Professional Documents

Culture Documents

EmployingaBroker Brochure

EmployingaBroker Brochure

Uploaded by

Danielle ThompsonCopyright:

Available Formats

You might also like

- Solnik & McLeavey - Global Investments 6th EdDocument8 pagesSolnik & McLeavey - Global Investments 6th Edhotmail13No ratings yet

- 9.2 Assignment - Allowable DeductionsDocument5 pages9.2 Assignment - Allowable Deductionssam imperialNo ratings yet

- Chap 10Document5 pagesChap 10Shiela DimaculanganNo ratings yet

- Hull OFOD10e MultipleChoice Questions and Answers Ch17Document7 pagesHull OFOD10e MultipleChoice Questions and Answers Ch17Kevin Molly KamrathNo ratings yet

- Quiz Bee Questions (Semis and Finals)Document4 pagesQuiz Bee Questions (Semis and Finals)John Vincent PardillaNo ratings yet

- 5Document3 pages5Dan Shadrach DapegNo ratings yet

- Investment Accounts: Basic ConceptsDocument13 pagesInvestment Accounts: Basic ConceptsDebasis KarNo ratings yet

- AC6101 Lecture 3 - Capital Structure (M&M) - Xid-2956908 - 1Document28 pagesAC6101 Lecture 3 - Capital Structure (M&M) - Xid-2956908 - 1Kelsey GaoNo ratings yet

- Group 6 Integrative AssessmentDocument4 pagesGroup 6 Integrative AssessmentElhaine MadulaNo ratings yet

- Group 6 Integrative AssessmentDocument4 pagesGroup 6 Integrative AssessmentElhaine MadulaNo ratings yet

- Week 2Document40 pagesWeek 2Ramzy ChahbounNo ratings yet

- Tutorial 11 - SolutionDocument11 pagesTutorial 11 - SolutionPump AestheticsNo ratings yet

- IRA No. 2 Answer KeyDocument2 pagesIRA No. 2 Answer KeyProlen AcantoNo ratings yet

- Lec 04Document14 pagesLec 04Ryan GroffNo ratings yet

- AA Chap 9Document42 pagesAA Chap 9Thu NguyenNo ratings yet

- Fixed Assets 1 - Kls AP 2 PJKDocument25 pagesFixed Assets 1 - Kls AP 2 PJKMarco LawinataNo ratings yet

- Chapter 03 - Securities MarketsDocument8 pagesChapter 03 - Securities MarketsA SNo ratings yet

- A Guide To Our Commercial Mortgage Fees and Charges - YBS2095COMMDocument3 pagesA Guide To Our Commercial Mortgage Fees and Charges - YBS2095COMMAncuţa AlupoaeiNo ratings yet

- Personalized Mortgage Report-0a2cc6-2Document5 pagesPersonalized Mortgage Report-0a2cc6-2Papiya DasNo ratings yet

- Answers Part2Document1 pageAnswers Part2Jamaica DavidNo ratings yet

- Note Payable Irrevocably Designated As at Fair Value Through Profit or LossDocument4 pagesNote Payable Irrevocably Designated As at Fair Value Through Profit or Lossnot funny didn't laughNo ratings yet

- Myka Eleonor Estole Quiz 5Document8 pagesMyka Eleonor Estole Quiz 5Julienne UntalascoNo ratings yet

- Tugas PPE 1Document12 pagesTugas PPE 1Bertha Liona0% (1)

- 04AFAR QuicknotesDocument23 pages04AFAR Quicknoteshelican.wenajeandbsa1993No ratings yet

- ch15 Non-Current LiabilitiesDocument66 pagesch15 Non-Current LiabilitiesDesain KPPN KPHNo ratings yet

- PGBPDocument3 pagesPGBPJimmy ShergillNo ratings yet

- Multi A SDN BHDDocument15 pagesMulti A SDN BHDMUHAMMAD AZIB ZAKHWAN BIN ZAKARIA (BG)No ratings yet

- 11 Accountancy t2 Sp01Document19 pages11 Accountancy t2 Sp01Lakshy BishtNo ratings yet

