Professional Documents

Culture Documents

Pas 38

Pas 38

Uploaded by

Patrick Alcober0 ratings0% found this document useful (0 votes)

6 views1 pageThis document outlines the essential elements for classifying an asset as an intangible asset according to accounting standards. It discusses that an intangible asset must be identifiable, have no physical substance, and provide future economic benefits. It also summarizes how intangible assets are initially measured at cost and subsequently measured, as well as how they are amortized, tested for impairment, and derecognized.

Original Description:

Original Title

PAS 38

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines the essential elements for classifying an asset as an intangible asset according to accounting standards. It discusses that an intangible asset must be identifiable, have no physical substance, and provide future economic benefits. It also summarizes how intangible assets are initially measured at cost and subsequently measured, as well as how they are amortized, tested for impairment, and derecognized.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

6 views1 pagePas 38

Pas 38

Uploaded by

Patrick AlcoberThis document outlines the essential elements for classifying an asset as an intangible asset according to accounting standards. It discusses that an intangible asset must be identifiable, have no physical substance, and provide future economic benefits. It also summarizes how intangible assets are initially measured at cost and subsequently measured, as well as how they are amortized, tested for impairment, and derecognized.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

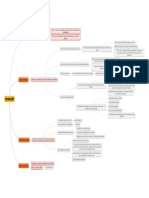

Essential Elements of an Applies to all intangible Recognition

Intangible Asset

Intangible Asset Assets except

Identifiable Identifiability Goodwill acquired in a future economic

business combination benefits are expected

No physical Seperable

substance Intagible assets

held as inventory

Legal right Cost of the asset can

non-monetary

be measured reliably

intangible assets

Control classified as held for

sale

Meets definition of

Measurement intangible asset

Initially at Cost Internally Generated

Intangible Assets

Depends

Seperate

on how it

Acquisition

is acquired

PAS 38 Research Phase Development

Purchase Cost + Phase

Deffered Payment Direct Costs will be

Amortization always capitalzed if it

can Fair

Fair value

value at

at

Cash Price Acquired in Business expensed demonstrate all acquisition

acquisition date

date

Combination Straight line of the following

Equivalent

method

availability of Fair value to

intention at

Fair value at Diminishing

by way of adequate technical, acquisition

complete or date

sell it

Government Grant acquisition date balance method can be used

financial, and other

as long as

units of production appropriate resources

method ability to use or sell

Fair Value or Exchange of Assets the intangible asset

nominal amount ability to be

finite life is

amortized measured reliably

fair value generate probable

Internally Generated indefinite life is not

future economic

amortized benefits

if lacking commercial

substance or fair value is

not reliably measured required to test for

all directly impairment by comparing Derecognition

attributable costs

Carrying its recoverable amount iwth

carrying amount, annualy

necessary to amount

create, produce,

and prepare cost less any accumulated

On disposal

amortization and any

accumulated impairment

Cost Model

Subsequent losses

no future economic

Measurement carried at a

revalued fair value at the date of benefits are expected

amount revaluation less any from its use or disposal

Revaluation Model subsequent accumulated

amortization or any impairment

losses

You might also like

- Auditing Problems v.1 - 2018Document18 pagesAuditing Problems v.1 - 2018Christine Ballesteros Villamayor33% (3)

- Singson DM A. Concept Map RevisionDocument2 pagesSingson DM A. Concept Map RevisionDonna Mae SingsonNo ratings yet

- Abusama Impairment of AssetsDocument1 pageAbusama Impairment of AssetsGarp BarrocaNo ratings yet

- 74516bos60448 Indas23Document2 pages74516bos60448 Indas23pave.scgroupNo ratings yet

- IAS 38 Intangibles Summary FinalDocument1 pageIAS 38 Intangibles Summary FinalSaqib IqbalNo ratings yet

- Ind As 40Document2 pagesInd As 40Nithish KumarNo ratings yet

- Chap09 - Student (Revised)Document36 pagesChap09 - Student (Revised)Fung Yat Kit KeithNo ratings yet

