Professional Documents

Culture Documents

PAST

PAST

Uploaded by

patel harshadOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PAST

PAST

Uploaded by

patel harshadCopyright:

Available Formats

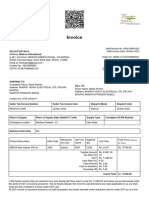

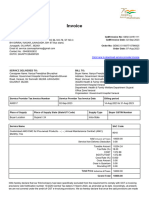

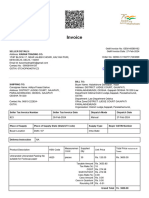

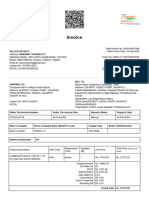

Invoice

GeM Invoice No: GEM-24978567

SELLER DETAILS: GeM Invoice Date: 30-Nov-2020

Address: SWAMI MEDICAL & SURGICAL AGENCY

Order No: GEMC-511687717899148

4,MEDICARE COMPLEX.OLD HOUSING ROAD, NEAR.AVON

Order Date: 19-Nov-2020

AUTO GARAJ, HDFC BANK-AC.NO.05192020000421-IFSC

-HDFC0000519, SURENDRANAGAR, SURENDRANAGAR,

GUJARAT, 363001

Click here to download seller

Email Id: patelharshad2611@gmail.com

invoice

Contact No : 09825049125

GSTIN: 24ACKPP8335M1Z1

I /We hereby declare that our firm/company has been specifically excluded from the requirement to comply with GST e-invoicing

BILL TO:

SHIPPING TO: Buyer Name: Amarsingh Ramsingh Chauhan , MEDICAL

Consignee Name: Amarsingh Ramsingh Chauhan OFFICER

Address: Zydus Hospital Campus, Station Road Dahod Address: Zydus Hospital Campus, Station Road Dahod Dahod

DAHOD GUJARAT 389151 Health & Family Welfare Department

GUJARAT 389151 Gujarat N/A

GSTIN:

Contact No: 02673- Department: Health & Family Welfare Department Gujarat

247445GSTIN: Office Zone:DISTRICT TUBERCULOSIS CENTER DAHOD

Organisation: N/A

Seller Tax Invoice Number Seller Tax Invoice Date Dispatch Mode Dispatch Date

DB-T-179 30-Nov-2020 Courier 30-Nov-2020

Type of Transport Tracking No Tracking URL Type & No of Packages

- 452136 Click here for tracking Box 1

Place of Supply Place of Supply State (State/UT Code) Supply Type Buyer GSTIN Number

Buyer Location Gujarat / 24 Intra-State

provisions vide Notification number 13/2020-Central Tax dated 21 March 2020, as amended up to date. Accordingly, at present,

Measurem GST UQ Supplied Total Price inclusive

Product Description HSN Code Unit Price

ent Unit Name Qty all Taxes

PROTIEN POWDER

7419 pieces BOX 10000 Rs. 250.00 Rs. 2500000.00

Taxable Amount Rs. 2119000.00

Tax Rate (%) 18

CGST Rs. 190500.00

SGST/UTGST Rs. 190500.00

Cess Rate (%) 0.000

Cess Amount Rs. 0.00

Cess in Quantum Rs. 0.00

Rounding Off Rs. -0.00

Grand Total Rs. 2500000.00

we are not covered under the ambit of GST e-invoicing provisions. We do hereby declare that once the said provisions are

made applicable to us, we shall issue the duly complied e-Invoice under GST Law.

All GST invoice or document issued by us shall be properly and timely reported under respective returns under GST by us in line

with the notified provisions and the applicable tax collected from Buyer shall be timely and correctly paid to the respective

Government by us.

In case the Input Tax Credit of GST is denied or demand is recovered from Buyer on account of any act/ omission of us in this

regard, we shall be liable in respect of all claims of tax, penalty and/or interest, loss, damages, costs, expenses and liability that

may arise due to such non-compliance. Buyer shall have the right to recover such amount from any payments due to us or from

Performance Security, or any other legal recourse from us.

