Professional Documents

Culture Documents

Mary Doe - (EE & ER) - PDOC-Date Paid-2022-02-25

Mary Doe - (EE & ER) - PDOC-Date Paid-2022-02-25

Uploaded by

rahul_ransure0 ratings0% found this document useful (0 votes)

5 views1 pageMary Doe was paid $230 on February 25, 2022 by her employer Patel. $12.90 was deducted from her pay for CPP and EI contributions, leaving her with a net pay of $217.10. Her year-to-date pensionable earnings and insurable earnings were recorded as $230. Her employer is required to remit $27.25 to cover CPP and EI contributions for Mary Doe.

Original Description:

Original Title

Mary Doe-(EE & ER)-PDOC-Date paid-2022-02-25

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMary Doe was paid $230 on February 25, 2022 by her employer Patel. $12.90 was deducted from her pay for CPP and EI contributions, leaving her with a net pay of $217.10. Her year-to-date pensionable earnings and insurable earnings were recorded as $230. Her employer is required to remit $27.25 to cover CPP and EI contributions for Mary Doe.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5 views1 pageMary Doe - (EE & ER) - PDOC-Date Paid-2022-02-25

Mary Doe - (EE & ER) - PDOC-Date Paid-2022-02-25

Uploaded by

rahul_ransureMary Doe was paid $230 on February 25, 2022 by her employer Patel. $12.90 was deducted from her pay for CPP and EI contributions, leaving her with a net pay of $217.10. Her year-to-date pensionable earnings and insurable earnings were recorded as $230. Her employer is required to remit $27.25 to cover CPP and EI contributions for Mary Doe.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Mary Doe-(EE & ER)-PDOC-Date paid-2022-02-25.

Payroll Deductions Online Calculator

Result

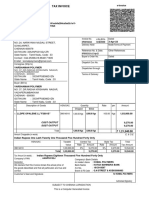

Employee's name: Mary Doe

Employer's name: Patel

Pay period frequency: Weekly (52 pay periods a year)

Date the employee is paid: 2022-02-25 (YYYY-MM-DD)

Province of employment: Ontario

Federal amount from TD1: 14,398.00

Provincial amount from TD1: 11,141.00

Salary or wages income 230.00

Total cash income 230.00

Federal tax deduction 0.00

Provincial tax deduction 0.00

Total tax deductions on income 0.00

CPP deductions 9.27

EI deductions 3.63

Total deductions 12.90

Net amount 217.10

Taxable income for the pay period 230.00

Pensionable earnings for the pay period 230.00

Insurable earnings for the pay period 230.00

Year-to-Date Amounts Inputted Value Total for this Record

Pensionable earnings 0.00 230.00

CPP contributions 0.00 9.27

Insurable earnings 0.00 230.00

EI premiums 0.00 3.63

Employer Remittance Summary

Employee's name: Mary Doe

Date the employee is paid: 2022-02-25 (YYYY-MM-DD)

Canada Pension Plan (CPP)

Employee CPP contributions 9.27

Employer CPP contributions 9.27

Subtotal of Canada Pension Plan (CPP) 18.54

Employment Insurance (EI)

Employee EI contributions 3.63

Employer EI contributions 5.08

Subtotal of Employment Insurance (EI) 8.71

Tax deductions 0.00

For this calculation, remit this amount 27.25

Please note the employee and employer Canada Pension Plan contribution maximum for the year is $3,499.80.

The printed calculations created by PDOC are not intended to be used as a statement of earnings. Please contact

your employment standards representative for all of the information legally required on a statement of earnings specific

to your province or territory.

