Professional Documents

Culture Documents

Semmm

Semmm

Uploaded by

b20fa1209Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Semmm

Semmm

Uploaded by

b20fa1209Copyright:

Available Formats

FIN-449 Төслийн ба компанийг санхүүгийн загварчлал

Monthly mean 2.61% -0.24%

Monthly variance 0.012477 0.010174

Monthly standard

deviation 11.17% 10.09%

Annual mean 31.31% -2.91%

Annual variance 0.149726 0.12209

Annual standard

deviation 38.69% 34.94%

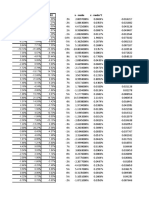

date AAPL Google AAPL Google Product

2/Jul/07 7.66% 10.74% 0.0505 0.1098 0.0055

1/Aug/07 4.97% -7.47% 0.0236 (0.0723) (0.0017)

4/Sep/07 10.28% -1.13% 0.0767 (0.0089) (0.0007)

1/Oct/07 21.33% -14.03% 0.1872 (0.1379) (0.0258)

1/Nov/07 -4.15% 4.91% (0.0676) 0.0515 (0.0035)

3/Dec/07 8.35% 10.97% 0.0574 0.1121 0.0064

2/Jan/08 -38.07% -17.58% (0.4068) (0.1734) 0.0705

1/Feb/08 -7.95% 4.37% (0.1056) 0.0461 (0.0049)

3/Mar/08 13.79% 2.81% 0.1118 0.0305 0.0034

1/Apr/08 19.24% 7.55% 0.1663 0.0779 0.0130

1/May/08 8.17% 4.44% 0.0556 0.0468 0.0026

2/Jun/08 -11.98% -2.15% (0.1459) (0.0191) 0.0028

1/Jul/08 -5.20% -1.07% (0.0781) (0.0083) 0.0006

1/Aug/08 6.44% -6.66% 0.0383 (0.0642) (0.0025)

2/Sep/08 -39.98% 9.93% (0.4259) 0.1017 (0.0433)

1/Oct/08 -5.49% -15.46% (0.0810) (0.1522) 0.0123

3/Nov/08 -14.93% -15.56% (0.1754) (0.1532) 0.0269

1/Dec/08 -8.23% 7.45% (0.1084) 0.0769 (0.0083)

2/Jan/09 5.45% -8.59% 0.0284 (0.0835) (0.0024)

2/Feb/09 -0.91% 8.75% (0.0352) 0.0899 (0.0032)

2/Mar/09 16.30% 7.93% 0.1369 0.0817 0.0112

1/Apr/09 17.98% 7.58% 0.1537 0.0782 0.0120

1/May/09 7.63% -7.37% 0.0502 (0.0713) (0.0036)

1/Jun/09 4.76% 0.59% 0.0215 0.0083 0.0002

1/Jul/09 13.73% 15.69% 0.1112 0.1593 0.0177

3/Aug/09 2.91% -6.15% 0.0030 (0.0591) (0.0002)

1/Sep/09 9.70% -8.38% 0.0709 (0.0814) (0.0058)

1/Oct/09 1.69% -7.81% (0.0092) (0.0757) 0.0007

2/Nov/09 5.88% -7.14% 0.0327 (0.0690) (0.0023)

1/Dec/09 5.27% -4.12% 0.0266 (0.0388) (0.0010)

4/Jan/10 -9.28% -4.96% (0.1189) (0.0472) 0.0056

1/Feb/10 6.33% -1.04% 0.0372 (0.0080) (0.0003)

1/Mar/10 13.84% -5.23% 0.1123 (0.0499) (0.0056)

1/Apr/10 10.53% -12.90% 0.0792 (0.1266) (0.0100)

3/May/10 -1.63% -2.94% (0.0424) (0.0270) 0.0011

1/Jun/10 -2.10% 0.16% (0.0471) 0.0040 (0.0002)

