Professional Documents

Culture Documents

Capital Gains Tax

Capital Gains Tax

Uploaded by

lheamaecayabyab4Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Gains Tax

Capital Gains Tax

Uploaded by

lheamaecayabyab4Copyright:

Available Formats

CAPITAL GAINS TAX

DESCRIPTION

Capital Gains Tax is a tax imposed on the gains presumed to have been realized by the seller from the sale,

exchange, or other disposition of capital assets located in the Philippines, including pacto de retro sales and other

forms of conditional sale.

INCOME TAX OF CORPORATE TAXPAYERS

● The applicable income tax of a corporation depends on the type of the corporation and the income subject

to tax.

➢ What are the Capital Gains subject to Capital Gains Tax (CGT) ?

1. Sale of Shares of closely held Domestic Corporations.

2. Sale of Real Property in the Philippines.

➢ What are Ordinary Assets? (Under Tax Code of the Philippines)

1. Stock in Trade of the taxpayer or other property of a kind which would properly be included in the

inventory of the taxpayer if on hand at the close of the taxable year.

2. Property used in trade or business subject to depreciation.

3. Real property held by the taxpayer primarily for sale to customers in the ordinary course of trade or

business.

4. Real property used in trade or business of the taxpayer.

➢ What are Capital Assets? (Under Tax Code of the Philippines)

● Capital Assets include all other property held by the taxpayer (whether or not connected with his trade or

business) under Sec. 39(A)(1) of the Code. [Sec. 2(a) of RR No. 7-2003]

➢ Sale of Capital Assets Subject to CGT:

1. Shares of Stocks (15% CG - DC) ; if applicable in Foreign Corporation, Old Rating should be used.

2. Real Properties ( 6% SP or FMV - DC) ; not applicable in Foreign Corporations.

➢ Real Estate Terms:

● Real Property: Defined as per the Civil Code of the Philippines, encompassing land, buildings, and related

assets.

● Real Estate Dealer: Buys and sells properties, acting as a principal, engaging in real estate transactions as a

business.

● Real Estate Developer: Engaged in the business of developing real properties, creating subdivisions,

constructing residential or commercial units for sale or lease.

● Real Estate Lessor: Leases or rents properties to others, making it available for use in exchange for

payment.

● Engaged in Real Estate Business: Encompasses real estate dealers, developers, and lessors actively

involved in real estate transactions.

● Not Engaged in Real Estate Business: Individuals or entities not falling under the categories of dealers,

developers, or lessors.

➢ Classification of Real Properties:

● Capital Assets: Include real properties acquired by real estate entities, excluding specific exemptions.

● Ordinary Assets: Encompass properties used in business activities or those not in use for more than two

years.

● Change of Business: Real properties retained but no longer used in the real estate business remain ordinary

assets.

● Involuntary Transfers: Classification remains unaffected, regardless of the circumstances of the sale.

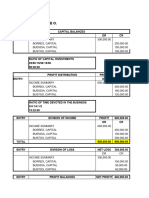

➢ Determining Capital Gains:

● Valuation: Based on selling price, fair market value, or zonal value, selecting the higher of these figures.

● Net Capital Gains: Calculated as the excess of gains from sales or exchanges of capital assets over related

losses.

➢ Shares of Stocks Transactions:

● Determination of Selling Price: Involves various scenarios such as cash sales, partial payment in kind, or

exchanges.

● Fair Market Value: Determined using methods defined by regulations, essential for accurate valuation.

● Gain/Loss Calculation: Difference between amount realized from the sale and the basis or adjusted basis.

➢ Capital Gains Tax Rates (Effective April 11, 2021):

● Real Properties: Subject to a 6% tax rate, applied to the higher value between selling price and fair market

value.

● Shares of Stocks (Unlisted): Individuals and corporations are taxed at a flat rate of 15% for unlisted shares.

➢ Exemptions from Final Capital Gains Tax:

● Exempt Entities: Includes dealers in securities, entities enjoying specific investment incentives, and

government entities.

