Professional Documents

Culture Documents

Income Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)

Income Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)

Uploaded by

ikbalbahar19920 ratings0% found this document useful (0 votes)

18 views1 pageThis document contains details of salary and income tax liability for Saiful Islam, a Headmaster. It shows that in financial year 2023-24, his gross salary was Rs. 14,71,724. After deductions for standard deduction and exemptions, his net taxable income was Rs. 14,21,724. Based on his income levels, his total income tax payable was Rs. 1,50,119. However, Rs. 1,10,000 was already deducted at source, so the balance tax payable was Rs. 40,119.

Original Description:

Original Title

NEW

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains details of salary and income tax liability for Saiful Islam, a Headmaster. It shows that in financial year 2023-24, his gross salary was Rs. 14,71,724. After deductions for standard deduction and exemptions, his net taxable income was Rs. 14,21,724. Based on his income levels, his total income tax payable was Rs. 1,50,119. However, Rs. 1,10,000 was already deducted at source, so the balance tax payable was Rs. 40,119.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

18 views1 pageIncome Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)

Income Tax Statement For Financial Year 2023-24 (Assessment Year 2024-25)

Uploaded by

ikbalbahar1992This document contains details of salary and income tax liability for Saiful Islam, a Headmaster. It shows that in financial year 2023-24, his gross salary was Rs. 14,71,724. After deductions for standard deduction and exemptions, his net taxable income was Rs. 14,21,724. Based on his income levels, his total income tax payable was Rs. 1,50,119. However, Rs. 1,10,000 was already deducted at source, so the balance tax payable was Rs. 40,119.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

New Tax Regime

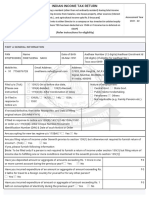

INCOME TAX STATEMENT FOR FINANCIAL YEAR 2023-24 (ASSESSMENT YEAR 2024-25)

Name of the Employee : Saiful Islam Designation : Head master

PAN No. : ACNP9025Q Office :

DETAILS OF SALARY PAID, ANY OTHER INCOME & TAX LIABILITY

Sl. AMOUNT

PARTICULARS

No. (in Rs.)

1

a) Gross Salary including arrear overtime Compensatory Allowance Perquisites etc. 1471724.00

b) Arrear Salary of previous years(s) received during the year

2 Total (a+b) 1471724.00

Deduct alowances to the extent exempt U/S – 10 (13A) [HRA admissible (i), (ii) & (iii) whichever is

least]

3 i) H.R.A. received during the year Rs. Rs. 0.00

ii) H.R. paid in excess of 10% of salary (BP+DA) Rs.

iii) 40% of salary (BP+DA) Rs.

a) Deduction U/S - 16 (ia) Standard Deduction (@50000/-) Rs. 50000.00

4 b) Deduction U/S – 16 (III) Professional Tax Rs.

c) Deduction U/S–24 (I) interest on Capital borrowed for purpose/construction of house property Rs.

5 Sub – Total of [3 &4] Rs. 50000.00 50000.00

6 BALANCE (2 – 5)……………………. 1421724.00

ADD ANY OTHER INCOME WITH DETAILS

7 a) Interest on securities/NSC…………………………….. Rs.

b) Interest deposit/Investment etc……………………….. Rs.

8 Sub – Total of [7 (a & b)] Rs. 0.00 0.00

9 TOTAL (6 + 8)…………………………………….. 1421724.00

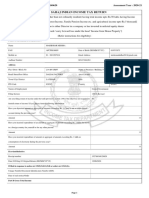

DEDUCATION UNDER CHAPTER VI-A

a) U/S – 80D : Medical Insurance Premium, MMLSAY subscription Rs.

b) U/S – 80DD : Medical Treatment of handicapped Dependent Rs.

c) U/S – 80DDA : Rs.

10

d) U/S – 80DDB : Selected Medical Treatment for self/ dependent Rs.

e) U/S - 80E : Interest Paid on Educational Loan Rs.

f) U/S - 80G(1) : Donation to approved fund for Assam Arogya Nidhi Trust Rs.

g) U/S - 80U : For Physically Disable Assesses Rs.

