Professional Documents

Culture Documents

Securecode Processing - Matrix - 12 2011

Securecode Processing - Matrix - 12 2011

Uploaded by

caprediempayCopyright:

Available Formats

You might also like

- ARTA MC 2022 05 Annex A. CSM QuestionnaireDocument1 pageARTA MC 2022 05 Annex A. CSM QuestionnaireMarites Taniegra100% (5)

- Action Codes Guide For Cardinal CruiseDocument1 pageAction Codes Guide For Cardinal CruiseErnesto GuerraNo ratings yet

- 3-5-Emv L2Document6 pages3-5-Emv L2Rafael Perez MendozaNo ratings yet

- Requirement Traceability Matrix-SampleDocument5 pagesRequirement Traceability Matrix-Samplemdrazi10No ratings yet

- Web Logic VulnerabilityDocument57 pagesWeb Logic Vulnerabilitysetyahangga3No ratings yet

- EMV Level-2Document6 pagesEMV Level-2Abiy MulugetaNo ratings yet

- PunchPointAction Export 30-03-2024Document2 pagesPunchPointAction Export 30-03-2024Mohsin MansooriNo ratings yet

- GST Billing BrochureDocument6 pagesGST Billing Brochureexecellence solutionsNo ratings yet

- EMV L2-IC5100 Full PDFDocument6 pagesEMV L2-IC5100 Full PDFAnonymous 1BuyZjZNo ratings yet

- Module Attributes List: Heiwa Heaven ResortDocument13 pagesModule Attributes List: Heiwa Heaven ResortNimeshNo ratings yet

- CRF Transmittal Form: (If No, Enter Comment)Document1 pageCRF Transmittal Form: (If No, Enter Comment)rohedy adel0% (1)

- V3X LOA HITO 12259 31oct16Document6 pagesV3X LOA HITO 12259 31oct16Emmanuel KAMANDANo ratings yet

- AccpacEdition DifferencesDocument2 pagesAccpacEdition Differencesasu23No ratings yet

- KitchKo Financial Projections - #OrdersDocument68 pagesKitchKo Financial Projections - #Ordersqzbtbq7y6dNo ratings yet

- 2.how To Fix VS1295 LED - MBDocument41 pages2.how To Fix VS1295 LED - MBRichard emerson Lazcano barajasNo ratings yet

- CommDocument14 pagesCommJithu MonNo ratings yet

- DM Objects - Mapping Tracker - Local - V1.0Document30 pagesDM Objects - Mapping Tracker - Local - V1.0SandeepNo ratings yet

- KitchKo - Financial - Projections - #CustomersDocument88 pagesKitchKo - Financial - Projections - #Customersqzbtbq7y6dNo ratings yet

- 2203201907004478502427Document215 pages2203201907004478502427Nam LeNo ratings yet

- ES - Eng - Micro - MozambiqueDocument25 pagesES - Eng - Micro - MozambiqueAnney LimNo ratings yet

- OBS05 Result CodeDocument2 pagesOBS05 Result CodeNiraj TungareNo ratings yet

- Retail Info Nov'20Document358 pagesRetail Info Nov'20Shahriar SabbirNo ratings yet

- Step 1) Core Model: Investment Planning For Going To College After 3 PeriodsDocument2 pagesStep 1) Core Model: Investment Planning For Going To College After 3 PeriodsDivom SharmaNo ratings yet

- OTC Interview Evaluation Sheet - ARIVIND BEERELLIDocument2 pagesOTC Interview Evaluation Sheet - ARIVIND BEERELLIVikky VikramNo ratings yet

- Level 1 Level 1 Level 1 Code Level Sequence Number Mandatory Mandatory MandatoryDocument9 pagesLevel 1 Level 1 Level 1 Code Level Sequence Number Mandatory Mandatory MandatoryHAMMADHRNo ratings yet

- Adyen Visa Claims Resolution ManualDocument12 pagesAdyen Visa Claims Resolution ManualWael AlkathiriNo ratings yet

- Kingdom Building FlowchartDocument1 pageKingdom Building FlowchartRandyNo ratings yet

- OTC Interview Evaluation Sheet - Abhishek SanyalDocument2 pagesOTC Interview Evaluation Sheet - Abhishek SanyalVikky VikramNo ratings yet

- Basic Vantage TrainingDocument114 pagesBasic Vantage TrainingVivek Kundu100% (1)

