Professional Documents

Culture Documents

Land and Property Tax 3

Land and Property Tax 3

Uploaded by

chhavi jainOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Land and Property Tax 3

Land and Property Tax 3

Uploaded by

chhavi jainCopyright:

Available Formats

Land and Property Tax

Ram Singh

Lecture 3

Course 602 (DSE) Land and Property Tax 1 / 14

Locations and Investments I

A location is characterized by

Amenities such as quality of roads, transport and other facilities,

streetlights, law and order, greenery, etc.

These locational facilities in our model are captured by a vector a.

Let us assume the vector of amenities can be indexed by a single

number, a.

Take a property of land area L

Value of land depends on a

For given L and K , the value of the house will also depend on a.

Course 602 (DSE) Land and Property Tax 2 / 14

Locations and Investments II

Suppose, value of a property is can be expressed as:

V = p(a)K α L1−α

where a is locational advantage of the property

p(a = 0) = 1, p′ (a) > 0

The OP for the landowner is: The maximisation problem of the landowner :

max p(a)K α L1−α − rK

x

The FOC yields:

1

∗ αp(a) 1−α

K (a) = ( ) L

r

Course 602 (DSE) Land and Property Tax 3 / 14

Locations and Investments III

Let

t p be tax rate (per-unit) of property value

Now, the OP of the landowner becomes:

max{ (1 − t p )p(a)K α L1−α − rK }

K

The FOC yields:

1

αp(a)(1 − t p ) 1−α

K ∗∗ (a) = ( ) L

r

The tax collected is given by

T P (t p , a, L) = t p p(a)K ∗ α L1−α

Clearly, for given a,

K ∗∗ (a) < K ∗ (a)

Course 602 (DSE) Land and Property Tax 4 / 14

Locally Funded Public Good I

In view of the above:

when there is no tax and no public amenities, i.e., t p = 0 = a

1

α 1−α

K ∗ (a = 0) = ( ) L

r

Suppose:

Govt provides a but this is funded by property tax

Let g(a) be the cost of a, i.e., t p p(a)K α L1−α = g(a)

The governement first provides a and then recovers g(a)

This gives us:

1

αp(a)(1 − t p ) 1−α

K ∗∗ (a) = ( ) L

r

Course 602 (DSE) Land and Property Tax 5 / 14

Locally Funded Public Good II

Question:

How does K ∗ (a = 0) compare with K ∗∗ (a)

Is K ∗ (a = 0) >=< K ∗∗ (a)?

When should a government fund local public good with local taxation?

Course 602 (DSE) Land and Property Tax 6 / 14

Land Value Tax I

Henry George propounded the idea of land value tax (LVT)

Under LVT, THE Tax obligation is t L L

Under the LVT, the maximisation problem of the landowner looks like :

max p(a)K α L1−α − rK − (t L )L

K

The FOC for optimization yields :

α 1

K L = p(a)( ) 1−α L = K ∗

r

Clearly,

the investment K L equals its efficient level K ∗ .

The LVT is superior to Property tax

The tax revenue is given by

T L (t L , a, L) = t L L

Course 602 (DSE) Land and Property Tax 7 / 14

Land Value Tax II

Consider

two localities- 1 and 2 with different locational advantages, a1 and a2 ;

a1 > a2 . So p(a1 ) > p(a2 ),

two parcels of same size - one in each locality

tiL as land tax rate in locality i

Surplus accruing to landowners in the two regions are:

π1 = p(a1 )(K α L1−α ) − rK − t1L L

π2 = p(a2 )(K α L1−α ) − rK − t2L L

Course 602 (DSE) Land and Property Tax 8 / 14

Land Value Tax III

The optimization exercise of the landowners in the two regions yields:

αp(a1 ) 1−α

1

K1∗ = ( ) L

r

αp(a2 ) 1−α

1

K2∗ = ( ) L

r

It can be seen that π1 (K1∗ ) > π2 (K2∗ ). (You can see this from the Envelop

theorem)