1/Jul/10 2.25% -9.56% (0.0036) (0.0932) 0.0003

2/Aug/10 -5.66% -4.89% (0.0827) (0.0465) 0.0038

1/Sep/10 15.46% 20.43% 0.1285 0.2067 0.0266

1/Oct/10 5.90% 10.84% 0.0329 0.1108 0.0036

1/Nov/10 3.32% 14.56% 0.0071 0.1480 0.0011

1/Dec/10 3.60% 2.23% 0.0099 0.0247 0.0002

3/Jan/11 5.07% 10.54% 0.0246 0.1078 0.0027

1/Feb/11 4.01% 10.69% 0.0140 0.1093 0.0015

1/Mar/11 -1.34% -1.98% (0.0395) (0.0174) 0.0007

1/Apr/11 0.46% -26.53% (0.0215) (0.2629) 0.0056

2/May/11 -0.66% 6.74% (0.0327) 0.0698 (0.0023)

1/Jun/11 -3.56% 18.03% (0.0617) 0.1827 (0.0113)

1/Jul/11 15.12% 20.32% 0.1251 0.2056 0.0257

1/Aug/11 -1.46% 0.22% (0.0407) 0.0046 (0.0002)

1/Sep/11 -0.92% 2.00% (0.0353) 0.0224 (0.0008)

3/Oct/11 5.97% -22.02% 0.0336 (0.2178) (0.0073)

1/Nov/11 -5.74% -9.62% (0.0835) (0.0938) 0.0078

1/Dec/11 5.79% -1.02% 0.0318 (0.0078) (0.0002)

3/Jan/12 11.97% 2.46% 0.0936 0.0270 0.0025

1/Feb/12 17.25% -4.86% 0.1464 (0.0462) (0.0068)

1/Mar/12 10.01% -5.48% 0.0740 (0.0524) (0.0039)

2/Apr/12 -2.63% -2.84% (0.0524) (0.0260) 0.0014

1/May/12 -1.08% -1.92% (0.0369) (0.0168) 0.0006

1/Jun/12 1.08% 10.96% (0.0153) 0.1120 (0.0017)

