Professional Documents

Culture Documents

Absa OMFIF AFMI 2023

Absa OMFIF AFMI 2023

Uploaded by

Isaac NiiCopyright:

Available Formats

You might also like

- Internship Report Soneri Bank LimitedDocument59 pagesInternship Report Soneri Bank Limitedsaif_4583% (6)

- SAS Money Laundering Detection - Development Bank of The PhilippinesDocument56 pagesSAS Money Laundering Detection - Development Bank of The Philippinesapi-3696796100% (2)

- Barclays AFMIndex 2017Document36 pagesBarclays AFMIndex 2017Joao Pedro RodriguesNo ratings yet

- Capture D'écran . 2024-04-25 À 08.07.39Document1 pageCapture D'écran . 2024-04-25 À 08.07.39yannkambeu2003No ratings yet

- 2010 Annual Report Ecobank GhanaDocument76 pages2010 Annual Report Ecobank GhanaADDONo ratings yet

- Imara Corporate Finance Profile June 2011Document16 pagesImara Corporate Finance Profile June 2011Loretta WiseNo ratings yet

- Worlds Best Banks in Africa 2017 1489505422Document2 pagesWorlds Best Banks in Africa 2017 1489505422Juan Daniel Garcia VeigaNo ratings yet

- 12th Africa Bank 4.0 Summit - SADC Region - FINAL AGENDADocument17 pages12th Africa Bank 4.0 Summit - SADC Region - FINAL AGENDAulrikp32No ratings yet

- WAIF BrochureDocument4 pagesWAIF Brochurefazee1985No ratings yet

- 2017 Ghana Annual ReportDocument90 pages2017 Ghana Annual Reportviticor20121No ratings yet

- CountryDocument327 pagesCountryZebedee TaltalNo ratings yet

- 2009 ASEA YearbookDocument278 pages2009 ASEA YearbookAfricanExchangesNo ratings yet

- Abc Annual Report 08 - FinalDocument136 pagesAbc Annual Report 08 - FinalNixons ShingiNo ratings yet

- 5th African Economic Forum - Brochure - 210211Document12 pages5th African Economic Forum - Brochure - 210211MegaBabeNo ratings yet

- Vision: To Provide Visionary Services and Dynamic Banking Solutions To Cater The Needs of All Our Stake HoldersDocument58 pagesVision: To Provide Visionary Services and Dynamic Banking Solutions To Cater The Needs of All Our Stake HoldersIqra NadeemNo ratings yet

- CPSD Burkina Faso EN PDFDocument88 pagesCPSD Burkina Faso EN PDFNgendahayo EricNo ratings yet

- The Decline in Access To Correspondent Banking Services in Emerging Markets: Trends, Impacts, and SolutionsDocument56 pagesThe Decline in Access To Correspondent Banking Services in Emerging Markets: Trends, Impacts, and SolutionsforcetenNo ratings yet

- African Stock MarketsDocument126 pagesAfrican Stock MarketsFanele ChesterNo ratings yet

- May Edition ASEA Newsletter 2013 (Final) PDFDocument46 pagesMay Edition ASEA Newsletter 2013 (Final) PDFAfricanExchanges100% (1)

- History: NSGB Is A SBU To A Big Company in France Called Societal GénéraleDocument21 pagesHistory: NSGB Is A SBU To A Big Company in France Called Societal GénéraleHossam CarterNo ratings yet

- Internship Report On First Woman BankDocument21 pagesInternship Report On First Woman BankAbrar Khan100% (2)

- Ecobank Financial Report For 2018Document186 pagesEcobank Financial Report For 2018Fuaad DodooNo ratings yet

- Please Review BSP Circular 1022 and MTPP ManualDocument26 pagesPlease Review BSP Circular 1022 and MTPP ManualAbygail GangayNo ratings yet

- ASEA Yearbook 2013 PDFDocument234 pagesASEA Yearbook 2013 PDFAfricanExchangesNo ratings yet

- Panafrican Daily Market Report 20-June-2014)Document1 pagePanafrican Daily Market Report 20-June-2014)Oladipupo Mayowa PaulNo ratings yet

- Final 1Document46 pagesFinal 1abdul moizNo ratings yet

- Uob Ar2011 PDFDocument180 pagesUob Ar2011 PDFSassy TanNo ratings yet

- Sida2136en Short Study On Microfinance in EthiopiaDocument60 pagesSida2136en Short Study On Microfinance in EthiopiaUnanimous ClientNo ratings yet

- Nigeria's Booming Borders. The Drivers and Consequences. Leena Koni Hoffmann and Paul Melly, 2015Document62 pagesNigeria's Booming Borders. The Drivers and Consequences. Leena Koni Hoffmann and Paul Melly, 2015Satoko Kojima HoshinoNo ratings yet

- INVESTECDocument3 pagesINVESTEChlbeckleyNo ratings yet

- Insurance SADocument137 pagesInsurance SAmkhize.christian.21No ratings yet

- Virtual University of Pakistan: Report On Bank Alfalah LimitedDocument25 pagesVirtual University of Pakistan: Report On Bank Alfalah LimitedXFaq AhmadNo ratings yet

- RBI Guidelines On Introduction of CDSDocument86 pagesRBI Guidelines On Introduction of CDSkrishnaj1967No ratings yet

- Aslkari Bank LimitedDocument79 pagesAslkari Bank LimitedziashoukatNo ratings yet

- 2009 SEC Audited Financial StatementsDocument15 pages2009 SEC Audited Financial StatementsProshareNo ratings yet

- Bank FinanceDocument61 pagesBank FinancerajrudrapaaNo ratings yet

- Chapter 3 - Control of Money Laundering in KenyaDocument73 pagesChapter 3 - Control of Money Laundering in KenyaFrancis Njihia KaburuNo ratings yet

- Annual Report 2013Document104 pagesAnnual Report 2013Reynaldo Sedeño IIINo ratings yet

- Asea Conference Newslet TerDocument6 pagesAsea Conference Newslet TerFrancis WanjikuNo ratings yet

- 1.1 Organization Overview: 1,105,226,569 During The Year 2009. and in June 2010 Profit After Tax Is 793,726,000Document94 pages1.1 Organization Overview: 1,105,226,569 During The Year 2009. and in June 2010 Profit After Tax Is 793,726,000Md. Saiful IslamNo ratings yet

- Monetary Policy Regime of NamibiaDocument67 pagesMonetary Policy Regime of NamibiaPanganayi JamesNo ratings yet

- 2015 Annual Report PDFDocument80 pages2015 Annual Report PDFFuaad DodooNo ratings yet

- PA00W6H9Document76 pagesPA00W6H9meenaheeralal053No ratings yet

- Bank AsiaDocument63 pagesBank AsiaMustabshira rodie0% (1)

- Annual Report 2008Document90 pagesAnnual Report 2008ericmacknorrNo ratings yet

- Southafricapecongress Feb 2010Document8 pagesSouthafricapecongress Feb 2010SAInnovationNetworkNo ratings yet

- Microfinance in Myanmar Sector AssessmentDocument54 pagesMicrofinance in Myanmar Sector AssessmentTHAN HANNo ratings yet

- Ashraf UBLDocument68 pagesAshraf UBLFarukh JanNo ratings yet

- Seamless Africa Agenda 2022Document7 pagesSeamless Africa Agenda 2022Muluken AlemuNo ratings yet

- Program and BODocument14 pagesProgram and BOEric LanzuelaNo ratings yet

- ID#16102091 Pranta Sarker Accounting.Document64 pagesID#16102091 Pranta Sarker Accounting.AshrafulNo ratings yet

- Arc19 Promo Brochure English FinalDocument12 pagesArc19 Promo Brochure English FinalRajat JainNo ratings yet

- Organizational Structure of National Bank of PakistanDocument24 pagesOrganizational Structure of National Bank of PakistanMobashar Ali67% (9)

- Professional Ethics and Social Responsibilities of Chartered Institute of Bankers of NigeriaDocument12 pagesProfessional Ethics and Social Responsibilities of Chartered Institute of Bankers of NigeriaVictory M. DankardNo ratings yet

- Ghana Banking Survey 2010Document51 pagesGhana Banking Survey 2010Kofi GyapongNo ratings yet

- Zimbabwe: The Link Between Politics and the Economy: The Link Between Politics and the EconomyFrom EverandZimbabwe: The Link Between Politics and the Economy: The Link Between Politics and the EconomyRating: 4 out of 5 stars4/5 (1)

- Harnessing Migration for Inclusive Growth and Development in Southern AfricaFrom EverandHarnessing Migration for Inclusive Growth and Development in Southern AfricaNo ratings yet

- The Cash Dividend: The Rise of Cash Transfer Programs in Sub-Saharan AfricaFrom EverandThe Cash Dividend: The Rise of Cash Transfer Programs in Sub-Saharan AfricaNo ratings yet

- World Bank East Asia and Pacific Economic Update, April 2013: A Fine BalanceFrom EverandWorld Bank East Asia and Pacific Economic Update, April 2013: A Fine BalanceRating: 3 out of 5 stars3/5 (1)

