Professional Documents

Culture Documents

MBA Job Order Costing

MBA Job Order Costing

Uploaded by

umangsharma0494Copyright:

Available Formats

You might also like

- Case 21Document14 pagesCase 21Gabriela LueiroNo ratings yet

- ANSWER: See On The Right, A & B. Items Answer To Question A Answer To Question BDocument6 pagesANSWER: See On The Right, A & B. Items Answer To Question A Answer To Question BphoebeNo ratings yet

- Test 1 - Ma1 Practice in ClassDocument8 pagesTest 1 - Ma1 Practice in ClassNgaka MokakeNo ratings yet

- Mock Exam Part 1 Essay September 07, 2018Document13 pagesMock Exam Part 1 Essay September 07, 2018bernard cruzNo ratings yet

- Accounitng Answers Mid Term QuizDocument9 pagesAccounitng Answers Mid Term QuizWarda Tariq0% (1)

- Bajaj Capital Innovative Marketing Strategies Used by Bajaj Capital Towards Mutual FundsDocument95 pagesBajaj Capital Innovative Marketing Strategies Used by Bajaj Capital Towards Mutual FundsMuma's Doll50% (2)

- Quiz 2 - Job Costing - Printable, V (5.0)Document7 pagesQuiz 2 - Job Costing - Printable, V (5.0)Edward Prima KurniawanNo ratings yet

- 3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Document2 pages3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Jonathan Altamirano Burgos0% (1)

- Practice Questions: Global Certified Management AccountantDocument23 pagesPractice Questions: Global Certified Management AccountantThiha WinNo ratings yet

- Assessment Formal AssessmentDocument8 pagesAssessment Formal Assessmentashish100% (1)

- Problem 4-47 Application of Overhead Service IndustryDocument26 pagesProblem 4-47 Application of Overhead Service IndustryIkram100% (1)

- Costing and Pricing Final ExaminationDocument3 pagesCosting and Pricing Final ExaminationRobbie Ceralvo0% (1)

- Bai Tap On Tap QTDNDocument4 pagesBai Tap On Tap QTDNDuyên Nguyễn Nữ KỳNo ratings yet

- BA 7000 Study Guide 1Document11 pagesBA 7000 Study Guide 1ekachristinerebecaNo ratings yet

- Session 1 ProblemsDocument5 pagesSession 1 ProblemsdonjazonNo ratings yet

- Quiz 3 SolutionDocument5 pagesQuiz 3 SolutionMichel BanvoNo ratings yet

- Attempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting PeriodDocument18 pagesAttempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting Periodpragadeeshwaran100% (2)

- Assignment (2) - Problem Set-1Document5 pagesAssignment (2) - Problem Set-1yunsu638No ratings yet

- BusinessManagement MidtermDocument6 pagesBusinessManagement MidtermHoàng Thị Phương TrinhNo ratings yet

- Exercises cms-3: 1. ABC Corporation Has Developed The Following Standards For One of Its ProductsDocument2 pagesExercises cms-3: 1. ABC Corporation Has Developed The Following Standards For One of Its ProductsThaa Manitha DinataNo ratings yet

- Full Book Test 5Document12 pagesFull Book Test 5alihanaveed9No ratings yet

- Practice Problems For Midterm - Spring 2017Document6 pagesPractice Problems For Midterm - Spring 2017Derny FleurimaNo ratings yet

- Job CostingDocument19 pagesJob CostingSteven HouNo ratings yet

- Discussion Question 2Document6 pagesDiscussion Question 2Sadhna MaharjanNo ratings yet

- MA 习题带练 Chapter 8-13Document13 pagesMA 习题带练 Chapter 8-13roseliu.521.jackNo ratings yet

- Answer Key To Test #1 - ACCT-312 - Fall 2019Document8 pagesAnswer Key To Test #1 - ACCT-312 - Fall 2019Amir ContrerasNo ratings yet

- Week 5 Tutorial SolutionDocument6 pagesWeek 5 Tutorial SolutionRosemarie Mae DezaNo ratings yet

- BACOSTMX Module 3 Self-ReviewerDocument5 pagesBACOSTMX Module 3 Self-ReviewerlcNo ratings yet

