Professional Documents

Culture Documents

Adobe Scan 05 Jan 2024

Adobe Scan 05 Jan 2024

Uploaded by

Harshit Garg0 ratings0% found this document useful (0 votes)

8 views2 pages1. The document provides information to prepare a bank reconciliation statement as of a given date. It lists the balance per pass book, details of outstanding cheques and deposits, interest credited and bank charges debited.

2. The key information includes the balance as per pass book, cheques issued but not cleared, deposits made but not yet credited, interest earned and bank charges.

3. Based on the adjustments for these reconciling items, the balance as per cash book is calculated.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The document provides information to prepare a bank reconciliation statement as of a given date. It lists the balance per pass book, details of outstanding cheques and deposits, interest credited and bank charges debited.

2. The key information includes the balance as per pass book, cheques issued but not cleared, deposits made but not yet credited, interest earned and bank charges.

3. Based on the adjustments for these reconciling items, the balance as per cash book is calculated.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

8 views2 pagesAdobe Scan 05 Jan 2024

Adobe Scan 05 Jan 2024

Uploaded by

Harshit Garg1. The document provides information to prepare a bank reconciliation statement as of a given date. It lists the balance per pass book, details of outstanding cheques and deposits, interest credited and bank charges debited.

2. The key information includes the balance as per pass book, cheques issued but not cleared, deposits made but not yet credited, interest earned and bank charges.

3. Based on the adjustments for these reconciling items, the balance as per cash book is calculated.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

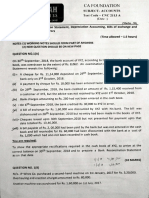

Book is given as Starting Balance

When Credit (Favourable) Balance as per Pass

Statement as on 31st August 2018:

16. Prepare a Bank Reconciliation )

(i) Balance as per Pass Book 20,120

credited on

(ü) Cheque deposited in bank on 25th August, but

2nd September, 20 18 3,600

(iüi) Cheques issued but not yet presented 3,000

(iv) Pass Book shows a credit for interest 320

(v) Pass Book also shows a debit for bank charges 160

(vi) Amount directly deposited by a customer. 1,360

[Ans. Balance as per Cash Book (Dr.) ?19,200|

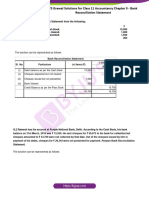

17. From the following information on 31st December, 2018:

(i) On 31st December, 2018 the Bank Pass Book of Karnikashowed a balance of? 18.000

to her credit.

(i) Before that date, she had issued cheques amounting to 9,600 of which cheques

amounting to T3,840 have so far been presented for payment.

(üi) Acheque of 2,640 deposited by her into the bank of 26th December, 2018 is not yet

credited in the Pass Book.

(iv) She had also received acheque of T600 which although entered by her in the bank

column of Cash Book, was omitted to be paid into the bank.

(v) On 30th December, 2018 acheque of 1,884 received by her was paid into the bankbut

the same was omitted to be entered in the Cash Book.

(vi) There was acredit of? 180 for interest on current account and adebit of? 30for bank

charges

Draw up a Bank Reconciliation Statement.

[Ans. Balance as per Cash Book (Dr) ?13,446}

18. Prepare a Bank Reconciliation Statement as on 3lst May, 2018:

) On 31st May, 2018 the Bank Pass Book showed a credit balance of ? 79,500.

(ü) Before that date, cheques had been issued amounting to ?25,000of which chequ

amounting to 720,200 have so far been presented for payment.

creditedin

(iii) Acheque of?15,000 deposited into the bank on 20th May, 2018is not yet

the Pass Book.

the bank column of Cash

(iv) Received acheque of 2,020 which although entered in

Book, was omitted to be paid into the bank.

Rank Reconciliation Statement

13.39

On80th May, 2018 a cheque of

was omitted to be entered in the 7,540 received and paid into the bank but the

Cash Book. same

(vì) There was a credit of 1,525 for interest and a

debit ofZ500 for bank charges.

.n Prepare a Bank [Ans. Balance as per Cash Book (Dr.)

Reconcillation 83,155]

particulars: Statement the books of M/s Arjun as on 30th April, 2017

in

from the following

G) Balance as per Pass Book ?15,000,

Gi) Out oftotal cheques

amounting

18,000 were encashed in

to 52,850 drawn by M/s Arjun,

cheques aggregating

in May 2017 and the rest April, 2017,cheques aggregating ?17,000 were encashed

have not

(iü) Out of total cheques amounting to ?been presented at all.

were credited in April, 2017, cheques 19,000 deposited, cheques aggregating ?9,250

2017 and the rest have not been aggregating 78,000 were credited in May,

collected at all.

