Professional Documents

Culture Documents

Class 11 Question Paper On Depriciation

Class 11 Question Paper On Depriciation

Uploaded by

Waheguru 123Copyright:

Available Formats

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Depreciation Accounts 1. Answer The Following. (4 Marks Each)Document2 pagesDepreciation Accounts 1. Answer The Following. (4 Marks Each)Yashvi FulwalaNo ratings yet

- Problems On DepreciationDocument3 pagesProblems On Depreciation203 555 Nishma DSouzaNo ratings yet

- Revision Assign - DepreciationDocument2 pagesRevision Assign - DepreciationTribhuwan JoshiNo ratings yet

- Depreciation AssignmentDocument3 pagesDepreciation Assignmentjainmoulding.jainjainNo ratings yet

- Depreciation Questions.Document2 pagesDepreciation Questions.doshifamily.raahilNo ratings yet

- Untitled DocumentDocument3 pagesUntitled Documentnyssapandey9No ratings yet

- Depreciation AssignmentDocument5 pagesDepreciation AssignmentFalak SagarNo ratings yet

- Booklet 13Document12 pagesBooklet 13lakishagupta25No ratings yet

- DepreciationDocument15 pagesDepreciationYash AggarwalNo ratings yet

- Depreciation: Illustration 1 (Journal Entries)Document3 pagesDepreciation: Illustration 1 (Journal Entries)Navnidh KaurNo ratings yet

- DDDDDocument1 pageDDDDGeet DharmaniNo ratings yet

- Practice Question For Depreciation & ProvisionDocument2 pagesPractice Question For Depreciation & ProvisionAli QasimNo ratings yet

- Depreciation Basic - Problem1Document2 pagesDepreciation Basic - Problem1Pallavi Ingale0% (1)

- HSC Bk1Document48 pagesHSC Bk1avtaran100% (1)

- Chapter 13 - DepreciationDocument30 pagesChapter 13 - DepreciationKumari Kumari100% (1)

- Adobe Scan Apr 06, 2023Document14 pagesAdobe Scan Apr 06, 2023ineshbanerjee80No ratings yet

- Depreciation 28-10-23Document8 pagesDepreciation 28-10-23RONAK THE LEGENDNo ratings yet

- BBA II Chapter 3 Depreciation ProblemsDocument4 pagesBBA II Chapter 3 Depreciation ProblemsSiddharth SalgaonkarNo ratings yet

- DepreciationDocument60 pagesDepreciationsafafasfasfasfsafNo ratings yet

- Financial Accounting Practice Questions of DepreciationDocument3 pagesFinancial Accounting Practice Questions of DepreciationRaffayNo ratings yet

- AdditionalPracticalProblemPg.14.52 14Document1 pageAdditionalPracticalProblemPg.14.52 14Vijay KumarNo ratings yet

- Vikas Mahila Campus Accountancy - Xi: ST STDocument1 pageVikas Mahila Campus Accountancy - Xi: ST STAnkit GuptaNo ratings yet

- Accounting of DepreciationDocument2 pagesAccounting of DepreciationAkshay KawadeNo ratings yet

- Problems On Hire PurchaseDocument2 pagesProblems On Hire Purchasekumarjhabhaskar3No ratings yet

- Depreciation Assignment SumsDocument2 pagesDepreciation Assignment SumsshuklaworiorNo ratings yet

- AbdulSamad 12 15796 1 DepreciationDocument12 pagesAbdulSamad 12 15796 1 DepreciationSyed SumamaNo ratings yet

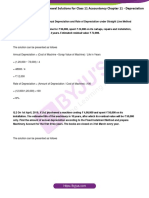

- Ts Grewal Solutions For Class 11 Accountancy Chapter 11 DepreciationDocument52 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 11 DepreciationKishore Kumar Chandra SekarNo ratings yet

- DepreciationDocument1 pageDepreciationSiva SankariNo ratings yet

- Depreciation Class WorkDocument5 pagesDepreciation Class WorkChaaru VarshiniNo ratings yet

- Exam Paper Class - Xi M. M. 32 Sub - Accountancy Time: 1hr.: Q.3. A Company Bought A Machinery On 1Document2 pagesExam Paper Class - Xi M. M. 32 Sub - Accountancy Time: 1hr.: Q.3. A Company Bought A Machinery On 1Iron ManNo ratings yet

- Unit III - DepreciationDocument5 pagesUnit III - Depreciationkailasbankar96No ratings yet

- Videep Institute Dhanbad 7979800517 Accounts TestDocument2 pagesVideep Institute Dhanbad 7979800517 Accounts TestMysterious RohitNo ratings yet