- Ind As 102Document12 pagesInd As 102Remaining lifeNo ratings yet

- Inocencio PFRS SMEs Matrix ACElec 1Document6 pagesInocencio PFRS SMEs Matrix ACElec 1alianna johnNo ratings yet

- Accounting Cycle Accrual and DeferralDocument30 pagesAccounting Cycle Accrual and Deferralfikru terfaNo ratings yet

- Ac 506 - Pas 16Document1 pageAc 506 - Pas 16Rome SibuyasNo ratings yet

- FINACC1 - Investment in Equity and Debt Instruments PDFDocument4 pagesFINACC1 - Investment in Equity and Debt Instruments PDFJerico DungcaNo ratings yet

- Foi CH 4Document18 pagesFoi CH 4Gurpreet kaurNo ratings yet

- Chapter 4 Stock ValuationDocument63 pagesChapter 4 Stock ValuationMUHAMMAD AFIF AHMAD ZAIDINo ratings yet

- Inocencio PFRS SmallEntites Matrix ACElec 1Document6 pagesInocencio PFRS SmallEntites Matrix ACElec 1alianna johnNo ratings yet

- Assignment of Depreciation PDFDocument50 pagesAssignment of Depreciation PDFMuhammad Arslan0% (2)

- At Cost: Initial Measurement Expenditures That Should Not Form Part of Cost ofDocument1 pageAt Cost: Initial Measurement Expenditures That Should Not Form Part of Cost ofreyNo ratings yet

- Reading 23 - Long-Lived AssetsDocument7 pagesReading 23 - Long-Lived AssetsLuis Henrique N. SpínolaNo ratings yet

- FIN - Chap 3 - Financial Statement, Cash Flows, and TaxesDocument1 pageFIN - Chap 3 - Financial Statement, Cash Flows, and Taxesduyennthds170525No ratings yet

- Intangible AssetDocument2 pagesIntangible AssetNath BongalonNo ratings yet

- Far 21 Notes and Loans Payable Debt RestructuringDocument7 pagesFar 21 Notes and Loans Payable Debt RestructuringJulie Mae Caling MalitNo ratings yet

- Flow Chart IAS 32Document1 pageFlow Chart IAS 32Hameed Ullah Khan100% (1)

- Intacc1A - M4 Map - SantosDocument3 pagesIntacc1A - M4 Map - SantosRosette SANTOSNo ratings yet

- Chapter 4Document36 pagesChapter 4wasilqureshi2004No ratings yet

- Security Valuation CA FinalDocument1 pageSecurity Valuation CA FinalAzru KhanNo ratings yet

- Cfas - Matrix FinalDocument24 pagesCfas - Matrix FinalFrances Ann CapalonganNo ratings yet

- Agriculture Accounting For Businesses Government AccountingDocument3 pagesAgriculture Accounting For Businesses Government AccountingZeniah Domecyas ArizoNo ratings yet

- Investing and Financing Decisions and The Balance SheetDocument41 pagesInvesting and Financing Decisions and The Balance SheetFadyNo ratings yet

- Recasting FSDocument1 pageRecasting FSCapung SolehNo ratings yet

- Partnership FormationDocument2 pagesPartnership Formationkimingyuse1010No ratings yet

- (Chap2) CFFR SummaryDocument2 pages(Chap2) CFFR Summaryliza marie basiaNo ratings yet

- 2.2 Audit of InvestmentsDocument1 page2.2 Audit of Investmentsantonette seradNo ratings yet

- Sample 500593 PDFDocument5 pagesSample 500593 PDFEnvisage123No ratings yet

- Chap 04Document36 pagesChap 04Ahmad AlayanNo ratings yet

- CH 4 PPTDocument36 pagesCH 4 PPTJoseph IbrahimNo ratings yet

- IND As 16 Revision Notes HWDocument6 pagesIND As 16 Revision Notes HWSuman SharmaNo ratings yet