- The Global Financial and Economic Crisis in the South: Impact and ResponsesFrom EverandThe Global Financial and Economic Crisis in the South: Impact and ResponsesNo ratings yet

- Jafza Investor Guide New 1.2Document29 pagesJafza Investor Guide New 1.2nunov_144376No ratings yet

- 09 Yi Accounts Payable Risk AssessmentDocument2 pages09 Yi Accounts Payable Risk AssessmentMalik Khayyam OmerNo ratings yet

- Solution Manual For Managerial Economics Foundations of Business Analysis and Strategy 13th Edition Christopher Thomas S Charles MauriceDocument12 pagesSolution Manual For Managerial Economics Foundations of Business Analysis and Strategy 13th Edition Christopher Thomas S Charles Mauriceexosmosetusche.mmh6998% (43)

- M.C. Mehta and Anr Vs Union of India & Ors On 20 December, 1986 Equivalent Citations: 1987 AIR 1086, 1987 SCR (1) 819 Bench: Bhagwati, P.N. (CJ)Document3 pagesM.C. Mehta and Anr Vs Union of India & Ors On 20 December, 1986 Equivalent Citations: 1987 AIR 1086, 1987 SCR (1) 819 Bench: Bhagwati, P.N. (CJ)Prakher ShuklaNo ratings yet

- Панта Срећковић - Свеопшта историјаDocument945 pagesПанта Срећковић - Свеопшта историјаMica TarabicNo ratings yet

- Surat Rangkuman Perlindungan: Jaminan Nilai SantunanDocument2 pagesSurat Rangkuman Perlindungan: Jaminan Nilai SantunanWandiieBoomBoomNo ratings yet

- Surya Pricelist Compressed 1Document92 pagesSurya Pricelist Compressed 1Raj Kumar VermaNo ratings yet

- Makati SEP 2018Document38 pagesMakati SEP 2018Yanni AlmadronesNo ratings yet

- B) Write Briefly On Financial Planning For Disaster ManagementDocument4 pagesB) Write Briefly On Financial Planning For Disaster ManagementLevingstan YesudhasNo ratings yet

- Building Maintenance Inspection and Facilities Assessment: Case Study: Office Block A2, University Malaysia PahangDocument11 pagesBuilding Maintenance Inspection and Facilities Assessment: Case Study: Office Block A2, University Malaysia PahangNrsyfqah SuleimanNo ratings yet

- Cottages Plan - AllDocument7 pagesCottages Plan - AllArjun KumarNo ratings yet

- Marketing Communication PlanDocument35 pagesMarketing Communication PlanShahan ShakeelNo ratings yet

- Precious M. Resaba: ProfileDocument2 pagesPrecious M. Resaba: ProfileaishwaryaNo ratings yet

- ASUFRIN, JR., v. SAN MIGUEL CORPORATIONDocument2 pagesASUFRIN, JR., v. SAN MIGUEL CORPORATIONMonica FerilNo ratings yet

- (Nov 2020) Latest Safecustody ListingDocument923 pages(Nov 2020) Latest Safecustody Listingcinta amaniNo ratings yet

- MDI Placement-1Document87 pagesMDI Placement-1Aditya GavadeNo ratings yet

- Negotiation Bargaining Video ScriptDocument2 pagesNegotiation Bargaining Video ScriptseattlechazNo ratings yet

- Accra Technical University: Department of Building TechnologyDocument13 pagesAccra Technical University: Department of Building TechnologyKj mingle100% (1)

- BBFH107 - Business Statistics II Assignment IIDocument2 pagesBBFH107 - Business Statistics II Assignment IIPeter TomboNo ratings yet

- Audit Financier by Falloul Moulay El MehdiDocument1 pageAudit Financier by Falloul Moulay El MehdiDriss AitbourigueNo ratings yet

- Consumer ProtectionDocument3 pagesConsumer ProtectionADITYA JOSHINo ratings yet

- Stages of Digital Transformation in Competency Management - TejaDocument6 pagesStages of Digital Transformation in Competency Management - TejaImmanuel Teja HarjayaNo ratings yet

- Advanced Transport ManagementDocument5 pagesAdvanced Transport ManagementCOT Management Training InsituteNo ratings yet

- Ede MicrprjctDocument21 pagesEde Micrprjct68 Nitesh PundgeNo ratings yet

- Noter Onayli Belgeler 12-09-2022Document6 pagesNoter Onayli Belgeler 12-09-2022MetinNo ratings yet

- Waiters and Waitress Job DescriptionDocument3 pagesWaiters and Waitress Job Descriptionobabaru gaddis ivanNo ratings yet

- BR 115 Iii Serie 2019Document30 pagesBR 115 Iii Serie 2019Akshaya NairNo ratings yet

- CH 4 Globalisation and The Indian Economy Class 10Document33 pagesCH 4 Globalisation and The Indian Economy Class 10Adhish RNo ratings yet

- Avon Products, Inc.: A Case Narrative in Company Relations With Customers and SuppliersDocument13 pagesAvon Products, Inc.: A Case Narrative in Company Relations With Customers and SuppliersAndreea IoanaNo ratings yet

- Fourth Section: Case of Beşleagă and Others V. RomaniaDocument9 pagesFourth Section: Case of Beşleagă and Others V. Romaniaasm_samNo ratings yet

Absa OMFIF AFMI 2023

Absa OMFIF AFMI 2023

Uploaded by

Isaac NiiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Absa OMFIF AFMI 2023

Absa OMFIF AFMI 2023

Uploaded by

Isaac NiiCopyright:

Available Formats

Absa Africa Financial

Markets Index 2023

Valuable African insights, border to border

Pictured: The Skeleton Coast natural border of Namibia

AFMI_2023_01_cover.indd 1 10/2/2023 3:11:19 PM

Acknowledgements

he Absa Africa Financial Markets Inde was roduced by OMFIF in Sheng Zhao conomic Affairs Officer nited Nations conomic

association with Absa rou Limited. Commission for Africa

he Absa rou Limited and OMFIF Ltd. All Rights Reserved. Ingrid Hagen, Senior ice President of Strategic Pro ects Frontclear

Management B

Peter Werner, Senior Counsel International Swa s and erivatives

Absa CIB Project Team Association

Erica Bopape ead of Marketing Investment Banking Fiona

Mbalula Senior Marketing Manager Investment Banking Jerome Organisation acknowledgements

Raman ternal Communications Manager Varini Chetty ead e consulted more than institutions across Africa including

igital Marketing and ata O tmisation Deen Schroeder, Senior central banks stock e changes regulators and market ractitioners.

Manager igital Marketing ata nablement Prudence Mlangeni, Although some re uested anonymity we thank the following for

vents and S onsorshi Activations Manager David Fernandes- sharing their views

Collett Chief O erating Officer lobal Markets Absa Regional Banco de Fomento Angola Banco de Mo ambi ue Banco Nacional de

Operations, Gerald Katsenga ead of Cor orate Sales Absa Angola Bank al Maghrib Bank of Botswana Bank of Namibia Bank

Regional O erations of an ania Bank of ganda Bankers Association of ambia Banky

Individuals Foiben I Madagaskira Ban ue Centrale du Congo Bolsa de vida e

alores de Angola Bolsa de alores de Cabo erde Bolsa de alores de

Jeff Gable ead of Macro and Fi ed Income Research Absa Mo ambi ue Botswana Stock change Bourse de unis Bourse des

Anthony Kirui ead of lobal Markets Absa Regional O erations aleurs Mobili res de l Afri ue Centrale Bourse R gionale des aleurs

Absa Mobili res Ca ital Markets and Securities Authority an ania Ca ital

Markets Authority of enya Ca ital Markets Authority of ganda

OMFIF Central Bank of swatini Central Bank of enya Central Bank Of

Lesotho Central Bank of Seychelles Central e ository Settlement

Report authors Co. Ltd Mauritius Commission de Surveillance du March Financier de

Nikhil Sanghani Managing irector of Research OMFIF l Afri ue Centrale ar es Salaam Stock change ebt Management

Arunima Sharan Senior Research Analyst OMFIF Office Nigeria swatini Stock change thio ia Securities change

Katerina Liu Research Analyst OMFIF thio ian Ca ital Market Authority Financial Regulatory Authority

( gy t) Financial Sector Conduct Authority (South Africa) FM

Edward Maling Research Analyst OMFIF

rou PLC hana Stock change International Finance Cor oration

OMFIF Editorial, Meetings and Marketing Team ohannesburg Stock change Mauritius Commercial Bank M R

change Nairobi Securities change Namibian Stock change

Clive Horwood, Managing ditor and e uty Chief ecutive Officer

National Bank of Rwanda National Microfinance Bank an ania

Simon Hadley irector Production William Coningsby-Brown,

Nigerian change Limited PricewaterhouseCoo ers ( hana)

Production Manager Sarah Moloney Chief Subeditor Janan Jama,

PricewaterhouseCoo ers (Nigeria) Reserve Bank of Malawi Reserve

Subeditor, James Fitzgerald e uty ead of vents and Marketing

Bank of imbabwe Securities and change Commission ( hana)

Ophelia Mather Marketing Coordinator Ben Rands irector of

Securities and change Commission (Nigeria) South African Reserve

vents and Marketing Jamie Bulgin Relationshi irector conomic

Bank Stock change of Mauritius an ania Bankers Association

and Monetary Policy Institute Avnish Patel, Senior Programme

ganda Securities change imbabwe Stock change.

