Professional Documents

Culture Documents

Screenshot 2021-03-06 at 3.27.48 PM

Screenshot 2021-03-06 at 3.27.48 PM

Uploaded by

austinmc20030 ratings0% found this document useful (0 votes)

5 views1 pageThis document discusses receiving the first Economic Impact Payment. It provides answers to frequently asked questions about whether the payment will be reduced if the recipient owes certain debts, how the IRS will determine where to send the payment, and what to do if the recipient's bank account information has changed or they do not have a bank account. It also provides directions to use the Get My Payment application or find additional information on eligibility and payment topics.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses receiving the first Economic Impact Payment. It provides answers to frequently asked questions about whether the payment will be reduced if the recipient owes certain debts, how the IRS will determine where to send the payment, and what to do if the recipient's bank account information has changed or they do not have a bank account. It also provides directions to use the Get My Payment application or find additional information on eligibility and payment topics.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5 views1 pageScreenshot 2021-03-06 at 3.27.48 PM

Screenshot 2021-03-06 at 3.27.48 PM

Uploaded by

austinmc2003This document discusses receiving the first Economic Impact Payment. It provides answers to frequently asked questions about whether the payment will be reduced if the recipient owes certain debts, how the IRS will determine where to send the payment, and what to do if the recipient's bank account information has changed or they do not have a bank account. It also provides directions to use the Get My Payment application or find additional information on eligibility and payment topics.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

SEARCH HELP MENU

Economic Impact

Payment Information

Center — Topic D:

Receiving My

Payment

English Español

More In News +

This Topic is about the first Economic Impact

Payment.

Q D1. Will my payment be reduced

or offset if I owe tax, have a

payment agreement with the IRS,

owe other federal or state debt or

owe money to other debt collectors?

(updated November 5, 2020)

A1. The CARES Act limits offsets of Economic

Impact Payments to past-due child support. No

other federal or state debts that normally offset

your tax refunds will reduce the payment.

Nevertheless, tax refunds paid under the

Internal Revenue Code, including the Economic

Impact Payment, are not protected from

garnishment by creditors once the proceeds are

deposited into an individual’s bank account.

Q D2. Will my payment be offset if

my spouse or I owe past-due child

support? (updated December 11,

2020)

Q D3. How will the IRS know where

to send my Payment? (updated May

15, 2020)

Q D4. What if the bank account

number I used on my recent tax

return is closed or no longer

active? (updated December 3, 2020)

Q D5. If I filed my 2019 tax return

and paid my taxes electronically

from my bank account using an

electronic funds withdrawal, Direct

Pay, or Electronic Federal Tax

Payment System (EFTPS)) will the

IRS send my Payment to the account

I used? (updated November 5, 2020)

Q D6. Where do I find the bank

account information the IRS needs?

(updated November 5, 2020)

Q D7. What if I don’t have a bank

account? (updated May 20, 2020)

Q D8. What happens to my payment

if my address on my filed 2019 tax

return is different? (updated

January 15, 2021)

Q D9. Where did you get the bank

information for me, and what if I

need to change it? (updated May 14,

2020)

Q D10. If I requested a direct deposit

of my Payment. Why are you mailing

it to me as a check? (updated

November 5, 2020)

Q D11. What should I do if I think I

received more than one Economic

Impact Payment? (updated

September 25, 2020)

Q D12. I received an Economic

Impact Payment at my address

abroad. The check cannot be

deposited into my foreign bank

account. Can I send the check back

and ask for a deposit? (added

September 22, 2020)

Get My Payment

Use the Get My Payment application and FAQs to

answer your questions about your payment, using

the application, eligibility, and more.

