Professional Documents

Culture Documents

Equity Note On MJLBL

Equity Note On MJLBL

Uploaded by

fneelavCopyright:

Available Formats

You might also like

- Kali Linux DocumentationDocument22 pagesKali Linux DocumentationTech VkNo ratings yet

- Gender Criticism What Isn't GenderDocument18 pagesGender Criticism What Isn't GenderLuis CaceresNo ratings yet

- Tuition Fees Chart of KG 1 PDF - Manarat272202024933AMDocument1 pageTuition Fees Chart of KG 1 PDF - Manarat272202024933AMfneelav100% (3)

- JHM - KENANGA - 2020-06-29 - BUY - 2.00 - JHM Consolidation - 5G To Unlock Next Phase of Growth - 2021862268Document14 pagesJHM - KENANGA - 2020-06-29 - BUY - 2.00 - JHM Consolidation - 5G To Unlock Next Phase of Growth - 2021862268Faisal Zabidy100% (1)

- Equity Note - MJL Bangladesh Limited - January 2018Document4 pagesEquity Note - MJL Bangladesh Limited - January 2018Alchemist_JVCNo ratings yet

- 1390469516IDLC Investments - Company Insight - MJL Bangladesh Limited PDFDocument1 page1390469516IDLC Investments - Company Insight - MJL Bangladesh Limited PDFMrittunjayNo ratings yet

- Equity Note - Padma Oil Company LTDDocument2 pagesEquity Note - Padma Oil Company LTDMd Saiful Islam KhanNo ratings yet

- Course - 307, LINDEBD VALUATION REPORT PDFDocument26 pagesCourse - 307, LINDEBD VALUATION REPORT PDFFarzana Fariha LimaNo ratings yet

- Chandigarh Distilers N BotlersDocument3 pagesChandigarh Distilers N BotlersNipun GargNo ratings yet

- Initiating Coverage - Gulf Oil Lubricants India Ltd. - 290822Document17 pagesInitiating Coverage - Gulf Oil Lubricants India Ltd. - 290822dbi003lavrajNo ratings yet

- Gujarat Alkalies and Chemical Init Mar 19 IndiaDocument15 pagesGujarat Alkalies and Chemical Init Mar 19 IndiaDave LiNo ratings yet

- Capacity Expansion Leads To Future Earning Visibility: BOC IndiaDocument1 pageCapacity Expansion Leads To Future Earning Visibility: BOC Indiasujaya24No ratings yet

- Jyothy Laboratories Ltd. - Update - CDDocument11 pagesJyothy Laboratories Ltd. - Update - CDagarohitNo ratings yet

- AngelBrokingResearch MahanagarGas IPONote 200616Document16 pagesAngelBrokingResearch MahanagarGas IPONote 200616durgasainathNo ratings yet

- Castrol India LTD: November 06, 2018Document17 pagesCastrol India LTD: November 06, 2018Yash AgarwalNo ratings yet

- ONGC - Stock Update 240921Document14 pagesONGC - Stock Update 240921Mohit MauryaNo ratings yet

- Equity Note On MJL Bangladesh Limited: Company OverviewDocument6 pagesEquity Note On MJL Bangladesh Limited: Company OverviewAsif MahmudNo ratings yet

- AmInv 95622347Document5 pagesAmInv 95622347Lim Chau LongNo ratings yet

- ANTONY WASTE HSL Initiating Coverage 190122Document17 pagesANTONY WASTE HSL Initiating Coverage 190122Tejesh GoudNo ratings yet

- Indian Oil Corporation: Interesting Times AheadDocument9 pagesIndian Oil Corporation: Interesting Times AheadNeelesh KumarNo ratings yet

- Equity Note - Active Fine Chemicals Ltd.Document3 pagesEquity Note - Active Fine Chemicals Ltd.Makame Mahmud DiptaNo ratings yet

- Balmer Lawrie Co Ltd-FinalDocument18 pagesBalmer Lawrie Co Ltd-FinalAyush AhujaNo ratings yet

- National Maize Equity Research - Jazira CapitalDocument9 pagesNational Maize Equity Research - Jazira CapitalMohamed FahmyNo ratings yet

- BPCL - Q1FY22 - MOStDocument10 pagesBPCL - Q1FY22 - MOStRahul JakhariaNo ratings yet

- 321 - AUM - Gravita IndiaDocument7 pages321 - AUM - Gravita IndianitinmuthaNo ratings yet

- GAIL - Resuming Coverage - HDFCDocument22 pagesGAIL - Resuming Coverage - HDFCSD HAWKNo ratings yet

- 435 FinalDocument16 pages435 FinalshakilnaimaNo ratings yet

- Minda Indus 15-12Document8 pagesMinda Indus 15-12ka raNo ratings yet

- Adani Wilmar IPO Note Angel OneDocument7 pagesAdani Wilmar IPO Note Angel OneRevant SatiNo ratings yet

- Company Name: IOCL (Indian Oil Corporation of India) Industry: Oil Gas and Consumable FuelsDocument12 pagesCompany Name: IOCL (Indian Oil Corporation of India) Industry: Oil Gas and Consumable FuelsAnkit PandaNo ratings yet