- Solution: - A) Gross Profit Net Sales-Cost of Sales 3,000,000-2,000,000Document4 pagesSolution: - A) Gross Profit Net Sales-Cost of Sales 3,000,000-2,000,000Eyasu DestaNo ratings yet

- Cdo, Cds & Irs: By: Fahad Siddiqui Meenakshi Chettiar Priyanka NarvekarDocument13 pagesCdo, Cds & Irs: By: Fahad Siddiqui Meenakshi Chettiar Priyanka NarvekarrakshayaNo ratings yet

- Kuis AkuntansiDocument3 pagesKuis AkuntansiNurul Khalishah AzzahraNo ratings yet

- CH 11Document51 pagesCH 11Quỳnh Anh Bùi ThịNo ratings yet

- Eun8e CH 005 PPTDocument47 pagesEun8e CH 005 PPTannNo ratings yet

- Case Study 15112019a TOFLDocument5 pagesCase Study 15112019a TOFLSunny SouravNo ratings yet

- Chapter 6 - Notes ReceivableDocument5 pagesChapter 6 - Notes ReceivableTurks100% (1)

- Time Value of MoneyDocument78 pagesTime Value of MoneyKALAI ARASANNo ratings yet

- Problems Problem 10.1: © John Wiley and Sons Australia, LTD 2010 10.21Document5 pagesProblems Problem 10.1: © John Wiley and Sons Australia, LTD 2010 10.21alfaressNo ratings yet

- Chapter Six 2024Document15 pagesChapter Six 2024Romario KhaledNo ratings yet

- Bact 310topic Four Accounting For Long Term Investments-2Document22 pagesBact 310topic Four Accounting For Long Term Investments-2Pa HabbakukNo ratings yet

- 8 13Document5 pages8 13Konrad Lorenz Madriaga UychocoNo ratings yet

- Loan Application FormDocument4 pagesLoan Application Formdiprodserv nigltdNo ratings yet

- MNGT 604 Day1 Problem Set SolutionsDocument8 pagesMNGT 604 Day1 Problem Set Solutionsharini muthuNo ratings yet

- Southampton Investment BrochureDocument7 pagesSouthampton Investment BrochureMark I'AnsonNo ratings yet

- NUDJPIA FAR AND AFAR SOLUTIONS - ReceivablesDocument6 pagesNUDJPIA FAR AND AFAR SOLUTIONS - ReceivablesKyla Artuz Dela CruzNo ratings yet

- CB ProblemsDocument8 pagesCB ProblemsabhinaymarupakulaNo ratings yet

- TDS Ready Reckoner (1) 11Document1 pageTDS Ready Reckoner (1) 11senthilkumar_kskNo ratings yet

- Problem 5 and 6Document4 pagesProblem 5 and 6Lalaina EnriquezNo ratings yet

- Loan AgentDocument4 pagesLoan AgentAMITH GOWDA ENo ratings yet

- Jan 2016 p3Document9 pagesJan 2016 p3Veronica BaileyNo ratings yet

- ORQUIA AssignmentDocument4 pagesORQUIA AssignmentClint RoblesNo ratings yet

- Module 2 - Notes Payable & Debt Restructuring - Rev2Document44 pagesModule 2 - Notes Payable & Debt Restructuring - Rev2Bea Angelle CamongayNo ratings yet

- Tugas KB Aklan TM 13-Kelompok 1Document10 pagesTugas KB Aklan TM 13-Kelompok 1AdnanNo ratings yet

- Union Bank LTD.: Head Office, DhakaDocument7 pagesUnion Bank LTD.: Head Office, DhakaMd.Kefayet Ullah Chowdhury 181-33-669No ratings yet

- Borrowing Cost SWDocument12 pagesBorrowing Cost SWMarian Augelio PolancoNo ratings yet

- Part 2 - Leases (Accounting by Lessors)Document31 pagesPart 2 - Leases (Accounting by Lessors)Poru SenpiiNo ratings yet