Get My Payment application

Get My Payment FAQs

Economic Impact Payment Topics

Topic A: EIP Eligibility

Topic B: Requesting My Economic Impact

Payment

Topic C: Calculating My Economic Impact

Payment

Topic D: Receiving My Payment

Topic E: EIP Cards

Topic F: Payment Issued but Lost, Stolen,

Destroyed or Not Received

Topic G: Non-Filers Tool

Topic H: Social Security, Railroad Retirement

and Department of Veteran Affairs benefit

recipients

Topic I: Returning the Economic Impact

Payment

Topic J: Reconciling on your 2020 tax return

Topic K: General Information

Page Last Reviewed or Updated: 25-Jan-2021

& Share ' Print

+ OUR AGENCY

+ KNOW YOUR RIGHTS

+ RESOLVE AN ISSUE

+ LANGUAGES

+ RELATED SITES

!"#$%

Privacy Policy

Accessibility

You might also like

- Case 1 Sample SolutionsDocument9 pagesCase 1 Sample SolutionsBillie JeanNo ratings yet

- Targeted and Supplemental Advance FAQ - FINAL-508Document8 pagesTargeted and Supplemental Advance FAQ - FINAL-508Earnell BrownNo ratings yet

- Cruz2007 Chapter3 SM FinalDocument20 pagesCruz2007 Chapter3 SM Finalasd50% (4)

- 1B-FNDC003 BOM12 2S2021 EA07: Adjusting Entries: End of QuizDocument9 pages1B-FNDC003 BOM12 2S2021 EA07: Adjusting Entries: End of QuizNina Donato100% (1)

- Five Star Health and Safety Management System Audit ReportDocument34 pagesFive Star Health and Safety Management System Audit Reportkirandevi198150% (2)

- No Description Uptime Tier Topology TIA-942-BDocument2 pagesNo Description Uptime Tier Topology TIA-942-BJeff100% (3)

- Reflections of Feelings - RogersDocument3 pagesReflections of Feelings - RogersUyên TrươngNo ratings yet

- Clinical Prescription Management Problems: Laura Kravitz and Aamer SafdarDocument32 pagesClinical Prescription Management Problems: Laura Kravitz and Aamer SafdarAnand RajNo ratings yet

- Fs 2022 07Document27 pagesFs 2022 07gloober22No ratings yet

- IRS FAQ On The Recovery Rebate CreditDocument32 pagesIRS FAQ On The Recovery Rebate CreditCurtis Heyen100% (1)

- Fs 2022 26Document33 pagesFs 2022 26ukikalynn76No ratings yet

- IRS Updates The 2021 Child Tax Credit and Advance Child Tax Credit Frequently Asked QuestionsDocument25 pagesIRS Updates The 2021 Child Tax Credit and Advance Child Tax Credit Frequently Asked QuestionsCrystal KleistNo ratings yet

- IRS FAQ On 2021 Child Tax Credit and Advance Child Tax Credit PaymentsDocument21 pagesIRS FAQ On 2021 Child Tax Credit and Advance Child Tax Credit PaymentsCurtis HeyenNo ratings yet

- View Payments: Information On Novel CoronavirusDocument2 pagesView Payments: Information On Novel CoronavirusKevin M WoodardNo ratings yet

- Byrd and Chens Canadian Tax Principles Canadian 1st Edition Byrd Test Bank 1Document36 pagesByrd and Chens Canadian Tax Principles Canadian 1st Edition Byrd Test Bank 1matthewmannocjqnixymt100% (33)

- Chinatown Foundation COVID-19 Relief Summary - EnglishDocument3 pagesChinatown Foundation COVID-19 Relief Summary - EnglishXiaoleen SiowNo ratings yet

- 2022 Ontario Personal Tax Credits Return - Ivano Volpe PDFDocument2 pages2022 Ontario Personal Tax Credits Return - Ivano Volpe PDFLISA VOLPENo ratings yet

- Chapter 5 - Tax PayableDocument36 pagesChapter 5 - Tax PayableRyan YangNo ratings yet

- +Document1 page+K'Gun Kanlaya ChafuNo ratings yet

- Shade NeDocument4 pagesShade Nezermaine.brooksNo ratings yet

- CpaDocument17 pagesCpaKeti AnevskiNo ratings yet

- Tax Organizer ShortDocument28 pagesTax Organizer ShortExactCPANo ratings yet

- Frequently Asked Questions Concerning Retirement and Tax ErrorsDocument2 pagesFrequently Asked Questions Concerning Retirement and Tax ErrorsAbsNo ratings yet

- Rose Hudson Workbook Case StudyDocument6 pagesRose Hudson Workbook Case StudyMary O'KeeffeNo ratings yet