- HSL - IC - Gujarat Themis Biosyn - 02012023Document12 pagesHSL - IC - Gujarat Themis Biosyn - 02012023Prasad NawaleNo ratings yet

- Rubber Chemicals - Accelarater - Antioxidant and AntiozonentDocument25 pagesRubber Chemicals - Accelarater - Antioxidant and AntiozonentRajdeep MalNo ratings yet

- CHAMBLFERT 19052022210352 InvestorPresentation310322Document30 pagesCHAMBLFERT 19052022210352 InvestorPresentation310322bradburywillsNo ratings yet

- IOC Research InsightDocument4 pagesIOC Research InsightHARSH GARODIANo ratings yet

- Lumax Inds - Q3FY22 Result Update - 15022022 - 15-02-2022 - 14Document7 pagesLumax Inds - Q3FY22 Result Update - 15022022 - 15-02-2022 - 14Mridul Kumar BanerjeeNo ratings yet

- Stalwart of Bio-Economy Revolution!Document22 pagesStalwart of Bio-Economy Revolution!nitinmuthaNo ratings yet

- Tata Chemicals LTD: 12-Feb-2008 Pioneer Intermediaries PVT LTD - Agarwalla, AshwaniDocument32 pagesTata Chemicals LTD: 12-Feb-2008 Pioneer Intermediaries PVT LTD - Agarwalla, Ashwaniapi-3828752No ratings yet

- Oil & Natural Gas Corporation LTD: Key Financial IndicatorsDocument5 pagesOil & Natural Gas Corporation LTD: Key Financial Indicatorsneethub3No ratings yet

- Business Case - RSMDocument17 pagesBusiness Case - RSMduyvuluongNo ratings yet

- 7204 - D&O - PUBLIC BANK - 2023-08-24 - BUY - 4.37 - DOGreenTechnologiesExpectingaVShapeRecovery - 1840691060Document5 pages7204 - D&O - PUBLIC BANK - 2023-08-24 - BUY - 4.37 - DOGreenTechnologiesExpectingaVShapeRecovery - 1840691060Nicholas ChehNo ratings yet

- 1182311122021672glenmark Pharma Q2FY22Document5 pages1182311122021672glenmark Pharma Q2FY22Prajwal JainNo ratings yet

- Equity Note - Aftab Automobiles Limited - March 2017Document2 pagesEquity Note - Aftab Automobiles Limited - March 2017Sarwar IqbalNo ratings yet

- OswalDocument13 pagesOswalPRIYANKA KNo ratings yet

- A Comparative Analysis On Fuel-Oil Distribution Companies of BangladeshDocument15 pagesA Comparative Analysis On Fuel-Oil Distribution Companies of BangladeshTanzir HasanNo ratings yet

- Tata Motors Limited: Business OverviewDocument5 pagesTata Motors Limited: Business OverviewAryan SharmaNo ratings yet

- Castrol Initiation 211020Document30 pagesCastrol Initiation 211020Dusk TilldownNo ratings yet

- Esearch Eport: Riddhi Siddhi Gluco Biols LTDDocument9 pagesEsearch Eport: Riddhi Siddhi Gluco Biols LTDanny2k1No ratings yet

- Revenue From International Operations of (A ET 500 Company) Submitted To Prof.R.K.ChawalaDocument7 pagesRevenue From International Operations of (A ET 500 Company) Submitted To Prof.R.K.Chawalakrishan_28No ratings yet

- VRL Logistics Moti 01022022Document18 pagesVRL Logistics Moti 01022022ChatgptguyNo ratings yet

- Balaji Amines - Omkar AminDocument6 pagesBalaji Amines - Omkar AminTYBFM A 302 AMIN OMKARNo ratings yet

- CEAT Annual Report 2019Document5 pagesCEAT Annual Report 2019Roberto GrilliNo ratings yet

- Hindalco: CMP: INR442 TP: INR520 (+18%) Higher LME Prices To Drive Earnings GrowthDocument14 pagesHindalco: CMP: INR442 TP: INR520 (+18%) Higher LME Prices To Drive Earnings GrowthVinayak ChennuriNo ratings yet

- Balkrishna Inds Initial (Key Note)Document20 pagesBalkrishna Inds Initial (Key Note)beza manojNo ratings yet

- Tata Motors Group Q4fy23 Investor PresentationDocument58 pagesTata Motors Group Q4fy23 Investor PresentationSohail AlamNo ratings yet

- Godrej Consumer Products LTD: Key Financial IndicatorsDocument4 pagesGodrej Consumer Products LTD: Key Financial IndicatorsJustlazinNo ratings yet

- Voltamp Transformers (VAMP IN) : Management Meet UpdateDocument6 pagesVoltamp Transformers (VAMP IN) : Management Meet UpdateDarwish MammiNo ratings yet

- Lub-Rref (Bangladesh) Ltd. IPO NoteDocument8 pagesLub-Rref (Bangladesh) Ltd. IPO NoteAhm FerdousNo ratings yet

- Bharat Heavy Electricals Limited: Weak Operations Affects PerformanceDocument5 pagesBharat Heavy Electricals Limited: Weak Operations Affects PerformancevahssNo ratings yet