- AML-Excercise Week 1 & 2 (Reviandi Ramadhan)Document26 pagesAML-Excercise Week 1 & 2 (Reviandi Ramadhan)reviandiramadhanNo ratings yet

- EXERCISECHAPTER2Document8 pagesEXERCISECHAPTER2Bạch ThanhNo ratings yet

- FMA Assgnments - EX 2022Document12 pagesFMA Assgnments - EX 2022Natnael BelayNo ratings yet

- Problems and Exercises in Introduction in Acctg and CVPDocument4 pagesProblems and Exercises in Introduction in Acctg and CVPJanelleNo ratings yet

- Short AnswerDocument4 pagesShort AnswerMichiko Kyung-soonNo ratings yet

- Job Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetDocument8 pagesJob Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetNessa MarasiganNo ratings yet

- Cost Accounting CH 3Document11 pagesCost Accounting CH 3Nour Al KaddahNo ratings yet

- MA1-Pre Exam (R)Document2 pagesMA1-Pre Exam (R)BRos THivNo ratings yet

- Job Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetDocument8 pagesJob Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetTherese Grace PostreroNo ratings yet

- ACT202 Midterm ExamDocument2 pagesACT202 Midterm ExamSalahuddin BadhonNo ratings yet

- Hypercompuglobalmeganet Corporation Assumptions For Financial Projections Description Value Comment Revenue AssumptionsDocument4 pagesHypercompuglobalmeganet Corporation Assumptions For Financial Projections Description Value Comment Revenue AssumptionsKSXNo ratings yet

- Quiz 4 CADocument8 pagesQuiz 4 CAbasilnaeem7No ratings yet

- Manacc Ans KeyDocument4 pagesManacc Ans KeyJimmer CapeNo ratings yet

- QS05 - Class Exercises SolutionDocument3 pagesQS05 - Class Exercises Solutionlyk0texNo ratings yet

- Job CostingDocument24 pagesJob CostingRam KnowlesNo ratings yet

- Wa0025Document5 pagesWa0025Anggari SaputraNo ratings yet

- Problem 3 4 Chapter 14Document6 pagesProblem 3 4 Chapter 14freaann03No ratings yet

- WK5 - JOC Exercise 1Document5 pagesWK5 - JOC Exercise 1LIM YIN SHUAN KM-PelajarNo ratings yet

- Faculty of Business and Management BBA/DBA 211 Managerial AccountingDocument4 pagesFaculty of Business and Management BBA/DBA 211 Managerial AccountingMichael AronNo ratings yet

- CH 3Document19 pagesCH 3hey100% (1)

- Micro Shots 2010Document158 pagesMicro Shots 2010Arifin MasruriNo ratings yet

- COMM305 MT1 Practice Problems (F21)Document9 pagesCOMM305 MT1 Practice Problems (F21)Rachel KantersNo ratings yet

- Class Handout - Job Costing Session - 2and3-2Document4 pagesClass Handout - Job Costing Session - 2and3-2Ritwik MahajanNo ratings yet

- CVP Analysis Learning ExercisesDocument3 pagesCVP Analysis Learning ExercisesSUNNY BHUSHANNo ratings yet

- MASDocument7 pagesMASHelen IlaganNo ratings yet

- Test 2 Second Online TestDocument6 pagesTest 2 Second Online TestTrâm LêNo ratings yet

- Cost Classification: Total Product/ ServiceDocument21 pagesCost Classification: Total Product/ ServiceThureinNo ratings yet

- Job Order CostingDocument3 pagesJob Order Costingsus meetaNo ratings yet

- GNB13 e CH 03 ExamDocument6 pagesGNB13 e CH 03 ExamAnne Dorcas S. DomingoNo ratings yet

- A. Calculate The Break-Even Dollar Sales For The MonthDocument25 pagesA. Calculate The Break-Even Dollar Sales For The MonthPriyankaNo ratings yet

- Bài Tập Tự LuậnDocument5 pagesBài Tập Tự Luậnhn0743644No ratings yet

- Cost Actg June 2019 Test 1Document7 pagesCost Actg June 2019 Test 1GiangNguyễnNo ratings yet