- Level 1 Contributor: EOH Holdings Limited and SubsidiariesDocument7 pagesLevel 1 Contributor: EOH Holdings Limited and Subsidiariesvaibhav1004No ratings yet

- Sangfor Vs Symantec Vs Sandvine Simple Comparison - v2Document1 pageSangfor Vs Symantec Vs Sandvine Simple Comparison - v2MOKTAR BAKARNo ratings yet

- Visitor Tracking Systems Comparison UPDATED 20230718Document9 pagesVisitor Tracking Systems Comparison UPDATED 20230718Khalid HassanNo ratings yet

- 3-11 Afm Responses AnalysusDocument18 pages3-11 Afm Responses AnalysusAbdul AsadNo ratings yet

- Store Managers Daily ChecklistDocument8 pagesStore Managers Daily Checklistrb8q5tprw2No ratings yet

- BP-5.1.2D OJT Effectiveness SHEET - Level-2Document1 pageBP-5.1.2D OJT Effectiveness SHEET - Level-2shinuNo ratings yet

- Select ViewDocument3 pagesSelect ViewcipehrshockNo ratings yet

- Deisy Yuliana Avendaño - 212063 - 5Document14 pagesDeisy Yuliana Avendaño - 212063 - 5Camilo Suarez CastilloNo ratings yet

- 3DS v2 Flow Chart IngenicoDocument1 page3DS v2 Flow Chart IngenicoSerge BoliNo ratings yet

- Laboratory 7Document2 pagesLaboratory 7Joe LagartejaNo ratings yet

- Invoice ProcessingDocument40 pagesInvoice ProcessingRAVITEJANo ratings yet

- Omnitracs IVG User Manual Driver Hours AssistDocument84 pagesOmnitracs IVG User Manual Driver Hours AssistGotte Charles EiccaNo ratings yet

- Decision Table TestingDocument5 pagesDecision Table TestingM. R. KHAN DIPUNo ratings yet

- The 7 Basic Quality Tools: Michele CanoDocument72 pagesThe 7 Basic Quality Tools: Michele CanoAnonymous ibmeej9No ratings yet

- Evaluation Scorecard - Soumya Rajput - 85Document3 pagesEvaluation Scorecard - Soumya Rajput - 85SLAUGHTER GAMINGNo ratings yet

- TQM Unit 3Document168 pagesTQM Unit 3bhuvansparks100% (1)

- (Updated 2.0) Controls Check ListDocument12 pages(Updated 2.0) Controls Check Listjayasa5557No ratings yet

- 1 GR 12 Acc P2 June 2024 MGDocument10 pages1 GR 12 Acc P2 June 2024 MGTumiNo ratings yet

- Gr10 ACC P1 (ENG) June 2022 Possible AnswersDocument11 pagesGr10 ACC P1 (ENG) June 2022 Possible Answersfauziahakhalwaya4No ratings yet

- RevenueDocument1 pageRevenuevishista06No ratings yet

- OTC Interview Evaluation Sheet - Ravi KumarDocument2 pagesOTC Interview Evaluation Sheet - Ravi KumarVikky VikramNo ratings yet

- Make It Happen - Make It An Awesome Check-In: Just Give Them The Key!Document35 pagesMake It Happen - Make It An Awesome Check-In: Just Give Them The Key!sushma vinodNo ratings yet

- A77 Sample FAT REPORT PDFDocument11 pagesA77 Sample FAT REPORT PDFingguedezandresNo ratings yet

- EP-3169 Upgrade Firmware (WEB) - 1 - Service ManualDocument94 pagesEP-3169 Upgrade Firmware (WEB) - 1 - Service ManualjojoloNo ratings yet

- Define Phase TemplateDocument15 pagesDefine Phase TemplateNikhil DwivediNo ratings yet

- Larry Fredendall's Sinking Fund: A B C D A B C D ADocument2 pagesLarry Fredendall's Sinking Fund: A B C D A B C D AYadav_BaeNo ratings yet

- Bid Evaluation Sheet Furniture Final 2019-20Document60 pagesBid Evaluation Sheet Furniture Final 2019-20Asghar FaizNo ratings yet

- Vernier Caliper FormateDocument4 pagesVernier Caliper Formatevishal patelNo ratings yet

- Evaluation Scorecard - Ankur Saini - Inbound Call - 75Document2 pagesEvaluation Scorecard - Ankur Saini - Inbound Call - 75SLAUGHTER GAMINGNo ratings yet

