Professional Documents

Culture Documents

Audit 7

Audit 7

Uploaded by

batistillenieOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit 7

Audit 7

Uploaded by

batistillenieCopyright:

Available Formats

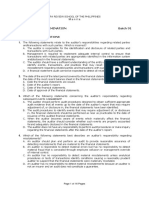

1.

Which of the following characteristics MOST likely would heighten an auditor's concern about the risk of

intentional manipulation of financial statements?

A. Turnover of senior accounting personnel is low.

B. The rate of change in the entity's industry is slow

C. Insiders recently purchased additional shares of the entity's stock.

D. Management places substantial emphasis on meeting earnings projections.

2. When an identified misstatement may be indicative of fraud, the auditor considers the implications of the

misstatement in relation to other aspects of the audit, particularly the

A. reliability of management representations.

B. adequacy of financial statement disclosures.

C. opinion presented in the financial statements.

D. amount of audit fees documented in the engagement letter.

3. The most difficult type of cash defalcation for the auditor to detect is that which occurs

A. in amounts under P 100.

B. before the cash is recorded.

C. out of the balance kept in the cash register.

D. after cash is recorded but before it goes to the bank.

4. The MOST LIKELY explanation why the auditor's examination cannot reasonably be expected to bring all illegal

acts by the client to the auditor's attention is that

A. illegal acts are perpetrated by management override of internal accounting controls.

B. illegal acts by clients often relate to operating aspects rather than accounting aspects.

C. the client's system of internal accounting control may be so strong that the auditor performs only minimal

substantive testing.

D. illegal acts may be perpetrated by the only person in the client's organization with access to both assets

and the accounting records.

5. If the auditor suspects that members of senior management, including members of the board of directors, are

involved in noncompliance to laws as regulations, and he believes his report may not be acted upon, he would

A. do nothing.

B. issue a disclaimer of opinion.

C. consider seeking legal advice.

D. make special investigation in order to fully determine the extent of client's noncompliance.

6. An auditor concludes that a client has committed an illegal act that has not been properly accounted for or

disclosed. The auditor should withdraw from the engagement if the

A. client refuses to accept the auditor's report as modified for the illegal act.

B. illegal act has an effect on the financial statements that is both material and direct.

C. auditor is precluded from obtaining sufficient competent evidence about the illegal act.

D. auditor cannot reasonably estimate the effect of the illegal act on the financial statements.

7. An auditor who finds that the client has committed an illegal act would be most likely to withdraw from the

engagement when the

A. illegal act has received widespread publicity.

B. illegal act has material financial statement implications.

C. illegal act affects auditor's ability to rely on management representations.

D. auditor cannot reasonably estimate the effect of the illegal act on the financial statements.

Planning & risk assessment

8. The senior auditor responsible for coordinating the field work usually schedules a pre-audit conference with the

audit team primarily to

A. provide an opportunity to document staff disagreements regarding technical issues.

B. give guidance to the staff regarding both technical and personnel aspects of the audit.

C. discuss staff suggestions concerning the establishment and maintenance of time budgets.

D. discuss staff suggestions concerning the establishment and maintenance of time budgets.

9. The audit risk model is used primarily

A. while doing tests of controls.

B. to determine the type of opinion to express.

C. to evaluate the evidence which has been gathered.

D. for planning purposes in determining how much evidence to accumulate.

10. Auditors appear NOT to exhibit due audit care if there was a

A. high audit risk C. low control risk

B. high inherent risk D. low detection risk

You might also like

- Mid Term Exam in ClassDocument34 pagesMid Term Exam in Classaliza tharaniNo ratings yet

- CHECK LIST BRCGS V9 (Español)Document104 pagesCHECK LIST BRCGS V9 (Español)Coper CPerúNo ratings yet

- 09 Fraud, Error and Non-ComplianceDocument5 pages09 Fraud, Error and Non-ComplianceEdwina Cornel100% (1)

- PRTC - AT4 - Audit of Financial StatementsDocument3 pagesPRTC - AT4 - Audit of Financial Statementselle86867% (3)

- Internal Audit ManualDocument92 pagesInternal Audit Manualdhuvadpratik100% (9)

