Professional Documents

Culture Documents

CT 1 A Solution

CT 1 A Solution

Uploaded by

Ansary LabibCopyright:

Available Formats

You might also like

- Chapter 20 PartnershipsDocument10 pagesChapter 20 PartnershipsJessica Garcia100% (1)

- Ibs Lahad Datu 1 30/06/21Document79 pagesIbs Lahad Datu 1 30/06/21Yazid N AsiahNo ratings yet

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Salary Slip Template V1.1Document1 pageSalary Slip Template V1.1JoyRoyNo ratings yet

- CT 1 B SolutionDocument2 pagesCT 1 B SolutionAnsary LabibNo ratings yet

- Class - Problems On The Assessment of NonresidentDocument2 pagesClass - Problems On The Assessment of Nonresidentsakibctg416No ratings yet

- Direct Tax-IDocument21 pagesDirect Tax-Ivivek rajakNo ratings yet

- tax qpDocument6 pagestax qpAashish kumarNo ratings yet

- Sem - IV Taxation - I Sample Paper-1Document5 pagesSem - IV Taxation - I Sample Paper-1yadavkari497No ratings yet

- Rana Fin.623Document1 pageRana Fin.623Adnan MurtazaNo ratings yet

- Tax Quiz 1Document3 pagesTax Quiz 1KimbabNo ratings yet

- IncomeTax-2Document6 pagesIncomeTax-2Aditya .cNo ratings yet

- Tax H Question 2021Document3 pagesTax H Question 2021Aporupa BarNo ratings yet

- Residential Status, Exempt Income & AMT - SolutionDocument5 pagesResidential Status, Exempt Income & AMT - SolutionGajender JhaNo ratings yet

- F Business Taxation 671079211Document4 pagesF Business Taxation 671079211anand0% (1)

- IT Module 4 Incidence of TaxDocument4 pagesIT Module 4 Incidence of Taxrahulking219No ratings yet

- Tutorial 2 - Trust (Q)Document3 pagesTutorial 2 - Trust (Q)Xin RuNo ratings yet

- 819-C-82051-Assignment 2 CH 2Document3 pages819-C-82051-Assignment 2 CH 2ramankantjain07No ratings yet

- Sri Bharathi Women'S Arts and Science College Kunnathur - ArniDocument3 pagesSri Bharathi Women'S Arts and Science College Kunnathur - ArniElumalaiNo ratings yet

- 1686044906DTS-2 Taxation CA InteranswerDocument11 pages1686044906DTS-2 Taxation CA InteranswerViraj SharmaNo ratings yet

- TAX PLANNING & COMPLIANCE - ND-2022 - Suggested - AnswersDocument9 pagesTAX PLANNING & COMPLIANCE - ND-2022 - Suggested - AnswersMohammad FaridNo ratings yet

- 37524E240 Reg. NoDocument7 pages37524E240 Reg. Noshejal naikNo ratings yet

- PTP SolutionsDocument5 pagesPTP SolutionsSanah SahniNo ratings yet

- Bcom TaxDocument6 pagesBcom TaxAditya .cNo ratings yet

- Bíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆDocument8 pagesBíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆSudhir SoudagarNo ratings yet

- Paper7 Set2Document7 pagesPaper7 Set2ashrant69No ratings yet

- Taxation ManagementDocument2 pagesTaxation ManagementAdnan MurtazaNo ratings yet

- ACC 203 Taxation in NepalDocument9 pagesACC 203 Taxation in NepalSophiya PrabinNo ratings yet

- Solution of CS PROFESSIONAL Income Tax Test by CA Vivek GabaDocument13 pagesSolution of CS PROFESSIONAL Income Tax Test by CA Vivek Gabaarohi guptaNo ratings yet

- Da 144Document4 pagesDa 144GeethaNo ratings yet

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- Paper7 Set2 SolutionDocument17 pagesPaper7 Set2 SolutionMayuri KolheNo ratings yet

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- Other TaxDocument3 pagesOther TaxAnkit Jung RayamajhiNo ratings yet