- External Audits (Jan Dec'20)Document9 pagesExternal Audits (Jan Dec'20)Muhammad Asad SaeedNo ratings yet

- Civil Engineering Important MCQ PDF-Hydraulics and Fluid Mechanics Part 3 - WWW - ALLEXAMREVIEW.COMDocument10 pagesCivil Engineering Important MCQ PDF-Hydraulics and Fluid Mechanics Part 3 - WWW - ALLEXAMREVIEW.COMMuhammad WaqarNo ratings yet

- The Revision Bias: Ximena Garcia-Rada Ed O'Brien Leslie K. John Michael I. NortonDocument44 pagesThe Revision Bias: Ximena Garcia-Rada Ed O'Brien Leslie K. John Michael I. NortonmanimaransudhaNo ratings yet

- WS Ac PDFDocument8 pagesWS Ac PDFSriHarsha PoolaNo ratings yet

- Diktat Praktikum TBK 2021Document71 pagesDiktat Praktikum TBK 2021Muhammad Handika100% (1)

- BricksDocument44 pagesBricksSimeon Woyesa100% (1)

- Indian Railway Swot AnalysisDocument5 pagesIndian Railway Swot AnalysisSaurabh Kumar Tiwari0% (1)

- Rosemount 2110 Compact Vibrating Fork Liquid Level SwitchDocument8 pagesRosemount 2110 Compact Vibrating Fork Liquid Level SwitchSakahi SharmaNo ratings yet

- Format Eapp Research PaperDocument4 pagesFormat Eapp Research Paperrosa4rosata1No ratings yet

- Issue Resolution Status ReportDocument3 pagesIssue Resolution Status ReportBrady_tomNo ratings yet

- Cambridge IGCSE: 0500/12 First Language EnglishDocument8 pagesCambridge IGCSE: 0500/12 First Language EnglishJonathan Chu100% (1)

- Window AC Breeze Master R410ADocument2 pagesWindow AC Breeze Master R410ARAFID SUHAILNo ratings yet

- MT7688 Datasheet v1 4Document317 pagesMT7688 Datasheet v1 4Hardiksingh RajputNo ratings yet

- Python 3 Core Cheat Sheet by Kalamar - Download Free From Cheatography - Cheatography - Com - Cheat Sheets For Every OccasionDocument6 pagesPython 3 Core Cheat Sheet by Kalamar - Download Free From Cheatography - Cheatography - Com - Cheat Sheets For Every OccasionNett2kNo ratings yet

- Start Up School 2013 NotesDocument31 pagesStart Up School 2013 NotesIspon Asep YuranoNo ratings yet

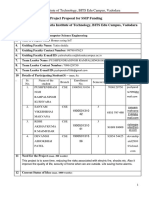

- Project Proposal - SSIP - Blank - Babaria Institute of Technology1Document13 pagesProject Proposal - SSIP - Blank - Babaria Institute of Technology1Pushpendra KushvahaNo ratings yet

- 6000 Chiller ManualDocument43 pages6000 Chiller Manualhytham.midani.63No ratings yet

- Technical CommunicationDocument135 pagesTechnical CommunicationRitu SulamNo ratings yet

- App 1 Cylindrical Shells - ASMEDocument2 pagesApp 1 Cylindrical Shells - ASMEwassim2014No ratings yet

- BSP-02-Standard-1630 - General Electrical Safety (Mod 13, Rev. 4.0)Document29 pagesBSP-02-Standard-1630 - General Electrical Safety (Mod 13, Rev. 4.0)atiqahmed_aaNo ratings yet

- Gy2g0200d020n-Mf VP10RTDocument6 pagesGy2g0200d020n-Mf VP10RTTungstenCarbideNo ratings yet

- DryingDocument8 pagesDryingGeeva Prasanth ANo ratings yet

- MS EmfDocument305 pagesMS EmfpcpaterNo ratings yet

- MNL 32-2014Document74 pagesMNL 32-2014Hassan MokhtarNo ratings yet

- To JT 2 B. InggrisDocument13 pagesTo JT 2 B. Inggrisagus margonoNo ratings yet

- Analisa Pola: Pattern AnalysisDocument30 pagesAnalisa Pola: Pattern AnalysisFERDI FERDINANDNo ratings yet

