Professional Documents

Culture Documents

New All-Time High in The USA After Strong Earnings Season

New All-Time High in The USA After Strong Earnings Season

Uploaded by

Dar SteOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New All-Time High in The USA After Strong Earnings Season

New All-Time High in The USA After Strong Earnings Season

Uploaded by

Dar SteCopyright:

Available Formats

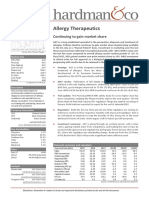

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 1/146

GLOBAL EQUITY RATINGS

New all-time high in the USA after strong earnings

season

Sector recommendations: Technology, Healthcare, Consumer Discretionary

Analysts Rating Changes

Hans Engel

hans.engel@erstegroup.com Company Rating New Rating Prev. Rating Prev. Date Page

+43 50100 19835 (Vienna) Home Depot Buy Hold 10.03.2023 100

Equinor Hold Buy 29.06.2023 39

Stephan Lingnau

stephan.lingnau@erstegroup.com Amgen Hold Buy 17.08.2023 74

+43 50100 16574 (Vienna) AmBev Not Rated Hold 12.06.2018 137

Kering Not Rated Hold 25.04.2023 11

Source: Erste Group Research

Prices as of

13.02.2023 Update Equity Markets

In the current US reporting season for 4Q 2023, 75% of the companies in the

Report Created

14.02.2024 15:30

S&P 500 have published positive earnings surprises. The energy, technology

and industrial sectors had the highest proportion of positive earnings

Report published surprises. US earnings growth should total +2.9% (y/y) in the 4Q. Earnings

14.02.2024 15:45 growth rates of +4% (y/y) and +9.1% (y/y) are forecast for 1Q and 2Q

respectively. The S&P 500 recently reached a new all-time high of over 5,000

Editor

Gudrun Egger

points on the back of the companies' good results and prospects.

Major Markets & Credit Research

The 4Q reporting season is going worse in Europe than in the US. Only 53% of

Note: companies were able to report profits that exceeded expectations. Profits of

Our estimates are in absolute and not in

relative terms. Bond yields and equity European companies should fall by -5.5% year-on-year in 4Q overall. For 1Q

market returns in local currencies. Past 2024, a decline in profits of -8.4% is expected. Profits will only grow slightly

performance is not a reliable indicator of

future performance. again from 2Q onwards (2Q 2024e: +2.2%).

Company Updates

BP: Sales fell by -13% in 2023, number of shares reduced by 6%, further high

buybacks announced

Microsoft: 4Q23: AI & cloud drive growth

Alphabet: Advertising revenues up in 4Q, revenue growth at Google Cloud

+26% Y/Y

Qualcomm: Price increases and rise in operating margin

Novartis: 2023: positive results in ten phase 3 trials for product candidates

with significant sales potential

Novo Nordisk: 4Q23 sales: +37%, guidance of +18% to +26% in 2024

McDonalds: Strong year 2023, sales: +10%, EBIT: +24%, target: 2,000 new

stores worldwide p.a. in the next four years

Netflix: More than 13 million new subscribers in 4Q23, EBIT margin guidance

for this year raised to 24%

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 2/146

Western Europe

Sector Company Rating Price Ctry. Rec. since Update PEe DYe 3M 12M Page

Discretionary Adidas Hold EUR 170.6 DE 19.10.21 15.12.23 55.2 0.6 0.3 21.9 6

BMW Hold EUR 100.9 DE 20.08.21 15.12.23 6.2 5.5 9.5 3.4 7

Cie Financiere Richemont Hold CHF 132.7 CH 22.09.21 15.12.23 20.1 2.6 26.9 -6.7 8

Hermes International Buy EUR 2,132 FR 23.01.24 12.02.24 49.4 0.8 14.7 24.5 9

Inditex Hold EUR 39.11 ES 30.01.18 15.12.23 20.9 4.3 13.7 39.0 10

Kering Not Rated EUR 410.9 FR 14.02.24 14.02.24 16.7 3.4 4.4 -27.5 11

LOreal Buy EUR 428.0 FR 28.07.15 12.02.24 33.0 1.6 3.2 9.8 12

LVMH Hold EUR 800.8 FR 23.01.24 29.01.24 24.8 1.7 16.3 -1.2 13

Mercedes-Benz Group Hold EUR 65.44 DE 17.08.23 15.12.23 5.6 7.9 15.6 -8.4 14

Porsche AG Hold EUR 80.64 DE 31.10.22 15.03.23 14.6 3.1 -8.2 -29.1 15

Ryanair Hold EUR 20.02 IE 09.08.23 15.12.23 10.1 2.4 19.6 34.5 16

Volkswagen Hold EUR 118.6 DE 26.03.20 15.12.23 3.9 7.5 12.9 -7.6 17

Financials Allianz Buy EUR 245.7 DE 28.11.22 24.10.23 9.8 5.2 11.0 11.8 18

Banco Santander Buy EUR 3.66 ES 08.09.23 05.02.24 5.2 5.2 0.3 5.2 19

BNP Paribas Hold EUR 53.83 FR 05.10.22 05.02.24 5.9 8.6 -3.5 -15.0 20

Deutsche Bank Sell EUR 11.88 DE 07.04.13 05.02.24 5.6 5.7 12.0 4.5 21

Deutsche Boerse Hold EUR 187.0 DE 03.05.23 12.02.24 18.9 2.1 12.2 9.8 22

HSBC Hold GBP 610.5 UK 30.06.17 07.02.24 6.3 10.7 0.4 -0.5 23

UBS Hold CHF 24.12 CH 12.06.18 07.02.24 22.5 2.9 10.3 20.5 24

UniCredit Hold EUR 29.39 IT 10.06.21 12.02.24 5.8 7.2 19.3 57.3 25

Staples Anheuser Busch Inbev Hold EUR 59.40 BE 06.06.23 15.12.23 18.5 2.1 6.2 8.4 26

Beiersdorf Hold EUR 138.0 DE 15.03.18 15.12.23 30.7 0.7 11.9 23.0 27

Danone Hold EUR 60.98 FR 31.07.20 15.12.23 17.2 3.5 5.1 20.5 28

Diageo Hold GBP 2,861 UK 18.11.22 15.12.23 18.8 2.9 -1.0 -19.1 29

Nestle Hold CHF 96.40 CH 10.03.23 15.12.23 19.1 3.4 -2.5 -13.1 30

Unilever Hold EUR 46.97 NL 07.02.23 13.02.24 17.1 3.8 3.8 -2.5 31

Health Care AstraZeneca Hold GBP 9,600 UK 08.09.23 12.02.24 14.8 2.6 -6.3 -16.0 32

GlaxoSmithKline Hold GBP 1,642 UK 24.04.17 07.02.24 10.5 3.7 16.7 10.4 33

Novartis Buy CHF 88.02 CH 08.09.23 05.02.24 14.1 4.0 4.0 9.5 34

Novo Nordisk Buy DKK 832.3 DK 09.08.23 05.02.24 36.4 1.4 20.0 67.5 35

Roche Holding Hold CHF 228.5 CH 08.08.22 05.02.24 12.9 4.3 -4.3 -18.2 36

Sanofi Hold EUR 85.69 FR 18.08.22 05.02.24 10.9 4.5 0.5 -2.2 37

Energy BP Hold GBP 479.8 UK 19.06.18 14.02.24 7.3 5.0 -1.0 -13.9 38

Equinor Hold NOK 271.5 NO 14.02.24 14.02.24 8.0 9.8 -26.6 -17.7 39

Shell Hold EUR 29.64 UK 23.01.24 05.02.24 8.4 4.3 -4.1 2.9 40

TotalEnergies Hold EUR 60.30 FR 29.06.23 12.02.24 7.1 5.3 -4.0 1.3 41

Industrials ABB Buy CHF 38.14 CH 14.05.20 05.02.24 19.8 2.3 17.2 22.0 42

DHL Group Hold EUR 41.88 DE 26.09.22 15.12.23 12.4 4.5 6.7 2.5 43

Schneider Electric Buy EUR 191.8 FR 18.11.22 15.12.23 22.9 2.0 19.3 25.0 44

Siemens Hold EUR 163.7 DE 17.08.23 15.12.23 14.9 3.1 23.2 12.0 45

Materials BASF Hold EUR 45.06 DE 15.03.18 15.12.23 12.6 7.5 2.2 -12.8 46

Holcim Buy CHF 65.44 CH 21.12.23 21.12.23 12.1 4.3 7.5 18.4 47

Vinci Hold EUR 114.9 FR 09.08.23 12.02.24 13.4 4.1 7.2 6.2 48

Technology ASML Buy EUR 850.7 NL 30.08.19 29.01.24 45.2 0.8 38.9 37.1 49

Infineon Hold EUR 32.57 DE 22.08.23 15.12.23 14.8 1.1 9.9 -9.0 50

SAP Buy EUR 162.8 DE 08.09.23 29.01.24 35.5 1.3 20.2 47.8 51

Telecom Deutsche Telekom Hold EUR 22.22 DE 15.03.18 15.12.23 12.2 3.8 2.6 9.2 52

Utilities RWE Hold EUR 32.19 DE 16.02.22 15.12.23 10.9 3.4 -11.3 -19.2 53

Source: Erste Group Research, FactSet Consensus Estimates.

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 3/146

United States (1/2)

Sector Company Rating Price Ctry. Rec. since Update PEe DYe 3M 12M Page

Technology Adobe Buy USD 601.9 US 28.03.23 15.12.23 33.3 - 2.0 60.5 54

Advanced Micro Devices Buy USD 171.5 US 07.02.23 05.02.24 48.3 - 46.9 106.4 55

Alphabet Buy USD 145.1 US 11.10.12 02.02.24 21.3 - 9.9 53.4 56

Amazon.Com Buy USD 168.6 US 09.08.23 05.02.24 41.0 - 18.3 69.4 57

Apple Buy USD 185.0 US 07.11.17 16.01.24 27.6 0.5 0.1 20.3 58

Broadcom Buy USD 1,252 US 09.08.23 15.12.23 26.4 1.7 32.2 108.2 59

Cadence Design Systems Buy USD 294.3 US 25.07.22 13.02.24 49.7 - 11.5 58.5 60

Cisco Buy USD 49.64 US 22.08.23 22.12.23 12.6 3.2 -5.0 3.7 61

IBM Hold USD 183.7 US 20.02.19 29.01.24 18.3 3.6 24.0 33.7 62

Intel Hold USD 43.16 US 31.07.20 29.01.24 32.1 1.2 12.9 51.2 63

Intuit Buy USD 638.3 US 21.07.23 14.02.24 36.9 0.6 19.9 52.7 64

Meta Platforms Buy USD 460.1 US 24.05.23 05.02.24 23.0 0.2 39.8 156.4 65

Microsoft Buy USD 406.3 US 21.03.14 31.01.24 32.8 0.8 10.8 49.8 66

NVIDIA Buy USD 721.3 US 25.04.23 24.10.23 37.1 0.0 48.4 231.0 67

Oracle Hold USD 113.7 US 21.12.23 21.12.23 19.2 1.4 -0.4 27.1 68

Qualcomm Hold USD 150.0 US 05.06.20 27.12.23 15.1 2.2 21.1 14.7 69

Salesforce.com Buy USD 281.2 US 07.02.23 27.12.23 29.8 - 30.6 64.3 70

ServiceNow Hold USD 773.8 US 12.05.21 29.01.24 58.8 - 21.2 67.8 71

Health Care Abbott Laboratories Hold USD 111.3 US 25.08.22 29.01.24 24.2 1.9 16.2 2.6 72