The payoffs to the owner are:

π1 (K1∗ ) = p(a1 )(K1∗ α L1−α ) − cK1∗ − t1L L

π2 (K2∗ ) = p(a2 )(K2∗ α L1−α ) − cK2∗ − t2L L

If t1L = t2L , we have π1 (K1∗ ) > π2 (K2∗ ). The outcome can be non-progressive

Course 602 (DSE) Land and Property Tax 9 / 14

Land Value Tax IV

Consider t1L and t2L such that:

π1 (K1∗ ) = p(a1 )(K1∗ α L1−α ) − cK1∗ − t1L L = 0

π2 (K2∗ ) = p(a2 )(K1∗ α L1−α ) − cK2∗ − t2L L = 0

That is, the tax rates are given by:

t1L > t2L (0.1)

Course 602 (DSE) Land and Property Tax 10 / 14

Property Tax and Non-distortionary corruption I

Assume

p(a) = 1, for simplicity

V denotes the true value of the property

the owner can under-report by putting in value hiding activities

V R be the reported value on which tax is paid.

b denotes the bribe for under-reporting the property value;

V R is a decreasing function of b; the owner is successful in hiding value

equal to u(b) = V − V R (b)

V̄ be the minimum value on which tax is to be paid.

Course 602 (DSE) Land and Property Tax 11 / 14

Property Tax and Non-distortionary corruption II

Ignoring V̄ , the optimisation problem for the taxpayer/landowner now

becomes :

max K α L1−α − rK − t p V R (b) − b, i.e.,

b,K

max K α L1−α − rK − t p (K α L1−α − u(b)) − b, i.e.,

b,K

max (1 − t p )K α L1−α − rK + t p u(b) − b,

b,K

It is easy to see that

the optimal choice of activity level under corruption K c remains the same

i.e., K ∗∗ = K c .

The FOC with respect to the level of the bribe is t p u ′ (b) = 1.

Question: What is the effect of V̄ on the reporting behaviour?

Course 602 (DSE) Land and Property Tax 12 / 14

Nash-bargaining over the bribe I

Assume

the taxpayer can under-report by bribing the assessor

V R be the reported value on which tax is paid.

V̄ be the minimum value on which tax is to be paid.

Nash bargaining over bribe

In case of disagreement, the owner has to pay tax on the true value

Surplus from negotiations= Sum of agreement payoffs - Sum of

disagreement payoffs

Disagreement payoffs

Inspector: Zero

Owner: V − t p V

Course 602 (DSE) Land and Property Tax 13 / 14

Nash-bargaining over the bribe II

Agreement payoffs

Inspector: bribe b

Owner: V − t p V R − b

So Surplus from negotiations=

[V − t p V R − b + b] − [V − t p V ] = t p (V − V R )

Each agent gets half of the surplus, i.e., :

(1/2)t p (V − V R )

What value V R will maximize gains for the parties?

Exercise

Set up and solve the optimization problem for the owner. Compare the

investment level K with the first best level.

Course 602 (DSE) Land and Property Tax 14 / 14

You might also like

- Moodys Default Rate PDFDocument60 pagesMoodys Default Rate PDFSaad OlathNo ratings yet

- Annexes TOS Effective October 2022Document37 pagesAnnexes TOS Effective October 2022Rhad Estoque100% (12)

- 3 Two Period Model 2Document7 pages3 Two Period Model 2Sandrine MattheyNo ratings yet

- QA-week16-Solow Growh Open PDFDocument8 pagesQA-week16-Solow Growh Open PDFdariusNo ratings yet

- 2.1 The Basic Structure: 8 Chapter 2: The Solow-Swan ModelDocument27 pages2.1 The Basic Structure: 8 Chapter 2: The Solow-Swan ModelAayush PandeyNo ratings yet

- Cost Constraint/Isocost LineDocument38 pagesCost Constraint/Isocost LinejamesyuNo ratings yet