Created by the Payroll Deductions Online Calculator Page 1 of 1 Saved on 2024-02-20

You might also like

- Plain Paper PayslipDocument4 pagesPlain Paper PayslipmisprumbokodoNo ratings yet

- 26 USC 6033a3Document2 pages26 USC 6033a3helpinghandoutreach100% (4)

- Health Insurance ParentsDocument1 pageHealth Insurance ParentsReema Khati67% (3)

- New Tax Return Transcript 2222Document7 pagesNew Tax Return Transcript 2222James Franklin67% (3)

- Pay Slip July 2020...Document2 pagesPay Slip July 2020...laxman lucky100% (2)

- Tax Accounting Acc 3400 Chapter ExamsDocument188 pagesTax Accounting Acc 3400 Chapter Examshmgheidi100% (2)

- Mirjana Myra Ribich (EE) PDOC Date Paid 2023-08-11Document1 pageMirjana Myra Ribich (EE) PDOC Date Paid 2023-08-11mirjana ribichNo ratings yet

- A - (EE & ER) - PDOC-Date Paid-2022-08-05Document1 pageA - (EE & ER) - PDOC-Date Paid-2022-08-05armanf2020zNo ratings yet

- Employee Name - (EE & ER) - PDOC-Date Paid-2023-02-26Document1 pageEmployee Name - (EE & ER) - PDOC-Date Paid-2023-02-26William JoeNo ratings yet

- Employee Name - (EE & ER) - PDOC-Date Paid-2024-03-28Document2 pagesEmployee Name - (EE & ER) - PDOC-Date Paid-2024-03-28RileyNo ratings yet

- Candy Simpson - (EE & ER) - PDOC-Date Paid-2020-12-12 (WEEK 2)Document1 pageCandy Simpson - (EE & ER) - PDOC-Date Paid-2020-12-12 (WEEK 2)mcocampo2No ratings yet

- Iulian Ababei 49 Woodfield Avenue Wembley Ha0 3Np: Pay Reconciliation: Unit Rate AmountDocument1 pageIulian Ababei 49 Woodfield Avenue Wembley Ha0 3Np: Pay Reconciliation: Unit Rate AmountAbabei IulianNo ratings yet

- PayslipDocument2 pagesPayslipjzeb.gonzales18No ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsKlevin LloydNo ratings yet

- Ifive Inc.: 8/F Zeta Tower Robinsons Bridgetowne C5 Road, Ugong Norte, 1110 Quezon CityDocument1 pageIfive Inc.: 8/F Zeta Tower Robinsons Bridgetowne C5 Road, Ugong Norte, 1110 Quezon CityReymar BanaagNo ratings yet

- Invitation LetterDocument32 pagesInvitation LetterPRASENJIT DENo ratings yet

- PayslipDocument1 pagePayslipSuyash RaulNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVanessa SarraNo ratings yet

- PAYSLIP FOR THE MONTH OF September, 2023: Toyota Kirloskar Motor PVT LTDDocument2 pagesPAYSLIP FOR THE MONTH OF September, 2023: Toyota Kirloskar Motor PVT LTDevilghostevilghost666No ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Prudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)Document2 pagesPrudential Life Assurance Page 1 of 2 (Date Printed: 09-Oct-2019)KomalaNo ratings yet

- India JUN-2020 ...Document1 pageIndia JUN-2020 ...laxman luckyNo ratings yet

- Computation of Total Income: Zenit - A KDK Software Software ProductDocument2 pagesComputation of Total Income: Zenit - A KDK Software Software Productkunjal mistryNo ratings yet

- XR 80Document1 pageXR 80ncanellosNo ratings yet

- Aun NoaDocument4 pagesAun Noatkxb2zyztsNo ratings yet

- Draft Computation SheetDocument3 pagesDraft Computation Sheettax advisorNo ratings yet

- March Pay SlipDocument1 pageMarch Pay SlipBale MishraNo ratings yet

- Payslip Tax 1 2024Document2 pagesPayslip Tax 1 2024n17mahey09No ratings yet

- Payslip Tax 12 2023-1Document2 pagesPayslip Tax 12 2023-1n17mahey09No ratings yet

- Declaration 3520219250593Document4 pagesDeclaration 3520219250593fiaz AhmadNo ratings yet