- Loan Rein Ex InfoDocument5 pagesLoan Rein Ex InfoGomezLiliNo ratings yet

- "Child Tax Credits and Economic Impact Payments" May Have Considerable Implications For Your Tax FilingDocument2 pages"Child Tax Credits and Economic Impact Payments" May Have Considerable Implications For Your Tax FilingNewzjunky0% (1)

- Form p50Document2 pagesForm p50Carlos ResendeNo ratings yet

- Tax Deduction Sheet Paid Money in 2021Document6 pagesTax Deduction Sheet Paid Money in 2021rasool mehrjooNo ratings yet

- Ssa 1099 - Ssa 1042s Letter 6 5Document2 pagesSsa 1099 - Ssa 1042s Letter 6 5Dutchavelli5thNo ratings yet

- Ontario TD1Document2 pagesOntario TD1Diego Gallo MacínNo ratings yet

- ACC 330 Final Project Formal Letter To Client TemplateDocument4 pagesACC 330 Final Project Formal Letter To Client TemplateBREANNA JOHNSONNo ratings yet

- TD1 2023 - BCDocument2 pagesTD1 2023 - BCਸੁਖਮਨਪ੍ਰੀਤ ਕੌਰ ਢਿੱਲੋਂNo ratings yet

- Advance Payments of The Child Tax Credit: Which Online Tool Should I Use?Document1 pageAdvance Payments of The Child Tax Credit: Which Online Tool Should I Use?Shelby TateNo ratings yet

- Payroll Accounting 2019 5Th Edition Landin Test Bank Full Chapter PDFDocument67 pagesPayroll Accounting 2019 5Th Edition Landin Test Bank Full Chapter PDFentrickaretologyswr100% (9)

- FAO Reco Account Payable J285611951Document3 pagesFAO Reco Account Payable J285611951dotaemumNo ratings yet

- IRS Notice 1444-DDocument2 pagesIRS Notice 1444-DCourier JournalNo ratings yet

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This Packagetarles666No ratings yet

- Important Information About Form 1099-G: J Cruz 598 Courtlandt Av Apt 2B Bronx Ny 10451Document1 pageImportant Information About Form 1099-G: J Cruz 598 Courtlandt Av Apt 2B Bronx Ny 10451Victor ErazoNo ratings yet

- Tax Credit Return PDFDocument2 pagesTax Credit Return PDFserbisyongtotooNo ratings yet

- Connecticut Resident Income Tax InformationDocument11 pagesConnecticut Resident Income Tax InformationShraddhanand MoreNo ratings yet

- 2022 Individual Tax Organizer FillableDocument6 pages2022 Individual Tax Organizer FillableTham DangNo ratings yet

- Ssa 1099 - Ssa 1042s LetterDocument2 pagesSsa 1099 - Ssa 1042s LetterMr AssNo ratings yet

- How To Prepare Adjusting Entries - Step-By-Step (2023)Document10 pagesHow To Prepare Adjusting Entries - Step-By-Step (2023)Yaseen GhulamNo ratings yet

- Appeal Form 2023-2024Document3 pagesAppeal Form 2023-2024Thushara ThomasNo ratings yet

- Lupoaeveronica 2022 1BDocument18 pagesLupoaeveronica 2022 1BBianca DuracNo ratings yet

- Td1on Fill 22eDocument2 pagesTd1on Fill 22eOluwafeyikemi olusogaNo ratings yet

- The Q Word: Balance DueDocument5 pagesThe Q Word: Balance DueCenter for Economic ProgressNo ratings yet

- Form 11sDocument12 pagesForm 11sgilbert.belciugNo ratings yet

- What Is Taxable Income?: Key TakeawaysDocument4 pagesWhat Is Taxable Income?: Key TakeawaysBella AyabNo ratings yet

- 2021 Instructions For Schedule 8812: Credits For Qualifying Children and Other DependentsDocument12 pages2021 Instructions For Schedule 8812: Credits For Qualifying Children and Other DependentsCrystal KleistNo ratings yet

- SETC Tax Credit Guide 130316Document2 pagesSETC Tax Credit Guide 130316r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Federal Income Tax OutlineDocument62 pagesFederal Income Tax OutlineLiz ElidrissiNo ratings yet

- On-Site Guide (BS 7671 - 2018) (Electrical Regulations)Document4 pagesOn-Site Guide (BS 7671 - 2018) (Electrical Regulations)Farshid AhmadiNo ratings yet