- Bharat Heavy Electricals LTDDocument3 pagesBharat Heavy Electricals LTDDeepak SinghNo ratings yet

- 1 - PCBL Company Update - 01 Dec 2023Document7 pages1 - PCBL Company Update - 01 Dec 2023Abhinav KumarNo ratings yet

- Reliance Industries: Manifesting The Standalone BusinessDocument16 pagesReliance Industries: Manifesting The Standalone BusinessRajat GroverNo ratings yet

- Reliance Industries: Manifesting The Standalone BusinessDocument16 pagesReliance Industries: Manifesting The Standalone BusinessRajat GroverNo ratings yet

- Reaching Zero with Renewables: Biojet FuelsFrom EverandReaching Zero with Renewables: Biojet FuelsNo ratings yet

- Spec A - 1475.23.02.0625Document1 pageSpec A - 1475.23.02.0625fneelavNo ratings yet

- Spec B - 1475.23.01.0957Document1 pageSpec B - 1475.23.01.0957fneelavNo ratings yet

- Cummins Oil Specifying 2017 PDFDocument5 pagesCummins Oil Specifying 2017 PDFfneelav100% (1)

- Shell Mysella S5 N 40: Performance, Features & Benefits Specifications, Approvals & RecommendationsDocument2 pagesShell Mysella S5 N 40: Performance, Features & Benefits Specifications, Approvals & RecommendationsfneelavNo ratings yet

- Fundamentals of Smart MeteringDocument34 pagesFundamentals of Smart MeteringSUDDHA CHAKRABARTYNo ratings yet

- Resume Help For StudentsDocument6 pagesResume Help For Studentsfhmdduwhf100% (1)

- Muslim Reformist MovementsDocument103 pagesMuslim Reformist MovementsShehryar AzizNo ratings yet

- Vaishnava Song BookDocument115 pagesVaishnava Song Bookapi-260953818No ratings yet

- SOLARIS CommandsDocument34 pagesSOLARIS CommandsYahya LateefNo ratings yet

- Process Industry Practices Piping: PIP PNC00001 Pipe Support Criteria For ASME B31.3 Metallic PipingDocument11 pagesProcess Industry Practices Piping: PIP PNC00001 Pipe Support Criteria For ASME B31.3 Metallic PipingRaymundo Maldonado AlvarezNo ratings yet

- F) OO (F .: Philippine Health Insurance CorporationDocument11 pagesF) OO (F .: Philippine Health Insurance CorporationXyla Joy Araneta PerezNo ratings yet

- Project 1 2 3 Extra TestsDocument100 pagesProject 1 2 3 Extra TestsAnitaNo ratings yet

- Shiong Shieng: Rogue (1) Charlatan Halfling/Lightfoot Chaotic GoodDocument3 pagesShiong Shieng: Rogue (1) Charlatan Halfling/Lightfoot Chaotic GoodpilchowskiNo ratings yet

- Issuu PDF Download: Preliminares para Ser MasonDocument17 pagesIssuu PDF Download: Preliminares para Ser MasonMagNo ratings yet

- College Algebra 12th Edition Lial Test BankDocument36 pagesCollege Algebra 12th Edition Lial Test Bankstilarassigner.zyro8100% (19)

- Smart City ProjectDocument22 pagesSmart City ProjectTaukir SiddiqueNo ratings yet

- Lim Tanhu v. Ramolete, 66 SCRA 425 (1975)Document40 pagesLim Tanhu v. Ramolete, 66 SCRA 425 (1975)Clauds Gadzz100% (1)

- Biology - Lesson Notes g12 PDFDocument3 pagesBiology - Lesson Notes g12 PDFSomebodyNo ratings yet

- DX DiagDocument31 pagesDX DiagAntonio MarrazzoNo ratings yet

- Franchise Brochure - NirulasDocument13 pagesFranchise Brochure - NirulasAnuj BhargavaNo ratings yet

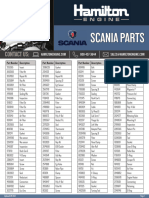

- Scania Diesel Engine Parts CatalogDocument3 pagesScania Diesel Engine Parts CatalogTarek MassimoNo ratings yet

- MariamNersisyanResume SWDocument3 pagesMariamNersisyanResume SWPushpendraNo ratings yet

- Director Human Resources in Denver CO Resume Janice ClewellDocument2 pagesDirector Human Resources in Denver CO Resume Janice ClewellJaniceClewellNo ratings yet

- Installatie en Onderhouds Manual CPAN XHE 3Document52 pagesInstallatie en Onderhouds Manual CPAN XHE 3valerivelikovNo ratings yet

- Core Values Module PaoloDocument9 pagesCore Values Module PaoloLala BoraNo ratings yet

- Salatin Sept03Document4 pagesSalatin Sept03api-3733859No ratings yet

- Britannia BourbonDocument12 pagesBritannia BourbonDebmalya De100% (1)

- ALP Consulting - SAP StaffingDocument12 pagesALP Consulting - SAP StaffingAnindya SharmaNo ratings yet

- Insultech Acoustical WrapDocument2 pagesInsultech Acoustical WrapScott VitkoNo ratings yet

- Consolidated QuestionsDocument77 pagesConsolidated QuestionsvenkatNo ratings yet

- Labor Standards (Azucena, JR., 2013) 165Document1 pageLabor Standards (Azucena, JR., 2013) 165Marlo Caluya ManuelNo ratings yet

- 1ghadjzftewifvsmn PDFDocument282 pages1ghadjzftewifvsmn PDFAlex MingNo ratings yet

Equity Note On MJLBL

Equity Note On MJLBL

Uploaded by

fneelavOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Equity Note On MJLBL

Equity Note On MJLBL

Uploaded by

fneelavCopyright:

Available Formats

MJL BANGLADESH LIMITED.