- (B) Provide For Foreclosure of Outstanding Loan/debt Amounts. Only Unsecured Loans Are RelevantDocument6 pages(B) Provide For Foreclosure of Outstanding Loan/debt Amounts. Only Unsecured Loans Are RelevantAmit GuptaNo ratings yet

- Exercise 9.1 1Document10 pagesExercise 9.1 1NavinNo ratings yet

- Liabilities Are Classified On The Balance Sheet As Either:: Chapter 10 SummaryDocument6 pagesLiabilities Are Classified On The Balance Sheet As Either:: Chapter 10 SummaryAreeba QureshiNo ratings yet

- Pascal Mosa Ananda W - Latihan KP Financial Accounting 2Document14 pagesPascal Mosa Ananda W - Latihan KP Financial Accounting 2Brenda FreitasNo ratings yet

- Tariff_Guide_2023Document1 pageTariff_Guide_2023michealoketcho29No ratings yet

- Week 6 NotesDocument7 pagesWeek 6 NotescalebNo ratings yet

- F6ROM - 2012 - Dec - Q ACCADocument11 pagesF6ROM - 2012 - Dec - Q ACCAgeorgetacaprarescuNo ratings yet

- Centre Whitepaper PDFDocument24 pagesCentre Whitepaper PDFwilliamhancharekNo ratings yet

- ECON 352 Problem Set 3 (With Key)Document18 pagesECON 352 Problem Set 3 (With Key)Ceylin SenerNo ratings yet

- The Implications of The IMF'Programme in ZambiaDocument83 pagesThe Implications of The IMF'Programme in ZambiahmvungeNo ratings yet

- Materi Accounting AdvancedDocument12 pagesMateri Accounting AdvancedRianty AstaniaNo ratings yet

- Analysis of Forex MarketDocument78 pagesAnalysis of Forex MarketAmit MishraNo ratings yet

- Chapter 5 IntAcct Sum21-DropboxDocument68 pagesChapter 5 IntAcct Sum21-DropboxPhuong Anh NguyenNo ratings yet

- Apan's Policy Trap: Dollars, Deflation, and The Crisis of Japanese FinanceDocument305 pagesApan's Policy Trap: Dollars, Deflation, and The Crisis of Japanese FinanceooNo ratings yet

- Chapter 13 Evaluation of Countries For Operations2Document29 pagesChapter 13 Evaluation of Countries For Operations2Raphael hernandezNo ratings yet

- Atlas ClubDocument29 pagesAtlas ClubConsumatore InformatoNo ratings yet

- Advanced Financial Accounting 3 (Acyava3) Derivatives & HedgingDocument4 pagesAdvanced Financial Accounting 3 (Acyava3) Derivatives & HedgingalyssaNo ratings yet

- CH 12Document19 pagesCH 12Ahmed Al EkamNo ratings yet

- Afar 2 Module CH 11 12Document16 pagesAfar 2 Module CH 11 12Joyce Anne MananquilNo ratings yet

- Derivatives The Tools That Changed FinanceDocument202 pagesDerivatives The Tools That Changed FinanceShakeeb Ashai100% (1)

- Full Uganda Budget Speech For Financial Year 2022/2023Document51 pagesFull Uganda Budget Speech For Financial Year 2022/2023The Campus TimesNo ratings yet

- 14.0 PP 99 113 Industrialization and The Rise of RMGDocument15 pages14.0 PP 99 113 Industrialization and The Rise of RMGAfifa Afrin UrmiNo ratings yet

- Administration SAPDocument98 pagesAdministration SAPAbbie Sajonia DollenoNo ratings yet

- Specialized Strategies Adopting Pricing To Accommodate Common ChallengesDocument3 pagesSpecialized Strategies Adopting Pricing To Accommodate Common ChallengesJoyce CastroNo ratings yet

- SIB 675 - Assignment 2upDocument6 pagesSIB 675 - Assignment 2upMelissa TothNo ratings yet

- Notes and Points On IMFDocument135 pagesNotes and Points On IMFUnni AmpadiNo ratings yet

