Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3 viewsMarket+Risk Worksheet

Market+Risk Worksheet

Uploaded by

Haritika ChhatwalThis document discusses Value at Risk (VaR) and how to calculate it. VaR is defined as the maximum potential loss over a target period and given confidence level, excluding extreme events. It provides an example calculation of VaR for a $100 million bond portfolio at the 95% confidence level over one month. Using historical monthly medium-term bond returns from 1953 to 1995, it determines that the VaR is $1.7 million, meaning there is a 5% chance of losing more than this amount in a given month. The document also outlines parametric and historical simulation approaches to computing VaR and provides stock market data to calculate VaR for individual stocks using these two methods.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Distribution Management: Get To Know Each OtherDocument43 pagesDistribution Management: Get To Know Each OtherBuyco, Nicole Kimberly M.No ratings yet

- DMFAS 6 User's Guide PDFDocument263 pagesDMFAS 6 User's Guide PDFRandi Nugraha100% (1)

- Marlinspike Sailor's Arts and Crafts: A Step-by-Step Guide to Tying Classic Sailor's Knots to Create, Adorn, and Show OffFrom EverandMarlinspike Sailor's Arts and Crafts: A Step-by-Step Guide to Tying Classic Sailor's Knots to Create, Adorn, and Show OffRating: 5 out of 5 stars5/5 (2)

- ITP-Day 2 - Deck 28129Document107 pagesITP-Day 2 - Deck 28129Rohit AngiraNo ratings yet

- Model Deployment - SlideDocument14 pagesModel Deployment - Slideph8ks7p89gNo ratings yet

- FRA Week 2Document11 pagesFRA Week 2MonicaNo ratings yet

- ITP-Day 4 - DeckDocument52 pagesITP-Day 4 - DeckRohit AngiraNo ratings yet

- NPV Deck 4Document85 pagesNPV Deck 4harishNo ratings yet

- Logistic Regression VideoDocument37 pagesLogistic Regression VideoSHEKHAR SWAMINo ratings yet

- Hypothesis TestingDocument52 pagesHypothesis TestingMANISH CHOWDARY KakumaniNo ratings yet

- NPV Deck 1Document81 pagesNPV Deck 1harishNo ratings yet

- Stock Prices Stats ExerciseDocument2 pagesStock Prices Stats Exerciseakshayallapur8No ratings yet

- ITP-Day 3 - DeckDocument72 pagesITP-Day 3 - DeckRohit AngiraNo ratings yet

- NPV Deck 2Document89 pagesNPV Deck 2harishNo ratings yet

- FRA Week 1Document30 pagesFRA Week 1MonicaNo ratings yet

- Probability 2Document28 pagesProbability 2MANISH CHOWDARY KakumaniNo ratings yet

- Logistic RegressionDocument13 pagesLogistic Regressionaaryani6991No ratings yet

- FRA Week 1Document30 pagesFRA Week 1borade.vijayNo ratings yet

- Probability DistributionDocument28 pagesProbability DistributionMANISH CHOWDARY KakumaniNo ratings yet

- Class Notes - Intro To MLDocument5 pagesClass Notes - Intro To MLnitheeshbharathi.mNo ratings yet

- Slides - Sentiment AnalysisDocument5 pagesSlides - Sentiment AnalysisGirish ChadhaNo ratings yet

- Economics:: The Core IssuesDocument33 pagesEconomics:: The Core IssuesZahraa SweidanNo ratings yet

- Drivers and Problems of Supply ChainDocument6 pagesDrivers and Problems of Supply ChainNeeraj KumarNo ratings yet

- Descriptive StatsisticsDocument44 pagesDescriptive StatsisticsFaizan SiddiquiNo ratings yet

- Statistical Learning - Probability and DistributionsDocument20 pagesStatistical Learning - Probability and DistributionsGirish ChadhaNo ratings yet

- Chap 7 OshaDocument18 pagesChap 7 OshaSiti Sarah Zalikha Binti Umar BakiNo ratings yet

- Descriptive Statistics 2Document40 pagesDescriptive Statistics 2ARCHANA RNo ratings yet

- Unsupervised Learning - ClusteringDocument40 pagesUnsupervised Learning - ClusteringHiral ShahNo ratings yet

- LAW205 Intentional Torts Chp.7Document23 pagesLAW205 Intentional Torts Chp.7Edward DomanicoNo ratings yet

- Fundamentals of Advanced Accounting 8th Edition Hoyle Solutions ManualDocument36 pagesFundamentals of Advanced Accounting 8th Edition Hoyle Solutions Manualnucleolerebellow.sqelNo ratings yet

- Fundamentals of Advanced Accounting 8th Edition Hoyle Solutions ManualDocument37 pagesFundamentals of Advanced Accounting 8th Edition Hoyle Solutions Manualjocosevannerh98oj100% (34)

- Adm CHP 4 RecruitmentDocument43 pagesAdm CHP 4 RecruitmentLYDIANA LISADNo ratings yet

- EnsembleDocument6 pagesEnsembleGirish ChadhaNo ratings yet

- Chapter 2 - Defining Business EthicsDocument20 pagesChapter 2 - Defining Business EthicsLena KhalidNo ratings yet

- The Challenges of Human Resources ManagementDocument44 pagesThe Challenges of Human Resources ManagementKritika AhujaNo ratings yet

- ML - Week 2 MLSDocument13 pagesML - Week 2 MLSGirish ChadhaNo ratings yet

- Principles of Human Resource Management 16 e Bohlander - SnellDocument18 pagesPrinciples of Human Resource Management 16 e Bohlander - SnellSiti Sarah Zalikha Binti Umar BakiNo ratings yet