11 Sub – Total of [10 (a to g)] Rs. 0.00 0.00

12 BALANCE (9 – 11) 1421724.00

DEDUCTION UNDER SECTION CHAPTER 80C

a) Contribution to Provident Fund : GPF Rs.

b) Employee’s contribution towards NPS (u/s 80CCD) Rs.

c) Life Insurance Premium paid (Self/Spouse/Children) Rs.

d) NSC purchase during the year Rs.

e) Accrued interest in NSC Purchased in previous year………………… Rs.

13

f) Contribution of Post Office 10 years/15 years, CTD……………………….. Rs.

g) Re-payment to capital sum borrowed for purchase/construction of house……… Rs.

h) Contribution of PPF…………………. Rs.

i) Tuition fees (for two children) Rs.

j) Contribution to eligible Pension Fund/ELLS set up by any Mutual Fund Rs.

k) G. I. S. Rs.

14 Sub – Total of [13 (a to k)] Rs. 0.00 0.00

15 BALANCE : (12 – 14) 1421724.00

16 Additional contribution towards NPS [u/s 80CCD(1B)] (maximum limit upto 50000/-) Rs. 0.00

17 BALANCE : (15 – 16) : NET TAXABLE INCOME 1421724.00

INCOME TAX CALCULATION

a) Up to Rs. 3,00,000/- Nil Nil

b) Exceed Rs. 3,00,001/- to 6,00,000/- Rs. 300000.00 5% Rs. 15000.00

18 c) Exceed Rs. 6,00,001/- to 9,00,000/- Rs. 300000.00 10% Rs. 30000.00

d) Exceed Rs. 9,00,001/- to 12,00,000/- Rs. 300000.00 15% Rs. 45000.00

e) Exceed Rs. 12,00,001/- to 15,00,000/- Rs. 271724.00 20% Rs. 54345.00

f) Exceed Rs. 15,00,001/- to above Rs. 30% Rs. 0.00

19 TAX ON TOTAL INCOME [18 (a to f)] Rs. 144345.00

20 Tax rebate (up to Rs. 25000/- for net taxable income upto Rs. 7.00 Lakhs U/S 87-A) Rs.

21 Relief U/S – 89 – (attach details)…………. Rs.

22 TAX ON TOTAL INCOME AFTER REBATE [19- (20, 21)] Rs. 144345.00

23 Health & Education Cess @ 4% on (20) Rs. 5774.00

24 TOTAL INCOME TAX PAYABLE (22 + 23) Rs. 150119.00

25 Less : Tax already deducted at source Rs. 110000.00

26 BALANCE TAX PAYABLE (24 – 26) Rs. 40119.00

Signature of the Employee DDO's Signature & Seal

You might also like

- General Principles AND National Taxation: As Lectured by Atty. Rizalina LumberaDocument137 pagesGeneral Principles AND National Taxation: As Lectured by Atty. Rizalina LumberaMarvin Marciano DiñoNo ratings yet

- 11 DOF BLGF Local Revenue Generation and LGU ForecastingDocument20 pages11 DOF BLGF Local Revenue Generation and LGU ForecastingDilg Sadakbayan100% (3)

- Tax Planning and ManagementDocument23 pagesTax Planning and ManagementMinisha Gupta100% (19)

- Salary Computation Ass Yr 2017-18Document2 pagesSalary Computation Ass Yr 2017-18CA Kaushik Ranjan GoswamiNo ratings yet

- Income Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiDocument1 pageIncome Tax Calculation 2023-24 (Old Tax Regime) : Annexure - IiGOKUL HD LIVE EVENTSNo ratings yet

- ITDocument4 pagesITMahesh KumarNo ratings yet

- IT FormDocument4 pagesIT FormVimal PatelNo ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inKATHI JAYANo ratings yet

- B) Excess of Rent Paid Over 10% of Basic+DADocument4 pagesB) Excess of Rent Paid Over 10% of Basic+DAHaresh RajputNo ratings yet