Manager conomic and Monetary Policy Institute

Individual acknowledgements

Supported by

Sonia Essobmadje Chief Innovative Finance and Ca ital Markets

nited Nations conomic Commission for Africa

Jean-Marc Malambwe Kilolo conomic Affairs Officer nited

Nations conomic Commission for Africa

Absa rou Limited ( Absa rou ) is listed on the ohannesburg Stock change and is one of Africa s largest diversified financial services grou s.

Absa Group offers an integrated set of products and services across personal and business banking, corporate and investment banking, wealth and

investment management and insurance.

Absa rou has a resence in countries in Africa with a ro imately em loyees.

he rou s registered head office is in ohannesburg South Africa and it owns ma ority stakes in banks in Botswana hana enya Mauritius

Mo ambi ue Seychelles South Africa an ania (Absa Bank an ania and National Bank of Commerce) ganda and ambia. he rou also has

re resentative offices in Namibia and Nigeria as well as insurance o erations in Botswana enya Mo ambi ue South Africa an ania and ambia.

For further information about Absa rou Limited lease visit www.absa.africa

he Official Monetary and Financial Institutions Forum is an inde endent think tank for central banking economic olicy and ublic investment

a non lobbying network for best ractice in worldwide ublic rivate sector e changes. At its heart are lobal Public Investors central

banks sovereign funds and ublic ension funds with investable assets of tn e uivalent to of world P. ith a resence in London

ashington and New ork OMFIF focuses on global olicy and investment themes articularly in asset management ca ital markets and financial

su ervision regulation relating to central banks sovereign funds ension funds regulators and treasuries. OMFIF romotes higher standards

invigorating e changes between the ublic and rivate sectors and a better understanding of the world economy in an atmos here of mutual trust.

For further information about OMFIF lease visit www.omfif.org

2 | Absa Africa Financial Markets Index 2023

AFMI_2023_02_Mhead_Contents_FWDs_Intro.indd 2 10/3/2023 10:47:09 AM

Contents

Introduction 4

Pillar 4:

Forewords 4-5 Pillar 4:

Executive summary 6-9

Capacity of local

Contains country comparisons and highlights

investors

opportunities and challenges for the region’s financial

markets.

Highlights 10 - 11

Pillar 1:

Market depth 28-31

Pillar 5:

12-17 Macroeconomic

environment and

Pillar 2:

transparency

32-35

Access to foreign

exchange Pillar 6:

Legal standards

and enforceability

18-21

36-41

Pillar 3:

Indicators and methodology 42-43

Market

transparency, tax

and regulatory

environment 22-27

Absa Africa Financial Markets Index 2023 | 3

AFMI_2023_02_Mhead_Contents_FWDs_Intro.indd 3 10/3/2023 10:49:26 AM

Introduction Forewords

nlocking the Arrie Rautenbach

potential of

Chief Executive

Officer, Absa

Africa

Now in its seventh year the Absa Africa Financial

Markets Inde evaluates countries financial A destination for

development based on measures of market

accessibility o enness and trans arency. he capital investment

aim is to show how economies can reduce

barriers to investment and boost sustainable

growth. he inde has become a benchmark for e are destined to live in interesting times. Little could

the investment community to gauge African we have known when the first version of this inde was

countries’ market infrastructure and is used by launched seven years ago that the world would go through

policy-makers to learn from developments across a global pandemic, a land war in Europe and the steepest

the continent. rise in global olicy rates since the in ation shocks of the

s. here has been much for African olicy makers to

ith su ort from the nited Nations conomic contend with, which has at times distracted from a focus

Commission for Africa coverage in this year s on long term structural reform of financial markets.

report has grown to 28 countries with the

addition of Cabo erde and unisia. he inde The challenging global macroenvironment continues to

now encom asses a ro imately of the make itself felt throughout this inde . Many countries

o ulation and gross domestic roduct of Africa. have seen the si e of their domestic ca ital markets shrink

as global risk aversion, higher global borrowing costs and

o construct the inde OMFIF conducted

concerns over debt sustainability have resulted in some

e tensive uantitative research and data

ullback to Africa s access to global ca ital markets. here

analysis with surveys of over organisations

remains a clear focus among policy-makers on improving

across Africa, including central banks, securities

countries financial markets o enness trans arency and

e changes regulators and market artici ants.

accessibility. ust over half of the countries in the inde

Over 40 indicators are considered across have seen their scores im rove year on year.

si illars Pillar 1 – Market depth; Pillar 2 –

More than countries in the inde now have some

Access to foreign exchange; Pillar 3 – Market

transparency, tax and regulatory environment; form of environmental, social and governance-linked

Pillar 4 – Capacity of local investors; Pillar 5 – financial olicies. Sukuk financing with new domestic

Macroeconomic environment and transparency; bond issuance in South Africa and an ania is a further

and Pillar 6 – Legal standards and enforceability. develo ment that hel s ensure Africa s financial markets

are o en to a wide range of ca ital. As a ur ose led

Pillar scores are based on countries relative pan-African bank, we believe bold ESG investments can

performance for each indicator, which is rebased su ort and im rove the continent s financial resilience.

to fit a harmonised scale from . Overall

scores are calculated as an average of the scores he Absa Africa Financial Markets Inde now covers

from each illar. countries across the continent. Last year the inde

welcomed the emocratic Re ublic of the Congo

Given its growing importance to global investors, Madagascar and imbabwe. his year we welcome Cabo

the availability of Islamic financial roducts erde and unisia into the AFMI fold. he results from the

is considered for the first time in this year s new oiners highlight the critical im ortance of roactive

inde . he methodology has been altered to

dialogue and knowledge e change.

include more robust measures of capital control

stringency and legal standards. Scores for ith global financial markets likely to remain tight for the

have been ad usted to this methodology to allow foreseeable future, it has never been more important to

for more accurate year-on-year comparisons, focus on Africa as a destination for ca ital investment.

so they may differ from those ublished in AFMI This seventh edition of the report is a critical contribution

. See . for more details. to that goal.

4 | Absa Africa Financial Markets Index 2023

AFMI_2023_02_Mhead_Contents_FWDs_Intro.indd 4 10/3/2023 10:49:29 AM

Clive Horwood Antonio Pedro

Deputy Chief Acting Executive

Executive Officer Secretary, United

and Managing Editor, Nations Economic

OMFIF Commission for Africa

nderstanding Financing sustainable

opportunities in Africa development goals

Since its launch in 2017, the Absa Africa Financial Amid the polycrisis, the global economy is at risk of not

Markets Inde has endeavoured to demystify the achieving the goals of the Agenda for Sustainable

continent as an investment destination. e do this by evelo ment. In Africa with shrinking fiscal s ace

applying global market standards on key issues such exchange rate turbulence and mounting external

as market accessibility o enness and trans arency. debt servicing costs the risk is highest. Still there

The aim is to measure progress in the development is a chance to meet the nited Nations sustainable

of capital markets and demonstrate to individual develo ment goals if countries can find innovative ways

countries the actions they could take to attract to mobilise financing.

international investment to their markets. Countries need to rioritise the strengthening of their

At OMFIF we are roud of the continual evolution financial markets. his re uires the creation of an

enabling environment through appropriate policies

of the index over the last seven years, and the

and frameworks that encourage investment in local

importance central banks, ministries of finance and

currencies in critical sectors, such as infrastructure

stock exchanges across the region attach to their

and agriculture, to strengthen the continent’s food

scores. Our scorecards of ca ital market develo ment

systems. Additionally it is crucial to develo innovative

began with 7 African countries and in the instruments that res ond to the financial needs of

number of countries covered by our analysis rises micro small and medium si ed enter rises and su ort

to . climate mitigation and ada tation measures. o this end

Among the countries we cover, three that ranked increasing awareness and strengthening the capacity of

in the to five in our inaugural rankings retain their stakeholders in using these financing tools will be critical.

osition in the highest tier South Africa Mauritius In the nited Nations conomic Commission for

and Namibia. Nigeria (ranked si th of 7 in 7) and Africa launched several initiatives to support countries in

ganda (rising from th of 7) round out the to five. market develo ment. hese included re arations for the

Progress over the ast two years has been launch of a securities exchange in Ethiopia, money market

develo ment in an ania local currency bond market

encouraging. In revious generations the global

develo ment in ganda the strengthening of institutional

shocks of Covid war in kraine issues around

investors ca acities in the est African conomic and

food and energy security and rising in ation may have

Monetary nion and the establishment of a artnershi

derailed or delayed important advances in capital

with AS A. Case studies were also conducted to assess

markets. oday these countries are more resilient. the feasibility of inclusive bonds in Cameroon and C te

e thank all of the institutions that devoted valuable d Ivoire. ogether with artners and stakeholders CA

time to assisting our research, through in-person aims to accelerate Africa s financing for the S s in a

conversations or by filling in our surveys. hanks sustainable and inclusive manner.

also to the N conomic Commission for Africa and he Absa Africa Financial Markets Inde continues to be a

the Southern African evelo ment Community for valuable tool for African countries. It serves as a reference

their invaluable su ort. And articular thanks to our oint for olicy makers aiming to strengthen financial

artners in this ro ect from day one Absa for their markets. At CA we are delighted to have su orted Cabo

commitment not ust to this ro ect but also erde and unisia in their first time inclusion in the

for their important work on developing Africa’s edition of the inde . e remain steadfast in our efforts to

ca ital markets. hel our member states develo their financial markets.