AbbVie Hold USD 173.3 US 22.09.21 05.02.24 15.5 3.6 25.0 12.7 73

Amgen Hold USD 290.5 US 14.02.24 14.02.24 14.9 3.2 8.9 19.2 74

Bristol-Myers Squibb Hold USD 48.71 US 24.04.18 05.02.24 7.0 4.9 -2.9 -33.4 75

Elevance Health Hold USD 505.3 US 25.07.22 29.01.24 13.6 1.3 9.5 2.0 76

Eli Lilly Hold USD 743.0 US 10.03.23 12.02.24 59.6 0.7 21.3 112.0 77

Gilead Sciences Hold USD 73.53 US 20.06.23 12.02.24 10.4 4.2 -1.9 -16.0 78

Intuitive Surgical Hold USD 378.9 US 09.12.21 29.01.24 60.9 - 34.1 54.6 79

Johnson & Johnson Hold USD 156.5 US 07.12.23 05.02.24 14.7 3.0 6.0 -3.9 80

Merck & Co Buy USD 125.4 US 25.08.22 05.02.24 14.7 2.5 22.4 14.5 81

Pfizer Hold USD 26.97 US 16.02.22 05.02.24 12.0 6.2 -6.9 -38.7 82

Regeneron Pharma Buy USD 940.5 US 28.03.23 05.02.24 21.0 - 18.0 23.1 83

Thermo Fisher Scientific Hold USD 538.6 US 01.04.21 05.02.24 25.0 0.3 21.0 -6.3 84

UnitedHealth Group Buy USD 516.9 US 01.04.21 15.01.24 18.6 1.5 -4.7 4.3 85

Vertex Pharmaceuticals Buy USD 416.0 US 29.03.22 06.02.24 25.1 - 9.8 39.1 86

Financials Arthur J. Gallagher Buy USD 236.3 US 27.10.23 14.02.24 23.2 1.0 -4.6 21.1 87

Bank of America Hold USD 32.75 US 07.02.23 15.01.24 10.4 3.1 18.2 -8.1 88

Charles Schwab Hold USD 62.71 US 10.03.23 22.01.24 18.8 1.7 16.2 -22.0 89

Citigroup Hold USD 52.76 US 19.03.20 15.01.24 9.1 4.1 23.6 3.5 90

JPMorgan Buy USD 174.3 US 29.05.20 15.01.24 11.0 2.5 19.5 22.2 91

Mastercard Hold USD 460.5 US 19.10.21 05.02.24 31.8 0.6 16.8 24.2 92

Morgan Stanley Hold USD 83.97 US 24.05.23 22.01.24 13.1 4.2 11.9 -15.5 93

Royal Bank of Canada Hold CAD 128.5 CA 16.03.23 07.12.23 10.7 4.5 10.0 -7.5 94

S&P Global Buy USD 422.5 US 08.09.23 12.02.24 30.0 0.9 7.0 14.0 95

Visa Buy USD 275.8 US 09.02.22 27.10.23 27.0 0.8 12.7 20.5 96

Discretionary Booking Holdings Buy USD 3,748 US 10.03.23 31.10.23 21.5 - 20.1 54.7 97

Costco Wholesale Buy USD 714.3 US 25.08.22 27.10.23 44.3 1.9 23.5 41.0 98

General Motors Hold USD 38.31 US 04.02.21 05.02.24 4.3 1.3 42.4 -8.8 99

Home Depot Buy USD 357.6 US 14.02.24 14.02.24 23.0 2.4 24.1 10.5 100

Netflix Buy USD 554.5 US 20.06.23 26.01.24 32.2 - 24.7 54.6 101

Nike Hold USD 105.0 US 08.09.23 31.10.23 26.7 1.4 0.8 -16.1 102

Procter & Gamble Hold USD 156.3 US 06.06.23 24.10.23 23.3 2.5 2.5 11.6 103

Tesla Hold USD 184.0 US 28.11.22 29.01.24 59.1 - -17.7 -5.5 104

Walt Disney Hold USD 110.5 US 02.04.20 13.11.23 23.0 0.7 23.5 2.6 105

Source: Erste Group Research, FactSet Consensus Estimates.

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 4/146

United States (2/2)

Sector Company Rating Price Ctry. Rec. since Update PEe DYe 3M 12M Page

Staples Coca-Cola Hold USD 59.35 US 15.02.13 14.02.24 21.1 3.2 4.3 -2.1 106

McDonalds Buy USD 287.1 US 12.05.21 06.02.24 23.1 2.4 6.7 7.9 107

Mondelez Hold USD 71.98 US 05.06.20 05.02.24 20.4 2.4 3.9 8.6 108

PepsiCo Hold USD 168.9 US 27.10.23 12.02.24 20.7 3.2 0.7 -5.0 109

Starbucks Hold USD 93.87 US 06.06.23 13.11.23 22.2 2.5 -9.3 -13.5 110

Walmart Hold USD 169.1 US 28.03.23 24.10.23 24.1 1.4 0.9 15.9 111

Industrials Caterpillar Hold USD 312.8 US 22.06.21 07.02.24 14.7 1.7 29.4 26.1 112

Deere & Co Hold USD 379.3 US 24.05.23 24.11.23 13.4 1.5 2.6 -8.7 113

United Parcel Service Hold USD 144.9 US 09.01.23 06.02.24 17.5 4.5 4.9 -22.7 114

Waste Management Buy USD 199.5 US 21.12.23 13.02.24 29.3 1.5 16.2 30.6 115

WW Grainger Buy USD 935.4 US 24.05.23 06.02.24 23.8 0.8 18.5 39.9 116

Energy Chevron Hold USD 150.6 US 17.06.21 06.02.24 11.8 4.3 4.6 -11.9 117

ConocoPhillips Hold USD 109.8 US 23.01.24 12.02.24 12.8 2.8 -4.8 -2.3 118

Exxon Mobil Hold USD 101.3 US 21.12.23 06.02.24 11.5 3.8 -3.3 -14.0 119

Marathon Petroleum Buy USD 169.9 US 23.01.24 06.02.24 11.1 2.0 15.8 32.9 120

Telecom AT&T Hold USD 16.90 US 11.11.16 29.01.24 7.7 6.6 8.5 -12.3 121

T-Mobile US Hold USD 161.5 US 16.09.21 06.02.24 17.9 1.6 9.7 10.2 122

Verizon Hold USD 40.13 US 29.03.22 29.01.24 8.7 6.7 12.0 -0.5 123

Utilities NextEra Energy Hold USD 55.25 US 25.04.23 29.01.24 16.3 3.7 1.4 -26.9 124

Southern Co Hold USD 67.51 US 27.04.22 31.10.23 16.8 4.2 0.3 0.6 125

Materials Linde Buy USD 416.3 US 29.09.20 12.02.24 26.9 1.3 4.1 24.6 126

Source: Erste Group Research, FactSet Consensus Estimates.

Asia, Australia & Latin America

Sector Company Rating Price Ctry. Rec. since Update PEe DYe 3M 12M Page

Technology Infosys Hold INR 1,685 IN 26.09.22 24.04.23 26.1 2.9 22.6 7.5 127

Samsung Electronics Buy KRW 75,200 KR 07.12.23 06.02.24 17.3 1.9 6.8 19.6 128

Taiwan Semiconductor Buy USD 127.6 TW 07.12.23 26.01.24 21.0 1.7 32.3 32.7 129

Tencent Hold HKD 287.2 HK 30.01.23 28.03.23 14.0 0.6 -7.3 -25.7 130

Tokyo Electron Hold JPY 33,720 JP 19.07.22 01.06.23 40.1 1.2 49.4 119.2 131

Materials BHP Group Hold GBP 2,349 AU 09.09.19 19.12.23 11.0 5.1 -1.3 -14.0 132

Rio Tinto Hold GBP 5,286 AU 29.06.22 19.12.23 10.3 5.8 -0.3 -11.6 133

Vale Hold BRL 65.92 BR 22.10.18 23.02.23 5.0 8.6 -7.7 -24.0 134

Discretionary Alibaba Hold USD 71.60 CN 30.01.23 24.05.23 7.9 1.4 -13.0 -31.7 135

Toyota Motor Buy JPY 3,456 JP 17.08.23 17.08.23 10.9 2.6 22.7 84.2 136

Staples AmBev Not Rated BRL 12.95 BR 14.02.24 14.02.24 13.9 5.9 -3.6 -1.4 137

Fomento Eco. Mexicano Buy MXN 241.5 MX 06.06.23 06.06.23 23.0 1.6 14.2 53.7 138

Financials China Construction Bank Sell HKD 4.61 CN 31.10.22 15.01.24 3.1 9.7 3.1 -6.9 139

ICICI Bank Buy INR 1,020 IN 24.05.23 06.02.24 16.8 1.1 9.2 20.0 140

Industrials Daikin Industries Hold JPY 21,445 JP 17.08.23 17.08.23 22.5 1.2 -7.4 -6.5 141

Source: Erste Group Research, FactSet Consensus Estimates.

Notes: PEe: Expected Price/Earnings Ratio for the current calendar year, DYe: Expected Dividend Yield for the current calendar year.

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 5/146

Screenings

Buy Rating & High Dividend Yield

Company 2024e 2025e

Banco Santander 5.2% 5.7%

Allianz 5.2% 5.5%

Holcim 4.3% 4.3%

Novartis 4.0% 4.1%

Cisco 3.2% 3.3%

Toyota Motor 2.6% 2.7%

JPMorgan 2.5% 2.6%

Merck & Co 2.5% 2.6%

Source: FactSet, Erste Group Research.

Buy Rating & Low PE

Company 2024e 2025e

Banco Santander 5.2x 4.9x

Allianz 9.8x 9.2x

Toyota Motor 10.9x 10.7x

JPMorgan 11.0x 10.8x

Marathon Petroleum 11.1x 11.2x

Holcim 12.1x 11.2x

Cisco 12.6x 12.2x

Source: FactSet, Erste Group Research.

Calendar

Date Time Company Result Rating

15.02. pre - open Deere & Co Q1 2024 Hold

15.02. Schneider Electric FY 2024 Buy

15.02. pre - open Southern Co Q4 2023 Hold

20.02. BHP Group H1 2024 Hold

20.02. pre - open Home Depot Q4 2024 Buy

20.02. pre - open Walmart Q4 2024 Hold

21.02. HSBC FY 2023 Hold

21.02. pre - open NVIDIA Q4 2024 Buy

21.02. Rio Tinto FY 2023 Hold

22.02. pre - open Booking Holdings Q4 2023 Buy

22.02. Danone FY 2023 Hold

22.02. Mercedes-Benz Group FY 2023 Hold

Source: Erste Group Research.

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 6/146

Adidas

Germany | Consumer Discretionary

Rating: Hold

Prices as of: 13.02.24 Close Price: EUR 170.60

Business Model Price in EUR

Adidas develops, manufactures and distributes a range of sports

footwear and sporting goods. The main sales markets are the regions 350

Europe/Middle East/Africa (38%), North America (28%), China (14%),

Asia/Pacific (10%) and Latin America (9%).