- Agenda: Why Is Economics Important in Business?Document4 pagesAgenda: Why Is Economics Important in Business?Sparsh DessaiNo ratings yet

- LU4 RecruitmentDocument32 pagesLU4 RecruitmentNur Rabiatul Anis binti RoslanNo ratings yet

- Product Mix - IntroductionDocument5 pagesProduct Mix - IntroductionSuprith MurthyNo ratings yet

- Chapter 1Document47 pagesChapter 1Faye ManalansanNo ratings yet

- Social+Media+Analytics v02Document57 pagesSocial+Media+Analytics v02Shubradip GhoshNo ratings yet

- Corporate Strategy: Strategic Alliances and Mergers & AcquisitionsDocument37 pagesCorporate Strategy: Strategic Alliances and Mergers & AcquisitionsakashNo ratings yet

- DSBA - Exploratory Data Analysis v2Document22 pagesDSBA - Exploratory Data Analysis v2StocknEarnNo ratings yet

- Python For Non-Programmers FinalDocument218 pagesPython For Non-Programmers FinalVinay KumarNo ratings yet

- Chapter 3 - External Analysis - Industry Structure - Competitive Forces - and Strategic GroupsDocument79 pagesChapter 3 - External Analysis - Industry Structure - Competitive Forces - and Strategic GroupsAlex Rossi100% (1)

- Lecture Slides - PreworkDocument20 pagesLecture Slides - PreworkMayur ShindeNo ratings yet

- Topic 5 Training and DevelopmentDocument38 pagesTopic 5 Training and Developmentinnocent angelNo ratings yet

- Measures+of+Central+Tendency Dispersion +Lecture+SlidesDocument14 pagesMeasures+of+Central+Tendency Dispersion +Lecture+SlidesKABILAN SNo ratings yet

- Bagging and BoostingDocument8 pagesBagging and Boostingaaryani6991No ratings yet

- Slides - Text MiningDocument12 pagesSlides - Text MiningGirish ChadhaNo ratings yet

- CH 2 - HR PlanningDocument40 pagesCH 2 - HR PlanningMark SullivanNo ratings yet

- Chap 2Document15 pagesChap 2Imran HakeemNo ratings yet

- Chapter 7Document29 pagesChapter 7Khan SahabNo ratings yet

- Machine Learning: K-Nearest NeighborsDocument8 pagesMachine Learning: K-Nearest NeighborsAshish Gupta100% (1)

- Fundamentals of Advanced Accounting 8th Edition Hoyle Solutions ManualDocument24 pagesFundamentals of Advanced Accounting 8th Edition Hoyle Solutions ManualJanetSmithonybNo ratings yet

- Chapter 1 LectureDocument35 pagesChapter 1 Lecturepm69kf4rmmNo ratings yet

- Python+for+Non ProgrammersDocument64 pagesPython+for+Non ProgrammersYudhistar GannabattulaNo ratings yet

- IPPTChap 013Document38 pagesIPPTChap 013jazzyxbieber14No ratings yet

- Micro ch21 Presentation6e (2012)Document50 pagesMicro ch21 Presentation6e (2012)Nguyễn Thị Bích TrâmNo ratings yet

- Compensation 12th Edition Milkovich Solutions ManualDocument44 pagesCompensation 12th Edition Milkovich Solutions Manualheidiwatsonwcjponqkai100% (16)

- Hargreaves Et Al (2002) Perspectives - On - Alternative - Assessment - ReformDocument29 pagesHargreaves Et Al (2002) Perspectives - On - Alternative - Assessment - ReformHaritika ChhatwalNo ratings yet

- Research Design Quantitative Analysis For DataDocument50 pagesResearch Design Quantitative Analysis For DataHaritika ChhatwalNo ratings yet

- Financial Statement AnalysisDocument7 pagesFinancial Statement AnalysisHaritika ChhatwalNo ratings yet

- Coding of Data SetDocument105 pagesCoding of Data SetHaritika ChhatwalNo ratings yet

- Syllabus OrientationDocument3 pagesSyllabus OrientationHaritika ChhatwalNo ratings yet

- Ws 9igcse Business July 2018-19Document5 pagesWs 9igcse Business July 2018-19Haritika ChhatwalNo ratings yet

- Ws 9igcse Business October 2018-19Document3 pagesWs 9igcse Business October 2018-19Haritika ChhatwalNo ratings yet

- Solution Set For Mergers and Acquisitions MBA IIIDocument20 pagesSolution Set For Mergers and Acquisitions MBA IIIHaritika ChhatwalNo ratings yet

- WS 9igcse Business April May 2018-19Document6 pagesWS 9igcse Business April May 2018-19Haritika ChhatwalNo ratings yet

- Giisacp Igcse10 BS 2018 19Document6 pagesGiisacp Igcse10 BS 2018 19Haritika ChhatwalNo ratings yet

- Giisacp Igcse10 BS 2018 19Document2 pagesGiisacp Igcse10 BS 2018 19Haritika ChhatwalNo ratings yet

- Prob Dist PracticeDocument2 pagesProb Dist PracticeHaritika ChhatwalNo ratings yet

- CH 5 - Legal DimensionsDocument49 pagesCH 5 - Legal DimensionsHaritika ChhatwalNo ratings yet

- Ch-18 Cross Border Merger DealsDocument35 pagesCh-18 Cross Border Merger DealsHaritika ChhatwalNo ratings yet

- FPI FortnightlyDocument30 pagesFPI FortnightlyHaritika ChhatwalNo ratings yet

- Good Questions On As-14Document97 pagesGood Questions On As-14Haritika ChhatwalNo ratings yet

- Session 1 - Fmi - 17 NovDocument10 pagesSession 1 - Fmi - 17 NovHaritika ChhatwalNo ratings yet