INK SIGNED SIGNATURES ARE NOT REQUIRED IN SYSTEM GENERATED DOCUMENTS

You might also like

- Rent AgreementDocument109 pagesRent AgreementShunna BhaiNo ratings yet

- V3NHaGM2NCtsTm5kNmpwQnhBekVzQT09 InvoiceDocument2 pagesV3NHaGM2NCtsTm5kNmpwQnhBekVzQT09 InvoiceOmkar DaveNo ratings yet

- DFpTQkJ2RS9Bak4rRWFHRFZyelJ2dz09 InvoiceDocument2 pagesDFpTQkJ2RS9Bak4rRWFHRFZyelJ2dz09 Invoiceomkar daveNo ratings yet

- ASSAMBILLDocument2 pagesASSAMBILLmahavirtrading0201No ratings yet

- OVZ6cGp4bElEM2syMkZFU2t3M1lkQT09 InvoiceDocument2 pagesOVZ6cGp4bElEM2syMkZFU2t3M1lkQT09 InvoiceLakshaya EnterprisesNo ratings yet

- Zk1HeFpuMjMwanpiTjg3TnNPb2w5UT09 InvoiceDocument2 pagesZk1HeFpuMjMwanpiTjg3TnNPb2w5UT09 Invoicerajrathwa85No ratings yet

- Gem InvoiceDocument2 pagesGem InvoicenimaygabaNo ratings yet

- QW1OTXI3YjFzd2VhdlJxSXZ4MHRJZz09 InvoiceDocument2 pagesQW1OTXI3YjFzd2VhdlJxSXZ4MHRJZz09 Invoiceomkar daveNo ratings yet

- Invoice: Click Here To Download Seller InvoiceDocument2 pagesInvoice: Click Here To Download Seller InvoicearyandjNo ratings yet

- WEZHeGk3a1hjWERCR05senlFYW9XQT09 InvoiceDocument2 pagesWEZHeGk3a1hjWERCR05senlFYW9XQT09 Invoiceomkar daveNo ratings yet

- TldEdURCaElod0FGVE12NldQL2l6Zz09 InvoiceDocument2 pagesTldEdURCaElod0FGVE12NldQL2l6Zz09 InvoicePratyush kumar NayakNo ratings yet

- AThvdnVjYkI3ZGRGQzVyeFRvTThIUT09 InvoiceDocument2 pagesAThvdnVjYkI3ZGRGQzVyeFRvTThIUT09 InvoiceRobin singhNo ratings yet

- UmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceDocument2 pagesUmMwWHVzMFEwc3paWkRSWkVjS0o3Zz09 InvoiceNSTI AKKINo ratings yet

- RSs4RzhtcEw0akJJNC9EZHlPTmp4QT09 InvoiceDocument2 pagesRSs4RzhtcEw0akJJNC9EZHlPTmp4QT09 InvoiceRavi Kant RohillaNo ratings yet

- L0JJYm1iUlAzNDUvRE1tektJQnlqZz09 InvoiceDocument2 pagesL0JJYm1iUlAzNDUvRE1tektJQnlqZz09 Invoicemankari.kamal.18022963No ratings yet

- ZVpOSWQ4Um4wRldyeWtaaU9pd1ZXUT09 InvoiceDocument2 pagesZVpOSWQ4Um4wRldyeWtaaU9pd1ZXUT09 InvoicePratyush kumar NayakNo ratings yet

- RzhHNnk0V3QzeXNZbzBQUU9HMEM5UT09 InvoiceDocument2 pagesRzhHNnk0V3QzeXNZbzBQUU9HMEM5UT09 InvoiceInclusive Education BranchNo ratings yet

- DldHNENiUVNKOU45Vit0MkZ4dXdXdz09 InvoiceDocument2 pagesDldHNENiUVNKOU45Vit0MkZ4dXdXdz09 Invoicedevenmistry2003No ratings yet

- eWw4THBjYTZNRHZEZ00vSzRtNXFVZz09 InvoiceDocument2 pageseWw4THBjYTZNRHZEZ00vSzRtNXFVZz09 InvoiceRuskin S. KhadirahNo ratings yet

- NXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceDocument2 pagesNXZGWUpKQzhGaHIzS0NEbFlUT0ZsUT09 InvoiceInclusive Education BranchNo ratings yet

- Canon Printer InvoiceDocument2 pagesCanon Printer InvoiceTYCS35 SIDDHESH PENDURKARNo ratings yet

- NDkySFNWeWUyYTVQbU9KSC85akVaUT09 InvoiceDocument2 pagesNDkySFNWeWUyYTVQbU9KSC85akVaUT09 InvoiceInclusive Education BranchNo ratings yet

- aGlWTUxqUGZwSHUxN0hodHduM3AvUT09 InvoiceDocument2 pagesaGlWTUxqUGZwSHUxN0hodHduM3AvUT09 InvoiceSandeep KumarNo ratings yet

- MnVyK1hpRDdlQXF6R25YbmwwSElXZz09 InvoiceDocument2 pagesMnVyK1hpRDdlQXF6R25YbmwwSElXZz09 InvoiceInclusive Education BranchNo ratings yet

- Target Face 150 (PSH)Document2 pagesTarget Face 150 (PSH)sarthakgan29No ratings yet