- Income Tax Law and PracticeDocument4 pagesIncome Tax Law and PracticeShruthi VijayanNo ratings yet

- Income Tax Divyastra CH 2 Scope of Total Income RDocument15 pagesIncome Tax Divyastra CH 2 Scope of Total Income Rjhansiaj06No ratings yet

- GST Model Paper 2Document3 pagesGST Model Paper 2Joshua StarkNo ratings yet

- Bsa Quiz 2.0 - Pure ProbsDocument4 pagesBsa Quiz 2.0 - Pure ProbsCyrss BaldemosNo ratings yet

- Tax Planning and Compliance: Page 1 of 5Document5 pagesTax Planning and Compliance: Page 1 of 5Srikrishna DharNo ratings yet

- TAXATION (Preps)Document5 pagesTAXATION (Preps)Navya GulatiNo ratings yet

- PEOBLEMS2Document3 pagesPEOBLEMS2Awesome AngelNo ratings yet

- FinalroundDocument35 pagesFinalroundJenny Keece RaquelNo ratings yet

- Nanadanam Key-1Document6 pagesNanadanam Key-1santha kumariNo ratings yet

- Basics (DT) Revision P Ques Jan 23Document10 pagesBasics (DT) Revision P Ques Jan 23Grave diggerNo ratings yet

- Income From House Property: Annual ValueDocument6 pagesIncome From House Property: Annual ValueSaddam KhanNo ratings yet

- Advanced Taxation (ACCA)Document6 pagesAdvanced Taxation (ACCA)sarthaksenNo ratings yet

- Solution CA Inter TaxationDocument17 pagesSolution CA Inter TaxationBhola Shankar PrasadNo ratings yet

- Mega Test PDFDocument73 pagesMega Test PDFFalak HanifNo ratings yet

- Mohit Agarwal QP Tax LawsDocument17 pagesMohit Agarwal QP Tax LawsManisha DasNo ratings yet

- Paper - 4: Taxation Section A: Income TaxDocument24 pagesPaper - 4: Taxation Section A: Income TaxChhaya JajuNo ratings yet

- MT Test Review-Taxation 1-Win 2024Document4 pagesMT Test Review-Taxation 1-Win 2024Mariola AlkuNo ratings yet

- Adobe Scan 09 Nov 2023Document11 pagesAdobe Scan 09 Nov 2023Sanskruti BarikNo ratings yet

- BAM031 - P2 - Q2 - Introduction To Gross Income, Inclusions and Exclusions - AnswersDocument8 pagesBAM031 - P2 - Q2 - Introduction To Gross Income, Inclusions and Exclusions - AnswersShane QuintoNo ratings yet

- ICAEW - Tax - Mini Test 3 - STDDocument6 pagesICAEW - Tax - Mini Test 3 - STDlinhdinhphuong02No ratings yet

- CA Inter Mighty 50Document47 pagesCA Inter Mighty 50INTER SMARTIANSNo ratings yet

- DeductionsDocument13 pagesDeductionsShivaram ShivaramNo ratings yet

- S20 TX SGP Sample AnswersDocument7 pagesS20 TX SGP Sample AnswersKAH MENG KAMNo ratings yet

- MCQ OF CHAPTER 12 A & B - Payment of TaxDocument11 pagesMCQ OF CHAPTER 12 A & B - Payment of TaxAman AgarwalNo ratings yet

- Taxation Assignment No 1Document8 pagesTaxation Assignment No 1Ha MimNo ratings yet

- It 1Document18 pagesIt 1naheensyeda20No ratings yet

- Income Tax 1 - 20223Document3 pagesIncome Tax 1 - 20223nimalpes21No ratings yet

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet

- Corporate Governance CodeDocument15 pagesCorporate Governance CodeAnsary LabibNo ratings yet

- Competition Act, 2012Document4 pagesCompetition Act, 2012Ansary LabibNo ratings yet

- CHP 5Document2 pagesCHP 5Ansary LabibNo ratings yet

- CT 1 B SolutionDocument2 pagesCT 1 B SolutionAnsary LabibNo ratings yet

- DO IT Salary Income With SolutionDocument3 pagesDO IT Salary Income With SolutionAnsary LabibNo ratings yet