Earnings Update 02.10.2023 300

Adidas achieved sales growth of +6% (y/y) to EUR 22.5 billion in the

last fiscal year 2022. A strong sales decline (-36% y/y) was recorded in 250

China. There were positive sales developments in North and South

America and in the Europe/Middle East/Africa region, respectively. On

the other hand, product manufacturing costs (+10% Y/Y) and operating 200

costs (+8% Y/Y) increased significantly. As a result, operating income

declined significantly (-85% Y/Y) to EUR 243 million. Overall, a loss of

EUR -251 million was realized. 150

Rating Rationale Analyst: Stephan Lingnau

Adidas faces strong competition from Nike, its more stable growing

competitor. Growth in China, an important market for Adidas, is also 100

being held back by local competitors and negative sentiment against

foreign companies. High inventories and high receivables from

50

customers cloud the prospects for an early recovery of the stock. 2020 2021 2022 2023 2024

Adidas 200 DMA 100 DMA

Overview Sales y/y EPS y/y

Mkt. Cap. mn: EUR 31,265 Next Earnings: 13.03.2024 CY, % CY, %

20 200

Employees: 59,258 Div. Yield 22: 0.5%

Last FY End: 31.12.2022 Div. Yield 23e: 0.4% 100

10

Exchange: XETRA 1Y Price Perf.: 21.9% 0

ISIN: DE000A1EWWW 5Y Price Perf.: -14.1% 0

-100

0

-10 -200

Ratios Value 22 23 24e 25e 26e 22 23 24e 25e 26e

(%, CY ) Comp. Peers (x, CY) Comp. Peers Company Peers Company Peers

Net Margin 2.3 9.6 PE 23 - 19.2

EBIT Margin Equity vs Global Sector

EBIT Margin 4.1 12.2 PE 24e 55.2 16.1 CY, % 1 year in EUR, %

ROE 10.3 22.4 PB 24e 5.69 3.53 20 50

Sales (y/y) 4.7 7.0 EV/EBIT 24e 35.3 12.6 15

EPS (y/y) 100.0 15.2 EV/EBIT 25e 17.7 10.5 0

10

Financials

5

EUR mn. FY 2021 FY 2022 FY 2023e FY 2024e -50

Sales 21,234 22,511 21,427 22,427 0 Jul.23 Jan.24

22 23 24e 25e 26e

% y/y 15.2 6.0 -4.8 4.7 Company Index

Company Peers

EBITDA 3,105 1,794 1,415 2,033

% y/y 53.7 -42.2 -21.1 43.7 ESG Profile Ratings

EBIT 1,986 669 268 928 4Q22 Consensus

% y/y 164.4 -66.3 -59.9 246.3

Env. Soc. Buy 15

Net Profit 1,492 254 -2 507

GH

ME

% y/y 247.8 -83.0 - -

HI

D

IU

M

EPS (EUR) 7.47 1.25 -0.04 3.09 Hold 15

% y/y 247.4 -83.3 - -

DPS (EUR) 3.30 0.70 0.70 1.00 MEDIUM

Sell 6

Yield 1.3 0.5 0.4 0.6

Source: Erste Group Research, FactSet Consensus Estimates. Gov.

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 7/146

BMW

Germany | Consumer Discretionary

Rating: Hold

Prices as of: 13.02.24 Close Price: EUR 100.88

Business Model Price in EUR

BMW produces and sells cars and motorcycles. With the brands BMW,

Mini and Rolls-Royce a wide range of products is covered. 120

Furthermore, engines for outside companies and motorcycles are

produced. BMW has 3 segments: Automobiles (74%), Motorcycles

(2%) and Financial Services (24%). The main sales markets are: 100

Europe (36%), America (20%), Asia (38%).

Earnings Update 28.03.2023

For BMW, 2022 was the most successful year in the company's history.

80

Sales increased strongly by +28% y/y to EUR 142 billion. Adjusted

profit also reached a record level of EUR 18.5 billion (+49% y/y). At

8.6%, the EBIT margin in the automotive segment was within the

guidance range of 8 to 10%. Overall, BMW sold only 2.4 million cars 60

due to a lack of chips and wiring harnesses from Ukraine - around 5%

fewer than a year earlier. Only the Rolls-Royce brand increased sales

to 6,000 units (+8%). In the BEV (Battery Electric Vehicle) segment, 40

BMW achieved only 88% of the target it had set itself, despite doubling

sales to 215,000 units. The dividend is expected to increase to EUR

8.50 per share and thus just under one third of the profit will continue to

be distributed. 20

2020 2021 2022 2023 2024

Rating Rationale Analyst: Stephan Lingnau

BMW 200 DMA 100 DMA

BMW has reiterated its target of an EBIT margin in the automotive

segment of 8-10% in FY 2023. The share of BEVs is expected to

increase to 15% of total sales this year and rise to more than 50% by

2030. We consider these targets realistic. However, the stock is only

neutrally valued in a peer group comparison.

Overview Sales y/y EPS y/y

Mkt. Cap. mn: EUR 66,288 Next Earnings: 20.03.2024 CY, % CY, %

30 50

Employees: 149,475 Div. Yield 22: 10.2%

Last FY End: 31.12.2022 Div. Yield 23e: 5.7% 20 25

Exchange: XETRA 1Y Price Perf.: 3.4% 10 0

ISIN: DE0005190003 5Y Price Perf.: 43.3%

0 -25

Ratios Value -10 -50

(%, CY ) Comp. Peers (x, CY) Comp. Peers 22 23 24e 25e 26e 22 23 24e 25e 26e

Net Margin 6.6 5.9 PE 23 5.5 6.3 Company Peers Company Peers

EBIT Margin 9.9 7.0 PE 24e 6.2 5.6

EBIT Margin Equity vs Global Sector

ROE 10.4 12.4 PB 24e 0.64 0.67 CY, % 1 year in EUR, %

Sales (y/y) 1.1 1.7 EV/EBIT 24e 2.6 3.8 12.5 25

EPS (y/y) -11.8 -0.2 EV/EBIT 25e 2.5 4.5

10

Financials 0

EUR mn. FY 2021 FY 2022 FY 2023e FY 2024e 7.5

Sales 111,239 142,610 153,579 155,223 -25

% y/y 12.4 28.2 7.7 1.1 5 Jul.23 Jan.24

22 23 24e 25e 26e

EBITDA 19,939 22,551 27,057 24,654 Company Index

Company Peers

% y/y 81.2 13.1 20.0 -8.9

EBIT 12,753 13,999 17,932 15,313 ESG Profile Ratings

% y/y 164.0 9.8 28.1 -14.6 4Q22 Consensus

Net Profit 12,463 18,582 11,566 10,195

Env. Soc. Buy 13

% y/y 223.1 49.1 -37.8 -11.9

GH

ME

EPS (EUR) 18.77 27.31 18.48 16.29

HI

DI

MU

% y/y 227.6 45.5 -32.3 -11.8 Hold 13

DPS (EUR) 5.80 8.50 5.75 5.50

Yield 6.6 10.2 5.7 5.5

Source: Erste Group Research, FactSet Consensus Estimates. Sell 5

HIGH

Gov.

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 8/146

Cie Financiere Richemont

Switzerland | Consumer Discretionary

Rating: Hold

Prices as of: 13.02.24 Close Price: CHF 132.70

Business Model Price in CHF

Richemont is a Swiss luxury goods manufacturer. The divisions are:

Jewellery Maisons (e.g. Cartier brand), Specialist Watchmakers 175

(Piaget, A. Lange & Soehne, Jaeger-LeCoultre), Montblanc Maison

and other brands such as Alfred Dunhill, Chloe. The largest sales

markets are: Asia/Pacific (45%), Europe (23%) and Americas (18%). 150

Earnings Update 12.02.2024

The Group increased sales by +19% to EUR 20 billion in the 2023 125

financial year. Jewelry sales increased by +21% to EUR 13.4 billion.

Sales of luxury watches rose by +12.8% to EUR 3.9 billion. The

operating margin in the jewelry business was 33.9% and 19% in the 100

watch segment. Overall, the operating margin reached 25.2% (vs.

22.4% a year earlier). Operating profit increased by +31% (Y/Y) to EUR

5.1 bn. Adjusted net profit rose by +57% to EUR 3.9 bn. 75

Rating Rationale Analyst: Stephan Lingnau

Richemont's sales will increase less strongly in the current financial

year than in the last financial year. Adjusted net profit should fall 50

slightly. From the 2025 financial year (starting on March 31, 2024),

sales and profit growth will increase more strongly. The Group's sales

25

growth has recently been strong in almost all regions, particularly in 2020 2021 2022 2023 2024

Japan, Asia-Pacific and the Americas.

Cie Financiere Richemont 200 DMA 100 DMA

Overview Sales y/y EPS y/y

Mkt. Cap. mn: EUR 79,657 Next Earnings: 17.05.2024 CY, % CY, %

20 75

Employees: 33,959 Div. Yield 23: 2.3%

Last FY End: 31.03.2023 Div. Yield 24e: 2.5% 15 50

Exchange: SIX Swiss SE 1Y Price Perf.: -6.7% 10 25

ISIN: CH0210483332 5Y Price Perf.: 81.2%

5 0

Ratios Value 0 -25

(%, CY ) Comp. Peers (x, CY) Comp. Peers 22 23 24e 25e 26e 22 23 24e 25e 26e

Net Margin 18.8 10.9 PE 23 21.6 16.0 Company Peers Company Peers

EBIT Margin 24.0 14.6 PE 24e 20.1 15.8

EBIT Margin Equity vs Global Sector

ROE 18.1 20.1 PB 24e 3.63 3.06 CY, % 1 year in EUR, %

Sales (y/y) 5.5 2.8 EV/EBIT 24e 14.6 10.7 30 25

EPS (y/y) 7.0 -0.5 EV/EBIT 25e 13.1 9.5 25 0

Financials 20

-25

EUR mn. FY 2022 FY 2023 FY 2024e FY 2025e

15

Sales 17,868 19,825 20,337 21,658 -50

% y/y 26.4 11.0 2.6 6.5 10 Jul.23 Jan.24

22 23 24e 25e 26e

EBITDA 5,520 6,408 6,241 6,674 Company Index

Company Peers

% y/y 67.2 16.1 -2.6 6.9

EBIT 3,583 4,902 4,822 5,213 ESG Profile Ratings

% y/y 121.4 36.8 -1.6 8.1 4Q22 Consensus

Net Profit 2,136 3,811 3,673 4,134

Env. Soc. Buy 24

% y/y 51.3 78.4 -3.6 12.6

GH

ME

EPS (EUR) 3.82 6.60 6.47 7.12

HI

D

IU

M

% y/y 50.0 72.8 -2.1 10.1 Hold 9

DPS (EUR) 3.13 3.41 3.30 3.56

Yield 2.7 2.3 2.5 2.7 MEDIUM

Source: Erste Group Research, FactSet Consensus Estimates. Sell

Gov.

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 9/146

Hermes International

France | Consumer Discretionary

Rating: Buy

Prices as of: 13.02.24 Close Price: EUR 2,131.50

Business Model Price in EUR

Hermes International is a luxury products manufacturer based in

France. The company divides its business into several segments, 2500

including leather goods such as bags and equestrian products (approx.

40% of sales) and ready-to-wear and accessories (approx. 30% of

sales). It also sells belts, gloves, watches, jewelry and perfumes. 2000

Earnings Update 09.02.2024

Hermes increased sales by +16% to EUR 13.4 billion in FY 2023.