DSE: MJLBD

BLOOMBERG: MJLBD:BD

Company Overview ‘Total’ at 5% and Shell, Castrol and Caltex with 2% each and the

other 2% share has been secured by the MJLBD’s subsidiary

MJL Bangladesh Limited (MJLBD), a Joint Venture in the Omera Petroleum Ltd. The remaining 46% share of the market

downstream petroleum industry between Jamuna Oil Company is controlled by other products. Currently there are almost 70

Ltd. (JOCL) and EC Securities Ltd (subsidiary of the East Coast brands of lubricants in Bangladesh and the number is increasing

Group), was incorporated in 1998. The company started its day by day.

commercial operation in 1999. The company initiated as a

lubricating oil marketing company of Mobil brand but later in Company Fundamentals

2003 with the introduction of Lube Oil Blending Plant (LOBP) it Market Cap (BDT mn) 29,284.5

also got engaged in blending lubricant and grease products. Market Weight 1.1%

Currently the company has three subsidiaries – Omera

No. of Shares (mn) 238.5

Petroleum Ltd. (MJLBD owns 75% share), Omera Cylinders Ltd.

(MJLBD owns 99.99% share) and MJL & AKT Petroleum Ltd. Free-float (Public + Inst.) 22.2

(MJLBD owns 51% share). The company procures base oils from Paid-up Capital (BDT mn) 2385.0

ExxonMobil while the additives are sourced from other global 3 Months Average Turnover (BDT mn) 175.2

suppliers. MJLBD’s products can be categorized into three 3 Months Return 34.6%

segments – Mobil brand products, Omera brand products and Current Price (BDT) 122.8

other brand products. Some of the products of the company

52-week Price Range 68 – 123.5

are blended in the country while some finished products are

imported to meet the local as well as to export in the foreign Sector Forward P/E 14.0

market. MJLBD uses 16 depots, 431 filling stations, 852 agents 2014

2011 2012 2013

and 181 packed point dealers of JOCL to distribute its products (Q 2 Annu.)

to the major state owned industries and power plants. Other Financial Information (BDT mn):

than that MJLBD distributes its products directly to the

Net Sales 6,017 6,994 7,202 8,231

industrial buyers or through its own appointed 82 wholesalers.

Operating Profit 709 879 968 1,854

In 2013, the MJLBD attained 2.77% growth in its total revenue Profit After Tax 637 651 685 1,198

based on the positive growth rates of Oil tanker unit (20.79%) Assets 11,409 11,312 14,132 16,329

and trading unit (9.91%) and declining growth rate of the Long Term Debt 175 745 425 1,426

revenue from the manufacturing unit (7.03%). Out of the total Equity 6,872 7,212 7,780 8,093

sales 49% were generated by the Industrial lubricants while Dividend (C/B)% 15/15 25/- 25/- --/--

commercial vehicle lubricants and private vehicle lubricants Margin:

constituted 31% and 20% respectively of the total sales. In FY

Gross Profit 18.8% 19.0% 20.8% 27.1%

2013, the company’s gross profit margin increased to 20.79%

Operating Profit 11.8% 12.6% 13.4% 22.5%

from the last year’s rate of 18.97% as the company purchased

lower amount of raw materials for the manufacturing unit. As Pretax Profit 15.5% 12.4% 13.3% 21.2%

on December 31 2013, the company utilized 51% of its total Net Profit 10.6% 9.3% 9.7% 14.6%

capacity against the previous year’s 56.28%. Growth:

The firm was enlisted in the DSE and the CSE in June 2011. Sales 56.4% 16.2% 3.0% 14.3%

Around 58.36% of shares of the company are held by the Gross Profit 19.1% 17.3% 12.8% 49.3%

Sponsors, 19.45% by the Government and rest 12.91% & 9.12% Operating Profit -0.7% 23.9% 10.2% 91.5%

are held by the Institute & General Investors respectively. Net Profit 25.3% 2.3% 7.4% 74.8%

Profitability:

Industry Overview

ROA 7.7% 5.7% 5.5% 7.9%

The lubricant industry in Bangladesh can be segmented into ROE 12.6% 9.2% 9.3% 15.1%

three categories – industrial lubricant, commercial vehicle Leverage:

lubricant and private vehicle lubricant. Commercial vehicle

Debt Ratio 28.7% 22.4% 32.2% 34.2%

lubricant and private vehicle lubricant accounts for 46% and

29% of the total demand for lubricants in Bangladesh while Debt-Equity 47.7% 35.2% 58.4% 69.0%

industrial sector demands 25%. The demand for industrial Int. Coverage 1.9 2.8 3.7 9.2

lubricant is mainly dominated by the energy sector while Valuation:

manufacturing and processing industry also contributes to it. Price/Earnings 37.4 29.19 25.6 24.4