- New Zealand LastDocument8 pagesNew Zealand LastAnsary LabibNo ratings yet

- Macroeconomics Term PaperDocument35 pagesMacroeconomics Term PaperAnsary LabibNo ratings yet

- Sustainability and Environmental ImpactDocument1 pageSustainability and Environmental ImpactAnsary LabibNo ratings yet

- Pelzer Company Reconciled Its Bank and Book Statement Balances ofDocument2 pagesPelzer Company Reconciled Its Bank and Book Statement Balances ofAmit PandeyNo ratings yet

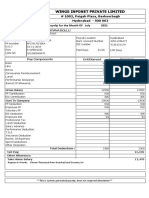

- Wings Infonet Private Limited: # 1002, Paigah Plaza, Basheerbagh Hyderabad - 500 063 2021Document1 pageWings Infonet Private Limited: # 1002, Paigah Plaza, Basheerbagh Hyderabad - 500 063 2021Venkatanarayana BolluNo ratings yet

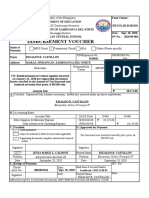

- Earnest Money Receipt AgreementDocument3 pagesEarnest Money Receipt AgreementwilliesyNo ratings yet

- Bill For Current MonthDocument3 pagesBill For Current Monthramkumartanwar0% (1)

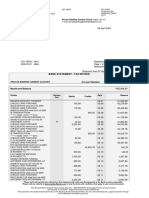

- Sbi StatementDocument4 pagesSbi Statement321910303040 gitamNo ratings yet

- Servlet ControllerDocument1 pageServlet Controllermukesh sahuNo ratings yet

- Security Bank Credit Card Supplementary FormDocument3 pagesSecurity Bank Credit Card Supplementary FormRBCD INDUSTRIAL SUPPLYNo ratings yet

- EmiratesNBD Schedule of ChargesDocument3 pagesEmiratesNBD Schedule of ChargesbunklyNo ratings yet

- Shopee Voucher 2Document2 pagesShopee Voucher 2mariaNo ratings yet

- Nego - Bar 2007-2013Document9 pagesNego - Bar 2007-2013yukibambam_28No ratings yet

- Exam For Business TaxDocument3 pagesExam For Business TaxJenyll MabborangNo ratings yet

- U4.3 Optional Standard Deduction (Presentation Slides)Document4 pagesU4.3 Optional Standard Deduction (Presentation Slides)Marc Geoffrey HababNo ratings yet

- Disbursement Voucher - Check #101-200Document91 pagesDisbursement Voucher - Check #101-200Jessa Mariz Lecias CalimotNo ratings yet

- 82276BIR Form 1702-EXDocument7 pages82276BIR Form 1702-EXJessicaWeinNo ratings yet

- Taxation Review - General PrinciplesDocument6 pagesTaxation Review - General PrinciplesKenneth Bryan Tegerero Tegio0% (1)

- 6 April 2023Document7 pages6 April 2023mapondaglodiNo ratings yet

- Application For Direct Debit Payment Authorisation FormDocument2 pagesApplication For Direct Debit Payment Authorisation Formmarmud100% (1)

- 9 - Special JournalDocument30 pages9 - Special JournalYallyNo ratings yet

- How To Become A Tax PreparerDocument3 pagesHow To Become A Tax Preparerrebelstarr001No ratings yet

- Income Tax - 2018 - TabagDocument34 pagesIncome Tax - 2018 - TabagLeojelaineIgcoyNo ratings yet

- Receiving Payments and Making DepositsDocument28 pagesReceiving Payments and Making DepositsElla MaeNo ratings yet

- Income Tax Course Manual (2021 T1) PDFDocument138 pagesIncome Tax Course Manual (2021 T1) PDFMrDorakonNo ratings yet

- University of Tokyo GUC IntroDocument2 pagesUniversity of Tokyo GUC Introabigale5.66No ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVishal JainNo ratings yet

- Cashless Economy in India UPSC NotesDocument14 pagesCashless Economy in India UPSC NotesIshan KaushikNo ratings yet