Absa Africa Financial Markets Index 2023 | 5

AFMI_2023_02_Mhead_Contents_FWDs_Intro.indd 5 10/3/2023 10:49:38 AM

Executive summary

Pictured: Saffron, South Africa

Further signs of progress

For the second year running, scores have risen for commodity importers, this has been compounded by

the majority of AFMI countries. They increased in 15 a deterioration in trade balances. These factors have

countries largely due to an improvement in market contributed to weaker foreign exchange reserves and

transparency, particularly a rise in the number of credit lower scores for 17 index countries in Pillar 2. The

ratings, which boosts scores in Pillar 3. Most countries challenging global environment has also impacted

also score higher in Pillar 5 as macroeconomic conditions liquidity and the size of domestic financial markets in

have generally stabilised following shocks from the dollar terms, which weighs on scores in Pillar 1. The size

pandemic and the Russia- kraine conflict. of pension assets in dollar terms has also declined for

most countries, which reduces scores in Pillar 4.

Among the biggest improvements in the overall score

were Zimbabwe and Rwanda, rising by almost 2 points Egypt has been hit especially hard and its overall score

each, linked to progress in building sustainable financial falls by 3 points, with the country now ranking outside

market frameworks. Zimbabwe has added climate risks to the top 10. Overall scores have also declined in South

financial stability regulation while Rwanda is working with Africa, Nigeria and ganda although they all maintain

multilateral organisations to improve market standards their position in the top five, as do Mauritius and Namibia.

for green investments. Overall, 20 AFMI countries now

The underlying message is one of slow progress in

incorporate environmental, social and governance-

building capital markets. In 17 countries, scores are

linked financial policies, which can help to mobilise new

higher this year than when they were first introduced

investment.

to the index. But there is a wide gap between the

There have been other encouraging initiatives across the highest scoring countries and the rest. Based on the

continent. Survey respondents in nine AFMI countries new methodology, only the top five score above 60.

mentioned measures for improving central security South Africa and Mauritius remain the only countries

depositories to enhance efficiency. New assets are to score above 70 – as has been the case since 2019.

becoming available on domestic exchanges, including This suggests there is plenty of scope for further

the first sukuk bonds in South Africa and Tanzania. improvement across the continent.

Otherwise, while not directly impacting scores, survey

There are three general areas where Africa’s investment

participants mentioned various financial inclusion policies

climate can be improved. Liquidity is limited in domestic

to boost local investor capacity.

equity, fixed income and foreign exchange markets

However, progress in the index has not been uniform. in most cases. Tax environments are becoming less

Each country experienced a lower score in at least one conducive to investment in some jurisdictions. And

of the six pillars. This is mainly due to unfavourable legislation to promote the use of standard master

global conditions outside of African policy-makers’ direct agreements remains sparse, leading to low scores for

control. Rising interest rates in advanced economies most AFMI countries in Pillar 6. Policy-makers should

have prompted exchange rate depreciation and capital look to address these barriers to further develop capital

outflows for many African countries. In the case of markets and unlock the potential of Africa.

6 | Absa Africa Financial Markets Index 2023

AFMI_2023_03_ExecSumm_scores.indd 6 10/2/2023 3:18:20 PM

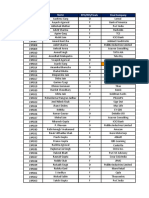

Rank Score

Country Comments

2023 2022 2023 2022

1 1 South Africa 88 89 Lower pension assets in dollar terms weigh on score

2 2 Mauritius 77 77 Rise in sovereign and corporate credit ratings

3 3 Nigeria 67 68 Foreign e change shortages and rising in ation reduces score

4 4 Uganda 63 64 Fall in FX reserves and liquidity

5 5 Namibia 63 63 Large ension assets but decline in fi ed income market

6 8 Botswana 59 58 New incentives for ESG asset issuance lifts score

7 6 Kenya 59 60 Lower F reserves and market li uidity

8 10 Morocco 58 57 New climate stress testing and higher FX liquidity

9 7 Ghana 58 59 Deterioration in FX reserves and price stability

10 12 Tanzania 55 55 Im roved roduct diversity with sukuk bond issuance

11 9 Egypt 55 58 eaker F reserves and macroeconomic outlook

12 11 Zambia 55 55 Reduction in external debt after restructuring

13 13 Malawi 49 49 Surge in market ca italisation but li uidity remains low

14 14 Eswatini 46 46 igher ension fund assets but limited market activity

15 15 Seychelles 46 45 Jump in value of pension fund assets

16 Cabo Verde 45 New framework and issuance of blue bonds

17 16 Rwanda 44 43 Stronger S market framework with su ort of international bodies

18 19 Zimbabwe 43 42 New climate risk management guidelines lift score

19 Tunisia 43 Macroeconomic vulnerabilities constrains score

20 17 Angola 43 42 Im rovement in in ation and e ternal debt

21 18 Côte d'Ivoire 40 42 Fall in FX reserves reduces score

22 21 Cameroon 40 40 Market si e and li uidity remains relatively low

23 20 Senegal 38 40 Rise in e ternal debt to P ratio

24 22 Mozambique 37 36 Strong growth ros ects from li uified natural gas boost

25 23 DRC 35 34 Improvement in monetary policy reporting

26 24 Lesotho 34 34 Limited market activity and high ta rates

27 25 Madagascar 31 32 Fall in FX reserves coverage

28 26 Ethiopia 29 27 Moving closer to launching a securities exchange

Source: Absa Africa Financial Markets Index 2023

Note: Overall scores calculated as an average of six pillar scores. Maximum score 100. Scores from 2022 are updated to incorporate any revisions and/or improved

data collection methods and may not reflect those published in AFMI 2022. More information on pp.42-43.

Absa Africa Financial Markets Index 2023 | 7

AFMI_2023_03_ExecSumm_scores.indd 7 10/2/2023 3:18:22 PM

Country snapshots

Angola (43) Botswana (59) Cabo Verde (45) Cameroon (40) Côte D’Ivoire (40)

33 54 36 26 28

57 68 68 55 54

66 78 58 51 52

12 57 23 16 11

64 87 63 66 71

25 10 25 25 25

DRC (35) Egypt (55) Eswatini (46) Ethiopia (29) Ghana (58)

18 42 23 10 46

40 87 49 41 51

55 87 61 40 82

10 15 60 11 22

76 76 76 63 60

10 25 10 10 85

Kenya (59) Lesotho (34) Madagascar (31) Malawi (49) Mauritius (77)

42 12 16 28 56

70 54 58 43 75

92 31 32 62 94

18 25 10 12 61

76 72 61 65 76

55 10 10 85 100

Morocco (58) Mozambique (37) Namibia (63) Nigeria (67) Rwanda (45)

60 33 43 56 31

76 49 56 60 59

89 47 61 88 79

29 13 100 27 13

70 70 76 79 74

25 10 40 90 10

Senegal (38) Seychelles (46) South Africa (88) Tanzania (55) Tunisia (43)