- Long Answer Type QuestionsDocument2 pagesLong Answer Type QuestionssarithaNo ratings yet

- Depreciation 11 TH Class 16.12.2024Document1 pageDepreciation 11 TH Class 16.12.2024anchalrktg22No ratings yet

- CBSE Class 11 Accountancy - DepreciationDocument1 pageCBSE Class 11 Accountancy - Depreciationrohan guptaNo ratings yet

- Topic: Depreciation (Cost of Machine) Made by Sir Hyder AliDocument4 pagesTopic: Depreciation (Cost of Machine) Made by Sir Hyder AliHaroon KhatriNo ratings yet

- DepreciationDocument4 pagesDepreciationMadhura KhapekarNo ratings yet

- Assignment BHM AccountsDocument2 pagesAssignment BHM AccountsShahbaz AlamNo ratings yet

- Accounts Final RaoDocument190 pagesAccounts Final RaoSameer Krishna100% (1)

- 1st Semester Accounts Selected Question PDFDocument32 pages1st Semester Accounts Selected Question PDFVernon Roy100% (1)

- Accounting of DepreciationDocument9 pagesAccounting of DepreciationPrasad BhanageNo ratings yet

- Assignment DepreciationDocument1 pageAssignment DepreciationRishit PrakashNo ratings yet

- Ambience Academy: STD 11 Commerce Account DepeciationDocument2 pagesAmbience Academy: STD 11 Commerce Account DepeciationMenu GargNo ratings yet

- DEPRECIATION2Document2 pagesDEPRECIATION2PearlNo ratings yet

- Depreciation DPP 0365e7569cab6efa00184768ceDocument6 pagesDepreciation DPP 0365e7569cab6efa00184768ceag552259No ratings yet

- 2023 Tutorials Capital Allow & RecoupmtDocument10 pages2023 Tutorials Capital Allow & RecoupmtNchafie AsemahleNo ratings yet

- AccountingDocument6 pagesAccountingGourav SaxenaNo ratings yet

- Additional Practical Problems-15Document5 pagesAdditional Practical Problems-15areet2701No ratings yet

- Depreciation ActivityDocument4 pagesDepreciation ActivityAngelica PagaduanNo ratings yet

- 9 Depreciation 08-2022 Regular Ca FoundationDocument6 pages9 Depreciation 08-2022 Regular Ca FoundationjahnaviNo ratings yet

- Accounting For DepreciationDocument6 pagesAccounting For DepreciationKaran GNo ratings yet

- Depreciation WorksheetDocument1 pageDepreciation WorksheetbnbcafejaipurNo ratings yet

- Accounting Long Questions II YearDocument10 pagesAccounting Long Questions II Yeararshad aliNo ratings yet

- Reliable Classes / C.A.F.C. / Accounts / Depreciation: Prof. Bhambwani'sDocument4 pagesReliable Classes / C.A.F.C. / Accounts / Depreciation: Prof. Bhambwani'sRohit MathurNo ratings yet

- Depreciation: For 11 CommerceDocument12 pagesDepreciation: For 11 CommerceAaditya Agrawal100% (1)

- T Shape Account PreprationDocument5 pagesT Shape Account Preprationrajindere sainiNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034.: First Semester - Nov 2005Document4 pagesLoyola College (Autonomous), Chennai - 600 034.: First Semester - Nov 2005Charles VinothNo ratings yet

- 247942) Depreciation QuestionDocument1 page247942) Depreciation Questionramizrazaa813No ratings yet

- DepreciationDocument3 pagesDepreciationTheivanayaki M PSGRKCWNo ratings yet

Class 11 Question Paper On Depriciation

Class 11 Question Paper On Depriciation

Uploaded by

Waheguru 123Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Class 11 Question Paper On Depriciation

Class 11 Question Paper On Depriciation

Uploaded by

Waheguru 123Copyright:

Available Formats

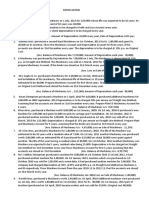

Class 11 Test Paper

Chapter - Depriciation

1. A firm purchased on 1st January, 2010 a second-

hand machinery for Rs.36,000 and spent

Rs.4,000 on its installation.

On 1st July in the same year, another machinery

costing Rs.20,000 was purchased. On 1st July,

2012 machinery brought on 1st January, 2010

was sold for Rs.12,000 and a new machine

purchased for Rs.64,000 on the same date.

Depreciation is provided annually on 31st

December @ 10% per annum on the written

down value method. Show the machinery

account from 2010 to 2012.