(iv) Bank has charged ?120 as its

allowed interest 586 on his bankcommission for collecting outstation cheques and has

balance.

(v) Amount wrongly debited by bank?4,268.

(vi) Acheque of 2,000 was entered in the Cash

Bank in May, 2017. Book in April, 2017, but was sent to the

(vii) Acheque ofR9,980 paid into the bank was returned

was received from the bank till April 2017. dishonoured but no intimation

[Ans. Balance as per Cash Book (Dr.) 5,682]

20. Prepare a Bank Reconciliation Statement as on 30th

particulars:

September, 2018 from the following

(i) Bank balance as per Bank Statement ()

10,000

(u) Cheque deposited into the Bank, but no entry was passed in the Cash Book 500

(ui) Cheque received and entered in the Cash Book but not sent to bank

1,200

(iv) Credit side of the Cash Book bank column cast short

200

() Insurance premium paid directly by the bank under the standing advice 600

(i) Bank charges entered twice in the Cash Book 20

(vn) Cheque issued, but not presented to the bank for payment 500

(u) Cheque received and sent to the bank but entered twice in the Cash Book 1,000

(Ix) Bill discounted dishonoured recorded by bank but not recorded in

the Cash Book 5,000

[Ans. Balance as per Cash Book (Dr.) 16,9801

raw up abank reconciliation statement showing adjustments between your cash book and

pass book as on 31st March, 2017:

On 3lst March, 2017 your pass book showed a balance of 6,000 to your credit.

) Before that date, you had issued cheques amounting to ? 1,500 out of which cheques

of only 900 have been presented for payment.

u) Acheque of 7800 paid by you into the bank on 29th March,2017 is not yet credited

in pass book.

You might also like

- Auditing Concept Problems Cash and Cash EquivalentDocument7 pagesAuditing Concept Problems Cash and Cash EquivalentJoanah TayamenNo ratings yet

- EXAMPLE 2.2: The Cement Factory Case: SolutionDocument20 pagesEXAMPLE 2.2: The Cement Factory Case: SolutionIMRAN KHANNo ratings yet

- This Study Resource WasDocument4 pagesThis Study Resource WasDerista septhiana100% (1)

- Audit of CashDocument3 pagesAudit of CashCleopha Mae Torres100% (3)

- Brs Practical QuestionsDocument5 pagesBrs Practical QuestionsSwarupa VNo ratings yet

- Chapter 9 - Bank Reconciliation StatementDocument15 pagesChapter 9 - Bank Reconciliation StatementSaurabh GohanNo ratings yet

- Bank Reconciliation StatementDocument12 pagesBank Reconciliation StatementBhuvan PrajapatiNo ratings yet

- Tsgrewal BRSDocument11 pagesTsgrewal BRSDhruvNo ratings yet

- Accounts RTP CA Foundation May 2020Document31 pagesAccounts RTP CA Foundation May 2020YashNo ratings yet

- Paper - 1: Principles & Practice of Accounting Questions True and FalseDocument31 pagesPaper - 1: Principles & Practice of Accounting Questions True and FalseUnknown 1No ratings yet

- BRS PDFDocument8 pagesBRS PDFAnshumanNo ratings yet

- Bank Reconcilaition Statement Problems PDF 1 4 PDFDocument4 pagesBank Reconcilaition Statement Problems PDF 1 4 PDFHakim JanNo ratings yet

- BRS SCANNER by Nahta PDFDocument24 pagesBRS SCANNER by Nahta PDFVaidika JainNo ratings yet

- RTP Accounting CA Foundation May 18Document35 pagesRTP Accounting CA Foundation May 18kanishk bahetiNo ratings yet

- Unit-Iii Bank Reconciliation Statement Debit (+) Credit (-) Credit (-) Debit (+)Document6 pagesUnit-Iii Bank Reconciliation Statement Debit (+) Credit (-) Credit (-) Debit (+)aiswarya sNo ratings yet

- CA Foundation Accounts Q MTP 1 June 2024 Castudynotes ComDocument8 pagesCA Foundation Accounts Q MTP 1 June 2024 Castudynotes Comgokulthilagam362No ratings yet

- Document PDFDocument9 pagesDocument PDFOneil HernandezNo ratings yet

- Additional Practical Problems-13-1Document5 pagesAdditional Practical Problems-13-1sharmaarmaan103No ratings yet

- Practice With MT - BRSDocument6 pagesPractice With MT - BRSsrushtibhawsar07No ratings yet

- BRS 2Document2 pagesBRS 2Aarnav SharmaNo ratings yet

- 1 Cash and ReceivablesDocument8 pages1 Cash and ReceivablesSamantha Suan CatambingNo ratings yet