- Saved RecsDocument488 pagesSaved RecsSpruha JNo ratings yet

- Computer Network System Administrator Interview QuestionDocument4 pagesComputer Network System Administrator Interview Questionkk4953No ratings yet

- Daniel Hutto Radical EnactivismDocument269 pagesDaniel Hutto Radical Enactivismandre magela100% (5)

- IOSRJEN (WWW - Iosrjen.org) IOSR Journal of EngineeringDocument4 pagesIOSRJEN (WWW - Iosrjen.org) IOSR Journal of EngineeringIOSRJEN : hard copy, certificates, Call for Papers 2013, publishing of journalNo ratings yet

- Smart Street Light Based On IOTDocument5 pagesSmart Street Light Based On IOTAmar Nath Babar100% (1)

Securecode Processing - Matrix - 12 2011

Securecode Processing - Matrix - 12 2011

Uploaded by

caprediempayOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Securecode Processing - Matrix - 12 2011

Securecode Processing - Matrix - 12 2011

Uploaded by

caprediempayCopyright:

Available Formats

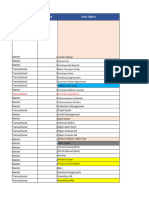

MasterCard SecureCode Merchant Process and Liability Shift Matrix

Authentication Process Authorization Process

PARes Notes Banknet DE48 Liability Shift (See Note)

VEReq VERes PAReq Authorization

Authentication Scenario Fully

Sent? Status Sent? Status ECI AAV Proccessing SE42 SE43(UCAF) Merchant-Only

Authenticated

Auth Success Yes Y Yes Y 02 Yes Yes 2-1-2 Yes Yes Yes

Auth Success (without AAV) Yes Y Yes Y 02 No Yes 2-1-1 No Yes No

Auth Failure (SecureCode failure) Yes Y Yes N - No No 1 2-1-0* No No No

Auth Failure (Signature verification incorrect) Yes Y Yes All All All No 1 2-1-0* No No No

Unable to Authenticate Yes Y Yes U - No Merchant Optional 3 2-1-1 No Yes No

Attempt Yes Y Yes A 01 Yes Yes 2 2-1-1 No Yes No

Attempt (without AAV) Yes Y Yes A 01 No Yes 2-1-1 No Yes No

Cardholder Not Participating Yes N No - - - Yes 2-1-1 No Yes No

Unable to Authenticate Yes U No - - - Yes 2-1-1 No Yes No

Cardholder Not Participating (via directory cache) No - - - - - Yes 2-1-1 No Yes No

DS does not respond to MPI No - - - - - Yes 2-1-1 No Yes No

Error on VEReq Error - No - - - Merchant Optional 3 2-1-1 No Yes No

Error on VERes Yes Error No - - - Merchant Optional 3 2-1-1 No Yes No

Error on PARes Yes Y Yes Error Merchant Optional 3 2-1-1 No Yes No

Merchant Not SecureCode-enabled - - - - - - Yes 2-1-0 No No No

Banknet DE 48:

These indicators map to MasterCard authorization specification requirements for acquirers and issuers. SE42 is the Security Level Indicator and SE43 is the UCAF Data,

which contains the AAV. Merchants must refer to the appropriate acquirer or payment processor message specifications for specific formatting requirements.

Liability Shift

With effect from October 2011 MasterCard has a global Merchant Oinly Liability shift in place. For up to date information on chargebacks and liability for personal and

commercial cards always refer to the current chageback guide.

Notes:

*(1) Best practice would suggest that fraud may be involved and the merchant should prompt the consumer to try again or to use a different form of payment. If merchant

decides to send for authorization, the transaction is not eligible for the liability shift and must therefore be coded as a non SecureCode transaction.

(2) The AAV associated with an attempt must not be included in any subsequent authorization message.

(3) The merchant should check the reason for the error message before deciding whether to proceed with the authorization. Not all reason codes may indicate a failure.

