Professional Documents

Culture Documents

Annual Report 2022 - Bank of America

Annual Report 2022 - Bank of America

Uploaded by

张文珂0 ratings0% found this document useful (0 votes)

3 views2 pages- Total assets decreased 4% to $3.1 trillion due to lower debt securities and cash balances, partially offset by increases in loans and trading account assets.

- Total liabilities decreased 4% to $2.8 trillion primarily due to lower deposits, partially offset by increases in federal funds sold/repurchased agreements and other liabilities.

- Shareholders' equity increased 1% to $273.2 billion due to net income and preferred stock issuance, partially offset by market value decreases and capital returns to shareholders.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document- Total assets decreased 4% to $3.1 trillion due to lower debt securities and cash balances, partially offset by increases in loans and trading account assets.

- Total liabilities decreased 4% to $2.8 trillion primarily due to lower deposits, partially offset by increases in federal funds sold/repurchased agreements and other liabilities.

- Shareholders' equity increased 1% to $273.2 billion due to net income and preferred stock issuance, partially offset by market value decreases and capital returns to shareholders.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesAnnual Report 2022 - Bank of America

Annual Report 2022 - Bank of America

Uploaded by

张文珂- Total assets decreased 4% to $3.1 trillion due to lower debt securities and cash balances, partially offset by increases in loans and trading account assets.

- Total liabilities decreased 4% to $2.8 trillion primarily due to lower deposits, partially offset by increases in federal funds sold/repurchased agreements and other liabilities.

- Shareholders' equity increased 1% to $273.2 billion due to net income and preferred stock issuance, partially offset by market value decreases and capital returns to shareholders.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

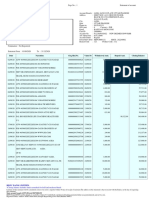

Balance Sheet Overview

Table 5 Selected Balance Sheet Data

December 31

(Dollars in millions) 2022 2021 $ Change % Change

Assets

Cash and cash equivalents $ 230,203 $ 348,221 $ (118,018) (34)%

Federal funds sold and securities borrowed or purchased under agreements to resell 267,574 250,720 16,854 7

Trading account assets 296,108 247,080 49,028 20

Debt securities 862,819 982,627 (119,808) (12)

Loans and leases 1,045,747 979,124 66,623 7

Allowance for loan and lease losses (12,682) (12,387) (295) 2

All other assets 361,606 374,110 (12,504) (3)

Total assets $ 3,051,375 $ 3,169,495 $ (118,120) (4)

Liabilities

Deposits $ 1,930,341 $ 2,064,446 $ (134,105) (6)

Federal funds purchased and securities loaned or sold under agreements to repurchase 195,635 192,329 3,306 2

Trading account liabilities 80,399 100,690 (20,291) (20)

Short-term borrowings 26,932 23,753 3,179 13

Long-term debt 275,982 280,117 (4,135) (1)

All other liabilities 268,889 238,094 30,795 13

Total liabilities 2,778,178 2,899,429 (121,251) (4)

Shareholders’ equity 273,197 270,066 3,131 1

Total liabilities and shareholders’ equity $ 3,051,375 $ 3,169,495 $ (118,120) (4)

Assets purchased under agreements to resell increased $16.9 billion

At December 31, 2022, total assets were approximately $3.1 primarily due to client activity within Global Markets.

trillion, down $118.1 billion from December 31, 2021. The Trading Account Assets

decrease in assets was primarily due to lower debt securities Trading account assets consist primarily of long positions in

and cash and cash equivalents, partially offset by an increase in equity and fixed-income securities including U.S. government

loans and leases, trading account assets and federal funds sold and agency securities, corporate securities and non-U.S.

and securities borrowed or purchased under agreements to sovereign debt. Trading account assets increased $49.0 billion

resell. primarily due to client activity within Global Markets.