- SESSION 1-2 (Autosaved) (Autosaved)Document79 pagesSESSION 1-2 (Autosaved) (Autosaved)Haritika ChhatwalNo ratings yet

- Amara Raja BatteriesDocument13 pagesAmara Raja BatteriesHaritika ChhatwalNo ratings yet

- Session - 1 FmiDocument17 pagesSession - 1 FmiHaritika ChhatwalNo ratings yet

- Assignment Food Nutrition 2019Document10 pagesAssignment Food Nutrition 2019Haritika ChhatwalNo ratings yet

- Dias PresentationDocument12 pagesDias PresentationHaritika ChhatwalNo ratings yet

- 6.1 Chapter 24 Government Economic Objectives: and PoliciesDocument59 pages6.1 Chapter 24 Government Economic Objectives: and PoliciesHaritika ChhatwalNo ratings yet

- Session 17-18 Consumer and Wholesale Banking (Autosaved)Document61 pagesSession 17-18 Consumer and Wholesale Banking (Autosaved)Haritika ChhatwalNo ratings yet

- Unit Two RDMDocument14 pagesUnit Two RDMHaritika ChhatwalNo ratings yet

- Unit Four RDMDocument7 pagesUnit Four RDMHaritika ChhatwalNo ratings yet

- BADocument1 pageBAHaritika ChhatwalNo ratings yet

- Unit Three RDMDocument12 pagesUnit Three RDMHaritika ChhatwalNo ratings yet

- Final Assignment Cardiogood FitnessDocument31 pagesFinal Assignment Cardiogood FitnessHaritika ChhatwalNo ratings yet

- Unit 1 RDM: February 2018Document16 pagesUnit 1 RDM: February 2018Haritika ChhatwalNo ratings yet

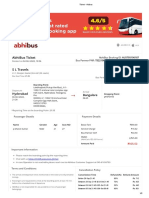

- Ticket - AbibusDocument2 pagesTicket - Abibuspalyadabharat kumarNo ratings yet

- 1 - Introduction To Accountign - Icap - Questions and Answers PDFDocument202 pages1 - Introduction To Accountign - Icap - Questions and Answers PDFM.Abdullah MBIT100% (1)

- Case1 - LEK Vs PWCDocument26 pagesCase1 - LEK Vs PWCmayolgalloNo ratings yet

- TOM EffectsDocument15 pagesTOM EffectsAhmed AÏRNo ratings yet

- Taxation Workbook 2022Document204 pagesTaxation Workbook 2022Navya GulatiNo ratings yet

- PCH Retail Prosectus June 2011Document309 pagesPCH Retail Prosectus June 2011ankurmac1No ratings yet

- PF Admin Charges Reduced To 0.5% From 1 June 2018 and EDLI Admin Charges Waived by EPFO - CA ClubDocument4 pagesPF Admin Charges Reduced To 0.5% From 1 June 2018 and EDLI Admin Charges Waived by EPFO - CA ClubNISHA SONARNo ratings yet

- Here Are Five Reasons Why Should I Study FinanceDocument5 pagesHere Are Five Reasons Why Should I Study Financekazi A.R RafiNo ratings yet

- IX. How To Read Financial Bond Pages: Notes HDocument7 pagesIX. How To Read Financial Bond Pages: Notes HZvioule Ma FuentesNo ratings yet

- Calculate Z ScoreDocument4 pagesCalculate Z ScoreKarthuu RaajNo ratings yet

- Buoyant Factsheet 2023 11Document4 pagesBuoyant Factsheet 2023 11Sabyasachi ChatterjeeNo ratings yet

- 2010 BIR-RMC ContentsDocument19 pages2010 BIR-RMC ContentsMary Grace Caguioa AgasNo ratings yet

- Esop FinalDocument31 pagesEsop Finalansh384100% (2)

- Market Reaction To Multiple Buybacks in IndiaDocument32 pagesMarket Reaction To Multiple Buybacks in Indiagautam_gujral3088488No ratings yet

- Macroeconomics QuestionsDocument2 pagesMacroeconomics QuestionsBaber AminNo ratings yet

- Veritaseum Opposition BriefDocument36 pagesVeritaseum Opposition BriefAnonymous RXEhFbNo ratings yet

- Unit 1: Vocabulary: AKT 9 OctDocument3 pagesUnit 1: Vocabulary: AKT 9 OctPecinta bobaNo ratings yet

- Shri Ganesh Dal Mill Is A Prominent Name in The Dal IndustryDocument9 pagesShri Ganesh Dal Mill Is A Prominent Name in The Dal IndustryNeerajSinghNo ratings yet

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesDocument2 pagesFixedline and Broadband Services: Your Account Summary This Month'S ChargesShahid MNo ratings yet

- 28 Solved PCC Cost FM Nov09Document16 pages28 Solved PCC Cost FM Nov09Karan Joshi100% (1)

- Case 1 MACCDocument4 pagesCase 1 MACCFatima ShakeelNo ratings yet

- AACONAPPS2 - Audit of Cash Reviewer (Theories)Document2 pagesAACONAPPS2 - Audit of Cash Reviewer (Theories)Dawson Dela CruzNo ratings yet

- Annual Report 2016Document202 pagesAnnual Report 2016Asif NawazNo ratings yet

- HB 1250 Housing Trust FundDocument2 pagesHB 1250 Housing Trust FundKING 5 NewsNo ratings yet

- GST 106 (Ebo Timileyin Jonathan Pka Ijoba Psyc) - 1Document20 pagesGST 106 (Ebo Timileyin Jonathan Pka Ijoba Psyc) - 1lisahenry6001No ratings yet