- Roic Current Ratio Operating Cycle: Unilever PLC GSK PLC Unilever PLC GSK PLC Unilever PLC GSK PLCDocument4 pagesRoic Current Ratio Operating Cycle: Unilever PLC GSK PLC Unilever PLC GSK PLC Unilever PLC GSK PLCMd. Real MiahNo ratings yet

- Tax Law AssgimentDocument8 pagesTax Law AssgimentGopan NishantNo ratings yet

CT 1 A Solution

CT 1 A Solution

Uploaded by

Ansary LabibOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CT 1 A Solution

CT 1 A Solution

Uploaded by

Ansary LabibCopyright:

Available Formats

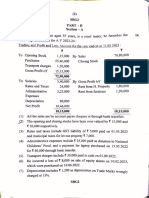

Residential Status

Question 1:

The following are the particulars of income of Mr. Zaman for the income year 2022-23:

1. Rent from a property in Dhaka received in India Tk. 40,000

2. Income from a business in USA controlled from Bangladesh Tk. 150,000

3. Income from a business in Dhaka controlled from Pakistan Tk. 180,000

4. Rent from a property in Canada received there but subsequently remitted to Bangladesh Tk.

60,000

5. Interest from bank deposits in Canada Tk. 20,000

6. Gifts received from his parents Tk. 45,000

Compute total income of Mr. Zaman, assuming that he is a (a) Resident; (b) Non-resident

Solution 1:

Mr. Zaman

Income year: 2022-23

Assessment year: 2023-24

Computation of total income

Particulars Resident Tk. Non-resident Tk.

Rent from property in Bangladesh (wherever 40,000 40,000

paid)

Income from business in USA controlled from 150,000

Bangladesh

Income from business in Dhaka controlled 180,000 180,000

from Pakistan (as it is received in Bangladesh)

Interest on bank deposits at Canada 20,000

Total income 3,90,000 2,20,000

Surcharge

Question 2:

Mr. Sabbir has a total income of Tk. 13,00,000 (of which Tk. 4,00,000 from cigarette

manufacturing business) and net wealth of Tk. 10,10,00,000. He owns two motor cars of 1500 cc

and 2300 cc respectively. Calculate his tax liability.

Solution 2:

Regular Tax (3,50,000 * 0% + 1,00,000 * 5% + 3,00,000 * 10% + 1,50,000 * 15% + 4,00,000 *

45%) = 2,37,500

Rebate = (3% of 13,00,000) = 39,000 or 10 lac (lower one)

Tax after rebate = (2,37,500 – 39,000) = 1,98,500

For having assets withing 10-20 crore = (1,98,500 * 20%) = 39,700

2.5% on income from cigarette = (4,00,000 * 2.5%) = 10,000

Environmental surcharge for 2300 CC = 75,000

Total Tax = 3,23,200

Minimum Tax (Company)

Question 3:

X Limited is a Public Limited Company registered in Bangladesh involved in manufacturing

chips (Not Listed in the Stock Exchange). During the assessment year 2023-24, its net operating

income was 2,50,000 and interest income was 50,000. If sales revenue is 20,00,000 and income

tax rate is applicable as per law, Calculate income tax liability.

Solution 3:

Regular Tax = 3,00,000 * 27.5% = 82,500

Minimum Tax (20,00,000 + 50,000) * .60% = 12,300

Regular Tax 82,500 is payable.

Understatement of export amount

Question 4:

ABC limited, a private limited company, claimed that the value of their total export during the

income year 2022-23 was Tk. 5,00,00,000. But through an investigation, it was revealed that the

actual amount of exports was Tk. 6,00,00,000. What will be the consequences?

Solution 4:

(6,00,00,000 – 5,00,00,000) * 50% = 50,00,000 Tk. Penalty.