- Forward Contract Form - MD50 - V.1.1Document11 pagesForward Contract Form - MD50 - V.1.1Sandeep GantaNo ratings yet

- 6 Hong Kong, China: Barbara ShiuDocument44 pages6 Hong Kong, China: Barbara ShiuowltbigNo ratings yet

- IAS 21 Foreign CurrencyDocument17 pagesIAS 21 Foreign CurrencyTanvir HossainNo ratings yet

- BBA 6 Sem Fin PDFDocument8 pagesBBA 6 Sem Fin PDFvidyashree patilNo ratings yet

- Economics HLSL P2 Markscheme May 2014Document18 pagesEconomics HLSL P2 Markscheme May 2014tyrramNo ratings yet

- Economics Honours SyllabusDocument25 pagesEconomics Honours SyllabusRia ChowdhuryNo ratings yet

- ME Class 11-12Document25 pagesME Class 11-12Dixith GandheNo ratings yet

- ABC - Final Exam: RequiredDocument17 pagesABC - Final Exam: RequiredCristel TannaganNo ratings yet

EmployingaBroker Brochure

EmployingaBroker Brochure

Uploaded by

Danielle ThompsonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

EmployingaBroker Brochure

EmployingaBroker Brochure

Uploaded by

Danielle ThompsonCopyright:

Available Formats

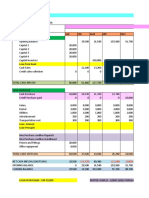

Employing a Broker

Unique point of contact reviewing all

offers vs applying yourself to various

banks, losing time and money

Cheaper rates due to the volume of

Why? business vs accepting the rate the

local bank offers

Higher mortgage amount not

approaching the wrong bank to get a

smaller sum

For which benefits?

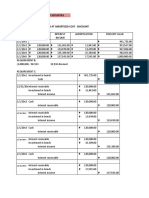

Income Financial committments Debt to Income (DTI)

Mrs. €3,000 Mortgage €900

1.250 / 6.000

Mr. €3,000 Car €300

~ 20%

Total €6,000 Total €1,250

Bank A: uses 30% DTI Bank B: uses 35% DTI Bank C: uses 40% DTI

€6,000 x 30%=€1,800 €6,000 x 35%=€2,100 €6,000 x 40%=€2,400

- €1,250 fin.comm.=€500 - €1,250 fin.comm.=€ 850 - €1,250 fin.comm.=€1,150

Max mortgage (20years): Max mortgage (20years): Max mortgage (20years):

€90,000 €140,000 €190,000

By employing a professional, the client could borrow €100.000 more!

Mortgages taken out in currencies other than the currency in which you earn are considered Foreign Currency Mortgages. Changes in the exchange rate may therefore increase the

equivalent of your debt. Under the Mortgage Law 5/2019 banks in Spain have introduced mechanisms to protect consumers from exchange-rate risk. For more information, please

speak to your broker. Mortgage Direct, S.L. is a company registered in the Registro de Intermediarios de Crédito Inmobiliario del BdE with the no D108.

(+34) 963 156 011 info@mortgagedirectsl.com www.mortgagedirectsl.com

You might also like

- Solnik & McLeavey - Global Investments 6th EdDocument8 pagesSolnik & McLeavey - Global Investments 6th Edhotmail13No ratings yet

- 9.2 Assignment - Allowable DeductionsDocument5 pages9.2 Assignment - Allowable Deductionssam imperialNo ratings yet

- Chap 10Document5 pagesChap 10Shiela DimaculanganNo ratings yet

- Hull OFOD10e MultipleChoice Questions and Answers Ch17Document7 pagesHull OFOD10e MultipleChoice Questions and Answers Ch17Kevin Molly KamrathNo ratings yet

- Quiz Bee Questions (Semis and Finals)Document4 pagesQuiz Bee Questions (Semis and Finals)John Vincent PardillaNo ratings yet

- 5Document3 pages5Dan Shadrach DapegNo ratings yet

- Investment Accounts: Basic ConceptsDocument13 pagesInvestment Accounts: Basic ConceptsDebasis KarNo ratings yet