- Insurance Reviewer Richard Allan A. Lim: For Personal Use Only. Unauthorized Distribution Prohibited 1Document8 pagesInsurance Reviewer Richard Allan A. Lim: For Personal Use Only. Unauthorized Distribution Prohibited 1Richard Allan LimNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-3Document4 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-3Pramod VasudevNo ratings yet

- Original Ketar BP EditedDocument19 pagesOriginal Ketar BP EditedlemadanielNo ratings yet

- Iim TirchapaliDocument16 pagesIim TirchapaliAditya SharmaNo ratings yet

Market+Risk Worksheet

Market+Risk Worksheet

Uploaded by

Haritika Chhatwal0 ratings0% found this document useful (0 votes)

3 views18 pagesThis document discusses Value at Risk (VaR) and how to calculate it. VaR is defined as the maximum potential loss over a target period and given confidence level, excluding extreme events. It provides an example calculation of VaR for a $100 million bond portfolio at the 95% confidence level over one month. Using historical monthly medium-term bond returns from 1953 to 1995, it determines that the VaR is $1.7 million, meaning there is a 5% chance of losing more than this amount in a given month. The document also outlines parametric and historical simulation approaches to computing VaR and provides stock market data to calculate VaR for individual stocks using these two methods.

Original Description:

Market+Risk

Original Title

Market+Risk worksheet

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses Value at Risk (VaR) and how to calculate it. VaR is defined as the maximum potential loss over a target period and given confidence level, excluding extreme events. It provides an example calculation of VaR for a $100 million bond portfolio at the 95% confidence level over one month. Using historical monthly medium-term bond returns from 1953 to 1995, it determines that the VaR is $1.7 million, meaning there is a 5% chance of losing more than this amount in a given month. The document also outlines parametric and historical simulation approaches to computing VaR and provides stock market data to calculate VaR for individual stocks using these two methods.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views18 pagesMarket+Risk Worksheet

Market+Risk Worksheet

Uploaded by

Haritika ChhatwalThis document discusses Value at Risk (VaR) and how to calculate it. VaR is defined as the maximum potential loss over a target period and given confidence level, excluding extreme events. It provides an example calculation of VaR for a $100 million bond portfolio at the 95% confidence level over one month. Using historical monthly medium-term bond returns from 1953 to 1995, it determines that the VaR is $1.7 million, meaning there is a 5% chance of losing more than this amount in a given month. The document also outlines parametric and historical simulation approaches to computing VaR and provides stock market data to calculate VaR for individual stocks using these two methods.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 18

MARKET RISK

haritika74@gmail.com

BABIINTLMAY19001

Financial and Risk Analytics

This file is meant for personal use by haritika74@gmail.com only.

Proprietary content. ©GreatSharing

Learning. All Rights the

or publishing Reserved.

contentsUnauthorized

in part or full isuse orfor

liable distribution prohibited.

legal action.

Agenda

haritika74@gmail.com

BABIINTLMAY19001

This file is meant for personal use by haritika74@gmail.com only.

Proprietary content. ©GreatSharing

Learning. All Rights the

or publishing Reserved.

contentsUnauthorized

in part or full isuse orfor

liable distribution prohibited.

legal action.

Value at Risk (VAR)

VAR is the maximum loss over a target,

horizon within a confidence interval (or, under

normal market conditions)

In other words, if none of the “extreme

haritika74@gmail.com

BABIINTLMAY19001

events”(i.e., low-probability events) occurs,

what is my maximum loss over a given time

period?

This file is meant for personal use by haritika74@gmail.com only.

Proprietary content. ©GreatSharing

Learning. All Rights the

or publishing Reserved.

contentsUnauthorized

in part or full isuse orfor

liable distribution prohibited.

legal action.

Another Definition of VAR

•A forecast of a given percentile, usually in the

lower tail, of the distribution of returns on a

portfolio over some period; similar in principle

to an estimate of the expected return on a

haritika74@gmail.com

BABIINTLMAY19001

portfolio, which is a forecast of the 50th

percentile.

Ex: 95% one-tail normal distribution is 1.645

sigma (Pr(x<=X)=0.05, X=-1.645) while 99%

normal distribution is 2.326 sigma

This file is meant for personal use by haritika74@gmail.com only.

Proprietary content. ©GreatSharing

Learning. All Rights the

or publishing Reserved.

contentsUnauthorized

in part or full isuse orfor

liable distribution prohibited.

legal action.

VAR: Example

•Consider a $100 million portfolio of medium-

term bonds. Suppose my confidence interval is

95% (i.e., 95% of possible market events is defined

as “normal”.) Then, what is the maximum

haritika74@gmail.com

BABIINTLMAY19001

monthly loss under normal markets over any

month?

•To answer this question, let’s look at the

monthly medium-term bond returns from 1953 to

1995:

•Lowest: -6.5% vs. Highest: 12%

This file is meant for personal use by haritika74@gmail.com only.

Proprietary content. ©GreatSharing

Learning. All Rights the

or publishing Reserved.

contentsUnauthorized

in part or full isuse orfor

liable distribution prohibited.

legal action.

History of Medium Bond Returns

haritika74@gmail.com

BABIINTLMAY19001

This file is meant for personal use by haritika74@gmail.com only.

Proprietary content. ©GreatSharing

Learning. All Rights the

or publishing Reserved.

contentsUnauthorized

in part or full isuse orfor

liable distribution prohibited.

legal action.

Distribution of

Medium Bond Returns

haritika74@gmail.com

BABIINTLMAY19001

This file is meant for personal use by haritika74@gmail.com only.

Proprietary content. ©GreatSharing

Learning. All Rights the

or publishing Reserved.

contentsUnauthorized

in part or full isuse orfor

liable distribution prohibited.

legal action.