You might also like

- Chapter 20 PartnershipsDocument10 pagesChapter 20 PartnershipsJessica Garcia100% (1)

- Ibs Lahad Datu 1 30/06/21Document79 pagesIbs Lahad Datu 1 30/06/21Yazid N AsiahNo ratings yet

- P.Y Question Paper Income Tax Delhi UniversityDocument5 pagesP.Y Question Paper Income Tax Delhi UniversityHarsh chetiwal50% (2)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Salary Slip Template V1.1Document1 pageSalary Slip Template V1.1JoyRoyNo ratings yet

- CT 1 B SolutionDocument2 pagesCT 1 B SolutionAnsary LabibNo ratings yet

- Class - Problems On The Assessment of NonresidentDocument2 pagesClass - Problems On The Assessment of Nonresidentsakibctg416No ratings yet

- Direct Tax-IDocument21 pagesDirect Tax-Ivivek rajakNo ratings yet

- tax qpDocument6 pagestax qpAashish kumarNo ratings yet

- Sem - IV Taxation - I Sample Paper-1Document5 pagesSem - IV Taxation - I Sample Paper-1yadavkari497No ratings yet

- Rana Fin.623Document1 pageRana Fin.623Adnan MurtazaNo ratings yet

- Tax Quiz 1Document3 pagesTax Quiz 1KimbabNo ratings yet

- IncomeTax-2Document6 pagesIncomeTax-2Aditya .cNo ratings yet

- Tax H Question 2021Document3 pagesTax H Question 2021Aporupa BarNo ratings yet

- Residential Status, Exempt Income & AMT - SolutionDocument5 pagesResidential Status, Exempt Income & AMT - SolutionGajender JhaNo ratings yet

- F Business Taxation 671079211Document4 pagesF Business Taxation 671079211anand0% (1)

- IT Module 4 Incidence of TaxDocument4 pagesIT Module 4 Incidence of Taxrahulking219No ratings yet

- Tutorial 2 - Trust (Q)Document3 pagesTutorial 2 - Trust (Q)Xin RuNo ratings yet

- 819-C-82051-Assignment 2 CH 2Document3 pages819-C-82051-Assignment 2 CH 2ramankantjain07No ratings yet

- Sri Bharathi Women'S Arts and Science College Kunnathur - ArniDocument3 pagesSri Bharathi Women'S Arts and Science College Kunnathur - ArniElumalaiNo ratings yet

- 1686044906DTS-2 Taxation CA InteranswerDocument11 pages1686044906DTS-2 Taxation CA InteranswerViraj SharmaNo ratings yet

- TAX PLANNING & COMPLIANCE - ND-2022 - Suggested - AnswersDocument9 pagesTAX PLANNING & COMPLIANCE - ND-2022 - Suggested - AnswersMohammad FaridNo ratings yet

- 37524E240 Reg. NoDocument7 pages37524E240 Reg. Noshejal naikNo ratings yet

- PTP SolutionsDocument5 pagesPTP SolutionsSanah SahniNo ratings yet

- Bcom TaxDocument6 pagesBcom TaxAditya .cNo ratings yet

- Bíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆDocument8 pagesBíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆSudhir SoudagarNo ratings yet

- Paper7 Set2Document7 pagesPaper7 Set2ashrant69No ratings yet

- Taxation ManagementDocument2 pagesTaxation ManagementAdnan MurtazaNo ratings yet

- ACC 203 Taxation in NepalDocument9 pagesACC 203 Taxation in NepalSophiya PrabinNo ratings yet

- Solution of CS PROFESSIONAL Income Tax Test by CA Vivek GabaDocument13 pagesSolution of CS PROFESSIONAL Income Tax Test by CA Vivek Gabaarohi guptaNo ratings yet

- Da 144Document4 pagesDa 144GeethaNo ratings yet

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- Paper7 Set2 SolutionDocument17 pagesPaper7 Set2 SolutionMayuri KolheNo ratings yet

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- Other TaxDocument3 pagesOther TaxAnkit Jung RayamajhiNo ratings yet

- Income Tax Law and PracticeDocument4 pagesIncome Tax Law and PracticeShruthi VijayanNo ratings yet

- Income Tax Divyastra CH 2 Scope of Total Income RDocument15 pagesIncome Tax Divyastra CH 2 Scope of Total Income Rjhansiaj06No ratings yet