Cash and Cash Equivalents Debt Securities

Cash and cash equivalents decreased $118.0 billion primarily Debt securities primarily include U.S. Treasury and agency

driven by lower deposits and continued loan growth. securities, mortgage-backed securities (MBS), principally agency

Federal Funds Sold and Securities Borrowed or Purchased MBS, non-U.S. bonds, corporate bonds and municipal debt. We

Under Agreements to Resell use the debt securities portfolio primarily to manage interest

Federal funds transactions involve lending reserve balances on rate and liquidity risk and to leverage market conditions that

a short-term basis. Securities borrowed or purchased under create economically attractive returns on these investments.

agreements to resell are collateralized lending transactions Debt securities decreased $119.8 billion primarily driven by

utilized to accommodate customer transactions, earn interest lower deposits and continued loan growth. For more information

rate spreads and obtain securities for settlement and for on debt securities, see Note 4 – Securities to the Consolidated

collateral. Federal funds sold and securities borrowed or Financial Statements.

Bank of America 2022 77

Loans and Leases Short-term Borrowings

Loans and leases increased $66.6 billion primarily driven by Short-term borrowings provide an additional funding source and

growth in commercial loans, higher credit card spending and primarily consist of Federal Home Loan Bank (FHLB) short-term

higher residential mortgages due to lower paydowns and borrowings, notes payable and various other borrowings that

continued originations. For more information on the loan generally have maturities of one year or less. Short-term

portfolio, see Credit Risk Management on page 106. borrowings increased $3.2 billion primarily due to an increase in

FHLB advances and commercial paper to manage liquidity

Allowance for Loan and Lease Losses

needs. For more information on short-term borrowings, see Note

The allowance for loan and lease losses increased $295 million 10 – Securities Financing Agreements, Short-term Borrowings,

primarily driven by loan growth and a dampened macroeconomic

Collateral and Restricted Cash to the Consolidated Financial

outlook, partially offset by a reserve release for reduced

Statements.

pandemic uncertainties. For more information, see Allowance for

Credit Losses on page 120. Long-term Debt

Long-term debt decreased $4.1 billion primarily due to

All Other Assets

maturities, redemptions and valuation adjustments, partially

All other assets decreased $12.5 billion primarily driven by a

offset by issuances. For more information on long-term debt,

decline in margin loans and loans held-for-sale (LHFS).

see Note 11 – Long-term Debt to the Consolidated Financial

Liabilities Statements.

At December 31, 2022, total liabilities were approximately $2.8

All Other Liabilities

trillion, down $121.3 billion from December 31, 2021, primarily

All other liabilities increased $30.8 billion primarily driven by

due to lower deposits.

Global Markets client activity.

Deposits Shareholders’ Equity

Deposits decreased $134.1 billion primarily due to an increase

Shareholders’ equity increased $3.1 billion primarily due to net

in customer spending and a shift to higher yielding accounts.

income and the issuance of preferred stock, partially offset by

Federal Funds Purchased and Securities Loaned or Sold market value decreases on derivatives and debt securities, and

Under Agreements to Repurchase returns of capital to shareholders through common and

Federal funds transactions involve borrowing reserve balances preferred stock dividends and common stock repurchases.

on a short-term basis. Securities loaned or sold under

agreements to repurchase are collateralized borrowing

Cash Flows Overview

transactions utilized to accommodate customer transactions, The Corporation’s operating assets and liabilities support our

earn interest rate spreads and finance assets on the balance global markets and lending activities. We believe that cash

sheet. Federal funds purchased and securities loaned or sold flows from operations, available cash balances and our ability to

under agreements to repurchase increased $3.3 billion primarily generate cash through short- and long-term debt are sufficient to

driven by an increase in repurchase agreements to support fund our operating liquidity needs. Our investing activities

liquidity. primarily include the debt securities portfolio and loans and

leases. Our financing activities reflect cash flows primarily

Trading Account Liabilities related to customer deposits, securities financing agreements,

Trading account liabilities consist primarily of short positions in long-term debt and common and preferred stock. For more

equity and fixed-income securities including U.S. Treasury and information on liquidity, see Liquidity Risk on page 101.

agency securities, non-U.S. sovereign debt and corporate

securities. Trading account liabilities decreased $20.3 billion

primarily due to lower levels of short positions within Global

Markets.