Calculating VAR at

95% Confidence

•At the 95% confidence interval, the lowest

monthly return is -1.7%. (I.e., there is a 5% chance

that the monthly medium bond return is lower

than -1.7%)

haritika74@gmail.com

BABIINTLMAY19001

That is, there are 26 months out of the 516 for

which themonthly returns were lower than -1.7%.

•VAR = 100 million X 1.7% = $1.7 million

•(95% of the time, the portfolio’s loss will be no

more than $1.7 million!)

This file is meant for personal use by haritika74@gmail.com only.

Proprietary content. ©GreatSharing

Learning. All Rights the

or publishing Reserved.

contentsUnauthorized

in part or full isuse orfor

liable distribution prohibited.

legal action.

VaR Computation

•Parametric: Delta-Normal

Portfolio return is normally distributed as it is

the linear combination of risky assets

haritika74@gmail.com

•Historical simulation

BABIINTLMAY19001

Looking at the simulation data to compute the

returns with a confidence level

This file is meant for personal use by haritika74@gmail.com only.

Proprietary content. ©GreatSharing

Learning. All Rights the

or publishing Reserved.

contentsUnauthorized

in part or full isuse orfor

liable distribution prohibited.

legal action.

Game

1.Compute the Value At Risk of Single

Stocks using 2 Methods:

1.Historical Simulation

haritika74@gmail.com

BABIINTLMAY19001

2.Parametric

2.Provided is the Data for NSE and BSE

Stocks for the Period 2009-12

This file is meant for personal use by haritika74@gmail.com only.

Proprietary content. ©GreatSharing

Learning. All Rights the

or publishing Reserved.

contentsUnauthorized

in part or full isuse orfor

liable distribution prohibited.

legal action.

Game –Single Stock

Step 1: Choose any 2 Stocks

Step 2: Compute the Weekly Returns (choose 2

years)

Step 3: Do Frequency Distribution Plot

haritika74@gmail.com

BABIINTLMAY19001

Step 4: Compute Mean, Standard Deviation,

Coefficient of Variation etc.

Step 5: Compute VaR(99%) using Parametric

Method & Historical Simulation

Step 6: Validate the results on year three.

This file is meant for personal use by haritika74@gmail.com only.

Proprietary content. ©GreatSharing

Learning. All Rights the

or publishing Reserved.

contentsUnauthorized

in part or full isuse orfor

liable distribution prohibited.

legal action.

Step 1 and 2: ACC

haritika74@gmail.com

BABIINTLMAY19001

This file is meant for personal use by haritika74@gmail.com only.

Proprietary content. ©GreatSharing

Learning. All Rights the

or publishing Reserved.

contentsUnauthorized

in part or full isuse orfor

liable distribution prohibited.

legal action.

Step 3: ACC

haritika74@gmail.com

BABIINTLMAY19001

This file is meant for personal use by haritika74@gmail.com only.

Proprietary content. ©GreatSharing

Learning. All Rights the

or publishing Reserved.

contentsUnauthorized

in part or full isuse orfor

liable distribution prohibited.

legal action.

Step 4: ACC

Mean 0.61%

Stdev

haritika74@gmail.com

BABIINTLMAY19001

4%

COV 670.9%

This file is meant for personal use by haritika74@gmail.com only.

Proprietary content. ©GreatSharing

Learning. All Rights the

or publishing Reserved.

contentsUnauthorized

in part or full isuse orfor

liable distribution prohibited.

legal action.

Step 5: ACC

M Returns with 99% Prob -9% 546,459

Value at Risk (Normal Method) 56,939

M Returns with worst 1% Actual

Dist

haritika74@gmail.com -11% 533,405

BABIINTLMAY19001

Value at Risk (Dist Method) 69,993

This file is meant for personal use by haritika74@gmail.com only.

Proprietary content. ©GreatSharing

Learning. All Rights the

or publishing Reserved.

contentsUnauthorized

in part or full isuse orfor

liable distribution prohibited.

legal action.

Game -Portfolio

Step 1: Choose any 8-10 Stocks

Step 2: Compute Steps 2-4

Step 3: Compute the Portfolio Mean, Standard

haritika74@gmail.com

Deviation etc.

BABIINTLMAY19001

Step4: Compute VaR(99%) using Parametric

Method & Historical Simulation

Step 5: Validate your results using third year

data

This file is meant for personal use by haritika74@gmail.com only.

Proprietary content. ©GreatSharing

Learning. All Rights the

or publishing Reserved.

contentsUnauthorized

in part or full isuse orfor

liable distribution prohibited.

legal action.

How to calculate

Mean/Variance of the portfolio

Let W = [ w1, w2, w3……..w10] – weights invested in 10 Stocks

Mean of the portfolio = Σ w(i)Mean(i), where i= 1…10

Variance of the portfolio = W(i)’Cov(1…10)W(i)

haritika74@gmail.com

BABIINTLMAY19001

This file is meant for personal use by haritika74@gmail.com only.

Proprietary content. ©GreatSharing

Learning. All Rights the

or publishing Reserved.

contentsUnauthorized

in part or full isuse orfor

liable distribution prohibited.

legal action.

Game : Does Mean-Variance

Approach Work for India Market?

Step1: Start with the Same Portfolio from Game

Four.

Step2: Make a Note the Mean, Variance and VaRof

the Portfolio*

haritika74@gmail.com

BABIINTLMAY19001

Step3: Determine the Portfolio Weight Assuming

Mean-Variance Theorem of Markowitz

Step4: Compute and Compare the VaRof this

Portfolio to Portfolio from Game 4.

Step5: What do you Infer?

This file is meant for personal use by haritika74@gmail.com only.