- GST Model Paper 2Document3 pagesGST Model Paper 2Joshua StarkNo ratings yet

- Bsa Quiz 2.0 - Pure ProbsDocument4 pagesBsa Quiz 2.0 - Pure ProbsCyrss BaldemosNo ratings yet

- Tax Planning and Compliance: Page 1 of 5Document5 pagesTax Planning and Compliance: Page 1 of 5Srikrishna DharNo ratings yet

- TAXATION (Preps)Document5 pagesTAXATION (Preps)Navya GulatiNo ratings yet

- PEOBLEMS2Document3 pagesPEOBLEMS2Awesome AngelNo ratings yet

- FinalroundDocument35 pagesFinalroundJenny Keece RaquelNo ratings yet

- Nanadanam Key-1Document6 pagesNanadanam Key-1santha kumariNo ratings yet

- Basics (DT) Revision P Ques Jan 23Document10 pagesBasics (DT) Revision P Ques Jan 23Grave diggerNo ratings yet

- Income From House Property: Annual ValueDocument6 pagesIncome From House Property: Annual ValueSaddam KhanNo ratings yet

- Advanced Taxation (ACCA)Document6 pagesAdvanced Taxation (ACCA)sarthaksenNo ratings yet

- Solution CA Inter TaxationDocument17 pagesSolution CA Inter TaxationBhola Shankar PrasadNo ratings yet

- Mega Test PDFDocument73 pagesMega Test PDFFalak HanifNo ratings yet

- Mohit Agarwal QP Tax LawsDocument17 pagesMohit Agarwal QP Tax LawsManisha DasNo ratings yet

- Paper - 4: Taxation Section A: Income TaxDocument24 pagesPaper - 4: Taxation Section A: Income TaxChhaya JajuNo ratings yet

- MT Test Review-Taxation 1-Win 2024Document4 pagesMT Test Review-Taxation 1-Win 2024Mariola AlkuNo ratings yet

- Adobe Scan 09 Nov 2023Document11 pagesAdobe Scan 09 Nov 2023Sanskruti BarikNo ratings yet

- BAM031 - P2 - Q2 - Introduction To Gross Income, Inclusions and Exclusions - AnswersDocument8 pagesBAM031 - P2 - Q2 - Introduction To Gross Income, Inclusions and Exclusions - AnswersShane QuintoNo ratings yet

- ICAEW - Tax - Mini Test 3 - STDDocument6 pagesICAEW - Tax - Mini Test 3 - STDlinhdinhphuong02No ratings yet

- CA Inter Mighty 50Document47 pagesCA Inter Mighty 50INTER SMARTIANSNo ratings yet

- DeductionsDocument13 pagesDeductionsShivaram ShivaramNo ratings yet

- S20 TX SGP Sample AnswersDocument7 pagesS20 TX SGP Sample AnswersKAH MENG KAMNo ratings yet

- MCQ OF CHAPTER 12 A & B - Payment of TaxDocument11 pagesMCQ OF CHAPTER 12 A & B - Payment of TaxAman AgarwalNo ratings yet

- Taxation Assignment No 1Document8 pagesTaxation Assignment No 1Ha MimNo ratings yet

- It 1Document18 pagesIt 1naheensyeda20No ratings yet

- Income Tax 1 - 20223Document3 pagesIncome Tax 1 - 20223nimalpes21No ratings yet

- Quiz 1 - StrataxDocument3 pagesQuiz 1 - Strataxspongebob SquarepantsNo ratings yet

- Corporate Governance CodeDocument15 pagesCorporate Governance CodeAnsary LabibNo ratings yet

- Competition Act, 2012Document4 pagesCompetition Act, 2012Ansary LabibNo ratings yet

- CHP 5Document2 pagesCHP 5Ansary LabibNo ratings yet

- CT 1 B SolutionDocument2 pagesCT 1 B SolutionAnsary LabibNo ratings yet

- DO IT Salary Income With SolutionDocument3 pagesDO IT Salary Income With SolutionAnsary LabibNo ratings yet