- Lecture 2 - Stamp DutyDocument12 pagesLecture 2 - Stamp Dutychhavi jainNo ratings yet

- MAT1106-Formula Sheet For ExamDocument3 pagesMAT1106-Formula Sheet For ExamQueh Chen HongNo ratings yet

- Yap Lecture 2 PDF PDFDocument18 pagesYap Lecture 2 PDF PDFTeh Kim SinNo ratings yet

- Tutorial 1 SolutionsDocument4 pagesTutorial 1 Solutionsnelly_damiaNo ratings yet

- PHYS511HW4Document3 pagesPHYS511HW4Jherson Miguel HerreraNo ratings yet

- Practice2 Test1 AnswerKeyDocument5 pagesPractice2 Test1 AnswerKeyMarie StéphanNo ratings yet

- E20214 Math Econ 04 2 Variables Unconstrained OptimizationDocument3 pagesE20214 Math Econ 04 2 Variables Unconstrained OptimizationJohn ChanNo ratings yet

- 511 PS8 Soln PDFDocument12 pages511 PS8 Soln PDFNickNo ratings yet

- 02 Econ 208 Week 2 Tutorial SolutionsDocument11 pages02 Econ 208 Week 2 Tutorial SolutionsdariusNo ratings yet

- ECO364 F18 Pset 3 SolutionsDocument7 pagesECO364 F18 Pset 3 SolutionsHan ZhongNo ratings yet

- Solution To Problem Set #4Document4 pagesSolution To Problem Set #4testingNo ratings yet

- EC203 - Problem Set 6 - SolutionsDocument9 pagesEC203 - Problem Set 6 - SolutionshayalabiNo ratings yet

- Macroeconomic Theory and Analysis, (Spring 2020) Midterm 1 Suggested SolutionsDocument8 pagesMacroeconomic Theory and Analysis, (Spring 2020) Midterm 1 Suggested SolutionsLiu Huanyue EricNo ratings yet

- Test Practice Exam Questions and Answers Solow ModelDocument5 pagesTest Practice Exam Questions and Answers Solow ModelFiranbek BgNo ratings yet

- MFE Macro PsDocument134 pagesMFE Macro Psprw1118No ratings yet

- Perturbation BasicsDocument3 pagesPerturbation Basicsresat akanNo ratings yet

- Answer Key Test1Document5 pagesAnswer Key Test1Marie StéphanNo ratings yet

- 1 Lecture Notes: The Solow ModelDocument5 pages1 Lecture Notes: The Solow Modelmrs dosadoNo ratings yet

- Elements de Correction TD4 Microeconmie 1Document7 pagesElements de Correction TD4 Microeconmie 1Ornel DJEUDJI NGASSAMNo ratings yet

- Exam April 2014Document4 pagesExam April 2014zaurNo ratings yet

- Notes For Econ202A: Investment: Pierre-Olivier Gourinchas UC BerkeleyDocument35 pagesNotes For Econ202A: Investment: Pierre-Olivier Gourinchas UC BerkeleySharon AmondiNo ratings yet

- Econ 281 Chapter07Document50 pagesEcon 281 Chapter07Elon MuskNo ratings yet

- Macroeconomics PracticeDocument3 pagesMacroeconomics PracticeSarah TseungNo ratings yet

- Neoclassical Growth Theory With Exogenous Saving: 1 Stylized FactsDocument18 pagesNeoclassical Growth Theory With Exogenous Saving: 1 Stylized FactsoumNo ratings yet

- Problem Set 1: ECON 4330Document14 pagesProblem Set 1: ECON 4330NeemaNo ratings yet

- Lecsl3w08 PDFDocument18 pagesLecsl3w08 PDFKasey PastorNo ratings yet

- AMA1 Lecture3Document16 pagesAMA1 Lecture3D. KNo ratings yet

- Blanchard, Olivier, AppendixDocument17 pagesBlanchard, Olivier, AppendixannoporciNo ratings yet