Proprietary content. ©GreatSharing

Learning. All Rights the

or publishing Reserved.

contentsUnauthorized

in part or full isuse orfor

liable distribution prohibited.

legal action.

You might also like

- Distribution Management: Get To Know Each OtherDocument43 pagesDistribution Management: Get To Know Each OtherBuyco, Nicole Kimberly M.No ratings yet

- DMFAS 6 User's Guide PDFDocument263 pagesDMFAS 6 User's Guide PDFRandi Nugraha100% (1)

- Marlinspike Sailor's Arts and Crafts: A Step-by-Step Guide to Tying Classic Sailor's Knots to Create, Adorn, and Show OffFrom EverandMarlinspike Sailor's Arts and Crafts: A Step-by-Step Guide to Tying Classic Sailor's Knots to Create, Adorn, and Show OffRating: 5 out of 5 stars5/5 (2)

- ITP-Day 2 - Deck 28129Document107 pagesITP-Day 2 - Deck 28129Rohit AngiraNo ratings yet

- Model Deployment - SlideDocument14 pagesModel Deployment - Slideph8ks7p89gNo ratings yet

- FRA Week 2Document11 pagesFRA Week 2MonicaNo ratings yet

- ITP-Day 4 - DeckDocument52 pagesITP-Day 4 - DeckRohit AngiraNo ratings yet

- NPV Deck 4Document85 pagesNPV Deck 4harishNo ratings yet

- Logistic Regression VideoDocument37 pagesLogistic Regression VideoSHEKHAR SWAMINo ratings yet

- Hypothesis TestingDocument52 pagesHypothesis TestingMANISH CHOWDARY KakumaniNo ratings yet

- NPV Deck 1Document81 pagesNPV Deck 1harishNo ratings yet

- Stock Prices Stats ExerciseDocument2 pagesStock Prices Stats Exerciseakshayallapur8No ratings yet

- ITP-Day 3 - DeckDocument72 pagesITP-Day 3 - DeckRohit AngiraNo ratings yet

- NPV Deck 2Document89 pagesNPV Deck 2harishNo ratings yet

- FRA Week 1Document30 pagesFRA Week 1MonicaNo ratings yet

- Probability 2Document28 pagesProbability 2MANISH CHOWDARY KakumaniNo ratings yet

- Logistic RegressionDocument13 pagesLogistic Regressionaaryani6991No ratings yet

- FRA Week 1Document30 pagesFRA Week 1borade.vijayNo ratings yet

- Probability DistributionDocument28 pagesProbability DistributionMANISH CHOWDARY KakumaniNo ratings yet

- Class Notes - Intro To MLDocument5 pagesClass Notes - Intro To MLnitheeshbharathi.mNo ratings yet

- Slides - Sentiment AnalysisDocument5 pagesSlides - Sentiment AnalysisGirish ChadhaNo ratings yet

- Economics:: The Core IssuesDocument33 pagesEconomics:: The Core IssuesZahraa SweidanNo ratings yet

- Drivers and Problems of Supply ChainDocument6 pagesDrivers and Problems of Supply ChainNeeraj KumarNo ratings yet

- Descriptive StatsisticsDocument44 pagesDescriptive StatsisticsFaizan SiddiquiNo ratings yet

- Statistical Learning - Probability and DistributionsDocument20 pagesStatistical Learning - Probability and DistributionsGirish ChadhaNo ratings yet

- Chap 7 OshaDocument18 pagesChap 7 OshaSiti Sarah Zalikha Binti Umar BakiNo ratings yet

- Descriptive Statistics 2Document40 pagesDescriptive Statistics 2ARCHANA RNo ratings yet

- Unsupervised Learning - ClusteringDocument40 pagesUnsupervised Learning - ClusteringHiral ShahNo ratings yet

- LAW205 Intentional Torts Chp.7Document23 pagesLAW205 Intentional Torts Chp.7Edward DomanicoNo ratings yet

- Fundamentals of Advanced Accounting 8th Edition Hoyle Solutions ManualDocument36 pagesFundamentals of Advanced Accounting 8th Edition Hoyle Solutions Manualnucleolerebellow.sqelNo ratings yet

- Fundamentals of Advanced Accounting 8th Edition Hoyle Solutions ManualDocument37 pagesFundamentals of Advanced Accounting 8th Edition Hoyle Solutions Manualjocosevannerh98oj100% (34)

- Adm CHP 4 RecruitmentDocument43 pagesAdm CHP 4 RecruitmentLYDIANA LISADNo ratings yet

- EnsembleDocument6 pagesEnsembleGirish ChadhaNo ratings yet

- Chapter 2 - Defining Business EthicsDocument20 pagesChapter 2 - Defining Business EthicsLena KhalidNo ratings yet

- The Challenges of Human Resources ManagementDocument44 pagesThe Challenges of Human Resources ManagementKritika AhujaNo ratings yet

- ML - Week 2 MLSDocument13 pagesML - Week 2 MLSGirish ChadhaNo ratings yet

- Principles of Human Resource Management 16 e Bohlander - SnellDocument18 pagesPrinciples of Human Resource Management 16 e Bohlander - SnellSiti Sarah Zalikha Binti Umar BakiNo ratings yet

- Agenda: Why Is Economics Important in Business?Document4 pagesAgenda: Why Is Economics Important in Business?Sparsh DessaiNo ratings yet

- LU4 RecruitmentDocument32 pagesLU4 RecruitmentNur Rabiatul Anis binti RoslanNo ratings yet

- Product Mix - IntroductionDocument5 pagesProduct Mix - IntroductionSuprith MurthyNo ratings yet

- Chapter 1Document47 pagesChapter 1Faye ManalansanNo ratings yet

- Social+Media+Analytics v02Document57 pagesSocial+Media+Analytics v02Shubradip GhoshNo ratings yet