Average 2.61% -0.24%

Variance 0.012477 0.010174 Covariance computation

Standard deviation 0.111701 0.100867 0.0020

0.111701 0.100867 0.001956

0.001956

0.012269 0.010005 0.001989

0.110766 0.100023 0.001989

0.110766 0.100023

Correlation computation

0.176535

0.176535

0.176535

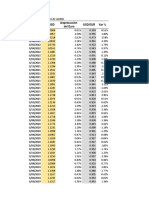

CALCULATING THE MEAN AND STANDARD DEVIATION OF A PORTFOLIO

Proportion of AAPL 0.5

Proportion of GooG 0.5

date AAPL Google Portfolio return Assets returns AAPL

2/Jul/07 7.66% 10.74% 0.092 Mean return 2.61%

1/Aug/07 4.97% -7.47% -0.0125 Variance 0.012477

4/Sep/07 10.28% -1.13% 0.04575 Standard dev 0.111701

1/Oct/07 21.33% -14.03% 0.0365 Covariance 0.001989

1/Nov/07 -4.15% 4.91% 0.0038

Portfolio mean

3/Dec/07 8.35% 10.97% 0.0966 return

2/Jan/08 -38.07% -17.58% -0.27825 0.011831

1/Feb/08 -7.95% 4.37% -0.0179 0.011831

Portfolio return

3/Mar/08 13.79% 2.81% 0.083 variance

1/Apr/08 19.24% 7.55% 0.13395 0.006657

1/May/08 8.17% 4.44% 0.06305 0.006657

Portfolio return

2/Jun/08 -11.98% -2.15% -0.07065 standard dev

1/Jul/08 -5.20% -1.07% -0.03135 0.081592

1/Aug/08 6.44% -6.66% -0.0011 0.081592

2/Sep/08 -39.98% 9.93% -0.15025

1/Oct/08 -5.49% -15.46% -0.10475

3/Nov/08 -14.93% -15.56% -0.15245

1/Dec/08 -8.23% 7.45% -0.0039

2/Jan/09 5.45% -8.59% -0.0157

2/Feb/09 -0.91% 8.75% 0.0392

2/Mar/09 16.30% 7.93% 0.12115

1/Apr/09 17.98% 7.58% 0.1278

1/May/09 7.63% -7.37% 0.0013

1/Jun/09 4.76% 0.59% 0.02675

1/Jul/09 13.73% 15.69% 0.1471

3/Aug/09 2.91% -6.15% -0.0162

1/Sep/09 9.70% -8.38% 0.0066

1/Oct/09 1.69% -7.81% -0.0306

2/Nov/09 5.88% -7.14% -0.0063

1/Dec/09 5.27% -4.12% 0.00575

4/Jan/10 -9.28% -4.96% -0.0712

1/Feb/10 6.33% -1.04% 0.02645

1/Mar/10 13.84% -5.23% 0.04305

1/Apr/10 10.53% -12.90% -0.01185

3/May/10 -1.63% -2.94% -0.02285

1/Jun/10 -2.10% 0.16% -0.0097

1/Jul/10 2.25% -9.56% -0.03655

2/Aug/10 -5.66% -4.89% -0.05275

1/Sep/10 15.46% 20.43% 0.17945

1/Oct/10 5.90% 10.84% 0.0837

1/Nov/10 3.32% 14.56% 0.0894

1/Dec/10 3.60% 2.23% 0.02915

3/Jan/11 5.07% 10.54% 0.07805

1/Feb/11 4.01% 10.69% 0.0735

1/Mar/11 -1.34% -1.98% -0.0166

1/Apr/11 0.46% -26.53% -0.13035

2/May/11 -0.66% 6.74% 0.0304

1/Jun/11 -3.56% 18.03% 0.07235

1/Jul/11 15.12% 20.32% 0.1772

1/Aug/11 -1.46% 0.22% -0.0062

1/Sep/11 -0.92% 2.00% 0.0054

3/Oct/11 5.97% -22.02% -0.08025

1/Nov/11 -5.74% -9.62% -0.0768

1/Dec/11 5.79% -1.02% 0.02385

3/Jan/12 11.97% 2.46% 0.07215

1/Feb/12 17.25% -4.86% 0.06195

1/Mar/12 10.01% -5.48% 0.02265

2/Apr/12 -2.63% -2.84% -0.02735

1/May/12 -1.08% -1.92% -0.015

1/Jun/12 1.08% 10.96% 0.0602

GOOG

-0.24%

0.010174

0.100867

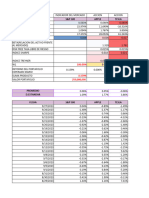

CALCULATING THE STANDARD DEVIATION OF PORTFOLIO

Asset returns AAPL GOOG

Mean return 0.02609 -0.002428

Variance 0.012477 0.010174

Standard dev 0.111701 0.100867

Covariance 0.001989

Proportion of AAPL 0.5

Portfolio mean return 0.011831

Portfolio return variance 0.006657

Portfolio return st.dev 0.081592

0.081592 0.011831

-0.5 -0.5

-0.4 -0.4

-0.3 -0.3

-0.2 -0.2

-0.1 -0.1

0 0

0.1 0.1

0.2 0.2

0.3 0.3

0.4 0.4

0.5 0.5

0.6 0.6

0.7 0.7

0.8 0.8

0.9 0.9

1 1

1.1 1.1

1.2 1.2

1.3 1.3

1.4 1.4

1.5 1.5

1.6 1.6

You might also like

- Modern Business Statistics With Microsoft Excel 6th Edition Anderson Test BankDocument52 pagesModern Business Statistics With Microsoft Excel 6th Edition Anderson Test Bankjonathanstewartrgnoexczkf100% (13)

- Business Statistics 10th Edition Groebner Solutions ManualDocument36 pagesBusiness Statistics 10th Edition Groebner Solutions Manualswellishhonorer.fem0dz100% (44)

- FinanceDocument22 pagesFinanceMemo NerNo ratings yet

- Assignment Regression Beta 03Document5 pagesAssignment Regression Beta 03John DummiNo ratings yet

- Date Nifty 50 Index Stock (Wipro) RM - (C) Stock Return - (Y) RF Stock Return-RfDocument5 pagesDate Nifty 50 Index Stock (Wipro) RM - (C) Stock Return - (Y) RF Stock Return-RfJohn DummiNo ratings yet

- Beta Computation of Six Bse Stock CompaniesDocument6 pagesBeta Computation of Six Bse Stock CompaniesNandini BhotikaNo ratings yet

- Currency (Yearly) TrendDocument3 pagesCurrency (Yearly) Trendismun nadhifahNo ratings yet

- HC Investimentos - Como Calcular A Correlação Entre InvestimentosDocument7 pagesHC Investimentos - Como Calcular A Correlação Entre InvestimentosMario Sergio GouveaNo ratings yet