- AC6101 Lecture 3 - Capital Structure (M&M) - Xid-2956908 - 1Document28 pagesAC6101 Lecture 3 - Capital Structure (M&M) - Xid-2956908 - 1Kelsey GaoNo ratings yet

- Group 6 Integrative AssessmentDocument4 pagesGroup 6 Integrative AssessmentElhaine MadulaNo ratings yet

- Group 6 Integrative AssessmentDocument4 pagesGroup 6 Integrative AssessmentElhaine MadulaNo ratings yet

- Week 2Document40 pagesWeek 2Ramzy ChahbounNo ratings yet

- Tutorial 11 - SolutionDocument11 pagesTutorial 11 - SolutionPump AestheticsNo ratings yet

- IRA No. 2 Answer KeyDocument2 pagesIRA No. 2 Answer KeyProlen AcantoNo ratings yet

- Lec 04Document14 pagesLec 04Ryan GroffNo ratings yet

- AA Chap 9Document42 pagesAA Chap 9Thu NguyenNo ratings yet

- Fixed Assets 1 - Kls AP 2 PJKDocument25 pagesFixed Assets 1 - Kls AP 2 PJKMarco LawinataNo ratings yet

- Chapter 03 - Securities MarketsDocument8 pagesChapter 03 - Securities MarketsA SNo ratings yet

- A Guide To Our Commercial Mortgage Fees and Charges - YBS2095COMMDocument3 pagesA Guide To Our Commercial Mortgage Fees and Charges - YBS2095COMMAncuţa AlupoaeiNo ratings yet

- Personalized Mortgage Report-0a2cc6-2Document5 pagesPersonalized Mortgage Report-0a2cc6-2Papiya DasNo ratings yet

- Answers Part2Document1 pageAnswers Part2Jamaica DavidNo ratings yet

- Note Payable Irrevocably Designated As at Fair Value Through Profit or LossDocument4 pagesNote Payable Irrevocably Designated As at Fair Value Through Profit or Lossnot funny didn't laughNo ratings yet

- Myka Eleonor Estole Quiz 5Document8 pagesMyka Eleonor Estole Quiz 5Julienne UntalascoNo ratings yet

- Tugas PPE 1Document12 pagesTugas PPE 1Bertha Liona0% (1)

- 04AFAR QuicknotesDocument23 pages04AFAR Quicknoteshelican.wenajeandbsa1993No ratings yet

- ch15 Non-Current LiabilitiesDocument66 pagesch15 Non-Current LiabilitiesDesain KPPN KPHNo ratings yet

- PGBPDocument3 pagesPGBPJimmy ShergillNo ratings yet

- Multi A SDN BHDDocument15 pagesMulti A SDN BHDMUHAMMAD AZIB ZAKHWAN BIN ZAKARIA (BG)No ratings yet

- 11 Accountancy t2 Sp01Document19 pages11 Accountancy t2 Sp01Lakshy BishtNo ratings yet

- Solution: - A) Gross Profit Net Sales-Cost of Sales 3,000,000-2,000,000Document4 pagesSolution: - A) Gross Profit Net Sales-Cost of Sales 3,000,000-2,000,000Eyasu DestaNo ratings yet

- Cdo, Cds & Irs: By: Fahad Siddiqui Meenakshi Chettiar Priyanka NarvekarDocument13 pagesCdo, Cds & Irs: By: Fahad Siddiqui Meenakshi Chettiar Priyanka NarvekarrakshayaNo ratings yet

- Kuis AkuntansiDocument3 pagesKuis AkuntansiNurul Khalishah AzzahraNo ratings yet

- CH 11Document51 pagesCH 11Quỳnh Anh Bùi ThịNo ratings yet

- Eun8e CH 005 PPTDocument47 pagesEun8e CH 005 PPTannNo ratings yet

- Case Study 15112019a TOFLDocument5 pagesCase Study 15112019a TOFLSunny SouravNo ratings yet