Sales growth was high in all regions. A solid increase of +19% (Y/Y)

1500

was also achieved in Asia (excluding Japan) in 2023. Sales growth was

also very dynamic in the 4Q at +13% (Y/Y). 4Q revenue amounted to

EUR 3.4 billion. The highest growth rates in 4Q were achieved in

Europe (+17.4%), the Americas region (+15.7%) and Japan (+15.0%). 1000

Sales growth was lowest in the Asia-Pacific region (excl. Japan) at

+6.6% (Y/Y). Adjusted operating income rose by +20% (y/y) to EUR

5.65 bn in 2023. The operating margin increased year-on-year to 500

42.1% (vs. 40.5% in the previous year). Profit/share increased by

+25% to EUR 41.19.

Rating Rationale Analyst: Stephan Lingnau

0

Hermes continues to achieve strong sales growth. The EBIT margin is 2020 2021 2022 2023 2024

at a record high. An important factor for customers is that many

Hermes International 200 DMA 100 DMA

Hermes products retain or increase in value after purchase. We

consider the high valuation of the Hermes stock to be justified in view

of the strong growth, profitability and unique selling points in the luxury

segment.

Overview Sales y/y EPS y/y

Mkt. Cap. mn: EUR 225,021 Next Earnings: 09.02.2024 CY, % CY, %

40 40

Employees: 22,037 Div. Yield 23: 1.3%

Last FY End: 31.12.2023 Div. Yield 24e: 0.8% 30

20

Exchange: Euronext Paris 1Y Price Perf.: 24.5% 20

ISIN: FR0000052292 5Y Price Perf.: 290.4% 0

10

Ratios Value 0 -20

(%, CY ) Comp. Peers (x, CY) Comp. Peers 22 23 24e 25e 26e 22 23 24e 25e 26e

Net Margin 29.8 14.8 PE 23 46.7 19.8 Company Peers Company Peers

EBIT Margin 41.3 23.0 PE 24e 49.4 19.2

EBIT Margin Equity vs Global Sector

ROE 26.1 20.7 PB 24e 12.89 3.72 CY, % 1 year in EUR, %

Sales (y/y) 12.6 4.0 EV/EBIT 24e 34.0 12.6 50 50

EPS (y/y) 5.0 2.5 EV/EBIT 25e 29.9 11.1

40 25

Financials

0

EUR mn. FY 2022 FY 2023 FY 2024e FY 2025e 30

Sales 11,602 13,427 15,121 16,631 -25

% y/y 29.2 15.7 12.6 10.0 20 Jul.23 Jan.24

22 23 24e 25e 26e

EBITDA 5,304 6,278 6,929 7,815 Company Index

Company Peers

% y/y 29.6 18.4 10.4 12.8

EBIT 4,697 5,650 6,248 7,021 ESG Profile Ratings

% y/y 33.1 20.3 10.6 12.4 4Q22 Consensus

Net Profit 3,367 4,311 4,503 5,021

Env. Soc. Buy 10

% y/y 37.7 28.0 4.5 11.5

GH

HI

GH

EPS (EUR) 32.09 41.12 43.19 47.98

HI

% y/y 37.7 28.1 5.0 11.1 Hold 13

DPS (EUR) 13.00 25.00 17.05 19.07 LOW

Yield 0.9 1.3 0.8 0.9

Source: Erste Group Research, FactSet Consensus Estimates. Sell 4

Gov.

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 10/146

Inditex

Spain | Consumer Discretionary

Rating: Hold

Prices as of: 13.02.24 Close Price: EUR 39.11

Business Model Price in EUR

Inditex (Industria de Diseño Textil) manufactures and distributes

clothing. The group includes, among others: Zara, Bershka and 45

Pull&Bear. The company operates retail chains in Europe, America,

Asia and Africa. The main sales markets are: Spain (18%), other

countries in Europe (46%), Asia (21%) and America (15%). 40

Earnings Update 23.02.2023

Inditex achieved revenue growth of +36% to EUR 27.7 bn in FY2022, 35

with product costs increasing at a lower rate. Operating costs (+16.7%

y/y) increased much less than revenues. As a result, operating profit

increased strongly. It increased by +182% to EUR 4.3 billion. The 30

operating margin also expanded significantly. It amounted to 15.5% in

FY 2022 (vs. 7.4%) a year earlier. Adjusted net profit increased by

+147% (y/y) to EUR 3.3 billion. 25

Rating Rationale Analyst: Stephan Lingnau

Sales and earnings growth will weaken in the current fiscal year. The

operating margin should increase slightly. The stock is reasonably 20

valued on the basis of the P/E ratio. The expected dividend yield 2023e

is high.

15

2020 2021 2022 2023 2024

Inditex 200 DMA 100 DMA

Overview Sales y/y EPS y/y

Mkt. Cap. mn: EUR 121,728 Next Earnings: 13.03.2024 CY, % CY, %

20 40

Employees: 164,997 Div. Yield 23: 4.2%

Last FY End: 31.01.2023 Div. Yield 24e: 3.9% 15

20

Exchange: Bolsa de Madrid 1Y Price Perf.: 39.0% 10

ISIN: ES0148396007 5Y Price Perf.: 56.9% 0

5

Ratios Value 0 -20

(%, CY ) Comp. Peers (x, CY) Comp. Peers 22 23 24e 25e 26e 22 23 24e 25e 26e

Net Margin 15.1 9.7 PE 23 22.6 24.2 Company Peers Company Peers

EBIT Margin 19.1 12.2 PE 24e 20.9 20.5

EBIT Margin Equity vs Global Sector

ROE 29.5 23.7 PB 24e 6.17 5.07 CY, % 1 year in EUR, %

Sales (y/y) 7.4 4.4 EV/EBIT 24e 14.9 14.7 30 50

EPS (y/y) 10.8 15.2 EV/EBIT 25e 13.7 13.3 25

Financials 20 0

EUR mn. FY 2022 FY 2023 FY 2024e FY 2025e

15

Sales 27,716 32,569 35,974 38,549 -50

% y/y 35.8 17.5 10.5 7.2 10 Jul.23 Jan.24

22 23 24e 25e 26e

EBITDA 7,421 8,717 9,822 10,562 Company Index

Company Peers

% y/y 49.1 17.5 12.7 7.5

EBIT 4,282 5,674 6,778 7,361 ESG Profile Ratings

% y/y 184.1 32.5 19.5 8.6 4Q22 Consensus

Net Profit 3,243 4,147 5,347 5,826

Env. Soc. Buy 20

% y/y 193.2 27.9 29.0 8.9

GH

HI

GH

EPS (EUR) 1.04 1.33 1.72 1.88

HI

% y/y 193.5 27.4 29.6 9.5 Hold 10

DPS (EUR) 0.93 1.20 1.53 1.70

Yield 3.5 4.2 3.9 4.4 MEDIUM

Source: Erste Group Research, FactSet Consensus Estimates. Sell 4

Gov.

10

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 11/146

Kering

France | Consumer Discretionary

Rating: Not

Rated

Prices as of: 13.02.24 Close Price: EUR 410.90

Business Model Price in EUR

Kering operates in the luxury goods sector. Well-known brands are:

Gucci, Alexander McQueen, Balenciaga, Bottega Veneta, Boucheron, 900

Brioni, Girard-Perregaux, JeanRichard, and Saint Laurent Paris. Sales

markets: Asia/Pacific (41%), Western Europe (19%) and North America

(29%). 800

Earnings Update 14.02.2024

Kering increased sales by 15% (y/y) to EUR 20.4 billion in 2022. On a 700

comparable basis, sales increased by +9% (y/y). All business units

achieved sales growth. Sales growth was strongest in the eyewear

segment (+25% y/y) and for the Yves Saint Laurent brand (+23% y/y). 600

This brand also made the main contribution to the increase in operating

income. This rose by +13% y/y to EUR 5.4 billion. The operating

margin was high. It was 26.5% (vs. 27.2% a year earlier). Adjusted net 500

profit also rose by +13% to EUR 3.7 billion in the last financial year.

Rating Rationale Analyst: Stephan Lingnau

Coverage of this company will be terminated. 400

300

2020 2021 2022 2023 2024

Kering 200 DMA 100 DMA

Overview Sales y/y EPS y/y

Mkt. Cap. mn: EUR 50,368 Next Earnings: 08.02.2024 CY, % CY, %

30 20

Employees: 47,227 Div. Yield 23: 3.5%

Last FY End: 31.12.2023 Div. Yield 24e: 3.4% 20 10

Exchange: Euronext Paris 1Y Price Perf.: -27.5% 10 0

ISIN: FR0000121485 5Y Price Perf.: -14.4%

0 -10

Ratios Value -10 -20

(%, CY ) Comp. Peers (x, CY) Comp. Peers 22 23 24e 25e 26e 22 23 24e 25e 26e

Net Margin 15.0 11.4 PE 23 16.0 24.2 Company Peers Company Peers

EBIT Margin 23.5 16.1 PE 24e 16.7 25.0

EBIT Margin Equity vs Global Sector

ROE 18.3 19.8 PB 24e 3.06 4.14 CY, % 1 year in EUR, %

Sales (y/y) 2.8 5.0 EV/EBIT 24e 12.4 16.7 40 50

EPS (y/y) -1.7 7.8 EV/EBIT 25e 10.9 14.8

30

Financials 0

EUR mn. FY 2022 FY 2023 FY 2024e FY 2025e 20

Sales 20,351 19,566 20,117 21,408 -50

% y/y 15.3 -3.9 2.8 6.4 10 Jul.23 Jan.24

22 23 24e 25e 26e

EBITDA 7,255 6,569 6,458 7,161 Company Index

Company Peers

% y/y 12.1 -9.5 -1.7 10.9

EBIT 5,589 4,746 4,718 5,234 ESG Profile Ratings

% y/y 11.4 -15.1 -0.6 10.9 4Q22 Consensus

Net Profit 3,747 3,061 3,023 3,401

Env. Soc. Buy 9

% y/y 11.5 -18.3 -1.3 12.5

GH

HI

GH

EPS (EUR) 30.42 25.01 24.60 27.53

HI

% y/y 12.8 -17.8 -1.7 11.9 Hold 22

DPS (EUR) 14.00 14.00 13.99 14.49

Yield 2.9 3.5 3.4 3.5 MEDIUM

Source: Erste Group Research, FactSet Consensus Estimates. Sell 1

Gov.

11

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 12/146

LOreal

France | Consumer Discretionary

Rating: Buy

Prices as of: 13.02.24 Close Price: EUR 428.00

Business Model Price in EUR

L'Oreal is the largest cosmetics manufacturer in the world. The regions

with the highest sales are: Europe (30%), North Asia (25%), North 500

America (27%). The main product segments by sales are: Consumer

Products (39%, L'Oreal Paris, Garnier) and L'Oréal Luxe (36%, 450

Lancome, Yves Saint Laurent) and Dermatological Beauty.

Earnings Update 23.02.2023

400

L'Oreal strengthened its global leadership position in the beauty market

last fiscal year. Sales were up +18.5% (y/y) to EUR 38.3 billion in

FY2022. On a like-for-like basis, sales growth was +10.9% (y/y). Strong 350

sales growth was achieved in all of the company's segments, as well

as in all sales regions. Sales increases were particularly high in Latin

300

America and in the SAPMENA: South Asia/Pacific/Middle East and

North Africa region. Market share gains were also achieved in China.