- Anticipatory Income Tax Statement 2024-25 (MANJUSHA - 27.01.2024)Document5 pagesAnticipatory Income Tax Statement 2024-25 (MANJUSHA - 27.01.2024)prialiapradeepNo ratings yet

- Form No.16 Aa-1Document2 pagesForm No.16 Aa-1Vishnu Vardhan ANo ratings yet

- (I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)Document4 pages(I) Total Gross Salary Income: (If Above 60, Indicate Senior Citizen)dpfsopfopsfhopNo ratings yet

- Form No. 16: (See Rule 31 (1) (A) )Document5 pagesForm No. 16: (See Rule 31 (1) (A) )amit kr AdhikaryNo ratings yet

- Cps Tax Form Format For 23-24Document11 pagesCps Tax Form Format For 23-24sr91919No ratings yet

- Annexure Ii Income Tax Calculation For The Financial Year 2020-2021 Name: Jeevana Jyothi. B Designation: Junior Lecturer in ZoologyDocument3 pagesAnnexure Ii Income Tax Calculation For The Financial Year 2020-2021 Name: Jeevana Jyothi. B Designation: Junior Lecturer in ZoologySampath SanguNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 449048510080820 Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 449048510080820 Assessment Year: 2020-21రాకేష్ బాబు చట్టిNo ratings yet

- Old Scheme: Radhamani K SDocument4 pagesOld Scheme: Radhamani K SSUREMAN FINANCIAL SERVICESNo ratings yet

- Income Tax CalculationDocument2 pagesIncome Tax CalculationMadhan Kumar BobbalaNo ratings yet

- Anb Form 16 ITR (Saral II) 2010 ModelDocument7 pagesAnb Form 16 ITR (Saral II) 2010 Modelvanbu1967No ratings yet

- Jammu Kashmir Employee From 16Document6 pagesJammu Kashmir Employee From 16mrnavkhanNo ratings yet

- Periyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Document2 pagesPeriyar University: (NAAC Reaccredited With 'A++' Grade - State University-NIRF Rank 73-ARIIA RANK 10)Indumadhi SalemNo ratings yet

- 2016-17 ItDocument36 pages2016-17 ItKingKamalNo ratings yet

- Blank Income Tax FormDocument3 pagesBlank Income Tax FormmmmukhtarNo ratings yet

- Ecr CHLN Rec CBSLM1563373000 4132106004223 1623647158165 2021061438158165867Document1 pageEcr CHLN Rec CBSLM1563373000 4132106004223 1623647158165 2021061438158165867Kbg ConsultancyNo ratings yet

- Itr Anju Bhagat (Ay 2020-21)Document7 pagesItr Anju Bhagat (Ay 2020-21)mathshelpline21No ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 433739630310720 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 433739630310720 Assessment Year: 2020-21Satyajeet SahooNo ratings yet

- Ecr CHLN Rec GRCDP0043475000 1212204007476 1651122031576 2022042837831576920Document1 pageEcr CHLN Rec GRCDP0043475000 1212204007476 1651122031576 2022042837831576920Shaik BashaNo ratings yet

- INCOME TAX 2015-16. Annexure - IDocument5 pagesINCOME TAX 2015-16. Annexure - IPhani PitchikaNo ratings yet

- Thiroo - Income Tax - 09-10Document6 pagesThiroo - Income Tax - 09-10thiroo_2008No ratings yet

- Income Tax Calculation Statement: (Financial Year 2021-2022, and The Assessment Year 2022 - 2023)Document18 pagesIncome Tax Calculation Statement: (Financial Year 2021-2022, and The Assessment Year 2022 - 2023)mohamed ismailNo ratings yet

- Form PDF 120738610260722Document6 pagesForm PDF 120738610260722chinmay.kshitijNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Jagadesh PNo ratings yet

- Indian Income Tax Return: Part A General InformationDocument8 pagesIndian Income Tax Return: Part A General Informationsushilprajapati10_77No ratings yet

- Income Tax Calculation: Name: S. Ram Mohan ReddyDocument6 pagesIncome Tax Calculation: Name: S. Ram Mohan ReddyCA Swamyreddy MvNo ratings yet