- Corporate Strategy: Strategic Alliances and Mergers & AcquisitionsDocument37 pagesCorporate Strategy: Strategic Alliances and Mergers & AcquisitionsakashNo ratings yet

- DSBA - Exploratory Data Analysis v2Document22 pagesDSBA - Exploratory Data Analysis v2StocknEarnNo ratings yet

- Python For Non-Programmers FinalDocument218 pagesPython For Non-Programmers FinalVinay KumarNo ratings yet

- Chapter 3 - External Analysis - Industry Structure - Competitive Forces - and Strategic GroupsDocument79 pagesChapter 3 - External Analysis - Industry Structure - Competitive Forces - and Strategic GroupsAlex Rossi100% (1)

- Lecture Slides - PreworkDocument20 pagesLecture Slides - PreworkMayur ShindeNo ratings yet

- Topic 5 Training and DevelopmentDocument38 pagesTopic 5 Training and Developmentinnocent angelNo ratings yet

- Measures+of+Central+Tendency Dispersion +Lecture+SlidesDocument14 pagesMeasures+of+Central+Tendency Dispersion +Lecture+SlidesKABILAN SNo ratings yet

- Bagging and BoostingDocument8 pagesBagging and Boostingaaryani6991No ratings yet

- Slides - Text MiningDocument12 pagesSlides - Text MiningGirish ChadhaNo ratings yet

- CH 2 - HR PlanningDocument40 pagesCH 2 - HR PlanningMark SullivanNo ratings yet

- Chap 2Document15 pagesChap 2Imran HakeemNo ratings yet

- Chapter 7Document29 pagesChapter 7Khan SahabNo ratings yet

- Machine Learning: K-Nearest NeighborsDocument8 pagesMachine Learning: K-Nearest NeighborsAshish Gupta100% (1)

- Fundamentals of Advanced Accounting 8th Edition Hoyle Solutions ManualDocument24 pagesFundamentals of Advanced Accounting 8th Edition Hoyle Solutions ManualJanetSmithonybNo ratings yet

- Chapter 1 LectureDocument35 pagesChapter 1 Lecturepm69kf4rmmNo ratings yet

- Python+for+Non ProgrammersDocument64 pagesPython+for+Non ProgrammersYudhistar GannabattulaNo ratings yet

- IPPTChap 013Document38 pagesIPPTChap 013jazzyxbieber14No ratings yet

- Micro ch21 Presentation6e (2012)Document50 pagesMicro ch21 Presentation6e (2012)Nguyễn Thị Bích TrâmNo ratings yet

- Compensation 12th Edition Milkovich Solutions ManualDocument44 pagesCompensation 12th Edition Milkovich Solutions Manualheidiwatsonwcjponqkai100% (16)

- Hargreaves Et Al (2002) Perspectives - On - Alternative - Assessment - ReformDocument29 pagesHargreaves Et Al (2002) Perspectives - On - Alternative - Assessment - ReformHaritika ChhatwalNo ratings yet

- Research Design Quantitative Analysis For DataDocument50 pagesResearch Design Quantitative Analysis For DataHaritika ChhatwalNo ratings yet

- Financial Statement AnalysisDocument7 pagesFinancial Statement AnalysisHaritika ChhatwalNo ratings yet

- Coding of Data SetDocument105 pagesCoding of Data SetHaritika ChhatwalNo ratings yet

- Syllabus OrientationDocument3 pagesSyllabus OrientationHaritika ChhatwalNo ratings yet

- Ws 9igcse Business July 2018-19Document5 pagesWs 9igcse Business July 2018-19Haritika ChhatwalNo ratings yet

- Ws 9igcse Business October 2018-19Document3 pagesWs 9igcse Business October 2018-19Haritika ChhatwalNo ratings yet

- Solution Set For Mergers and Acquisitions MBA IIIDocument20 pagesSolution Set For Mergers and Acquisitions MBA IIIHaritika ChhatwalNo ratings yet

- WS 9igcse Business April May 2018-19Document6 pagesWS 9igcse Business April May 2018-19Haritika ChhatwalNo ratings yet

- Giisacp Igcse10 BS 2018 19Document6 pagesGiisacp Igcse10 BS 2018 19Haritika ChhatwalNo ratings yet

- Giisacp Igcse10 BS 2018 19Document2 pagesGiisacp Igcse10 BS 2018 19Haritika ChhatwalNo ratings yet

- Prob Dist PracticeDocument2 pagesProb Dist PracticeHaritika ChhatwalNo ratings yet

- CH 5 - Legal DimensionsDocument49 pagesCH 5 - Legal DimensionsHaritika ChhatwalNo ratings yet

- Ch-18 Cross Border Merger DealsDocument35 pagesCh-18 Cross Border Merger DealsHaritika ChhatwalNo ratings yet

- FPI FortnightlyDocument30 pagesFPI FortnightlyHaritika ChhatwalNo ratings yet

- Good Questions On As-14Document97 pagesGood Questions On As-14Haritika ChhatwalNo ratings yet

- Session 1 - Fmi - 17 NovDocument10 pagesSession 1 - Fmi - 17 NovHaritika ChhatwalNo ratings yet

- SESSION 1-2 (Autosaved) (Autosaved)Document79 pagesSESSION 1-2 (Autosaved) (Autosaved)Haritika ChhatwalNo ratings yet

- Amara Raja BatteriesDocument13 pagesAmara Raja BatteriesHaritika ChhatwalNo ratings yet

- Session - 1 FmiDocument17 pagesSession - 1 FmiHaritika ChhatwalNo ratings yet

- Assignment Food Nutrition 2019Document10 pagesAssignment Food Nutrition 2019Haritika ChhatwalNo ratings yet