2008 MasterCard 21 March 2008

You might also like

- ARTA MC 2022 05 Annex A. CSM QuestionnaireDocument1 pageARTA MC 2022 05 Annex A. CSM QuestionnaireMarites Taniegra100% (5)

- Action Codes Guide For Cardinal CruiseDocument1 pageAction Codes Guide For Cardinal CruiseErnesto GuerraNo ratings yet

- 3-5-Emv L2Document6 pages3-5-Emv L2Rafael Perez MendozaNo ratings yet

- Requirement Traceability Matrix-SampleDocument5 pagesRequirement Traceability Matrix-Samplemdrazi10No ratings yet

- Web Logic VulnerabilityDocument57 pagesWeb Logic Vulnerabilitysetyahangga3No ratings yet

- EMV Level-2Document6 pagesEMV Level-2Abiy MulugetaNo ratings yet

- PunchPointAction Export 30-03-2024Document2 pagesPunchPointAction Export 30-03-2024Mohsin MansooriNo ratings yet

- GST Billing BrochureDocument6 pagesGST Billing Brochureexecellence solutionsNo ratings yet

- EMV L2-IC5100 Full PDFDocument6 pagesEMV L2-IC5100 Full PDFAnonymous 1BuyZjZNo ratings yet

- Module Attributes List: Heiwa Heaven ResortDocument13 pagesModule Attributes List: Heiwa Heaven ResortNimeshNo ratings yet

- CRF Transmittal Form: (If No, Enter Comment)Document1 pageCRF Transmittal Form: (If No, Enter Comment)rohedy adel0% (1)

- V3X LOA HITO 12259 31oct16Document6 pagesV3X LOA HITO 12259 31oct16Emmanuel KAMANDANo ratings yet

- AccpacEdition DifferencesDocument2 pagesAccpacEdition Differencesasu23No ratings yet

- KitchKo Financial Projections - #OrdersDocument68 pagesKitchKo Financial Projections - #Ordersqzbtbq7y6dNo ratings yet

- 2.how To Fix VS1295 LED - MBDocument41 pages2.how To Fix VS1295 LED - MBRichard emerson Lazcano barajasNo ratings yet

- CommDocument14 pagesCommJithu MonNo ratings yet

- DM Objects - Mapping Tracker - Local - V1.0Document30 pagesDM Objects - Mapping Tracker - Local - V1.0SandeepNo ratings yet

- KitchKo - Financial - Projections - #CustomersDocument88 pagesKitchKo - Financial - Projections - #Customersqzbtbq7y6dNo ratings yet

- 2203201907004478502427Document215 pages2203201907004478502427Nam LeNo ratings yet

- ES - Eng - Micro - MozambiqueDocument25 pagesES - Eng - Micro - MozambiqueAnney LimNo ratings yet

- OBS05 Result CodeDocument2 pagesOBS05 Result CodeNiraj TungareNo ratings yet

- Retail Info Nov'20Document358 pagesRetail Info Nov'20Shahriar SabbirNo ratings yet

- Step 1) Core Model: Investment Planning For Going To College After 3 PeriodsDocument2 pagesStep 1) Core Model: Investment Planning For Going To College After 3 PeriodsDivom SharmaNo ratings yet

- OTC Interview Evaluation Sheet - ARIVIND BEERELLIDocument2 pagesOTC Interview Evaluation Sheet - ARIVIND BEERELLIVikky VikramNo ratings yet

- Level 1 Level 1 Level 1 Code Level Sequence Number Mandatory Mandatory MandatoryDocument9 pagesLevel 1 Level 1 Level 1 Code Level Sequence Number Mandatory Mandatory MandatoryHAMMADHRNo ratings yet

- Adyen Visa Claims Resolution ManualDocument12 pagesAdyen Visa Claims Resolution ManualWael AlkathiriNo ratings yet

- Kingdom Building FlowchartDocument1 pageKingdom Building FlowchartRandyNo ratings yet

- OTC Interview Evaluation Sheet - Abhishek SanyalDocument2 pagesOTC Interview Evaluation Sheet - Abhishek SanyalVikky VikramNo ratings yet

- Basic Vantage TrainingDocument114 pagesBasic Vantage TrainingVivek Kundu100% (1)

- Level 1 Contributor: EOH Holdings Limited and SubsidiariesDocument7 pagesLevel 1 Contributor: EOH Holdings Limited and Subsidiariesvaibhav1004No ratings yet

- Sangfor Vs Symantec Vs Sandvine Simple Comparison - v2Document1 pageSangfor Vs Symantec Vs Sandvine Simple Comparison - v2MOKTAR BAKARNo ratings yet

- Visitor Tracking Systems Comparison UPDATED 20230718Document9 pagesVisitor Tracking Systems Comparison UPDATED 20230718Khalid HassanNo ratings yet