- Form No 16 - Ay0607Document4 pagesForm No 16 - Ay0607api-3705645100% (1)

- Form PDF 375787380280821Document6 pagesForm PDF 375787380280821nthakur1410No ratings yet

- IT Form 16 Back - WWW - Ibadi.inDocument1 pageIT Form 16 Back - WWW - Ibadi.inGOKUL HD LIVE EVENTSNo ratings yet

- Sample Structure 10lpa - VI - VIIIDocument1 pageSample Structure 10lpa - VI - VIIIKiran IconNo ratings yet

- Ecr CHLN Rec GRCDP0043475000 1212203002720 1646735919520 2022030858119520249Document1 pageEcr CHLN Rec GRCDP0043475000 1212203002720 1646735919520 2022030858119520249Shaik BashaNo ratings yet

- Summary of SalaryDocument6 pagesSummary of SalaryRahul GhosaleNo ratings yet

- Final Itr PDFDocument8 pagesFinal Itr PDFharish1000No ratings yet

- Form PDF 712550240101120Document7 pagesForm PDF 712550240101120Animesh JainNo ratings yet

- Sample Structure 15lpa IX XDocument1 pageSample Structure 15lpa IX XKiran IconNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 353838160140620 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 353838160140620 Assessment Year: 2020-21ADITYA KUMAR MISHRANo ratings yet

- Form PDF 437810230020820Document7 pagesForm PDF 437810230020820Saurya KumarNo ratings yet

- Schedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CDocument2 pagesSchedule of Income Tax For The Year 2021-2022: PAN: ALCPB3668CJeevabinding xeroxNo ratings yet

- Tax CalculationDocument3 pagesTax Calculationreach2hardyNo ratings yet

- Abdul Naushad SiddiquiDocument2 pagesAbdul Naushad Siddiquiahad siddiquiNo ratings yet

- Form 16Document3 pagesForm 16Apte SatishNo ratings yet

- Form 16 2023-2024Document2 pagesForm 16 2023-2024Suprasanna KallakuntlaNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 742008690241120 Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 742008690241120 Assessment Year: 2020-21suhail amirNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)CA Madhu Sudhan ReddyNo ratings yet

- Form16 2982Document3 pagesForm16 2982yogesh magarNo ratings yet

- Free Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Document16 pagesFree Auto Tax Calculator FY-09-10 Version 4 (1) After Budget 06-07-2009Bijender Pal ChoudharyNo ratings yet

- Form PDF 696574080230622Document6 pagesForm PDF 696574080230622RUBY SHARMANo ratings yet

- Annexure ADocument1 pageAnnexure ASumit KumarNo ratings yet

- Ecr CHLN Rec Brpat2063029000 1402309005471 1694668661190 202309143886119015Document1 pageEcr CHLN Rec Brpat2063029000 1402309005471 1694668661190 202309143886119015Atul KumarNo ratings yet

- Consumer Decision MakingDocument7 pagesConsumer Decision MakingUtkarsh GurjarNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 592798150280920 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 592798150280920 Assessment Year: 2020-21manishNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 760683270291120 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 760683270291120 Assessment Year: 2020-21Chinmay BhattNo ratings yet

- ProjectDocument1 pageProjectSaurabh ShrivastavaNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- KalamDocument1 pageKalamikbalbahar1992No ratings yet

- 2024 EROLLGEN S03 55 FinalRoll Revision1 ASM 16 WIDocument36 pages2024 EROLLGEN S03 55 FinalRoll Revision1 ASM 16 WIikbalbahar1992No ratings yet

- FarzDocument1 pageFarzikbalbahar1992No ratings yet

- FazDocument1 pageFazikbalbahar1992No ratings yet

- W8 Ben Default - 2021 12 27 - Preview - DocDocument1 pageW8 Ben Default - 2021 12 27 - Preview - DocJavielito RamirezbriosoNo ratings yet

- DT Icai MCQ 4Document5 pagesDT Icai MCQ 4Anshul JainNo ratings yet

- TAX B41 Final Pre Board Exams Questions Answers - SolutionsDocument16 pagesTAX B41 Final Pre Board Exams Questions Answers - SolutionsangelikaNo ratings yet