78 Bank of America 2022

You might also like

- Full Download Principles of Corporate Finance 10th Edition Brealey Solutions ManualDocument14 pagesFull Download Principles of Corporate Finance 10th Edition Brealey Solutions Manualdrockadeobaq96% (24)

- Business Plan For A FMCG Company!!!!!Document31 pagesBusiness Plan For A FMCG Company!!!!!Ranjith AR76% (25)

- Travel and Tourism Coursebook AnswersDocument8 pagesTravel and Tourism Coursebook AnswersHuy LeNo ratings yet

- Erro Jaya Rosady - 042024353001Document6 pagesErro Jaya Rosady - 042024353001Erro Jaya RosadyNo ratings yet

- Overview of Yardi MaintenanceDocument49 pagesOverview of Yardi Maintenancestranfir100% (1)

- Quarterly Report 20120331Document25 pagesQuarterly Report 20120331TshegofatsoTaunyaneNo ratings yet

- Understanding Financial StatementsDocument9 pagesUnderstanding Financial StatementskozenameNo ratings yet

- Financial StatementsDocument112 pagesFinancial StatementsTriyono S. SiNo ratings yet

- Money MarketDocument23 pagesMoney MarketMark Andrei CanlasNo ratings yet

- Administration and Other Fiduciary Fees Revenue Is PrimarilyDocument20 pagesAdministration and Other Fiduciary Fees Revenue Is PrimarilyORION OMAR MENDOZA SALHUANo ratings yet

- 2022 Form 10-K Debt SecurityDocument2 pages2022 Form 10-K Debt SecurityYashasvi RaghavendraNo ratings yet

- Kit Valoración Cementos ArgosDocument19 pagesKit Valoración Cementos ArgosLEIDY DAYANA PARRA CARONo ratings yet

- Corporate Finance LectureDocument124 pagesCorporate Finance LectureMuhammad Kashif ZafarNo ratings yet

- CH 03Document51 pagesCH 03Lộc PhúcNo ratings yet

- Accounting - UCO Bank - Assignment1Document1 pageAccounting - UCO Bank - Assignment1KummNo ratings yet

- Cuet DebenturesDocument13 pagesCuet Debenturesjay752689No ratings yet

- JM Financial Products Information MemoDocument11 pagesJM Financial Products Information MemoSachin MondkarNo ratings yet

- Digital Advantage Insurance Company 6-30-22Document115 pagesDigital Advantage Insurance Company 6-30-22georgi.korovskiNo ratings yet

- Foreignex Comptroller HandbookDocument35 pagesForeignex Comptroller HandbookanzrainaNo ratings yet

- (In Millions, Except Par Values) Assets: The Kroger Co. C B SDocument1 page(In Millions, Except Par Values) Assets: The Kroger Co. C B ShashaamNo ratings yet

- Madam CaseDocument30 pagesMadam CaseihtishamNo ratings yet

- FY 2010 HEXA Hexindo+Adiperkasa+TbkDocument39 pagesFY 2010 HEXA Hexindo+Adiperkasa+TbkAnggit DewiNo ratings yet

- Saint Mary's College of California 2022 Audit - Financial StatementsDocument32 pagesSaint Mary's College of California 2022 Audit - Financial StatementsCristine Grace AcuyanNo ratings yet

- Long-Term Debt Handout (UPDATED 8-27-22)Document9 pagesLong-Term Debt Handout (UPDATED 8-27-22)Charudatta MundeNo ratings yet

- 1Q 2014 Op Supp Final 7-21-14Document19 pages1Q 2014 Op Supp Final 7-21-14bomby0No ratings yet

- CommerzMarketsLLC-Statement of Financial Condition JUN 2022Document15 pagesCommerzMarketsLLC-Statement of Financial Condition JUN 2022Катерина ЕгороваNo ratings yet

- FAC612S - Test 3 2023Document5 pagesFAC612S - Test 3 2023simaneka.shilongoNo ratings yet

- Packages Annualreport2002Document66 pagesPackages Annualreport2002omairNo ratings yet

- Federal Reserve: Statistical ReleaseDocument11 pagesFederal Reserve: Statistical ReleaseAhsan RazaNo ratings yet