2. Following balances exist in the books of Amrit as on

1st April, 2019:

2019 1st April

Machinery A/c 60,000

Provision for Depreciation A/c 36,000

On 1st April, 2019, they sold a machinery for 8,400

which was purchased on 1st April, 2015 for 16,000.

You are required to prepare the Machinery A/c,

Provision for Depreciation A/c and Machinery

Disposal A/c for the year ended 31st March, 2020.

Depreciation was charged at 10% on Cost following

SLM.

3. A firm imported a machine on 1st October, 2016 for ₹

2,00,000, paid custom duty and freight 40,000 and

incurred erection charges * 60,000. Another machinery

costing 1,00,000 was purchased from the local market on

1st April, 2017. On 1st October, 2018, one-third of the

Class 11 Test Paper

Chapter - Depriciation

imported machinery got out of order and was sold for

40,000. Another machinery was purchased to replace the

same for ₹ 50,000 on the same date. Depreciation is to be

charged at 20% per annum on the cost following Straight

Line Method. Accounts are closed each year on 31st

March. You are required to show:

(i) Machinery Account for 2016-17, 2017-18 and 2018-

19.

(ii) Machinery Account and Provision for

Depreciation Account for 2016-17, 2017-18 and 2018-

19.

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Depreciation Accounts 1. Answer The Following. (4 Marks Each)Document2 pagesDepreciation Accounts 1. Answer The Following. (4 Marks Each)Yashvi FulwalaNo ratings yet

- Problems On DepreciationDocument3 pagesProblems On Depreciation203 555 Nishma DSouzaNo ratings yet

- Revision Assign - DepreciationDocument2 pagesRevision Assign - DepreciationTribhuwan JoshiNo ratings yet

- Depreciation AssignmentDocument3 pagesDepreciation Assignmentjainmoulding.jainjainNo ratings yet

- Depreciation Questions.Document2 pagesDepreciation Questions.doshifamily.raahilNo ratings yet

- Untitled DocumentDocument3 pagesUntitled Documentnyssapandey9No ratings yet

- Depreciation AssignmentDocument5 pagesDepreciation AssignmentFalak SagarNo ratings yet

- Booklet 13Document12 pagesBooklet 13lakishagupta25No ratings yet

- DepreciationDocument15 pagesDepreciationYash AggarwalNo ratings yet

- Depreciation: Illustration 1 (Journal Entries)Document3 pagesDepreciation: Illustration 1 (Journal Entries)Navnidh KaurNo ratings yet

- DDDDDocument1 pageDDDDGeet DharmaniNo ratings yet

- Practice Question For Depreciation & ProvisionDocument2 pagesPractice Question For Depreciation & ProvisionAli QasimNo ratings yet

- Depreciation Basic - Problem1Document2 pagesDepreciation Basic - Problem1Pallavi Ingale0% (1)

- HSC Bk1Document48 pagesHSC Bk1avtaran100% (1)

- Chapter 13 - DepreciationDocument30 pagesChapter 13 - DepreciationKumari Kumari100% (1)

- Adobe Scan Apr 06, 2023Document14 pagesAdobe Scan Apr 06, 2023ineshbanerjee80No ratings yet

- Depreciation 28-10-23Document8 pagesDepreciation 28-10-23RONAK THE LEGENDNo ratings yet

- BBA II Chapter 3 Depreciation ProblemsDocument4 pagesBBA II Chapter 3 Depreciation ProblemsSiddharth SalgaonkarNo ratings yet

- DepreciationDocument60 pagesDepreciationsafafasfasfasfsafNo ratings yet

- Financial Accounting Practice Questions of DepreciationDocument3 pagesFinancial Accounting Practice Questions of DepreciationRaffayNo ratings yet

- AdditionalPracticalProblemPg.14.52 14Document1 pageAdditionalPracticalProblemPg.14.52 14Vijay KumarNo ratings yet

- Vikas Mahila Campus Accountancy - Xi: ST STDocument1 pageVikas Mahila Campus Accountancy - Xi: ST STAnkit GuptaNo ratings yet

- Accounting of DepreciationDocument2 pagesAccounting of DepreciationAkshay KawadeNo ratings yet

- Problems On Hire PurchaseDocument2 pagesProblems On Hire Purchasekumarjhabhaskar3No ratings yet

- Depreciation Assignment SumsDocument2 pagesDepreciation Assignment SumsshuklaworiorNo ratings yet