- HC Investimentos IBOV SMLL DiversificaçãoDocument7 pagesHC Investimentos IBOV SMLL DiversificaçãoFabiano MorattiNo ratings yet

- Beta Management SolutionDocument5 pagesBeta Management SolutionMuhammad IlyasNo ratings yet

- Template Data Harga SahamDocument3 pagesTemplate Data Harga SahamAsep AlipudinNo ratings yet

- HC Investimentos - HedgeDocument11 pagesHC Investimentos - HedgeFabiano MorattiNo ratings yet

- Exp 12 MesesDocument2 pagesExp 12 Mesesmaricelly.rincon.pNo ratings yet

- Fecha S&P 500 LN S&P 500 ABT LN Abt Valor NasvDocument12 pagesFecha S&P 500 LN S&P 500 ABT LN Abt Valor NasvKaren Xiomara Galeano ContrerasNo ratings yet

- Datos de Econometria Timepo de Negociacion 3 MesesDocument2 pagesDatos de Econometria Timepo de Negociacion 3 Mesesmaricelly.rincon.pNo ratings yet

- Ifi 5Document334 pagesIfi 5MARCO DAVID COPATITI ULURINo ratings yet

- Advanced Corporate Finance (ACF) : Bharti Airtel Ltd. NTPC Ltd. Sun Pharmaceutical LTDDocument4 pagesAdvanced Corporate Finance (ACF) : Bharti Airtel Ltd. NTPC Ltd. Sun Pharmaceutical LTDJayesh PurohitNo ratings yet

- Comm Float Minors Volatility AnalysisDocument818 pagesComm Float Minors Volatility AnalysisKoushik SenNo ratings yet

- Date Adj Close CCR CCR Adj Close CCR CCR CCRDocument17 pagesDate Adj Close CCR CCR Adj Close CCR CCR CCRRanjith KumarNo ratings yet

- Think RenewableDocument64 pagesThink RenewableWilliamNo ratings yet

- Price and Return Data For Walmart (WMT) and Target (TGT)Document8 pagesPrice and Return Data For Walmart (WMT) and Target (TGT)Raja17No ratings yet

- Date Close Returns Average Variance Sum Variance Count Variance StdevDocument13 pagesDate Close Returns Average Variance Sum Variance Count Variance StdevChinmmayya HajareNo ratings yet

- Copia de EjercicioDocument6 pagesCopia de EjercicioWilson Jose Soto De LeonNo ratings yet

- Fin RatiosDocument7 pagesFin Ratiosakankshag_13No ratings yet

- Chapter 12Document17 pagesChapter 12Faisal SiddiquiNo ratings yet

- Sesión 01Document5 pagesSesión 01MARIA NAYELI TORVISCO AGUILARNo ratings yet

- 1 Year Beta Calculated Using Weekly DataDocument9 pages1 Year Beta Calculated Using Weekly Datatopeq100% (1)

- Beta Gpo ArgosDocument56 pagesBeta Gpo Argoscamilo godoyNo ratings yet

- Date S&P500 Aapl MSFT BAC XOM PFE Correlation MatrixDocument14 pagesDate S&P500 Aapl MSFT BAC XOM PFE Correlation MatrixZeynep DerinözNo ratings yet

- Macro EstadisticasDocument61 pagesMacro EstadisticasRodolfo Alejandro CRUZ CANIZALESNo ratings yet

- Currency (Weekly) TrendDocument3 pagesCurrency (Weekly) Trendismun nadhifahNo ratings yet

- Average Monthly Returns: Date S&P 500 3 Month T-Bill RJR HasbroDocument16 pagesAverage Monthly Returns: Date S&P 500 3 Month T-Bill RJR HasbroKing CheungNo ratings yet

- Taller Riesgo FroDocument41 pagesTaller Riesgo FroSHARON ARANGONo ratings yet

- EjercicioDocument6 pagesEjercicioWilson Jose Soto De LeonNo ratings yet

- Midterm - Invest & Port MGTDocument11 pagesMidterm - Invest & Port MGTMohamed HelmyNo ratings yet

- Ta2 1-3Document12 pagesTa2 1-3Marcelo DelgadilloNo ratings yet

- TCDL c8Document11 pagesTCDL c8ThoanNo ratings yet

- اسايمنت المحافظ معاوية مسلمانيDocument25 pagesاسايمنت المحافظ معاوية مسلمانيMemo NerNo ratings yet

