Professional Documents

Culture Documents

PDF 4 Income Tax

PDF 4 Income Tax

Uploaded by

manishchd81Copyright:

Available Formats

You might also like

- E-Statement Dec 23Document4 pagesE-Statement Dec 23picam54533No ratings yet

- Royal Victoria Hospital Newcastle Site MapDocument1 pageRoyal Victoria Hospital Newcastle Site MapPete McLaughlin0% (3)

- 2018-09-05 DOC Re EIN Confirmation (DSJ Real Estate Holdings)Document2 pages2018-09-05 DOC Re EIN Confirmation (DSJ Real Estate Holdings)Doo Soo KimNo ratings yet

- Buckwold 21e - Ch10 Selected SolutionDocument15 pagesBuckwold 21e - Ch10 Selected SolutionLucyNo ratings yet

- Your Centrelink Statement For Parenting Payment: Reference: 207 828 705JDocument3 pagesYour Centrelink Statement For Parenting Payment: Reference: 207 828 705JLupe VakaNo ratings yet

- Japar Tax Part1 - Grupong Tapsi Notes - 2007Document83 pagesJapar Tax Part1 - Grupong Tapsi Notes - 2007jessiemariano100% (1)

- Base PlateDocument1 pageBase Platelingatong110372No ratings yet

- Appendix 20 - Sabudb - Far 2Document1 pageAppendix 20 - Sabudb - Far 2pdmu regionixNo ratings yet

- Clamp Ring Closures: Sizes: 16" and LargerDocument3 pagesClamp Ring Closures: Sizes: 16" and LargerUnidos Con PuerresNo ratings yet

- CR NotesDocument1 pageCR Notesvivekanantha velappanNo ratings yet

- FencingDocument1 pageFencingsulman iqbalNo ratings yet

- INCOMETAX 22-23 M A Labbai SRIDocument20 pagesINCOMETAX 22-23 M A Labbai SRIM. IsmailNo ratings yet

- Conectores-de-Borna TRAFODocument4 pagesConectores-de-Borna TRAFOJunior MartinezNo ratings yet

- Plumbing Specifications: Edit This Text For The Proposed Title 1Document1 pagePlumbing Specifications: Edit This Text For The Proposed Title 1Hanie FordNo ratings yet

- Bostik Global Bulletins Fact Sheet FS017 Explaining Initial StrengthDocument4 pagesBostik Global Bulletins Fact Sheet FS017 Explaining Initial StrengthAngelo Carlo MalabananNo ratings yet

- Mri Revised Upper Basement ModelDocument1 pageMri Revised Upper Basement ModelPinaky GuhaNo ratings yet

- Environmental System I Course Notes Part 2 SummaryDocument1 pageEnvironmental System I Course Notes Part 2 SummarySofia TrinidadNo ratings yet

- Interior Office Lobby Concept View: Interior Lobby Elevation 2 - West Side Shown, East Side Is SimilarDocument1 pageInterior Office Lobby Concept View: Interior Lobby Elevation 2 - West Side Shown, East Side Is Similartito_matrixNo ratings yet

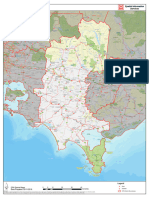

- Maps A1 District 09Document1 pageMaps A1 District 09julianvanraalteNo ratings yet

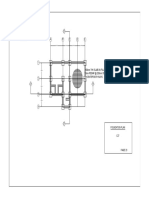

- Male Toilet-2 Toilet-2: E.M. Cuerpo, Inc./Dynamic Builders & Construction Co. (Phil.) IncDocument1 pageMale Toilet-2 Toilet-2: E.M. Cuerpo, Inc./Dynamic Builders & Construction Co. (Phil.) IncJett Mark ContrerasNo ratings yet

- X Dwight Eldrich S. Manaol 2015-081293 3CE-CDocument1 pageX Dwight Eldrich S. Manaol 2015-081293 3CE-CDwight Eldrich ManaolNo ratings yet