- GEMC-511687720852142 Invoice PDFDocument2 pagesGEMC-511687720852142 Invoice PDFrip111176No ratings yet

- InvoiceDocument2 pagesInvoiceMukesh ChoudharyNo ratings yet

- eEN1ZXRDVVllM214T0dqM1QxcjZjQT09 InvoiceDocument2 pageseEN1ZXRDVVllM214T0dqM1QxcjZjQT09 InvoiceAsad ShakilNo ratings yet

- GST Bill Format in ExcelDocument184 pagesGST Bill Format in Excelkrishna chaitanyaNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- dkNQenFEN3Jsb2R1b3EzQmRERVMzUT09 InvoiceDocument2 pagesdkNQenFEN3Jsb2R1b3EzQmRERVMzUT09 InvoiceAkash ChoudharyNo ratings yet

- ASG-23-0XXXX - Alam Industries & Export (Azizul)Document1 pageASG-23-0XXXX - Alam Industries & Export (Azizul)speeddemonmahfuj04No ratings yet

- Performa Invoice: State Name: Haryana, Code: 06Document2 pagesPerforma Invoice: State Name: Haryana, Code: 06Pushpendra KumarNo ratings yet

- Invoice PDFDocument1 pageInvoice PDFagam sai sidarNo ratings yet

- ZjcybEtEa0N1SVRxVGV5aXpwb2R0UT09 Invoice-3Document2 pagesZjcybEtEa0N1SVRxVGV5aXpwb2R0UT09 Invoice-3nagasesha ReddyNo ratings yet

- Sales AJ 033 24-25Document1 pageSales AJ 033 24-25A J INDUSTRIESNo ratings yet

- eFMyQStaTWk0dys2bnAxVjFlaElpZz09 InvoiceDocument2 pageseFMyQStaTWk0dys2bnAxVjFlaElpZz09 Invoicenagasesha ReddyNo ratings yet

- RealmeDocument1 pageRealmePíyûshGuptaNo ratings yet

- ODJtNXFuM09rSUY4SDlsMGZ2ZVJTQT09 InvoiceDocument2 pagesODJtNXFuM09rSUY4SDlsMGZ2ZVJTQT09 Invoiceomkar daveNo ratings yet

- Vvneq1m5ymzryny1nuj2swrlwef0dz09 InvoiceDocument2 pagesVvneq1m5ymzryny1nuj2swrlwef0dz09 InvoiceTYCS35 SIDDHESH PENDURKARNo ratings yet

- bkhWNWhJTzlTK0R4QkJwbmFvV1phZz09 InvoiceDocument2 pagesbkhWNWhJTzlTK0R4QkJwbmFvV1phZz09 InvoiceInclusive Education BranchNo ratings yet

- InvoiceDocument1 pageInvoiceycumoNo ratings yet

- InvoiceDocument1 pageInvoicerajesh sNo ratings yet

- Rakesh Pareek Aug22Document1 pageRakesh Pareek Aug22Raghvendra Singh JadounNo ratings yet

- Details of Receiver (Billed To) Details of Consignee (Shipped To)Document1 pageDetails of Receiver (Billed To) Details of Consignee (Shipped To)raninandupawarNo ratings yet

- Invoice - 624039545 00 322072 1Document1 pageInvoice - 624039545 00 322072 1drtarunbhatnagar25No ratings yet

- Maa Jwala Devi PiDocument1 pageMaa Jwala Devi Pidhananjay chaudharyNo ratings yet

- Tax InvoiceDocument2 pagesTax Invoiceojasprajapati6No ratings yet

- Sales PI 168 24-25Document1 pageSales PI 168 24-25A J INDUSTRIESNo ratings yet

- Invoice - 282 EnHDocument4 pagesInvoice - 282 EnHPriyank PawarNo ratings yet

- Tax InoiceDocument1 pageTax InoicerajanNo ratings yet

- VP 06DBJ4LK InvoicesDocument2 pagesVP 06DBJ4LK Invoicesjalpa daveNo ratings yet

- SmlFT3VYRHpYZzRnV010am9veC9IZz09 InvoiceDocument2 pagesSmlFT3VYRHpYZzRnV010am9veC9IZz09 InvoiceJitender NarulaNo ratings yet

- Sales PI 167 24-25Document1 pageSales PI 167 24-25A J INDUSTRIESNo ratings yet

- 1693290034164GHV Medical96757Document1 page1693290034164GHV Medical96757suritalks097No ratings yet

- Invoice: Seller DetailsDocument2 pagesInvoice: Seller DetailsMata BharatNo ratings yet