- Responsibility Accounting: Chapter Study ObjectivesDocument7 pagesResponsibility Accounting: Chapter Study ObjectivesLive LoveNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- What Is A Npa?Document3 pagesWhat Is A Npa?phaqrNo ratings yet

- Business CombinationDocument6 pagesBusiness CombinationJalieha Mahmod0% (1)

- Ecommerce in Cooperative BanksDocument9 pagesEcommerce in Cooperative BanksSIDDARTH BADAJENANo ratings yet

- Schedule of Charges Current AccountDocument8 pagesSchedule of Charges Current AccountAshif RejaNo ratings yet

- Project On AtmDocument51 pagesProject On AtmtriratnacomNo ratings yet

- General Banking LawDocument62 pagesGeneral Banking LawKristine FayeNo ratings yet

- Assure FundDocument58 pagesAssure FundVishalNo ratings yet

- Chapter 1 BPP QuestionsDocument9 pagesChapter 1 BPP Questionsmarlynrich3652No ratings yet

- Time Value of Money Notes & ConceptsDocument9 pagesTime Value of Money Notes & ConceptsRashi MehtaNo ratings yet

- Fair Value Measurement Edited GDDocument37 pagesFair Value Measurement Edited GDyonas alemuNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument32 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balanceassasas asasNo ratings yet

- Interest Free Banking in Ethiopia: Prospects and ChallengesDocument20 pagesInterest Free Banking in Ethiopia: Prospects and Challengessi labNo ratings yet

- Compound Interest CalculatorDocument6 pagesCompound Interest Calculatorbajramo1No ratings yet

- A212 - Topic 3 - FV PV - Part I (Narration)Document31 pagesA212 - Topic 3 - FV PV - Part I (Narration)Teo ShengNo ratings yet

- ATM ManipulationDocument3 pagesATM Manipulationabdul raheman sudesNo ratings yet

- Disbursement Process and Documentation: I) Ii) Iii)Document31 pagesDisbursement Process and Documentation: I) Ii) Iii)mr9_apeceNo ratings yet

- Nama Akun Akuntansi Dalam Bahasa InggrisDocument3 pagesNama Akun Akuntansi Dalam Bahasa Inggrisratih nikenNo ratings yet

- 19 Say No To Cash TransactionDocument6 pages19 Say No To Cash TransactionAmit Mantry100% (1)

- AUD339 - OBE Lesson Plan 1Document11 pagesAUD339 - OBE Lesson Plan 1MUHAMMAD AMIR HAMZAH NURZAFILNo ratings yet

- London Examinations GCE: Accounting (Modular Syllabus) Advanced Subsidiary/Advanced LevelDocument15 pagesLondon Examinations GCE: Accounting (Modular Syllabus) Advanced Subsidiary/Advanced Levelrahat879No ratings yet

- Key AnswerDocument2 pagesKey AnswerBSA3Tagum MariletNo ratings yet

- Current & Saving Account Statement: Vishnu Gupta S/O Jagdish Gupta HNO 417 Mo Arya Nagar Shiv Ganj EtahDocument6 pagesCurrent & Saving Account Statement: Vishnu Gupta S/O Jagdish Gupta HNO 417 Mo Arya Nagar Shiv Ganj Etahvishnu guptaNo ratings yet

- SummaryDocument3 pagesSummaryMaitet CarandangNo ratings yet

- A.Rahman Salah AmerDocument14 pagesA.Rahman Salah AmerA.Rahman SalahNo ratings yet

- Benton E. Gup The New Financial Architecture Banking Regulation in The 21st Century 2000Document277 pagesBenton E. Gup The New Financial Architecture Banking Regulation in The 21st Century 2000TheGR3ddyNo ratings yet

- LunchDocument38 pagesLunchAnaNo ratings yet

- Analysis and Interpretation of Financial Statements (Accounting)Document10 pagesAnalysis and Interpretation of Financial Statements (Accounting)aenNo ratings yet

MBA Job Order Costing

MBA Job Order Costing

Uploaded by

umangsharma0494Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MBA Job Order Costing

MBA Job Order Costing

Uploaded by

umangsharma0494Copyright:

Available Formats

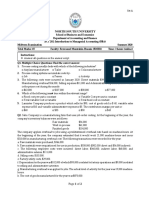

MBA 649 Tutorials Questions prepared by Mazri Hafiz

TUTORIAL QUESTIONS: JOB ORDER COSTING

The following cases/questions are fictitious. All references are not, in any form,

reflective of the person(s) or entities named in the text. These cases are for the

sole purpose of MBA 649 (Strategic Managerial Accounting & Control) tutorials.