- Tap-Changer Ecotap VPD 40.5 KV, As Shown For 10 To 17 Operating PositionsDocument3 pagesTap-Changer Ecotap VPD 40.5 KV, As Shown For 10 To 17 Operating Positionsmousamousa MohamedNo ratings yet

- Intac 3Document1 pageIntac 32022301307No ratings yet

- RME Data Sheet - RUSSELL Mill Relining MachineDocument1 pageRME Data Sheet - RUSSELL Mill Relining MachineСергейNo ratings yet

- DE7Document2 pagesDE7Ronnie Lee MickleNo ratings yet

- Belt Conveyor For Potato Chips Packaging Floor 02-03-22-ModelDocument1 pageBelt Conveyor For Potato Chips Packaging Floor 02-03-22-ModelJony BaruaNo ratings yet

- 198 PDFDocument1 page198 PDFKABIR CHOPRANo ratings yet

- System 03 P&ID Diagram: Project 03Document1 pageSystem 03 P&ID Diagram: Project 03Alonso RodriNo ratings yet

- Untitled TtyDocument1 pageUntitled TtyShaaban HassanNo ratings yet

- IND-500-MFG-9164-CW SH1 - Rev-2 - EN 500kV Indramayu Substation Control Building Electrical Drawing HVAC SystemDocument1 pageIND-500-MFG-9164-CW SH1 - Rev-2 - EN 500kV Indramayu Substation Control Building Electrical Drawing HVAC SystemSIMBOLON RIMBANGNo ratings yet

- Pioneer 15 m3 ETP Level ElivationDocument1 pagePioneer 15 m3 ETP Level ElivationAdam DevidNo ratings yet

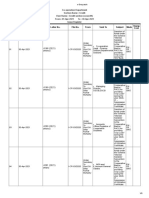

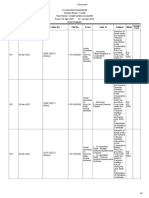

- SL.# Date Letter No. File No. From Sent To Subject Mode Stamp CostDocument3 pagesSL.# Date Letter No. File No. From Sent To Subject Mode Stamp CostCredit SectionNo ratings yet

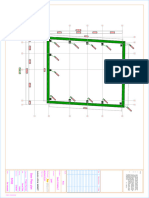

- DERF-051 Add - Perimeter RailingDocument1 pageDERF-051 Add - Perimeter RailingHaris Wibowo [MTI]No ratings yet

- To Jump To Each Sheet of The Schematic Hold Down The Control Key and Click On Required SheetDocument30 pagesTo Jump To Each Sheet of The Schematic Hold Down The Control Key and Click On Required Sheetworkwanta workNo ratings yet

- Tampak Samping-1 PDFDocument1 pageTampak Samping-1 PDFheri_prasetyadiNo ratings yet

- S 76850 Matchline S 76850 Matchline S 76850 Matchline: Elevation KeyplanDocument1 pageS 76850 Matchline S 76850 Matchline S 76850 Matchline: Elevation KeyplanPinak ProjectsNo ratings yet

- Lifting Specification RexDocument1 pageLifting Specification Rexsamir.ahmed7577No ratings yet

- Electric ChillerDocument1 pageElectric Chillerviero widyantoNo ratings yet

- Proposed 1 Storey Car Display and Repair Shop-PlumbingDocument1 pageProposed 1 Storey Car Display and Repair Shop-Plumbingmichael jan de celisNo ratings yet

- PM3 Dwall Option 20240109Document1 pagePM3 Dwall Option 20240109Tâm TrầnNo ratings yet

- sb9 Harvest Plan Map - July13Document1 pagesb9 Harvest Plan Map - July13Geo SpatialistNo ratings yet

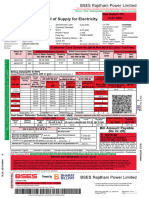

- Bill of Supply For Electricity: BSES Rajdhani Power LimitedDocument3 pagesBill of Supply For Electricity: BSES Rajdhani Power LimitedKishan GuptaNo ratings yet

- 10 Sketch Shear ConnectionDocument1 page10 Sketch Shear ConnectionER Deepak SutharNo ratings yet