- New Zealand LastDocument8 pagesNew Zealand LastAnsary LabibNo ratings yet

- Macroeconomics Term PaperDocument35 pagesMacroeconomics Term PaperAnsary LabibNo ratings yet

- Sustainability and Environmental ImpactDocument1 pageSustainability and Environmental ImpactAnsary LabibNo ratings yet

- Pelzer Company Reconciled Its Bank and Book Statement Balances ofDocument2 pagesPelzer Company Reconciled Its Bank and Book Statement Balances ofAmit PandeyNo ratings yet

- Wings Infonet Private Limited: # 1002, Paigah Plaza, Basheerbagh Hyderabad - 500 063 2021Document1 pageWings Infonet Private Limited: # 1002, Paigah Plaza, Basheerbagh Hyderabad - 500 063 2021Venkatanarayana BolluNo ratings yet

- Earnest Money Receipt AgreementDocument3 pagesEarnest Money Receipt AgreementwilliesyNo ratings yet

- Bill For Current MonthDocument3 pagesBill For Current Monthramkumartanwar0% (1)

- Sbi StatementDocument4 pagesSbi Statement321910303040 gitamNo ratings yet

- Servlet ControllerDocument1 pageServlet Controllermukesh sahuNo ratings yet

- Security Bank Credit Card Supplementary FormDocument3 pagesSecurity Bank Credit Card Supplementary FormRBCD INDUSTRIAL SUPPLYNo ratings yet

- EmiratesNBD Schedule of ChargesDocument3 pagesEmiratesNBD Schedule of ChargesbunklyNo ratings yet

- Shopee Voucher 2Document2 pagesShopee Voucher 2mariaNo ratings yet

- Nego - Bar 2007-2013Document9 pagesNego - Bar 2007-2013yukibambam_28No ratings yet

- Exam For Business TaxDocument3 pagesExam For Business TaxJenyll MabborangNo ratings yet

- U4.3 Optional Standard Deduction (Presentation Slides)Document4 pagesU4.3 Optional Standard Deduction (Presentation Slides)Marc Geoffrey HababNo ratings yet

- Disbursement Voucher - Check #101-200Document91 pagesDisbursement Voucher - Check #101-200Jessa Mariz Lecias CalimotNo ratings yet

- 82276BIR Form 1702-EXDocument7 pages82276BIR Form 1702-EXJessicaWeinNo ratings yet

- Taxation Review - General PrinciplesDocument6 pagesTaxation Review - General PrinciplesKenneth Bryan Tegerero Tegio0% (1)

- 6 April 2023Document7 pages6 April 2023mapondaglodiNo ratings yet

- Application For Direct Debit Payment Authorisation FormDocument2 pagesApplication For Direct Debit Payment Authorisation Formmarmud100% (1)

- 9 - Special JournalDocument30 pages9 - Special JournalYallyNo ratings yet

- How To Become A Tax PreparerDocument3 pagesHow To Become A Tax Preparerrebelstarr001No ratings yet

- Income Tax - 2018 - TabagDocument34 pagesIncome Tax - 2018 - TabagLeojelaineIgcoyNo ratings yet

- Receiving Payments and Making DepositsDocument28 pagesReceiving Payments and Making DepositsElla MaeNo ratings yet

- Income Tax Course Manual (2021 T1) PDFDocument138 pagesIncome Tax Course Manual (2021 T1) PDFMrDorakonNo ratings yet

- University of Tokyo GUC IntroDocument2 pagesUniversity of Tokyo GUC Introabigale5.66No ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument5 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVishal JainNo ratings yet

- Cashless Economy in India UPSC NotesDocument14 pagesCashless Economy in India UPSC NotesIshan KaushikNo ratings yet

- Roic Current Ratio Operating Cycle: Unilever PLC GSK PLC Unilever PLC GSK PLC Unilever PLC GSK PLCDocument4 pagesRoic Current Ratio Operating Cycle: Unilever PLC GSK PLC Unilever PLC GSK PLC Unilever PLC GSK PLCMd. Real MiahNo ratings yet

- Tax Law AssgimentDocument8 pagesTax Law AssgimentGopan NishantNo ratings yet