- 3-11 Afm Responses AnalysusDocument18 pages3-11 Afm Responses AnalysusAbdul AsadNo ratings yet

- Store Managers Daily ChecklistDocument8 pagesStore Managers Daily Checklistrb8q5tprw2No ratings yet

- BP-5.1.2D OJT Effectiveness SHEET - Level-2Document1 pageBP-5.1.2D OJT Effectiveness SHEET - Level-2shinuNo ratings yet

- Select ViewDocument3 pagesSelect ViewcipehrshockNo ratings yet

- Deisy Yuliana Avendaño - 212063 - 5Document14 pagesDeisy Yuliana Avendaño - 212063 - 5Camilo Suarez CastilloNo ratings yet

- 3DS v2 Flow Chart IngenicoDocument1 page3DS v2 Flow Chart IngenicoSerge BoliNo ratings yet

- Laboratory 7Document2 pagesLaboratory 7Joe LagartejaNo ratings yet

- Invoice ProcessingDocument40 pagesInvoice ProcessingRAVITEJANo ratings yet

- Omnitracs IVG User Manual Driver Hours AssistDocument84 pagesOmnitracs IVG User Manual Driver Hours AssistGotte Charles EiccaNo ratings yet

- Decision Table TestingDocument5 pagesDecision Table TestingM. R. KHAN DIPUNo ratings yet

- The 7 Basic Quality Tools: Michele CanoDocument72 pagesThe 7 Basic Quality Tools: Michele CanoAnonymous ibmeej9No ratings yet

- Evaluation Scorecard - Soumya Rajput - 85Document3 pagesEvaluation Scorecard - Soumya Rajput - 85SLAUGHTER GAMINGNo ratings yet

- TQM Unit 3Document168 pagesTQM Unit 3bhuvansparks100% (1)

- (Updated 2.0) Controls Check ListDocument12 pages(Updated 2.0) Controls Check Listjayasa5557No ratings yet

- 1 GR 12 Acc P2 June 2024 MGDocument10 pages1 GR 12 Acc P2 June 2024 MGTumiNo ratings yet

- Gr10 ACC P1 (ENG) June 2022 Possible AnswersDocument11 pagesGr10 ACC P1 (ENG) June 2022 Possible Answersfauziahakhalwaya4No ratings yet

- RevenueDocument1 pageRevenuevishista06No ratings yet

- OTC Interview Evaluation Sheet - Ravi KumarDocument2 pagesOTC Interview Evaluation Sheet - Ravi KumarVikky VikramNo ratings yet

- Make It Happen - Make It An Awesome Check-In: Just Give Them The Key!Document35 pagesMake It Happen - Make It An Awesome Check-In: Just Give Them The Key!sushma vinodNo ratings yet

- A77 Sample FAT REPORT PDFDocument11 pagesA77 Sample FAT REPORT PDFingguedezandresNo ratings yet

- EP-3169 Upgrade Firmware (WEB) - 1 - Service ManualDocument94 pagesEP-3169 Upgrade Firmware (WEB) - 1 - Service ManualjojoloNo ratings yet

- Define Phase TemplateDocument15 pagesDefine Phase TemplateNikhil DwivediNo ratings yet

- Larry Fredendall's Sinking Fund: A B C D A B C D ADocument2 pagesLarry Fredendall's Sinking Fund: A B C D A B C D AYadav_BaeNo ratings yet

- Bid Evaluation Sheet Furniture Final 2019-20Document60 pagesBid Evaluation Sheet Furniture Final 2019-20Asghar FaizNo ratings yet

- Vernier Caliper FormateDocument4 pagesVernier Caliper Formatevishal patelNo ratings yet

- Evaluation Scorecard - Ankur Saini - Inbound Call - 75Document2 pagesEvaluation Scorecard - Ankur Saini - Inbound Call - 75SLAUGHTER GAMINGNo ratings yet

- External Audits (Jan Dec'20)Document9 pagesExternal Audits (Jan Dec'20)Muhammad Asad SaeedNo ratings yet

- Civil Engineering Important MCQ PDF-Hydraulics and Fluid Mechanics Part 3 - WWW - ALLEXAMREVIEW.COMDocument10 pagesCivil Engineering Important MCQ PDF-Hydraulics and Fluid Mechanics Part 3 - WWW - ALLEXAMREVIEW.COMMuhammad WaqarNo ratings yet