30 23 100 49 45

54 58 88 54 51

42 50 98 78 70

11 57 63 15 11

67 77 78 81 54

25 10 100 55 25

Uganda (63) Zambia (55) Zimbabwe (43) KEY

Market de th

46 30 17

Access to foreign exchange

67 57 33

Market trans arency ta and regulatory environment

79 74 83 Capacity of local investors

14 11 18 Macroeconomic environment and transparency

86 74 70 Legal standards and enforceability

85 85 40

(xx) = overall score

8 | Absa Africa Financial Markets Index 2023

AFMI_2023_03_ExecSumm_scores.indd 8 10/2/2023 3:18:23 PM

Overall Pillar 1: Pillar 2: Pillar 3: Market

Market depth Access to foreign transparency, tax and

pillar scores exchange regulatory environment

max = 100 South Africa 100 South Africa 88 South Africa 98

Morocco 60 Egypt 87 Mauritius 94

Nigeria 56 Morocco 76 Kenya 92

Mauritius 56 Mauritius 75 Morocco 89

Botswana 54 Kenya 70 Nigeria 88

Tanzania 49 Botswana 68 Egypt 87

Ghana 46 Cabo Verde 68 Zimbabwe 83

Uganda 46 Uganda 67 Ghana 82

Tunisia 45 Nigeria 60 Uganda 79

Namibia 43 Rwanda 59 Rwanda 79

Kenya 42 Seychelles 58 Tanzania 78

Egypt 42 Madagascar 58 Botswana 78

Cabo Verde 36 Zambia 57 Zambia 74

Mozambique 33 Angola 57 Tunisia 70

Angola 33 Namibia 56 Angola 66

Rwanda 31 Cameroon 55 Malawi 62

Zambia 30 Tanzania 54 Eswatini 61

Senegal 30 Lesotho 54 Namibia 61

Côte d'Ivoire 28 Côte d'Ivoire 54 Cabo Verde 58

Malawi 28 Senegal 54 DRC 55

Cameroon 26 Ghana 51 Côte d'Ivoire 52

Seychelles 23 Tunisia 51 Cameroon 51

Eswatini 23 Mozambique 49 Seychelles 50

DRC 18 Eswatini 49 Mozambique 47

Zimbabwe 17 Malawi 43 Senegal 42

Madagascar 16 Ethiopia 41 Ethiopia 40

Lesotho 12 DRC 40 Madagascar 32

Ethiopia 10 Zimbabwe 33 Lesotho 31

Pillar 4: Pillar 5: Macroeconomic Pillar 6:

Capacity of environment and Legal standards

local investors transparency and enforceability

Namibia 100 Botswana 87 Mauritius 100

South Africa 63 Uganda 86 South Africa 100

Mauritius 61 Tanzania 81 Nigeria 90

Eswatini 60 Nigeria 79 Ghana 85

Botswana 57 South Africa 78 Malawi 85

Seychelles 57 Seychelles 77 Uganda 85

Morocco 29 Egypt 76 Zambia 85

Nigeria 27 Namibia 76 Kenya 55

Lesotho 25 Kenya 76 Tanzania 55

Cabo Verde 23 Eswatini 76 Namibia 40

Ghana 22 DRC 76 Zimbabwe 40

Kenya 18 Mauritius 76 Angola 25

Zimbabwe 18 Zambia 74 Cabo Verde 25

Cameroon 16 Rwanda 74 Cameroon 25

Tanzania 15 Lesotho 72 Côte d'Ivoire 25

Egypt 15 Côte d'Ivoire 71 Egypt 25

Uganda 14 Mozambique 70 Morocco 25

Rwanda 13 Morocco 70 Senegal 25

Mozambique 13 Zimbabwe 70 Tunisia 25

Malawi 12 Senegal 67 Botswana 10

Angola 12 Cameroon 66 DRC 10

Côte d'Ivoire 11 Malawi 65 Eswatini 10

Tunisia 11 Angola 64 Ethiopia 10

Zambia 11 Ethiopia 63 Lesotho 10

Senegal 11 Cabo Verde 63 Madagascar 10

Ethiopia 11 Madagascar 61 Mozambique 10

Madagascar 10 Ghana 60 Rwanda 10

DRC 10 Tunisia 54 Seychelles 10

Absa Africa Financial Markets Index 2023 | 9

AFMI_2023_03_ExecSumm_scores.indd 9 10/2/2023 3:18:24 PM

Highlights 2022-23 Pictured: Construction, Kenya

Market developments and policy

changes boost growth of financial

markets across the continent

Angola

The Bolsa de Divida e Valores de Angola launched

its repurchase market in mid-2022.

Botswana

The Botswana Stock Exchange unveiled a new

automated trading system and central securities

depository system.

Cabo Verde

In January 2023, the first blue bond was issued on

Cabo erde’s Blu-X sustainable finance platform. Pictured: 12 Apostles, South Africa

Cameroon

The Bourse des Valeurs Mobilières de l’Afrique

Centrale signed the Marrakech pledge to promote Ethiopia

green finance.

The Ethiopia Capital Markets Authority was

formally established in December 2022, paving the

Côte d’Ivoire and Senegal way for the creation of the Ethiopian Securities

The Bourse Régionale des Valeurs Mobilières was Exchange.

one of seven participating exchanges in phase one

of the African Exchanges Linkage Project, which

Ghana

went live in November 2022 to enable cross-

border trading. Ghana’s Stock Exchange launched the ESG

Disclosures Guidance Manual in November 2022.

Democratic Republic of the Congo

Kenya

Rawbank completed the first issue of negotiable

commercial paper in the Democratic Republic of The Central Bank of Kenya created a new central

the Congo. securities depository – DhowCSD – that went live

in July 2023.

Egypt

Egypt’s Capital Markets Law was amended to Lesotho

allow the introduction of new products including Lesotho issued a 15-year treasury bond for the

social bonds and climate bonds. first time in the market.

Eswatini Madagascar

Eswatini’s Stock Exchange launched its Policy-makers finalised a capital market master

environmental, social and governance guidelines in plan with support from the International Finance

late 2022. Corporation and Frontclear.

10 | Absa Africa Financial Markets Index 2023

AFMI_2023_04_highlights.indd 10 10/2/2023 3:20:29 PM

Pictured: Boabab Alley, Madagascar

Nigeria

The Central Bank of Nigeria unified all segments

of the foreign exchange market into the investors

and exporters window.

Rwanda

Rwanda was the first African country to reach an

agreement with the International Monetary Fund

through the Resilience and Sustainability Trust to

Pictured: Textiles, Morrocco

enhance climate adaptation and mitigation.

Seychelles

Seychelles concluded its national risk assessment

on virtual assets to support policy-makers with

designing a digital market framework.

South Africa

South Africa’s first gender-linked bond and sukuk

bond was issued on the Johannesburg Stock

Exchange.

Tanzania

The KCB Bank Tanzania’s Fursa Sukuk became the

Malawi

first Sharia-compliant sukuk bond listed on the

Malawi finalised a framework for market makers to Dar es Salaam Stock Exchange.

operate in the secondary market for government

bonds.

Tunisia

Tunisia is transitioning to International Financial

Mauritius

Reporting Standards frameworks, scheduled to

The Bank of Mauritius is developing a carbon-

come into force in January 2024.

trading framework for blue and green credits.

Uganda

Morocco

Ugandan local currency government bonds were

Bank Al-Maghrib carried out an initial study of

added to the FTSE Frontier Emerging Markets

banks’ exposure to physical and transitional

climate risks. Government Bond Index.

Mozambique Zambia

Tropigalia SA became the 12th company to list on In July 2023, the Bank of Zambia implemented

the Bolsa de alore de Mo ambique in December the straight through processing of payments for

2022. government securities to enhance efficiency in

settlements.

Namibia

The Namibian Stock Exchange is establishing a Zimbabwe

central securities depository which is expected to The first real estate investment trust was listed on

launch in Q1 2024. the Zimbabwe Stock Exchange in November 2022.

Absa Africa Financial Markets Index 2023 | 11

AFMI_2023_04_highlights.indd 11 10/2/2023 3:21:28 PM

Pillar 1:

Market depth

Pictured: A coffee plantation in Ethiopia

AFMI_2023_pillar1.indd 12 10/2/2023 3:25:23 PM

Pillar 1 evaluates the size and liquidity of domestic equity and

bond markets, along with the diversity of listed assets and the

existence of standard features that enhance market depth.

ey findings

. ifficult global conditions have weighed on market si e and li uidity across most AFMI

economies in the ast months.

. Product diversity continues to e and across the continent with the availability of Islamic

financial roducts and environmental social and governance assets becoming more wides read.

. Some countries are taking ste s to u grade central securities de ositories to enhance

efficiency trans arency and regulatory oversight.

Figure 1.1. South Africa remains largest and most advanced market

Contributing indicators and overall harmonised score for Pillar ma

100

90

80

70

60

50

40

30

20

10

0

Madagascar

Eswatini

Zimbabwe

Ethiopia

Rwanda

Mozambique

South Africa

Morocco

Mauritius

Nigeria

Tanzania

Ghana

Tunisia

Namibia

Kenya

Egypt

Cabo Verde

Angola

Senegal

Côte d'Ivoire

Malawi

Seychelles

DRC

Lesotho

Uganda

Zambia

Botswana

Cameroon

Size of markets Liquidity Product diversity Depth

Primary dealer system Pillar 1 Score - 2023 Pillar 1 Score - 2022

Source: AFMI 2023 survey, national central banks, national stock exchanges, national capital market authorities, International Monetary Fund, World

Federation of Exchanges

Note: The overall Pillar 1 score represents the average harmonised score across all Pillar 1 indicators. Scores from 2022 are updated to incorporate any

revisions, newly available data and/or improved data collection methods and may not reflect the Pillar 1 scores published in AFMI 2022. More information

on pp.42-43.