Reproduction and distribution of this document, in any form, is prohibited.

Solutions to these questions are only available by attending tutorials.

QUESTION 1: PREDETERMINED OVERHEAD RATES AND ADJUSTMENTS

Fieja was recently tasked with handling the assignment of overhead costs at

Naresh Academy Inc. Since the company follows a normal job order cost system,

Fieja felt it would be best to assign overhead based on a predetermined rate.

She compiled the following budgeted data:

• Estimated overhead for the year amounted to $2,365,000

• Expected labour cost of $2,956,250

• Expected labour hours amounted to 220,000 hours

• Expected machine hours amounted to 118,250 hours

Fieja then compiled the following actuals for all jobs worked during the year:

Actual Usage DL Dollars DL Hours Machine Hours

Job SZN 1 $ 980,000.00 70,000 30,000

Job SZN 2 $ 588,000.00 42,000 10,000

Job SZN 3 $ 1,120,000.00 80,000 40,000

JOB SZN 4 $ 420,000.00 30,000 15,000

Actual overhead costs for the year consisted of the following:

Manufacturing Overhead Cost

Rent $ 800,000.00

Utilities $ 600,000.00

Depreciation $ 500,000.00

Property Insurance $ 140,000.00

Indirect Materials $ 46,500.00

Indirect Labour $ 300,000.00

Required 1: Apply overhead based on direct labour cost. Calculate the

under or over-applied amount and adjust via cost of goods sold.

Required 2: Apply overhead based on direct labour hours. Calculate the

under or over-applied amount and adjust via cost of goods sold.

Required 3: Apply overhead based on machine hours. Calculate the under

or over-applied amount and adjust via cost of goods sold.

MBA 649 Tutorials Questions prepared by Mazri Hafiz

QUESTION 2: COMPREHENSIVE CHAPTER QUESTION

Laplante Inc. is an artificial hair manufacturer that uses normal job order costing.

Overhead for the year was estimated at $720,000. The company manufactures

the best hair anyone could ever ask for. The managerial accountant, Ryan, was

put in charge of creating year end reports. The company’s fiscal year ends on

December 31st 2012.

Job cost data showed the following:

Direct Materials Direct Labour

Job FWU $ 57,500.00 $ 41,000.00

Job FWV $ 144,000.00 $ 100,000.00

Job FWW $ 150,000.00 $ 180,000.00

Job FWX $ 186,500.00 $ 190,000.00

Job FWY $ 132,000.00 $ 89,000.00

Job FWZ $ 100,000.00 $ 60,000.00

The company applies overhead based on a direct labour dollars estimate of

$600,000. The company also applied $49,200 of overhead to Job FWU. During

the year, the company incurred factory rent, utilities, depreciation, indirect labour

and other factory expenditures at a cost of $300,000, $140,000, $96,000,

$75,000 and $180,000, respectively. Selling and administrative expenses for the

year were $2,500,000. On December 31st, 2012, Job FWT and FWZ were still in

process. All other jobs were completed and sold except for Job FWW.

Raw materials as at December 31st 2011 were $40,000. Materials purchases for

the year were $800,000. Total indirect materials requisition for the year

amounted to $20,000. The company’s income tax rate is 38%.

On December 31st, 2011, Job FWT and FWU were in process at a cost of

$180,000 and $152,000, respectively. Furthermore, the company already had

Job FWA completed and on hand at a cost of $420,000.

Company sales for the year amounted to $5,040,000 while maintaining a gross

margin of 60% prior to any adjustment.

Required 1: Determine the predetermined overhead rate

Required 2: Prepare a cost of goods manufactured schedule

Required 3: Prepare an income statement. Assume any under or over

applied amount to be immaterial.