- Slandour & Co. in Relation To This Matter. The Purpose of This Letter Is To Outline My Advices inDocument3 pagesSlandour & Co. in Relation To This Matter. The Purpose of This Letter Is To Outline My Advices inDavid HumphreysNo ratings yet

- td1bc 24eDocument2 pagestd1bc 24eprueba.etoroNo ratings yet

- Tax Law Changes As A Result of The CoronavirusDocument7 pagesTax Law Changes As A Result of The CoronavirusGraceNo ratings yet

- SETC Tax Credit Guide 214276Document2 pagesSETC Tax Credit Guide 214276r.i.c.h.a.rdca.l.dwell.u.sa1No ratings yet

- Coronavirus Economic Impact Payment FAQ 4.14.20 1Document2 pagesCoronavirus Economic Impact Payment FAQ 4.14.20 1Indiana Family to FamilyNo ratings yet

- Forward Budgeting: A Paperless and Electronic Household Budget SystemFrom EverandForward Budgeting: A Paperless and Electronic Household Budget SystemNo ratings yet

- Economic Impact Payments For Social Security and Ssi RecipientsDocument7 pagesEconomic Impact Payments For Social Security and Ssi RecipientsLeanne Joy RumbaoaNo ratings yet

- 21 MoneyDocument2 pages21 MoneyНаталія ГилюкNo ratings yet

- The Disability Tax Credit Ultimate Resource Guide Updated February 2021Document22 pagesThe Disability Tax Credit Ultimate Resource Guide Updated February 2021Michelle Van UdenNo ratings yet

- W2 2010Document2 pagesW2 2010Rick Nunns100% (2)

- Screenshot 2023-09-27 at 9.16.56 AMDocument1 pageScreenshot 2023-09-27 at 9.16.56 AMaustinmc2003No ratings yet

- Uploaded: 6 Jan 2021 at 3:50 PM Plagiarism: % Words: Checked WordsDocument17 pagesUploaded: 6 Jan 2021 at 3:50 PM Plagiarism: % Words: Checked Wordsaustinmc2003No ratings yet

- Screenshot 2021-08-12 at 12.16.56 PMDocument1 pageScreenshot 2021-08-12 at 12.16.56 PMaustinmc2003No ratings yet

- Screenshot 2021-09-02 at 10.52.16 PMDocument1 pageScreenshot 2021-09-02 at 10.52.16 PMaustinmc2003No ratings yet

- Mail - Austin Smith - OutlookDocument1 pageMail - Austin Smith - Outlookaustinmc2003No ratings yet

- AutorwillidanceDocument1 pageAutorwillidanceaustinmc2003No ratings yet

- Screenshot 2023-05-07 at 1.07.05 PMDocument1 pageScreenshot 2023-05-07 at 1.07.05 PMaustinmc2003No ratings yet

- Screenshot 2022-07-18 at 3.33.34 PMDocument1 pageScreenshot 2022-07-18 at 3.33.34 PMaustinmc2003No ratings yet

- Screenshot 2021-07-27 at 2.01.19 PMDocument1 pageScreenshot 2021-07-27 at 2.01.19 PMaustinmc2003No ratings yet

- VR RenewalDocument1 pageVR Renewalaustinmc2003No ratings yet

- Screenshot 2023-02-16 at 8.29.42 PMDocument1 pageScreenshot 2023-02-16 at 8.29.42 PMaustinmc2003No ratings yet

- Screenshot 2023-11-16 at 8.19.03 AMDocument1 pageScreenshot 2023-11-16 at 8.19.03 AMaustinmc2003No ratings yet

- Screenshot 2021-03-12 at 4.14.16 PMDocument1 pageScreenshot 2021-03-12 at 4.14.16 PMaustinmc2003No ratings yet

- Situation Analysis of Informal Settlements in KisumuDocument97 pagesSituation Analysis of Informal Settlements in KisumunyonjecollinsNo ratings yet