MJLBL has provided almost 60% of all industrial lubricants 3.9 3.7 3.4 3.6

Price/BV

during 2013 in Bangladesh. The Estimated consumption of

EPS (BDT) 2.7 2.7 2.9 5.0

lubricants in the country is around 1,00,000 tonnes which is

NAV Per Share 28.8 30.2 32.6 33.9

expected to grow at a rate of 2.5% in the coming years. Another

(BDT)

estimate shows that the market is worth to be BDT 2400 crore.

The lubricant market is led by the MJLBD with 30% market

share, followed by British Petroleum at 11%, French brand

1 September 11, 2014

Investment Positives 5 Year Earnings Per Share (BDT)

The Omera LPG Import Terminal & Bottling Plants Project, 5.00

75% owned subsidiary of MJLBD is expected to be

2.93

operational by October 2014. According the feasibility 2.67 2.73

2.13

report of the company, the project is expected to generate

the profit of approximately BDT 170 mn. This project is

aimed to meet the demand for LP Gas. The plant has a

Year 2010 Year 2011 Year 2012 Year 2013 Year 2014 (Q2

capacity of 100,000 TON/Annum. Annu.)

Omera Cylinders Ltd. another ongoing project of the

company (99.99% owned) is also expected to be

operational by October 2014. The company will provide Price Movement Since Listing

cylinders to the LP gas plants. The annual capacity of the 250

plant will be 5,00,000-5,50,000 cylinders annually. 200

The company has also signed an agreement with Balmer 150

Lawrie & Co. Ltd., a market leader in India in the 100

production of steel barrels. The purpose of signing is to 50

manufacture high quality steel drums for MJLBD for 0

storing of lubricant oil. Besides, it will also meet the Jun-11 Dec-11 Jun-12 Dec-12 Jun-13 Dec-13 Jun-14

market demand.

MJLBD penetrated in the Myanmar market with its Pricing Based on Relative Valuation:

subsidiary MJL & AKT Petroleum Co. Ltd. MJL & AKT Multiple Value

petroleum imports Mobil branded products as well as Market Forward P/E 17.2 based86.9

on

lubricants produced by MJLBD. Projection

Market Trailing P/E 17.1 50.2

(BDT)

To support the local manufacturers of LPG cylinders, the Sector Forward P/E 14.0 70.3

government increased the import duty from 5% to 10%. Sector Trailing P/E 13.2 38.7

Omera Cylinders Ltd. will be benefitted with this step. Sector P/B 2.1 71.3

Investment Negatives ** The average value per share is based on the current available data only.

However, two subsidiaries of the company are expected to be operational by

In FY 2013, the manufacturing unit witnessed a negative October 2014, which will accordingly improve the earnings and so as the price.

growth of 7.03% from the previous year. Sales of locally

blended lubricants and export sales of lubricants Concluding Remark

decreased from the previous year. MJLBD, a market leader in the lubricant industry, holds many

Shortage of gas supply and power adversely affects the projects which are expected to be fully operational within this

industrial growth which in turn lowers the demand for the year. All these projects may surge the EPS of the company. As

industrial lubricant consumption. per its latest half yearly financial statements, the Company

As the lube oil blending and marketing companies are fully reported net profit after tax of BDT 598.94 mn which was BDT

dependent on imported raw materials, price fluctuation of 400.19 mn for the same period of the previous year registering

raw materials overseas will have an adverse effect on a 50% growth due to decreasing COGS to Sales and reducing of

every company in this sector. financial expenses. As on date, the Company’s RSI (15) and MFI

(15) were 56.72 and 79.36 respectively.

Source: Annual Reports, the Financial Express, the Daily Star and ILSL Research, Company’s

concerned officials.

ILSL Research Team:

Name Designation

Rezwana Nasreen Head of Research Disclaimer: This document has been prepared by International Leasing Securities Limited (ILSL) for

Towhidul Islam Research Analyst information only of its clients on the basis of the publicly available information in the market and own

research. This document has been prepared for information purpose only and does not solicit any action

Md. Tanvir Islam Research Analyst based on the material contained herein and should not be construed as an offer or solicitation to buy or

Md. Imtiaz Uddin Khan Jr. Research Analyst sell or subscribe to any security. Neither ILSL nor any of its directors, shareholders, member of the

management or employee represents or warrants expressly or impliedly that the information or data of

the sources used in the documents are genuine, accurate, complete, authentic and correct. However all

reasonable care has been taken to ensure the accuracy of the contents of this document. ILSL will not

take any responsibility for any decisions made by investors based on the information herein.