- Ecc2 5Document7 pagesEcc2 5huynhngocvuducNo ratings yet

- Isoquant & IsocostDocument5 pagesIsoquant & IsocostFathimahNo ratings yet

- Romer, David (2012) Advanced MacroeconomicsDocument2 pagesRomer, David (2012) Advanced MacroeconomicsMinh Pham0% (1)

- Exam1 SolsDocument10 pagesExam1 Solsvtogether31No ratings yet

- Ex: Treasury Bond Provide A Return (KN) of 9% and The Inflation (I) Is 4%Document3 pagesEx: Treasury Bond Provide A Return (KN) of 9% and The Inflation (I) Is 4%MostakNo ratings yet

- TFF FormulasDocument12 pagesTFF Formulastallicahet81No ratings yet

- 1 Economic Growth and The Solow Growth ModelDocument6 pages1 Economic Growth and The Solow Growth ModellamallyNo ratings yet

- RCK ModelDocument2 pagesRCK ModeldReamLANDNo ratings yet

- Microeconomics (Exercises Chapter 7)Document5 pagesMicroeconomics (Exercises Chapter 7)DinaNo ratings yet

- Dynamic Element MatchingDocument22 pagesDynamic Element MatchingIvar Løkken100% (2)

- Simple Two-Period Model: September 2011Document20 pagesSimple Two-Period Model: September 2011Bang YangNo ratings yet

- 9.04 More Complex ReactionsDocument7 pages9.04 More Complex ReactionsAbdelfattah Mohamed OufNo ratings yet

- Skiba Points For Optimal Investment StrategiesDocument9 pagesSkiba Points For Optimal Investment StrategiespostscriptNo ratings yet

- The Short Run Lecture NotesDocument29 pagesThe Short Run Lecture NotesDuc Tao ManhNo ratings yet

- Fall2019 MidtermDocument10 pagesFall2019 MidtermHui LiNo ratings yet

- ST326 - Irdap2021Document5 pagesST326 - Irdap2021NgaNovaNo ratings yet

- Ec214 Spring 2018 2019 Class3Document5 pagesEc214 Spring 2018 2019 Class3Umay PelitNo ratings yet

- FandI SubjACiD 200004 ExamreportDocument13 pagesFandI SubjACiD 200004 Examreportdickson phiriNo ratings yet

- Threshold IngDocument17 pagesThreshold IngGeorge FormanNo ratings yet

- Home Assignment 1 - Ersa Berliana - 04211941000041Document6 pagesHome Assignment 1 - Ersa Berliana - 04211941000041roberto luckyNo ratings yet

- MMSB Exercise SolutionsDocument49 pagesMMSB Exercise SolutionsYolanda Winarny Eviphanie HutabaratNo ratings yet

- Answer Key - Midterm 1Document6 pagesAnswer Key - Midterm 1Marie StéphanNo ratings yet

- The BBP Algorithm For Pi: David H. Bailey September 17, 2006Document7 pagesThe BBP Algorithm For Pi: David H. Bailey September 17, 2006Ashish KumarNo ratings yet

- Precautionary Savings, Illiquid Assets, and the Aggregate Consequences of Shocks to Household Income RiskDocument37 pagesPrecautionary Savings, Illiquid Assets, and the Aggregate Consequences of Shocks to Household Income Riskweccywu2023No ratings yet

- Cost Constraint/Isocost LineDocument38 pagesCost Constraint/Isocost LinedongaquoctrungNo ratings yet

- Golden Rule ExampleDocument10 pagesGolden Rule ExampleAdonay DestaNo ratings yet

- L8 - RecursionDocument31 pagesL8 - Recursionحسن بوحواNo ratings yet

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Project 3Document130 pagesProject 3Yogi AnandNo ratings yet

- Analysis of Consumer Behaviour For Online Purchase of FurnitureDocument5 pagesAnalysis of Consumer Behaviour For Online Purchase of FurnitureThomas Dominic100% (1)

