover the

dues from the exporter for whom he has discounted the export receivable. Of course, a forfaiter covers this risk

by getting the export documents co-accepted by a importer’s bank/ reputable bank from the importer’s country.

A brief overview of general working mechanism of Forfaiting is as follows:

1. A foreign importer and an Indian exporter meet and finalize the transaction between them by entering in to a

contract.

2. Thereafter the exporter readies goods and ships the same to the importer as per contract terms.

3. Exporter simultaneously prepares set of export documents. (which are in a standardized formats of the forfait-

er.)

4. Before hand, the foreign importer agrees to get the co-acceptance the export documents sent by the Indian im-

porter, from his bank/reputed bank in his country as agreed between him and the exporter – this is known as

“avalised “document.

5. Once the co-accepted documents reach the exporter he hands over the same to the forfaiter ‘forfait’ the same -

.i.e. discount the same,” without recourse” basis to him.

6. The ‘forfaiter’ discounts the same and credits the amount of the bill after deducting his charges such as Commit-

ment Fee, Discount and Documentation fee.

7. The forfaiter thereafter sends the export documents to the importer’s bank/ co-accepted bank for reimburse-

ment on maturity date of the bill.

Forfaiting is an approved method of export financing by RBI. EXIM Bank in India has been authorised to facilitate the

forfaiting transactions. The advantage for the exporter is that he can convert the credit sale in to cash sale without

recourse to him or his banker.

Flexcil - The Smart Study Toolkit & PDF, Annotate, Note

This Document has been modified with Flexcil app (iOS) https://www.flexcil.com

3 Project Finance

The key participants in a project finance are:

Government – They participate indirectly in the project. Their work includes approval of the project, control of the

state company that sponsors the project, etc.

Project Sponsors or Owners.-They are the owners with the equity stake in the project The sponsors of a project fi-

nance deal include:- • Industrial sponsors – these are the industrialist who see some kind of connection of the pro-

ject with their core business • Public sponsors – These include central or local government, municipalities, or munici-

palized companies • Contractors / Sponsors –These include individuals who develop, build or run plants. • Financial

investor shall contain disclosures with regard to credit rating and rationale for roll-over.

Project Company –This entity is created solely for the purpose of execution of the project. They are controlled by the

project sponsors. They form the center of the project because of its contractual arrangements with operators, con-

tractors, suppliers and customers.

Contractor – The contractor is responsible for constructing the project to the technical specifications outlined in the

contract with the project company.

Supplier – They are the input provider for the project

Customer – They are the party who are willing to purchase the projects output

Commercial banks – They source the fund required for project financing. For arranging these large loans banks often

form syndicates to sell down their assets.

Project Report

For getting financial assistance from any Bank or Financial Institution for implementation of any business idea, a com-

pany is required to prepare a Project Report. A Project Report is a detailed report containing all the details of compa-

ny. A good project report must present diverse range analytical challenges to its clients and shareholders.

Report covering certain important aspects of the project as detailed below:

Introductory Page

Summary of the project

Details about the Promoters, their educational qualifications, work experience, etc.

Current Status of the Bank, its products and services, target market, and activities.

Infrastructure facilities, tools deployed, operational premises, machinery, etc.

Customers, details about them as well as prospective customers

Fiscal acquisitions and tie-ups

Means of Financing

Profitability projections and Cash flows for the entire repayment period of financial assistance

Balance Sheet

Profit and Loss Statements

Fund Flow Statement

Chief Ratios

Break Even Point Evaluations

Product with capacity to be built up and processes involved

Project location

Cost of the Project and Means of financing thereof

Availability of utilities

Technical arrangements

Market Prospects and Selling arrangements

Environmental aspects

Specimen of Project Report (Refer module for the specimen format)

Flexcil - The Smart Study Toolkit & PDF, Annotate, Note

This Document has been modified with Flexcil app (iOS) https://www.flexcil.com

4 Types of Factoring

Non-Recourse or Full Factoring Under this type of factoring the bank takes all the risk and bear all the loss in case

of debts becoming bad debts.

Recourse Factoring Under this type of factoring the bank purchases the receivables on the condition that any loss

arising out or bad debts will be borne by the company which has taken factoring.

Maturity Factoring Under this type of factoring bank does not give any advance to the company rather bank col-

lects it from customers and pays to the company either on the date of collection from the customers or on a guaran-

teed payment date.

Advance Factoring Under advance factoring arrangement the factor provides an advance against the uncollected

and non-due receivables to the firm.