- Bank Reconciliation StatementDocument13 pagesBank Reconciliation Statement20232024s5r14leungjacobNo ratings yet

- Bank Re-Conciliation QuesDocument3 pagesBank Re-Conciliation QuesGarima GarimaNo ratings yet

- K - J.K. Shah: TOPICS: Bank ReconclatlonDocument3 pagesK - J.K. Shah: TOPICS: Bank ReconclatlonJpNo ratings yet

- Cash and Cash Equivalents Problem SetDocument3 pagesCash and Cash Equivalents Problem Setmarinel pioquidNo ratings yet

- Accounts June 2024Document8 pagesAccounts June 2024rajdjpurohitNo ratings yet

- BRS RevisionDocument2 pagesBRS RevisionHarsh ModiNo ratings yet

- 1905 Cash and Accounts ReceivableDocument9 pages1905 Cash and Accounts ReceivableCykee Hanna Quizo LumongsodNo ratings yet

- RTP Dec2023 p1Document32 pagesRTP Dec2023 p1Vaibhav M S100% (1)

- Business Acoounting (2020)Document4 pagesBusiness Acoounting (2020)harshdeepgarg5No ratings yet

- AP Handount 01 Cash and Bank Reconciliation PDFDocument8 pagesAP Handount 01 Cash and Bank Reconciliation PDFTherese AlmiraNo ratings yet

- Prepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookDocument10 pagesPrepare Bank Reconciliation Statement From The Following: (I) Debit Balance As Per The Cash BookPragya ShuklaNo ratings yet

- Ts Grewal Solutions For Class 11 Accountancy Chapter 9 BankDocument34 pagesTs Grewal Solutions For Class 11 Accountancy Chapter 9 Bankmyankjindal9No ratings yet

- Bank Reconciliation StatementDocument33 pagesBank Reconciliation StatementMd TahirNo ratings yet

- FAR Handout 02 - Cash and Bank ReconciliationDocument7 pagesFAR Handout 02 - Cash and Bank ReconciliationadieNo ratings yet

- LQ - Cash and ReceivablesDocument1 pageLQ - Cash and ReceivablesWawex DavisNo ratings yet

- Bank Reconciliation Statement: Gravity 4 CaDocument13 pagesBank Reconciliation Statement: Gravity 4 CaAmit ChaudhryNo ratings yet

- BRS PDFDocument14 pagesBRS PDFGautam KhanwaniNo ratings yet

- 23 Accounts-RTP-DecemberDocument32 pages23 Accounts-RTP-Decemberjustinbieberm77No ratings yet

- Cash and Cash Equivalent Tutorial PDFDocument3 pagesCash and Cash Equivalent Tutorial PDFClara San MiguelNo ratings yet

- FA1 Bank ReconciliationDocument4 pagesFA1 Bank Reconciliationamir100% (1)

- Quiz Module 1 FINALDocument4 pagesQuiz Module 1 FINALeia aieNo ratings yet

- Baf1201 Financial Accounting I CatDocument5 pagesBaf1201 Financial Accounting I CatcyrusNo ratings yet

- PRACTICAL ACCOUNTING 1 - ReviewDocument21 pagesPRACTICAL ACCOUNTING 1 - ReviewMaria BeatriceNo ratings yet

- Acctg 102 Prelim Quiz 1 With SolutionDocument9 pagesAcctg 102 Prelim Quiz 1 With SolutionYsabel ApostolNo ratings yet

- Name: Section: Date:: PROBLEM NO. 1 (2pts)Document2 pagesName: Section: Date:: PROBLEM NO. 1 (2pts)Joovs JoovhoNo ratings yet

- Assignment BRSDocument2 pagesAssignment BRSveydantsharma42No ratings yet

- Accountancy XI: Pankaj Rajan 9810194206Document4 pagesAccountancy XI: Pankaj Rajan 9810194206A4S ARMY Akshdeep singhNo ratings yet

- FAR - CASH ProbDocument2 pagesFAR - CASH Prob2216391No ratings yet

- 1 - Cash & ReceivablesDocument7 pages1 - Cash & ReceivablesCharielle Esthelin BacuganNo ratings yet

- Cash Cash Equivalent Bank ReconDocument4 pagesCash Cash Equivalent Bank Reconmavie arellanoNo ratings yet

- BRS ProblemsDocument28 pagesBRS ProblemsKutbuddin JawadwalaNo ratings yet

- 2 Accounting PDFDocument3 pages2 Accounting PDFibrahimbdNo ratings yet

- 1 Cash and Cash EquivalentsDocument3 pages1 Cash and Cash EquivalentsJohn Aries Reyes100% (1)