- E-Portfolio: PAS 40 - Investment Property D E F I N I T I O NDocument4 pagesE-Portfolio: PAS 40 - Investment Property D E F I N I T I O NKaye NaranjoNo ratings yet

- Investing and Financing Decisions and The Balance SheetDocument42 pagesInvesting and Financing Decisions and The Balance SheetSap 155155No ratings yet

- Business Combinations: Advantages Disadvantages T Y E PDocument1 pageBusiness Combinations: Advantages Disadvantages T Y E PPrincessNo ratings yet

- IND AS 38 - MarkingsDocument11 pagesIND AS 38 - Markingshimanshugoyal1033No ratings yet

- Investment in Equity SecuritiesDocument42 pagesInvestment in Equity SecuritiesJhay AbabonNo ratings yet

- Ias 16 Property, Plant and Equipment: Fact SheetDocument13 pagesIas 16 Property, Plant and Equipment: Fact SheetXYZA JABILINo ratings yet

- 74507bos60448 Indas2Document4 pages74507bos60448 Indas2Danish AnsariNo ratings yet

- MoneyDocument1 pageMoneyShaviniNo ratings yet

- As-13accounting For InvestmentDocument1 pageAs-13accounting For Investmentbuddybest22No ratings yet

- Annual Report of IOCL 91Document1 pageAnnual Report of IOCL 91Nikunj ParmarNo ratings yet

- Accounting Equation - Part 2Document48 pagesAccounting Equation - Part 2Krrish BosamiaNo ratings yet

- Valuation of Real Estate-Full - BookformDocument68 pagesValuation of Real Estate-Full - BookformNarra Janardhan100% (1)

- Chapter 4 Concept MapDocument1 pageChapter 4 Concept MapClyde SaladagaNo ratings yet

- Cca CPP HcaDocument1 pageCca CPP Hcahusse fokNo ratings yet

- Full PFRS Pfrs For Smes: Directly Attributable To TheDocument12 pagesFull PFRS Pfrs For Smes: Directly Attributable To TheKristine Astorga-NgNo ratings yet

- Reading 24 - Understanding Balance SheetDocument1 pageReading 24 - Understanding Balance Sheetmaimaitaan120201No ratings yet

- DcfvalDocument198 pagesDcfvalHemant bhanawatNo ratings yet

- Intangible Assets - Mary and AllyDocument4 pagesIntangible Assets - Mary and AllyMary Ann B. GabucanNo ratings yet

- Pas 40 Concept MapDocument1 pagePas 40 Concept MapJohn Steve VasalloNo ratings yet

- Investing and Financing Decisions and The Balance SheetDocument15 pagesInvesting and Financing Decisions and The Balance SheetgeorgeredaNo ratings yet

- Afar.2905 Business Combination Mergers PDFDocument5 pagesAfar.2905 Business Combination Mergers PDFCyrille Keith FranciscoNo ratings yet

- Adjusting EntriesDocument1 pageAdjusting EntriesNadifa AisyahNo ratings yet

- FR Ind AS L7Document11 pagesFR Ind AS L7tushar bagalNo ratings yet

- Chap 004Document25 pagesChap 004abel JemalNo ratings yet

- Nature of Consolidated StatementsDocument8 pagesNature of Consolidated StatementsRoldan Arca PagaposNo ratings yet

- 1 Cash and Cash EquivalentsDocument6 pages1 Cash and Cash Equivalentsanon_752939353100% (1)

- FABM2 Q3 Module 2 Statement of Comprehensive IncomeDocument12 pagesFABM2 Q3 Module 2 Statement of Comprehensive IncomeLoriely De GuzmanNo ratings yet

- Financial Accounting & Reporting IIDocument6 pagesFinancial Accounting & Reporting IIKendrick PajarinNo ratings yet