- Loblaw Companies Limited 1 President's Choice Circle Brampton, ON L6Y 5S5 Allyssa Langford 1845 Cadillac Windsor, ON N8W 3X8 CanadaDocument1 pageLoblaw Companies Limited 1 President's Choice Circle Brampton, ON L6Y 5S5 Allyssa Langford 1845 Cadillac Windsor, ON N8W 3X8 CanadaAllyssa LangfordNo ratings yet

- Aluwani Matsego - PayslipDocument1 pageAluwani Matsego - PayslipAluwani MatsegoNo ratings yet

- Payslips 4513Document1 pagePayslips 4513Vanessa SantosNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsVincent FerrerNo ratings yet

- Payslip YemplateDocument2 pagesPayslip YemplateCristine GonzalesNo ratings yet

- Payslip For The Month of June, 2023: Toyota Kirloskar Motor PVT LTDDocument2 pagesPayslip For The Month of June, 2023: Toyota Kirloskar Motor PVT LTDevilghostevilghost666No ratings yet

- I Mumd44312Document1 pageI Mumd44312dbind1999No ratings yet

- 479455712-India-March 2024Document1 page479455712-India-March 2024navalsingh64555No ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsArmina Aguilar BaisNo ratings yet

- SalaryDocument1 pageSalaryBale MishraNo ratings yet

- PayslipsDocument6 pagesPayslipsbskapoor68No ratings yet

- PDFDocument3 pagesPDFdelmundomarkanthony15No ratings yet

- Payslip 102703 202303 PDFDocument1 pagePayslip 102703 202303 PDFAnagha AnuNo ratings yet

- Jul 2022Document2 pagesJul 2022Nikhil KumarNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsZarah BernabeNo ratings yet

- Encore Receivable Management, Inc. Philippine BranchDocument2 pagesEncore Receivable Management, Inc. Philippine BranchSamantha Joyce Valera TaezaNo ratings yet

- 2 - Australian Taxation OfficeDocument2 pages2 - Australian Taxation Officelakshmi.bodduluruNo ratings yet

- Total Earnings Total Deductions: Net Pay (RS.) 41,000.00Document1 pageTotal Earnings Total Deductions: Net Pay (RS.) 41,000.00Diwakar ChaturvediNo ratings yet

- JuneDocument1 pageJunenishankithkumarNo ratings yet

- Heads of Income Monthly Actual YTD Projected Total: EIT Services India PVT LTD Income Tax Computation StatementDocument2 pagesHeads of Income Monthly Actual YTD Projected Total: EIT Services India PVT LTD Income Tax Computation Statementsunit pattanayakNo ratings yet

- Detailed Computation AUPPA6498M 1632537 Old Regime 20230731220306Document3 pagesDetailed Computation AUPPA6498M 1632537 Old Regime 20230731220306Acharya SubhashishNo ratings yet

- Sutton Hill LTD - Employee Payslip For Oct-2023 For S GondalDocument1 pageSutton Hill LTD - Employee Payslip For Oct-2023 For S Gondalshahzaib.gondal1292No ratings yet

- April Pay SlipDocument1 pageApril Pay SlipBale MishraNo ratings yet

- Teleperformance Global Services Private Limited: Full and Final Settlement - July 2022Document3 pagesTeleperformance Global Services Private Limited: Full and Final Settlement - July 2022goal.iit09No ratings yet

- Pay Details: Taxable Gross 248.22Document1 pagePay Details: Taxable Gross 248.22ArtemisNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- BIR - Witholding Tax Calculator-24000Document2 pagesBIR - Witholding Tax Calculator-24000infiniteserv.ericaNo ratings yet

- Jun 2021 NikDocument2 pagesJun 2021 NikNikhil KumarNo ratings yet

- PDF&Rendition 1Document2 pagesPDF&Rendition 1vijaybhaskar damireddyNo ratings yet

- Lastthreemonth PayslipDocument3 pagesLastthreemonth Payslipgavin foxwellNo ratings yet

- Payroll Details: Statement of Earnings and DeductionsDocument2 pagesPayroll Details: Statement of Earnings and Deductionssaleh alamriNo ratings yet