L'Oreal also realized an increase in operating margin to 19.5% in 250

FY2022. Operating income reached EUR 7.5 billion, with

earnings/share up +27.6% (y/y) to EUR 11.26. 200

Rating Rationale Analyst: Stephan Lingnau

The outlook for the beauty products market is positive. L'Oreal is

150

expected to gain further market share. Sales and profits are expected 2020 2021 2022 2023 2024

to increase in 2023. The operating margin should also increase.

LOreal 200 DMA 100 DMA

Overview Sales y/y EPS y/y

Mkt. Cap. mn: EUR 228,863 Next Earnings: 08.02.2024 CY, % CY, %

20 30

Employees: 87,369 Div. Yield 23: 1.5%

Last FY End: 31.12.2023 Div. Yield 24e: 1.6% 15

20

Exchange: Euronext Paris 1Y Price Perf.: 9.8% 10

ISIN: FR0000120321 5Y Price Perf.: 92.1% 10

5

Ratios Value 0 0

(%, CY ) Comp. Peers (x, CY) Comp. Peers 22 23 24e 25e 26e 22 23 24e 25e 26e

Net Margin 15.8 8.6 PE 23 37.3 30.1 Company Peers Company Peers

EBIT Margin 20.1 14.2 PE 24e 33.0 27.7

EBIT Margin Equity vs Global Sector

ROE 21.8 15.4 PB 24e 7.18 4.59 CY, % 1 year in EUR, %

Sales (y/y) 7.0 5.5 EV/EBIT 24e 26.0 19.9 22.5 20

EPS (y/y) 7.4 10.8 EV/EBIT 25e 23.8 18.2 20

Financials 17.5 0

EUR mn. FY 2022 FY 2023 FY 2024e FY 2025e

15

Sales 38,261 41,183 44,054 46,967 -20

% y/y 18.5 7.6 7.0 6.6 12.5 Jul.23 Jan.24

22 23 24e 25e 26e

EBITDA 8,993 9,674 10,568 11,346 Company Index

Company Peers

% y/y 13.2 7.6 9.2 7.4

EBIT 7,457 8,143 8,867 9,563 ESG Profile Ratings

% y/y 21.1 9.2 8.9 7.8 4Q22 Consensus

Net Profit 6,054 6,487 6,953 7,488

Env. Soc. Buy 11

% y/y 22.6 7.1 7.2 7.7

HI

UM

GH

EPS (EUR) 11.26 12.08 12.97 14.02

DI

ME

% y/y 27.7 7.3 7.4 8.1 Hold 13

DPS (EUR) 6.00 6.60 7.00 7.59

Yield 1.8 1.5 1.6 1.8 MEDIUM

Source: Erste Group Research, FactSet Consensus Estimates. Sell 6

Gov.

12

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 13/146

LVMH

France | Consumer Discretionary

Rating: Hold

Prices as of: 13.02.24 Close Price: EUR 800.80

Business Model Price in EUR

LVMH Moet Hennessy Louis Vuitton is a diversified luxury goods

group. The top-selling areas are fashion and leather, selective retail, 1000

wines and spirits (9%). Furthermore, perfumes, as well as jewelry &

watches are produced and sold. Globally, the largest sales markets are 900

Asia with 30%, the USA with 27% and Europe with 16% of sales.

Earnings Update 24.10.2023 800

LVMH increased sales by +10% (Y/Y) to EUR 62.2 billion in the first 9

months of FY2023. Total organic sales growth was still +17% (Y/Y) in 700

H1, then +14% (Y/Y) in the first three quarters. All segments of the

Group, except the smallest segment, Wines & Spirits (-10% Y/Y), also 600

grew year-on-year. The most important segment, Leather & Fashion,

grew by +101% (Y/Y) and organically by +16% (Y/Y), respectively, 500

while Selective Retailing, with the Sephora cosmetics chain, increased

sales by +23% (Y/Y). In the first 9 months of 2023, double-digit organic

400

growth was achieved in Europe, Japan and the rest of Asia, and

revenue growth of +3% (Y/Y) was achieved in the USA.

300

Rating Rationale Analyst: Stephan Lingnau

LVMH will continue to impress with high growth through its strong

200

brands. In particular, the above-average margins and the high potential 2020 2021 2022 2023 2024

in Asia incl. Japan offer investors above-average earnings prospects in

LVMH 200 DMA 100 DMA

the long term.

Overview Sales y/y EPS y/y

Mkt. Cap. mn: EUR 402,040 Next Earnings: 25.07.2024 CY, % CY, %

30 20

Employees: 213,000 Div. Yield 23: 1.8%

Last FY End: 31.12.2023 Div. Yield 24e: 1.7% 20 15

Exchange: Euronext Paris 1Y Price Perf.: -1.2%

ISIN: FR0000121014 5Y Price Perf.: 171.8% 10 10

Ratios Value 0 5

(%, CY ) Comp. Peers (x, CY) Comp. Peers 22 23 24e 25e 26e 22 23 24e 25e 26e

Net Margin 18.0 15.8 PE 23 24.2 24.4 Company Peers Company Peers

EBIT Margin 26.3 22.5 PE 24e 24.8 25.2

EBIT Margin Equity vs Global Sector

ROE 23.1 19.5 PB 24e 5.71 3.69 CY, % 1 year in EUR, %

Sales (y/y) 5.3 5.5 EV/EBIT 24e 17.1 16.4 35 25

EPS (y/y) 6.7 7.0 EV/EBIT 25e 15.2 14.4 30

Financials 25 0

EUR mn. FY 2022 FY 2023 FY 2024e FY 2025e

20

Sales 79,184 86,153 90,694 98,033 -25

% y/y 23.3 8.8 5.3 8.1 15 Jul.23 Jan.24

22 23 24e 25e 26e

EBITDA 26,827 29,279 30,059 32,173 Company Index

Company Peers

% y/y 19.8 9.1 2.7 7.0

EBIT 21,055 22,802 23,864 26,218 ESG Profile Ratings

% y/y 22.8 8.3 4.7 9.9 4Q22 Consensus

Net Profit 14,103 15,174 16,320 17,919

Env. Soc. Buy 25

% y/y 17.2 7.6 7.6 9.8

GH

ME

EPS (EUR) 28.03 30.33 32.35 35.73

HI

D

IU

M

% y/y 17.3 8.2 6.7 10.4 Hold 9

DPS (EUR) 12.00 13.00 14.00 15.53

Yield 1.8 1.8 1.7 1.9 MEDIUM

Source: Erste Group Research, FactSet Consensus Estimates. Sell 1

Gov.

13

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 14/146

Mercedes-Benz Group

Germany | Consumer Discretionary

Rating: Hold

Prices as of: 13.02.24 Close Price: EUR 65.44

Business Model Price in EUR

Mercedes-Benz produces and sells passenger cars and vans and

offers mobility services. The largest sales regions for Mercedes Benz 80

passenger cars are Europe (32%), Asia (30%) and North America

(23%). 70

Earnings Update 17.08.2023

Mercedes-Benz Group increased passenger car sales by +5% (y/y) to

60

2.04 million units in 2022. Sales of vans increased by +8% (y/y) to 415

thousand units. Sales of fully electric vehicles reached 149 thousand

units (+67%), and those of vehicles with hybrid drives 184 thousand 50

units (+1%). Sales amounted to EUR 150 billion (+12% y/y). Operating

income increased at an above-average rate. It reached EUR 20.5

40

billion (+28% y/y). On a very positive note, the operating margin

expanded strongly. It amounted to 13.6% (vs. 10.7% a year earlier).

Earnings per share increased by +35% (y/y) to EUR 13.5. 30

Rating Rationale Analyst: Stephan Lingnau

Mercedes-Benz Group impresses with above-average margins in the 20

sector. However, in 2Q23 Mercedes had to report the highest inventory

level compared to sales since 2021. The Stuttgart-based carmaker will

10

therefore suffer more than others from a global stagnating car market 2020 2021 2022 2023 2024

that will likely last until at least the end of 2023.

Mercedes-Benz Group 200 DMA 100 DMA

Overview Sales y/y EPS y/y

Mkt. Cap. mn: EUR 70,008 Next Earnings: 22.02.2024 CY, % CY, %

30 10

Employees: 168,797 Div. Yield 22: 8.5%

Last FY End: 31.12.2022 Div. Yield 23e: 7.9% 20

0

Exchange: XETRA 1Y Price Perf.: -8.4% 10

ISIN: DE0007100000 5Y Price Perf.: 55.6% -10

0

Ratios Value -10 -20

(%, CY ) Comp. Peers (x, CY) Comp. Peers 22 23 24e 25e 26e 22 23 24e 25e 26e

Net Margin 8.1 5.9 PE 23 5.0 5.9 Company Peers Company Peers

EBIT Margin 11.2 7.0 PE 24e 5.6 5.9

EBIT Margin Equity vs Global Sector

ROE 12.4 12.3 PB 24e 0.69 0.66 CY, % 1 year in EUR, %

Sales (y/y) 0.6 4.0 EV/EBIT 24e 2.3 6.3 15 25

EPS (y/y) -10.9 -0.2 EV/EBIT 25e 2.1 6.2 12.5

Financials 10 0

EUR mn. FY 2021 FY 2022 FY 2023e FY 2024e

7.5

Sales 133,893 150,017 152,164 153,038 -25

% y/y 9.9 12.0 1.4 0.6 5 Jul.23 Jan.24

22 23 24e 25e 26e

EBITDA 18,099 29,612 25,944 23,912 Company Index

Company Peers

% y/y -24.2 63.6 -12.4 -7.8

EBIT 17,232 20,655 19,438 17,199 ESG Profile Ratings

% y/y 99.4 19.9 -5.9 -11.5 4Q22 Consensus

Net Profit 14,180 14,322 14,009 12,342

Env. Soc. Buy 18

% y/y 291.0 1.0 -2.2 -11.9

GH

HI

GH

EPS (EUR) 12.89 13.55 13.19 11.75

HI

% y/y 354.0 5.1 -2.7 -10.9 Hold 9

DPS (EUR) 5.00 5.20 5.20 5.18

Yield 7.4 8.5 7.9 7.9 MEDIUM

Source: Erste Group Research, FactSet Consensus Estimates. Sell 2

Gov.

14

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 15/146

Porsche AG

Germany | Consumer Discretionary

Rating: Hold

Prices as of: 13.02.24 Close Price: EUR 80.64

Business Model Price in EUR

Porsche AG is a Germany-based manufacturer of luxury vehicles. The

company sells vehicles in more than 120 countries worldwide. In 130

addition, Porsche AG offers vehicle leasing and financing. The group

generates 32% of its sales in Europe, 31% in China and 26% in North

America. 120

Earnings Update 31.10.2022

Porsche AG increased sales by +15.5% to EUR 33.1 billion in the last 110

fiscal year. The gross margin was expanded from 24.7% to 26.7%.

Operating profit increased by +27% (y/y) to EUR 5.3 billion. It is very

positive that the already high operating margin was increased further. It 100

amounted to 16% in the past financial year. Net profit amounted to

EUR 4 billion in 2021, an increase of +27.5% (y/y). The positive trend

continued in H1 2022. The operating margin increased to 19.4% in H1, 90

or net profit to EUR 2.6 billion (+18.4% y/y). For 2022, an operating

margin between 17 - 18% is expected. Sales should be in a range

between approx. EUR 38 - 39 billion. 80

Rating Rationale Analyst: Stephan Lingnau

The company is showing above-average profitability. However, there

70

are still significant supply risks for semiconductors and shortages of 2023 2023 2023 2024

various raw materials. In addition, there is a risk of a possible decline in

Porsche AG 200 DMA 100 DMA

sales due to rising inflation rates and interest rates.