● Conditional Exemptions: Apply to transactions like primary residence sales under defined conditions,

encouraging home ownership.

What are the applicable tax rates of Capital Gains Tax (CGT) under the National Internal Revenue Code of

1997, as amended by Republic Act No. 10963/ TRAIN Law?

A. For Real Properties – Six percent (6%)

B. For Shares of Stocks Not Traded in the Stock Exchange:

NOTE: The option of the taxpayers to be taxed either at 6% CGT or basic tax is not applicable to corporate

taxpayers. All of taxpayers is is subject to CGT of Shares of Stocks( Domestic Corporations only)

REFERENCE: Capital Gains Tax - Bureau of Internal Revenue (bir.gov.ph)

You might also like

- Ebook Strategic Management Competitiveness and Globalization Concepts and Cases 14E PDF Full Chapter PDFDocument67 pagesEbook Strategic Management Competitiveness and Globalization Concepts and Cases 14E PDF Full Chapter PDFsamuel.chapman416100% (33)

- Capital Assets Ordinary AssetsDocument2 pagesCapital Assets Ordinary AssetsjaypunzalanNo ratings yet

- Capital Gains Taxation: Lesson 6Document30 pagesCapital Gains Taxation: Lesson 6lc100% (4)

- Special Topics in Income TaxationDocument78 pagesSpecial Topics in Income TaxationPantas DiwaNo ratings yet

- 08 Dealings in Property - BigskyDocument5 pages08 Dealings in Property - BigskyKIM GABRIEL PAMITTANNo ratings yet

- Capital Gains TaxationDocument44 pagesCapital Gains TaxationPrince Anton DomondonNo ratings yet

- Capital Gains Tax Handouts May2020Document29 pagesCapital Gains Tax Handouts May2020Elsie GenovaNo ratings yet

- WK 7Document25 pagesWK 7JomarNo ratings yet

- Untitled DocumentDocument2 pagesUntitled DocumentMaria DubloisNo ratings yet

- Chapter 6 Capital Gains TaxationDocument34 pagesChapter 6 Capital Gains TaxationJason Mables100% (1)

- Chapter 4-Final Income TaxationDocument17 pagesChapter 4-Final Income TaxationPrincesa RoqueNo ratings yet

- Gains and Losses From Dealings in PropertiesDocument29 pagesGains and Losses From Dealings in PropertiesCj Garcia100% (1)

- Cpa Review - CGTDocument10 pagesCpa Review - CGTKenneth Bryan Tegerero TegioNo ratings yet

- Tranzen1A Income TaxDocument46 pagesTranzen1A Income TaxMonica SorianoNo ratings yet

- Value Added Tax Part 2Document14 pagesValue Added Tax Part 2Catherine LicudoNo ratings yet

- Chapter 6 TaxDocument17 pagesChapter 6 TaxAngelika OlarteNo ratings yet

- CHAPTER 7 Capital Gains Taxation (Module)Document15 pagesCHAPTER 7 Capital Gains Taxation (Module)Shane Mark CabiasaNo ratings yet

- Capital Assets - Any Other Assets That Does Not Fall Under The Definition of Ordinary AssetsDocument4 pagesCapital Assets - Any Other Assets That Does Not Fall Under The Definition of Ordinary Assetsdaenielle reyesNo ratings yet

- HQ05 - Capital Gains TaxationDocument10 pagesHQ05 - Capital Gains TaxationClarisaJoy Sy100% (3)

- Real Estate TaxesDocument5 pagesReal Estate TaxesJorgeNo ratings yet

- Chapter 6 Income Tax by BanggawanDocument11 pagesChapter 6 Income Tax by BanggawanEarth PirapatNo ratings yet

- Chapter 6 Income Tax by Banggawan Chapter 6 Income Tax by BanggawanDocument11 pagesChapter 6 Income Tax by Banggawan Chapter 6 Income Tax by BanggawanEarth PirapatNo ratings yet