- Chapter 6 - Notes ReceivableDocument5 pagesChapter 6 - Notes ReceivableTurks100% (1)

- Time Value of MoneyDocument78 pagesTime Value of MoneyKALAI ARASANNo ratings yet

- Problems Problem 10.1: © John Wiley and Sons Australia, LTD 2010 10.21Document5 pagesProblems Problem 10.1: © John Wiley and Sons Australia, LTD 2010 10.21alfaressNo ratings yet

- Chapter Six 2024Document15 pagesChapter Six 2024Romario KhaledNo ratings yet

- Bact 310topic Four Accounting For Long Term Investments-2Document22 pagesBact 310topic Four Accounting For Long Term Investments-2Pa HabbakukNo ratings yet

- 8 13Document5 pages8 13Konrad Lorenz Madriaga UychocoNo ratings yet

- Loan Application FormDocument4 pagesLoan Application Formdiprodserv nigltdNo ratings yet

- MNGT 604 Day1 Problem Set SolutionsDocument8 pagesMNGT 604 Day1 Problem Set Solutionsharini muthuNo ratings yet

- Southampton Investment BrochureDocument7 pagesSouthampton Investment BrochureMark I'AnsonNo ratings yet

- NUDJPIA FAR AND AFAR SOLUTIONS - ReceivablesDocument6 pagesNUDJPIA FAR AND AFAR SOLUTIONS - ReceivablesKyla Artuz Dela CruzNo ratings yet

- CB ProblemsDocument8 pagesCB ProblemsabhinaymarupakulaNo ratings yet

- TDS Ready Reckoner (1) 11Document1 pageTDS Ready Reckoner (1) 11senthilkumar_kskNo ratings yet

- Problem 5 and 6Document4 pagesProblem 5 and 6Lalaina EnriquezNo ratings yet

- Loan AgentDocument4 pagesLoan AgentAMITH GOWDA ENo ratings yet

- Jan 2016 p3Document9 pagesJan 2016 p3Veronica BaileyNo ratings yet

- ORQUIA AssignmentDocument4 pagesORQUIA AssignmentClint RoblesNo ratings yet

- Module 2 - Notes Payable & Debt Restructuring - Rev2Document44 pagesModule 2 - Notes Payable & Debt Restructuring - Rev2Bea Angelle CamongayNo ratings yet

- Tugas KB Aklan TM 13-Kelompok 1Document10 pagesTugas KB Aklan TM 13-Kelompok 1AdnanNo ratings yet

- Union Bank LTD.: Head Office, DhakaDocument7 pagesUnion Bank LTD.: Head Office, DhakaMd.Kefayet Ullah Chowdhury 181-33-669No ratings yet

- Borrowing Cost SWDocument12 pagesBorrowing Cost SWMarian Augelio PolancoNo ratings yet

- Part 2 - Leases (Accounting by Lessors)Document31 pagesPart 2 - Leases (Accounting by Lessors)Poru SenpiiNo ratings yet

- (B) Provide For Foreclosure of Outstanding Loan/debt Amounts. Only Unsecured Loans Are RelevantDocument6 pages(B) Provide For Foreclosure of Outstanding Loan/debt Amounts. Only Unsecured Loans Are RelevantAmit GuptaNo ratings yet

- Exercise 9.1 1Document10 pagesExercise 9.1 1NavinNo ratings yet

- Liabilities Are Classified On The Balance Sheet As Either:: Chapter 10 SummaryDocument6 pagesLiabilities Are Classified On The Balance Sheet As Either:: Chapter 10 SummaryAreeba QureshiNo ratings yet

- Pascal Mosa Ananda W - Latihan KP Financial Accounting 2Document14 pagesPascal Mosa Ananda W - Latihan KP Financial Accounting 2Brenda FreitasNo ratings yet

- Tariff_Guide_2023Document1 pageTariff_Guide_2023michealoketcho29No ratings yet

- Week 6 NotesDocument7 pagesWeek 6 NotescalebNo ratings yet

- F6ROM - 2012 - Dec - Q ACCADocument11 pagesF6ROM - 2012 - Dec - Q ACCAgeorgetacaprarescuNo ratings yet