- Proposed Residential BLDG.: Single Line DiagramDocument1 pageProposed Residential BLDG.: Single Line DiagramTUDELA MUNICIPAL ENGINEERING OFFICENo ratings yet

- Ilovepdf MergedDocument21 pagesIlovepdf MergedpengkysaptaindraNo ratings yet

- dd1348 - DoD Single Line Item Requisition System Document - ManualDocument1 pagedd1348 - DoD Single Line Item Requisition System Document - ManualThe MajorNo ratings yet

- s44Document2 pagess44Alaa MansourNo ratings yet

- Material Take Off: For Construction Dept.: Engineering Section: Construction EngineeringDocument13 pagesMaterial Take Off: For Construction Dept.: Engineering Section: Construction EngineeringriandiNo ratings yet

- SL.# Date Letter No. File No. From Sent To Subject Mode Stamp CostDocument3 pagesSL.# Date Letter No. File No. From Sent To Subject Mode Stamp CostCredit SectionNo ratings yet

- Pol808 3Document4 pagesPol808 3robert.leon007No ratings yet

- 5.1 Cost Spreadsheet of Idea in Two StagesDocument10 pages5.1 Cost Spreadsheet of Idea in Two StagesHector Luis Chilo ChaccaNo ratings yet

- Proposed Three-Storey Building: Typical Stiffener Beam/Column ElevationDocument1 pageProposed Three-Storey Building: Typical Stiffener Beam/Column ElevationAngelo AmarNo ratings yet

- scanrecoDocument3 pagesscanrecoCarlosBayonaMontenegroNo ratings yet

- SB-PLAN-25 VILLAS PROJECT-FUJAIRAH-03-11-2023-ModelDocument1 pageSB-PLAN-25 VILLAS PROJECT-FUJAIRAH-03-11-2023-Modelsulman iqbalNo ratings yet

- El-Ground Floor Plan Power Conduit Layout-20230120Document1 pageEl-Ground Floor Plan Power Conduit Layout-20230120Malhotra ArchitectsNo ratings yet

- V-41122 Pi PDFDocument1 pageV-41122 Pi PDFVivek VNo ratings yet

- 1-0758-CVL-GAD-01 Foundation Drawing RADocument4 pages1-0758-CVL-GAD-01 Foundation Drawing RAheriNo ratings yet

- The Wall Street Journal 20-01-24Document52 pagesThe Wall Street Journal 20-01-24milagrosNo ratings yet

- Rubber - 72VDocument1 pageRubber - 72VAnkit ShandilyaNo ratings yet

- E-EB-126-rev1 (Deck Plate) - ModelDocument1 pageE-EB-126-rev1 (Deck Plate) - ModelJoy FernandezNo ratings yet

- Proposed Office Building: Thahz Buhisan Dapogracion Rufo Aga-On AyagDocument1 pageProposed Office Building: Thahz Buhisan Dapogracion Rufo Aga-On AyagJhon SabinoNo ratings yet

- Quarterly Contribution Return and Report of Wages: REMINDER: File Your DE 9 and DE 9C TogetherDocument2 pagesQuarterly Contribution Return and Report of Wages: REMINDER: File Your DE 9 and DE 9C TogetherWomen Cup2No ratings yet

- WCT FC SD TP02 00061 00.C1 E Cs PDFDocument1 pageWCT FC SD TP02 00061 00.C1 E Cs PDFNaren PlaythatfunkymusicNo ratings yet

- Campaign Statements - CarpenterDocument8 pagesCampaign Statements - CarpenterLosAltosPatchNo ratings yet

- EWT Politicians FINALDocument43 pagesEWT Politicians FINALClark LimNo ratings yet

- Marsad Arain Sister FundDocument6 pagesMarsad Arain Sister FundAbdul Majid AwanNo ratings yet

- GSRTC Undva Mandli BorderDocument1 pageGSRTC Undva Mandli BorderNIRMAL PATELNo ratings yet

- Invoice No - 20151213 - SoldoutDocument1 pageInvoice No - 20151213 - SoldoutRONALD YUNo ratings yet