Overview Sales y/y EPS y/y

Mkt. Cap. mn: EUR 73,463 Next Earnings: 13.03.2024 CY, % CY, %

30 60

Employees: 36,996 Div. Yield 22: 0%

Last FY End: 31.12.2022 Div. Yield 23e: 3.0% 20 40

Exchange: XETRA 1Y Price Perf.: -29.1% 10 20

ISIN: DE000PAG9113 5Y Price Perf.: -2.3%

0 0

Ratios Value -10 -20

(%, CY ) Comp. Peers (x, CY) Comp. Peers 22 23 24e 25e 26e 22 23 24e 25e 26e

Net Margin 12.5 8.7 PE 23 14.2 10.9 Company Peers Company Peers

EBIT Margin 17.3 11.1 PE 24e 14.6 12.3

EBIT Margin Equity vs Global Sector

ROE 24.3 14.1 PB 24e 3.55 2.79 CY, % 1 year in EUR, %

Sales (y/y) 0.1 6.9 EV/EBIT 24e 10.8 8.8 20 50

EPS (y/y) -2.5 -0.2 EV/EBIT 25e 9.3 6.8 17.5

Financials 15 0

EUR mn. FY 2021 FY 2022 FY 2023e FY 2024e

12.5

Sales 33,138 37,630 40,110 40,170 -50

% y/y 15.5 13.6 6.6 0.1 10 Jul.23 Jan.24

22 23 24e 25e 26e

EBITDA 8,534 9,727 10,607 10,409 Company Index

Company Peers

% y/y 10.4 14.0 9.0 -1.9

EBIT 5,320 6,538 7,171 6,962 Ratings

% y/y 21.6 22.9 9.7 -2.9 Consensus

Net Profit 4,032 4,950 5,164 5,022

Buy 13

% y/y 27.5 22.8 4.3 -2.8

EPS (EUR) - 5.43 5.66 5.52

% y/y - - 4.3 -2.5 Hold 11

DPS (EUR) 0.0 0.0 2.40 2.51

Yield 0.0 0.0 3.0 3.1

Source: Erste Group Research, FactSet Consensus Estimates. Sell 1

15

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 16/146

Ryanair

Ireland | Consumer Discretionary

Rating: Hold

Prices as of: 13.02.24 Close Price: EUR 20.02

Business Model Price in EUR

Ryanair is the largest airline in Europe. It serves almost all European

countries, as well as countries in the Near East and Morocco. Ryanair 22.5

also markets accommodation services and travel insurance through its

website.

Earnings Update 09.08.2023 20

Ryanair grew revenue by +124% (y/y) to EUR 17.8 billion in FY2023

(ended 3/31/2023) on strong demand growth and higher fares. 17.5

Europe's largest airline is gaining market share in most countries as it

has been able to increase capacity faster than competitors. Sales of

business class flights are also increasing at present. Operating profit 15

for the year was EUR 1.4 billion, and the adjusted net loss reached

EUR 1.3 billion.

Rating Rationale Analyst: Hans Engel 12.5

The recovery in travel remains very strong this year. For this year,

Ryanair announced the expansion of its capacity by +25% (Y/Y).

However, visibility on aircraft utilization in the 2nd calendar half of 2023 10

has decreased. In order to fill the additional capacity, price reductions

in flight tickets will be implemented if necessary.

7.5

2020 2021 2022 2023 2024

Ryanair 200 DMA 100 DMA

Overview Sales y/y EPS y/y

Mkt. Cap. mn: EUR 22,759 Next Earnings: 20.05.2024 CY, % CY, %

150 150

Employees: 22,261 Div. Yield 23: 0%

Last FY End: 31.03.2023 Div. Yield 24e: 1.7% 100

100

Exchange: Irish SE 1Y Price Perf.: 34.5% 50

ISIN: IE00BYTBXV33 5Y Price Perf.: 69.9% 50

0

Ratios Value 0 -50

(%, CY ) Comp. Peers (x, CY) Comp. Peers 22 23 24e 25e 26e 22 23 24e 25e 26e

Net Margin 16.0 4.6 PE 23 12.3 4.5 Company Peers Company Peers

EBIT Margin 17.7 6.9 PE 24e 10.1 4.7

EBIT Margin Equity vs Global Sector

ROE 26.1 15.8 PB 24e 2.62 1.27 CY, % 1 year in EUR, %

Sales (y/y) 13.5 5.9 EV/EBIT 24e 7.9 5.6 20 50

EPS (y/y) 31.8 -1.5 EV/EBIT 25e 6.0 5.1 15 25

Financials 10

0

EUR mn. FY 2022 FY 2023 FY 2024e FY 2025e

5

Sales 4,801 10,775 13,408 14,823 -25

% y/y 193.5 124.4 24.4 10.6 0 Jul.23 Jan.24

22 23 24e 25e 26e

EBITDA 380 2,366 3,137 3,951 Company Index

Company Peers

% y/y - 522.9 32.6 26.0

EBIT -449 1,573 2,052 2,740 ESG Profile Ratings

% y/y - - 30.4 33.6 4Q22 Consensus

Net Profit -355 1,428 1,898 2,458

Env. Soc. Buy 22

% y/y - - 32.9 29.5

ME

EPS (EUR) -0.21 1.16 1.65 2.13

D

W

IU

LO

% y/y - - 42.2 29.3 Hold

DPS (EUR) 0.0 0.0 0.35 0.53

Yield 0.0 0.0 1.7 2.6

Source: Erste Group Research, FactSet Consensus Estimates. Sell 1

HIGH

Gov.

16

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 17/146

Volkswagen

Germany | Consumer Discretionary

Rating: Hold

Prices as of: 13.02.24 Close Price: EUR 118.62

Business Model Price in EUR

Volkswagen manufactures cars, trucks and buses. Volkswagen owns

the brands VW, Audi, Seat, Skoda, CUPRA, Bentley, Porsche, 225

Lamborghini, as well as Scania, MAN and Navistar. VW also offers

financial services. Revenue breakdown: Europe (55%), North America 200

(21%), Asia/Pacific (18%), South America (6%).

Earnings Update 10.05.2023

175

The Volkswagen Group increased sales by +11.6% to EUR 279.2

billion in 2022. The cost of sales of the products sold increased slightly

more than sales. As total operating costs also increased more strongly 150

(+12.2% y/y), operating profit increased by only +4.9% to EUR 20.2

billion. Net profit remained almost unchanged (+0.4% y/y) at EUR 15.4

125

billion. Volkswagen is focusing very strongly on fully electric cars and is

achieving sales success with them both in Europe and in the USA. The

recently unveiled VW ID.7 is expected to boost sales in all core 100

markets.

Rating Rationale Analyst: Stephan Lingnau 75

Sales and profit growth rates are expected to slow in 2023 and 2024.

The very strong competition limits the growth potential and also

50

prevents an expansion of the operating margin. The stock is favorably 2020 2021 2022 2023 2024

valued by P/E ratio due to the limited outlook. It also has a very high

Volkswagen 200 DMA 100 DMA

dividend yield.

Overview Sales y/y EPS y/y

Mkt. Cap. mn: EUR 59,464 Next Earnings: 12.03.2024 CY, % CY, %

20 20

Employees: 675,805 Div. Yield 22: 7.5%

Last FY End: 31.12.2022 Div. Yield 23e: 7.6% 10 10

Exchange: XETRA 1Y Price Perf.: -7.6%

ISIN: DE0007664039 5Y Price Perf.: -4.1% 0 0

Ratios Value -10 -10

(%, CY ) Comp. Peers (x, CY) Comp. Peers 22 23 24e 25e 26e 22 23 24e 25e 26e

Net Margin 4.8 6.6 PE 23 3.9 5.5 Company Peers Company Peers

EBIT Margin 7.0 8.5 PE 24e 3.9 6.2

EBIT Margin Equity vs Global Sector

ROE 8.6 12.4 PB 24e 0.34 0.67 CY, % 1 year in EUR, %

Sales (y/y) 0.1 1.7 EV/EBIT 24e 1.0 3.8 10 25

EPS (y/y) -0.5 -2.1 EV/EBIT 25e 0.8 6.0 9 0

Financials 8

-25

EUR mn. FY 2021 FY 2022 FY 2023e FY 2024e

7

Sales 250,200 279,232 316,418 316,616 -50

% y/y 12.3 11.6 13.3 0.1 6 Jul.23 Jan.24

22 23 24e 25e 26e

EBITDA 45,454 47,999 46,737 46,291 Company Index

Company Peers

% y/y 25.9 5.6 -2.6 -1.0

EBIT 20,026 22,523 22,461 22,178 ESG Profile Ratings

% y/y 88.8 12.5 -0.3 -1.3 4Q22 Consensus

Net Profit 14,843 14,867 15,404 15,294

Env. Soc. Buy 18

% y/y 73.0 0.2 3.6 -0.7

HI

UM

GH

EPS (EUR) 25.46 29.63 30.62 30.49

DI

ME

% y/y 78.3 16.4 3.4 -0.5 Hold 8

DPS (EUR) 6.50 8.70 9.05 8.94 LOW

Yield 4.3 7.5 7.6 7.5

Source: Erste Group Research, FactSet Consensus Estimates. Sell 2

Gov.

17

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 18/146

Allianz

Germany | Financials

Rating: Buy

Prices as of: 13.02.24 Close Price: EUR 245.70

Business Model Price in EUR

Allianz is a global financial services provider with products and services

in the areas of insurance, asset management (Allianz Global Investors, 275

PIMCO) and banking. The Group's most important segments by

operating income are property/casualty (29%), life/health (36%) and 250

asset management (22%).

Earnings Update 17.08.2023

225

Allianz increased total revenues by +4.8% y/y to EUR 85.6 bn in 1H23.

As in previous periods, the increases were mainly driven by the

property and casualty insurance segment. Sales in this segment 200

increased by an adjusted +9.8% y/y to EUR 41.7 billion. In this

segment, prices were raised and profitability increased as a result. As a

175

result, the combined ratio reached a solid 92.0% in 1H23. Operating

profit in Property-Casualty increased by almost +11% to EUR 3.9

billion, while Life/Health recorded an increase of +22% to EUR 2.5 150

billion. The return on equity is a very strong 16.7% compared to the

industry. 125

Rating Rationale Analyst: Stephan Lingnau

Allianz is developing very profitably in the property and casualty

100

insurance segment. In addition, there has recently been a significant 2020 2021 2022 2023 2024

increase in sales in the life insurance segment. In May, Allianz also

Allianz 200 DMA 100 DMA

announced a new share buyback program of up to EUR 1.5 bn in 2023.

The business outlook of a constant operating profit of EUR 14.2 bn this

year was confirmed in the 1H23 results. We consider the guidance

conservative and expect Allianz to exceed this target in 2023.

Overview ESG Profile EPS y/y

Mkt. Cap. mn: EUR 99,950 Next Earnings: 23.02.2024 4Q22 CY, %

40

Employees: 157,332 Div. Yield 22: 5.7%

Last FY End: 31.12.2022 Div. Yield 23e: 4.9% Env. Soc.

GH

ME

Exchange: XETRA 1Y Price Perf.: 11.8%

HI

20

D

IU

M

ISIN: DE0008404005 5Y Price Perf.: 32.3%

Ratios Value 0

(%, CY 24e) Comp. Peers (x, CY) Comp. Peers 22 23 24e 25e 26e

HIGH

ROE 10.9 15.4 PE 23 11.1 11.5 Company Peers

Gov.