For any Queries: research@ilslbd.com

2 September 11, 2014

You might also like

- Kali Linux DocumentationDocument22 pagesKali Linux DocumentationTech VkNo ratings yet

- Gender Criticism What Isn't GenderDocument18 pagesGender Criticism What Isn't GenderLuis CaceresNo ratings yet

- Tuition Fees Chart of KG 1 PDF - Manarat272202024933AMDocument1 pageTuition Fees Chart of KG 1 PDF - Manarat272202024933AMfneelav100% (3)

- JHM - KENANGA - 2020-06-29 - BUY - 2.00 - JHM Consolidation - 5G To Unlock Next Phase of Growth - 2021862268Document14 pagesJHM - KENANGA - 2020-06-29 - BUY - 2.00 - JHM Consolidation - 5G To Unlock Next Phase of Growth - 2021862268Faisal Zabidy100% (1)

- Equity Note - MJL Bangladesh Limited - January 2018Document4 pagesEquity Note - MJL Bangladesh Limited - January 2018Alchemist_JVCNo ratings yet

- 1390469516IDLC Investments - Company Insight - MJL Bangladesh Limited PDFDocument1 page1390469516IDLC Investments - Company Insight - MJL Bangladesh Limited PDFMrittunjayNo ratings yet

- Equity Note - Padma Oil Company LTDDocument2 pagesEquity Note - Padma Oil Company LTDMd Saiful Islam KhanNo ratings yet

- Course - 307, LINDEBD VALUATION REPORT PDFDocument26 pagesCourse - 307, LINDEBD VALUATION REPORT PDFFarzana Fariha LimaNo ratings yet

- Chandigarh Distilers N BotlersDocument3 pagesChandigarh Distilers N BotlersNipun GargNo ratings yet

- Initiating Coverage - Gulf Oil Lubricants India Ltd. - 290822Document17 pagesInitiating Coverage - Gulf Oil Lubricants India Ltd. - 290822dbi003lavrajNo ratings yet

- Gujarat Alkalies and Chemical Init Mar 19 IndiaDocument15 pagesGujarat Alkalies and Chemical Init Mar 19 IndiaDave LiNo ratings yet

- Capacity Expansion Leads To Future Earning Visibility: BOC IndiaDocument1 pageCapacity Expansion Leads To Future Earning Visibility: BOC Indiasujaya24No ratings yet

- Jyothy Laboratories Ltd. - Update - CDDocument11 pagesJyothy Laboratories Ltd. - Update - CDagarohitNo ratings yet

- AngelBrokingResearch MahanagarGas IPONote 200616Document16 pagesAngelBrokingResearch MahanagarGas IPONote 200616durgasainathNo ratings yet

- Castrol India LTD: November 06, 2018Document17 pagesCastrol India LTD: November 06, 2018Yash AgarwalNo ratings yet

- ONGC - Stock Update 240921Document14 pagesONGC - Stock Update 240921Mohit MauryaNo ratings yet

- Equity Note On MJL Bangladesh Limited: Company OverviewDocument6 pagesEquity Note On MJL Bangladesh Limited: Company OverviewAsif MahmudNo ratings yet

- AmInv 95622347Document5 pagesAmInv 95622347Lim Chau LongNo ratings yet

- ANTONY WASTE HSL Initiating Coverage 190122Document17 pagesANTONY WASTE HSL Initiating Coverage 190122Tejesh GoudNo ratings yet

- Indian Oil Corporation: Interesting Times AheadDocument9 pagesIndian Oil Corporation: Interesting Times AheadNeelesh KumarNo ratings yet

- Equity Note - Active Fine Chemicals Ltd.Document3 pagesEquity Note - Active Fine Chemicals Ltd.Makame Mahmud DiptaNo ratings yet

- Balmer Lawrie Co Ltd-FinalDocument18 pagesBalmer Lawrie Co Ltd-FinalAyush AhujaNo ratings yet

- National Maize Equity Research - Jazira CapitalDocument9 pagesNational Maize Equity Research - Jazira CapitalMohamed FahmyNo ratings yet

- BPCL - Q1FY22 - MOStDocument10 pagesBPCL - Q1FY22 - MOStRahul JakhariaNo ratings yet

- 321 - AUM - Gravita IndiaDocument7 pages321 - AUM - Gravita IndianitinmuthaNo ratings yet

- GAIL - Resuming Coverage - HDFCDocument22 pagesGAIL - Resuming Coverage - HDFCSD HAWKNo ratings yet

- 435 FinalDocument16 pages435 FinalshakilnaimaNo ratings yet

- Minda Indus 15-12Document8 pagesMinda Indus 15-12ka raNo ratings yet

- Adani Wilmar IPO Note Angel OneDocument7 pagesAdani Wilmar IPO Note Angel OneRevant SatiNo ratings yet

- Company Name: IOCL (Indian Oil Corporation of India) Industry: Oil Gas and Consumable FuelsDocument12 pagesCompany Name: IOCL (Indian Oil Corporation of India) Industry: Oil Gas and Consumable FuelsAnkit PandaNo ratings yet

- HSL - IC - Gujarat Themis Biosyn - 02012023Document12 pagesHSL - IC - Gujarat Themis Biosyn - 02012023Prasad NawaleNo ratings yet

- Rubber Chemicals - Accelarater - Antioxidant and AntiozonentDocument25 pagesRubber Chemicals - Accelarater - Antioxidant and AntiozonentRajdeep MalNo ratings yet