- Card Business Debit and Credit CardsDocument17 pagesCard Business Debit and Credit CardsmahiNo ratings yet

- Sap 9Th Bn. Sandhya Krishnagar Nadia Pay Slip Government of West BengalDocument1 pageSap 9Th Bn. Sandhya Krishnagar Nadia Pay Slip Government of West BengalSI Debasish MandalNo ratings yet

- Direct MayDocument8 pagesDirect MayabcNo ratings yet

- Fate of "Unjust Enrichment" Principle Under GSTDocument2 pagesFate of "Unjust Enrichment" Principle Under GSTRajula Gurva ReddyNo ratings yet

- Pacquiao v. MilabaoDocument26 pagesPacquiao v. Milabaoaudreydql5No ratings yet

- Taxation PrinciplesDocument22 pagesTaxation PrinciplesHazel Denisse GragasinNo ratings yet

- Revised Negotiable Instruments Law Annotated MPPDocument69 pagesRevised Negotiable Instruments Law Annotated MPPLyka Mae Palarca IrangNo ratings yet

- Walkie TalkieDocument3 pagesWalkie TalkieFire SafeNo ratings yet

- Concept of National Income PDFDocument11 pagesConcept of National Income PDFDaniel AdegboyeNo ratings yet

- Kap Jesus-August - 1661127045Document1 pageKap Jesus-August - 1661127045AlvinTamayoNo ratings yet

- fnoPnLFNO - PnLWed Aug 30 2023 004819 GMT+0530Document6 pagesfnoPnLFNO - PnLWed Aug 30 2023 004819 GMT+0530abhishekNo ratings yet

- GRNPrintDocument2 pagesGRNPrintshambhu_das29No ratings yet

- Od428496262499994100 1Document1 pageOd428496262499994100 1अमित कुमारNo ratings yet

- f1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONDocument2 pagesf1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONKeller Brown Jnr50% (2)

- Al Multaqa Kareem For Hotels $ Resorts Management - Muna Kareem HotelDocument2 pagesAl Multaqa Kareem For Hotels $ Resorts Management - Muna Kareem HotelASHIQ HUSSAINNo ratings yet

- Od330909343106606100 1Document7 pagesOd330909343106606100 1godaseamar275No ratings yet

- Final QuizDocument2 pagesFinal Quizasdfghjkl zxcvbnmNo ratings yet

- Buku Resit JP PrintingDocument1 pageBuku Resit JP PrintingferddashNo ratings yet

- 5 Income Tax On Estates Trusts Partnerships Joint Ventures and CoDocument4 pages5 Income Tax On Estates Trusts Partnerships Joint Ventures and CoConcerned CitizenNo ratings yet

- Account Statement From 1 Apr 2019 To 31 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 1 Apr 2019 To 31 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAbhay RajNo ratings yet

- Chapter 3 - Sales TransactionsDocument14 pagesChapter 3 - Sales TransactionsNatasha GhazaliNo ratings yet

PDF 4 Income Tax

PDF 4 Income Tax

Uploaded by

manishchd81Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PDF 4 Income Tax

PDF 4 Income Tax

Uploaded by

manishchd81Copyright:

Available Formats

Downloaded from (@Mission CA Final Join @Mission

CA Final Telegram Channel for

Iclegram Channel DEDUCTION U/S V-A

Chapter 24

Notes

Under limited

DEDUCTION U/S VI-A

F category. there is limit of the donee

Trust/institutionfurnishessa

certificate to the

donorinformNo.

(Applicable w.e.f.01/04/=

XXX EligibBe donation, (ii)

10BE upto 31st

May of next

FY.

deduction u/s 80G

not eligible for

H,T XXX Donationspaid in kindare allowed if it is made in cash of more than

C XXX

3

Deduction under this section

not

Relief Fund, the CM Relief*2,000

PM National

Mobile XXX

5

4

Employees make

donations to the

respective employers, EE's shall

Fund or t

be eligible

Total Donation XXX

LG Relief Fund through their issued in the name of ER, ER will issue certifico

even certificate

10% of ATI XXX deduction u/s 80G

XXX such donation.

to EE's about

Eligible Donation

*ATI - Adjusted Total XXX House Property (HRA not recd)

GTI income # Section 80GG: Rent paid of

(exclude Income Taxable at special a. Eligible

Assessee: Individual

() All Rate)

A

TI

deductions (except 80G)

XXX

(xx) b. Amount of

deduction;

(i) 5000 p.m.