Undisclosed Factoring Under this type of factoring, the customer is not informed of the factoring arrangement. The

firm may collect dues from the customer on its own or instruct to make remit once at some other address.

Invoice Discounting Under this type of factoring the bank provide an advance to the company against the account

receivables and in turn charges interest rate from the company for the payment which bank has given to the compa-

ny.

Advantages for the Seller

The Seller gets funds immediately after the sale is effected and on presentation of accepted sales invoices and Prom-

issory notes.

Major part of paper work and correspondence is taken care of by the factor.

The follow-up, for recovery of funds, is done mainly by the factor.

The Interest rates are not as high as normal discounting.

There is an Immediate funding arrangement, No additional debt is incurred on balance sheet.

Other assets are not encumbered and approval is not based on seller’s credit rating

ISLAMIC BANKING

Islamic Banking works on the principle of interest free banking. (interest is considered haram)

They do not invest money in business involved in alcohol, drugs, war weapon, etc. which are considered as ha-

5

ram.

They collect money from investors and invest in allowed business and take a share of the profits and divide it

among the investors.

In India, Banking Regulation Act has to be amended to incorporate Islamic Banking.

6

CMA DATA FOR DIFFERENT TYPES OF LOANS AND CREDIT FACILITIES

CMA refers to Credit Monitoring Arrangement data, which is a report to be presented to a bank to show the

company’s past financial history, current financial position and future financial planning.

It is necessary for a bank loan or a working capital loan or for seeking Cash Credit Limit.

In CMA data there are different parts.

In case of existing units, the data should be for current year estimated) and past 3 years (Audited) and projec-

tions for next 5 to 7 years covering the proposed repayment period of Term loan.

Flexcil - The Smart Study Toolkit & PDF, Annotate, Note

This Document has been modified with Flexcil app (iOS) https://www.flexcil.com

7 APPRAISAL METHODOLOGY FOR DIFFERENT TYPE OF LOANS AND CREDIT PRODUCTS

Appraisal of Working Capital

1. Operating Cycle Method:

The time gap between cash outlay & cash realization by sale of finished goods & realization of sundry debtors is

known as the length of the operating cycle.

Operating cycle is also called the cash-to-cash cycle & indicates how cash is converted into raw material, stocks in

process, finished goods, bills (receivables) & finally back to cash. Working capital is the total cash that is circulating

in this cycle. Therefore, working capital can be turned over or redeployed after completing the cycle.

2. Turnover Method (Nayak Committee) :

Working capital limit is computed as per Turnover method as under:

For example, the projected annual turnover of ABC Company is Rs 100 lakh for the FY 2018-19.

According to turnover method, working capital requirement of the unit is 25% of Rs.100 lakh = Rs.25 lakh

The margin of the borrower will be 5% of the projected sales turnover (5% of 100) = Rs.5 lakh

Hence, the working capital to be financed by bank is (25-5) – Rs.20 lakh.

3. Maximum Permissible Banking Finance Method (Tandon Committee)

There are three methods:

1st Method of Lending: 75% of the working capital gap (Working Capital Gap= Total current assets– Total current

liabilities other than bank borrowings) is financed by the bank and the balance 25% of the Working Capital Gap con-

sidered as margin is to come out of long term source i.e. owned funds and term borrowings.

2nd Method of Lending: Bank will finance maximum up to 75% of total current assets (TCA) and borrower has to

provide a minimum of 25% of total current assets as the margin out of long term sources.

3rd Method of Lending: This is same as 2nd method of lending, but excluding core current assets from total assets

and the core current assets are financed out of long term funds of the company. The term ‘core current assets‘ re-

fers to the absolute minimum level of investment in current assets, which is required at all times to carry out mini-

mum level of business activity.

4. Chore Committee: The committee recommended assessment of working capital requirements have to be mandato-

rily assessed based on 2nd method of lending suggested by Tandon Committee except for sick/Units under rehabilita-

tion.

5. Cash Budget System: In case of tea, sugar, construction companies, film industries and service sector requirement

of finance may be at the peak during certain months while the sale proceeds may be realised throughout the year to

repay the outstanding in the account. Therefore, credit limits are fixed on the basis of projected monthly cash budgets

to be received before beginning of the season.