- CHAMBLFERT 19052022210352 InvestorPresentation310322Document30 pagesCHAMBLFERT 19052022210352 InvestorPresentation310322bradburywillsNo ratings yet

- IOC Research InsightDocument4 pagesIOC Research InsightHARSH GARODIANo ratings yet

- Lumax Inds - Q3FY22 Result Update - 15022022 - 15-02-2022 - 14Document7 pagesLumax Inds - Q3FY22 Result Update - 15022022 - 15-02-2022 - 14Mridul Kumar BanerjeeNo ratings yet

- Stalwart of Bio-Economy Revolution!Document22 pagesStalwart of Bio-Economy Revolution!nitinmuthaNo ratings yet

- Tata Chemicals LTD: 12-Feb-2008 Pioneer Intermediaries PVT LTD - Agarwalla, AshwaniDocument32 pagesTata Chemicals LTD: 12-Feb-2008 Pioneer Intermediaries PVT LTD - Agarwalla, Ashwaniapi-3828752No ratings yet

- Oil & Natural Gas Corporation LTD: Key Financial IndicatorsDocument5 pagesOil & Natural Gas Corporation LTD: Key Financial Indicatorsneethub3No ratings yet

- Business Case - RSMDocument17 pagesBusiness Case - RSMduyvuluongNo ratings yet

- 7204 - D&O - PUBLIC BANK - 2023-08-24 - BUY - 4.37 - DOGreenTechnologiesExpectingaVShapeRecovery - 1840691060Document5 pages7204 - D&O - PUBLIC BANK - 2023-08-24 - BUY - 4.37 - DOGreenTechnologiesExpectingaVShapeRecovery - 1840691060Nicholas ChehNo ratings yet

- 1182311122021672glenmark Pharma Q2FY22Document5 pages1182311122021672glenmark Pharma Q2FY22Prajwal JainNo ratings yet

- Equity Note - Aftab Automobiles Limited - March 2017Document2 pagesEquity Note - Aftab Automobiles Limited - March 2017Sarwar IqbalNo ratings yet

- OswalDocument13 pagesOswalPRIYANKA KNo ratings yet

- A Comparative Analysis On Fuel-Oil Distribution Companies of BangladeshDocument15 pagesA Comparative Analysis On Fuel-Oil Distribution Companies of BangladeshTanzir HasanNo ratings yet

- Tata Motors Limited: Business OverviewDocument5 pagesTata Motors Limited: Business OverviewAryan SharmaNo ratings yet

- Castrol Initiation 211020Document30 pagesCastrol Initiation 211020Dusk TilldownNo ratings yet

- Esearch Eport: Riddhi Siddhi Gluco Biols LTDDocument9 pagesEsearch Eport: Riddhi Siddhi Gluco Biols LTDanny2k1No ratings yet

- Revenue From International Operations of (A ET 500 Company) Submitted To Prof.R.K.ChawalaDocument7 pagesRevenue From International Operations of (A ET 500 Company) Submitted To Prof.R.K.Chawalakrishan_28No ratings yet

- VRL Logistics Moti 01022022Document18 pagesVRL Logistics Moti 01022022ChatgptguyNo ratings yet

- Balaji Amines - Omkar AminDocument6 pagesBalaji Amines - Omkar AminTYBFM A 302 AMIN OMKARNo ratings yet

- CEAT Annual Report 2019Document5 pagesCEAT Annual Report 2019Roberto GrilliNo ratings yet

- Hindalco: CMP: INR442 TP: INR520 (+18%) Higher LME Prices To Drive Earnings GrowthDocument14 pagesHindalco: CMP: INR442 TP: INR520 (+18%) Higher LME Prices To Drive Earnings GrowthVinayak ChennuriNo ratings yet

- Balkrishna Inds Initial (Key Note)Document20 pagesBalkrishna Inds Initial (Key Note)beza manojNo ratings yet

- Tata Motors Group Q4fy23 Investor PresentationDocument58 pagesTata Motors Group Q4fy23 Investor PresentationSohail AlamNo ratings yet

- Godrej Consumer Products LTD: Key Financial IndicatorsDocument4 pagesGodrej Consumer Products LTD: Key Financial IndicatorsJustlazinNo ratings yet

- Voltamp Transformers (VAMP IN) : Management Meet UpdateDocument6 pagesVoltamp Transformers (VAMP IN) : Management Meet UpdateDarwish MammiNo ratings yet

- Lub-Rref (Bangladesh) Ltd. IPO NoteDocument8 pagesLub-Rref (Bangladesh) Ltd. IPO NoteAhm FerdousNo ratings yet

- Bharat Heavy Electricals Limited: Weak Operations Affects PerformanceDocument5 pagesBharat Heavy Electricals Limited: Weak Operations Affects PerformancevahssNo ratings yet

- Bharat Heavy Electricals LTDDocument3 pagesBharat Heavy Electricals LTDDeepak SinghNo ratings yet

- 1 - PCBL Company Update - 01 Dec 2023Document7 pages1 - PCBL Company Update - 01 Dec 2023Abhinav KumarNo ratings yet