Absa Africa Financial Markets Index 2023 | 13

AFMI_2023_pillar1.indd 13 10/2/2023 3:25:27 PM

The challenging global economic than doubled in dollar terms to $5.6bn Similar to equities, corporate bond

environment has hit financial in June, from $2.6bn a year before. As markets have generally come under

markets in Africa once again this a share of gross domestic product, pressure. In the 12 months to June

year. Various survey respondents it rose to 44.5% which is the fifth 2023, the value of corporate bonds

identified inflation, rising interest highest in the index (Figure 1.2). A outstanding fell in dollar terms and

rates in advanced economies and local survey participant mentioned the as a share of GDP in 17 of the 22

geopolitical tensions as challenges to surge in its stock market is due to the index countries with these assets

their domestic markets. One survey strong financial performance of listed available on domestic exchanges.

participant from Mauritius also companies and ‘investors rebalancing Ghana saw the steepest decline in

stated that ‘Foreign participation their overall investment portfolios corporate bonds outstanding to just

has declined since the advent of to hedge against high inflation’, with 0.1% of GDP in June, from 1.9% a

Covid-19 and the start of the Russia- ‘stocks more attractive than fixed- year before. Bonds issued by ESLA

Ukraine war. This has been triggered income securities’. This contributes to and Daakye Trust – special purpose

by the flight-to-quality phenomenon, vehicles set up by the government

Malawi’s 2-point rise in Pillar 1, though

generally observable in periods of and incorporated as public companies

it still ranks 20th as its securities

global uncertainty.’ – were restructured as part of its

market remains relatively illiquid.

domestic debt exchange programme

These factors have all contributed to Turnover across AFMI stock markets in February 2023.

the decline in equity markets across has generally declined. On average,

the continent. The depreciation of This restructuring has also weighed

annual equity turnover as a share of

most African currencies in the past 12 on the value and turnover of Ghana’s

market capitalisation fell to 6.0% in

months has exacerbated the weakness listed government bonds, with one

the 12 months to June, from 6.7% in local survey respondent stating that,

in dollar terms. In the 12 months to the previous year. Egypt continues to

June, the aggregate stock market ‘With the recent economic downturn

rank first on this measure despite a and the domestic debt exchange

capitalisation of AFMI countries fell by decline to 50.6%, from 62.0%, over

$50bn, down 4%. Declines were broad programme, investors have lost

this period. In its latest quarterly confidence in the Ghanaian economy.’

based, experienced by 16 economies report, the Egypt Stock Exchange Consequently, Ghana fell by 4 points

in the index. In dollar terms, the noted that foreign investors have in Pillar 1, to 46. One positive is that,

largest falls came in Zimbabwe (62%),

been net equity sellers in the first after further rounds of domestic

Nigeria (34%) and Kenya (30%), partly

half of 2023, but this has been offset debt reprofiling in August and

due to the sharp depreciation of their

by a surge in retail flows with local September, Ghana’s government is on

currencies.

investors accounting for close to 85% track to meet the terms of its $3bn

Malawi is a notable exception to this of the value traded in listed stocks, up IMF programme to release further

trend. Its market capitalisation more from 72% a year before. disbursements from the Fund.

Figure 1.2. Malawi an exception to declining market capitalisation

Stock market ca italisation of P

300

250

200

150

100

50

0

Eswatini

Zimbabwe

Rwanda

Mozambique

South Africa

Mauritius

Seychelles

Malawi

Morocco

Namibia

Tunisia

Senegal

Côte d'Ivoire

Kenya

Nigeria

Ghana

Tanzania

Egypt

Cabo Verde

Angola

Lesotho

Cameroon

Zambia

Uganda

Botswana

June 2022 June 2023

Source: AFMI 2023 survey, World Federation of Exchanges, national stock exchanges, OMFIF analysis

Note: Excludes the DRC, Ethiopia and Madagascar, which are yet to establish securities exchanges.

14 | Absa Africa Financial Markets Index 2023

AFMI_2023_pillar1.indd 14 10/2/2023 3:25:27 PM

Concerns over inflation and proceeds are being used to finance markets. In June 2023, the World

fiscal positions have weighed on small- and medium-sized Sharia- Bank approved a new financing deal

government bond markets in other compliant businesses. for Rwanda, which will support the

major African economies such as issuance of a sustainability-linked

Other countries are also looking to

Egypt, Nigeria and South Africa. The bond by the Development Bank of

incorporate Islamic financial products.

average value of listed sovereign Rwanda. In Tanzania, CRBD Bank

A respondent in Mauritius mentioned

bonds across AFMI countries was launched the Kijani bond – the largest

listing rules are being reviewed to

12.1% of GDP in June 2023, from green bond in sub-Saharan Africa

ensure the jurisdiction is ‘positioned as

12.7% a year earlier. But there – which will be listed on the Dar es

an attractive platform to list and trade

were increases in nine countries Salaam Stock Exchange later this

Islamic products’. This was echoed by

including Uganda, Mozambique and year. Similarly, a survey participant in

a respondent in Kenya who mentioned

Cote D’Ivoire. That links to a rise in Eswatini mentioned they hope for a

they are looking to establish the

domestic debt issuance as it has sustainable product listing by the end

country as ‘a regional Islamic financial

become increasingly costly to list of 2023 following the introduction

government bonds on international hub’ to allow individuals to explore ‘an

of ESG market guidelines. As shown

markets. One survey respondent from alternative investment choice away in Pillar 3, most index countries have

Kenya observed how ‘The national from traditional investment channels’. now implemented market standards to

treasury has been forced to rely on A respondent from Ethiopia stated issue ESG assets, suggesting policy-

the domestic credit market to finance they will ‘work towards developing makers see this as an opportunity to

the budget deficit as it is squeezed in Sharia-compliant Islamic financial attract fresh investment.

part by roadblocks in accessing the products’ to cater to the country’s

international capital markets.’ large Muslim population. Developing market infrastructure

Liquidity has declined in many Environmental, social and governance- For most AFMI countries, there is clear

government bond markets too. based assets are also gaining scope to improve financial market

Turnover fell in 11 index countries as traction. This is not just limited to infrastructure. That is especially the

a share of listed government bonds green bonds. Barloworld issued case in markets that are in relatively

in the 12 months to June. This ratio Africa’s first gender-linked bond on early stages of development such as

dropped sharply for Egypt to 12.6%, the Johannesburg Stock Exchange in the DRC, Madagascar and Ethiopia,

from 38.7%. This is mainly due to the August 2022, with coupon rates linked which are yet to establish a securities

normalisation of trading as there had to gender diversity in leadership exchange. In the latter, there have

been a surge of activity in early 2022 and the use of black women-owned been positive steps over the past

following Egypt’s inclusion in the JP businesses in the company’s supply year. The government established a

Morgan index for emerging market chain. This helps South Africa to Capital Markets Authority and the

bonds. For South Africa, despite a score highest on the availability of Ethiopian Securities Exchange Project

decline in bond turnover, liquidity listed ESG assets, alongside Mauritius Office in 2022, tasked with setting

remains higher than in all other AFMI and Morocco. Elsewhere, the first up an exchange. A survey respondent

countries combined. With the largest, blue bond in Cabo Verde was listed from Ethiopia mentioned the ESX

most liquid and most developed in January 2023 and a local survey Project Office is now in the process

financial market infrastructure on the respondent said the country ‘aims to of finalising an electronic trading

continent, South Africa continues to be a point of reference for inclusive platform and a rule book.

score 100 in Pillar 1 overall. and sustainable development’,

For countries that already have

which is ‘conducive to private sector

securities exchanges, there are

New products come to market investment’.

some market features that remain

New financial assets are becoming These examples aside, ESG products underdeveloped. On a positive note,

available in Africa to attract remain relatively scarce in Africa most index countries have primary

investment. Due to their increasing as they are listed in just nine AFMI dealers, which allow for more

importance to global finance, Islamic economies. But countries are looking efficient debt issuance. But horizontal

financial products are now included to build their sustainable financial repurchase agreements (short-

in our measure of product diversity

in Pillar 1. They are available in

eight AFMI economies, with the

first sukuk bonds being launched

on domestic exchanges in South

ESG products remain relatively scarce in

Africa and Tanzania in the past 12 Africa as they are listed in just nine AFMI

months (Figure 1.3). A Tanzanian

survey respondent described how

economies. But countries are looking to

the ethical Sharia-compliant sukuk build their sustainable financial markets.

bond, known as the KCB Fursa Sukuk,

was oversubscribed by 110% and the

Absa Africa Financial Markets Index 2023 | 15

AFMI_2023_pillar1.indd 15 10/2/2023 3:25:27 PM

Pictured Farming red soil in Angola

AFMI_2023_pillar1.indd 16 10/2/2023 3:25:55 PM

term loans between commercial ig re I la ic financial pro ct offere in eight co ntrie

banks) are low across AFMI countries, Availability of selected financial roducts on e changes or over the counter

with the exceptions of South Africa

and Morocco, which rank as the

top two in Pillar 1. Use of these Islamic

Government Corporate

instruments is closely tied to the Country Equities financial ESG assets

bonds bonds

adoption of Global Master Repurchase products

Agreements (considered in Pillar 6)

and the efficient operation of central Egypt

securities depositories, which can

foster activity in the fixed income Morocco

market. Meanwhile, half of index

countries also lack market makers Nigeria

in secondary markets for bonds,

though survey participants in Rwanda South Africa

and Malawi said they are due to be

introduced, which should improve Tanzania

liquidity and pricing.