- Quiz 1 Auditor's ResponsibilityDocument10 pagesQuiz 1 Auditor's ResponsibilityLiane Angelo Acero100% (1)

- First PreboardDocument5 pagesFirst PreboardRodmae VersonNo ratings yet

- 5ATDocument3 pages5ATPaula Mae DacanayNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument31 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoKaisher JaomeNo ratings yet

- Audtbans 5Document7 pagesAudtbans 5John DoesNo ratings yet

- At 07 FS Audit Process Audit Planning 1Document4 pagesAt 07 FS Audit Process Audit Planning 1Michael Oliver ApolongNo ratings yet

- Psa Challenge2-DoneDocument15 pagesPsa Challenge2-DoneclarencerclacioNo ratings yet

- AT Q1 Pre-Week - MAY 2019Document17 pagesAT Q1 Pre-Week - MAY 2019Aj Pacaldo100% (3)

- Auditing Theory Mcqs by Salosagcol With AnswersDocument50 pagesAuditing Theory Mcqs by Salosagcol With AnswersAnthony Koko CarlobosNo ratings yet

- AUD Review 10234Document4 pagesAUD Review 10234PachiNo ratings yet

- Review Materials For Auditing Theory: Multiple Choice QuestionsDocument16 pagesReview Materials For Auditing Theory: Multiple Choice QuestionsDanica PelenioNo ratings yet

- DocxDocument30 pagesDocxrandomlungs121223No ratings yet

- Auditing Theory Mcqs by Salosagcol With AnswersDocument31 pagesAuditing Theory Mcqs by Salosagcol With AnswersLeonard Cañamo100% (1)

- Aud ThEORY 2nd PreboardDocument11 pagesAud ThEORY 2nd PreboardJeric TorionNo ratings yet

- AT ReviewerDocument10 pagesAT Reviewerfer maNo ratings yet

- 5 Audit PlanningDocument53 pages5 Audit PlanningrogealynNo ratings yet

- Aud ThEORY - 2nd PreboardDocument11 pagesAud ThEORY - 2nd PreboardKim Cristian MaañoNo ratings yet

- MPC kiểm toánDocument9 pagesMPC kiểm toánDANH LÊ VĂNNo ratings yet

- SVC Review - Errors Fraud and NoclarDocument8 pagesSVC Review - Errors Fraud and Noclarduguitjinky20.svcNo ratings yet

- DQAT2Document7 pagesDQAT2Kurt dela TorreNo ratings yet

- At 4Document2 pagesAt 4Christopher PriceNo ratings yet

- Asuprin Activity Worksheet: Compiled By: A. S. MALQUISTODocument5 pagesAsuprin Activity Worksheet: Compiled By: A. S. MALQUISTOLynNo ratings yet

- At Final Pre BoardDocument4 pagesAt Final Pre BoardAira Mae CachoNo ratings yet

- Auditing Theory Mcqs by Salosagcol With AnswersDocument31 pagesAuditing Theory Mcqs by Salosagcol With AnswersCharilyn RemigioNo ratings yet

- 1-30 48Document7 pages1-30 48niki2cyreneNo ratings yet

- Auditing Theory 2013Document28 pagesAuditing Theory 2013James Rythe MisercordiaNo ratings yet

- AT ComprehensiveDocument15 pagesAT ComprehensiveXulian ChanNo ratings yet

- Audtg421 Week1-3 ULOa-b RationalizationDocument23 pagesAudtg421 Week1-3 ULOa-b RationalizationJohn Rich GamasNo ratings yet

- Prof. Falsado Online SeatworkDocument9 pagesProf. Falsado Online SeatworkMarian Grace DelapuzNo ratings yet

- Audit PlanningDocument12 pagesAudit Planninginto the unknownNo ratings yet

- Midterm Exam EnjoyDocument14 pagesMidterm Exam EnjoygarciarhodjeannemarthaNo ratings yet

- At WileyDocument9 pagesAt WileyAldonNo ratings yet

- Auditing Theory ComprehensiveDocument14 pagesAuditing Theory ComprehensiveMary GarciaNo ratings yet