- Purchase Order: Bill To Address Ship To AddressDocument4 pagesPurchase Order: Bill To Address Ship To Addressarvind.tiwariNo ratings yet

- E InvoiceDocument5 pagesE InvoiceVinodh KannaNo ratings yet

- Compress Invoice 20240402223953Document1 pageCompress Invoice 20240402223953h92662940No ratings yet

- Tax Invoice: Top-10 (Vasai West)Document1 pageTax Invoice: Top-10 (Vasai West)722 Ronit SawantNo ratings yet

- 1 Role of Accountable Authority: A. PurposeDocument6 pages1 Role of Accountable Authority: A. PurposeRakesh Ricki RadharamanNo ratings yet

- Diocese LawsuitDocument80 pagesDiocese LawsuitWTVCNo ratings yet

- For Further Correspondence, Quote The Above Letter Number and Address To The Secretary, FPSC)Document2 pagesFor Further Correspondence, Quote The Above Letter Number and Address To The Secretary, FPSC)farman ullahNo ratings yet

- Modern Diploma Privilege. A Path Rather Than A GateDocument40 pagesModern Diploma Privilege. A Path Rather Than A GateEve AthanasekouNo ratings yet

- Death PenaltyDocument1 pageDeath PenaltyDave IsoyNo ratings yet

- Business Studies Yr 12 Questions 2020Document16 pagesBusiness Studies Yr 12 Questions 2020pelroyalNo ratings yet

- MDC Reso 3-2022 Ver. 2Document2 pagesMDC Reso 3-2022 Ver. 2Enp Titus Velez100% (1)

- Chapter 2 ENSC 30 PDFDocument16 pagesChapter 2 ENSC 30 PDFMark Lawrence BuenviajeNo ratings yet

- Corpo Law Bar Syllabus With NotesDocument7 pagesCorpo Law Bar Syllabus With NotesJ. LapidNo ratings yet

- Owner Manual 511-523-524 Hy25-1501v-M1 Us Volvo-Mack 20190408Document16 pagesOwner Manual 511-523-524 Hy25-1501v-M1 Us Volvo-Mack 20190408Marko BeatzzNo ratings yet

- Phillips v. Reeves Et Al - Document No. 5Document8 pagesPhillips v. Reeves Et Al - Document No. 5Justia.comNo ratings yet

- Pre-Trial Brief - GROUP ADocument4 pagesPre-Trial Brief - GROUP AAnselmo Rodiel IVNo ratings yet

- PalauDocument20 pagesPalauDamian SolanoNo ratings yet

- Mod17Wk15-Constitutional-LawDocument30 pagesMod17Wk15-Constitutional-LawTiara LlorenteNo ratings yet

- Reality Television EssayDocument6 pagesReality Television Essayyeuroqaeg100% (2)

- Short Notes On IPR Topics As On 30042023Document15 pagesShort Notes On IPR Topics As On 30042023Srinivasa RaoNo ratings yet

- CIR v. San Miguel Corporation (180740) (180910) 11-11-2019 CDDocument2 pagesCIR v. San Miguel Corporation (180740) (180910) 11-11-2019 CDAnime FreakNo ratings yet

- 2060943-Hit Dice A Currency v1.02Document2 pages2060943-Hit Dice A Currency v1.02BasilNo ratings yet

- JA VictimMikoGruspe DraftDocument4 pagesJA VictimMikoGruspe DraftMichelle SulitNo ratings yet

- 33 - Austria vs. Court of Appeals, 39 SCRA 527 - 4pgDocument4 pages33 - Austria vs. Court of Appeals, 39 SCRA 527 - 4pgMela CorderoNo ratings yet

- Individual Assignment - SADRUDocument6 pagesIndividual Assignment - SADRUSadrudin MabulaNo ratings yet

- l5 m2m3 QuestionsDocument2 pagesl5 m2m3 QuestionsjaneNo ratings yet

- E TicDocument4 pagesE TictaeiramnadNo ratings yet

- Questions PDFDocument4 pagesQuestions PDFAYUSH ACHARYANo ratings yet

- Introduction To Security: or DamagesDocument26 pagesIntroduction To Security: or DamagesDivina DugaoNo ratings yet

- Coverage The Quiz BukasDocument51 pagesCoverage The Quiz BukasMel DonNo ratings yet

- UNIT 2 Kinds of LawDocument4 pagesUNIT 2 Kinds of LawKidooyyNo ratings yet

- D&D HammerfastDocument36 pagesD&D Hammerfastjpolette1977100% (2)

- Consulting-Service For Land SurveyingDocument29 pagesConsulting-Service For Land SurveyingSherrone SmithNo ratings yet