Côte d’Ivoire

One common step African policy-

makers have taken over the past Senegal

year is to develop central securities

depositories to improve efficiency, Tunisia

oversight and transparency. In

September 2022, the Botswana Stock Kenya

Exchange launched a new CSD system

alongside an automated trading Mauritius

system. A local survey respondent

mentioned this has ‘improved Namibia

settlement efficiency and compliance

with the International Organization

Cabo Verde

of Securities Commission’s Principles

for Financial Markets Infrastructures’.

Rwanda

More recently, the Central Bank of

Kenya introduced a new CSD called

Botswana

DhowCSD, which a survey participant

said will ‘enhance market liquidity,

Cameroon

improve operational efficiency in

the domestic debt market, promote

Eswatini

market deepening and foster financial

inclusion through expanded digital

Ghana

access’.

Elsewhere, the Namibian Stock Mozambique

Exchange is in the final stages of

setting up a CSD that is expected Seychelles

in Q1 2024. A participant from

Ethiopia said that ‘A multi-asset CSD Uganda

is being set up under the National

Bank of Ethiopia, with the support Zimbabwe

of FSD Africa. This is an essential

financial market infrastructure that Angola

is necessary for efficient post trade

settlement.’ Survey respondents in Lesotho

Ghana, Malawi, Seychelles, Uganda

and Zambia all mentioned initiatives Malawi

to upgrade their CSDs to improve

information transparency and Zambia

technological efficiency. These are

encouraging developments to bolster Source: AFMI 2023 survey

market infrastructure across Africa. Note: Excludes the DRC, Ethiopia and Madagascar, which are yet to establish securities exchanges.

Absa Africa Financial Markets Index 2023 | 17

AFMI_2023_pillar1.indd 17 10/2/2023 3:25:59 PM

Pillar 2:

Access to foreign

exchange

Pictured: Market in Morocco

AFMI_2023_pillar2.indd 18 10/2/2023 3:27:07 PM

Pillar 2 examines the ability of international investors to easily deploy

and repatriate capital, and the capacity of central banks to manage

volatility from forei n capital ows.

ey findings

. Pillar scores fell for the ma ority of economies mainly due to the deterioration in foreign e change

reserves ade uacy.

. A um in interbank F li uidity lifts Morocco into the to three behind South Africa and gy t.

. Countries score well for their daily re orting of e change rates but trans arency can be im roved

through more wides read ado tion of the F lobal Code.

Figure 2.1. Weaker reserves adequacy constrains scores

Contributing indicators and overall harmonised scores for Pillar ma

100

90

80

70

60

50

40

30

20

10

0

Madagascar

Eswatini

Seychelles

Ethiopia

Rwanda

Mozambique

South Africa

Egypt

Morocco

Mauritius

Kenya

Cabo Verde

Nigeria

Angola

Namibia

Tanzania

Lesotho

Côte d'Ivoire

Senegal

Ghana

Tunisia

Malawi

DRC

Uganda

Zambia

Zimbabwe

Botswana

Cameroon

Reserve adequacy FX liquidity FX arrangement & controls

Reporting standards Pillar 2 Score - 2023 Pillar 2 Score - 2022

Sources: AFMI 2023 survey, IMF, national central banks

Note: the overall Pillar 2 score represents the average harmonised score of all Pillar 2 indicators. Scores from 2022 are updated to incorporate any

revisions and may not reflect those published in AFMI 2022. More information about revisions can be found on pp.42-43.

Absa Africa Financial Markets Index 2023 | 19

AFMI_2023_pillar2.indd 19 10/2/2023 3:27:11 PM

Pillar 2 considers how conducive 10 of these cases, such as in Egypt. economies could potentially cause

AFMI economies are to foreign Reserves there fell to 3.7 months of exiting of FX flows’. These challenging

investment. It includes indicators for imports in 2022, from 4.6 in 2021. external conditions may constrain the

capital control stringency, flexibility This led to Egypt slipping to second ability of central banks across Africa to

of exchange rate regimes and level of place in Pillar 2 behind South Africa, rebuild their reserves in the near term.

interbank foreign exchange liquidity. where reserves coverage has held up

The reporting of FX data is considered well at above 5 months of imports. Tighter FX liquidity

as a measure of transparency. This Ghana, like Egypt, has been vulnerable Access to FX relies on a well-

pillar also assesses the ability of to the surge in commodity prices. developed banking system to provide

central banks to manage the potential There were also capital outflows liquidity to market participants and

volatility from capital flows through due to concerns about public debt allow for more accurate pass-through

the adequacy of FX reserves. sustainability ahead of the sovereign of official exchange rates to the

default in late 2022. Ghana’s FX domestic economy. South Africa and

FX reserves under pressure reserves fell to just 0.6 months of Egypt continue to score highest as

Scores declined for the majority of imports in 2022, from 2.4 in 2021 their interbank FX liquidity remains

AFMI countries in Pillar 2, largely due (Figure 2.2). This led to the country much higher than elsewhere in Africa.

to the fall in FX reserves adequacy falling by 7 points, to 51, in Pillar 2.

Morocco rises to third on this metric

– measured in months of imports. Ghana and Egypt are among the many and in Pillar 2 overall. Bank Al-

Rising interest rates in advanced index countries which have agreed Maghrib’s 2022 annual report notes

economies and a flight to safety an International Monetary Fund deal that ‘The average monthly volume

amid the Russia- kraine war have to bolster their FX reserves. In the of foreign currency traded against

led to capital outflows for much of first half of 2023, 12 AFMI economies the dirham on the interbank market

Africa. For commodity importers, the have received financing from the increased by 140 to Mad36bn.’ This

deterioration in the terms of trade Fund worth over a cumulative $2.5bn. is equivalent to approximately $42.5bn

due to higher food and fuel prices Partly due to IMF support, the latest annually. The central bank stated this

has also contributed to a reduction data show that the level of reserves sharp increase was due to ‘ongoing

in international reserves. Aggregate has generally stabilised across the deepening of the interbank FX market

FX reserves among AFMI countries continent this year. and an increase in the use of hedging

dropped by $35bn in 2022, equivalent instruments’.

However, more than 10 survey

to a 10% fall.

respondents mentioned that limited However, Morocco was the exception

Overall, 21 index economies access to FX remains a key challenge as many other countries experienced

experienced a decline in reserves to their market development. And a decline in interbank FX turnover last

adequacy. A decrease in reserves one participant from Uganda stated year. One bank in Tanzania explained

was coupled with a rise in imports in ‘further rate hikes in advanced in their survey that ‘The market has

Figure 2.2. Widespread fall in FX reserve coverage

otal foreign e change reserves in months of im orts

14

12

10

0

Madagascar

Eswatini

Zimbabwe

Rwanda

Ethiopia

Mozambique

Mauritius

Angola

Botswana

Cabo Verde

Nigeria

Morocco

South Africa

Namibia

Cameroon

Côte d'Ivoire

Senegal

Lesotho

Tanzania

Egypt

Kenya

Seychelles

Tunisia

DRC

Malawi

Ghana

Uganda

Zambia

2021 2022

Source: IMF, OMFIF analysis

20 | Absa Africa Financial Markets Index 2023

AFMI_2023_pillar2.indd 20 10/2/2023 3:27:11 PM

witnessed increased tightening of

dollar liquidity as demand for dollars

Ethiopia, Mozambique and Zimbabwe

remain the lowest scorers due to their

There remain

exceeds supply.’ In Uganda, which broad-based and stringent capital si nificant barriers

was previously third highest on this restrictions. to capital ows

measure, annual interbank FX turnover

edged lower to $28.3bn. It also FX systems and transparency

across the continent

declined in Ghana, Nigeria and Kenya

As well as capital controls, another

and the average

where survey respondents mentioned

growing concerns about a shortage of possible hurdle for international score on this

FX. investors is distortionary exchange measure is just 44

Note that scores across AFMI are

rate regimes. Almost all AFMI out of 100 across

economies have unitary exchange

assigned on a relative, rather than

rates, although the existence of the sample.

absolute, basis so the dramatic

improvement in Morocco contributed multiple exchange rates in Zimbabwe

to a steep fall in Pillar 2 scores for and Nigeria, which can lead to

Uganda, Ghana, Nigeria and Kenya. inefficiencies and misallocation of

Interbank FX liquidity remains limited, resources, weighs on their Pillar 2

or negligible, for other economies in scores. A survey participant mentioned

AFMI. ‘Nigeria’s FX management system

has led to a scarcity of FX, which has

FX controls negatively impacted foreign investors.’