Appraisal of Term Loans

Appraisal of term loan for an industrial unit is a process comprising several steps. There are four broad aspects of ap-

praisal, namely

Technical Feasibility - To determine the suitability of the technology selected & the adequacy of the technical investi-

gation & design;

Economic Feasibility - To ascertain the extent of profitability of the project & its sufficiency in relation to the repay-

ment obligations pertaining to term assistance;

Financial Feasibility - To determine the accuracy of cost estimates, suitability of the envisaged pattern of financing &

general soundness of the capital structure; &

Managerial Competency – To ascertain that competent men are behind the project to ensure its successful implementa-

tion & efficient management after commencement of commercial production .

Flexcil - The Smart Study Toolkit & PDF, Annotate, Note

This Document has been modified with Flexcil app (iOS) https://www.flexcil.com

Flexcil - The Smart Study Toolkit & PDF, Annotate, Note

You might also like

- Accounting For Time-ShareDocument4 pagesAccounting For Time-Shareaca_trader100% (2)

- Functions of Credit Administration DepartmentDocument4 pagesFunctions of Credit Administration Departmentsamaritasaha100% (1)

- Introduction To Corporate Banking ServicesDocument14 pagesIntroduction To Corporate Banking Servicesbookworm2606100% (1)

- What Is FactoringDocument22 pagesWhat Is Factoringshah faisal100% (1)

- Factoring and Invoice Discounting Working Capital Management OptionsDocument5 pagesFactoring and Invoice Discounting Working Capital Management OptionsKomal ParikhNo ratings yet

- Difference Between Trust and Retention Account and Escrow AccountDocument12 pagesDifference Between Trust and Retention Account and Escrow Accountrao_gmail67% (6)

- Factoring 1Document21 pagesFactoring 1Sudhir GijareNo ratings yet

- Factor and ForfaitingDocument11 pagesFactor and ForfaitingDishaNo ratings yet

- Financial Management AssignmentDocument12 pagesFinancial Management AssignmentrohanpujariNo ratings yet

- Factoring 1Document15 pagesFactoring 1nikitaneha0603No ratings yet

- Subject Code-B-103 Section A: Part One:: A. Ignored Non-Corporate EnterpriseDocument8 pagesSubject Code-B-103 Section A: Part One:: A. Ignored Non-Corporate EnterpriseRamusubu PsrkNo ratings yet

- Alternate Source of Finance, Private and Social Cost-Benefit, Public Private PartnershipDocument20 pagesAlternate Source of Finance, Private and Social Cost-Benefit, Public Private PartnershipRewant MehraNo ratings yet

- Unit 3 Non-Banking Financial ServicesDocument29 pagesUnit 3 Non-Banking Financial ServicesAllwynThomasNo ratings yet

- Internal Guide:-Submitted ByDocument13 pagesInternal Guide:-Submitted Byjitu247100% (2)

- IInd Unit - Factoring and Venture CapitalDocument28 pagesIInd Unit - Factoring and Venture Capitalguna57617No ratings yet

- Banking PortfolioDocument25 pagesBanking Portfolioranahaider081315No ratings yet

- Factoring and ForefaitingDocument17 pagesFactoring and ForefaitingShradhaNo ratings yet

- Presented By: 1. Pravin Gavali 2. Vickram Singh MIT-MBA (Finance)Document24 pagesPresented By: 1. Pravin Gavali 2. Vickram Singh MIT-MBA (Finance)shrikant_gaikwad100No ratings yet

- Role of Merchant Banking - : Raising FinanceDocument10 pagesRole of Merchant Banking - : Raising FinanceAadil KakarNo ratings yet

- Specialist Services Offered by Banks13Document14 pagesSpecialist Services Offered by Banks13Jacy VykeNo ratings yet

- Credit Schemes of State Bank of Pakistan (SBP)Document29 pagesCredit Schemes of State Bank of Pakistan (SBP)M. AdnanNo ratings yet

- CH 6 Factoring & Forfaiting (M.Y.khan)Document32 pagesCH 6 Factoring & Forfaiting (M.Y.khan)mr_gelda6183No ratings yet

- Trade 4Document5 pagesTrade 4krissh_87No ratings yet

- Short Term and Loans Term Loans To Business FirmsDocument10 pagesShort Term and Loans Term Loans To Business FirmsAli Asad BaigNo ratings yet

- Meaning of Borrowing CostDocument5 pagesMeaning of Borrowing CostRituNo ratings yet

- 667Bank financeDocument18 pages667Bank finance77Rohan AgroyaNo ratings yet

- Fact FofeitDocument34 pagesFact Fofeitmrchavan143No ratings yet

- Areas Covered in FPRDocument4 pagesAreas Covered in FPRNikunj BhatnagarNo ratings yet