- Financial Statement Analysis: Jeddah International College Answer PaperDocument4 pagesFinancial Statement Analysis: Jeddah International College Answer PaperBushraYousafNo ratings yet

- Finance: Jump ToDocument16 pagesFinance: Jump Tochandak24No ratings yet

- FINC600 Week 4 DQ. Balance SheetDocument4 pagesFINC600 Week 4 DQ. Balance SheetashibhallauNo ratings yet

- Karora Q2 2022 FSDocument19 pagesKarora Q2 2022 FSprenges prengesNo ratings yet

- Dialog Finance PLC: ConfidentialDocument12 pagesDialog Finance PLC: ConfidentialgirihellNo ratings yet

- Parrino Corp Fin 5e PPT Ch03Document76 pagesParrino Corp Fin 5e PPT Ch03trangnnhhs180588No ratings yet

- Fourth Quarter 2009 Financial ResultsDocument26 pagesFourth Quarter 2009 Financial ResultsZerohedgeNo ratings yet

- Appendix PfizerDocument2 pagesAppendix PfizerelatobouloNo ratings yet

- Financialstatement UnauditedDocument12 pagesFinancialstatement UnauditedbrianNo ratings yet

- Solutions Totutorial 2-Fall 2022Document8 pagesSolutions Totutorial 2-Fall 2022chtiouirayyenNo ratings yet

- 2021 Fed Combined Financial StatementsDocument58 pages2021 Fed Combined Financial StatementsxxNo ratings yet

- Bodie Investments PPT CH01Document35 pagesBodie Investments PPT CH01rafat.jalladNo ratings yet

- Week 10 - Financing Decision (Part 1) v3Document31 pagesWeek 10 - Financing Decision (Part 1) v3NabilNo ratings yet

- 2020 Annual Report 43Document1 page2020 Annual Report 43Wilson BastidasNo ratings yet

- Other Long-Term Investments: Sinking Fund Requirements Maturitie SDocument3 pagesOther Long-Term Investments: Sinking Fund Requirements Maturitie SXiena0% (1)

- Chapter 12 - Other Long-Term InvestmentsDocument3 pagesChapter 12 - Other Long-Term InvestmentsJEFFERSON CUTENo ratings yet

- 2020 Friendly Hills BankDocument34 pages2020 Friendly Hills BankNate TobikNo ratings yet

- KRR FS Q1Document17 pagesKRR FS Q1prenges prengesNo ratings yet

- Chap 003Document80 pagesChap 003Châu Anh ĐàoNo ratings yet

- FS 1999 - Gabriel Resources YukonDocument18 pagesFS 1999 - Gabriel Resources YukonelenaNo ratings yet

- 1 - BanksDocument13 pages1 - Banksmammadli.mammaddNo ratings yet

- HE 6 Questions - Updated-1Document8 pagesHE 6 Questions - Updated-1halelz69No ratings yet

- Statement August 31 2020Document30 pagesStatement August 31 2020NicolasNo ratings yet

- Ambc 7sec-Amda-1tkrmb-1193125-13-334909 PDFDocument135 pagesAmbc 7sec-Amda-1tkrmb-1193125-13-334909 PDFpeterlee100No ratings yet

- Chapter13 HKAS23Document9 pagesChapter13 HKAS23Kelviw02 WuuoqwoNo ratings yet

- 6-Two Faces of DebtDocument29 pages6-Two Faces of DebtscottyupNo ratings yet

- The Phoenix Companies, Inc. Investment Portfolio Supplement: As of March 31, 2009Document31 pagesThe Phoenix Companies, Inc. Investment Portfolio Supplement: As of March 31, 2009wagnebNo ratings yet

- FM Ii Case 4 Group 5Document8 pagesFM Ii Case 4 Group 5AntonNo ratings yet

- MOD Technical Proposal 1.0Document23 pagesMOD Technical Proposal 1.0Scott TigerNo ratings yet

- Chap 010Document19 pagesChap 010AshutoshNo ratings yet

- Welcome TO Our PresentationDocument20 pagesWelcome TO Our Presentationতোফায়েল আহমেদNo ratings yet