XXX

Nofe : Deduction under this

section is not allowed if donation made in cash is (ii) 25 %of Adj. GTI

than 2000. more GTI

(iüi) Rent Paid -10% of Adj.

child or HUF should not own ony he.

Note: The assessee or his spouse or minor

Example: deductions u/c VIA (Except uWe R0ce

place of his duty. Adjusted GTI=GTI- All

F, O

25,000

scientific research or.

HTC Mobile

40,000 Section 80GGA : Deduction in respect of Donation for

Total Donation

65,000 development

10% of ATI(4,50,000) 45,000 Eliaible ASsessee: All assessees (except assessees having income under the head PG

45,000 b Amount of deduction: 100% of donation.

F.0. (100%)

25,000 x 100% = 25000

K (50%)BAL (HTC MOB)

C.

#

Ifdonation amount is more than &2,000 then should be made other than Cash

Section 80GGB: Donation to Political Parties or Electoral Trust

20,000 x50%= 10,000

Notes: Eligible Assessee: Indian company

1

If doner made donation to any Trust/Institution then deduction shall be allowed only b Amount of deduction: 100% of donation.

if such trust/institution is registered u/s 80G(5). Time limit and procedure of

Section 80GGC: Donation to Political Parties or Electoral Trust

registration is similar to whatever we have discussed in trust topic u/s 12A and 12AB.

Doner shall be entitled to deduction u/s 80G oniy if: Eligible Assessee: Any person (other than Indian co.)

() the donee Trust/institution prepares a statement in Form No. 108D and b Amount of deduction: 100% of donation

submitted to PDGIT(System) upto 31st May of next FY, and Note:o jecucior, us 80GGB/80GGCif dcnatior mcde in CASH

271

270

You might also like

- E-Statement Dec 23Document4 pagesE-Statement Dec 23picam54533No ratings yet

- Royal Victoria Hospital Newcastle Site MapDocument1 pageRoyal Victoria Hospital Newcastle Site MapPete McLaughlin0% (3)

- 2018-09-05 DOC Re EIN Confirmation (DSJ Real Estate Holdings)Document2 pages2018-09-05 DOC Re EIN Confirmation (DSJ Real Estate Holdings)Doo Soo KimNo ratings yet

- Buckwold 21e - Ch10 Selected SolutionDocument15 pagesBuckwold 21e - Ch10 Selected SolutionLucyNo ratings yet

- Your Centrelink Statement For Parenting Payment: Reference: 207 828 705JDocument3 pagesYour Centrelink Statement For Parenting Payment: Reference: 207 828 705JLupe VakaNo ratings yet

- Japar Tax Part1 - Grupong Tapsi Notes - 2007Document83 pagesJapar Tax Part1 - Grupong Tapsi Notes - 2007jessiemariano100% (1)

- Base PlateDocument1 pageBase Platelingatong110372No ratings yet

- Appendix 20 - Sabudb - Far 2Document1 pageAppendix 20 - Sabudb - Far 2pdmu regionixNo ratings yet

- Clamp Ring Closures: Sizes: 16" and LargerDocument3 pagesClamp Ring Closures: Sizes: 16" and LargerUnidos Con PuerresNo ratings yet

- CR NotesDocument1 pageCR Notesvivekanantha velappanNo ratings yet

- FencingDocument1 pageFencingsulman iqbalNo ratings yet

- INCOMETAX 22-23 M A Labbai SRIDocument20 pagesINCOMETAX 22-23 M A Labbai SRIM. IsmailNo ratings yet

- Conectores-de-Borna TRAFODocument4 pagesConectores-de-Borna TRAFOJunior MartinezNo ratings yet