- CA Foundation Accounts RTP May 2023Document32 pagesCA Foundation Accounts RTP May 2023PushkarNo ratings yet

- Test Aldine FinalDocument3 pagesTest Aldine FinalAkshay TulshyanNo ratings yet

- 73432bos59248 p1Document32 pages73432bos59248 p1sneha rajputNo ratings yet

- 39759Document3 pages39759MonikaNo ratings yet

- Additional Illustrations-13Document5 pagesAdditional Illustrations-13Deepak YadavNo ratings yet

- BRSDocument2 pagesBRSexcelclassesjindNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- LP - Entrepreneurship Week 16Document9 pagesLP - Entrepreneurship Week 16Romnick SarmientoNo ratings yet

- 2020 MUSE Conference - Sessions - March 6 2020Document73 pages2020 MUSE Conference - Sessions - March 6 2020Michele LambertNo ratings yet

- Central Government Role in Road Infrastructure Development and Economic Growth in The Form of Future Study: The Case of IndonesiaDocument12 pagesCentral Government Role in Road Infrastructure Development and Economic Growth in The Form of Future Study: The Case of IndonesiaRidho ridhoNo ratings yet

- IATA RoleDocument13 pagesIATA RoleAbhishek TiwariNo ratings yet

- Goldman Sachs Cover Letter AdviceDocument7 pagesGoldman Sachs Cover Letter Advicefdgwmljbf100% (2)

- Questions 2 For Case Study 2 ChallengesDocument4 pagesQuestions 2 For Case Study 2 Challengesotaku himeNo ratings yet

- Samsung Corp V Devon Industries SDN BHD (1995) 3 SLR (R) 603 (1995) SGHC 246Document10 pagesSamsung Corp V Devon Industries SDN BHD (1995) 3 SLR (R) 603 (1995) SGHC 246SiddharthNo ratings yet

- Assure FundDocument58 pagesAssure FundVishalNo ratings yet

- Sample of Company Profile3Document33 pagesSample of Company Profile3Muhammad Kawser PatwaryNo ratings yet

- Supply Chain of HascolDocument9 pagesSupply Chain of HascolqamarunnisaNo ratings yet

- Bitcoin Mining SurveyDocument7 pagesBitcoin Mining SurveyxxNo ratings yet

- Auction Market Theory!Document3 pagesAuction Market Theory!Nav KarlNo ratings yet

- MEFA Unit 1 QuestionsDocument1 pageMEFA Unit 1 QuestionsNarendraNo ratings yet

- 07 - The MultiplierDocument26 pages07 - The MultiplierZarin TasnimNo ratings yet

- CBDT SOP For Prosecution in Cases of TDS TCS DefaultDocument8 pagesCBDT SOP For Prosecution in Cases of TDS TCS DefaultAkash GuptaNo ratings yet

- XodoDocument1 pageXodoAayush SinghNo ratings yet

- Kanzun Wealth Fund - Fund Fact SheetDocument2 pagesKanzun Wealth Fund - Fund Fact Sheetieda1718No ratings yet

- 10.procurements 5.4.1Document27 pages10.procurements 5.4.1Sparsh ChhattaniNo ratings yet

- CMS Fee Payment ProcedureDocument2 pagesCMS Fee Payment ProceduresrijithspNo ratings yet

- Uthizhhus AE22.-Cost-Accounting FL-Syllabus 22-23 SignedDocument7 pagesUthizhhus AE22.-Cost-Accounting FL-Syllabus 22-23 Signedkira cornelioNo ratings yet

- 17 181 FirstSolar Thompson PDFDocument33 pages17 181 FirstSolar Thompson PDFGideon Oyibo0% (1)

- Metabical Case Study SolutionDocument7 pagesMetabical Case Study SolutionAshutosh PatkarNo ratings yet

- KHK HandbookDocument37 pagesKHK HandbookA JoshiNo ratings yet

- Corporate KycDocument24 pagesCorporate KycJamaluddin SaidNo ratings yet

- Villanueva vs. Gonzaga 498 SCRA 285Document8 pagesVillanueva vs. Gonzaga 498 SCRA 285Eunice Anne MitoNo ratings yet

- Conceptual FrameworkDocument1 pageConceptual FrameworkthestroNo ratings yet

- Sandhya Rani Das 0472200100004006Document7 pagesSandhya Rani Das 0472200100004006gautambarbhuiya29905gNo ratings yet

- Tenancy Agreement (Industrial) 30.7.2020Document9 pagesTenancy Agreement (Industrial) 30.7.2020Hii Yiik YewNo ratings yet