ROA - - PE 24e 9.8 9.5

Equity vs Global Sector

EPS (y/y) 12.5 15.4 PE 25e 9.2 8.5 1 year in EUR, %

PB 23 1.66 1.48 25

PB 24e 1.53 1.37

Financials 0

EUR mn FY 2021 FY 2022 FY 2023e FY 2024e

Gross Prem. 110,490 112,524 153,954 160,866 -25

% y/y -7.1 1.8 36.8 4.5 Jul.23 Jan.24

Net Profit 6,560 6,619 8,706 9,721 Company Index

% y/y -3.6 0.9 31.5 11.7

ROE 8.5 10.9 15.0 15.6 Ratings

+/- -0.4 2.3 4.1 0.6 Consensus

EPS (EUR) 15.96 16.35 22.18 24.97

Buy 22

% y/y -3.2 2.4 35.7 12.5

DPS (EUR) 10.80 11.40 12.00 12.70

Yield % 5.2 5.7 4.9 5.2 Hold 3

Source: Erste Group Research, FactSet Consensus Estimates.

Sell 1

18

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 19/146

Banco Santander

Spain | Financials

Rating: Buy

Prices as of: 13.02.24 Close Price: EUR 3.66

Business Model Price in EUR

Banco Santander is a commercial and private bank based in Spain. Its

core businesses are retail banking, asset management and global 5

wholesale banking. The bank operates in continental Europe, the

United Kingdom, Latin America and the United States. 4.5

Earnings Update 08.09.2023

Banco Santander increased revenues by +9.6% (y/y) to EUR 14.5 4

billion in the last quarter, with net interest income up +10% (y/y) to EUR

10.8 billion. Non-interest income increased by +7.4% (y/y) to EUR 3.6 3.5

billion. Loan loss provisions amounted to EUR 2.9 billion (+11% y/y).

Overall, operating income increased +10.7% (y/y) to EUR 4.0 billion. 3

Adjusted net income/diluted share increased to EUR 0.15 (+17% y/y).

Return on equity increased year-on-year from 9.5% to 11% at last 2.5

count. The cost/income ratio fell slightly to 52.4% (vs. 52.7% a year

earlier).

2

Rating Rationale Analyst: Hans Engel

The consensus estimates for revenue and profit development are on 1.5

the upside for 2023 and 2024. Revenues should grow at a double-digit

percentage rate this year. Profitability (operating margin and ROE)

1

should also increase this year. 2020 2021 2022 2023 2024

Banco Santander 200 DMA 100 DMA

Overview Total Income y/y EPS y/y

Mkt. Cap. mn: EUR 59,258 Next Earnings: 30.04.2024 CY, % CY, %

20 40

Employees: 212,764 Div. Yield 23: 0%

Last FY End: 31.12.2023 Div. Yield 24e: 5.2% 15

20

Exchange: Bolsa de Madrid 1Y Price Perf.: 5.2% 10

ISIN: ES0113900J37 5Y Price Perf.: -4.6% 0

5

Ratios Value 0 -20

(%, CY 23) Comp. Peers (x, CY) Comp. Peers 22 23 24e 25e 26e 22 23 24e 25e 26e

Net Int. Margin 2.7 1.2 PE 23 5.8 7.6 Company Peers Company Peers

NPL Ratio 1.2 2.8 PE 24e 5.2 6.4

Cost Income Ratio Equity vs Global Sector

Cost Inc. Ratio 40.6 56.3 PE 25e 4.9 6.0 CY, %, Lower is better 1 year in EUR, %

ROE 13.1 14.9 PB 24e 0.57 0.84 80 25

ROA 0.7 0.63 PB 25e 0.52 0.76 70

60 0

Financials

50

EUR mn FY 2022 FY 2023 FY 2024e FY 2025e

40

Total Income 57,019 62,619 59,857 61,106 -25

% y/y 8.8 9.8 -4.4 2.1 30 Jul.23 Jan.24

19 20 21 22 23

Net Profit 10,508 12,031 11,155 11,349 Company Index

Company Peers

% y/y 14.5 14.5 -7.3 1.7

ROE 12.0 13.1 10.8 10.5 ESG Profile Ratings

+/- 1.0 1.1 -2.4 -0.2 4Q22 Consensus

EPS (EUR) 0.54 0.65 0.70 0.74

Env. Soc. Buy 22

% y/y 23.1 20.7 7.3 6.1

GH

ME

DPS (EUR) 0.10 0.0 0.19 0.21

HI

D

IU

M

Yield % 3.4 0.0 5.2 5.7 Hold 10

Source: Erste Group Research, FactSet Consensus Estimates.

MEDIUM

Sell 1

Gov.

19

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 20/146

BNP Paribas

France | Financials

Rating: Hold

Prices as of: 13.02.24 Close Price: EUR 53.83

Business Model Price in EUR

BNP Paribas is one of the largest financial institutions in France and

Europe. The bank's segments: Commercial, Personal Banking & 70

Services, Investement & Protection Services and Corporate &

Institutional Banking. The main markets by net sales are: Europe (75%)

and the Americas (11%). 60

Earnings Update 11.10.2023

BNP Paribas increased net interest income by +8% to EUR 20.8 billion

in the past fiscal year. Loan loss provisions amounted to EUR 3 billion

50

(+1% y/y). Net interest income after loan loss provisions thus increased

by 10% (Y/Y) to EUR 17.8 billion. Non-interest expenses increased by

+8% (Y/Y). Net profit increased +8% y/y to EUR 10.2 bn. ROE of 9.1%

was above that of peers (8.2%). For 2023, BNP Paribas is expected to 40

see a decline in revenues (approx. -7% y/y). However, earnings per

share should increase slightly.

Rating Rationale Analyst: Stephan Lingnau 30

According to the consensus forecast, BNP Paribas' revenues and

earnings will not grow slightly more strongly again until 2024. The

share is moderately valued according to the expected P/E ratio 2023.

20

The expected dividend yield is very high. 2020 2021 2022 2023 2024

BNP Paribas 200 DMA 100 DMA

Overview Total Income y/y EPS y/y

Mkt. Cap. mn: EUR 61,728 Next Earnings: 25.04.2024 CY, % CY, %

20 100

Employees: 208,089 Div. Yield 23: 7.3%

Last FY End: 31.12.2023 Div. Yield 24e: 8.6% 10

Exchange: Euronext Paris 1Y Price Perf.: -15.0% 0 50

ISIN: FR0000131104 5Y Price Perf.: 30.1%

-10

Ratios Value -20 0

(%, CY 23) Comp. Peers (x, CY) Comp. Peers 22 23 24e 25e 26e 22 23 24e 25e 26e

Net Int. Margin 0.8 1.2 PE 23 7.3 6.2 Company Peers Company Peers

NPL Ratio - 2.8 PE 24e 5.9 5.7

Cost Income Ratio Equity vs Global Sector

Cost Inc. Ratio 62.3 69.4 PE 25e 5.3 5.2 CY, %, Lower is better 1 year in EUR, %

ROE 10.2 10.3 PB 24e 0.54 0.59 75 25

ROA 0.5 0.63 PB 25e 0.51 0.54 70

Financials 65 0

EUR mn FY 2022 FY 2023 FY 2024e FY 2025e

60

Total Income 53,911 49,677 48,073 50,558 -25

% y/y 2.1 -7.9 -3.2 5.2 55 Jul.23 Jan.24

19 20 21 22 23

Net Profit 10,902 11,885 10,240 11,600 Company Index

Company Peers

% y/y 0.6 9.0 -13.8 13.3

ROE 10.0 10.2 9.1 9.7 ESG Profile Ratings

+/- -0.3 0.2 -1.1 0.6 4Q22 Consensus

EPS (EUR) 7.80 8.58 9.09 10.16

Env. Soc. Buy 18

% y/y 7.5 10.0 6.0 11.8

HI

UM

GH

DPS (EUR) 3.90 4.60 4.62 5.16

DI

ME

Yield % 7.3 7.3 8.6 9.6 Hold 7

Source: Erste Group Research, FactSet Consensus Estimates.

MEDIUM

Sell 2

Gov.

20

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 21/146

Deutsche Bank

Germany | Financials

Rating: Sell

Prices as of: 13.02.24 Close Price: EUR 11.88

Business Model Price in EUR

Deutsche Bank AG is a global provider of financial services. The

largest internal segments are Corporate & Investment Bank (58%), 15

Private & Business Clients (32%) and Asset Management (10%). The

most important countries and regions by net revenues are Germany

(31%), UK (19%), Americas (25%) and Asia (13%). 12.5

Earnings Update 10.05.2023

Deutsche Bank increased net interest income by +22.7% (y/y) to EUR

13.7 billion in 2022. Loan loss provisions were strongly increased. They

10

were expanded by EUR 1.2 billion (vs. EUR 500 million a year earlier).

Non-interest expenses increased only moderately (+5% y/y to EUR

23.1bn). By contrast, the bank's non-interest income showed a

declining trend. They fell by -4.8% (y/y) to EUR 16.2 billion. Overall, a 7.5

high net profit increase to EUR 5.5 billion was achieved (vs. EUR 2.4

billion a year earlier).

Rating Rationale Analyst: Stephan Lingnau 5

Deutsche Bank is expected to generate a slight increase in revenues

this year. Net profit, however, is expected to weaken. Only in 2024

should revenues and profits rise again slightly. The stock should

2.5

underperform its sector benchmark in the medium and long term due to 2020 2021 2022 2023 2024

the company's below-average profitability.

Deutsche Bank 200 DMA 100 DMA

Overview Total Income y/y EPS y/y

Mkt. Cap. mn: EUR 24,227 Next Earnings: 25.04.2024 CY, % CY, %

15 150

Employees: 84,930 Div. Yield 23: 0%

Last FY End: 31.12.2023 Div. Yield 24e: 5.7% 10 100

Exchange: XETRA 1Y Price Perf.: 4.5% 5 50

ISIN: DE0005140008 5Y Price Perf.: 56.8%

0 0

Ratios Value -5 -50

(%, CY 23) Comp. Peers (x, CY) Comp. Peers 22 23 24e 25e 26e 22 23 24e 25e 26e

Net Int. Margin - 0.8 PE 23 6.0 6.8 Company Peers Company Peers

NPL Ratio - 2.8 PE 24e 5.6 5.6

Cost Income Ratio Equity vs Global Sector

Cost Inc. Ratio 69.4 62.3 PE 25e 4.8 4.9 CY, %, Lower is better 1 year in EUR, %

ROE 6.5 7.4 PB 24e 0.35 0.48 80 25

ROA - 0.45 PB 25e 0.32 0.45

70 0

Financials

-25

EUR mn FY 2022 FY 2023 FY 2024e FY 2025e 60

Total Income 29,769 31,319 29,350 30,000 -50

% y/y 5.1 5.2 -6.3 2.2 50 Jul.23 Jan.24

19 20 21 22 23

Net Profit 5,498 5,168 4,232 4,666 Company Index

Company Peers

% y/y 154.2 -6.0 -18.1 10.3

ROE 9.2 - 6.2 6.6 ESG Profile Ratings

+/- 5.3 -9.2 6.2 0.4 4Q22 Consensus

EPS (EUR) 2.42 2.06 2.11 2.45

Env. Soc. Buy 10

% y/y 153.5 -14.7 2.3 16.2

UM

ME

DPS (EUR) 0.30 0.0 0.68 1.00

D

DI

IU

ME

Yield % 2.8 0.0 5.7 8.4 Hold 12

Source: Erste Group Research, FactSet Consensus Estimates.