- Growth of Consumer Financing in PakistanDocument7 pagesGrowth of Consumer Financing in Pakistannimra khaliqNo ratings yet

- Factoring and FoerfaitingDocument34 pagesFactoring and FoerfaitingKuntal DasNo ratings yet

- Working Capital ManagementDocument16 pagesWorking Capital ManagementAmit RoyNo ratings yet

- Week 10 Trade Financing ImportersDocument14 pagesWeek 10 Trade Financing ImportersJ DreamerNo ratings yet

- Post Shipment FinanceDocument5 pagesPost Shipment FinanceJc Duke M EliyasarNo ratings yet

- Topic:-Factoring Vs Forfaiting: Dr. Dileep Kumar SinghDocument20 pagesTopic:-Factoring Vs Forfaiting: Dr. Dileep Kumar SinghDileep SinghNo ratings yet

- Purpose of FinanceDocument10 pagesPurpose of FinanceManjith BoloorNo ratings yet

- 5 Factoring & Forfaiting ServicesDocument30 pages5 Factoring & Forfaiting ServicesSaurabh SinghNo ratings yet

- Factoring and IngDocument40 pagesFactoring and IngSajan VargheseNo ratings yet

- 160_16CCCCM15-16CCCBM15-16CCCAC15_2020052605363635Document25 pages160_16CCCCM15-16CCCBM15-16CCCAC15_2020052605363635sandeepattigeri65No ratings yet

- Term LoanDocument8 pagesTerm LoanDarshan PatilNo ratings yet

- M. Com IV Semester Paper: Financial Services Module: Factoring and ForfaitingDocument19 pagesM. Com IV Semester Paper: Financial Services Module: Factoring and ForfaitingAishwarya100% (1)

- Factoring and ForfaitingDocument3 pagesFactoring and ForfaitingSushant RathiNo ratings yet

- Financing Working Capital - Naveen SavitaDocument7 pagesFinancing Working Capital - Naveen SavitaMurli SavitaNo ratings yet

- Collateral Loan Info PDFDocument8 pagesCollateral Loan Info PDFcasmith43No ratings yet

- Submitted By: Vivek SharmaDocument18 pagesSubmitted By: Vivek SharmaVe1kNo ratings yet

- Factoring Project ReportDocument15 pagesFactoring Project ReportSiddharth Desai100% (3)

- VN Projects - S.Resources - QuestionnairesDocument3 pagesVN Projects - S.Resources - QuestionnairesAZHAR HASANNo ratings yet

- Funded & Non-Funded FacilitiesDocument3 pagesFunded & Non-Funded Facilitiesbhavin shahNo ratings yet

- Sources of Funds: Unit IiDocument36 pagesSources of Funds: Unit IiFara HameedNo ratings yet

- Corporate Banking ServicesDocument12 pagesCorporate Banking ServicesArif_Khan_1268No ratings yet

- Sources of funds-CHAPTER 2Document30 pagesSources of funds-CHAPTER 2SojinNo ratings yet

- Policy Guidelines HDFCDocument3 pagesPolicy Guidelines HDFCkwangdidNo ratings yet

- Module 8 Receivable FinancingDocument6 pagesModule 8 Receivable FinancingMa Leobelle BiongNo ratings yet

- Project Financing Program - VN QuestionnairesDocument3 pagesProject Financing Program - VN QuestionnairesAZHAR HASANNo ratings yet

- Factoring and Forfaiting: DR Saif SiddiquiDocument30 pagesFactoring and Forfaiting: DR Saif SiddiquiSuman AcharyaNo ratings yet

- Trade FinanceDocument46 pagesTrade Financeeslamnaser73No ratings yet

- Factoring and IngDocument7 pagesFactoring and IngAnsh SardanaNo ratings yet

- BankingDocument9 pagesBankingIshaanKapoorNo ratings yet

- Different Types of Factoring: Financial Transaction Accounts Receivable Invoices Factor DiscountDocument4 pagesDifferent Types of Factoring: Financial Transaction Accounts Receivable Invoices Factor DiscountSunaina Kodkani100% (1)

- Factoring and ForfaitingDocument21 pagesFactoring and ForfaitingDilip RajNo ratings yet

- Financing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksFrom EverandFinancing Handbook for Companies: A Practical Guide by A Banking Executive for Companies Seeking Loans & Financings from BanksRating: 5 out of 5 stars5/5 (1)