- Payslip India June - 2023Document2 pagesPayslip India June - 2023RAJESH DNo ratings yet

- DownloadDocument1 pageDownloadJitaram SamalNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Guide To Taxation in The PhilippinesDocument5 pagesA Guide To Taxation in The PhilippinesNathaniel MartinezNo ratings yet

- 181320250 (2)Document1 page181320250 (2)Maharshi DattaNo ratings yet

- Bill RS 4-2Document2 pagesBill RS 4-2JBFC UPBNo ratings yet

- Estate CPA Report SampleDocument5 pagesEstate CPA Report SampleNeptali MarotoNo ratings yet

- DE1MP21221553301623047715Document1 pageDE1MP21221553301623047715Abhishek BandalNo ratings yet

- TAX 2202E TBS01 03.solutionDocument3 pagesTAX 2202E TBS01 03.solutionZhitong LuNo ratings yet

- Salary Income Tax Calculation in EthiopiaDocument4 pagesSalary Income Tax Calculation in EthiopiaMulatu Teshome90% (42)

- Solved Adrian Was Awarded An Academic Scholarship To State University For PDFDocument1 pageSolved Adrian Was Awarded An Academic Scholarship To State University For PDFAnbu jaromiaNo ratings yet

- Tax InvoiceDocument2 pagesTax InvoiceTechnetNo ratings yet

- Introduction of GSTDocument27 pagesIntroduction of GSTaksh40% (5)

- Declaration of Tax Representative: TB Refund LTD., Ida Business & Technology Park, Ring Road Kilkenny, IrelandDocument9 pagesDeclaration of Tax Representative: TB Refund LTD., Ida Business & Technology Park, Ring Road Kilkenny, Irelandfacundo59No ratings yet

- 2021 22 SARS ELogbookDocument17 pages2021 22 SARS ELogbookBlack Snow ServicesNo ratings yet

- No Chapter Name Page No. Goods and Service Tax (75 Marks) : Indirect Taxes by CA Kedar JunnarkarDocument4 pagesNo Chapter Name Page No. Goods and Service Tax (75 Marks) : Indirect Taxes by CA Kedar JunnarkarMala M PrasannaNo ratings yet

- IT-1 Unit-3 Part-B NotesDocument6 pagesIT-1 Unit-3 Part-B NotesTrial 001No ratings yet

- Private Party Vehi: Cle Use Tax Chart For 2022Document1 pagePrivate Party Vehi: Cle Use Tax Chart For 2022StojkiNo ratings yet

- Corporation TRAIN and CREATE LawDocument8 pagesCorporation TRAIN and CREATE LawdgdeguzmanNo ratings yet

- JuneDocument1 pageJuneRmillionsque FinserveNo ratings yet

- Pay SlipDocument1 pagePay Slipdanish_83No ratings yet

- MattressDocument1 pageMattressAnoy das MahapatraNo ratings yet

- Jignesh RathodDocument1 pageJignesh RathodRonak VNo ratings yet

- Quiz 1Document2 pagesQuiz 1Nickie RosberoNo ratings yet

- Number of Instalments and Payment Mode Received Date Coll. Br. Serv. Br. Premium/ Additional Premium Amount Service Tax / GST Amount ReceivedDocument2 pagesNumber of Instalments and Payment Mode Received Date Coll. Br. Serv. Br. Premium/ Additional Premium Amount Service Tax / GST Amount ReceivedKrishna KSNo ratings yet

- 1444 09 16 - 705 FileDocument6 pages1444 09 16 - 705 Fileعلي الخضيرNo ratings yet

- GST Law Communique Dec 2023 1704557082Document5 pagesGST Law Communique Dec 2023 1704557082nirmalseervi.mkdNo ratings yet

- Rajesh Bora Itr PLBS 2022Document5 pagesRajesh Bora Itr PLBS 2022ABDUL KHALIKNo ratings yet

- 968 Glass & Aluminum Co.Document10 pages968 Glass & Aluminum Co.Ben Carlo RamosNo ratings yet