- Payslip 2023 2024 1 hf134698 HDBFSDocument1 pagePayslip 2023 2024 1 hf134698 HDBFSuipathbabu1No ratings yet

- Special Tax Regime For TradersDocument5 pagesSpecial Tax Regime For TradersArsalan LobaniyaNo ratings yet

- Tatckt2 Link 2Document18 pagesTatckt2 Link 2Nguyễn Ngọc Thanh TrangNo ratings yet

- Salary Slip NovDocument1 pageSalary Slip NovRahul RajawatNo ratings yet

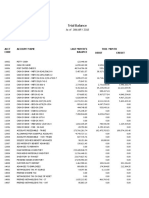

- ABC Co. Trial BalanceDocument10 pagesABC Co. Trial BalanceGraceeyNo ratings yet

- Pan HR Solution PVT LTD.: Plot No.9, Sector-4, Vaishali, Ghaziabad (U.P.) 201010Document1 pagePan HR Solution PVT LTD.: Plot No.9, Sector-4, Vaishali, Ghaziabad (U.P.) 201010NOOB GAMERNo ratings yet

- LinkedIn Content Calendar Excel TemplateDocument31 pagesLinkedIn Content Calendar Excel TemplateSandeep Singh100% (1)

- GSTR3B 03alnpk4728k1zv 042021Document2 pagesGSTR3B 03alnpk4728k1zv 042021Harish VermaNo ratings yet

- Chapter 6 Capital Gains TaxationDocument4 pagesChapter 6 Capital Gains TaxationBisag AsaNo ratings yet

- Phil Gold Processing & Refining Corp: RF Monthly-Lgm 3Document1 pagePhil Gold Processing & Refining Corp: RF Monthly-Lgm 3bonemarkcosNo ratings yet

- UTGST - Salient FeaturesDocument9 pagesUTGST - Salient Featureskoushiki mishraNo ratings yet

- 68 UPSC Prelims Test Series-2023-24 (30 Tests Brochure) (Eng)Document20 pages68 UPSC Prelims Test Series-2023-24 (30 Tests Brochure) (Eng)Faltu KaamNo ratings yet

- Bcom Sem 4 Atkt Sample MCQ 100 MarksDocument24 pagesBcom Sem 4 Atkt Sample MCQ 100 MarksRuchi ShuklaNo ratings yet

- RPS-PCF-Class - Invoice - 41Document4 pagesRPS-PCF-Class - Invoice - 41Srinivasa HelavarNo ratings yet

- TX - Mock Test - Đáp ÁnDocument12 pagesTX - Mock Test - Đáp ÁnPhán Tiêu Tiền100% (1)

- Finance Development of ScienceDocument6 pagesFinance Development of ScienceIryna HoncharukNo ratings yet

- Buckwold12e Solutions Ch11Document40 pagesBuckwold12e Solutions Ch11Fang YanNo ratings yet

- Zviad Barkaia Public Choice PaperDocument8 pagesZviad Barkaia Public Choice PaperZviad BarkaiaNo ratings yet

- Presentation On Income Tax ActDocument31 pagesPresentation On Income Tax ActJst DeepakNo ratings yet

- Bustax Chapter 1Document9 pagesBustax Chapter 1Pineda, Paula MarieNo ratings yet

- Moh Derajad Imam Suprabowo CV-1Document3 pagesMoh Derajad Imam Suprabowo CV-1Mas DerajadNo ratings yet

- COP44A - Apply For Help With Court of Protection FeesDocument4 pagesCOP44A - Apply For Help With Court of Protection FeesIvicore MusicNo ratings yet

- Tax Compliance Guide For Foreign Investors Mozambique: in Partnership WithDocument46 pagesTax Compliance Guide For Foreign Investors Mozambique: in Partnership WithKeizer MirzaNo ratings yet

- Bipin Enterprises: GST Tax InvoiceDocument1 pageBipin Enterprises: GST Tax Invoicebipin enterprisesNo ratings yet