- Sample Working Capital Per Dollar of Sales Calculation: Total Sales Income StatementDocument7 pagesSample Working Capital Per Dollar of Sales Calculation: Total Sales Income StatementsanjusarkarNo ratings yet

- Credit Derivatives and Structured Credit: A Guide for InvestorsFrom EverandCredit Derivatives and Structured Credit: A Guide for InvestorsNo ratings yet

- Amravati: Presented By: Sushant S. Tantarpale Mba 2 YearDocument11 pagesAmravati: Presented By: Sushant S. Tantarpale Mba 2 YearSushantNo ratings yet

- Assignment 1Document11 pagesAssignment 1sajaniNo ratings yet

- EI - 2010 - High Level Framework PSMDocument43 pagesEI - 2010 - High Level Framework PSMMaxNo ratings yet

- Ebook KFIC Proven Sales Methodology RoadmapDocument9 pagesEbook KFIC Proven Sales Methodology Roadmapvijayjain347No ratings yet

- Idbi Financial In4mationDocument9 pagesIdbi Financial In4mationKishor PatelNo ratings yet

- 18PM0044 - 1.0 ML Clear White Ring Snap Off & Yellow Ring On Neck Glass AmpouleDocument2 pages18PM0044 - 1.0 ML Clear White Ring Snap Off & Yellow Ring On Neck Glass Ampoulesystacare remediesNo ratings yet

- Engstrom Auto Mirror Plant: Alex Barbosa Kelly Downes Justin Domingo Andy Fazzone Dave CassDocument16 pagesEngstrom Auto Mirror Plant: Alex Barbosa Kelly Downes Justin Domingo Andy Fazzone Dave CassDave CassNo ratings yet

- Vertical Analysis of Financial Statements - Pepsi V CokeDocument2 pagesVertical Analysis of Financial Statements - Pepsi V CokeCarneades33% (3)

- Ipru Annual Outlook 2022Document53 pagesIpru Annual Outlook 2022Harsha AechuriNo ratings yet

- Rmit University Graduates 2021Document452 pagesRmit University Graduates 2021butlicker1000No ratings yet

- Invoice 207Document1 pageInvoice 207morerahul5889No ratings yet

- Accounting Concepts and ConventionsDocument2 pagesAccounting Concepts and ConventionsWelcome 1995No ratings yet

- Submission of Requirements For Appointment For ReclassificationDocument3 pagesSubmission of Requirements For Appointment For ReclassificationSibs Academic ServicesNo ratings yet

- Ilustre Family Agreement1Document5 pagesIlustre Family Agreement1Joke JoNo ratings yet

- CRSL Presentation 2nd October 2013 FinalDocument41 pagesCRSL Presentation 2nd October 2013 FinalWilliam FergusonNo ratings yet

- Political Economy - A Beginner's CourseDocument232 pagesPolitical Economy - A Beginner's CourseFelipe RodriguesNo ratings yet

- The Fundamentals of Managerial Economics Answers To Questions and ProblemsDocument42 pagesThe Fundamentals of Managerial Economics Answers To Questions and Problemsrodop82No ratings yet

- Mark Minervini Quotes (@MinerviniQuote) - Twitter1Document1 pageMark Minervini Quotes (@MinerviniQuote) - Twitter1LNo ratings yet

- Foundations of AccountingDocument2 pagesFoundations of AccountingHạ MộcNo ratings yet

- Met 2Document7 pagesMet 2alya nurNo ratings yet

- Indirect Price DiscrimanationDocument11 pagesIndirect Price DiscrimanationCarrie DangNo ratings yet

- V SRMT 2Document10 pagesV SRMT 2Aeshvery RajouraNo ratings yet

- MGT603 Short NotesDocument20 pagesMGT603 Short NotesAdnan JavedNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument6 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceMeghna ShandilyaNo ratings yet

- (Microsoft Dynamics Navision Technical Consultant) : Building, and MS Power BIDocument8 pages(Microsoft Dynamics Navision Technical Consultant) : Building, and MS Power BIHR Recruiter100% (1)

- w9 Request JeffCo District Court 3-22-2022Document2 pagesw9 Request JeffCo District Court 3-22-2022otis tolbertNo ratings yet