- Mercado de CapitalesDocument18 pagesMercado de CapitalesDanisa Isabel Osorio BelmarNo ratings yet

- Empresa: Ferrari Ferrari S&P RF RM Probabilidad P (RF) P (RM)Document4 pagesEmpresa: Ferrari Ferrari S&P RF RM Probabilidad P (RF) P (RM)Ribaul DiazNo ratings yet

- Date HP - Price SP500 - Price T-Bills (Adj. Close) (Adj. Close) (%, APR) Stock Return Excess Return HP Market Index HP Market IndexDocument16 pagesDate HP - Price SP500 - Price T-Bills (Adj. Close) (Adj. Close) (%, APR) Stock Return Excess Return HP Market Index HP Market IndexAlfieNo ratings yet

- IAPM Report 3 Calculations With Supporting Data For Portfolio and Benchmark Variance Calculations UpdatedDocument17 pagesIAPM Report 3 Calculations With Supporting Data For Portfolio and Benchmark Variance Calculations UpdatedAYUSHI NAGARNo ratings yet

- ProjectDocument14 pagesProjectSameer BhattaraiNo ratings yet

- Latihan CAPM CALDocument6 pagesLatihan CAPM CALanwarchoiNo ratings yet

- BTC RelationshipsDocument522 pagesBTC RelationshipsNaresh KumarNo ratings yet

- Grasim Industries LTD.: Group HeadDocument4 pagesGrasim Industries LTD.: Group Headsanchit bhasinNo ratings yet

- Accounts (A), Case #KE1056Document25 pagesAccounts (A), Case #KE1056Amit AdmuneNo ratings yet

- Converting Into Decimal Return Till Dec 2015 Date VBTLX Vfiax Date VBTLX VfiaxDocument4 pagesConverting Into Decimal Return Till Dec 2015 Date VBTLX Vfiax Date VBTLX VfiaxShNo ratings yet

- Converting Into Decimal Return Till Dec 2015 Date VBTLX Vfiax Date VBTLX VfiaxDocument4 pagesConverting Into Decimal Return Till Dec 2015 Date VBTLX Vfiax Date VBTLX VfiaxShNo ratings yet

- Converting Into Decimal Return Till Dec 2015 Date VBTLX Vfiax Date VBTLX VfiaxDocument4 pagesConverting Into Decimal Return Till Dec 2015 Date VBTLX Vfiax Date VBTLX VfiaxShNo ratings yet

- MMult Function and Demo of ROIDocument6 pagesMMult Function and Demo of ROIJITESHNo ratings yet

- Chapter 3 CovarianceDocument4 pagesChapter 3 CovarianceGovind SinghNo ratings yet

- Nedl ArchDocument147 pagesNedl ArchMichaelNo ratings yet

- Date Gilat Satellite Networks CENTURYLINK INC S&P 500 3 Month T BillDocument3 pagesDate Gilat Satellite Networks CENTURYLINK INC S&P 500 3 Month T BillNiyati ShahNo ratings yet

- Date Microsoft General Motors Delta Air Lines Walmart PfizerDocument11 pagesDate Microsoft General Motors Delta Air Lines Walmart PfizerNiyati ShahNo ratings yet

- Date Nifty RT Max Min Bin WidthDocument26 pagesDate Nifty RT Max Min Bin Widthnikomaso tesNo ratings yet

- Portfolio Support FileDocument9 pagesPortfolio Support FileAbhinav KumarNo ratings yet

- DATOS DE ECONOMETRIA 1 MesDocument3 pagesDATOS DE ECONOMETRIA 1 Mesmaricelly.rincon.pNo ratings yet

- Date Nifty RT Max Min Bin WidthDocument26 pagesDate Nifty RT Max Min Bin WidthIndira ChoudharyNo ratings yet

- T2 Rodriguez Valladares JuniorDocument4 pagesT2 Rodriguez Valladares JuniorRosa AzabacheNo ratings yet

- 3) LabS 03 2023 First Part - RIFATTADocument11 pages3) LabS 03 2023 First Part - RIFATTAgiovanni lazzeriNo ratings yet

- Full Ebook of R Data Analysis Without Programming Explanation and Interpretation 2Nd Edition David W Gerbing Online PDF All ChapterDocument69 pagesFull Ebook of R Data Analysis Without Programming Explanation and Interpretation 2Nd Edition David W Gerbing Online PDF All Chapterroberttravers539140100% (6)