- Plumbing Specifications: Edit This Text For The Proposed Title 1Document1 pagePlumbing Specifications: Edit This Text For The Proposed Title 1Hanie FordNo ratings yet

- Bostik Global Bulletins Fact Sheet FS017 Explaining Initial StrengthDocument4 pagesBostik Global Bulletins Fact Sheet FS017 Explaining Initial StrengthAngelo Carlo MalabananNo ratings yet

- Mri Revised Upper Basement ModelDocument1 pageMri Revised Upper Basement ModelPinaky GuhaNo ratings yet

- Environmental System I Course Notes Part 2 SummaryDocument1 pageEnvironmental System I Course Notes Part 2 SummarySofia TrinidadNo ratings yet

- Interior Office Lobby Concept View: Interior Lobby Elevation 2 - West Side Shown, East Side Is SimilarDocument1 pageInterior Office Lobby Concept View: Interior Lobby Elevation 2 - West Side Shown, East Side Is Similartito_matrixNo ratings yet

- Maps A1 District 09Document1 pageMaps A1 District 09julianvanraalteNo ratings yet

- Male Toilet-2 Toilet-2: E.M. Cuerpo, Inc./Dynamic Builders & Construction Co. (Phil.) IncDocument1 pageMale Toilet-2 Toilet-2: E.M. Cuerpo, Inc./Dynamic Builders & Construction Co. (Phil.) IncJett Mark ContrerasNo ratings yet

- X Dwight Eldrich S. Manaol 2015-081293 3CE-CDocument1 pageX Dwight Eldrich S. Manaol 2015-081293 3CE-CDwight Eldrich ManaolNo ratings yet

- Tap-Changer Ecotap VPD 40.5 KV, As Shown For 10 To 17 Operating PositionsDocument3 pagesTap-Changer Ecotap VPD 40.5 KV, As Shown For 10 To 17 Operating Positionsmousamousa MohamedNo ratings yet

- Intac 3Document1 pageIntac 32022301307No ratings yet

- RME Data Sheet - RUSSELL Mill Relining MachineDocument1 pageRME Data Sheet - RUSSELL Mill Relining MachineСергейNo ratings yet

- DE7Document2 pagesDE7Ronnie Lee MickleNo ratings yet

- Belt Conveyor For Potato Chips Packaging Floor 02-03-22-ModelDocument1 pageBelt Conveyor For Potato Chips Packaging Floor 02-03-22-ModelJony BaruaNo ratings yet

- 198 PDFDocument1 page198 PDFKABIR CHOPRANo ratings yet

- System 03 P&ID Diagram: Project 03Document1 pageSystem 03 P&ID Diagram: Project 03Alonso RodriNo ratings yet

- Untitled TtyDocument1 pageUntitled TtyShaaban HassanNo ratings yet

- IND-500-MFG-9164-CW SH1 - Rev-2 - EN 500kV Indramayu Substation Control Building Electrical Drawing HVAC SystemDocument1 pageIND-500-MFG-9164-CW SH1 - Rev-2 - EN 500kV Indramayu Substation Control Building Electrical Drawing HVAC SystemSIMBOLON RIMBANGNo ratings yet

- Pioneer 15 m3 ETP Level ElivationDocument1 pagePioneer 15 m3 ETP Level ElivationAdam DevidNo ratings yet

- SL.# Date Letter No. File No. From Sent To Subject Mode Stamp CostDocument3 pagesSL.# Date Letter No. File No. From Sent To Subject Mode Stamp CostCredit SectionNo ratings yet

- DERF-051 Add - Perimeter RailingDocument1 pageDERF-051 Add - Perimeter RailingHaris Wibowo [MTI]No ratings yet

- To Jump To Each Sheet of The Schematic Hold Down The Control Key and Click On Required SheetDocument30 pagesTo Jump To Each Sheet of The Schematic Hold Down The Control Key and Click On Required Sheetworkwanta workNo ratings yet

- Tampak Samping-1 PDFDocument1 pageTampak Samping-1 PDFheri_prasetyadiNo ratings yet