- Auditing Theory Comprehensive Exam - Jan2021Document16 pagesAuditing Theory Comprehensive Exam - Jan2021Aireen MacapangalNo ratings yet

- Gov Midterm1 2 3Document61 pagesGov Midterm1 2 3ctremaine072820No ratings yet

- Aaconapps2 00-C91pb2aDocument21 pagesAaconapps2 00-C91pb2aJane DizonNo ratings yet

- AUD Final Preboard Examination QuestionnaireDocument16 pagesAUD Final Preboard Examination QuestionnaireJoris YapNo ratings yet

- 409 Exam 2Document45 pages409 Exam 2Amber HigginbothamNo ratings yet

- AUDITING THEORY - Review MaterialsDocument5 pagesAUDITING THEORY - Review MaterialsorehuelajdNo ratings yet

- Auditing Theory Mcqs by Salosagcol With Answers CompressDocument37 pagesAuditing Theory Mcqs by Salosagcol With Answers CompressShaina BustosNo ratings yet

- AUDIT HERORY QUIZ-2-Answer-Key PDFDocument3 pagesAUDIT HERORY QUIZ-2-Answer-Key PDF시나50% (2)

- May 2019 First PBDocument6 pagesMay 2019 First PBRandy PaderesNo ratings yet

- Second Preboards in Auditing - FinalDocument9 pagesSecond Preboards in Auditing - FinalROMAR A. PIGANo ratings yet

- Bsac303 Final Examination - RoldanDocument16 pagesBsac303 Final Examination - RoldanJheraldinemae RoldanNo ratings yet

- Uts Auditing 1 Marselisa NinditoDocument2 pagesUts Auditing 1 Marselisa NinditoEko BudiNo ratings yet

- ACT1207 Review of Audit ProcessDocument8 pagesACT1207 Review of Audit Processantonioregina000No ratings yet

- Introduction To Financial Statements AuditDocument6 pagesIntroduction To Financial Statements AuditMadelyn Jane IgnacioNo ratings yet

- Professional Responsibilities (AUD THEO)Document5 pagesProfessional Responsibilities (AUD THEO)Francine HollerNo ratings yet

- Second Preboards in Auditing - Answer KeyDocument15 pagesSecond Preboards in Auditing - Answer KeyROMAR A. PIGANo ratings yet

- Seatwork Answer KeyDocument6 pagesSeatwork Answer KeyKathreen Aya Exconde100% (1)

- AT Preweek B93 - QuestionnaireDocument16 pagesAT Preweek B93 - QuestionnaireSilver LilyNo ratings yet

- At 5915 Other Psas and PapssDocument11 pagesAt 5915 Other Psas and PapssMichael Brian TorresNo ratings yet

- Auditing - First Preboard QuestionnaireDocument11 pagesAuditing - First Preboard QuestionnairewithyouidkNo ratings yet

- Auditing Exam 1 MultipleDocument65 pagesAuditing Exam 1 MultipleChristian Dalos100% (1)

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Apa 6Document1 pageApa 6batistillenieNo ratings yet

- Aap 6Document2 pagesAap 6batistillenieNo ratings yet

- Poa 8Document2 pagesPoa 8batistillenieNo ratings yet

- Audit 22Document1 pageAudit 22batistillenieNo ratings yet

- Audit 19Document1 pageAudit 19batistillenieNo ratings yet

- Audit 8Document1 pageAudit 8batistillenieNo ratings yet

- Cis 11Document2 pagesCis 11batistillenieNo ratings yet

- Audit 6Document2 pagesAudit 6batistillenieNo ratings yet

- Audit 5Document1 pageAudit 5batistillenieNo ratings yet

- Audit 4Document2 pagesAudit 4batistillenieNo ratings yet

- Note Osha Chapter 5Document5 pagesNote Osha Chapter 5FrancisNo ratings yet

- Enron Corporation and Andersen LlP Đã Chuyển Đổi 1Document17 pagesEnron Corporation and Andersen LlP Đã Chuyển Đổi 1Kim NguyenNo ratings yet

- Certificate of Appearance.01Document24 pagesCertificate of Appearance.01sheena labaoNo ratings yet