- Reliance Industries: Manifesting The Standalone BusinessDocument16 pagesReliance Industries: Manifesting The Standalone BusinessRajat GroverNo ratings yet

- Reliance Industries: Manifesting The Standalone BusinessDocument16 pagesReliance Industries: Manifesting The Standalone BusinessRajat GroverNo ratings yet

- Reaching Zero with Renewables: Biojet FuelsFrom EverandReaching Zero with Renewables: Biojet FuelsNo ratings yet

- Spec A - 1475.23.02.0625Document1 pageSpec A - 1475.23.02.0625fneelavNo ratings yet

- Spec B - 1475.23.01.0957Document1 pageSpec B - 1475.23.01.0957fneelavNo ratings yet

- Cummins Oil Specifying 2017 PDFDocument5 pagesCummins Oil Specifying 2017 PDFfneelav100% (1)

- Shell Mysella S5 N 40: Performance, Features & Benefits Specifications, Approvals & RecommendationsDocument2 pagesShell Mysella S5 N 40: Performance, Features & Benefits Specifications, Approvals & RecommendationsfneelavNo ratings yet

- Fundamentals of Smart MeteringDocument34 pagesFundamentals of Smart MeteringSUDDHA CHAKRABARTYNo ratings yet

- Resume Help For StudentsDocument6 pagesResume Help For Studentsfhmdduwhf100% (1)

- Muslim Reformist MovementsDocument103 pagesMuslim Reformist MovementsShehryar AzizNo ratings yet

- Vaishnava Song BookDocument115 pagesVaishnava Song Bookapi-260953818No ratings yet

- SOLARIS CommandsDocument34 pagesSOLARIS CommandsYahya LateefNo ratings yet

- Process Industry Practices Piping: PIP PNC00001 Pipe Support Criteria For ASME B31.3 Metallic PipingDocument11 pagesProcess Industry Practices Piping: PIP PNC00001 Pipe Support Criteria For ASME B31.3 Metallic PipingRaymundo Maldonado AlvarezNo ratings yet

- F) OO (F .: Philippine Health Insurance CorporationDocument11 pagesF) OO (F .: Philippine Health Insurance CorporationXyla Joy Araneta PerezNo ratings yet

- Project 1 2 3 Extra TestsDocument100 pagesProject 1 2 3 Extra TestsAnitaNo ratings yet

- Shiong Shieng: Rogue (1) Charlatan Halfling/Lightfoot Chaotic GoodDocument3 pagesShiong Shieng: Rogue (1) Charlatan Halfling/Lightfoot Chaotic GoodpilchowskiNo ratings yet

- Issuu PDF Download: Preliminares para Ser MasonDocument17 pagesIssuu PDF Download: Preliminares para Ser MasonMagNo ratings yet

- College Algebra 12th Edition Lial Test BankDocument36 pagesCollege Algebra 12th Edition Lial Test Bankstilarassigner.zyro8100% (19)

- Smart City ProjectDocument22 pagesSmart City ProjectTaukir SiddiqueNo ratings yet

- Lim Tanhu v. Ramolete, 66 SCRA 425 (1975)Document40 pagesLim Tanhu v. Ramolete, 66 SCRA 425 (1975)Clauds Gadzz100% (1)

- Biology - Lesson Notes g12 PDFDocument3 pagesBiology - Lesson Notes g12 PDFSomebodyNo ratings yet

- DX DiagDocument31 pagesDX DiagAntonio MarrazzoNo ratings yet

- Franchise Brochure - NirulasDocument13 pagesFranchise Brochure - NirulasAnuj BhargavaNo ratings yet

- Scania Diesel Engine Parts CatalogDocument3 pagesScania Diesel Engine Parts CatalogTarek MassimoNo ratings yet

- MariamNersisyanResume SWDocument3 pagesMariamNersisyanResume SWPushpendraNo ratings yet

- Director Human Resources in Denver CO Resume Janice ClewellDocument2 pagesDirector Human Resources in Denver CO Resume Janice ClewellJaniceClewellNo ratings yet

- Installatie en Onderhouds Manual CPAN XHE 3Document52 pagesInstallatie en Onderhouds Manual CPAN XHE 3valerivelikovNo ratings yet

- Core Values Module PaoloDocument9 pagesCore Values Module PaoloLala BoraNo ratings yet

- Salatin Sept03Document4 pagesSalatin Sept03api-3733859No ratings yet

- Britannia BourbonDocument12 pagesBritannia BourbonDebmalya De100% (1)

- ALP Consulting - SAP StaffingDocument12 pagesALP Consulting - SAP StaffingAnindya SharmaNo ratings yet

- Insultech Acoustical WrapDocument2 pagesInsultech Acoustical WrapScott VitkoNo ratings yet

- Consolidated QuestionsDocument77 pagesConsolidated QuestionsvenkatNo ratings yet

- Labor Standards (Azucena, JR., 2013) 165Document1 pageLabor Standards (Azucena, JR., 2013) 165Marlo Caluya ManuelNo ratings yet

- 1ghadjzftewifvsmn PDFDocument282 pages1ghadjzftewifvsmn PDFAlex MingNo ratings yet