- S 76850 Matchline S 76850 Matchline S 76850 Matchline: Elevation KeyplanDocument1 pageS 76850 Matchline S 76850 Matchline S 76850 Matchline: Elevation KeyplanPinak ProjectsNo ratings yet

- Lifting Specification RexDocument1 pageLifting Specification Rexsamir.ahmed7577No ratings yet

- Electric ChillerDocument1 pageElectric Chillerviero widyantoNo ratings yet

- Proposed 1 Storey Car Display and Repair Shop-PlumbingDocument1 pageProposed 1 Storey Car Display and Repair Shop-Plumbingmichael jan de celisNo ratings yet

- PM3 Dwall Option 20240109Document1 pagePM3 Dwall Option 20240109Tâm TrầnNo ratings yet

- sb9 Harvest Plan Map - July13Document1 pagesb9 Harvest Plan Map - July13Geo SpatialistNo ratings yet

- Bill of Supply For Electricity: BSES Rajdhani Power LimitedDocument3 pagesBill of Supply For Electricity: BSES Rajdhani Power LimitedKishan GuptaNo ratings yet

- 10 Sketch Shear ConnectionDocument1 page10 Sketch Shear ConnectionER Deepak SutharNo ratings yet

- Proposed Residential BLDG.: Single Line DiagramDocument1 pageProposed Residential BLDG.: Single Line DiagramTUDELA MUNICIPAL ENGINEERING OFFICENo ratings yet

- Ilovepdf MergedDocument21 pagesIlovepdf MergedpengkysaptaindraNo ratings yet

- dd1348 - DoD Single Line Item Requisition System Document - ManualDocument1 pagedd1348 - DoD Single Line Item Requisition System Document - ManualThe MajorNo ratings yet

- s44Document2 pagess44Alaa MansourNo ratings yet

- Material Take Off: For Construction Dept.: Engineering Section: Construction EngineeringDocument13 pagesMaterial Take Off: For Construction Dept.: Engineering Section: Construction EngineeringriandiNo ratings yet

- SL.# Date Letter No. File No. From Sent To Subject Mode Stamp CostDocument3 pagesSL.# Date Letter No. File No. From Sent To Subject Mode Stamp CostCredit SectionNo ratings yet

- Pol808 3Document4 pagesPol808 3robert.leon007No ratings yet

- 5.1 Cost Spreadsheet of Idea in Two StagesDocument10 pages5.1 Cost Spreadsheet of Idea in Two StagesHector Luis Chilo ChaccaNo ratings yet

- Proposed Three-Storey Building: Typical Stiffener Beam/Column ElevationDocument1 pageProposed Three-Storey Building: Typical Stiffener Beam/Column ElevationAngelo AmarNo ratings yet

- scanrecoDocument3 pagesscanrecoCarlosBayonaMontenegroNo ratings yet

- SB-PLAN-25 VILLAS PROJECT-FUJAIRAH-03-11-2023-ModelDocument1 pageSB-PLAN-25 VILLAS PROJECT-FUJAIRAH-03-11-2023-Modelsulman iqbalNo ratings yet

- El-Ground Floor Plan Power Conduit Layout-20230120Document1 pageEl-Ground Floor Plan Power Conduit Layout-20230120Malhotra ArchitectsNo ratings yet

- V-41122 Pi PDFDocument1 pageV-41122 Pi PDFVivek VNo ratings yet

- 1-0758-CVL-GAD-01 Foundation Drawing RADocument4 pages1-0758-CVL-GAD-01 Foundation Drawing RAheriNo ratings yet

- The Wall Street Journal 20-01-24Document52 pagesThe Wall Street Journal 20-01-24milagrosNo ratings yet

- Rubber - 72VDocument1 pageRubber - 72VAnkit ShandilyaNo ratings yet

- E-EB-126-rev1 (Deck Plate) - ModelDocument1 pageE-EB-126-rev1 (Deck Plate) - ModelJoy FernandezNo ratings yet

- Proposed Office Building: Thahz Buhisan Dapogracion Rufo Aga-On AyagDocument1 pageProposed Office Building: Thahz Buhisan Dapogracion Rufo Aga-On AyagJhon SabinoNo ratings yet