- The Constitution of DystopiaDocument8 pagesThe Constitution of Dystopiaapi-512159305No ratings yet

- Two Column Cash BookDocument24 pagesTwo Column Cash BookDarshans dadNo ratings yet

- Unit 3 - Lesson 6 Price Elasticity of SupplyDocument14 pagesUnit 3 - Lesson 6 Price Elasticity of Supplyapi-260512563No ratings yet

- Mergers and Acquisitions Topic 4 Accounting For MergersDocument10 pagesMergers and Acquisitions Topic 4 Accounting For MergersMohit OberoiNo ratings yet

- Actuarial Science Undergraduate Thesis TopicsDocument4 pagesActuarial Science Undergraduate Thesis TopicsPayToWritePapersCorona100% (1)

- Module1 - BSAIS1A Bulay, Ericalaine R.Document22 pagesModule1 - BSAIS1A Bulay, Ericalaine R.Klen AnganaNo ratings yet

- Anglogold Ashanti: - LocationDocument2 pagesAnglogold Ashanti: - LocationKodwoPNo ratings yet

- Building Strong Brands Aaker en 359Document6 pagesBuilding Strong Brands Aaker en 359Ana Lucia Valenzuela CadavidNo ratings yet

- Case 28 University of VirginiaDocument4 pagesCase 28 University of VirginiaSaiyed Anver Akhtar43% (7)

- Market IntegrationDocument37 pagesMarket IntegrationRyan Estonio100% (2)

- OM PPT FinalDocument29 pagesOM PPT Finalramya patraNo ratings yet

- 2-ZI-2211-0473-Pak Budi Yulianto-R1 Project Furniture Outdoor Rooftop OfficeDocument5 pages2-ZI-2211-0473-Pak Budi Yulianto-R1 Project Furniture Outdoor Rooftop OfficeRendy GunawanNo ratings yet

- Gold ManDocument5 pagesGold Manyuvrajs554No ratings yet

- PR2 Questionnaire-2Document5 pagesPR2 Questionnaire-2naxzleidomingoNo ratings yet

- Accountancy Notes Ch.1 Introduction To AccountingDocument6 pagesAccountancy Notes Ch.1 Introduction To AccountingSancia D'silva100% (1)

- A DIY Piggy Bank Using A BottleDocument2 pagesA DIY Piggy Bank Using A BottleAbegailNo ratings yet

- Rajiv Gandhi Equity Savings Scheme (80-CCG)Document9 pagesRajiv Gandhi Equity Savings Scheme (80-CCG)shaannivasNo ratings yet

- Ecoxyztem Presentation For Univ. MataramDocument19 pagesEcoxyztem Presentation For Univ. Mataramfelix fisabilillah bayuNo ratings yet

- Accounting StandardsDocument24 pagesAccounting Standardslakhan619No ratings yet

- Backflushing - 2019Document3 pagesBackflushing - 2019Pavan SharmaNo ratings yet

- Activity - Translation of Foreign Currency Financial Statements (PAS 21 & PAS 29)Document1 pageActivity - Translation of Foreign Currency Financial Statements (PAS 21 & PAS 29)PaupauNo ratings yet

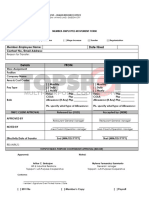

- TMPC Employee Movement FormDocument1 pageTMPC Employee Movement FormGabriel GarciaNo ratings yet

- Food Stall Vendors DraftDocument42 pagesFood Stall Vendors Draftjanssen2000calacalNo ratings yet

- The Cemex WayDocument9 pagesThe Cemex Wayhassan ijazNo ratings yet

- What Are The Components of A Strategy Statement?: 1. Strategic IntentDocument7 pagesWhat Are The Components of A Strategy Statement?: 1. Strategic IntentIana MontemayorNo ratings yet

- Exposition Text ReadingDocument4 pagesExposition Text ReadingOvi AuliaNo ratings yet