- AbdulSamad 12 15796 1 DepreciationDocument12 pagesAbdulSamad 12 15796 1 DepreciationSyed SumamaNo ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 11 DepreciationDocument52 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 11 DepreciationKishore Kumar Chandra SekarNo ratings yet

- DepreciationDocument1 pageDepreciationSiva SankariNo ratings yet

- Depreciation Class WorkDocument5 pagesDepreciation Class WorkChaaru VarshiniNo ratings yet

- Exam Paper Class - Xi M. M. 32 Sub - Accountancy Time: 1hr.: Q.3. A Company Bought A Machinery On 1Document2 pagesExam Paper Class - Xi M. M. 32 Sub - Accountancy Time: 1hr.: Q.3. A Company Bought A Machinery On 1Iron ManNo ratings yet

- Unit III - DepreciationDocument5 pagesUnit III - Depreciationkailasbankar96No ratings yet

- Videep Institute Dhanbad 7979800517 Accounts TestDocument2 pagesVideep Institute Dhanbad 7979800517 Accounts TestMysterious RohitNo ratings yet

- Long Answer Type QuestionsDocument2 pagesLong Answer Type QuestionssarithaNo ratings yet

- Depreciation 11 TH Class 16.12.2024Document1 pageDepreciation 11 TH Class 16.12.2024anchalrktg22No ratings yet

- CBSE Class 11 Accountancy - DepreciationDocument1 pageCBSE Class 11 Accountancy - Depreciationrohan guptaNo ratings yet

- Topic: Depreciation (Cost of Machine) Made by Sir Hyder AliDocument4 pagesTopic: Depreciation (Cost of Machine) Made by Sir Hyder AliHaroon KhatriNo ratings yet

- DepreciationDocument4 pagesDepreciationMadhura KhapekarNo ratings yet

- Assignment BHM AccountsDocument2 pagesAssignment BHM AccountsShahbaz AlamNo ratings yet

- Accounts Final RaoDocument190 pagesAccounts Final RaoSameer Krishna100% (1)

- 1st Semester Accounts Selected Question PDFDocument32 pages1st Semester Accounts Selected Question PDFVernon Roy100% (1)

- Accounting of DepreciationDocument9 pagesAccounting of DepreciationPrasad BhanageNo ratings yet

- Assignment DepreciationDocument1 pageAssignment DepreciationRishit PrakashNo ratings yet

- Ambience Academy: STD 11 Commerce Account DepeciationDocument2 pagesAmbience Academy: STD 11 Commerce Account DepeciationMenu GargNo ratings yet

- DEPRECIATION2Document2 pagesDEPRECIATION2PearlNo ratings yet

- Depreciation DPP 0365e7569cab6efa00184768ceDocument6 pagesDepreciation DPP 0365e7569cab6efa00184768ceag552259No ratings yet

- 2023 Tutorials Capital Allow & RecoupmtDocument10 pages2023 Tutorials Capital Allow & RecoupmtNchafie AsemahleNo ratings yet

- AccountingDocument6 pagesAccountingGourav SaxenaNo ratings yet

- Additional Practical Problems-15Document5 pagesAdditional Practical Problems-15areet2701No ratings yet

- Depreciation ActivityDocument4 pagesDepreciation ActivityAngelica PagaduanNo ratings yet

- 9 Depreciation 08-2022 Regular Ca FoundationDocument6 pages9 Depreciation 08-2022 Regular Ca FoundationjahnaviNo ratings yet

- Accounting For DepreciationDocument6 pagesAccounting For DepreciationKaran GNo ratings yet

- Depreciation WorksheetDocument1 pageDepreciation WorksheetbnbcafejaipurNo ratings yet

- Accounting Long Questions II YearDocument10 pagesAccounting Long Questions II Yeararshad aliNo ratings yet

- Reliable Classes / C.A.F.C. / Accounts / Depreciation: Prof. Bhambwani'sDocument4 pagesReliable Classes / C.A.F.C. / Accounts / Depreciation: Prof. Bhambwani'sRohit MathurNo ratings yet

- Depreciation: For 11 CommerceDocument12 pagesDepreciation: For 11 CommerceAaditya Agrawal100% (1)

- T Shape Account PreprationDocument5 pagesT Shape Account Preprationrajindere sainiNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034.: First Semester - Nov 2005Document4 pagesLoyola College (Autonomous), Chennai - 600 034.: First Semester - Nov 2005Charles VinothNo ratings yet

- 247942) Depreciation QuestionDocument1 page247942) Depreciation Questionramizrazaa813No ratings yet

- DepreciationDocument3 pagesDepreciationTheivanayaki M PSGRKCWNo ratings yet