- Aristotle, PolitcsDocument354 pagesAristotle, PolitcsMariana Elsner100% (2)

- The Land Reform Act of 1955Document14 pagesThe Land Reform Act of 1955Elaine PolicarpioNo ratings yet

- Criminal Law 2 Quiz 3Document1 pageCriminal Law 2 Quiz 3Zubair BatuaNo ratings yet

- ACCY112 Tut 2Document15 pagesACCY112 Tut 2goh rainNo ratings yet

- Test Bank For Microeconomics Fifth EditionDocument99 pagesTest Bank For Microeconomics Fifth Editionmichaelmckayksacoxebfi100% (29)

- S4611 EN Col14 ILT FV CO A4Document23 pagesS4611 EN Col14 ILT FV CO A4Tabe TambeNo ratings yet

- USCG Public Affairs ManualDocument192 pagesUSCG Public Affairs Manualcgreport100% (1)

- Mhmun Ecosoc BGDocument17 pagesMhmun Ecosoc BGsudeep.mallik23No ratings yet

- University of Calcutta: B.A. LL.B. (Hons.)Document3 pagesUniversity of Calcutta: B.A. LL.B. (Hons.)Shivendra SinghNo ratings yet

- Endorsement For Issuance of Gate Pass Id Request FormDocument4 pagesEndorsement For Issuance of Gate Pass Id Request FormDOÑYA AVANo ratings yet

- Central Surety and Insurance CompanyDocument2 pagesCentral Surety and Insurance CompanyxyrakrezelNo ratings yet

- Chapter 07 - Exercises - Part IDocument2 pagesChapter 07 - Exercises - Part IRawan YasserNo ratings yet

- California Professional Engineers State Laws and Board Rules Examination (Take Home Examination)Document7 pagesCalifornia Professional Engineers State Laws and Board Rules Examination (Take Home Examination)Pawan KumarNo ratings yet

- Former Virginia Tech Soccer Player Sues CoachDocument13 pagesFormer Virginia Tech Soccer Player Sues CoachWSETNo ratings yet

- Cambodia: Commune Council Development ProjectDocument55 pagesCambodia: Commune Council Development ProjectIndependent Evaluation at Asian Development BankNo ratings yet

- ITC Tempus Sans Font Webfont & Desktop MyFontsDocument1 pageITC Tempus Sans Font Webfont & Desktop MyFontsHydar123 FliNo ratings yet

- 12-08-24 Supplemental Google DisclosuresDocument10 pages12-08-24 Supplemental Google DisclosuresFlorian MuellerNo ratings yet

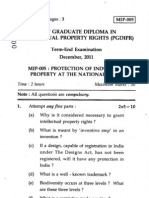

- Mip 005Document3 pagesMip 005zakirkhilji0% (1)

- FPSC 16Document2 pagesFPSC 16Zakir HussainNo ratings yet

- App Iii Summer Midterm ExamDocument9 pagesApp Iii Summer Midterm ExamCharmaine PamintuanNo ratings yet

- Student's HandbookDocument15 pagesStudent's HandbookMi Co100% (1)

- Forensic Analisys of Web Browser With Dual Layout Engine (Slides - Linda - ICDFI2012)Document20 pagesForensic Analisys of Web Browser With Dual Layout Engine (Slides - Linda - ICDFI2012)whiskmanNo ratings yet

- TDS Fosroc Solvent 102 Saudi ArabiaDocument2 pagesTDS Fosroc Solvent 102 Saudi ArabiaShaikhRizwanNo ratings yet

- Banking Law PresentationDocument15 pagesBanking Law PresentationSahana BalarajNo ratings yet

- Enrollment Form: Name of StudentDocument2 pagesEnrollment Form: Name of StudentThat's EntertainmentNo ratings yet

- "The Hand Book of Islam" in English & Urdu, and Many Books On Islam, Christianity and Judaism Are Freely Available @Document46 pages"The Hand Book of Islam" in English & Urdu, and Many Books On Islam, Christianity and Judaism Are Freely Available @ardianNo ratings yet

- A Lawyer Is Not Expected To Know All The LawDocument9 pagesA Lawyer Is Not Expected To Know All The LawAilein Grace100% (1)

- Tatlong Taong Walang DiyosDocument2 pagesTatlong Taong Walang DiyosCyberVODSNo ratings yet

- Service Manual: Publication NoDocument6 pagesService Manual: Publication NohamdaNo ratings yet