- Introduction To CISADocument13 pagesIntroduction To CISAefficiencyomanNo ratings yet

- Influence of Human Resources Competency and Prevention of Fraud Against The Quality of Government Financial Statements in Gorontalo ProvinceDocument6 pagesInfluence of Human Resources Competency and Prevention of Fraud Against The Quality of Government Financial Statements in Gorontalo ProvinceInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Environmental Consultant Scope of Work - FinalDocument10 pagesEnvironmental Consultant Scope of Work - FinalborrowmanaNo ratings yet

- An Internship Report On International Financial Reporting Standards (IFRS) Practices and Its Implementation at BRAC UniversityDocument37 pagesAn Internship Report On International Financial Reporting Standards (IFRS) Practices and Its Implementation at BRAC UniversityShahid MahmudNo ratings yet

- HR Application Owner & Project ManagerDocument4 pagesHR Application Owner & Project ManagerAnkur HalderNo ratings yet

- Varun Wadhwa: Mobile: 9468291877 Address: House No-756, Sec-22, Faridabad EmailDocument4 pagesVarun Wadhwa: Mobile: 9468291877 Address: House No-756, Sec-22, Faridabad Emailvarun wadhwaNo ratings yet

- Auditing The RPA Environment - FinalDocument13 pagesAuditing The RPA Environment - FinalVikram ThoratNo ratings yet

- Astm E1212-99Document5 pagesAstm E1212-99Carlos Raul Caballero LeonNo ratings yet

- Auditor Changes and Discretionary Accruals DeFond and Subramanyam 1998Document33 pagesAuditor Changes and Discretionary Accruals DeFond and Subramanyam 1998goyal mitraNo ratings yet

- 21MonthsEvaluationlReportforGOAVision2018asatDec2014 PDFDocument25 pages21MonthsEvaluationlReportforGOAVision2018asatDec2014 PDFGlory Outreach AssemblyNo ratings yet

- Village Development Committee - Capacity Assessment ToolDocument36 pagesVillage Development Committee - Capacity Assessment ToolDejan Šešlija100% (2)

- Software Quality Assurance Activities Software Project Management Computer Science Software Engineering - 1626431126394Document5 pagesSoftware Quality Assurance Activities Software Project Management Computer Science Software Engineering - 1626431126394AsheberNo ratings yet

- Gaurav Goel Gurgaon 5.00 YrsDocument3 pagesGaurav Goel Gurgaon 5.00 YrsJoke ScrapperNo ratings yet

- Windows Azure Hipaa Implementation GuidanceDocument7 pagesWindows Azure Hipaa Implementation GuidanceogandalfNo ratings yet

- Peer Review of Ican in DetailDocument74 pagesPeer Review of Ican in DetailbinuNo ratings yet

- Michigan Childrens Trust Fund Auditor General Report 2018Document32 pagesMichigan Childrens Trust Fund Auditor General Report 2018Beverly TranNo ratings yet

- ITAF-3rd-Edition FMK Eng 1014Document103 pagesITAF-3rd-Edition FMK Eng 1014chokriNo ratings yet

- Module 4 Introduction To The Audit ProcessDocument38 pagesModule 4 Introduction To The Audit ProcessRoyce Maenard EstanislaoNo ratings yet

- Verif of AssetsDocument7 pagesVerif of Assetsajeet singhNo ratings yet

- Course Title: Audit Course ID: ACN403 Section: 02 Assignment OnDocument12 pagesCourse Title: Audit Course ID: ACN403 Section: 02 Assignment OnIbn ShuraimNo ratings yet

- Excel de Checklist+ISO9001Document22 pagesExcel de Checklist+ISO9001Jaime Verdugo100% (1)

- CAS OBE Syllabus CooperativesDocument17 pagesCAS OBE Syllabus CooperativesGuilbert AtilloNo ratings yet

- The Risk Management of EverythingDocument15 pagesThe Risk Management of EverythingUntuk KegiatanNo ratings yet

- Case Study 1 - Health and Safety Policy - Final Draft - August 2018Document76 pagesCase Study 1 - Health and Safety Policy - Final Draft - August 2018lonnyNo ratings yet