- Centre Whitepaper PDFDocument24 pagesCentre Whitepaper PDFwilliamhancharekNo ratings yet

- ECON 352 Problem Set 3 (With Key)Document18 pagesECON 352 Problem Set 3 (With Key)Ceylin SenerNo ratings yet

- The Implications of The IMF'Programme in ZambiaDocument83 pagesThe Implications of The IMF'Programme in ZambiahmvungeNo ratings yet

- Materi Accounting AdvancedDocument12 pagesMateri Accounting AdvancedRianty AstaniaNo ratings yet

- Analysis of Forex MarketDocument78 pagesAnalysis of Forex MarketAmit MishraNo ratings yet

- Chapter 5 IntAcct Sum21-DropboxDocument68 pagesChapter 5 IntAcct Sum21-DropboxPhuong Anh NguyenNo ratings yet

- Apan's Policy Trap: Dollars, Deflation, and The Crisis of Japanese FinanceDocument305 pagesApan's Policy Trap: Dollars, Deflation, and The Crisis of Japanese FinanceooNo ratings yet

- Chapter 13 Evaluation of Countries For Operations2Document29 pagesChapter 13 Evaluation of Countries For Operations2Raphael hernandezNo ratings yet

- Atlas ClubDocument29 pagesAtlas ClubConsumatore InformatoNo ratings yet

- Advanced Financial Accounting 3 (Acyava3) Derivatives & HedgingDocument4 pagesAdvanced Financial Accounting 3 (Acyava3) Derivatives & HedgingalyssaNo ratings yet

- CH 12Document19 pagesCH 12Ahmed Al EkamNo ratings yet

- Afar 2 Module CH 11 12Document16 pagesAfar 2 Module CH 11 12Joyce Anne MananquilNo ratings yet

- Derivatives The Tools That Changed FinanceDocument202 pagesDerivatives The Tools That Changed FinanceShakeeb Ashai100% (1)

- Full Uganda Budget Speech For Financial Year 2022/2023Document51 pagesFull Uganda Budget Speech For Financial Year 2022/2023The Campus TimesNo ratings yet

- 14.0 PP 99 113 Industrialization and The Rise of RMGDocument15 pages14.0 PP 99 113 Industrialization and The Rise of RMGAfifa Afrin UrmiNo ratings yet

- Administration SAPDocument98 pagesAdministration SAPAbbie Sajonia DollenoNo ratings yet

- Specialized Strategies Adopting Pricing To Accommodate Common ChallengesDocument3 pagesSpecialized Strategies Adopting Pricing To Accommodate Common ChallengesJoyce CastroNo ratings yet

- SIB 675 - Assignment 2upDocument6 pagesSIB 675 - Assignment 2upMelissa TothNo ratings yet

- Notes and Points On IMFDocument135 pagesNotes and Points On IMFUnni AmpadiNo ratings yet

- Forward Contract Form - MD50 - V.1.1Document11 pagesForward Contract Form - MD50 - V.1.1Sandeep GantaNo ratings yet

- 6 Hong Kong, China: Barbara ShiuDocument44 pages6 Hong Kong, China: Barbara ShiuowltbigNo ratings yet

- IAS 21 Foreign CurrencyDocument17 pagesIAS 21 Foreign CurrencyTanvir HossainNo ratings yet

- BBA 6 Sem Fin PDFDocument8 pagesBBA 6 Sem Fin PDFvidyashree patilNo ratings yet

- Economics HLSL P2 Markscheme May 2014Document18 pagesEconomics HLSL P2 Markscheme May 2014tyrramNo ratings yet

- Economics Honours SyllabusDocument25 pagesEconomics Honours SyllabusRia ChowdhuryNo ratings yet

- ME Class 11-12Document25 pagesME Class 11-12Dixith GandheNo ratings yet

- ABC - Final Exam: RequiredDocument17 pagesABC - Final Exam: RequiredCristel TannaganNo ratings yet