- Taxation Prefinal CoverageDocument12 pagesTaxation Prefinal CoverageDarlyn Dalida San PedroNo ratings yet

- Chapter 5 v5 RevisedDocument18 pagesChapter 5 v5 RevisedThe makas AbababaNo ratings yet

- vALUE ADDED TAXDocument5 pagesvALUE ADDED TAXKeshlyn KellyNo ratings yet

- Dealings in Property-Income TaxationDocument70 pagesDealings in Property-Income TaxationKana Lou Cassandra Besana67% (3)

- Module 6 CGT - 1Document3 pagesModule 6 CGT - 1Marklein DumangengNo ratings yet

- Income and Withholding TaxesDocument67 pagesIncome and Withholding TaxesPo EllaNo ratings yet

- 4 Sources of IncomeDocument16 pages4 Sources of IncomeRommel Espinocilla Jr.No ratings yet

- The Taxes Involved in A Sale of Real Estate PropertyDocument7 pagesThe Taxes Involved in A Sale of Real Estate PropertyJessa CaberteNo ratings yet

- 7.0 Capital Gains TaxationDocument23 pages7.0 Capital Gains TaxationElle VernezNo ratings yet

- Finals Inc TaxDocument8 pagesFinals Inc TaxJOHN ALDRICH CABIGNo ratings yet

- PDF Document 7Document147 pagesPDF Document 7jenallynNo ratings yet

- Taxation 2 NIRCDocument84 pagesTaxation 2 NIRCEric GarciaNo ratings yet

- NT - Items of Gross Income 0510 - Income TaxDocument7 pagesNT - Items of Gross Income 0510 - Income TaxElizah PorcadoNo ratings yet

- Capital Gains TaxDocument25 pagesCapital Gains TaxZander100% (1)

- Module 06 - Capital Gains TaxDocument17 pagesModule 06 - Capital Gains TaxMark Emil Barit100% (1)

- Dealings in Property: Capital Gains, Capital Loss, and Capital Gains TaxDocument24 pagesDealings in Property: Capital Gains, Capital Loss, and Capital Gains TaxJezza Mae Gomba RegidorNo ratings yet

- ACC311 3rd Exam CoverageDocument108 pagesACC311 3rd Exam CoverageHilarie JeanNo ratings yet

- Introduction To Business Taxes: September 4, 2020Document20 pagesIntroduction To Business Taxes: September 4, 2020Bancas YvonNo ratings yet

- Module No 4 - Capital Gains TaxDocument9 pagesModule No 4 - Capital Gains TaxLysss EpssssNo ratings yet

- Capital Gains Tax PDFDocument6 pagesCapital Gains Tax PDFjanus lopezNo ratings yet

- Discussion On Dealings of PropertiesDocument2 pagesDiscussion On Dealings of PropertieshazeerkeedNo ratings yet

- Deductions To Gross IncomeDocument45 pagesDeductions To Gross IncomeKenzel lawasNo ratings yet

- Author Ayan Ahmed Blog Capital Gain in FranceDocument5 pagesAuthor Ayan Ahmed Blog Capital Gain in FranceAYAN AHMEDNo ratings yet

- INCOMETAX M45 ReviewerDocument15 pagesINCOMETAX M45 ReviewerCaryl Isabel Francisco100% (1)

- Capital Gains TaxDocument6 pagesCapital Gains Taxnadj72576No ratings yet

- Tax Notes For AprilDocument27 pagesTax Notes For AprilGabriel De GuzmanNo ratings yet

- Chapter 12 Dealings in PropertyDocument7 pagesChapter 12 Dealings in PropertyCharmie JaviertoNo ratings yet

- Reviewer in Business TaxationDocument18 pagesReviewer in Business Taxationdianacaindoy0127No ratings yet

- M6 - Capital Gains TaxationDocument31 pagesM6 - Capital Gains TaxationTERRIUS AceNo ratings yet

- Regular Income Tax: Inclusion in Gross IncomeDocument9 pagesRegular Income Tax: Inclusion in Gross IncomeE.D.JNo ratings yet