- CoilDocument8 pagesCoilJosé Luis Martinez GodoyNo ratings yet

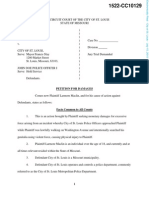

- Maclin SuitDocument5 pagesMaclin Suitnicholas.phillipsNo ratings yet

- SPE-177272-MS Replacement of ESP With Long Stroke Pumping Units in Heavy and High Viscous Oil in Maranta Block WellsDocument16 pagesSPE-177272-MS Replacement of ESP With Long Stroke Pumping Units in Heavy and High Viscous Oil in Maranta Block WellsFajar Putra NugrahaNo ratings yet

- Butterfly Valve?: No Valve No Description Size Type Type Dmv/Econ DrawingDocument1 pageButterfly Valve?: No Valve No Description Size Type Type Dmv/Econ DrawingRafael MedinaNo ratings yet

- Soal PAS 2019 Bahasa Inggris IX Paket ADocument11 pagesSoal PAS 2019 Bahasa Inggris IX Paket AOka Antara100% (1)

- Klarer Alexandra Resume 2020Document4 pagesKlarer Alexandra Resume 2020api-372551104No ratings yet

- Phil.. Cartoon'sDocument17 pagesPhil.. Cartoon'sKaye Anthonette VedadNo ratings yet

- Action Plan On Early Reg2Document2 pagesAction Plan On Early Reg2motmag94% (64)

- 27 Sps Nilo and Stella Cha V CADocument3 pages27 Sps Nilo and Stella Cha V CAJunNo ratings yet

- Administration Manual: Khelo India Fitness Assessment in Schools - Version 2.0Document35 pagesAdministration Manual: Khelo India Fitness Assessment in Schools - Version 2.0Devesh JeenaNo ratings yet

- University of San Agustin: Senior High School DepartmentDocument3 pagesUniversity of San Agustin: Senior High School DepartmentJana Viktoria SecretoNo ratings yet

- General Epidemiology:: Historical Development, Definition, Scope and ApplicationDocument32 pagesGeneral Epidemiology:: Historical Development, Definition, Scope and ApplicationscholasticaNo ratings yet

- Nutanix EUC Solutions Sales Enabler For PartnersDocument2 pagesNutanix EUC Solutions Sales Enabler For PartnersKevin Karl Gabutin JornacionNo ratings yet

- Fs Nawi Artikel1998 OnlineDocument13 pagesFs Nawi Artikel1998 OnlineRahul SharmaNo ratings yet

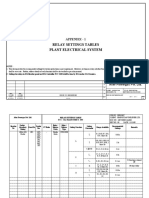

- Relay Settings TablesDocument29 pagesRelay Settings Tablesgirishprabhu1984No ratings yet

- Dental Changes in Humans With Untreated Normal Occlusion Throughout Lifetime A Systematic Scoping ReviewDocument26 pagesDental Changes in Humans With Untreated Normal Occlusion Throughout Lifetime A Systematic Scoping ReviewNatasha NascimentoNo ratings yet

- Parental Satisfaction (Parents of Children 0-17, Elementary-High School) - 0Document4 pagesParental Satisfaction (Parents of Children 0-17, Elementary-High School) - 0Sergio Alejandro Blanes CàceresNo ratings yet

- Blood Gas Control - Level 3 (BG Control 3)Document2 pagesBlood Gas Control - Level 3 (BG Control 3)Xuarami Estrada QuintanaNo ratings yet

- MSDS B-Kurita KF SBL-20Document1 pageMSDS B-Kurita KF SBL-20Arief SetiawanNo ratings yet

- HFGHFGHDocument5 pagesHFGHFGHcredo99No ratings yet

- Methodology For Puff Test at Descharge Pressure.Document4 pagesMethodology For Puff Test at Descharge Pressure.kazmi naqashNo ratings yet

- The Spirit Controlled Life Ebook PDF 1Document184 pagesThe Spirit Controlled Life Ebook PDF 1Okesola AbayomiNo ratings yet

- US Internal Revenue Service: Irb07-39Document72 pagesUS Internal Revenue Service: Irb07-39IRSNo ratings yet

- Eating Disorders Reading AssignmentDocument2 pagesEating Disorders Reading AssignmentNasratullah sahebzadaNo ratings yet

- Part V (C) - Risk Management - JSA & SOP (Day 2)Document22 pagesPart V (C) - Risk Management - JSA & SOP (Day 2)kwong siongNo ratings yet