Required 4: Adjust for over or under applied manufacturing overhead

assuming any under or over applied amount is material.

You might also like

- Case 21Document14 pagesCase 21Gabriela LueiroNo ratings yet

- ANSWER: See On The Right, A & B. Items Answer To Question A Answer To Question BDocument6 pagesANSWER: See On The Right, A & B. Items Answer To Question A Answer To Question BphoebeNo ratings yet

- Test 1 - Ma1 Practice in ClassDocument8 pagesTest 1 - Ma1 Practice in ClassNgaka MokakeNo ratings yet

- Mock Exam Part 1 Essay September 07, 2018Document13 pagesMock Exam Part 1 Essay September 07, 2018bernard cruzNo ratings yet

- Accounitng Answers Mid Term QuizDocument9 pagesAccounitng Answers Mid Term QuizWarda Tariq0% (1)

- Bajaj Capital Innovative Marketing Strategies Used by Bajaj Capital Towards Mutual FundsDocument95 pagesBajaj Capital Innovative Marketing Strategies Used by Bajaj Capital Towards Mutual FundsMuma's Doll50% (2)

- Quiz 2 - Job Costing - Printable, V (5.0)Document7 pagesQuiz 2 - Job Costing - Printable, V (5.0)Edward Prima KurniawanNo ratings yet

- 3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Document2 pages3. If the critical path is longer than 60 days, what is the least amount that Dr. Watage can spend and still achieve the schedule objective? How can he prove to the Pathminder Fund that this is the minimum cost alternative?Jonathan Altamirano Burgos0% (1)

- Practice Questions: Global Certified Management AccountantDocument23 pagesPractice Questions: Global Certified Management AccountantThiha WinNo ratings yet

- Assessment Formal AssessmentDocument8 pagesAssessment Formal Assessmentashish100% (1)

- Problem 4-47 Application of Overhead Service IndustryDocument26 pagesProblem 4-47 Application of Overhead Service IndustryIkram100% (1)

- Costing and Pricing Final ExaminationDocument3 pagesCosting and Pricing Final ExaminationRobbie Ceralvo0% (1)

- Bai Tap On Tap QTDNDocument4 pagesBai Tap On Tap QTDNDuyên Nguyễn Nữ KỳNo ratings yet

- BA 7000 Study Guide 1Document11 pagesBA 7000 Study Guide 1ekachristinerebecaNo ratings yet

- Session 1 ProblemsDocument5 pagesSession 1 ProblemsdonjazonNo ratings yet

- Quiz 3 SolutionDocument5 pagesQuiz 3 SolutionMichel BanvoNo ratings yet

- Attempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting PeriodDocument18 pagesAttempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting Periodpragadeeshwaran100% (2)

- Assignment (2) - Problem Set-1Document5 pagesAssignment (2) - Problem Set-1yunsu638No ratings yet

- BusinessManagement MidtermDocument6 pagesBusinessManagement MidtermHoàng Thị Phương TrinhNo ratings yet

- Exercises cms-3: 1. ABC Corporation Has Developed The Following Standards For One of Its ProductsDocument2 pagesExercises cms-3: 1. ABC Corporation Has Developed The Following Standards For One of Its ProductsThaa Manitha DinataNo ratings yet

- Full Book Test 5Document12 pagesFull Book Test 5alihanaveed9No ratings yet

- Practice Problems For Midterm - Spring 2017Document6 pagesPractice Problems For Midterm - Spring 2017Derny FleurimaNo ratings yet

- Job CostingDocument19 pagesJob CostingSteven HouNo ratings yet

- Discussion Question 2Document6 pagesDiscussion Question 2Sadhna MaharjanNo ratings yet

- MA 习题带练 Chapter 8-13Document13 pagesMA 习题带练 Chapter 8-13roseliu.521.jackNo ratings yet

- Answer Key To Test #1 - ACCT-312 - Fall 2019Document8 pagesAnswer Key To Test #1 - ACCT-312 - Fall 2019Amir ContrerasNo ratings yet

- Week 5 Tutorial SolutionDocument6 pagesWeek 5 Tutorial SolutionRosemarie Mae DezaNo ratings yet