- BIR IssuancesDocument47 pagesBIR IssuancesJill De Dumo-CornistaNo ratings yet

- BIR RR 07-2003Document8 pagesBIR RR 07-2003Brian BaldwinNo ratings yet

- Taxation Gr.6Document43 pagesTaxation Gr.6Michael V. SalubreNo ratings yet

- Module 4 VAT On Sales of Goods or Properties With Answers PDFDocument37 pagesModule 4 VAT On Sales of Goods or Properties With Answers PDFJustine JaymaNo ratings yet

- Chapter VIII Ordinary Asset and Capital AssetsDocument3 pagesChapter VIII Ordinary Asset and Capital AssetsJasmin Alapag100% (2)

- Chapter VIII Ordinary Asset and Capital AssetsDocument3 pagesChapter VIII Ordinary Asset and Capital AssetsJasmin AlapagNo ratings yet

- Mastering REIT Investments - A Comprehensive Guide to Wealth Building: Real Estate Investing, #3From EverandMastering REIT Investments - A Comprehensive Guide to Wealth Building: Real Estate Investing, #3No ratings yet

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesFrom EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNo ratings yet

- Income Tax - Reviewer MaterialsDocument22 pagesIncome Tax - Reviewer Materialslheamaecayabyab4No ratings yet

- Lesson 4a Multimodal TextsDocument7 pagesLesson 4a Multimodal Textslheamaecayabyab4No ratings yet

- LECTURE Jan. 3 2023Document17 pagesLECTURE Jan. 3 2023lheamaecayabyab4No ratings yet

- Exercise 3-1Document5 pagesExercise 3-1lheamaecayabyab4No ratings yet

- Exercise 1 5Document1 pageExercise 1 5lheamaecayabyab4No ratings yet

- Exercise 4-2Document1 pageExercise 4-2lheamaecayabyab4No ratings yet

- Exercise 5-4 - BSA1 - CayabyabDocument1 pageExercise 5-4 - BSA1 - Cayabyablheamaecayabyab4No ratings yet

- NSTP RevDocument1 pageNSTP Revlheamaecayabyab4No ratings yet

- Reviewer in Ethics Final Exam Bsa1Document1 pageReviewer in Ethics Final Exam Bsa1lheamaecayabyab4No ratings yet

- Exercise 5-3 - BSA1 - CayabyabDocument2 pagesExercise 5-3 - BSA1 - Cayabyablheamaecayabyab4No ratings yet

- Exercise 2.3Document2 pagesExercise 2.3lheamaecayabyab4No ratings yet

- Cost AccountingDocument11 pagesCost Accountinglheamaecayabyab4No ratings yet

- Book 2Document12 pagesBook 2lheamaecayabyab4No ratings yet

- Defferals and Accruals Transportation Cost Exercises Per Lecture Dated Dec. 12 2022Document2 pagesDefferals and Accruals Transportation Cost Exercises Per Lecture Dated Dec. 12 2022lheamaecayabyab4No ratings yet

- Exercise 4-1Document1 pageExercise 4-1lheamaecayabyab4No ratings yet

- Exercise 2.2Document3 pagesExercise 2.2lheamaecayabyab4No ratings yet

- Exercise 4-2Document1 pageExercise 4-2lheamaecayabyab4No ratings yet

- Cost AccountingDocument17 pagesCost Accountinglheamaecayabyab4No ratings yet

- Financial Analysis - ActivityDocument9 pagesFinancial Analysis - Activitylheamaecayabyab4No ratings yet

- Average and Fifo MethodDocument2 pagesAverage and Fifo Methodlheamaecayabyab4No ratings yet

- Payroll - With Payslip ActivityDocument17 pagesPayroll - With Payslip Activitylheamaecayabyab4No ratings yet

- Departmental ConceptDocument6 pagesDepartmental ConceptbinuNo ratings yet

- BankFin Midterm Mod 4Document6 pagesBankFin Midterm Mod 4Devon DebarrasNo ratings yet