- Assignment ANOVADocument21 pagesAssignment ANOVAsuhaimi sobrieNo ratings yet

- Experimental Psychology Chapter 15 Flashcards - QuizletDocument4 pagesExperimental Psychology Chapter 15 Flashcards - QuizletPie MacailingNo ratings yet

- 4.analyze 184Document49 pages4.analyze 184lucky prajapatiNo ratings yet

- Population Estimation of Rice Grains Via Mark-Recapture MethodDocument11 pagesPopulation Estimation of Rice Grains Via Mark-Recapture MethodSophia Lorraine TendenillaNo ratings yet

- IB Biology StatisticsDocument11 pagesIB Biology StatisticsChanan100% (1)

- DEV Lab ManualDocument55 pagesDEV Lab Manualpalaniappan.cseNo ratings yet

- Allama Iqbal Open University, Islamabad (Department of Statistics) WarningDocument3 pagesAllama Iqbal Open University, Islamabad (Department of Statistics) WarningMaryam AminNo ratings yet

- Inferential StatisticsDocument28 pagesInferential Statisticsadityadhiman100% (3)

- Chap013 Test BankDocument7 pagesChap013 Test Banksayed7777No ratings yet

- Design of Experiments WorkshopDocument13 pagesDesign of Experiments WorkshopAlex Wuil MuñozNo ratings yet

- Chapter 05 Pratice Sheet SolutionDocument4 pagesChapter 05 Pratice Sheet Solutionstudent.devyankgosainNo ratings yet

- Audit Sampling For Tests of Controls and Substantive Tests of TransactionsDocument40 pagesAudit Sampling For Tests of Controls and Substantive Tests of TransactionssusilawatiNo ratings yet

- Hypothesis Testing With Two SamplesDocument43 pagesHypothesis Testing With Two SamplesPavithraNo ratings yet

- CHEM-205 Analytical Chemistry-I: AnovaDocument20 pagesCHEM-205 Analytical Chemistry-I: AnovaTanya DilshadNo ratings yet

- Scoring Key and Interpretation Norms RPMDocument5 pagesScoring Key and Interpretation Norms RPMEmotion JarNo ratings yet

- (Download PDF) Essentials of Statistics For The Behavioral Sciences Frederick J Gravetter Online Ebook All Chapter PDFDocument42 pages(Download PDF) Essentials of Statistics For The Behavioral Sciences Frederick J Gravetter Online Ebook All Chapter PDFtracy.freeman31794% (17)

- FINALTERM Mth302 Solved by Chanda Rehman Paper No19Document9 pagesFINALTERM Mth302 Solved by Chanda Rehman Paper No19Noor Khan KNo ratings yet

- Introduction To Econometrics, 5 Edition: Chapter 4: Nonlinear Models and Transformations of VariablesDocument24 pagesIntroduction To Econometrics, 5 Edition: Chapter 4: Nonlinear Models and Transformations of VariablesRamarcha KumarNo ratings yet

- Examples of MCQ - ECVPHDocument3 pagesExamples of MCQ - ECVPHM7md AllahhamNo ratings yet

- NAVEED StatisticsDocument4 pagesNAVEED Statisticsyusha habibNo ratings yet

- Marketing AspectDocument14 pagesMarketing Aspectmeara_julian100% (2)

- My Courses: Home UGRD-GE6114-2113T Week 10: Midterm Examination Midterm ExamDocument11 pagesMy Courses: Home UGRD-GE6114-2113T Week 10: Midterm Examination Midterm ExamMiguel Angelo GarciaNo ratings yet

- Statistical TreatmentDocument7 pagesStatistical TreatmentIvy Frias JapaNo ratings yet

- Statistics and Machine LearningDocument51 pagesStatistics and Machine LearningARCHANA RNo ratings yet

- Fit Symbol 50H8/d9 100H7/ 60 /h12Document21 pagesFit Symbol 50H8/d9 100H7/ 60 /h12Prajwal ShakyaNo ratings yet

- Real Statistics Examples ANOVA 1Document317 pagesReal Statistics Examples ANOVA 1MeNo ratings yet

- Regression Analysis A Practical Introduction CompressDocument363 pagesRegression Analysis A Practical Introduction CompressAgung IbrahimNo ratings yet