- BACOSTMX Module 3 Self-ReviewerDocument5 pagesBACOSTMX Module 3 Self-ReviewerlcNo ratings yet

- AML-Excercise Week 1 & 2 (Reviandi Ramadhan)Document26 pagesAML-Excercise Week 1 & 2 (Reviandi Ramadhan)reviandiramadhanNo ratings yet

- EXERCISECHAPTER2Document8 pagesEXERCISECHAPTER2Bạch ThanhNo ratings yet

- FMA Assgnments - EX 2022Document12 pagesFMA Assgnments - EX 2022Natnael BelayNo ratings yet

- Problems and Exercises in Introduction in Acctg and CVPDocument4 pagesProblems and Exercises in Introduction in Acctg and CVPJanelleNo ratings yet

- Short AnswerDocument4 pagesShort AnswerMichiko Kyung-soonNo ratings yet

- Job Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetDocument8 pagesJob Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetNessa MarasiganNo ratings yet

- Cost Accounting CH 3Document11 pagesCost Accounting CH 3Nour Al KaddahNo ratings yet

- MA1-Pre Exam (R)Document2 pagesMA1-Pre Exam (R)BRos THivNo ratings yet

- Job Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetDocument8 pagesJob Order Costing Practice Problem 1 Davis Manufacturing, Inc. 1994 Manufacturing Overhead BudgetTherese Grace PostreroNo ratings yet

- ACT202 Midterm ExamDocument2 pagesACT202 Midterm ExamSalahuddin BadhonNo ratings yet

- Hypercompuglobalmeganet Corporation Assumptions For Financial Projections Description Value Comment Revenue AssumptionsDocument4 pagesHypercompuglobalmeganet Corporation Assumptions For Financial Projections Description Value Comment Revenue AssumptionsKSXNo ratings yet

- Quiz 4 CADocument8 pagesQuiz 4 CAbasilnaeem7No ratings yet

- Manacc Ans KeyDocument4 pagesManacc Ans KeyJimmer CapeNo ratings yet

- QS05 - Class Exercises SolutionDocument3 pagesQS05 - Class Exercises Solutionlyk0texNo ratings yet

- Job CostingDocument24 pagesJob CostingRam KnowlesNo ratings yet

- Wa0025Document5 pagesWa0025Anggari SaputraNo ratings yet

- Problem 3 4 Chapter 14Document6 pagesProblem 3 4 Chapter 14freaann03No ratings yet

- WK5 - JOC Exercise 1Document5 pagesWK5 - JOC Exercise 1LIM YIN SHUAN KM-PelajarNo ratings yet

- Faculty of Business and Management BBA/DBA 211 Managerial AccountingDocument4 pagesFaculty of Business and Management BBA/DBA 211 Managerial AccountingMichael AronNo ratings yet

- CH 3Document19 pagesCH 3hey100% (1)

- Micro Shots 2010Document158 pagesMicro Shots 2010Arifin MasruriNo ratings yet

- COMM305 MT1 Practice Problems (F21)Document9 pagesCOMM305 MT1 Practice Problems (F21)Rachel KantersNo ratings yet

- Class Handout - Job Costing Session - 2and3-2Document4 pagesClass Handout - Job Costing Session - 2and3-2Ritwik MahajanNo ratings yet

- CVP Analysis Learning ExercisesDocument3 pagesCVP Analysis Learning ExercisesSUNNY BHUSHANNo ratings yet

- MASDocument7 pagesMASHelen IlaganNo ratings yet

- Test 2 Second Online TestDocument6 pagesTest 2 Second Online TestTrâm LêNo ratings yet

- Cost Classification: Total Product/ ServiceDocument21 pagesCost Classification: Total Product/ ServiceThureinNo ratings yet

- Job Order CostingDocument3 pagesJob Order Costingsus meetaNo ratings yet

- GNB13 e CH 03 ExamDocument6 pagesGNB13 e CH 03 ExamAnne Dorcas S. DomingoNo ratings yet

- A. Calculate The Break-Even Dollar Sales For The MonthDocument25 pagesA. Calculate The Break-Even Dollar Sales For The MonthPriyankaNo ratings yet