- Dias PresentationDocument12 pagesDias PresentationHaritika ChhatwalNo ratings yet

- 6.1 Chapter 24 Government Economic Objectives: and PoliciesDocument59 pages6.1 Chapter 24 Government Economic Objectives: and PoliciesHaritika ChhatwalNo ratings yet

- Session 17-18 Consumer and Wholesale Banking (Autosaved)Document61 pagesSession 17-18 Consumer and Wholesale Banking (Autosaved)Haritika ChhatwalNo ratings yet

- Unit Two RDMDocument14 pagesUnit Two RDMHaritika ChhatwalNo ratings yet

- Unit Four RDMDocument7 pagesUnit Four RDMHaritika ChhatwalNo ratings yet

- BADocument1 pageBAHaritika ChhatwalNo ratings yet

- Unit Three RDMDocument12 pagesUnit Three RDMHaritika ChhatwalNo ratings yet

- Final Assignment Cardiogood FitnessDocument31 pagesFinal Assignment Cardiogood FitnessHaritika ChhatwalNo ratings yet

- Unit 1 RDM: February 2018Document16 pagesUnit 1 RDM: February 2018Haritika ChhatwalNo ratings yet

- Ticket - AbibusDocument2 pagesTicket - Abibuspalyadabharat kumarNo ratings yet

- 1 - Introduction To Accountign - Icap - Questions and Answers PDFDocument202 pages1 - Introduction To Accountign - Icap - Questions and Answers PDFM.Abdullah MBIT100% (1)

- Case1 - LEK Vs PWCDocument26 pagesCase1 - LEK Vs PWCmayolgalloNo ratings yet

- TOM EffectsDocument15 pagesTOM EffectsAhmed AÏRNo ratings yet

- Taxation Workbook 2022Document204 pagesTaxation Workbook 2022Navya GulatiNo ratings yet

- PCH Retail Prosectus June 2011Document309 pagesPCH Retail Prosectus June 2011ankurmac1No ratings yet

- PF Admin Charges Reduced To 0.5% From 1 June 2018 and EDLI Admin Charges Waived by EPFO - CA ClubDocument4 pagesPF Admin Charges Reduced To 0.5% From 1 June 2018 and EDLI Admin Charges Waived by EPFO - CA ClubNISHA SONARNo ratings yet

- Here Are Five Reasons Why Should I Study FinanceDocument5 pagesHere Are Five Reasons Why Should I Study Financekazi A.R RafiNo ratings yet

- IX. How To Read Financial Bond Pages: Notes HDocument7 pagesIX. How To Read Financial Bond Pages: Notes HZvioule Ma FuentesNo ratings yet

- Calculate Z ScoreDocument4 pagesCalculate Z ScoreKarthuu RaajNo ratings yet

- Buoyant Factsheet 2023 11Document4 pagesBuoyant Factsheet 2023 11Sabyasachi ChatterjeeNo ratings yet

- 2010 BIR-RMC ContentsDocument19 pages2010 BIR-RMC ContentsMary Grace Caguioa AgasNo ratings yet

- Esop FinalDocument31 pagesEsop Finalansh384100% (2)

- Market Reaction To Multiple Buybacks in IndiaDocument32 pagesMarket Reaction To Multiple Buybacks in Indiagautam_gujral3088488No ratings yet

- Macroeconomics QuestionsDocument2 pagesMacroeconomics QuestionsBaber AminNo ratings yet

- Veritaseum Opposition BriefDocument36 pagesVeritaseum Opposition BriefAnonymous RXEhFbNo ratings yet

- Unit 1: Vocabulary: AKT 9 OctDocument3 pagesUnit 1: Vocabulary: AKT 9 OctPecinta bobaNo ratings yet

- Shri Ganesh Dal Mill Is A Prominent Name in The Dal IndustryDocument9 pagesShri Ganesh Dal Mill Is A Prominent Name in The Dal IndustryNeerajSinghNo ratings yet

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesDocument2 pagesFixedline and Broadband Services: Your Account Summary This Month'S ChargesShahid MNo ratings yet

- 28 Solved PCC Cost FM Nov09Document16 pages28 Solved PCC Cost FM Nov09Karan Joshi100% (1)

- Case 1 MACCDocument4 pagesCase 1 MACCFatima ShakeelNo ratings yet

- AACONAPPS2 - Audit of Cash Reviewer (Theories)Document2 pagesAACONAPPS2 - Audit of Cash Reviewer (Theories)Dawson Dela CruzNo ratings yet

- Annual Report 2016Document202 pagesAnnual Report 2016Asif NawazNo ratings yet

- HB 1250 Housing Trust FundDocument2 pagesHB 1250 Housing Trust FundKING 5 NewsNo ratings yet

- GST 106 (Ebo Timileyin Jonathan Pka Ijoba Psyc) - 1Document20 pagesGST 106 (Ebo Timileyin Jonathan Pka Ijoba Psyc) - 1lisahenry6001No ratings yet

- Insurance Reviewer Richard Allan A. Lim: For Personal Use Only. Unauthorized Distribution Prohibited 1Document8 pagesInsurance Reviewer Richard Allan A. Lim: For Personal Use Only. Unauthorized Distribution Prohibited 1Richard Allan LimNo ratings yet

- Ultimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-3Document4 pagesUltimate Book of Accountancy: Class - XII Accountancy Chapter - 04 (Part - B) : Accounting Ratios Part-3Pramod VasudevNo ratings yet

- Original Ketar BP EditedDocument19 pagesOriginal Ketar BP EditedlemadanielNo ratings yet

- Iim TirchapaliDocument16 pagesIim TirchapaliAditya SharmaNo ratings yet