Sell 3

HIGH

Gov.

21

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 22/146

Deutsche Boerse

Germany | Financials

Rating: Hold

Prices as of: 13.02.24 Close Price: EUR 187.00

Business Model Price in EUR

Deutsche Boerse AG is a global financial services provider that

provides marketplaces for financial derivatives, equities, ETFs and 200

energy. It also offers custody of securities and sells market data. Sales

regions are: Eurozone (50%), Rest of EU (38%).

Earnings Update 03.05.2023 180

Deutsche Börse increased its sales revenue by +24% (y/y) to EUR 4.2

billion in the last financial year. They increased by only +18% (y/y) to 160

EUR 2.2 billion. As a result, operating income increased strongly. It

increased by +30% (y/y) to EUR 2.2 billion. The operating margin

remained at a very high level of 56%. Adjusted net income increased 140

by +21% (y/y) to EUR 473 million.

Rating Rationale Analyst: Stephan Lingnau

The acquisition of the Danish software company Simcorp, announced 120

at the end of April 2023, comes at a very high valuation (price/sales

approx. 6.9x). The offered price of DKK 735/share seems simply too

high in view of the expected slowdown in sales growth and because of 100

Simcorp's declining profitability.

80

2020 2021 2022 2023 2024

Deutsche Boerse 200 DMA 100 DMA

Overview Sales y/y EPS y/y

Mkt. Cap. mn: EUR 34,359 Next Earnings: 23.04.2024 CY, % CY, %

30 40

Employees: 11,078 Div. Yield 23: 2.0%

Last FY End: 31.12.2023 Div. Yield 24e: 2.1% 20 20

Exchange: XETRA 1Y Price Perf.: 9.8%

ISIN: DE0005810055 5Y Price Perf.: 64.2% 10 0

Ratios Value 0 -20

(%, CY ) Comp. Peers (x, CY) Comp. Peers 22 23 24e 25e 26e 22 23 24e 25e 26e

Net Margin 31.8 42.8 PE 23 18.7 22.4 Company Peers Company Peers

EBIT Margin 47.6 60.6 PE 24e 18.9 22.1

EBIT Margin Equity vs Global Sector

ROE 17.5 12.0 PB 24e 3.30 2.68 CY, % 1 year in EUR, %

Sales (y/y) 11.9 5.4 EV/EBIT 24e 15.2 16.3 70 20

EPS (y/y) -0.8 10.0 EV/EBIT 25e 13.9 14.6

60

Financials 0

EUR mn. FY 2022 FY 2023 FY 2024e FY 2025e 50

Sales 4,338 5,077 5,679 5,946 -20

% y/y 23.6 17.0 11.9 4.7 40 Jul.23 Jan.24

22 23 24e 25e 26e

EBITDA 2,526 2,944 3,235 3,428 Company Index

Company Peers

% y/y 23.6 16.6 9.9 6.0

EBIT 2,156 2,526 2,705 2,885 ESG Profile Ratings

% y/y 23.2 17.2 7.1 6.6 4Q22 Consensus

Net Profit 1,494 1,724 1,806 1,928

Env. Soc. Buy 13

% y/y 23.5 15.4 4.8 6.7

UM

ME

EPS (EUR) 8.61 9.98 9.90 10.56

D

DI

IU

ME

% y/y 23.4 15.9 -0.8 6.7 Hold 13

DPS (EUR) 3.60 3.80 3.99 4.15

Yield 2.2 2.0 2.1 2.2

Source: Erste Group Research, FactSet Consensus Estimates. Sell 1

HIGH

Gov.

22

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 23/146

HSBC

United Kingdom | Financials

Rating: Hold

Prices as of: 13.02.24 Close Price: GBp 611.00

Business Model Price in GBp

HSBC Holdings is a global bank that has four business divisions: Retail

Banking and Wealth Management, Corporate Banking, Global Banking 800

and Markets and Global Private Banking. The main markets are: Asia

(63%) and Europe (19%).

Earnings Update 09.03.2023 700

HSBC reported revenue growth of +4% for 2022. The increase was

driven by strong growth in net interest income and higher revenues 600

from the global foreign exchange business. However, currency effects

and an impairment charge in connection with the planned sale of the

retail banking business in France had a negative impact. Provisioning 500

for non-performing loans was USD 3.6 billion (vs. USD -928 million a

year earlier). Non-interest income decreased by -9% (y/y). Operating

income was USD 14.8 bn (-6.7% y/y). Adjusted net income, however, 400

increased by +16.7%.

Rating Rationale Analyst: Stephan Lingnau

A significant increase in net interest income is expected for 2023. 300

Operating costs should increase only moderately and therefore

operating income and net income will rise significantly this year.

200

According to the P/E ratio, the stock is valued significantly lower than 2020 2021 2022 2023 2024

those of peer companies. The dividend yield is above average.

HSBC 200 DMA 100 DMA

Overview Total Income y/y EPS y/y

Mkt. Cap. mn: EUR 143,336 Next Earnings: 21.02.2024 CY, % CY, %

20 100

Employees: 219,000 Div. Yield 22: 4.2%

Last FY End: 31.12.2022 Div. Yield 23e: 8.3% 10 50

Exchange: London SE 1Y Price Perf.: -0.5%

ISIN: GB0005405286 5Y Price Perf.: -7.3% 0 0

Ratios Value -10 -50

(%, CY 22) Comp. Peers (x, CY) Comp. Peers 22 23 24e 25e 26e 22 23 24e 25e 26e

Net Int. Margin 1.2 1.2 PE 23 6.0 11.7 Company Peers Company Peers

NPL Ratio 2.0 0.6 PE 24e 6.3 9.8

Cost Income Ratio Equity vs Global Sector

Cost Inc. Ratio 64.4 64.7 PE 25e 6.4 8.4 CY, %, Lower is better 1 year in EUR, %

ROE 10.2 9.9 PB 24e 0.82 0.91 70 20

ROA 0.6 0.71 PB 25e 0.76 0.84

65

Financials 0

USD mn FY 2021 FY 2022 FY 2023e FY 2024e 60

Total Income 36,843 45,591 65,142 65,129 -20

% y/y 3.2 23.7 42.9 - 55 Jul.23 Jan.24

19 20 21 22 23

Net Profit 9,273 13,732 25,595 26,506 Company Index

Company Peers

% y/y 235.5 48.1 86.4 3.6

ROE 7.2 10.2 14.8 13.1 ESG Profile Ratings

+/- 5.0 3.0 4.6 -1.7 4Q22 Consensus

EPS (USD) 0.72 0.74 1.26 1.23

Env. Soc. Buy 17

% y/y 99.4 3.0 70.1 -2.1

UM

ME

DPS (GBp) 18.00 26.00 50.79 65.07

D

DI

IU

ME

Yield % 3.0 4.2 8.3 10.7 Hold 7

Source: Erste Group Research, FactSet Consensus Estimates.

Sell 2

HIGH

Gov.

23

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 24/146

UBS

Switzerland | Financials

Rating: Hold

Prices as of: 13.02.24 Close Price: CHF 24.12

Business Model Price in CHF

UBS Group provides financial services to individuals, corporations and

institutions. UBS is organized into Global Wealth Management, 30

Business Banking, Investment Banking and Asset Management. In

terms of net revenues, the most important markets are: Americas

(41%), Switzerland (22%), rest of Europe (20%), Asia/Pacific (17%). 25

Earnings Update 15.03.2023

UBS achieved a slight decrease in revenues of -2.7% (y/y) to CHF 34.8

billion in 2022. Net interest income decreased by -1.2% (y/y) to CHF

20

6.3 billion, while other revenues (non-interest income) increased by

+1.4% (y/y) to CHF 28.4 billion. Net new money inflows of USD 60

billion were achieved in the investment business. Operating income

totaled CHF 9.2 bn and GAAP net income increased +2.3% to CHF 7.3 15

bn. The company plans to repurchase USD 5 bn of its own shares in

2023.

Rating Rationale Analyst: Stephan Lingnau 10

UBS is expected to achieve a moderate year-on-year decline in net

revenues this year. Operating income and net profit should also decline

slightly. Revenues and profit are not expected to rise again until 2024.

5

2020 2021 2022 2023 2024

UBS 200 DMA 100 DMA

Overview Total Income y/y EPS y/y

Mkt. Cap. mn: EUR 78,899 Next Earnings: 07.05.2024 CY, % CY, %

30 200

Employees: 72,597 Div. Yield 23: 2.1%

Last FY End: 31.12.2023 Div. Yield 24e: 2.9% 20

100

Exchange: SIX Swiss SE 1Y Price Perf.: 20.5% 10

ISIN: CH0244767585 5Y Price Perf.: 85.3% 0

0

Ratios Value -10 -100

(%, CY 23) Comp. Peers (x, CY) Comp. Peers 22 23 24e 25e 26e 22 23 24e 25e 26e

Net Int. Margin 0.5 1.3 PE 23 86.7 6.0 Company Peers Company Peers

NPL Ratio - 2.0 PE 24e 22.5 5.8

Cost Income Ratio Equity vs Global Sector

Cost Inc. Ratio 87.2 51.5 PE 25e 12.0 5.3 CY, %, Lower is better 1 year in EUR, %

ROE 1.3 13.1 PB 24e 1.00 0.57 100 50

ROA 2.0 0.57 PB 25e 0.93 0.52

80

Financials 0

CHF mn FY 2022 FY 2023 FY 2024e FY 2025e 60

Total Income 31,755 34,002 40,738 41,724 -50

% y/y -3.2 7.1 19.8 2.4 40 Jul.23 Jan.24

19 20 21 22 23

Net Profit 7,010 25,267 2,823 6,244 Company Index

Company Peers

% y/y 1.9 260.4 -88.8 121.2

ROE 13.0 - 4.4 7.8 ESG Profile Ratings

+/- 0.2 -13.0 4.4 3.4 4Q22 Consensus

EPS (CHF) 2.07 0.30 1.07 2.01

Env. Soc. Buy 14

% y/y 8.7 -85.4 256.4 87.6

GH

ME

DPS (CHF) 0.50 0.55 0.71 0.75

HI

DIU

M

Yield % 2.9 2.1 2.9 3.1 Hold 9

Source: Erste Group Research, FactSet Consensus Estimates.

Sell 4

HIGH

Gov.

24

For the exclusive use of Erste Group Client. (Erste Group)

Erste Group Research

Major Markets & Credit Research

14.02.2024

Page 25/146

UniCredit

Italy | Financials

Rating: Hold

Prices as of: 13.02.24 Close Price: EUR 29.39

Business Model Price in EUR

UniCredit offers consumer loans, mortgage loans, corporate loans, life

insurance, investment banking, asset management and other services. 35

Regionally, net revenues are generated in Italy (45%), Germany (25%),

Central Europe (17%), Eastern Europe excluding Russia (10%).

Earnings Update 23.08.2023 30

Unicredit benefited from the increase in key interest rates and yields in

fiscal year 2022. Net interest income increased by +17% (y/y) to EUR 25

11 bn. Non-interest income grew by +11% y/y to EUR 10.9 bn. Loan

loss provisions were increased by +25% (y/y). Operating income thus

increased by +114% (y/y) to EUR 6.9 billion in the last fiscal year. 20