- Bài Tập Tự LuậnDocument5 pagesBài Tập Tự Luậnhn0743644No ratings yet

- Cost Actg June 2019 Test 1Document7 pagesCost Actg June 2019 Test 1GiangNguyễnNo ratings yet

- Responsibility Accounting: Chapter Study ObjectivesDocument7 pagesResponsibility Accounting: Chapter Study ObjectivesLive LoveNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- What Is A Npa?Document3 pagesWhat Is A Npa?phaqrNo ratings yet

- Business CombinationDocument6 pagesBusiness CombinationJalieha Mahmod0% (1)

- Ecommerce in Cooperative BanksDocument9 pagesEcommerce in Cooperative BanksSIDDARTH BADAJENANo ratings yet

- Schedule of Charges Current AccountDocument8 pagesSchedule of Charges Current AccountAshif RejaNo ratings yet

- Project On AtmDocument51 pagesProject On AtmtriratnacomNo ratings yet

- General Banking LawDocument62 pagesGeneral Banking LawKristine FayeNo ratings yet

- Assure FundDocument58 pagesAssure FundVishalNo ratings yet

- Chapter 1 BPP QuestionsDocument9 pagesChapter 1 BPP Questionsmarlynrich3652No ratings yet

- Time Value of Money Notes & ConceptsDocument9 pagesTime Value of Money Notes & ConceptsRashi MehtaNo ratings yet

- Fair Value Measurement Edited GDDocument37 pagesFair Value Measurement Edited GDyonas alemuNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument32 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balanceassasas asasNo ratings yet

- Interest Free Banking in Ethiopia: Prospects and ChallengesDocument20 pagesInterest Free Banking in Ethiopia: Prospects and Challengessi labNo ratings yet

- Compound Interest CalculatorDocument6 pagesCompound Interest Calculatorbajramo1No ratings yet

- A212 - Topic 3 - FV PV - Part I (Narration)Document31 pagesA212 - Topic 3 - FV PV - Part I (Narration)Teo ShengNo ratings yet

- ATM ManipulationDocument3 pagesATM Manipulationabdul raheman sudesNo ratings yet

- Disbursement Process and Documentation: I) Ii) Iii)Document31 pagesDisbursement Process and Documentation: I) Ii) Iii)mr9_apeceNo ratings yet

- Nama Akun Akuntansi Dalam Bahasa InggrisDocument3 pagesNama Akun Akuntansi Dalam Bahasa Inggrisratih nikenNo ratings yet

- 19 Say No To Cash TransactionDocument6 pages19 Say No To Cash TransactionAmit Mantry100% (1)

- AUD339 - OBE Lesson Plan 1Document11 pagesAUD339 - OBE Lesson Plan 1MUHAMMAD AMIR HAMZAH NURZAFILNo ratings yet

- London Examinations GCE: Accounting (Modular Syllabus) Advanced Subsidiary/Advanced LevelDocument15 pagesLondon Examinations GCE: Accounting (Modular Syllabus) Advanced Subsidiary/Advanced Levelrahat879No ratings yet

- Key AnswerDocument2 pagesKey AnswerBSA3Tagum MariletNo ratings yet

- Current & Saving Account Statement: Vishnu Gupta S/O Jagdish Gupta HNO 417 Mo Arya Nagar Shiv Ganj EtahDocument6 pagesCurrent & Saving Account Statement: Vishnu Gupta S/O Jagdish Gupta HNO 417 Mo Arya Nagar Shiv Ganj Etahvishnu guptaNo ratings yet

- SummaryDocument3 pagesSummaryMaitet CarandangNo ratings yet

- A.Rahman Salah AmerDocument14 pagesA.Rahman Salah AmerA.Rahman SalahNo ratings yet

- Benton E. Gup The New Financial Architecture Banking Regulation in The 21st Century 2000Document277 pagesBenton E. Gup The New Financial Architecture Banking Regulation in The 21st Century 2000TheGR3ddyNo ratings yet

- LunchDocument38 pagesLunchAnaNo ratings yet

- Analysis and Interpretation of Financial Statements (Accounting)Document10 pagesAnalysis and Interpretation of Financial Statements (Accounting)aenNo ratings yet