- The Revision Bias: Ximena Garcia-Rada Ed O'Brien Leslie K. John Michael I. NortonDocument44 pagesThe Revision Bias: Ximena Garcia-Rada Ed O'Brien Leslie K. John Michael I. NortonmanimaransudhaNo ratings yet

- WS Ac PDFDocument8 pagesWS Ac PDFSriHarsha PoolaNo ratings yet

- Diktat Praktikum TBK 2021Document71 pagesDiktat Praktikum TBK 2021Muhammad Handika100% (1)

- BricksDocument44 pagesBricksSimeon Woyesa100% (1)

- Indian Railway Swot AnalysisDocument5 pagesIndian Railway Swot AnalysisSaurabh Kumar Tiwari0% (1)

- Rosemount 2110 Compact Vibrating Fork Liquid Level SwitchDocument8 pagesRosemount 2110 Compact Vibrating Fork Liquid Level SwitchSakahi SharmaNo ratings yet

- Format Eapp Research PaperDocument4 pagesFormat Eapp Research Paperrosa4rosata1No ratings yet

- Issue Resolution Status ReportDocument3 pagesIssue Resolution Status ReportBrady_tomNo ratings yet

- Cambridge IGCSE: 0500/12 First Language EnglishDocument8 pagesCambridge IGCSE: 0500/12 First Language EnglishJonathan Chu100% (1)

- Window AC Breeze Master R410ADocument2 pagesWindow AC Breeze Master R410ARAFID SUHAILNo ratings yet

- MT7688 Datasheet v1 4Document317 pagesMT7688 Datasheet v1 4Hardiksingh RajputNo ratings yet

- Python 3 Core Cheat Sheet by Kalamar - Download Free From Cheatography - Cheatography - Com - Cheat Sheets For Every OccasionDocument6 pagesPython 3 Core Cheat Sheet by Kalamar - Download Free From Cheatography - Cheatography - Com - Cheat Sheets For Every OccasionNett2kNo ratings yet

- Start Up School 2013 NotesDocument31 pagesStart Up School 2013 NotesIspon Asep YuranoNo ratings yet

- Project Proposal - SSIP - Blank - Babaria Institute of Technology1Document13 pagesProject Proposal - SSIP - Blank - Babaria Institute of Technology1Pushpendra KushvahaNo ratings yet

- 6000 Chiller ManualDocument43 pages6000 Chiller Manualhytham.midani.63No ratings yet

- Technical CommunicationDocument135 pagesTechnical CommunicationRitu SulamNo ratings yet

- App 1 Cylindrical Shells - ASMEDocument2 pagesApp 1 Cylindrical Shells - ASMEwassim2014No ratings yet

- BSP-02-Standard-1630 - General Electrical Safety (Mod 13, Rev. 4.0)Document29 pagesBSP-02-Standard-1630 - General Electrical Safety (Mod 13, Rev. 4.0)atiqahmed_aaNo ratings yet

- Gy2g0200d020n-Mf VP10RTDocument6 pagesGy2g0200d020n-Mf VP10RTTungstenCarbideNo ratings yet

- DryingDocument8 pagesDryingGeeva Prasanth ANo ratings yet

- MS EmfDocument305 pagesMS EmfpcpaterNo ratings yet

- MNL 32-2014Document74 pagesMNL 32-2014Hassan MokhtarNo ratings yet

- To JT 2 B. InggrisDocument13 pagesTo JT 2 B. Inggrisagus margonoNo ratings yet

- Analisa Pola: Pattern AnalysisDocument30 pagesAnalisa Pola: Pattern AnalysisFERDI FERDINANDNo ratings yet

- Saved RecsDocument488 pagesSaved RecsSpruha JNo ratings yet

- Computer Network System Administrator Interview QuestionDocument4 pagesComputer Network System Administrator Interview Questionkk4953No ratings yet

- Daniel Hutto Radical EnactivismDocument269 pagesDaniel Hutto Radical Enactivismandre magela100% (5)

- IOSRJEN (WWW - Iosrjen.org) IOSR Journal of EngineeringDocument4 pagesIOSRJEN (WWW - Iosrjen.org) IOSR Journal of EngineeringIOSRJEN : hard copy, certificates, Call for Papers 2013, publishing of journalNo ratings yet

- Smart Street Light Based On IOTDocument5 pagesSmart Street Light Based On IOTAmar Nath Babar100% (1)