- Quarterly Contribution Return and Report of Wages: REMINDER: File Your DE 9 and DE 9C TogetherDocument2 pagesQuarterly Contribution Return and Report of Wages: REMINDER: File Your DE 9 and DE 9C TogetherWomen Cup2No ratings yet

- WCT FC SD TP02 00061 00.C1 E Cs PDFDocument1 pageWCT FC SD TP02 00061 00.C1 E Cs PDFNaren PlaythatfunkymusicNo ratings yet

- Campaign Statements - CarpenterDocument8 pagesCampaign Statements - CarpenterLosAltosPatchNo ratings yet

- EWT Politicians FINALDocument43 pagesEWT Politicians FINALClark LimNo ratings yet

- Marsad Arain Sister FundDocument6 pagesMarsad Arain Sister FundAbdul Majid AwanNo ratings yet

- GSRTC Undva Mandli BorderDocument1 pageGSRTC Undva Mandli BorderNIRMAL PATELNo ratings yet

- Invoice No - 20151213 - SoldoutDocument1 pageInvoice No - 20151213 - SoldoutRONALD YUNo ratings yet

- Card Business Debit and Credit CardsDocument17 pagesCard Business Debit and Credit CardsmahiNo ratings yet

- Sap 9Th Bn. Sandhya Krishnagar Nadia Pay Slip Government of West BengalDocument1 pageSap 9Th Bn. Sandhya Krishnagar Nadia Pay Slip Government of West BengalSI Debasish MandalNo ratings yet

- Direct MayDocument8 pagesDirect MayabcNo ratings yet

- Fate of "Unjust Enrichment" Principle Under GSTDocument2 pagesFate of "Unjust Enrichment" Principle Under GSTRajula Gurva ReddyNo ratings yet

- Pacquiao v. MilabaoDocument26 pagesPacquiao v. Milabaoaudreydql5No ratings yet

- Taxation PrinciplesDocument22 pagesTaxation PrinciplesHazel Denisse GragasinNo ratings yet

- Revised Negotiable Instruments Law Annotated MPPDocument69 pagesRevised Negotiable Instruments Law Annotated MPPLyka Mae Palarca IrangNo ratings yet

- Walkie TalkieDocument3 pagesWalkie TalkieFire SafeNo ratings yet

- Concept of National Income PDFDocument11 pagesConcept of National Income PDFDaniel AdegboyeNo ratings yet

- Kap Jesus-August - 1661127045Document1 pageKap Jesus-August - 1661127045AlvinTamayoNo ratings yet

- fnoPnLFNO - PnLWed Aug 30 2023 004819 GMT+0530Document6 pagesfnoPnLFNO - PnLWed Aug 30 2023 004819 GMT+0530abhishekNo ratings yet

- GRNPrintDocument2 pagesGRNPrintshambhu_das29No ratings yet

- Od428496262499994100 1Document1 pageOd428496262499994100 1अमित कुमारNo ratings yet

- f1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONDocument2 pagesf1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONKeller Brown Jnr50% (2)

- Al Multaqa Kareem For Hotels $ Resorts Management - Muna Kareem HotelDocument2 pagesAl Multaqa Kareem For Hotels $ Resorts Management - Muna Kareem HotelASHIQ HUSSAINNo ratings yet

- Od330909343106606100 1Document7 pagesOd330909343106606100 1godaseamar275No ratings yet

- Final QuizDocument2 pagesFinal Quizasdfghjkl zxcvbnmNo ratings yet

- Buku Resit JP PrintingDocument1 pageBuku Resit JP PrintingferddashNo ratings yet

- 5 Income Tax On Estates Trusts Partnerships Joint Ventures and CoDocument4 pages5 Income Tax On Estates Trusts Partnerships Joint Ventures and CoConcerned CitizenNo ratings yet

- Account Statement From 1 Apr 2019 To 31 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 1 Apr 2019 To 31 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceAbhay RajNo ratings yet

- Chapter 3 - Sales TransactionsDocument14 pagesChapter 3 - Sales TransactionsNatasha GhazaliNo ratings yet