Alongside having adequate That said, the Central Bank of Nigeria

reserves and a developed interbank has taken steps this year to improve

market, having few restrictions to the situation. It harmonised the

international capital flows is key to multiple segments of the FX market

improving access to FX. This year, into the investors and exporters

we have introduced a more robust window. Another survey participant

measure of the stringency of capital from the country stated this move ‘is

controls. Having previously inferred primed to result in improved foreign

this from survey responses, we portfolio inflows’.

now use a standardised measure

by totalling the number of controls Pillar 2 also considers the

on capital transactions using data transparency of FX markets. All

from the IMF’s Annual Report on countries score well for the daily

Exchange Arrangements and Exchange reporting of exchange rates by

Restrictions. Pillar 2 scores from 2022 central banks. However, there is

have been adjusted to take account of limited adoption of the FX Global

this new measure. Code in index countries. This is a set

Cabo Verde scores highest on this of best practice principles to ensure

front due to its open capital account. a transparent FX market, which

The IMF notes that ‘Legislative Decree underpins greater confidence for

No. 3/2018 of June 22, 2018, decreed market participants to transact.

the full liberalisation of all economic

South Africa, Egypt and Mauritius

and financial relations with the outside

world, especially capital movements.’ continue to score highly on this

Rwanda, Uganda and Botswana also measure for their widespread use

score highly for their relatively relaxed of the FX Global Code (or local

capital controls. Elsewhere, Angola equivalent). Kenya’s score improved

improves its score on this measure as this year as the Central Bank of

authorities have loosened regulations Kenya became a signatory of it and

on the purchase of foreign currency published the Kenya Foreign Exchange

for purposes abroad, including Code in March 2023, which draws on

investments. principles from the FX Global Code,

But, in general, there remain to strengthen the functioning of the

significant barriers to capital flows local market. A survey participant from

across the continent and the average Tanzania mentioned that the adoption

score on this measure is just 44 of the Global FX Code is planned for

out of 100 across the AFMI sample. later this year.

Absa Africa Financial Markets Index 2023 | 21

AFMI_2023_pillar2.indd 21 10/2/2023 3:27:11 PM

Pillar 3:

Market transparency,

tax and regulatory

environment

Pictured: International Lake Malawi, Malawi.

AFMI_2023_pillar3.indd 22 02/10/2023 15:23:44

Pillar 3 examines tax systems, regulation and information availability,

alon side sustainable financial market frameworks.

ey findings

. Pillar scores rise in countries largely driven by increases in the number of credit ratings.

. here is continued rogress on measures that incor orate sustainability into financial market frameworks

and or regulation which are now im lemented in AFMI countries.

. Many ta regimes in AFMI economies are becoming more challenging for investors.

Figure 3.1. South Africa, Mauritius and Kenya remain in the top three

Contributing indicators and overall harmonised scores for Pillar ma

100

90

80

70

60

50

40

30

20

10

0

Côte d'Ivoire

Eswatini

Ethiopia

Zambia

South Africa

Mauritius

Kenya

Morocco

Nigeria

Egypt

Zimbabwe

Ghana

Uganda

Rwanda

Tanzania

Tunisia

Angola

Malawi

Namibia

Cabo Verde

DRC

Cameroon

Seychelles

Mozambique

Senegal

Madagascar

Lesotho

Botswana

Financial stability regulation Corporate reporting standards and governance

Tax environment Financial information transparency

ESG initiatives & standards Existence of credit ratings

Pillar 3 Score - 2023 Pillar 3 Score - 2022

Sources: AFMI 2023 survey, Bank for International Settlements, International Financial Reporting Standards, Deloitte, PricewaterhouseCoopers,

Refinitiv, GCR Ratings

Note: The overall Pillar 3 score represents the average harmonised score across all Pillar 3 indicators. Scores from 2022 are updated to incorporate

any revisions, newly available data and/or improved data collection methods and may not reflect those published in AFMI 2022. More information

on pp.42-43

Absa Africa Financial Markets Index 2023 | 23

AFMI_2023_pillar3.indd 23 02/10/2023 15:23:46

20 of the 28 Pillar 3 considers the framework that

supports financial markets, including

same. Bank Al-Maghrib partnered

with the World Bank to carry out

countries measures for regulation, tax regimes climate stress-test exercises while

now implement and market transparency. Since the Reserve Bank of Zimbabwe issued

2021, this pillar has also considered a climate risk management guideline

some form of ESG environmental, social and governance in March 2023 that requires banks to

initiatives , up frameworks as sustainability is conduct scenario analysis and report

from 13 of the 23 becoming increasingly important to

global investors.

their results. These new initiatives

contribute to Morocco and Zimbabwe

countries covered in rising by three places in Pillar 3 to

South Africa, Mauritius and Kenya

. continue to rank as the top three

fourth and seventh, respectively.

in this pillar. They have transparent More broadly, 20 of the 28 AFMI

financial reporting standards, a countries now implement some

high number of credit ratings and form of ESG initiatives (71 ), up

widespread ESG initiatives. These from 13 of the 23 countries covered

three countries are also among the in AFMI 2021 (57 ). The most

few that have implemented climate common policies for promoting

stress-testing frameworks. Morocco sustainable financial markets have

and Zimbabwe are now doing the been to implement market standards

Figure 3.2. ESG policies now exist in 20 AFMI countries

istence of sustainability focused olicies

Climate stress ncentives for market

Country

testing issuing ESG assets standards

ypt

Kenya

Mauritius

orocco

outh frica

imbabwe

otswana

Cabo Verde

Ghana

Nigeria

wanda

Tanzania

Tunisia

Uganda

Zambia

Angola

Cameroon

swatini

alawi

Namibia

Source: AFMI 2023 survey

Note: Countries not included are Côte d’Ivoire, the DRC, Ethiopia, Lesotho, Madagascar, Mozambique,

Senegal and Seychelles.

24 | Absa Africa Financial Markets Index 2023

AFMI_2023_pillar3.indd 24 02/10/2023 15:23:46

regarding the issuance of ESG assets. women’s empowerment bonds and applied to renewable energy projects

climate bonds. only.

Cabo Verde passed regulation on blue

bond issuance in October 2022. These That said, introducing market

Challenging tax environments

rules paved the way for the first standards alone may not be enough

blue bond listing on Blu-X, the Bolsa to successfully promote the issuance Aside from measures to incorporate

de Valores de Cabo Verde’s regional of ESG assets. While 20 AFMI ESG factors, tax systems are

blue finance platform, in January countries have sustainability-related important for attracting investment.

2023. In Rwanda, the government is financial polices, only nine have Mauritius continues to score the

working with a range of multilateral ESG assets listed on their domestic highest on its conducive tax regime,

organisations to bolster climate- exchanges. Specific measures followed by Tunisia. These countries

related financing and was the for incentivising the issuance of both have low withholding tax rates

first sub-Saharan Africa country sustainable financial products can on interest and dividends, and over

to access the IMF’s Resilience and play an important role in bridging this 40 double-taxation treaties. These

Sustainability Facility arrangement gap. agreements are important as they

last year. Moreover, the new Ireme offer exemptions to foreign investors

Botswana’s Pillar 3 score rises by 9

Invest programme aims to scale up and therefore incentivise greater

points this year as it implemented

private sector green investments in portfolio inflows. In Tunisia, there

new measures on this front. In July

Rwanda based on common criteria are also regulations that offer a tax

2023, the Botswana Stock Exchange

for governance and reporting. The exemption for small- and medium-

approved a 25 discount on initial

country rises by two places into the sized enterprises that join an

listing fees for sustainable bonds.

top 10 for Pillar 3. alternative market segment.

This is similar to the Bourse de

Meanwhile, the Ghana Stock Exchange Tunis’ tax exemption on interest In Tanzania, the tax environment

and Eswatini Stock Exchange both for green or ESG bonds of up to has become more favourable to

published ESG disclosure guidelines Tnd10,000 per year. Mauritius, investors in the past year as coupon

in late 2022. Furthermore, a recent which already implements a variety payments for listed corporate bonds

amendment to Egypt’s Capital Market of ESG initiatives, went further have been made exempt from WHT.

Law allows the introduction of five and introduced a tax exemption on However, many tax systems in AFMI

new assets: sustainable development interest income from bonds of all jurisdictions remain unfavourable to

bonds, ESG bonds, social bonds, sustainable projects. This previously investors. While high taxes may

Figure 3.3. Relatively high tax rates in Lesotho

ithholding ta rates

25 KEN

LSO

MOZ

EGY COD

20 CPV ZMB

MDG

CIV

WHT rate on interest

SEN RWA CMR

15 MUS AGO SYC ZAF

BWA MWI UGA

NGA

MAR

10 TZA TUN SWZ NAM

GHA ETH

ZWE

0

0 5 10 15 20 25

WHT rate on dividends

Source: Deloitte, PwC, OMFIF analysis

Note: WHT may be reduced under applicable tax treaties. Where applicable, the tax rate shown is for non-residents.

Absa Africa Financial Markets Index 2023 25

AFMI_2023_pillar3.indd 25 02/10/2023 15:23:46

e elop ent in finance