- Zcmc6122 Set 1 Sem 1 2022-2023 Individual Assignment 4Document9 pagesZcmc6122 Set 1 Sem 1 2022-2023 Individual Assignment 4Mira DenisNo ratings yet

- Generali 1H22 Results PresentationDocument46 pagesGenerali 1H22 Results PresentationAmal SebastianNo ratings yet

- Prime Ash Capital - Client Agreement Version 2.0Document20 pagesPrime Ash Capital - Client Agreement Version 2.0moatlhodiNo ratings yet

- Wa0002.Document4 pagesWa0002.arviii63No ratings yet

- Management Leading and Collaborating in A Competitive World 10th Edition Bateman Solutions Manual DownloadDocument27 pagesManagement Leading and Collaborating in A Competitive World 10th Edition Bateman Solutions Manual DownloadThomas Weibel100% (24)

- BOND Part 1Document8 pagesBOND Part 1James Ryan AlzonaNo ratings yet

- MCQ QuestionsDocument6 pagesMCQ QuestionsÑízãr ÑzrNo ratings yet

- Overview of The IBBL 1.editedDocument4 pagesOverview of The IBBL 1.editedNur sadiaNo ratings yet

- MCQS Chapter 9 Company Law 2017Document5 pagesMCQS Chapter 9 Company Law 2017BablooNo ratings yet

- Cfmip31171bgm FaDocument223 pagesCfmip31171bgm FaAshish SinghNo ratings yet

- Tutorial 7 - (Solution) Analysis of Financial StatementsDocument4 pagesTutorial 7 - (Solution) Analysis of Financial StatementsSamer LaabidiNo ratings yet

- Real Estate InvestmentDocument9 pagesReal Estate InvestmentRiddhi PirogiwalNo ratings yet

- TEV Sports Studio EnterprisesDocument19 pagesTEV Sports Studio EnterprisesRama KrishnaNo ratings yet

- Bba III Year Finance-Optional-Paper - Working Capital Management 2022Document2 pagesBba III Year Finance-Optional-Paper - Working Capital Management 2022sajal dubeyNo ratings yet

- Unit 2.1 FOREX MarketDocument39 pagesUnit 2.1 FOREX Markethannah0781No ratings yet

- Commerce - Bcom Banking and Insurance - Semester 5 - 2023 - April - Financial Reporting Analysis CbcgsDocument6 pagesCommerce - Bcom Banking and Insurance - Semester 5 - 2023 - April - Financial Reporting Analysis CbcgsVishakha VishwakarmaNo ratings yet

- NPTEL Assign 4 Jan23 Behavioral and Personal FinanceDocument6 pagesNPTEL Assign 4 Jan23 Behavioral and Personal FinanceNitin Mehta - 18-BEC-030No ratings yet

- Jurnal Skripsi - Edwin GunawanDocument11 pagesJurnal Skripsi - Edwin GunawanEdwin GunawanNo ratings yet

- HW Solution Chapter 4 5Document15 pagesHW Solution Chapter 4 5Trần Thị Ngọc BíchNo ratings yet

- FMG2 ReportDocument28 pagesFMG2 ReportCherry Velle TangogNo ratings yet

- Elec 3 Activities..Document7 pagesElec 3 Activities..rashelann dalumpinesNo ratings yet

- Buy Back IntroductionDocument5 pagesBuy Back Introduction7013 Arpit DubeyNo ratings yet

- Quasar Chunawala: ObjectiveDocument2 pagesQuasar Chunawala: ObjectiveQuasar ChunawalaNo ratings yet

- BOZ FAQ'sDocument5 pagesBOZ FAQ'sPyanga FyonseNo ratings yet

- PFRS 10 - Consolidate FSDocument11 pagesPFRS 10 - Consolidate FSHannah TaduranNo ratings yet

- Summary #17Document2 pagesSummary #17atika suriNo ratings yet

- MKTG Mini Book - MergedDocument28 pagesMKTG Mini Book - MergedJITESHNo ratings yet