- Tutorial Chapter 5 Agr323Document2 pagesTutorial Chapter 5 Agr323faiztarmiziNo ratings yet

- Accounting and Finance For Non Specialists 11Th Edition Peter Atrill Full ChapterDocument51 pagesAccounting and Finance For Non Specialists 11Th Edition Peter Atrill Full Chapterdominique.ivory827100% (16)

- ch1 Slides Students - ANDocument24 pagesch1 Slides Students - ANakshitnagpal9119No ratings yet

- Ias16, 23, 36, 38, 40 and Ifrs 3Document71 pagesIas16, 23, 36, 38, 40 and Ifrs 3mulualemNo ratings yet

- Chapter 3 - Financial Statement AnalysisDocument4 pagesChapter 3 - Financial Statement AnalysisErlinda NavalloNo ratings yet

- IFA s1 QDocument8 pagesIFA s1 QКсения НиколоваNo ratings yet

- CHAPTER 1 Inventory - 1Document34 pagesCHAPTER 1 Inventory - 1Tesfaye Megiso BegajoNo ratings yet

- Business Entity ConceptDocument13 pagesBusiness Entity ConceptHina KhanNo ratings yet

- Tutorial Letter 103/0/2023: FAC4862/NFA4862/ZFA4862Document112 pagesTutorial Letter 103/0/2023: FAC4862/NFA4862/ZFA4862THABO CLARENCE MohleleNo ratings yet

- Financial Report H1 2009 enDocument27 pagesFinancial Report H1 2009 eniramkkNo ratings yet

- Analisis Biaya Dan Pendapatan Usahatani Kakao Di Kabupaten Lombok UtaraDocument9 pagesAnalisis Biaya Dan Pendapatan Usahatani Kakao Di Kabupaten Lombok UtaraNabilah NayliNo ratings yet

- FabmDocument68 pagesFabmAllyzza Jayne Abelido100% (1)

- Chapter 21 Accounting ChangesDocument35 pagesChapter 21 Accounting ChangesAryan ShahNo ratings yet

- Reg30LODR AuditReport 31dec2019Document13 pagesReg30LODR AuditReport 31dec2019Shreerangan ShrinivasanNo ratings yet

- Quiz - Chapter 3 - Partnership Dissolution - 2020 EditionDocument4 pagesQuiz - Chapter 3 - Partnership Dissolution - 2020 EditionHell Luci50% (2)

- Financial Statement Analiysis of Bangladesh Krishibank LTDDocument40 pagesFinancial Statement Analiysis of Bangladesh Krishibank LTDEdu WriterNo ratings yet

- 293 Financial Accounting - COURSE OUTLINEDocument7 pages293 Financial Accounting - COURSE OUTLINEsilenteyesNo ratings yet

- 2019 AFM Unit Test 1 Answer KeyDocument8 pages2019 AFM Unit Test 1 Answer KeyDR. PRASANTH.BNo ratings yet

- Audit of InvestmentsDocument10 pagesAudit of Investmentsaldrin elsisuraNo ratings yet

- ch.13 Practice QuestionsDocument4 pagesch.13 Practice QuestionsAshNo ratings yet

- Jawaban Soal Lat. Bu Iin+Soal (Visit ComDocument11 pagesJawaban Soal Lat. Bu Iin+Soal (Visit ComYhogan JayaNo ratings yet

- LKT 2019 Bumi ResourcesDocument165 pagesLKT 2019 Bumi ResourcesJefri Formen PangaribuanNo ratings yet

- Answer:: The Amount of Sales If The Company Lost P36,000 Last Year Was P976,500Document2 pagesAnswer:: The Amount of Sales If The Company Lost P36,000 Last Year Was P976,500Unknowingly AnonymousNo ratings yet

- Chapter 13 16Document7 pagesChapter 13 16labonno35No ratings yet

- AFAR06-01 Partnership AccountingDocument8 pagesAFAR06-01 Partnership AccountingEd MendozaNo ratings yet